“Buy and hold these stocks to pay your bills for life.” The Dividend Hunter declares with their secret plan you will win for life.

Who would not want to live unfettered with fears of debt and bankruptcy, but is this the real deal?

We are going deep in this The Dividend Hunter Review.

They promise it is “a 36-month plan where you could create $4,804 in monthly income that continues to grow each year.”

Sounds too good to be true if you ask me. But we will give them the benefit of the doubt as we peer into what they offer.

Join us in unveiling this intriguing newsletter and see if it can really squelch your retirement fears in this The Dividend Hunter Review!

Table of Contents

The Dividend Hunter Review: What is The Dividend Hunter

The Dividend Hunter is financial newsletter focus on stock market investments by Investors Alley Corp.

It promises to provide you with a steady income from high-yield dividend stocks and dividend growth over time.

The Dividend Hunter advocates for one lifelong strategy: Investing in companies that pay high, consistently rising dividends, the kind that let you “sleep well at night.”

As they say, it’s all laid out in the following easy-to-read special report and centered on income-producing stocks with high yield.

The game plan of the 36-month plan is as follows:

- Find healthy high-yield dividend companies

- Buy when the prices are low

- Collect the dividends & use the DRIP method

- As you find more plays, add them to your portfolio and/or grow your current positions

- Sell when the price gets too high or the yield gets too low

- Automatically pay your bills for life

But what is the DRIP method?

The word “DRIP” is an acronym for the dividend reinvestment plan, but DRIP also describes the way the plan works. With DRIPs, the cash dividends that an investor receives from a company are reinvested to purchase more stock, making the investment in the company grow little by little.

For example, let’s say that the TSJ Sports Conglomerate paid a $10 dividend on a stock that traded at $100 per share. Every time there was a dividend payment, investors within the DRIP plan would receive one-tenth of a share

As quoted from Investopedia

Dividend Hunter places two criteria in choosing the companies to invest on:

1) The company is growing in the next 3-5 years. If a company isn’t growing, it’s declining.

2) The dividends have a track record of increasing or staying steady.

Essentially, this newsletter presents three stocks that give increasing dividends regularly every year.

And you will re-invest the dividends back into the stocks to compound you investment.

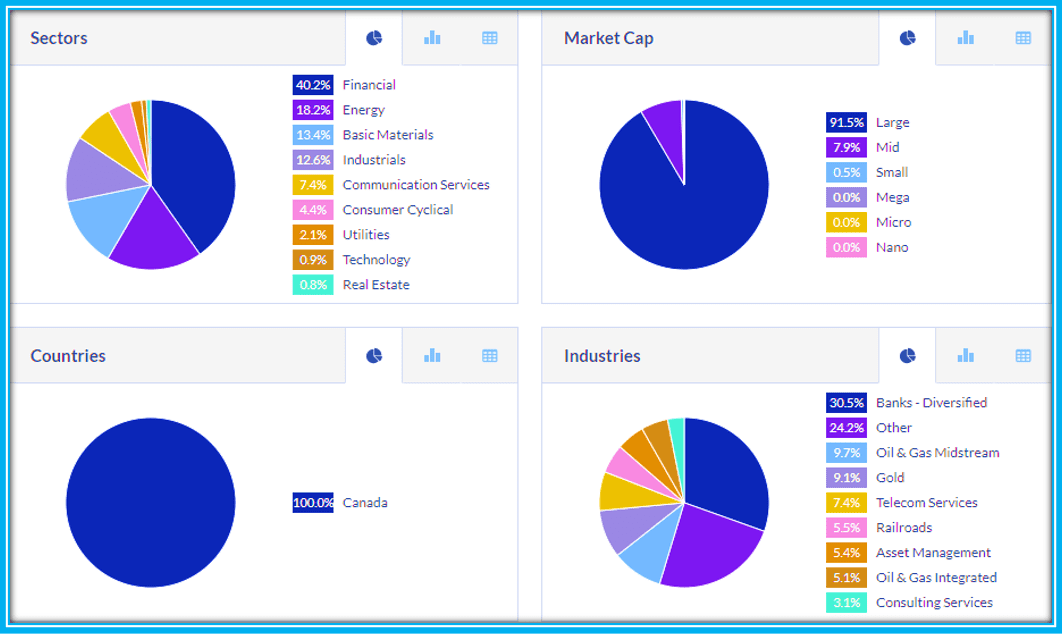

It also invests in five specific stock criteria:

