Upon learning that Morningstar Inc. is now offering reports centered on stocks, we were curious about how the hare and tortoise strategies work.

So what exactly are these strategies and how can you benefit from them are exactly the questions we are going to find out in this Morningstar Stock Investor Review.

Morningstar Inc. has then ventured into providing reports for stocks, which according to their website is beating S&P 500.

Hare and Tortoise? Isn’t that the animals from the story where the tortoise triumphed over the hare because of diligence and what is its connection with stocks?

Find out by reading our Morningstar Stock Investor Review below.

Table of Contents

Morningstar Stock Investor Review: What Is The Morningstar StockInvestor

StockInvestor newsletter is about the activities of the portfolios of Morningstar which utilizes the Tortoise and Hare strategies,

The monthly issue encompasses commentary on current events relevant to a wide-moat investing strategy and data, statistics, and research published by the analysts.

An economic moat, coined by Warren Buffet, is a distinct advantage a company has over its competitors, which allows it to protect its market share and profitability. It is often an advantage difficult to mimic or duplicate (brand identity, patents) and thus creates an effective barrier against competition from other firms.

As taken from Investopedia

Including an in-depth article on companies, a roundup of significant news events and earning reports plus a watch list of stocks that might fit with the portfolios’ investment mandates.

What Are The Tortoise and Hare Strategies

These strategies focus on investing in companies that are high quality but are trading at a discount.

The Tortoise

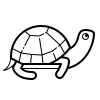

This strategy targets top-tier businesses that have both durable competitive advantages and strong balance sheets.

These companies usually are already well-established in their respective industries and have limited growth.

The Hare

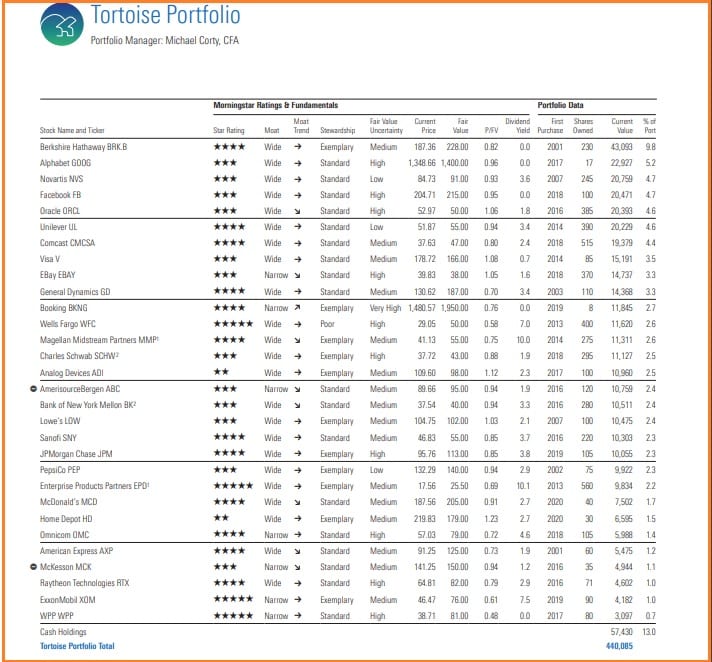

This strategy invests in companies that tend to be faster-growing, with both higher risk and higher return potential.

Both portfolios aim to outperform S&P 500 over a full market cycle.

What are the Tortoise and Hare Portfolio

The Tortoise and Hare are investable portfolios patterned after the model portfolios of the same names featured in StockInvestor.

The portfolios are not mutual funds or exchange-traded funds but are separately managed accounts.

As we learned in our Morningstar Investment Reviews, you do not own a mutual fund but instead the performance of that specific fund.

The main difference between the two is that if you invest in one of the portfolios, you own the individual securities unlike in the mutual fund.

That structure offers a tax advantage which is no unrealized capital gains at inception, and unlike ETFs, also allows for greater customization for the client.

Who Are Managing The Tortoise and Hare Portfolios

Morningstar Investment Services, a registered investment advisor and a wholly-owned subsidiary of Morningstar, manages the Tortoise and Hare portfolios.

That is based on the research of Morningstar equity strategists Paul Larson and Josh Peters.

The current portfolio manager is Michael Corty, CFA.

MIS manages about $4 billion across various mutual funds, exchange-traded funds, and separately managed stock portfolios.

Who Is The Current Editor Of The StockInvestor

David Harrell is the current Editorial Director of the Morningstar StockInvestor.

