Swing trading refers to the means of capturing short-to-medium-term gains in a stock (or any financial instrument) over the span of a few days to several weeks.

It needs technical analysis of past and present data which is highlighted in the following 2022 Best Swing Trading Books.

Don’t rush your money into it without any prior knowledge.

Best Swing Trading Books | 2022 Insights

Swing trading is a unique style of many veteran investors in the stock market.

Many novice investors are trying to master this art because of high gain on short-term goals.

Why Is Swing Trading So Appealing?

According to swing traders, capital opportunity costs are the driving force behind their strategy.

In other words, swing traders are essentially momentum traders, attracted to stocks experiencing rapid price rises, and trying to avoid having investment in stocks that don’t have the potential to rise suddenly.

Trading is a skill and not one that’s fit to master.

How To Get Your Edge in Swing Trading

Evolving into a profitable trader requires a serious commitment to learning the necessary skills and becoming proficient in using them.

Day-to-day trading is not everyone’s cup of tea, but still, it attracts every investor locking their money in stocks.

It would be best if you had trained and calming nerves for it.

Because where there is a risk, there is profit.

Here is a sneak peek into some best swing trading books to help master this art.

How to swing trade: A beginner guide to trading tools, money management, Rules, Routines, and strategies of swing traders

Authors: Brian Pezim and Andrew Aziz

Brian Pezim and Andrew Aziz co-author the best-selling book on every store and first pick.

It’s an ideal book for beginners.

The book covers stock trading basics and provides pro-level strategies for dealing with day-to-day trading.

The authors have also beautifully penned down short-term gains and many more principles.

If you are a veteran in trading, you won’t enjoy the first few chapters of this book because of its foundation knowledge.

Despite this, the upcoming chapters will provide you with valuable insights.

Handling risks and holdings are some of the best strategies explained in simple words.

Every chapter contains its key points and summary. It’s an excellent guide to remember all the principles of swing trading.

Swing Trading for Dummies: Author Omar Bassal

Every book teaches swing trading in a good way, but this book authored by Omar Bassal is an absolute banger.

This book covers all the essential knowledge one has to use in swing trading, from basic to advanced skills.

The author previously headed the assessment division of one of the largest banks in the Middle East, and now he runs his business firms.

The book mainly covers the technical analysis of stocks, followed by a fundamental analysis of stock prices, and finally covers how to build a portfolio and manage it.

Throughout this book, it is thoroughly explained and demonstrated how to avoid extreme risk-taking while still gaining profits.

Mastering the Trade: proven techniques for profiting from intraday and swing trading

Author: Alan Farley

Everyone in the game of trading knows about Alan Farley.

It discusses charting, identifying support and resistance, price action patterns, Fibonacci retracements, and how to identify and profit from short-term trading opportunities.

Farley spends half of the book describing his “7-Bells” – basically, seven swing trading setups that he believes to be most reliable.

Each trade setup is illustrated.

Clearly, the relative risk/reward ratio is described, and the trades are executed and managed accurately.

The book is not only for beginner investors but are also for expert who can take valuable insights from it.

Tools and Tactics for the Master Day Trader: Battle-Tested Techniques for Day, Swing, and Position Traders 1st Edition

Author: Velez and Capra

Velez and Capra have written their experience of the past four years.

They have written the complete strategies that work on swing trading.

They are also the masterminds behind the best website Presitine.com, with over thousands of visitors per month.

The book is written in plain language so everyone new to the market must easily understand.

The authors have explained the powerful strategies and psychology behind short trading in detail.

After reading the book, any trader can access the tools to capture more winning trades and procure original profits, regardless of their experience, market knowledge, or technical skills.

Come Into My Trading Room, A Complete Guide to Trading by Alexander Elder

Author: Alexander Elder

Trading stocks, commodities, and forex are just a few of the markets in which Alexander Elder is a legend among professional traders.

Furthermore, he has also written Trading for a living, keeping the rating of best seller book for more than 20 years.

There is a lot of discussion about the trading mindset in this book.

He has penned down how swing trading exactly works and what approach one must use to put money into these short-term investments.

Elder also delivers eye-opening advice on the sheer importance of money management and market time dealings, along with pointing out how attention to detail can make an enormous difference in your trading profitability.

Swing Trading Strategies: 3 Simple and Profitable Strategies for Beginners by Charles Reis

Author: Charles Reis

Swing trading, for Charles Reis, offers the ideal mix of opportunity and risk – significantly higher potential profits than long-term investing and substantially lower risk than day trading.

Only 66 pages long, this book explains three simple swing trading strategies.

One relies on trading breakouts, another uses options swing trading, and the third uses candlestick signals to generate trading signals.

Don’t go on the shortness of its length. It’s the book full of wisdom.

5 Secrets To Highly Profitable Swing Trading by Ivan Hoff

Author: Ivan Hoff

If you are new to the stock market and don’t understand the graphs and technical language, you must pick this excellent book on swing trading by Ivan Hoff.

You can know charts, technical values, and all the indicators.

User-friendliness is the keyword for this book.

Not only does this provide you with simple parts of information, but it does this in a way that does not leave the reader confused.

It’s a user-friendly book for beginners.

It’s a short book, and every word plays its own role.

Every moment spent while reading can benefit you when you are investing in swing trading in the long term.

It consists of different articles explaining the short plans and short investing.

This book can bring some quick wins for you.

Is Swing Trading Profitable?

Swing trading allows and gives your profit in short-term goals.

You can take it as a part-time job

or even a full time should you decide to make a living swing trading.

