Choosing an option strike price is one of the most important aspects of trading options.

Often traders over think this activity on how to choose the strike price of a position they want to trade.

In this tutorial, you will learn step-by-step what is a strike price, how to easily decide the strike price and get a free strike price calculator so that you can gauge all the nuances of strike price in options trading.

How To Choose a Strike Price in Options Trading | Definition

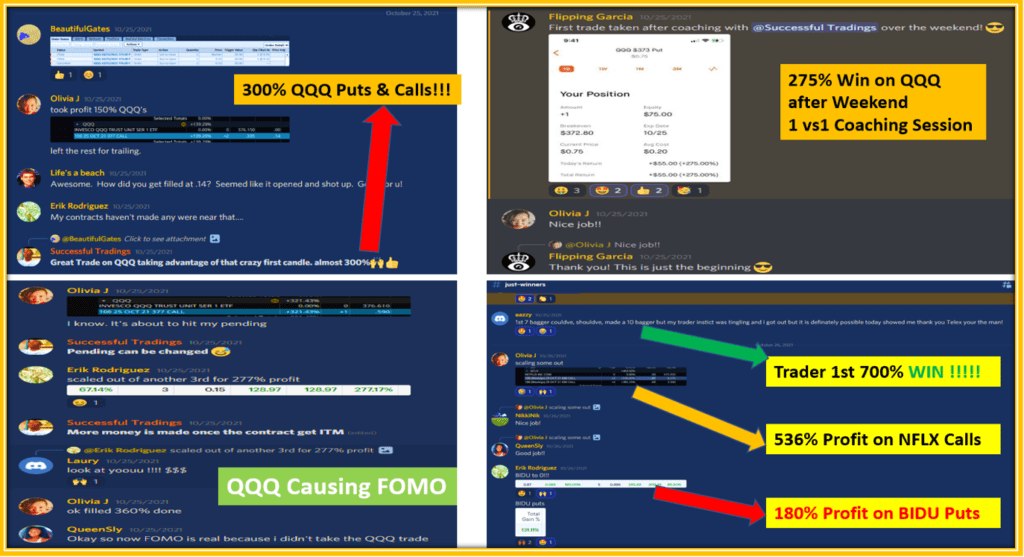

I have been coaching options traders for several years now.

One of the common confusions is when we start the discussion on strike prices.

Let’s take a look at the meaning of a strike price in options trading.

What is a Strike Price in Options Trading?

A strike price in options trading is a price you as a trader thinks the stock price will get to within your options expiration trading window.

