If you are looking to diversify or are a beginner who wants to start investing, then mutual funds might be for you.

Morningstar Inc. is a leading independent firm researching the best mutual funds and ETF’s in the market, which we will cover in this Morningstar Investment Review.

The firm solely reviewed mutual funds from its onset but ventured into reports of stocks and bonds.

Trading or investing in mutual funds can be beneficial if you know what you are doing and what suites your needs.

Find out why by reading our Morningstar Investment Review in 2020.

Table of Contents

Morningstar Investment Review: What Is Morningstar

Morningstar Inc. is an institution in researching reports about mutual funds and ETF’s as the data they provide are widely popular with investors and companies alike.

The Motley Fool is an example that religiously employs Morningstar data in their stock-picking newsletters.

It is headquartered in Chicago, Illinois, and has a presence in 27 countries worldwide.

Morningstar introduced the first-star rating in 1985 and is a mathematical measure of the past performance returns against the risk, compared to similar funds.

The firm uses a fundamental analysis which is a method of determining the Fair Value of the fund and the criteria are:

- Process

- People

- Parent

- Performance

- Price

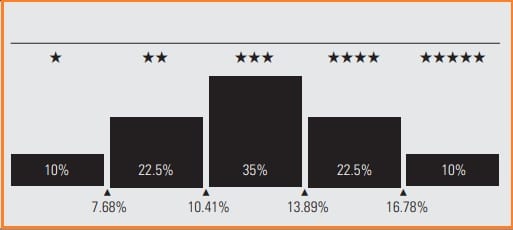

They rate the funds from one to five, five being the best and one the worst, with a period basis of three, five, and ten years and recalculated each month.

The 10% of funds in each category with the highest risk-adjusted return receive 5 stars.

The next 22.5 receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% one star.

| <3 Years of Historical Performance | Not rated |

| =3 Years of Historical Performance | Three-year rating equivalent to the overall star rating |

| +5 Years of Historical Performance | Five-year record amount to 60% overall rating; 40% will be the three-year performance |

| +10 Years of Historical Performance | The overall rating will be weighted of 50% for 10 years, 30% for five-year rating and 20 for a three-year rating |

Morningstar Investment Review: Who Owns Morningstar

Joseph “Joe” Daniel Mansueto is the founder of Morningstar Inc. which he started in his own apartment back in 1984.

He was a stock analyst at Harris Associates when he suddenly thought it was unfair that ordinary people did not have access to the same information as financial professionals or companies.

He then established Morningstar with an aim of empowering investors through delivering high-quality data and building a brighter future for investors.

Under his leadership, the research firm was featured in the press such as the Fortune, The Chicago Tribune, and Crain’s Chicago Business.

In 2010, Morningstar received the AIGA Chicago Chapter Corporate Design Leadership Award, which recognizes revolutionary organizations.

InvestmentNews initiated Mansueto to its list of 20 Icons & Innovators in December 2016.

Joe is also the owner of Major League Soccer club Chicago Fire FC.

How Can You Make Money With Morningstar

Morningstar publishes a newsletter funneling over 7,000 funds to bring you unbiased recommendations of the top 500 mutual funds.

You can use this to your advantage so you know what are the best mutual funds that you can invest into.

For example, if you are planning to invest for your retirement, you can select the mutual fund that fits your budget and needs with the data in the newsletter.

But what exactly is a mutual fund?

A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers, who allocate the fund’s assets and attempt to produce capital gains or income for the fund’s investors. A mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus.

Think of it as a Kickstarter where you contribute your money with other investors into a portfolio that is professionally managed.

You are not buying a share of the fund per se, but are buying the performance of the portfolio.

That is why it is vital to study the performance of the fund, especially the people who are handling your money.

One mutual fund contains over a hundred different securities which give you immense diversification unlike if you invest directly into stock.

The mutual fund pays you the income it generated over a year in the form of distribution which you can receive as it is or reinvest back into the mutual fund.

What You Will Get By Subscribing To Morningstar

Morningstars’ 25 mutual fund analyst and 100 equity analysts research the data, which includes:

FundInvestor500

This contains unvarnished recommendations and monthly performance on the top 500 funds on the market.

Plus access to the fund’s full-page, year-end Analyst Report via their website, mfi.morningstar.com.

Fund Analyst Rating

These are reports that contain a qualitative rating on a fund’s long-term prospects and are prospective recommendations.