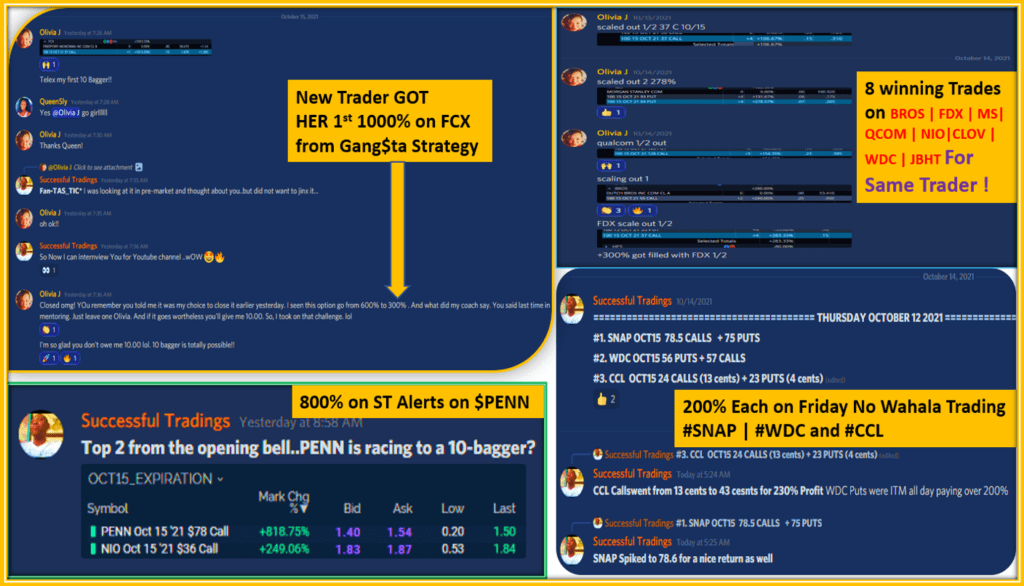

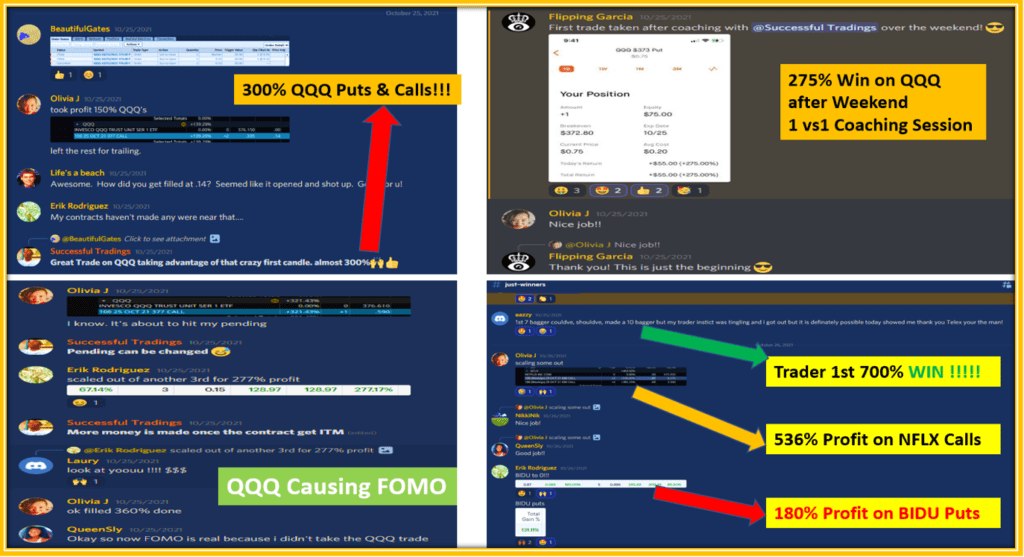

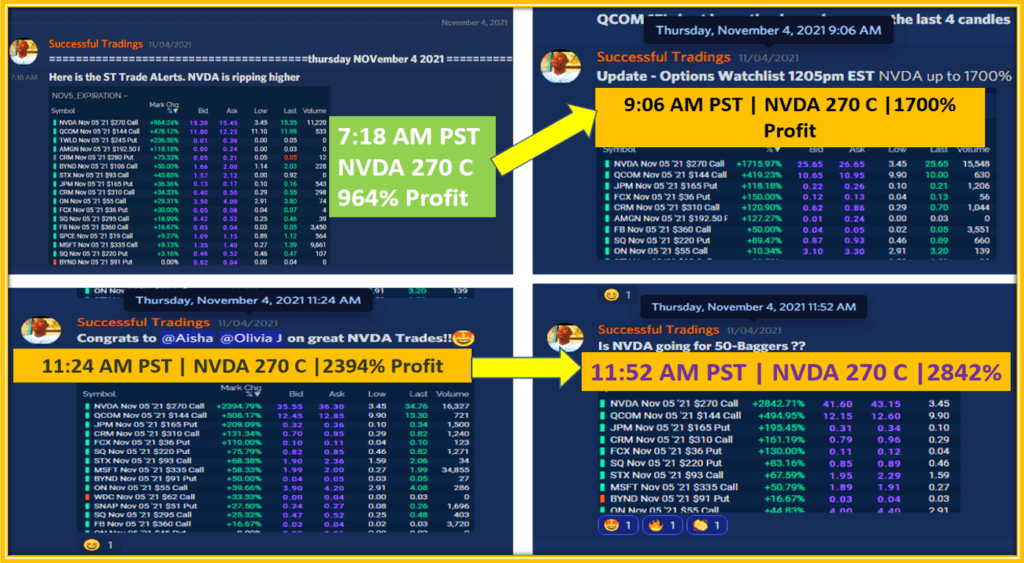

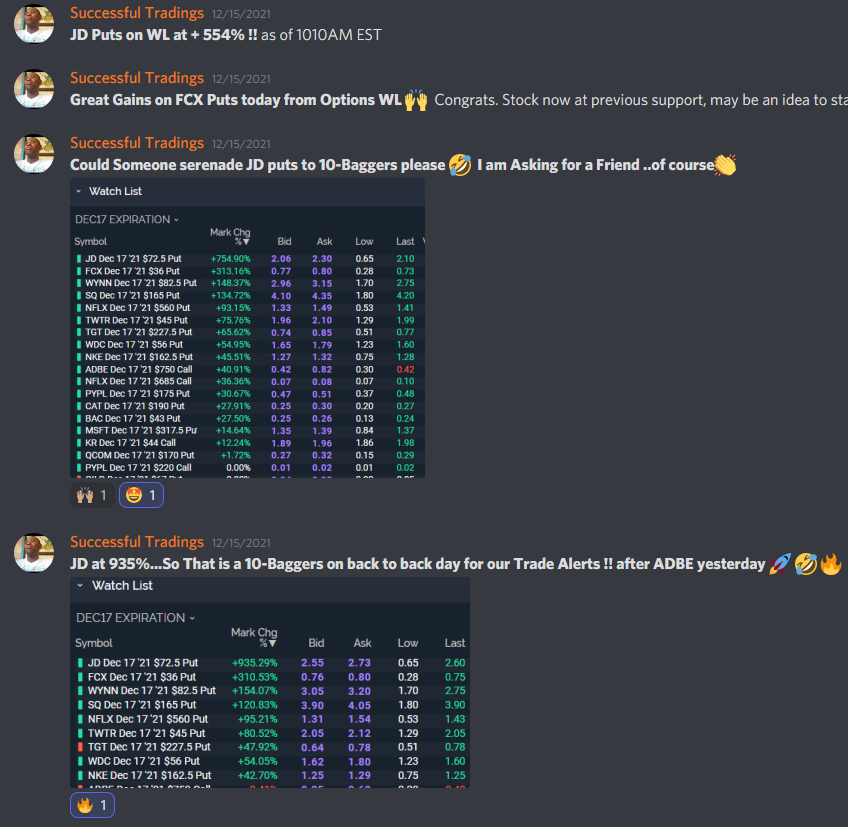

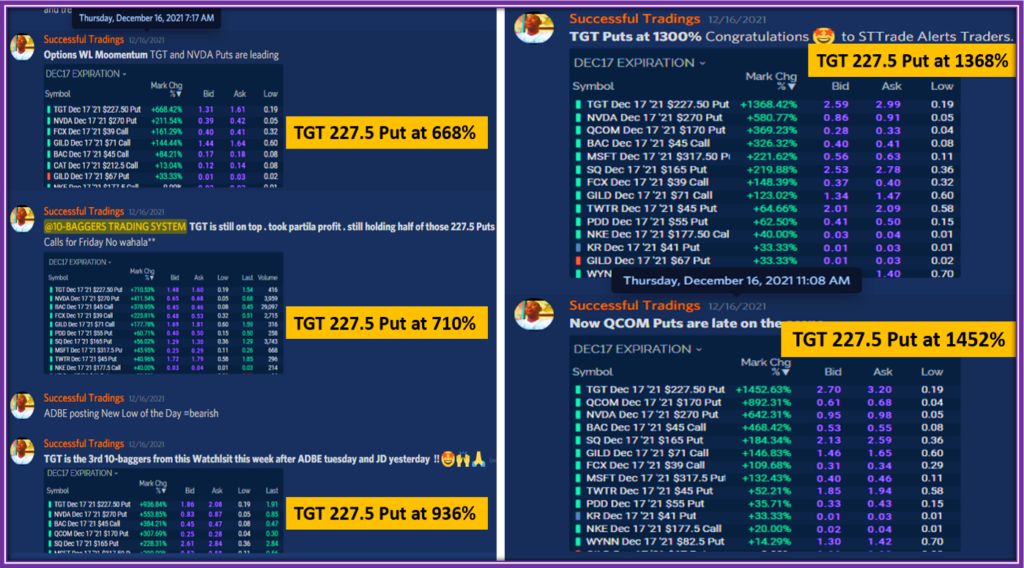

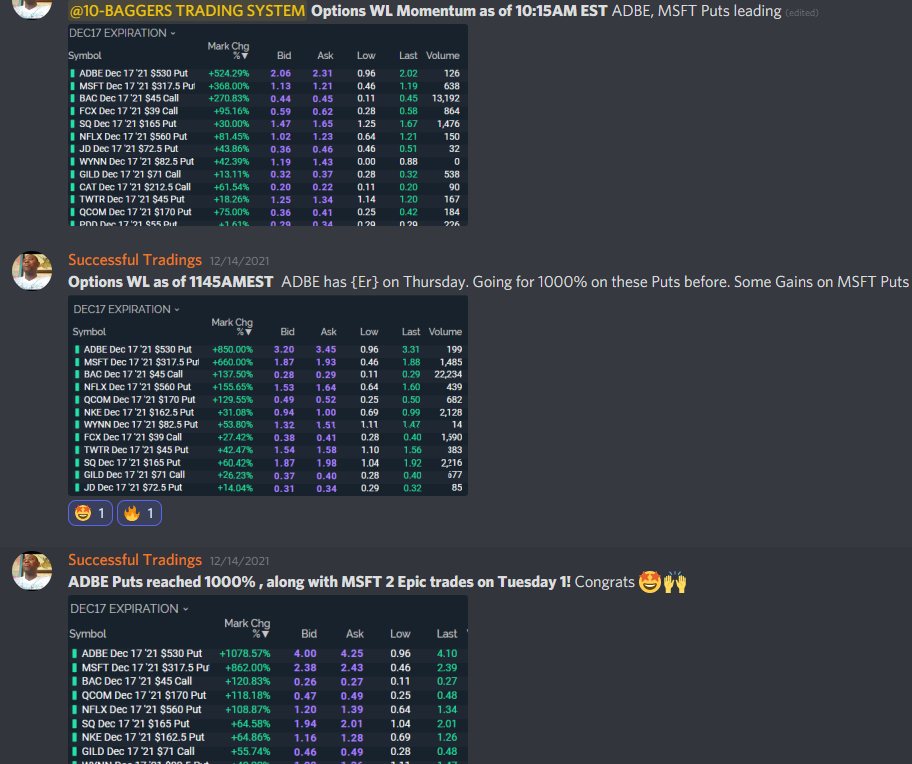

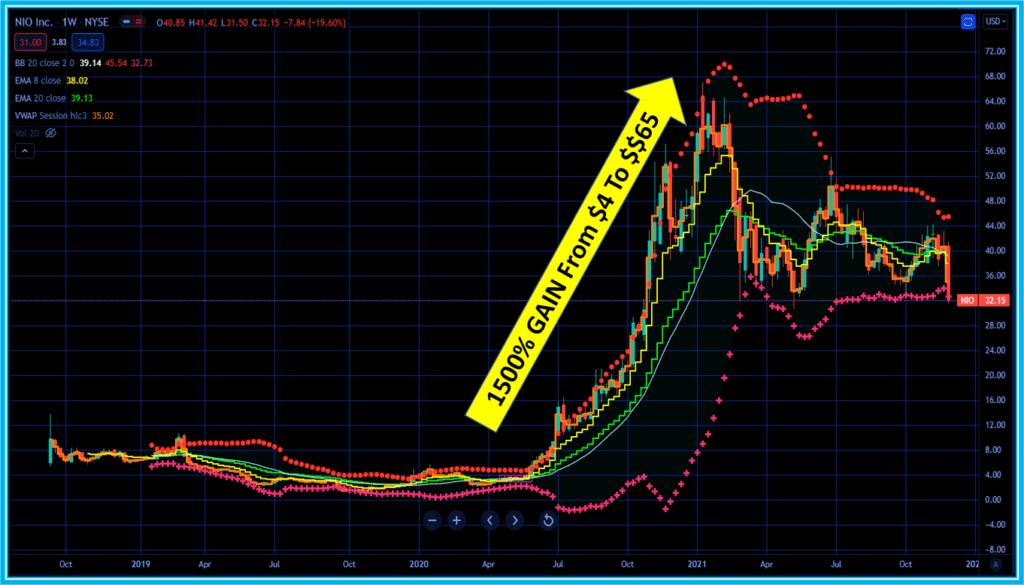

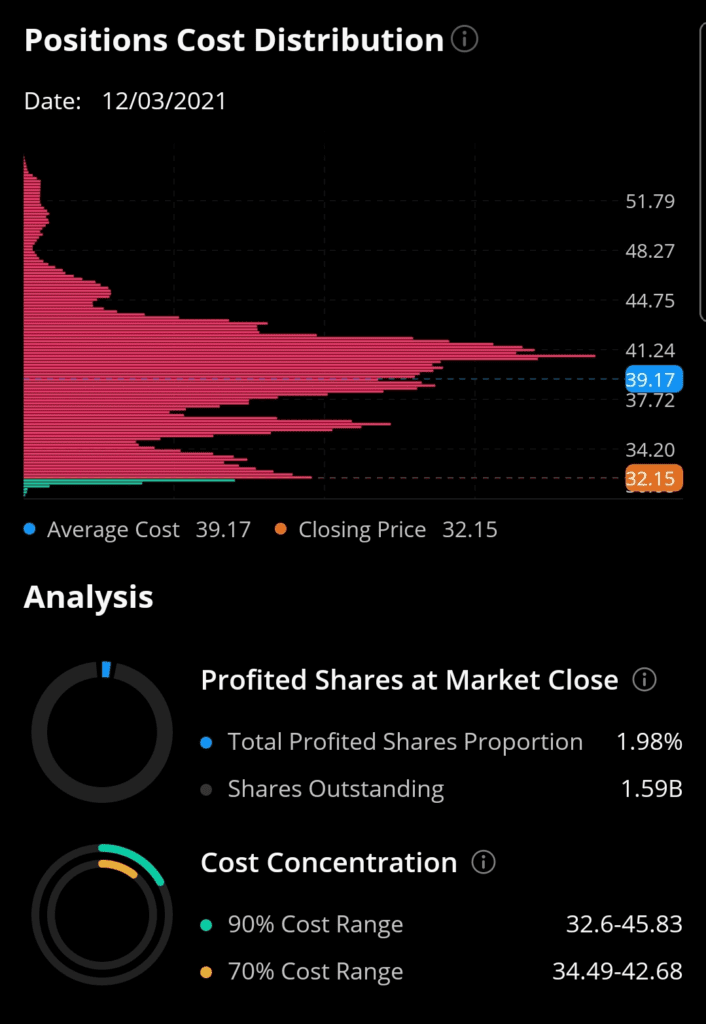