Throughout his career at Morningstar, Inc., he has implemented novel ways to better communicate complex investment ideas and data.

A few examples are the Morningstar Style Universe, ClearFuture, Portfolio Stack, and the Performance Clock.

StockInvestor Newsletter Feature

These are the list of the features inside the StockInvestor Newsletter:

Tortoise and Hare Portfolio

The goal of the Tortoise, as mentioned earlier, is to seek long-term capital appreciation by investing in select common stocks of undervalued companies with durable competitive advantages and strong balance sheets.

While the goal of Hare Portfolio is to seek long-term capital appreciation by investing in companies with strong and growing competitive advantages.

The Hare uses a “growth at a reasonable price” strategy, looking for companies with above-average earnings-per-share growth whose stocks are trading at reasonable multiples of long-term earnings potential.

Both the Tortoise and Hare’s benchmark is the S&P 500 index.

This feature lists the companies under their respective portfolios with the Morningstar Ratings & Fundamentals and the initial and current position of each company.

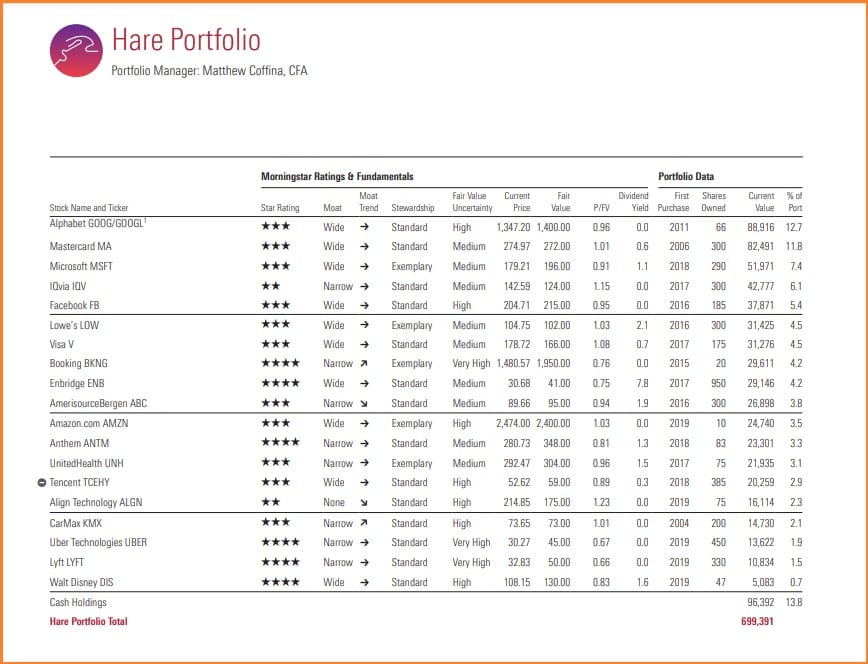

Tortoise and Hare Update

These are the changes in the portfolio such as recent trades and the effect of an economic downturn caused by the pandemic and the rationale behind the trades.

Investment Theses and Latest Thoughts

This feature is a quick analysis of each portfolio holding. This feature is useful if you want a brief analyst backed study of each company in the respective portfolio.

It includes the portfolio managers’ analysis and/or rationale for including each stock in Morningstar’s Tortoise and Hare portfolios.

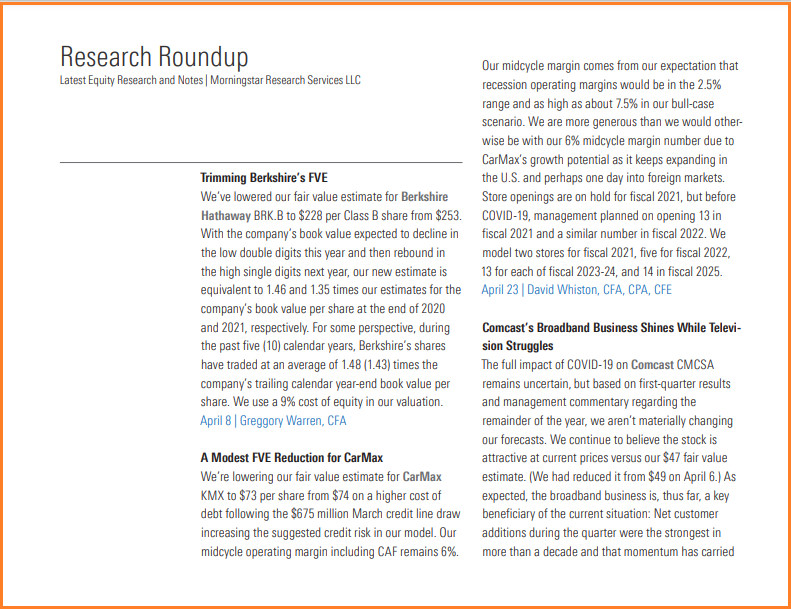

Research Roundup

This is a curated compilation of the latest research for Tortoise and Hare holdings by the analysts in Morningstar.

