In our previous articles, we discussed what is Fundrise and demystified the real-estate firm. But we leave no stone unturned.

One such stone is Fundrise Supplemental Income which we are covering in this Fundrise Supplemental Income Review.

Fundrise’s Supplemental Income seemed to have gained new traction since its re-introduction, but what makes it different with the other plans?

What are the fees involving this investing vehicle, and can you really make money by investing in Fundrise?

Discover the answers in our Fundrise Supplemental Income Review!

Table of Contents

Fundrise Supplemental Income Review: What Is Fundrise Supplemental Income

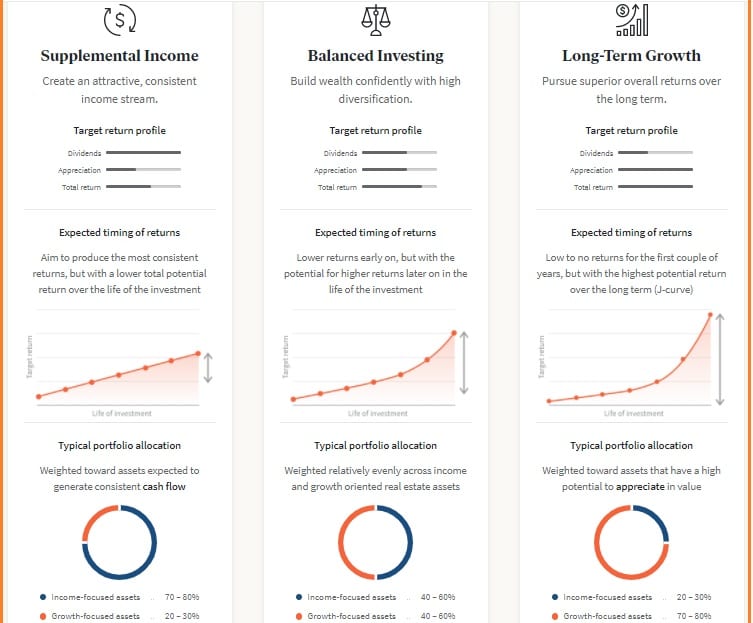

Supplemental Income is one of Fundrise real estate investment plans that you can select after choosing your account level.

These are the lists of the Fundrise Investment plans available:

- Supplemental

- Balanced Investing

- Long-Term Growth

- Starter

Fundrise developed the Supplemental Income for those who want to generate regular passive payment through dividends rather than investment appreciation.

Which means that you will receive a regular returns in the form of quarterly dividends, but your overall investment returns at the end might be lower than the other plans.

The company invests in assets that generate predictable returns from the moment it makes the investment.

This could mean lending to the developer of a new property, or buying an existing building with tenants in place and renovating it to increase the value of the property.

For example, in the income plan you can expect consistent cash flow via rent or interest payments, unlike the other strategies.

As depicted in the photo below, its income-focused assets comprise 70% – 80% while its Growth assets are only 20% – 30%.