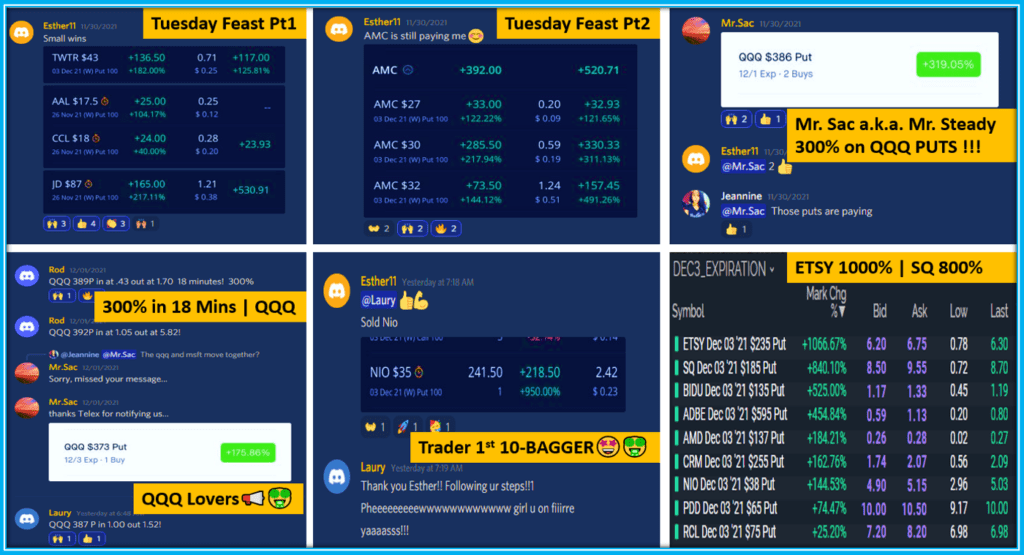

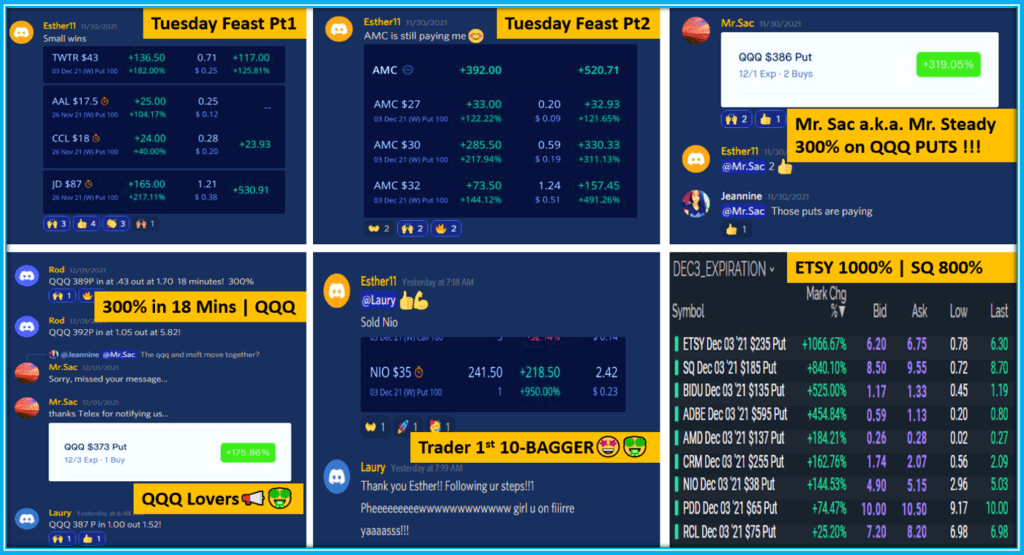

Examples of Swing Trading Success

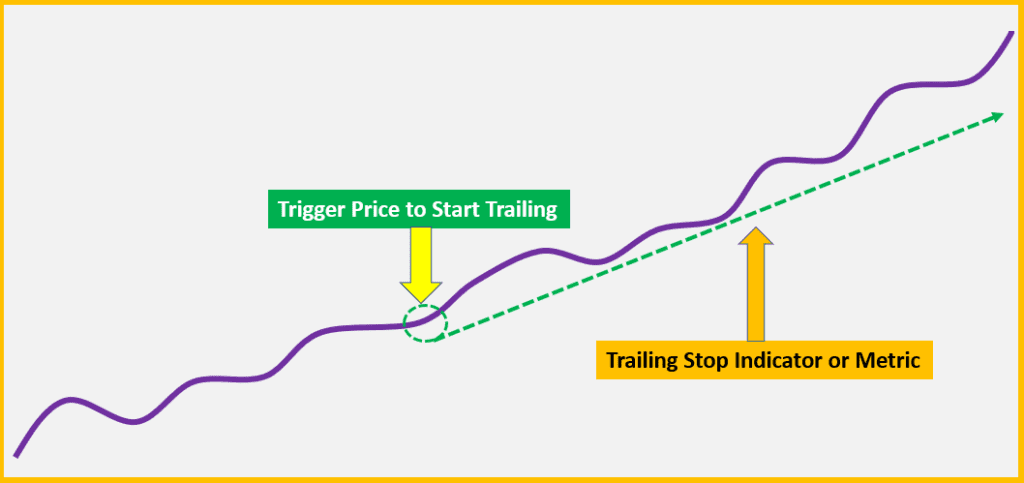

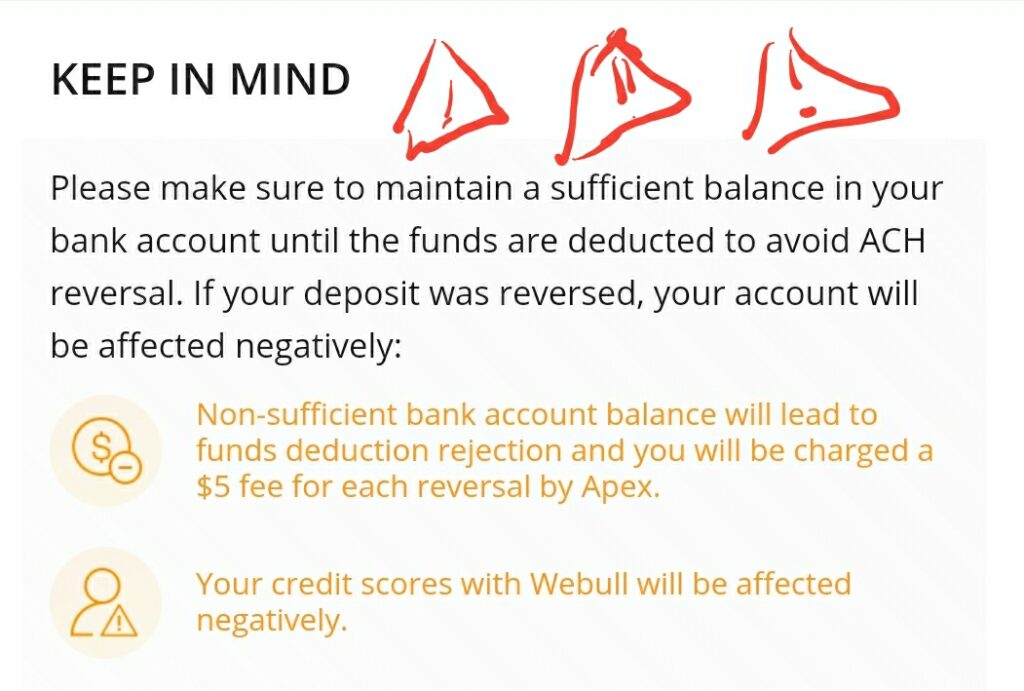

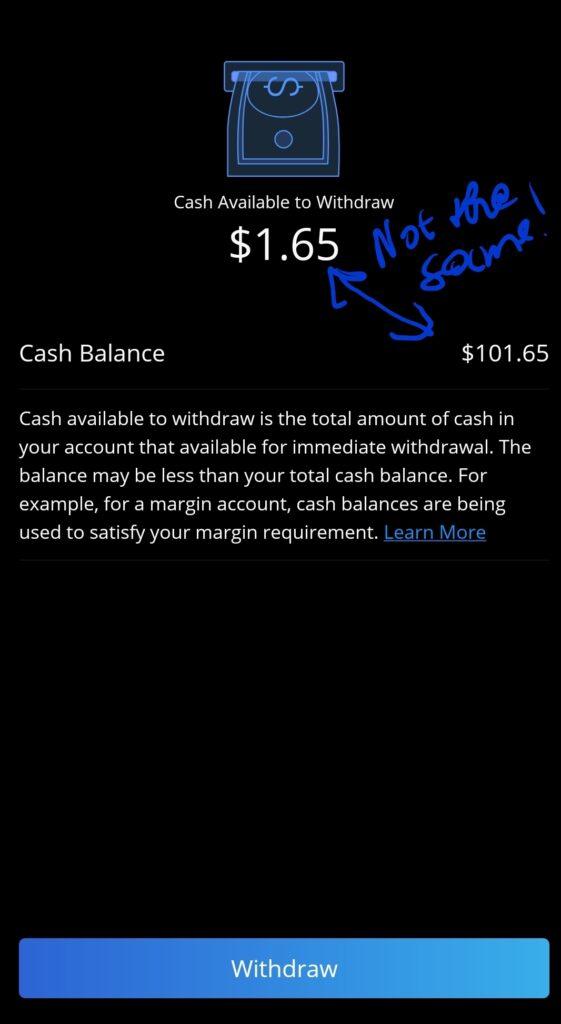

You can stop-loss orders by avoiding huge losses.