The analyst notes that are chosen for inclusion are prioritized based first on changes in moat ratings, changes in fair value uncertainty ratings, and on changes in fair value estimates.

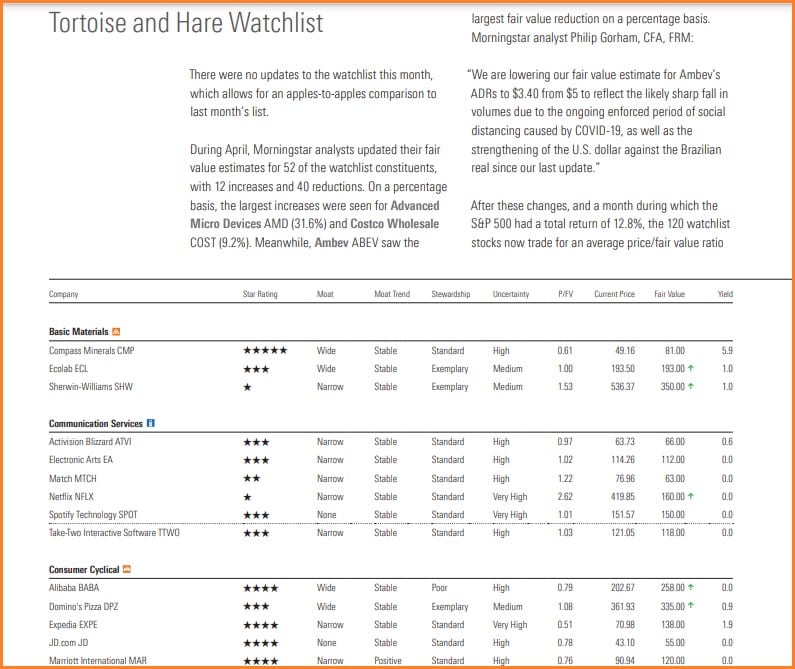

Tortoise and Hare Watchlist

This feature lists 120 companies that Morningstar believes you should put under your radar.

These may include companies with wide or narrow moats, positive or stable moat trends, and below-average price/fair value ratios according to analysts.

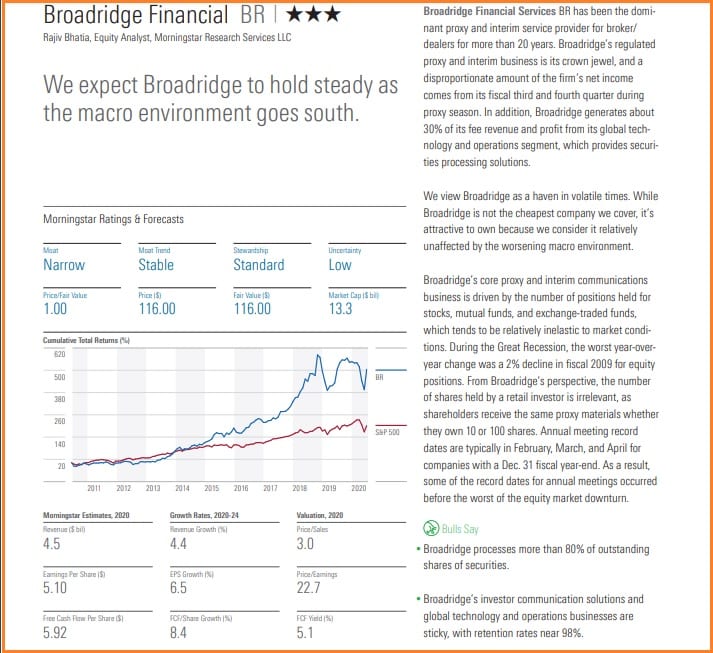

Stock Focus

The Stock Focus section contains an analysis of several stocks that the editors believe may be of interest to StockInvestor subscribers.