What Are The Assets Under The Fundrise Supplemental Income

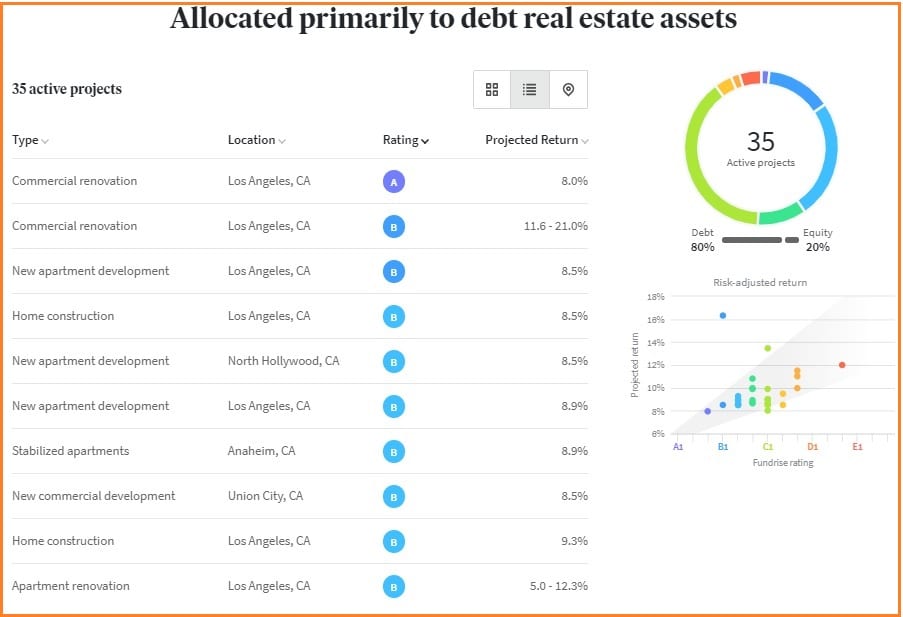

The Supplemental Income eREIT focuses primarily on making debt investments in commercial real estate assets that generate steady cash flow.

But first, what is an eREIT?

An eREIT is a professionally managed, diversified portfolio of commercial real estate assets, such as apartments, hotels, shopping centers, and office buildings from across the country. Similar to an ETF or mutual fund but specifically for commercial real estate, an eREIT allows an investor to diversify across many properties at a relatively low cost and with minimal effort.

As quoted from retirebeforedad

Up to now, the Income eREIT identify and curates quality assets that are sought out by institutional investors or simply those big-time real estate investors.

These quality assets which have a slightly smaller size are usually in an urban metro markets.

Fundrise sticks to three core principles in selecting projects for investment:

- Small Assets – assets that institutional investors and banks might overlook because of their size

- Regulatory Inefficiencies – due to the deregulation in the financial industry that permitted banks to engage in hedge fund trading with derivatives in 2008, this created new opportunities in the market for more lenders

- Urban Infill Location – assets in large cities have higher demand and of course higher pricing because of higher population and relative lack of supply.

What Is The Performance Of Fundrise Supplemental Income

As show in the table above, starting from its inception in 2015 Fundrise Income eREIT has a generally positive return.

But comparing its 2020 and 2019 run, the 2020 total return is actually slightly lower.

But that is understandable since the pandemic affected every aspect of the economy and the data is only up till September of this year.

How Can You Earn Money With Fundrise Supplemental Income

You can earn money with the Supplemental Income through two ways.

First is via quarterly dividends, and Second is via an appreciation of the assets in your portfolio.

These returns occur from rental income collected, interest or the potential appreciation in the property’s value.

When Can You Recieve Your Fundrise Supplemental Dividends

Dividends are typically distributed in the middle of the month following the end of each quarter, e.g. mid-April for dividends earned during the first quarter. You may also receive additional periodic cash distributions, as certain underlying properties are sold. The value of your shares is also typically re-calculated on a quarterly or semi-annual basis.

As quoted from Fundrise website

How Can You Redeem Your Fundrise Supplemetal Income Shares

Real estate is inherently a long-term, illiquid investment. Fundrise is intended for investors who have a minimum time horizon of approximately five years. However, we have adopted a redemption plan whereby an investor may obtain liquidity quarterly for the eREITs, or monthly after a minimum 60-day waiting period for the eFunds, subject to certain limitations.