It can bring massive profit if you niche it down and focus it on.

It can be a great resource to learn about long-term trading.

You can get used to the technical language of the stock market.

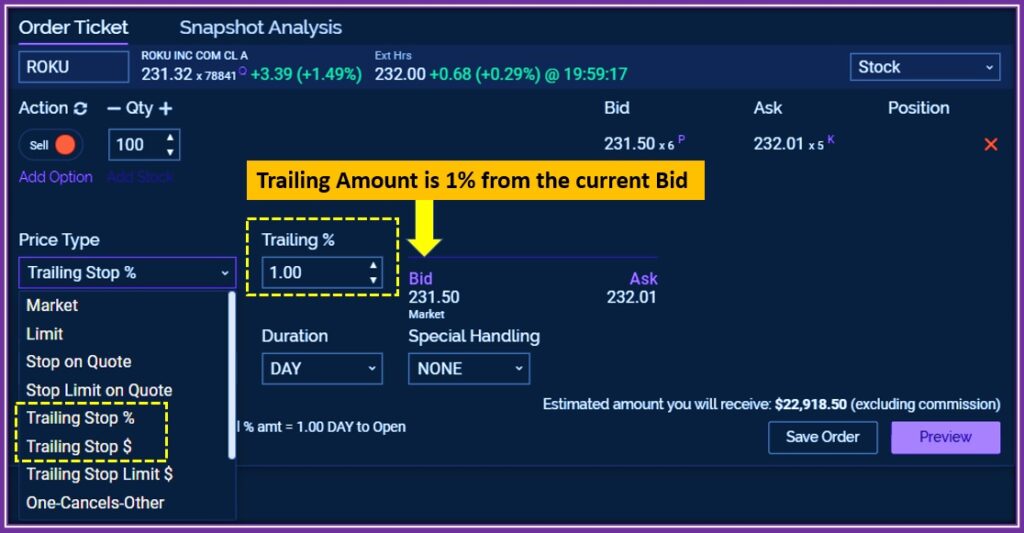

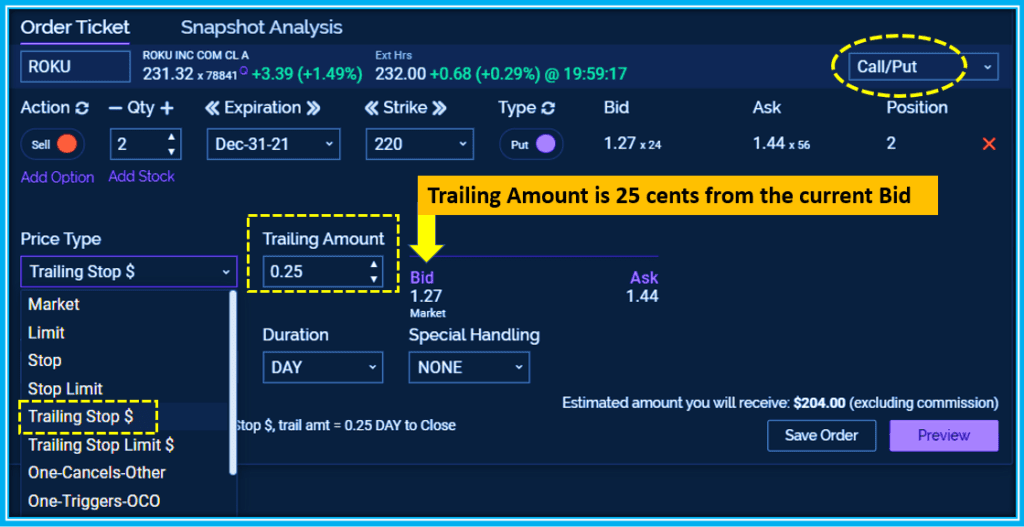

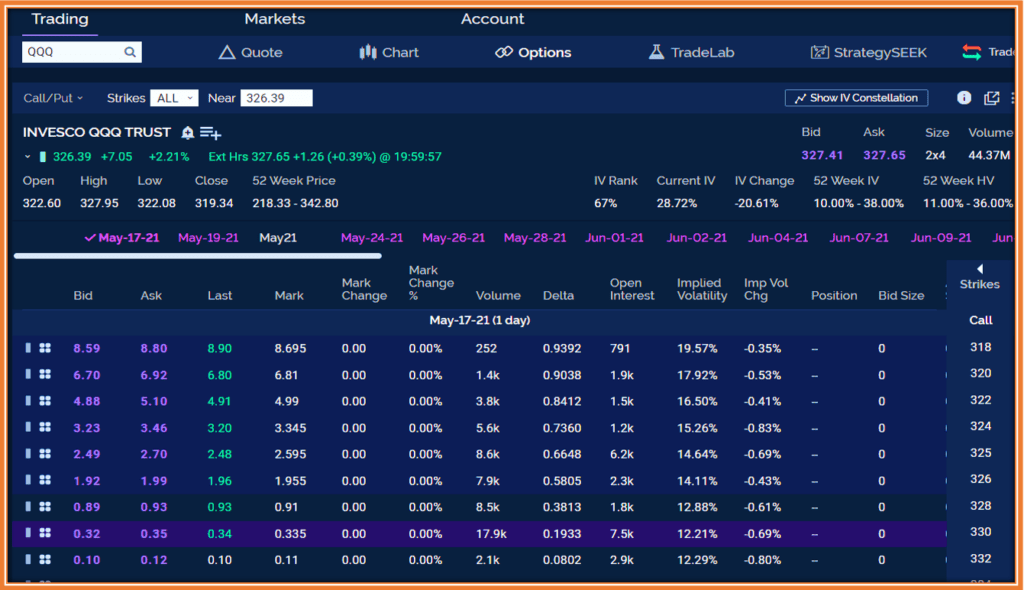

How To Swing Trade Options for Big Profit?