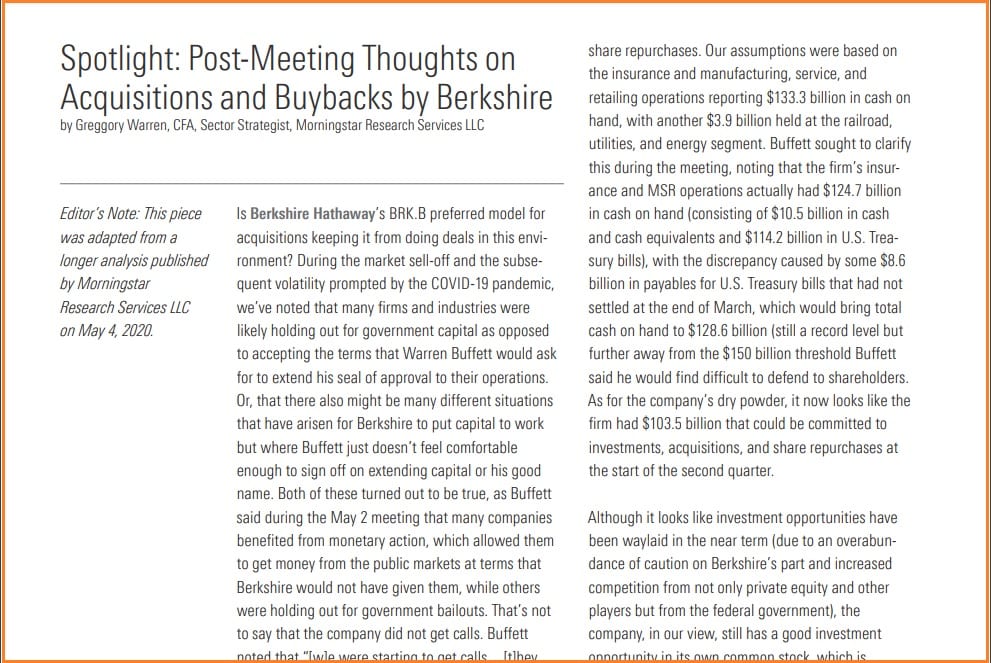

Spotlight

The Spotlight section includes recent investment research published by Morningstar.

The contents of these sections have been previously published on Morningstar.com or Morningstar Select, and have been edited.

How Can You Make Money With Morningstar StockInvestor

There two ways in which you can make money with StockInvestor, first is that you can the information provided in the newsletter and invest or trade the stocks in the portfolio.

Second is by investing directly in the Tortoise and Hare portfolio.

Where Will Be The Assets Held And How Can You Monitor Your Investment

Either Schwab Institutional or Fidelity can be the custodian for the Tortoise and Hare Select Stock Baskets accounts and the custodian will provide monthly statements, detailing the account’s balances, holdings, and any transactions. In addition to custodial account statements and other documentation, MIS will send any associated trades. MIS does not limit a client’s ability to add to or withdraw from an account.

As taken from Morningstar website

Is It Possible To Combine The Tortoise And Hare Holdings In One Investment

MIS doesn’t offer a Select Stock Basket that combines the holdings in this way. However, a client can accomplish roughly the same goal by opening two different Select Stock Basket accounts, one for the Tortoise Portfolio and the other for the Hare Portfolio, provided the appropriate minimums are met.

As taken from Morningstar website

How Can You Invest In The Tortoise And Hare Portfolio

MIS normally works exclusively with financial advisors. However, MIS is making the Tortoise and Hare Select Stock Baskets available directly to the subscribers of StockInvestor. Prospective investors will be asked to complete a questionnaire to determine their suitability for investing in these strategies. Those who qualify, based on their investment objectives, risk tolerance, and time horizon, will be eligible to invest in the Tortoise and Hare Select Stock Baskets. The minimum account size is $100,000 (or $250,000 when combining the portfolio with fixed income mutual funds or ETF).

As taken from Morningstar website

What Are The Cost And Any Restrictions Or Charges If You Want To Withdraw Or Add Funds?