The Contrarian

This helps you to discover new mutual funds that are undervalued and are promising.

Which is something good because you ca invest in fund that is still inexpensive but it shows a strong growth within its sector.

Morningstar Features

These are the list of the Morningstar Features:

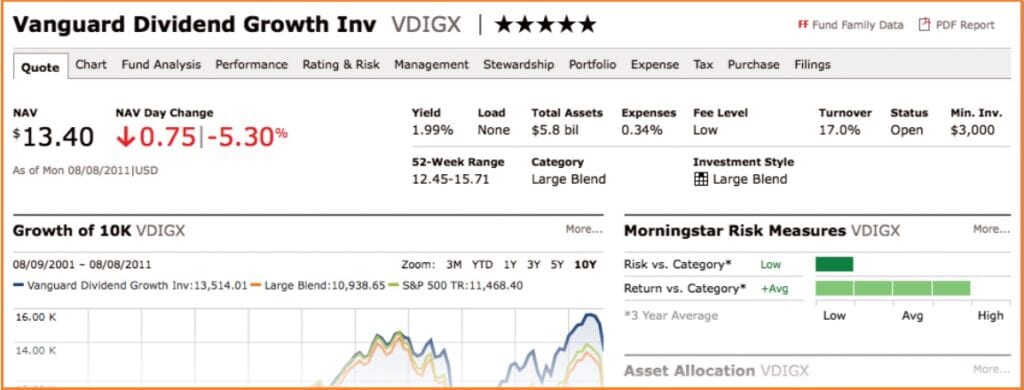

Analyst Reports

This is the key feature of Morningstar, which lessens the difficulty in finding the best mutual fund.

They list every mutual fund with every information that you need to make an informed decision.

The reports compile research from SEC filings, fund manager interviews, and industry peer analysis.

Incorporating proprietary measures like the Morningstar star rating and stewardship grade.

The reports feature interactive growth, price, and rolling returns charts, making it easy to compare funds and add personalized criteria such as benchmarks and moving averages.

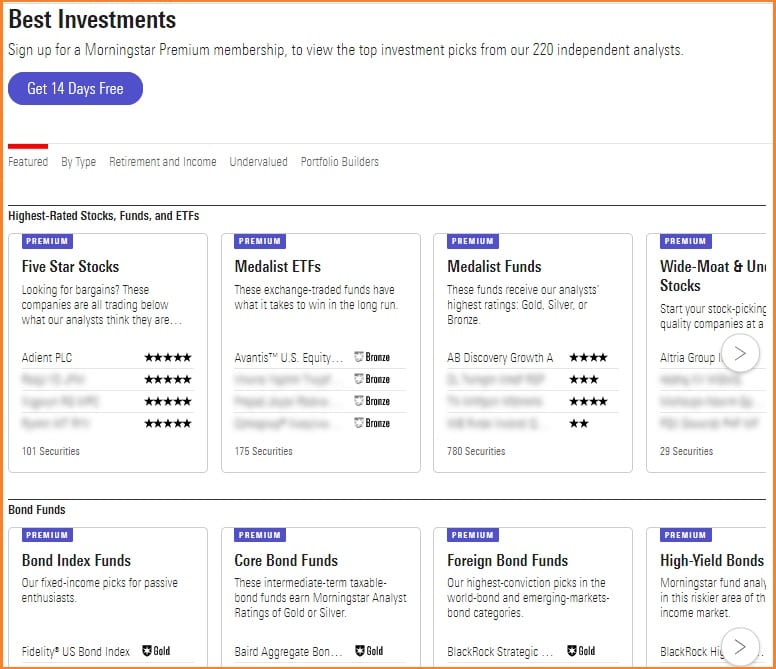

Best Investment

If you want an easier way of finding the best mutual fund to add to your portfolio, this feature lists the best investment ideas sourced from 220 independent analysts.

The categories are the following:

- Five-star Stocks

- ETFs

- Mutual Funds

- High-yield Bonds

- Core bond funds

- Foreign Bond Funds

- US Index Funds

- Foreign Index Funds

- Bond Index Funds

- Inflation Fighters

- Target-date Funds,

- Starter Funds

This feature is useful if you are still a greenhorn in mutual fund investing and do not know what are the criteria that make a great mutual fund.