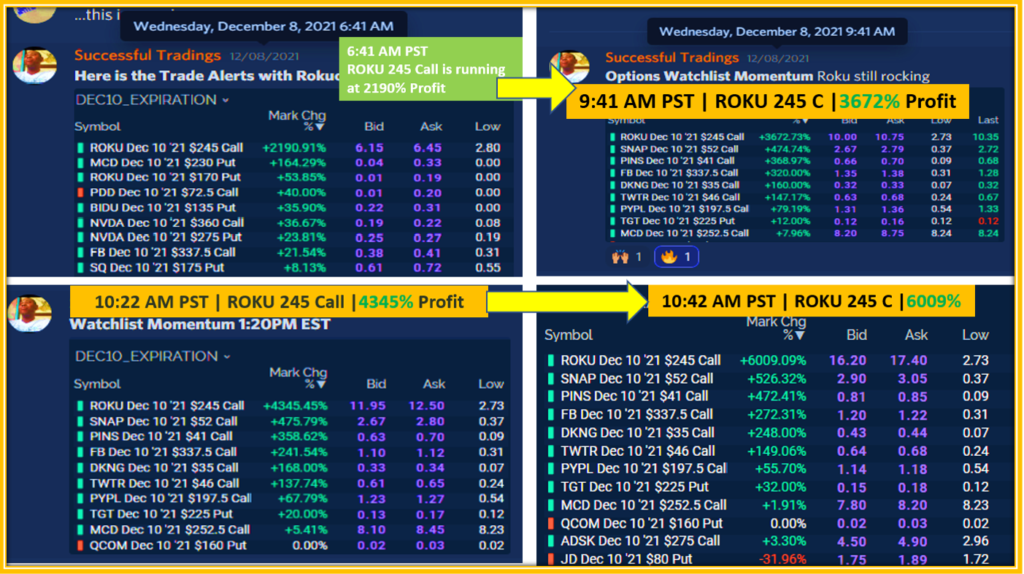

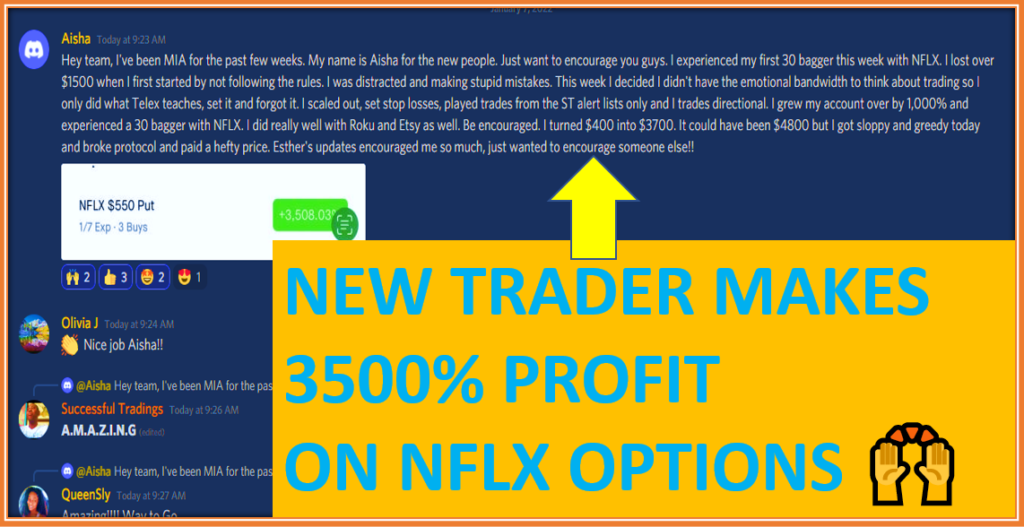

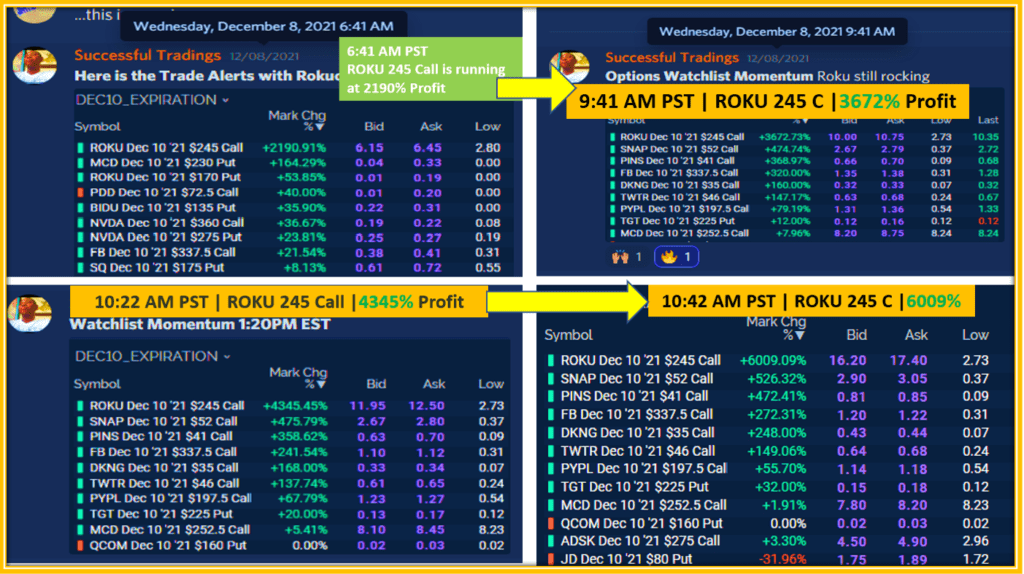

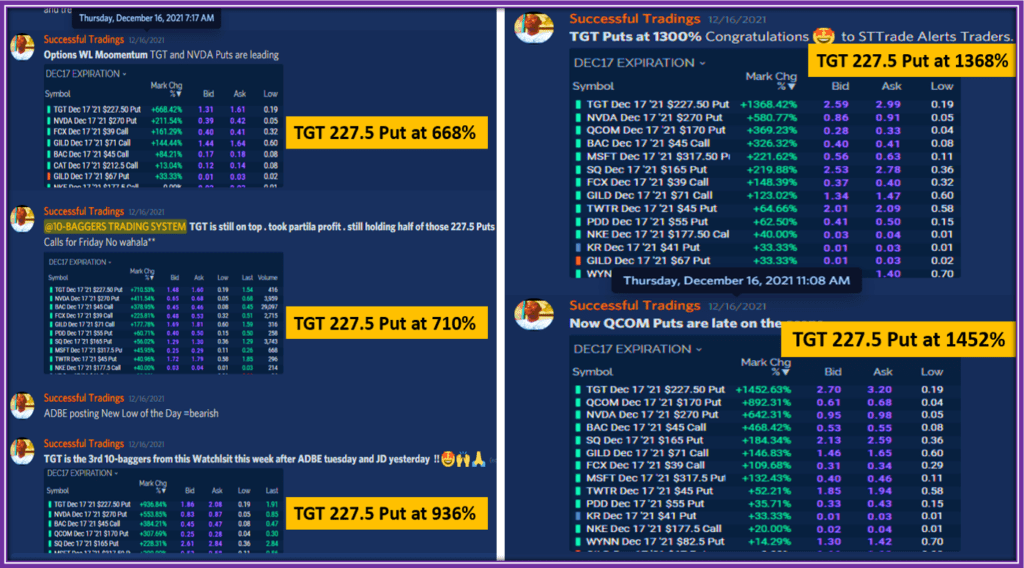

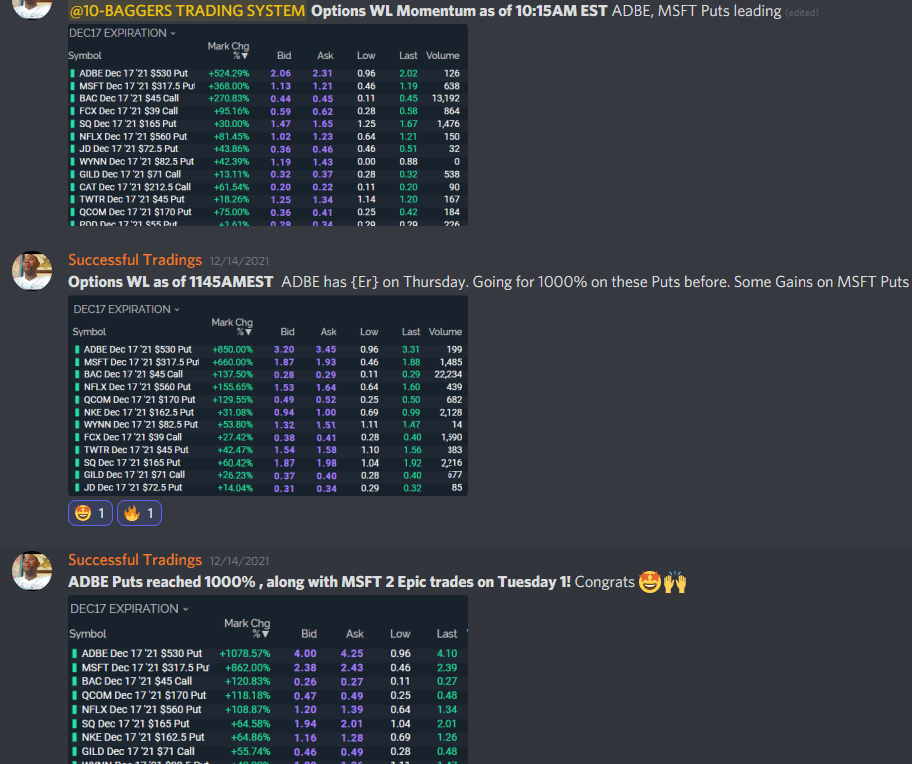

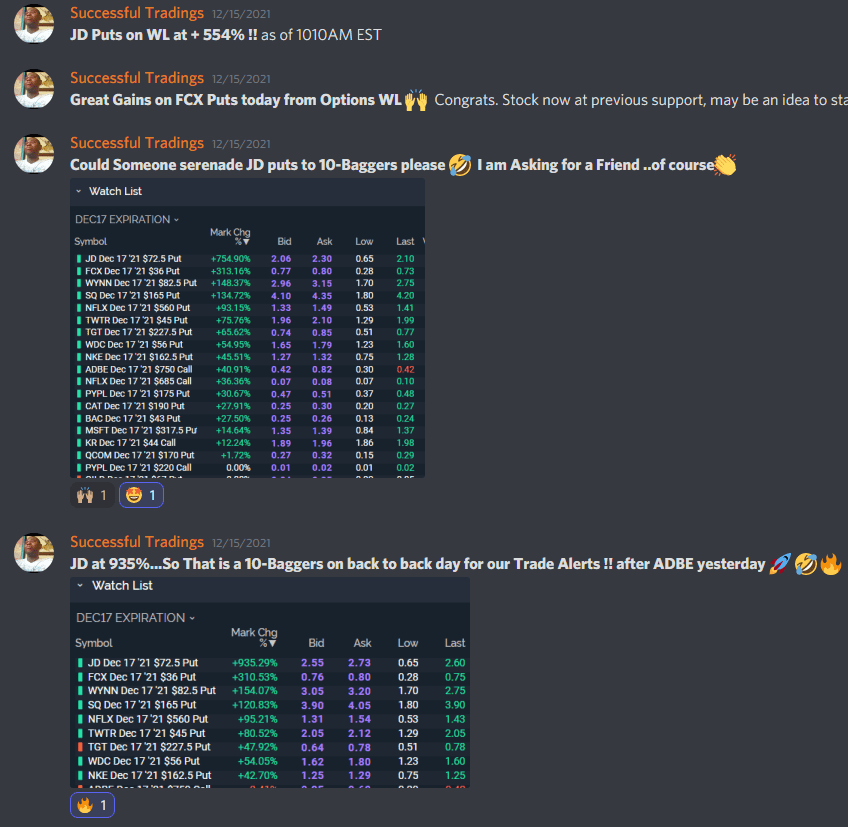

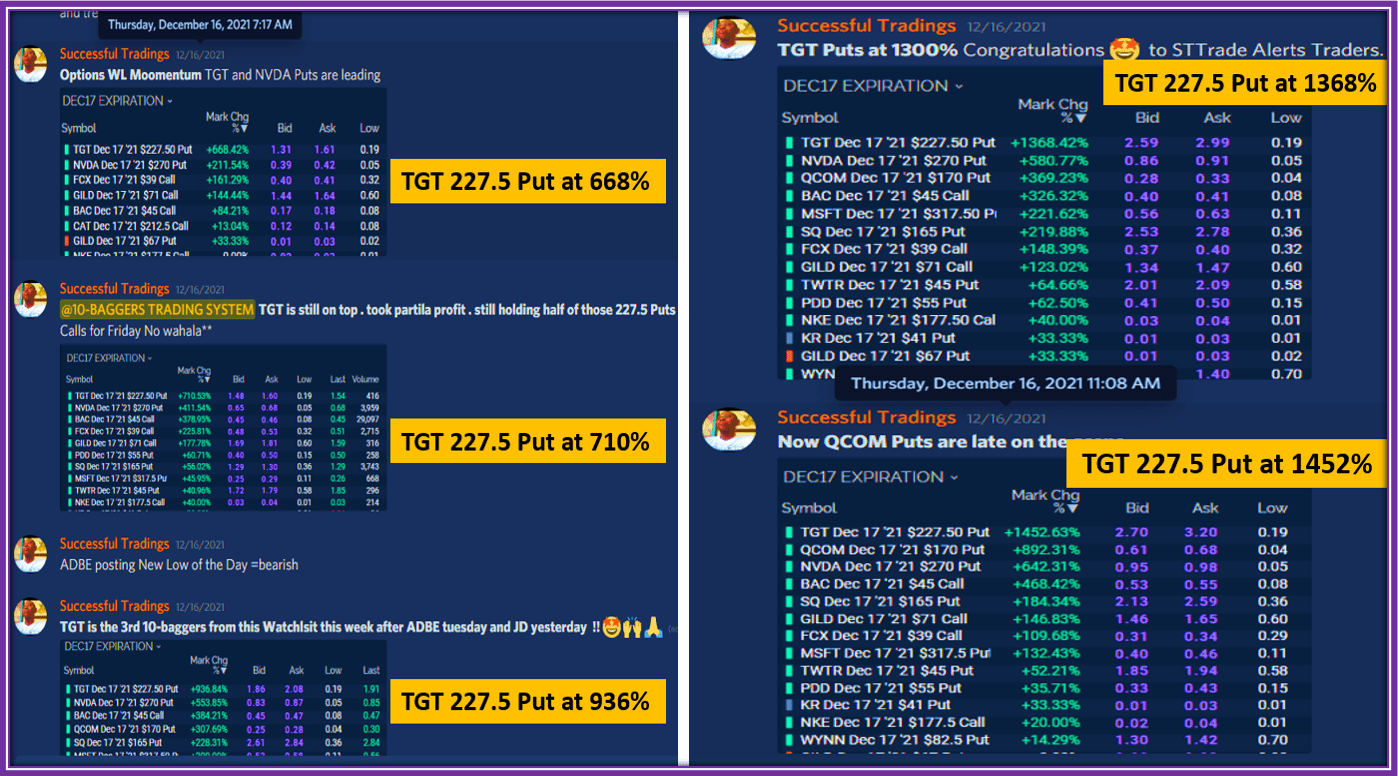

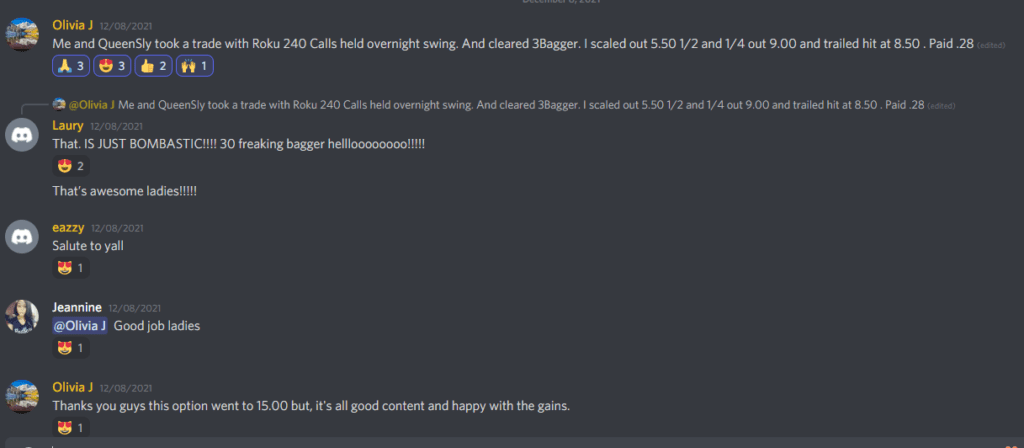

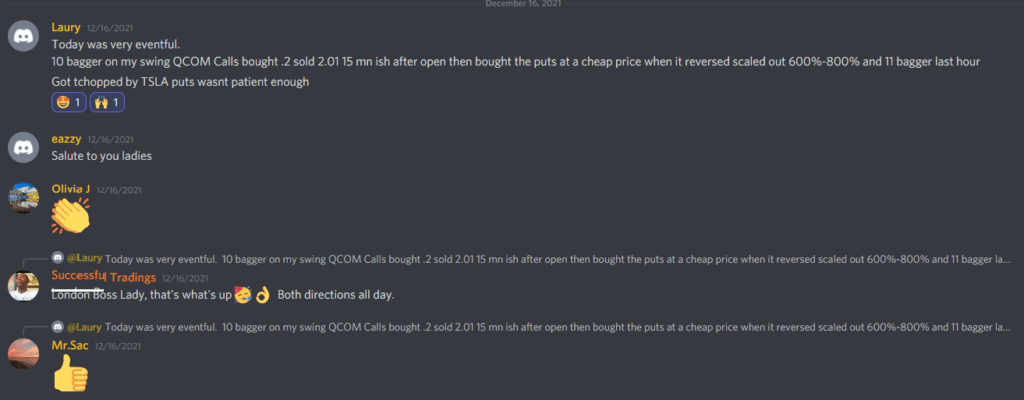