| Conservative | These are the stocks that show the best combination of dividend security and share price stability. |

| Secure Dividends with Volatile Share Prices | Stocks with huge yields, but go up and down fast. |

| Monthly Dividend Stocks | Companies that pay out cash monthly. |

| Discount Plays | Stocks that investors have driven down to discount-level prices because of company misconceptions such as financial trouble. |

| Positive Surprises This Year | Sleeper stocks who could boost their dividends without notice. When the price spikes high, you are in a nice spot to dump the shares with your dividends and gains in tow. |

Videos Resources to Learn More about The Dividend Hunter

| Title | Videos |

| 1. Get Access to the #1 Dividend Stock in America | https://youtu.be/IHL5Rj1fpDQ |

| 2. Stocks Stealth Growth strategy | https://youtu.be/qonzvjE4qFA |

| 3. How to Build & Manage your Portfolio: Tim Plaehn | https://youtu.be/aFGuUzy2-Sc |

The Dividend Hunter: Who is Tim Plaehn

Who is Tim Plaehn, Founder of the Dividend Hunter Newsletter ?

The Dividend Hunter is spearheaded by Investors Alley lead analyst Tim Plaehn, launched in 2014 and headquartered in West Hollywood, California.

Plaehn specializes in evaluating income-generating investments driven by management’s commitment to dividend growth.

Tim is a graduate of the United States Air Force Academy with a degree in mathematics.

He has written for The Motley Fool, USA Today, Seeking Alpha, eHow, SFGate, Chron.com, Wikinvest.com, Newsmax Media, among others.

Prior to his being the editor of The Dividend Hunter, he worked as a stockbroker, a Certified Financial Planner, and an F-16 Fighter pilot and instructor with the United States Air Force.

What You Will Get When You Subscribe to The Dividend Hunter

Monthly Newsletter Issues

These are the monthly newsletters delivered to you via email for 12 months. It includes the picks that you need for the 36-month plan.

It also discusses portfolio stocks, economic outlooks, and new opportunities that you can invest into. You also have access to past 38 volumes.

For example, in his stock pick below, he recommends buying New Residential Investment Corp. (NRZ) because it is a business that generates excess cash flow above the dividend.

New Residential has steadily built up its MSR portfolio.

The company controls the servicing rights on over $540 billion of unpaid mortgage balances.

For any investment the company shoots for 15% or higher targeted lifetime net yields.

This smart investing has allowed New Residential to pay great dividends, and grow book value and market cap.

Monthly Dividend Paycheck Calendar

This is a feature that lets you know when a particular company pays its dividend.

This is beneficial because you will know when the dividend checks hit your account and is a predictable dividend income stream.

This is sent to you via email and is updated each month.

The Dividend Hunter Start Out Portfolio

This includes a 5 starter stock picks that you can use as a primer to creating your own dividend portfolio.

This is useful if you do not know what stocks to choose or want to have a specialized portfolio for dividends focused on income.

Buy of the Week Recommendations

This is a feature that is sent to you every Tuesday that picks a specific stock to add to your portfolio.

This is helpful to have so that you will know what additional stock you can invest into and so that you further build your income stream.

Dividend Forecaster Tool

This is their proprietary system that helps you keep track of how much income you are making from your portfolio.

A handy tool if you want to monitor the health and profitability of your portfolio.

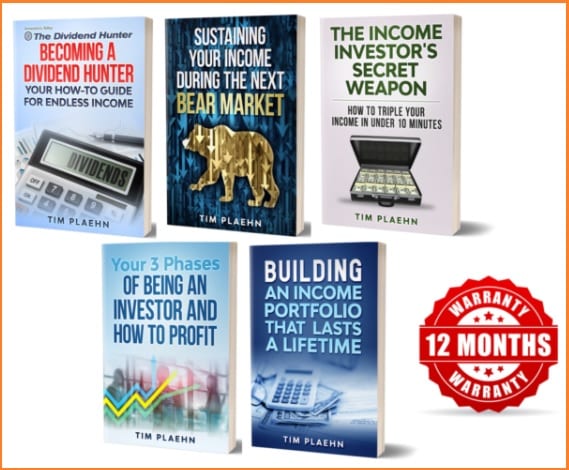

Endless Income Blueprint

These are five special reports that are included in your membership namely:

- Becoming a Dividend Hunter – gives you step-by-step details on how to best utilize your subscription, plus answers all relevant questions that you might have about the service.