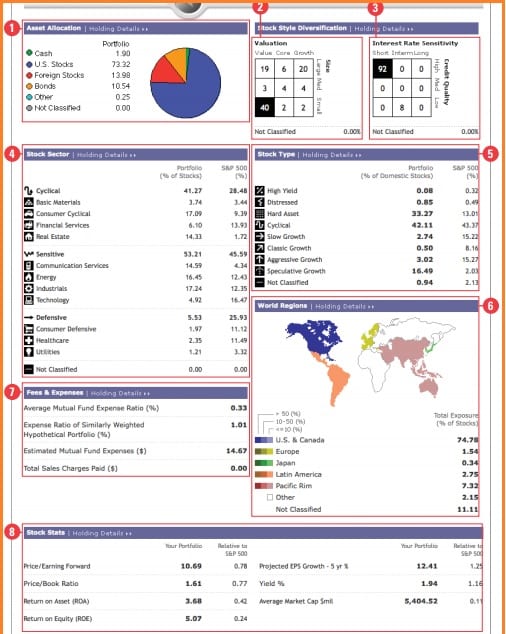

Portfolio Manager

The portfolio manager enables you to keep tabs of your investments, evaluate strategy and also create your own watch list of mutual funds that you are interested.

The components of the portfolio are:

1. Asset Allocation – allows you to easily see how your portfolio is divided amongst cash, stocks, bonds, and other categories.

2. Equity Style Box – shows you how well your investments are spread over nine styles and compares your portfolios to the S&P 500’s distribution.

3. Bond Style Box – x shows you how well your holdings are spread over nine combinations of interest-rate sensitivity and credit quality combinations.

4. Stock Sector – reveals where you are over- and under concentrated in 12 sectors under the headings Cyclical, Sensitive, and Defensive.

5. Stock Type – is a unique classification, ranging from High Yield to Speculative Growth, which helps you better understand if your investments fit your style.

6. World Regions – shows how your holdings are concentrated across five geographical regions. This analysis can surprise many who think they are invested 100% in the U.S.

7. Fee & Expenses – lets you see whether you are over- or underpaying compared with averages for similar portfolios

8. Stock Stats – assigns important ratios to your portfolios, including P/E, P/B, ROA, and more.

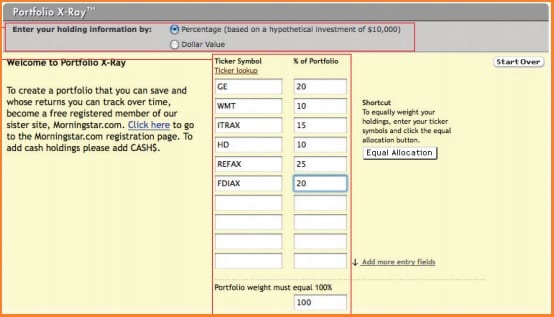

Portfolio X-Ray

This is a feature that allows you to view your portfolios and evaluate your asset allocation as well as sector weightings.

It will help you pinpoint if you are investing heavily in a specific sector and will help you in diversifying your portfolio by avoiding duplication.

While the tool and the resulting analysis are quite sophisticated, Morningstar’s graphical representation of results is easy for even novice investors to understand.

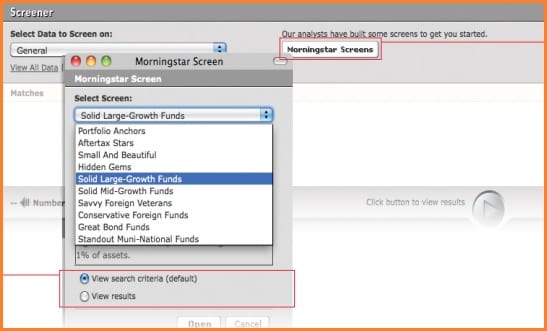

Screeners

Morningstars’ Screeners allow you to create shortlists of investments in mutual funds, stocks, and ETFs which you can use to find investments that meet your personal criteria.

For instance, you may want a shortlist of large-cap growth funds with a star rating of 4 or better, or stocks with low debt in the utility industry.

You can select from over 220 data points within Morningstar’s Fund Screener to build this list.

The pre-set screeners are developed and used by Morningstar analyst and there is enough variety to satisfy the investing style and goals of most investors.