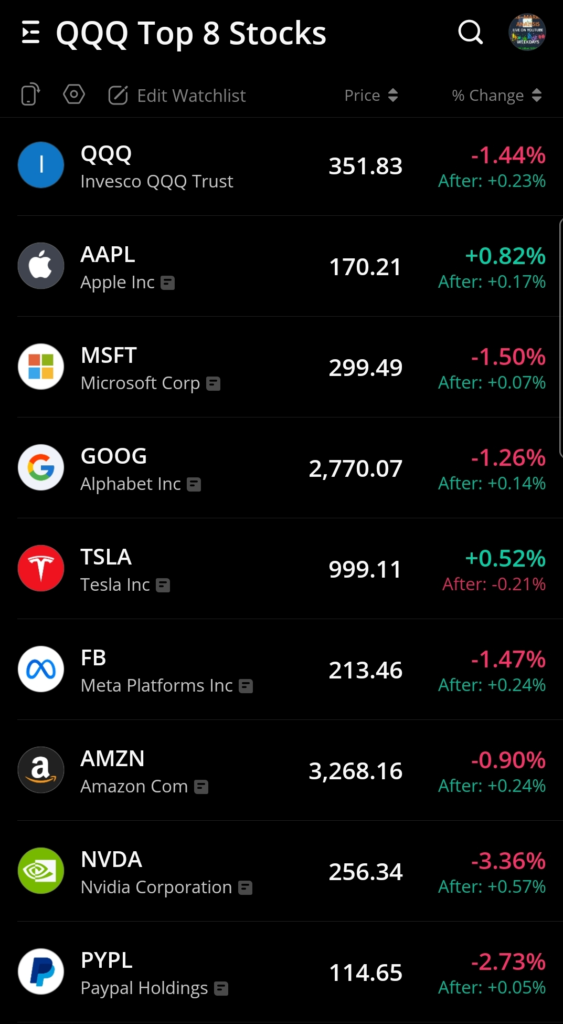

Suppose you are bullish on AAPL stock.

Let’s assume the current price of AAPL is $145 (that is actually AAPL real price as of this writing).

Then after you decide on your Expiration date, you can choose any strike price you want on the AAPL option chain.

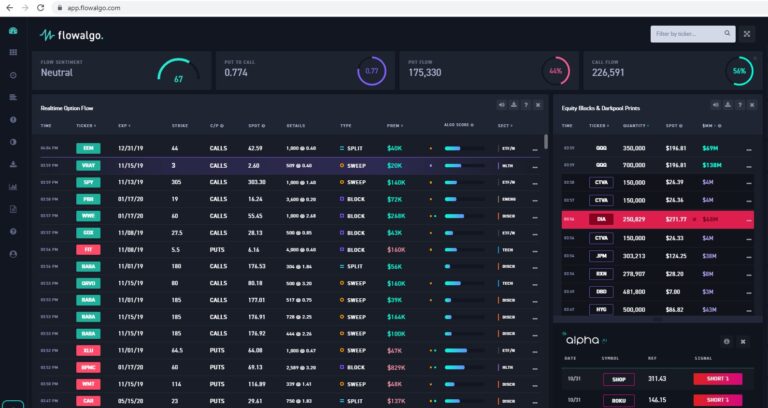

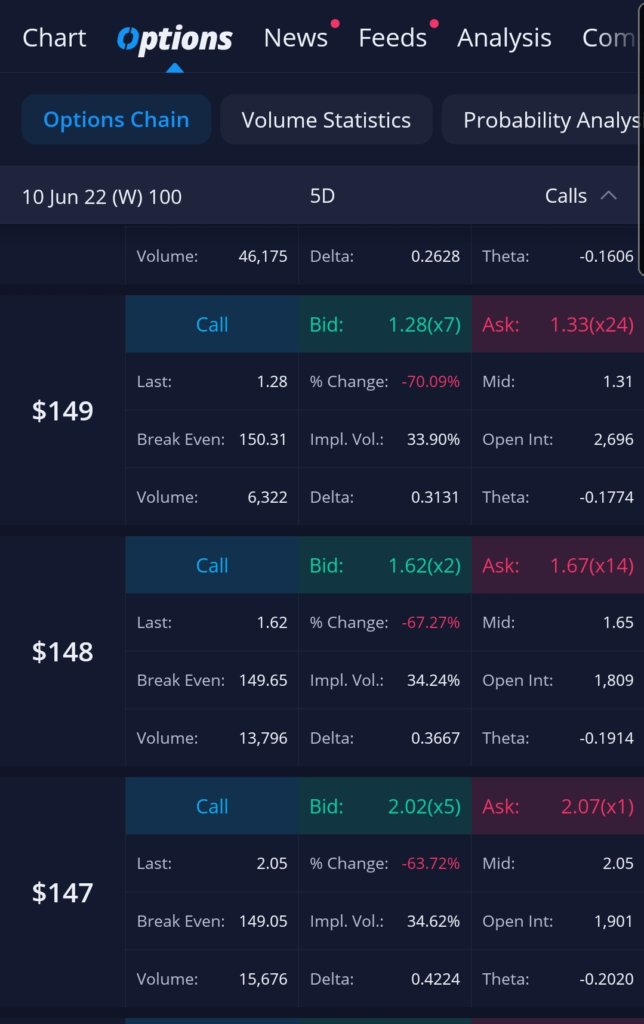

Below is an example of Option Chain for AAPL stock for June10 Expiration.