- Building an Income Portfolio that Lasts a Lifetime – dives into the nuts of bolts of building a never-ending income Portfolio.

- Sustaining Your Income During a Bear Market – this report includes strategies for handling bear markets so your dividend checks keep coming.

- How to Triple Your Income in 10 Minutes – this promises to give you a yield of 16-20% without touching your stocks.

- Your Three Phases of Being an Investor and How to Profit – this report discusses what kind of investor you are based on your financial situation and investing knowledge.

What People Say About the Dividend Hunter

These are reviews we found in stockgumshoe.com:

I have to generally concur with criticisms of his choices. I invested a pretty significant amount of $ two years ago and bought 17 of his recommendations. Many had gone way down before the virus and now with the virus, my overall investment and portfolio value is off 45%. In addition, several of his “picks” choices have had significant dividend cuts. I too, find his constant ”hawking” of additional services objectionable and also have a problem with his lack of forthrightness about some of his bad choices. Am still hooked on his way of doing things, but can’t say I’m happy even before the virus.

Chuch Grantham April 20, 2020

I think the idea is that if your stocks are fundamentally sound in the first place and have a fairly long history of paying dividends and of increasing them on a regular basis, you don’t have to worry about their price because you’re not going to sell. They will continue to pay the dividend unless they go bankrupt. Of course, if something weird happens that renders them unsound, they might have to cut or eliminate the dividend. I thought I saw something on his site where he cautioned subscribers , in addition to his due diligence, to do their own on a recommendation before buying it. This made me a little nervous.

Linda Joseph March 25, 2020

I am very satisfied with this service, which has taught me a lot about dividend investing, although I am a complete novice

Henry Hall May 11, 2017

So far, I’m very pleased with the Dividend Hunter service. Tim’s picks are helping my investments greatly. I have also emailed questions and have received a timely response.

Donna May 23, 2017

I just joined The Dividend Hunter, I am surprised that I didn’t get anything from them, there is a webinar at six that I want to watch, I hope I get some response. Does anybody know his phone number?

Ada October 19, 2017

Tim has great reasons for his choices, but he often recommends stocks which are weak and in downtrends. It would seem better to wait until the downtrend is apparently over before buying such stocks. If 50 day line is below 200 day line, I am not interested unless both are turning up. Why buy a loser? He also ignores some stocks that seem to fit his parameters. Should as least tell us why. But I mostly like the service.

Chuck Burton November 29, 2017

I subscribed to the Dividend Hunter about a year ago and participated in most of the special presentations that Tim has provided during that time. His views and research have definitely changed my way of thinking about stock investments, focusing on dividend income and growth versus worrying about the price of each stock every day. He has also personally answered a few questions I have e-mailed him over this time regarding dividend stocks I owned that he did not cover. I agree that some of his picks have declined in stock price, but as long as the overall stability of the business hasn’t changed, you still get the dividend income, along with a BUY opportunity.

Jay November 29, 2017

It all sounds good if the market remains stable, but to get these kinds of weekly or monthly paycheck streaming into your mailbox, you have to buy shares in the stock. I saw one example of a $2387 check in one month BUT what isn’t mentioned is the capital at risk for buying the stock. If the stock is $4o per share x 1000 shares = $40,000! Nice play if the stock does not go down by $2387 over 30 days! So even if this works, you still have to look over your shoulder and keep an eye on that stock’s daily value. The price is for the program is very generous but it is not so care free set it and forget it. You may get a few gray hairs over twelves month from the unexpected lows in the marketplace.

jvsaputo7 January 21, 2018

The stock research is sophomoric at best. In my judgement, with a bit of effort you can research divided stocks on your own and come up with a solid list of investment candidates.

gmw13145 April 14, 2018

If I could have only one investing newsletter, this would be it.

Martha June 1, 2018

I have just joined the newsletter, and now I am being asked to join his inner circle. Not quite sure how I like the up sale before I even get started. I went to my investment adviser to check out the initial stacks that were in the buy portfolio. Most of the stacks were rated a d or an f as in do not purchase or very high risk. Can anyone that has been using this portfolio for a while address this? I do not what to start investing and add high risk when I am getting close to retirement.