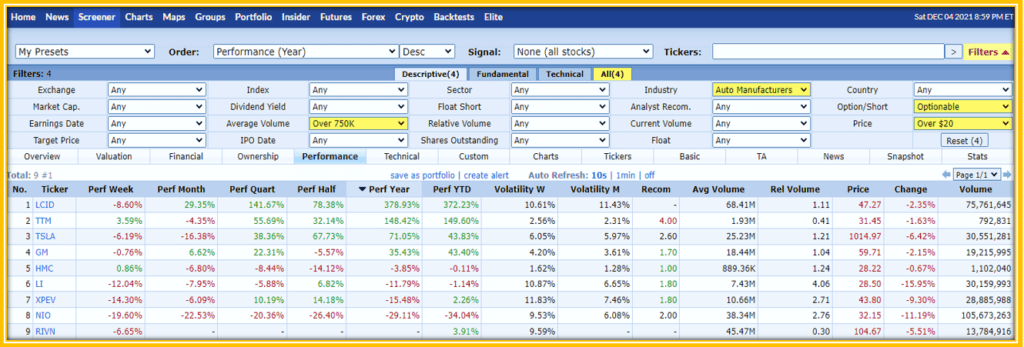

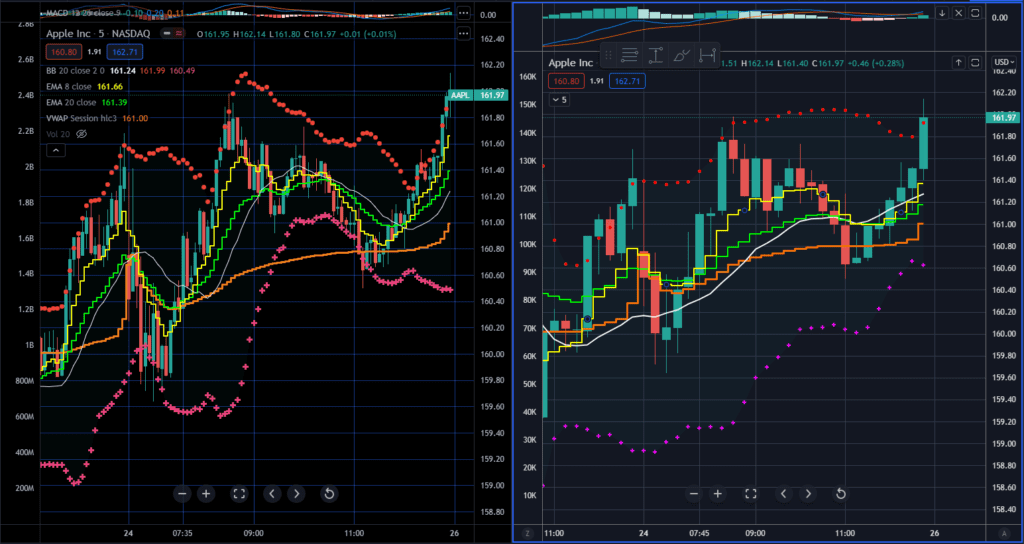

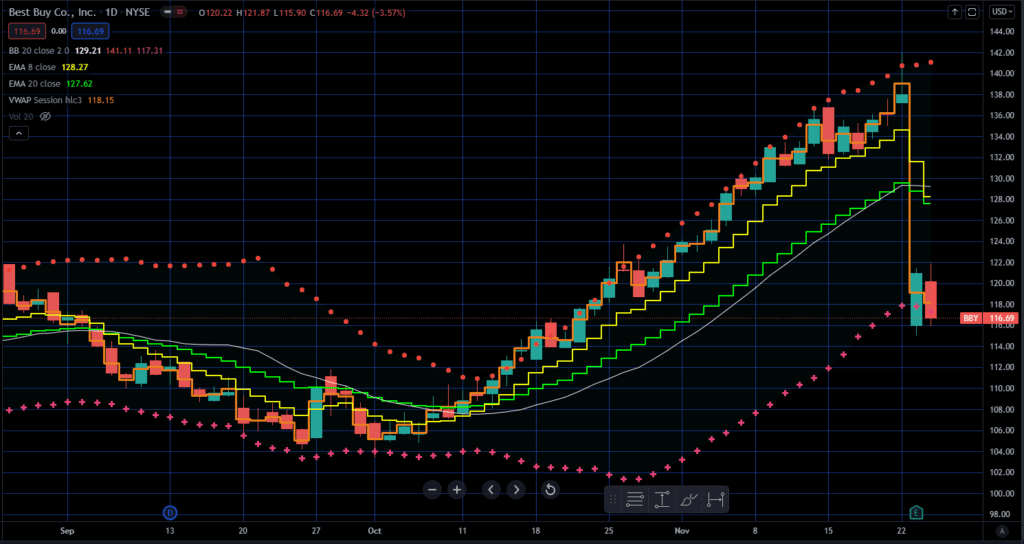

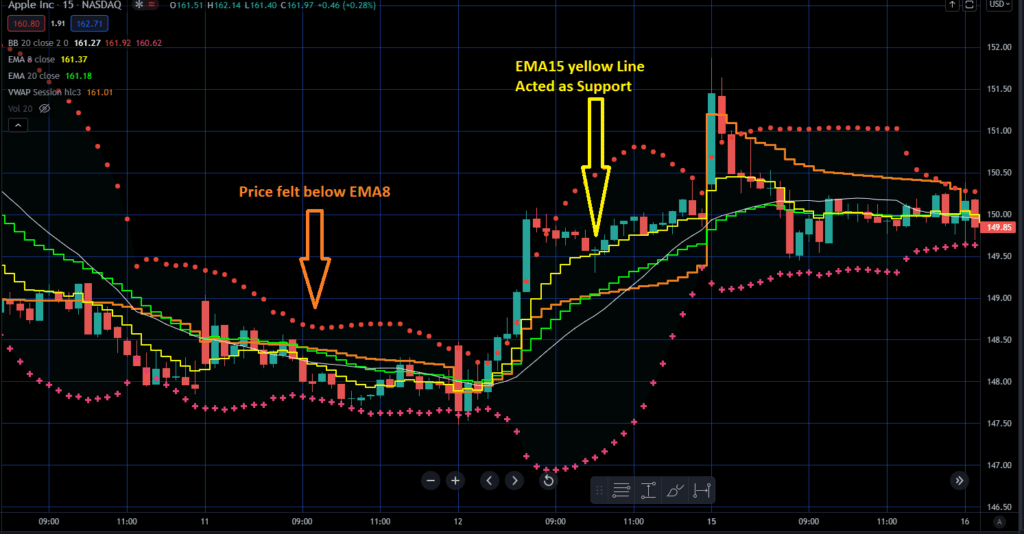

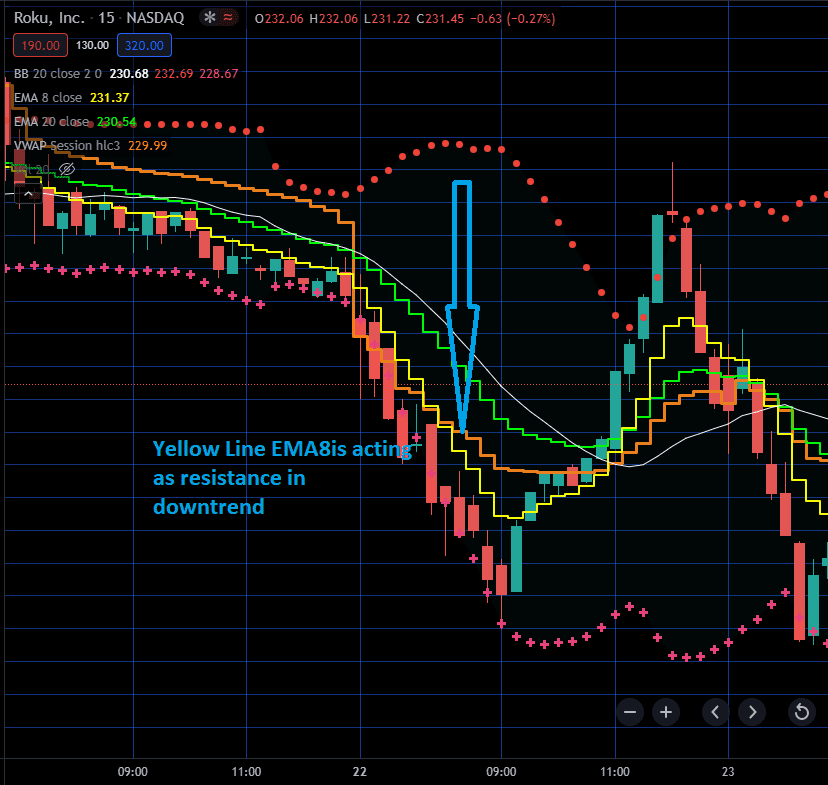

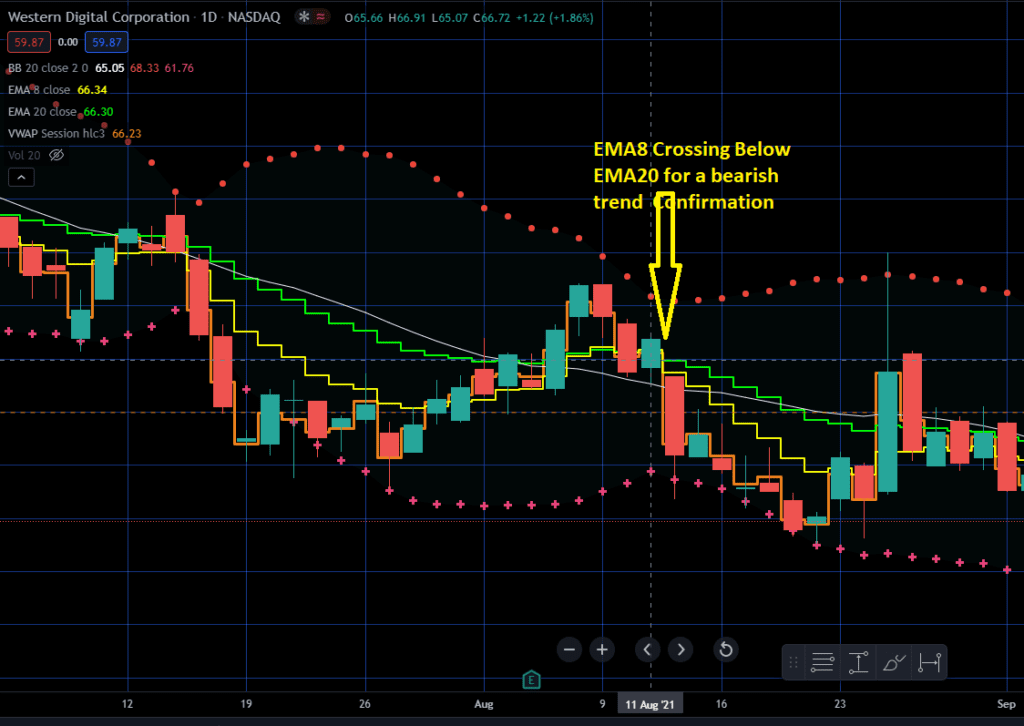

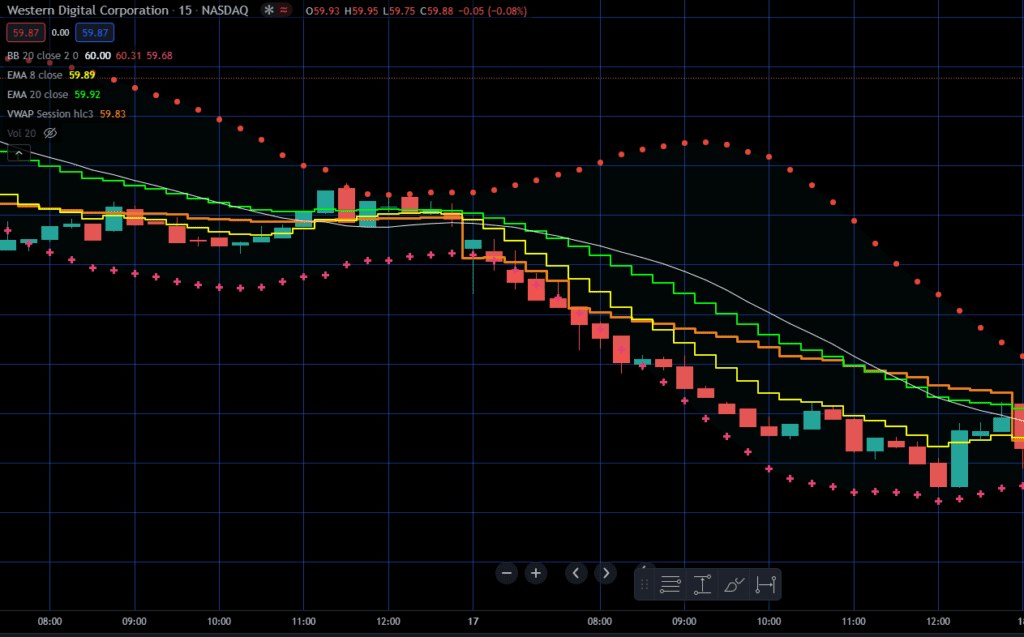

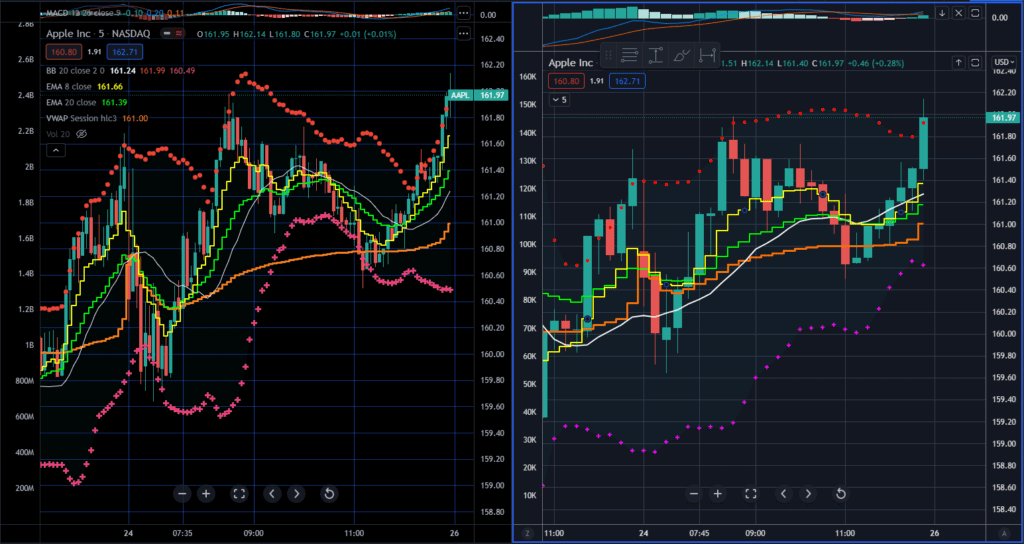

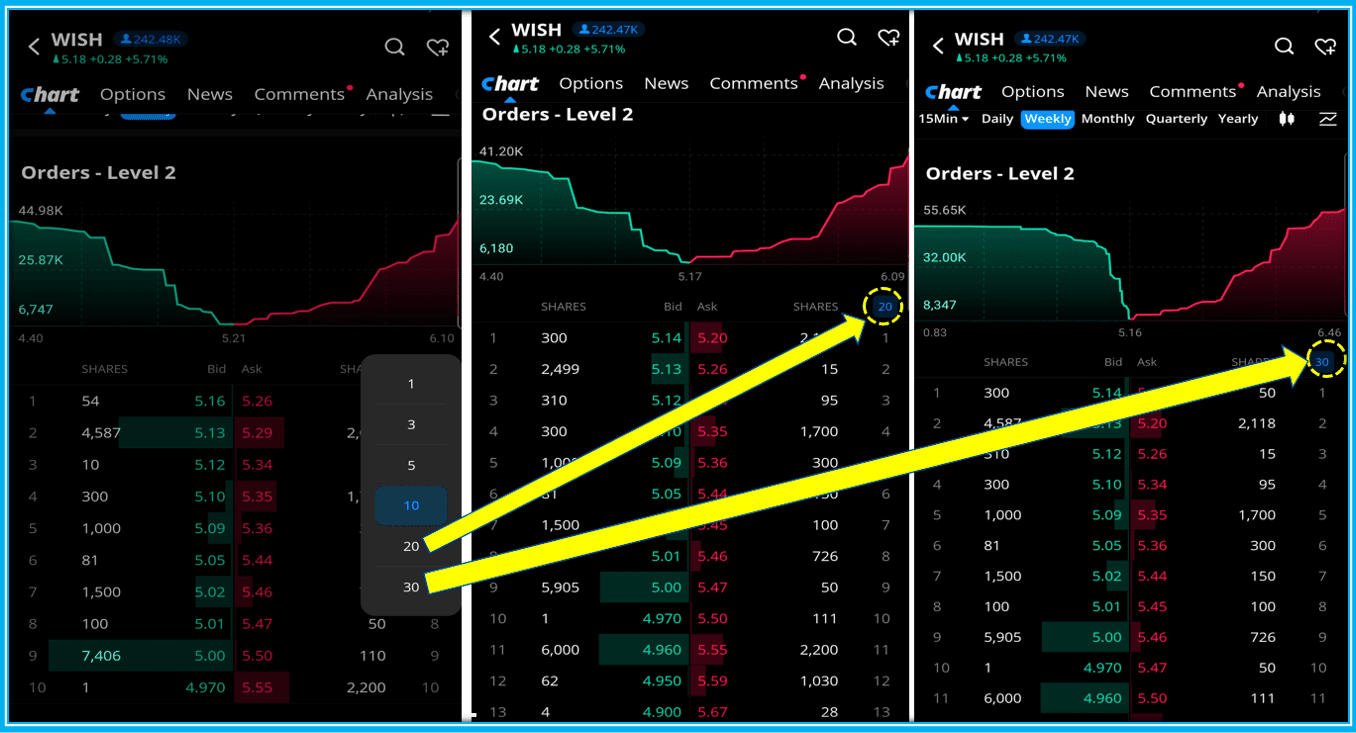

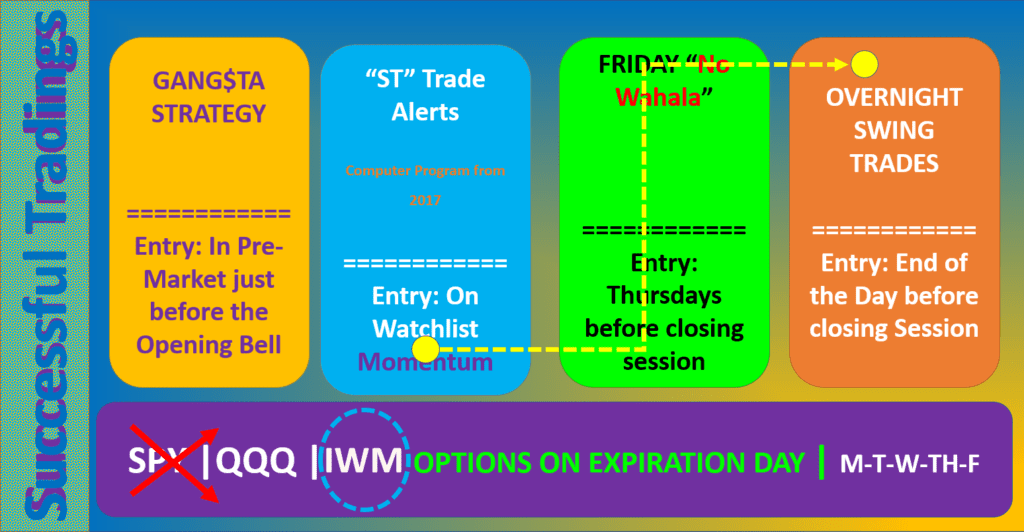