Stock Price vs Stock Option Strike Price

The first nuance options traders’ beginners need to gather is that the strike price is not the stock price.

One easy way to remember this concept is to think of the strike price as a fixed value which price varies as the stock price (known as the underlying) is moving.

In our previous example, if you select the 149 strike price for June10 expiration, you will stick with that strike price until you decide to close the position.

What will vary is the price of that strike price from your initial buy price which in our case is set around $1.29.

Strike Price vs Exercise Price

The exercise price of an option is in fact the strike price for that contract assuming the stock price is greater (for call options) or lower (for puts options) at the time of the exercise.

If you are holding the AAPL 149 calls and the stock is trading at 149.5 before or on June 10, you can decide to exercise your option which means you will be buy shares of AAPL at exactly $149.

Most traders will simply close the $149 call by selling the contract and cashing in the profit.

That is how most traders make money trading stock options.

How To Determine the Strike Price

Now that we have a good understanding of what an option strike price is and what it is not, let’s further provide key characteristics of strike price as they will help in deciding how to choose the strike price.

Strike Price in the money

Two categories need to be considered to explain the “In the Money Concept”.

For calls, a strike price in the money is a value that is lower than the current stock price.

Example, the AAPL 140 calls are $5 In the money because 140 is $5 higher than the current $145 AAPL stock price.

Conversely, for Puts, the AAPL 149 Puts are $4 In the Money because 149 is $4 higher than the current price of AAPL stock.

The main takeaway here is that the deeper IN the Money and Option strike price is, the more expensive the corresponding contract will be.

This means that for the same expiration date, the AAPL 140 calls will be more expensive than the AAPL 142 calls.

And this is true with both of them being “In the money” respectively by $5 and $3.

Strike price out of the money

Strike price out of the Money are the symmetrical opposite of the In the money strike price.

Some options trading platforms such as E*TRADE often shade In the Money vs Out of the Money strike prices in different colors.

For Calls, if the strike price is higher than the current stock price, that strike price is considered Out of the Money.

You may have guessed the next insights already.

The further out of the money a strike price is, the cheaper is the cost of that option contract for a given expiration day of course.

What Is a Good Strike Price?

Choosing a good strike price is achieving the perfect balance between the cost of the option contract of that strike price and the probability of making money trading that strike price.

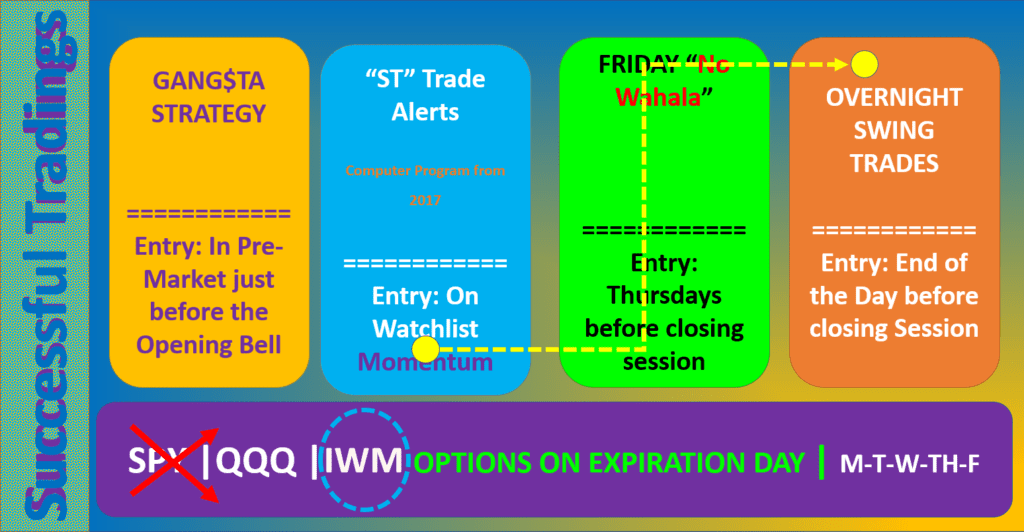

That is exactly what my methodology of choosing an option strike price is all about.