MIS charges an annual fee of 0.55% of assets on an account’s first $1 million, 0.50% on the next $4 million, and 0.45% thereafter.* This fee compensates MIS for managing the client’s account. The minimum annual MIS fee is $550 (or $1,375 when including an allocation to fixed-income mutual funds or ETFs). Clients will also be charged transaction costs, which vary according to the brokerage platform that they choose. There aren’t any restrictions for clients to withdraw or add funds, but clients can be assessed transaction costs for buying or selling holdings in the portfolio

As taken from Morningstar website

What Is the Performance Of The Tortoise And Hare Portfolio

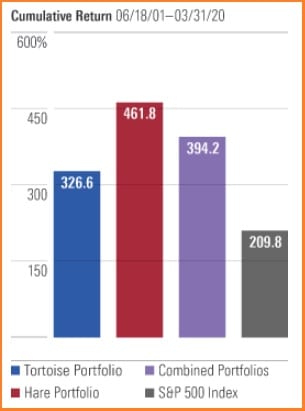

Morningstars StockInvestors has continuously outperformed the S&P 500 as show in its cumulative return above.

This is important since the S&P 500 represents the condition of the US market itself, having a portfolio who beats that benchmark means that the portfolio is well managed and you can expect enormous returns.

What Is An Alternative To Morningstar StockInvestor

The Motley Fool Stock Advisor is a good substitute to Morningstar StockInvestor.

The main difference is that with Morningstar StockInvestor you are presented two portfolios sorted through tortoise and hare strategy.

While Motley Fool Stock Advisor on the other hand is a basket of ten stocks that you can use as a starter stocks which are competitive in nature.

You have to keep in mind too that one The Motley Fools main sources of information is Morningstar Inc.

What I Like About StockInvestor And What Makes It Stand Out

What I really appreciate with the newsletter is that after the foreword from the editor, it immediately goes into the heart of the newsletter.

No fluff involved, just business.

How they sort the companies into two easy-to-understand portfolios is also another point to the newsletter.

I loved browsing through the lists and seeing what made them include the said company is effortless as every information you need is within one page.

As the newsletter is constantly updated every month, you are certain that the information within is relevant.

Morningstar StockInvestor Cost

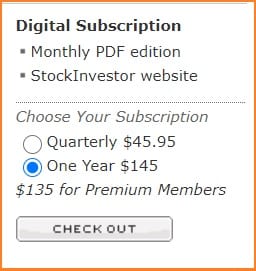

Morningstar StockInvestor is priced at $45.95/quarterly or $145/yearly.

Morningstar StockInvestor Refund Policy

If you cancel your subscription during your free trial period, you will not be responsible for the payment of a subscription fee. However, except as otherwise provided herein, if you cancel your Premium Service subscription at any time after your trial period expires, your subscription to the Premium Service will continue in effect until the next monthly anniversary of the effective date of your paid subscription. (For example, if your paid Premium Service subscription start date is on January 1 and you cancel it on June 15, your Premium Service subscription remains in effect until July 1, at which time it ends.) For those with yearly or multi-year subscriptions, any remaining prepaid charges will be refunded, prorated on a monthly basis, to your credit card after your Premium Service subscription ends.

As taken from Morningstar website

Pros and Cons

Pros

- You can easily understand the newsletter as all the information you need are within the newsletter itself

- Straight to the point

- Sources the information directly from Morningstar’s research database that is used by other stock-picking companies

- Access to the educational materials in the subscribers-only website

Cons

- Both the portfolio is geared for long-term investing and short-term investors might not like it

- Clunky website and developers are slow to update it

- Customer service is a hit or miss

Final Thoughts: Is It Worth The Money?

In this Morningstar Stock Investor Review, we have learned what it is, the portfolios and strategies as well as its pros and cons if you subscribe to the newsletter.

The Morningstar StockInvestor portfolios have outperformed S&P 500 since its inception in 2010.

This is a good sign as again, beating the market index means that you are investing your money in the right stock baskets or portfolios.

Adding the fact that the data coming from Morningstar are used by prestigious stock picking companies, you can’t go wrong with their newsletters.

I would like to stress out that Morningstar’s analysis is provided for informational purposes only and is not investment advice or an offer to buy or sell a security as they say in their newsletter.

Use the information they provide as a basis for your stocks and then do your own research.

Or in funds with their FundInvestor which we have reviewed in our Morningstar Investment Review.

What do you think? Leave your comments below!

Morningstar Stock Investor

$45.95/quarterly vs $145/yearlyPros

- You can easily understand the newsletter as all the information you need are within the newsletter itself

- Straight to the point

- Sources the information directly from Morningstar’s research database that is used by other stock-picking companies

- Access to the educational materials in the subscribers-only website

Cons

- Both the portfolio is geared for long-term investing and short-term investors might not like it

- Clunky website and developers are slow to update it

- Customer service is a hit or miss