Mark June 18, 2018

I did some reading/studying last fall, subscribed, and then invested using the Dividend Hunters list.

1. November 1, 2017, bought l7 of his recommendations with significant $.

2. Have had an 8% dividend return since then. This is good.

3. Stock corpus value has increased by 3%. This is good.

4. I was not prepared for some stocks’ very precipitous value changes. From what I paid, MIC is down 40%, GMLP is

down 30% but UNIT is up 33%. But as I said, the overall portfolio is up 3%

5. I sold and bought a couple of stocks based on Tim’s recommendations since November. This turned out to be good advice and were good decisions.

6. I wish Tim would deal more directly when a stock plummets, as did MIC and GMLP. Instead of saying,

“folks, we took a big hit last month, but I think we should hang with this stock” He is almost obfuscating and tends to skirt/not deal directly with a fairly significant fact.

Overall, I am cautiously pleased, but still watching as I liquidate management-intensive assets and am working on my handicap. Hope this helps.Chuck Grantham June 22, 2018

I would like to see the newsletter track total return. It is difficult to assess how the sticks picked in the newsletter are actually performing. For example, one of the pics in the newsletter was MIC. The stock declined over 40% after announcing a dividend cut early in the year. However, you cannot tell the stock even declined in the stock recommendation list.

mblairocc July 6, 2018

I’ve been a subscriber to Dividend Hunter for nearly two years.I have chosen several of his recommendations and most seem pretty good but a few are really falling behind. I’m frustrated over his latest pitch for the Dividend Hunter Insider subscription as he says he can’t give all his best recommendations in the Dividend Hunter so now I have to spend more money to get the best stuff. That’s distasteful to me in a big way. And also I have been trying to call their published phone number 1-855-566-6100 for several days and the recording says, ” this number is no longer in service or has been disconnected.” What’s up with this. Is there a new number? The old one used to be working.

Leonard May 28, 2019

I too subscribe to Dividend Hunter. Got the 1 year at $49.00. Had problems in beginning and couldn’t get through. I emailed Tim and left messages at the 855-566 6100 number. Too much advertisement for me. At end of term will not renew. It seems like it’s all about selling you more subscriptions.

You can email Tim and he’ll respond, or here’s another #1-212-566-6100.

Normal business hours are 9:30 a.m. to 4:30 p.m. eastern time, Monday through Friday excluding market holidays.

Good Luck…

Gmsdr May 28, 2019

This exactly what I wanted to say as a new member at $49 and then after you’re in he says something to the effect, “Now I have a list of super dividend picks but I can’t share them with you but for an additional $197 you can get the premium upgrade” CRAP! It makes you feel like you will get the old hammy downs that will never pay for your cost, let alone multiply. Some programs are very low cost the Dividend Drip program and one I know is free, Simply Sure Dividends. I think I will get my refund guarantee on this one. I just smells wrong and greedy.

John V. October 10, 2019

I think you get much more bang for the buck, with a lot more reliability out of Simply Safe Dividends. I don’t think Dividend Hunter /Investor Alley provides a comprehensive service and is constantly nickel and diming you to buy more of his services to get a more complete perspective. I think one of the reasons he is always pitching a lifetime membership is because his performance suffers over time, but if you have bought in for the lifetime membership, then you are a captive audience. Finviz, Seeking Alpha, Leveraged Investing Club, Yahoo Finance, Simply Safe Dividends, DripInvesting.org I think all offer a better and more comprehensive perspective than what is being offered at Dividend Hunter/Investor Alley

Gus Piccard July 8, 2019

For the introductory rate of $49, his picks are a good value. I’m considering the $297 lifetime offer, since it’s a $99 / yr. renewal subscription rate. I agree, don’t just use The Dividend hunter’s recommendations, thanks for the tips on the other resources.

lennypoulin March 25, 2020

I’ve been a subscriber now for about 9 months. The YTD returns, as of 6/20, on his current conservative and aggressive portfolios are a “train wreck”, and some of his holdings have suspended or significantly reduced their dividends. They can only go up from here! But I do like the overall strategy.

bob be June 20, 2020

Is The Dividend Hunter Reliable?