On one hand we do not want to Spend too much Money (this is the Risk side) for that contract.

Whereas on the other hand, we need to be mindful about the probability of that trade being successful.

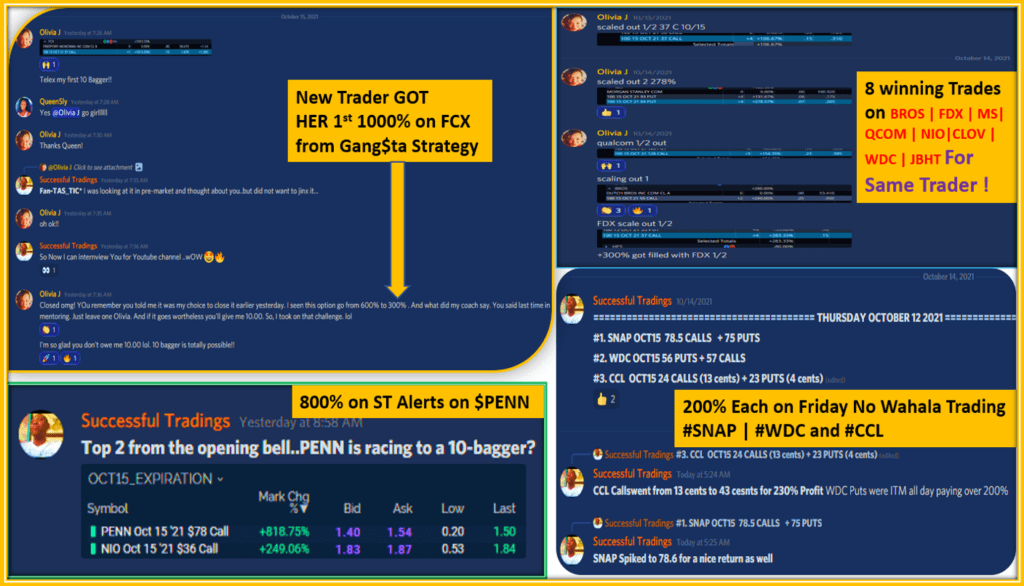

In need to add a very big myth options traders carry out there.

You do not need to be “In the Money” to make (big) Money.

In fact, the majority of my strategies are “Out of the Money” strategies but with a very high probability of being successfully profitable.

What Happens when the stock hits the Strike Price?

May traders have asked me why not just buy Out of the Money strike price ?

Since they are cheaper than the In the Money ones?

The Answer is quite simple.

When the stock hits the strike price and start getting In the money, the profit you make as a trader become much bigger.

This means that you have a higher probability of getting a winning trader when you trade In the money strike price.

The trade-off is that they are more expensive and may not be affordable for many options traders.

However, I want to caution you about the myth that all In the Money Strike price will be profitable.

That is simply not true because what if you buy deep in the money strike price for calls and the stock starts going down.

Well, you will lose a lot more money that someone who risked a smaller amount buy buying out of the money contracts.

In fact, here is an easy table to illustrate how much a $1 move impact the option contract when it gets in the money.

| at the Money | $1 In the Money | $2 In the Money | $3 In the Money | |

| Increase in Option Contract Price | 55 -60 cents | 65-70 cents | 75-80cents | 85-90 cents |

How The Strike Price is Calculated

With all the insights we have unveiled about options strike price, here is a very practical way you can go about determining the strike price for your options.

How to choose a strike price for Call Options

For both calls and puts, I have this simple methodology to reach a nice trade-ff between cost and probability of success in your options trading.