As you may know by now, I coach traders how to Day and swing trade in my Discord room.

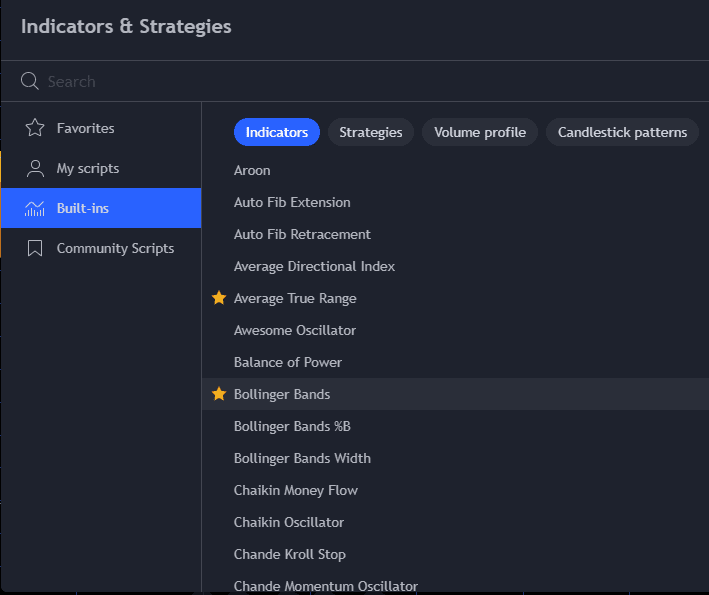

Here is a detailed video on how I use Swing trading to take advantage of momentum that last several days.

You can leverage the knowledge I provide in there to manage your overnight swing trades.

FINAL THOUGHTS ON BEST SWING TRADING BOOKS