We appreciate that the service is easy-to-understand and direct to the point.

It does not beat around the bush and gives you want to know.

Additionally, the calendar is also quite useful as it helps you to monitor which companies under your portfolio gives dividends in that month.

Dividend Hunter Upsell

A major drawback is that the service consistently tries to upsell you to their other newsletters.

To be fair, we understand that they are primarily a financial newsletter service and they earn by having people subscribe to their adjacent services.

But this really leaves a nasty feeling in you, especially when you are a new subscriber and they then try to sell you other stuff that you are not interested in.

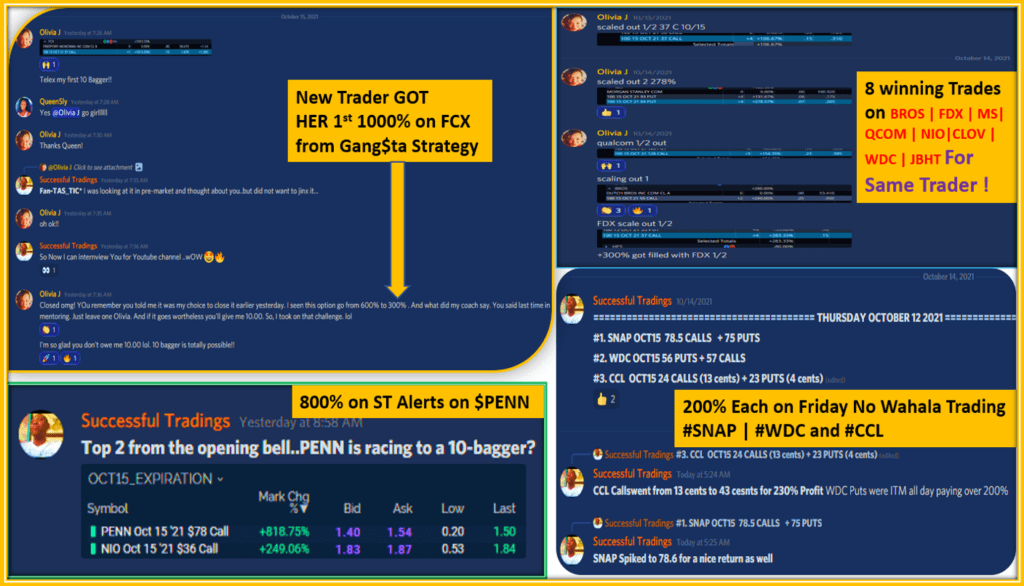

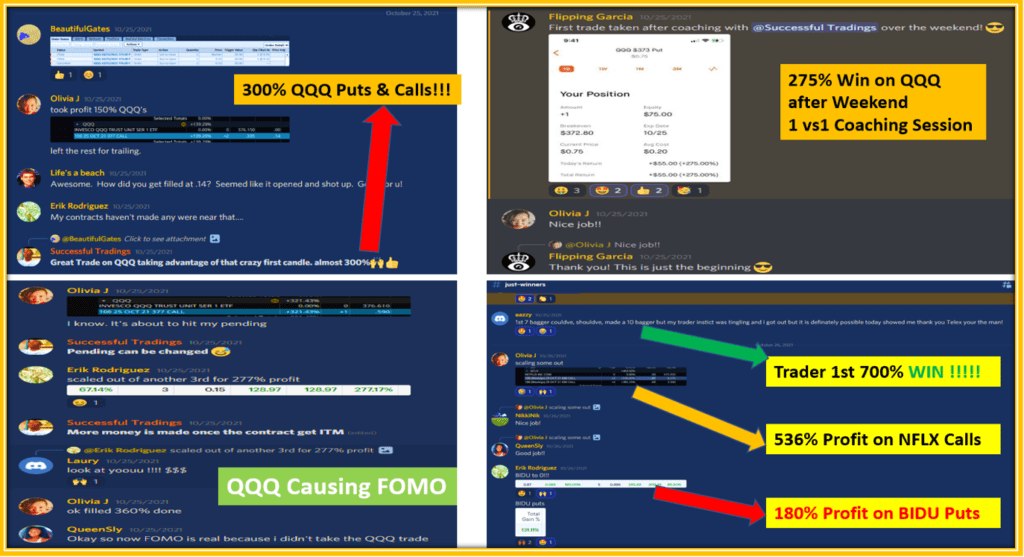