How to choose a strike price for Put Options

You will apply the instructions described in my simple video below and follow along with the free Excel Strike price Calculator.

My Free Options Strike Price Calculator

In order to help options traders, I have a developed a quick method to calculate the strike price for any stock.

It is an Excel spreadsheet calculator you can download and easily use to improve your strike price selection going forward.

Strike Price Calculator Methodology

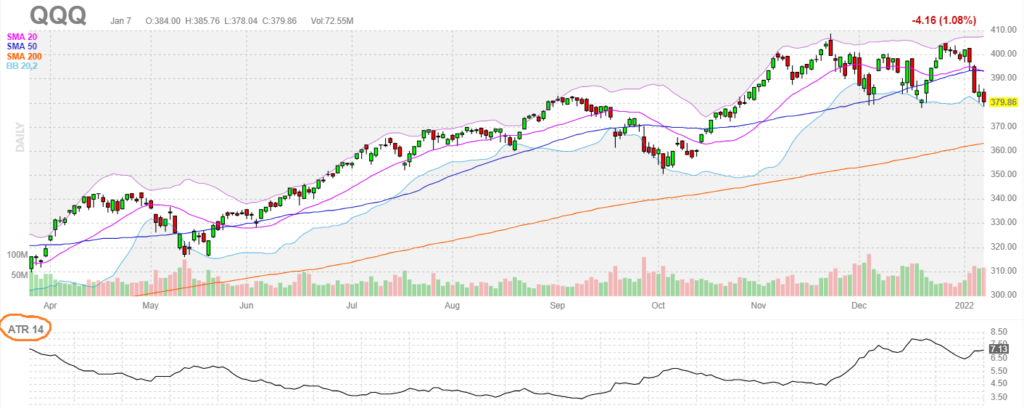

My simple strike price calculator uses a basic options trading indicator: the average true range.

How to calculate the average true range article and video below gives you further insights on the accuracy of this technique.

It really works well because you are using a high probability metric to increase your chance of success without overpaying for the options contracts.

FINAL THOUGHTS: How to Choose an Option Strike Price

I shared how you can easily choose a strike price based your Risk level tolerance and available capital to invest.

An Easy free Excel Strike price Calculator is available for download.

You can quickly determine your options strike price for any stock you are trading using a very simple indicator the average true range (ATR).