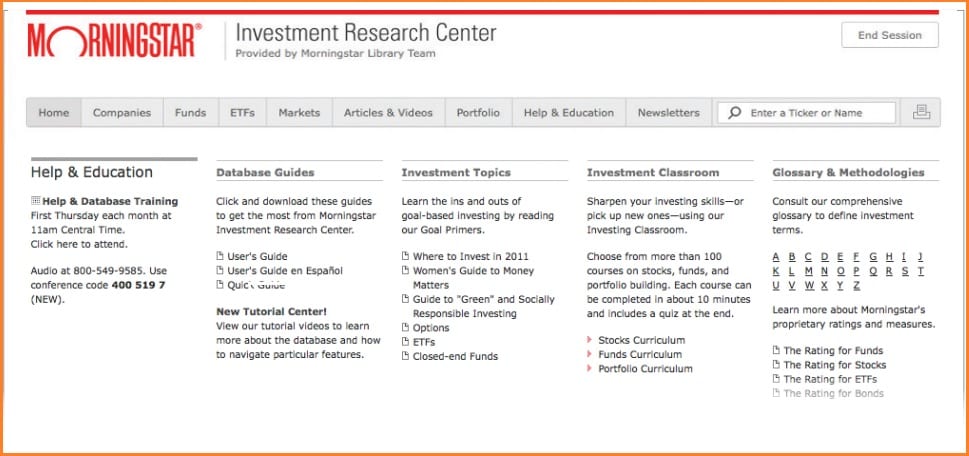

Help And Education Center

As with any reputable investment service, having a reliable source where you can effortlessly enrich your investment knowledge is something I always look forward to.

Whether you are looking for direction when using the site, tips for choosing funds or stocks, or the definition of an investment term, you’ll find it all here.

The components of the Help and Education Center are:

- Database Guides – provides access to the User’s Guide in English and in Spanish, Tutorial Center that includes a number of videos to help you navigate the Morningstar Investment Research Center.

- Investment Topics – features longer articles on a rotating set of topics, including in-depth explanations of different investment types and retirement planning.

- Investment Classroom – offers over 100 courses on stocks, funds, and portfolio building. With lessons that can be completed in about 10 minutes, you can learn at your own pace.

- Glossary and Methodologies – will help you better understand investment terms, as well as explain the logic behind Morningstar’s proprietary ratings and measures.

What People Say About Morningstar Investment

These are a few examples of peoples feedbacks with their experience with Morningstar:

I appreciate receiving a regular, levelheaded approach to the numerous funds that are now being offered. This fund analysis is the only one I use because it is objective, warns me of problems, and promotes consistency over drama.

Dr. Albert Miller, Highland Park, IL

In a world where people think they can Google their way into riches for free, the Morningstar service is relatively expensive. However, when you see them quoted in the news for free, it’s worth something.

I have subscribed to the Morningstar website for over 20 years and it has become my “go to” source of stock and fund research information.

Reliable, credible, well respected – it’s much more than a headline scraper.

The web page is a little clunky, but I’ve seen worse.

As for the “star ratings” specifically, I take them with a grain of salt, just as I do with all financial analysis services and headlines. It does seem to be more accurate at identifying the losers (1 star) than 5-starring your way into millions.

Scott Berg City Councilman 9/24/2018

Morningstar’s rating systems are reliable and, very important, unbiased.

Their famous star rating is in fact relatively straight-forward. Using specific metrics, Morningstar creates peer groups and then assigns the stars according to each fund’s performance against its peers. The star rating looks back at the performance.

Interestingly, Morningstar also has a system created in an attempt to guide investors as they look for outstanding fund managers and funds. As Morningstar focuses on the quality of both management and performance, it looks to single out those who would be able to replicate the good and consistent performance in the future.

Eduardo Levy 7/2/2016

I have tried to cancel my premium membership for two years now. The email that was given to do so was ignored and I continue to be charged. As a premium member, you cannot cancel your membership while on-line. You also are unable to remove your credit card details. This type of service is deceptive, which means fraudulent and unacceptable. Morningstar owes me credits for both 2018 and 2019.

MelindaW 02/24/2019

Their premium subscription is virtually uncancellable. There is no practical way to cancel it. They intentionally do not you allow to cancel it via any other means than with a phone call. When calling the line, they claim “high call volume” and say they will call you back. Shockingly, they do not rush to call you back, if at all. One thing I recommend is to call their line, select 2 for a technical problem, and then tell the representative you want to cancel your account. They will transfer you to the now-available billing department. They will now offer you discounts to keep your subscription instead of canceling completely. Like a cable company, making my subscription difficult to cancel and only offering discounts when I threaten to cancel, you’re confirming that your customer experience is intentionally terrible and over-priced.