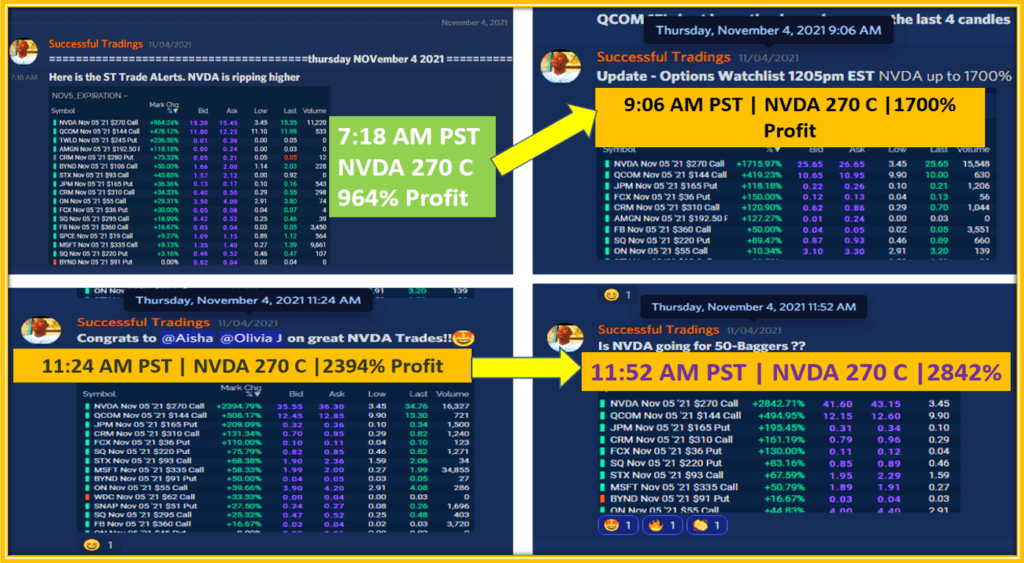

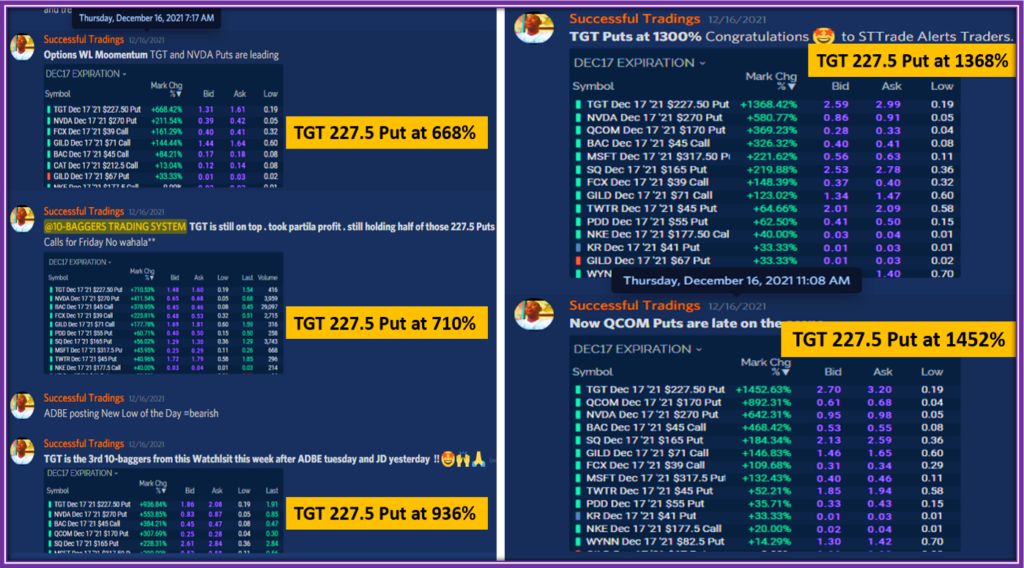

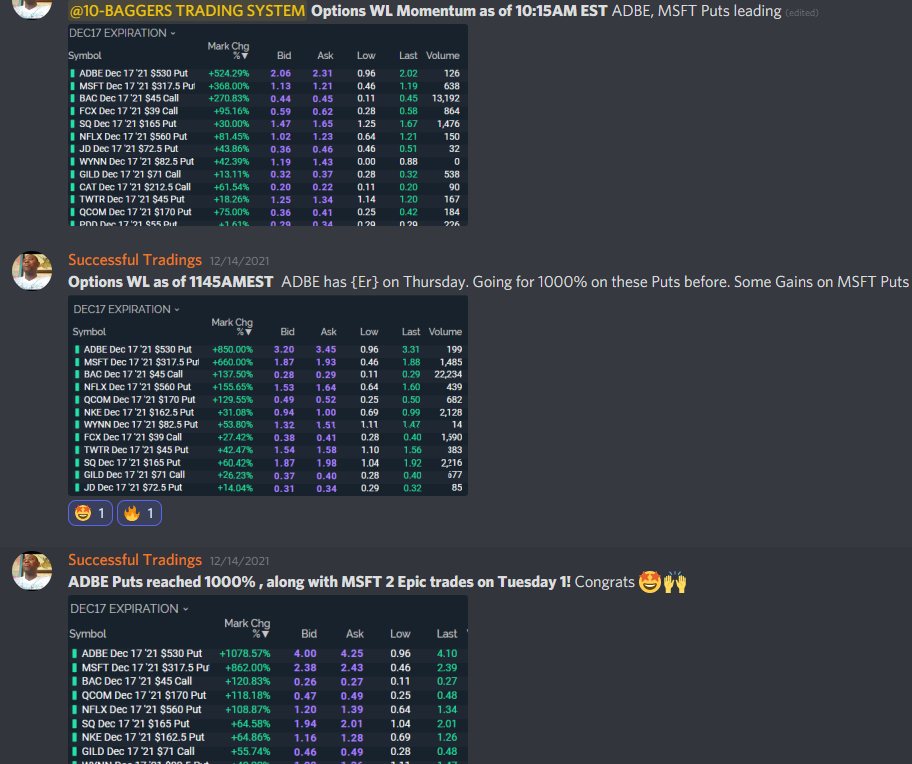

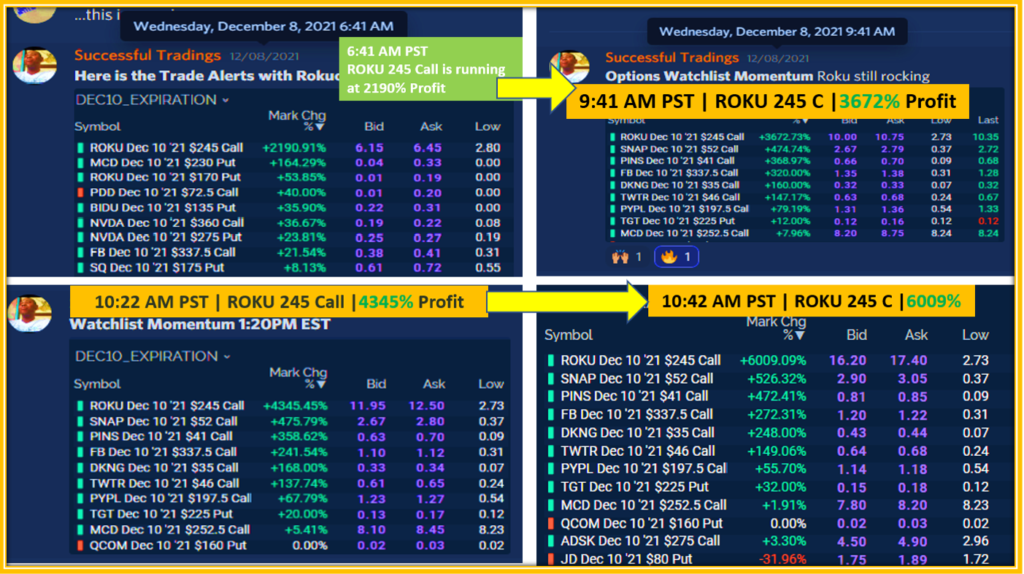

Successful Tradings Top 10 Dividend Stocks Below $10

Here is a special bonus for investors look for inexpensive dividend stocks.

For the First quarter of 2021, here is our Top 10 Best Dividend Stocks beow $10.