As quoted from Fundrise website

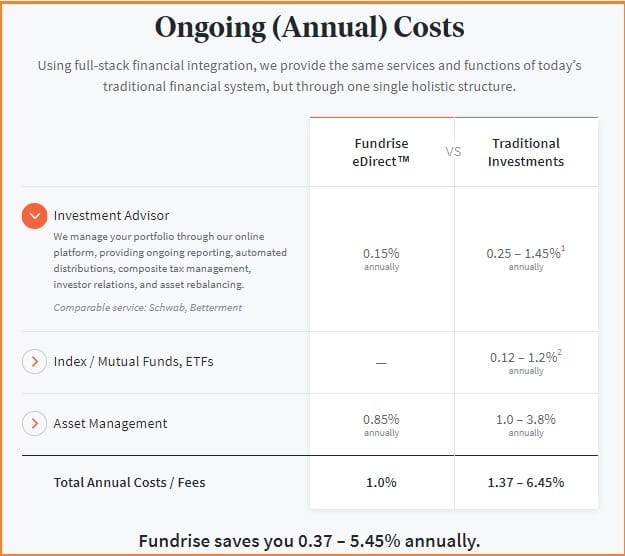

What Are The Fees Related To The Supplemental Income Plan

Projected return and dividend figures displayed on this page are net of fees. The offerings in this plan pay a 0.85% annual asset management fee. In addition, investors pay a 0.15% annual investment advisory fee, which may be waived under certain circumstances. This all-in 1% annual pricing model is up to 40% more cost-efficient than publicly available investments.

As quoted from Fundrise website

What Are The Tax Documents That You Will Receive

Investors in the Supplemental Income plan can expect to receive a Form 1099-DIV for each eREIT in the plan’s allocation.

As quoted from Fundrise website

What Are People Saying About Fundrise Supplemental Income

These are the reviews we found online in Financial Samurai:

One thing I realized after being with Fundrise for a while is

(1) hoo boy, this thing has great returns but is super tax inefficient – strongly consider putting your (Roth IRA) money here, rather than keeping Fundrise taxable and holding stocks/bonds in your IRA. I honestly think my returns would near-double if I had it in a tax-sheltered account.

(2) “Ramping Up” eREITs are a massive drag on your returns – always try to buy eREITs/funds that are going to give dividends soon

I’m primarily in Heartland and East Coast to diversify, they’ve all been in the 7-8% range, except those ramping up, which are 0% sadly. I got tricked into putting money into the ramping-up funds through the “dividend reinvestment”, which just targets a portfolio.Fat Tony January 16, 2019

I’ve invested in heartland, income, and the west. Had a small drop in the dividend on the Q4 2018 due to an issue with one of the investments but it’s back again to normal dividend rate. So far the dividend rate is about 7-8% very happy with that.

Income has the highest dividend rate so far.dustball April 16, 2019

In Reddit:

Income I and Income II eREITs are income producing eREITs at the moment, which will give you dividends. Income V and Balanced eREITs are still ramping up and aren’t going to produce any or very little yield at the moment. The truth is that you do have to “sacrifice” some of your initial investment so that you can get access to do direct investment capability to the income producing eREITs. There really is no way around it. Eventually the Income V and Balanced eREITs will produce yield, so it is not a lost cause.

Best advice is invest just the initial $1000 minimum in the supplemental income plan and once that clears, do direct investments into the Income I and Income II eREITs to beef up your dividend earning potential.

ericdabbs 4 months ago

Agree with ericdabbs. Would like to stress that Fundrise is a long-term investment. My early returns were not great, but they keep increasing each year as my investments mature. Fundrise auto-invest and dividend reinvest features tend to put you in the newest eREITs, which are ramping up and feel like dead money for a while.

dklemchuk 4 months ago

I’ve been with them for 1.5 years and my total return (capital + dividends) has been 11%. They regularly pay out dividends straight to my bank account.

anonymous 2 years ago

Nope, after about a year’s trial I cashed out. I was getting less than 5% return. Additionally, It took them 4 months to liquidate my account (quarterly schedule). Fundrise is a scam with high risks, low returns, and terribly liquidity.

jhirai20 2 years ago

I’ve been with them for 2.5 years. Overall, I’m very happy with the service and I think it’s an excellent vehicle for alternative investment.

Personally, I miss the older days on the platform when accredited individuals could make individual equity & debt investments. I’ve actually had a few of those from 2 years ago term and return principal + on average about 13% return.

The platform now is more mass market with all available options being some version of commercial real estate REITs. I have found the ability to get a solid understanding of return much weaker in these vehicles. Depending on the fund returns seem between 5% (growth funds with accrued upside) to 8% (more income styled funds).