CT 01/22/2018

What Is An Alternative To Morningstar

The main competitor of Morningstar when it comes to recommending mutual fund is Zack Investment Research.

The main difference is that Morningstar uses fundamental analysis, while Zacks is much more quantitative in nature.

Morningstar recommends on an unbiased scale, while the Zacks rating system is based solely on giving its members the most potential for profit.

What I Like About Morningstar And What Makes It Stand Out

Morningstar has a solid company record of 36 years in researching financial data and as such, it is a veritable source of mutual funds that you can add to your portfolio.

It provides analyst-backed ratings that are unvarnished and are constantly updated to reflect the effect of what is happening in the market relative to the mutual fund.

Adding the fact that it has an extensive educational feature which will help you understand the intricacies of investing in mutual funds.

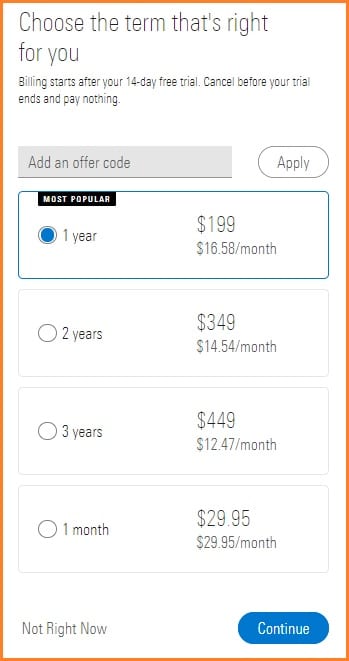

Morningstar Investment Cost

Morningstar offers a 14-day trial period, which you can use to see if the service can provide what you need.

After the trial period, you can choose between a monthly fee of $29.95 or an annual plan of $199.

Morningstar Refund Policy

If you cancel your subscription during your free trial period, you will not be responsible for the payment of a subscription fee. However, except as otherwise provided herein, if you cancel your Premium Service subscription at any time after your trial period expires, your subscription to the Premium Service will continue in effect until the next monthly anniversary of the effective date of your paid subscription. (For example, if your paid Premium Service subscription start date is on January 1 and you cancel it on June 15, your Premium Service subscription remains in effect until July 1, at which time it ends.) For those with yearly or multi-year subscriptions, any remaining prepaid charges will be refunded, prorated on a monthly basis, to your credit card after your Premium Service subscription ends.

As taken from their website

PROS AND CONS

These are the list of the Pros and Cons of Morningstar

Pros

- Morningstar is regarded as the leading independent financial research for funds in the industry

- The analysts’ ratings are unbiased which cover a wide topic of securities

- The ratings are consistently updated monthly which means the changes in the market are reflected in the reports

- Access to a wealth of educational materials for trouble-free learning of topics such as mutual funds and ETF’s

Cons

- Investors who want to prefer to look at charts will not find it particularly useful

- The customer service can be a hit or miss

- Clunky platform and does not offer constant platform upgrades

Final Thoughts: Is Their Star Rating Reliable?

Based on this Morningstar Investment Review, Morningstar is best for those who are looking to diversify their portfolio by investing in mutual funds.

Or those who are beginner investors who want a professionally managed portfolio.

For 36 years, Morningstar has continuously provided reliable data and is widely used by prestigious stock companies such as The Motley Fool and even by FINRA’s mutual fund analyzer.

We can safely assume that you can use the data they present as a well-founded source where you can use to analyze a fund before you decide to invest in it.

As Morningstar itself suggests to the investors to only use the rating system as a way of assessing a fund’s track record compared to their peers.

We also have covered Morningstar Stock Investor Review! Go check it out now!

We would love to hear what you think! Comment down below!

Morningstar Investment

$199Pros

- Morningstar is regarded as the leading independent financial research for funds in the industry

- The analysts' ratings are unbiased which cover a wide topic of securities

- The ratings are consistently updated monthly which means the changes in the market are reflected in the reports

- Access to a wealth of educational materials for trouble-free learning of topics such as mutual funds and ETF’s

Cons

- Investors who want to prefer to look at charts will not find it particularly useful

- The customer service can be a hit or miss

- Clunky platform and does not offer constant platform upgrades