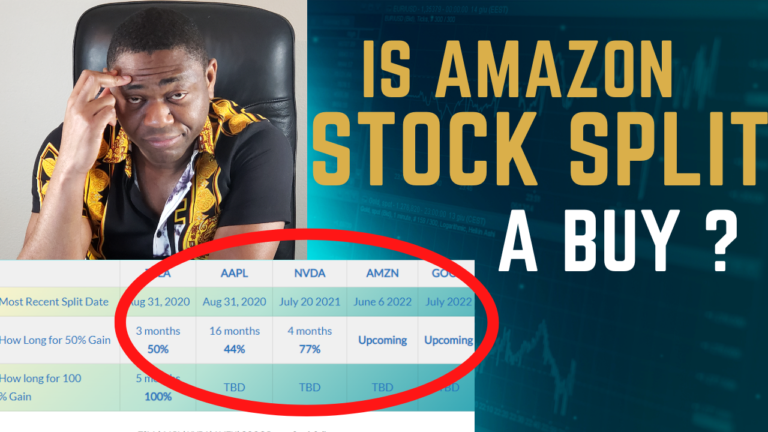

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

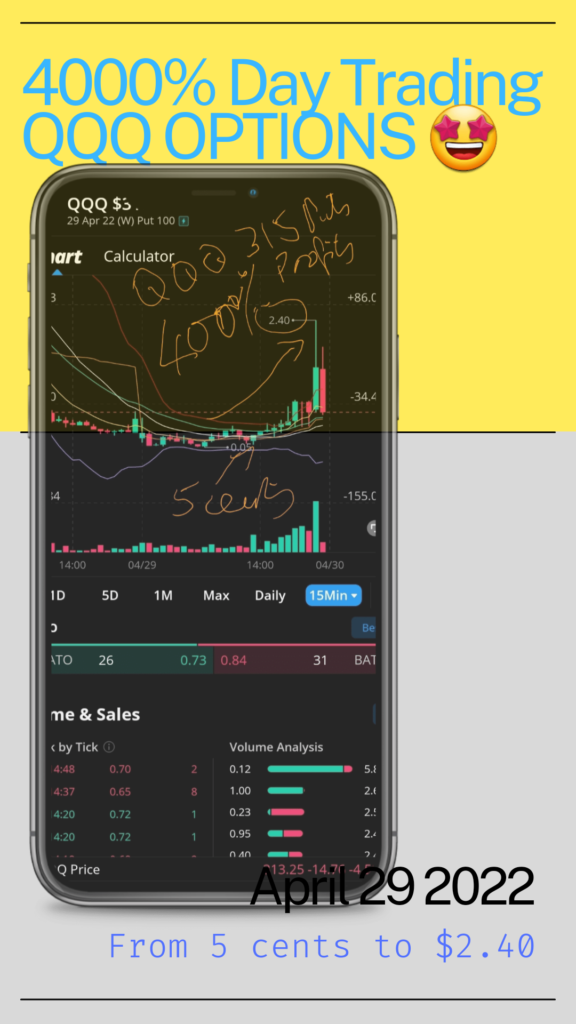

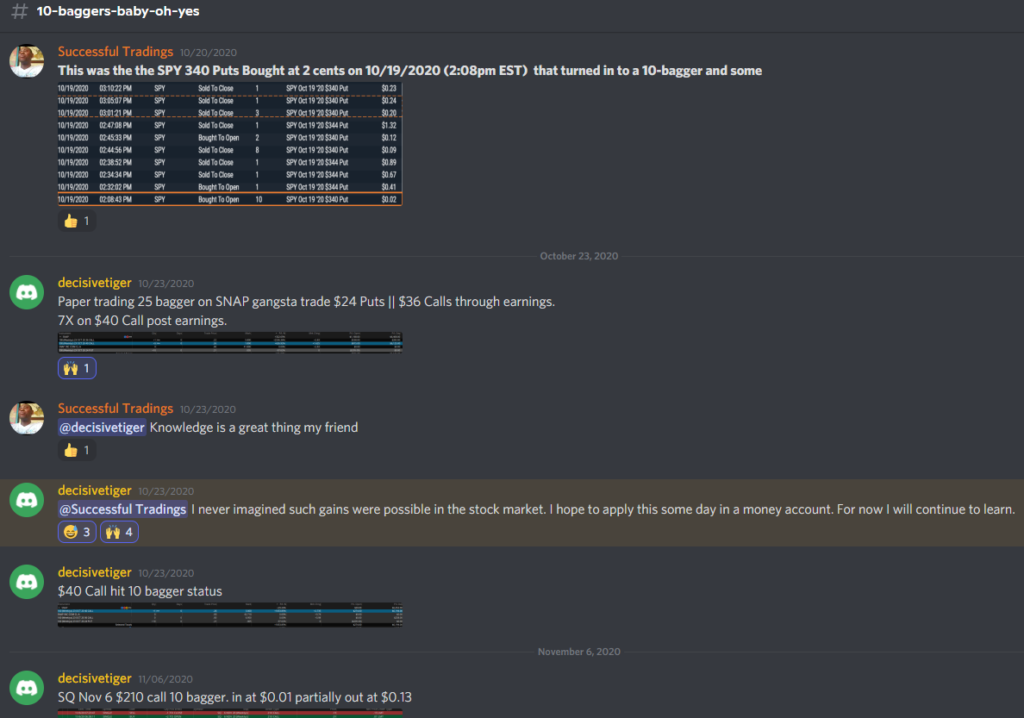

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/