I like the platform, but less with its new model. I think it’s worth an allocation of your portfolio but definitely would not go higher than 10%. They are still too young and unproven.

feadrus 2 years ago

I and my family invested with Fundrise in their eREIT products and still have holdings with them. There are several reasons I would tell you to [avoid] investing with them based on my experience.

The funds are illiquid – there is a 5 Year lockup period and you can’t get your money out like more liquid investments (without paying up to 3% penalty fees), or if suddenly there’s a ‘run on the bank’ and more than a certain % of shares want to cash out. Oh btw they will always redeem your last investment first, so adding more through a dividend reinvestment or lump sum will reset the clock!

They inflate performance by eating your principal; the Net Asset Value keeps deteriorating from your original investment

They charge high management fees

They speculate in real estate and are tied to the weakening housing/commercial market, which is currently under pressure with higher interest rates

Their business model is built around charging high-interest loans, so investors turn to them as financiers of last resort, adding more risk (normal banks won’t loan the same people the money they ask for)

If you choose to invest, be sure you know all the strings attached to getting your money out and understand the risks.

jcwj 1 year go

I invested a lot of money through Fundrise early last year and I just withdrew all of it after 3 months waiting period. Overall, I lost money with Fundrise.com due to minimal dividends and a 3% penalty for redeeming investment after 15 months. Also, the tax implications of investments with Fundrise are not favorable for most investors IMO. It cuts into the return heavily at yearend.

They say their real estate investment is for long term 5-7 years, but after calculating taxes and (tax preparer fees), your investments amount to a mere 1-2% return. I feel you are better off investing in REIT O, a CD, index fund, or any other place but Fundrise or any such alternative.

re-emerald 1 year ago

What Are Alternatives To Fundrise Supplemental Income

The major competitors of Fundrise are Realty Mogul and Realty Shares.

Realty Mogul has steeper requirement of $5000 and only two portfolios for non-accredited investors while Fundrise minimum requirement is $500 and has four different portfolios.

Their dividend distribution also varies as it is a monthly distribution with Realty Mogul and quarterly for Fundrise.

With Realty Shares, the main difference is that they only accept accredited investors, unlike Fundrise that are open to all accredited and non-accredited investors

What I Like And Don’t Like About Fundrise Supplemental Income

Per our Fundrise Investment Reviews, I still like that they have a lower minimum requirement when compared to other real-estate crowdfunding.

This really is their biggest draw, but as stated in our Is Fundrise A Scam, it takes a really long time to create an immense growth in your portfolio.

Plus, there are fees that they might deduct on your account that are not stated up front and you might not be able to liquidate your investment.

Pros And Cons

Pros

- Low minimum requirement of $500

- Non-accredited are allowed to invest

- You can reinvest your dividends back into the eREIT automatically

Cons

- Not publicly traded

- Dividends are taxed as ordinary income

- Fees that might pop up during the life of your investment

- Liquidity is not guaranteed

Final Thoughts: Is Fundrise The Best Passive Income In 2022

We still stand that Fundrise is a good way to diversify your portfolio if you want to invest in eREIT’s here in our Fundrise Supplemental Income Review.

The major drawback is that it takes a considerable period of time to see immense growth in the Fundrise portfolios and that dividends are taxed as ordinary income.

So, imagine with it being taxed as an ordinary income, the taxes may just as well engulf the money you receive from your dividends.

This is best for investors who are non-accredited or are not in the hurry to get money from their investment, as it is really best to reinvest your dividends back into the eREIT.

However, if capital is not a problem or you are an accredited investor, we suggest investing in real-estate companies that have a long company history and growth.

Have you heard about Andrew Keene? This “trading guru” is conning millions with his S.C.A.N. system!

Learn more about this scam in our The 1450 Club Review!

Click Here to Read My # 1 Top Scam: 1450 Club Review

Fundrise Supplemental Income Review

$500 minimumPros

- Low minimum requirement of $500

- Non-accredited are allowed to invest

- You can reinvest your dividends back into the eREIT automatically

Cons

- Not publicly traded

- Dividends are taxed as ordinary income

- Fees that might pop up during the life of your investment

- Liquidity is not guaranteed