If performed strategically, Swing Trading can be an enriching venture.

Whatever knowledge you gather from these books will need to be translated into money.

You can invest practically and learn from real experiences.

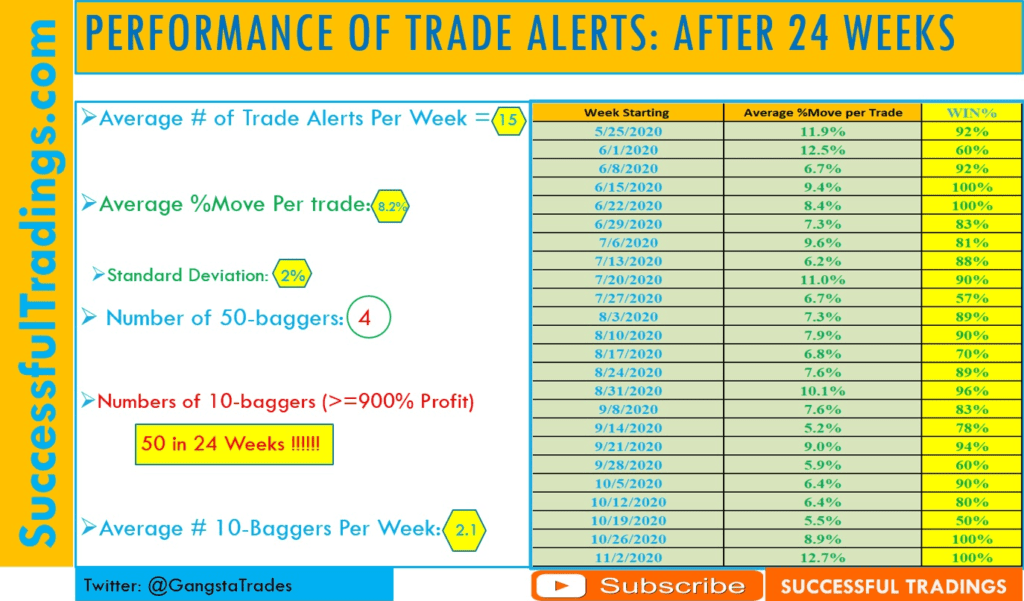

If you are serious about swing trading, I suggest you check out my 10-Baggers Trading System today.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/