You can download it for free today.

We will update thesese reports quarterly on this article.

So come back again to see the next List.

These 10 stocks have a dividend yield of more than 10%.

What Are Alternatives to the Dividend Hunter

A few suitable alternatives to The Dividend Hunter are Simply Safe Dividends and Sure Dividends.

With Simply Safe Dividends, it also geared for long-term and good for both beginner and advanced investors.

The crucial difference is that with Simply Safe, it focuses on stock picks that show immense capital growth, while with The Dividend Hunter is on dividends.

Sure Dividends on the other hand, focuses on both stocks that exhibits high dividend yield and capital growth.

It offers two different monthly newsletters.

One is catered for retirees, or near retirees, and it gears the other for normal investors.

Each newsletter has a model portfolio and detailed analysis and updated ratings of its curated dividend stocks.

Find out more about Sure Dividends in our Sure Dividend Reviews!

Another way for you to increase your knowledge in the Financial markets is to Join a World Class community of Investors.

Should that be the case, I recommend BIO Forum.

This is by Invitation Only space where you will have the opportunity to Leverage the knowledge of like minded investors and traders

The Dividend Hunter Pricing

The Dividend Hunter has a promotional price of $49 for new members, afterward it will be $99 annually.

The Dividend Hunter Refund Policy

The Dividend Hunter offers a 100% money-back guarantee on your first year. It will be pro-rated refunds for succeeding years,

How to Cancel Your Subscription to Dividend Hunter

For questions, comments or to simply cancel your subscription to the Dividend Hunter, the phone number is 1-855-566-6100.

This is the same contact information for the following memberships:

- Dividend Hunter Insiders

- Weekly Income Accelerator

- Options Floor Trader Pro

- Options Insiders

- Growth stock Advisor

- Stealth stock Riches

- 11-Day Trader

- Monthly Dividend Multiplier

Pros and Cons

Pros

- Easy-to-use and direct to the point

- Has a one-year money guarantee

- Relatively inexpensive

Cons

- The newsletter does not show an overall performance its stock picks

- The service constantly nickels and dime you to upgrade or upsell to their other services

- Does not directly address the dip in the previous stock picks but skirts around it

Final Thoughts: Is Dividend Hunter the Best Dividend Newsletter?

In this The Dividend Hunter Review, we have fleshed out what is the newsletter about and what are its pros and cons.

As the newsletter boldly claims, Cash Is King, this service is for investors who want to get higher dividend yield on their investments rather than on capital growth.

The crux in this mindset is that companies still have the final say if they will give out dividends and have the power to thin out their dividend payments.

They can drastically cut their dividends if in case the company is under financial strain, and this of course reflects poorly on the company’s health.

Also, dividends are attractive if it comes from excess cash flows, but if the dividends come debts not so much.

Thus, it is still imperative that you must research what are the stock picks that they tell you to invest on.

Because it the end it is still your money you are investing and you must safeguard it at all cost.

Thoughts? Comment down below!

The Dividend Hunter

$49 Introductory PricePros

- Easy-to-use and direct to the point

- Has a one-year money guarantee

- Relatively inexpensive

Cons

- The newsletter does not show an overall performance of its stock picks

- The service constantly nickel and dimes you to upgrade or upsell to their other service

- Does not directly address the dip in the previous stock picks but skirts around it

Data Accuracy

1

Ease of Use

0

Collaboration

0

Features

0

While they are pretty direct and to the point, they inundate a subscriber with daily new offers of additional services. In one last offer titled “A man retires at 35” etc. they promised to reveal their #1 dividend stock for free followed by two additional recommendations. they specifically stated for free now “to give you a headstart, I have my #1 rising dividend stock pick to show you for free.

Plus, I’ve found two others with tremendous dividend growth potential in the coming years

They aren’t speculative plays. You won’t have to trade options.

Just click ‘buy’, sit back and collect. Those three stocks are free for you to get today.

And rising dividends are more important now than ever before”. I continued to read through this seemingly endless material looking for the stocks they promised only to be told i would get them after i enrolled in a new service for $497 –hardly free.

You also never hear about names that have crashed way beyond any dividend support.

Greetings,

Thank you for the feedback on The Dividend Hunter.

This will help a great deal of investors.

We appreciate your time.