A good online Trading platform is just as important as the methodology you use to generate your trade.

Power eTrade is to many stock and Options traders what a reliable Wi-Fi signal is to anybody wanting to use the Internet.

In this very important Tutorial, you will learn everything you need to know about Power eTrade Trading Platform and how it can take your Trading (Account Balance) to the next Level.

Table of Contents

Power ETrade Review: How To Set It Up ?

Before we get into the Technical jargon, let’s address from the get go some of the basic questions you may have about e*Trade as a company and Power e*Trade (Formerly OptionHouse) as a Platform.

If you are wondering: Is eTrade a Good Company ?

Well the Answer depends on your intend.

Do you plan on applying for a Job over there or are you considering becoming one of their many clients ?

When can easily answer the latter with an emphatic Yes Based on my experience as a client since early 2017.

Their customer service has proven to me over the years what I needed to keep them as my broker.

This does not mean that I have not encountered issue over the years with the platform.

However, eTrade has always stepped up and offered a satisfactory resolution each time in timely manner.

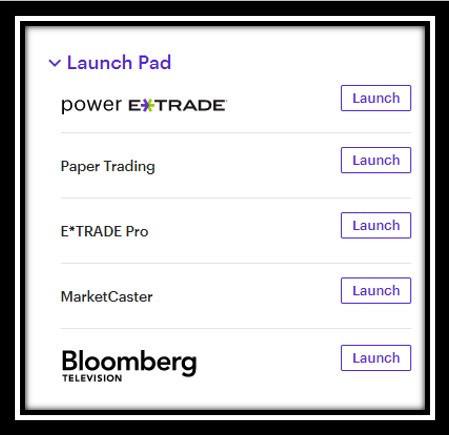

Next, Power E*Trade is free of charge to All E*Trade customers.

There are Options (no Pun intended) for Paid Data Subscription but you do not have to Buy them.

Many Data feed are free and are enough for your Options Trading Account.

There are no monthly or annual fees or inactivity fees as one may encounter in other online brokers.

Power ETrade Review: How To Trade Options on Power eTrade

When you open an eTrade Account, it comes with a Paper Trading Account as we explained in here.

This makes eTrade a very friendly online Trading Platform for beginners.

We always recommend that beginners spend a few months (how many ? It depends on your learning curve) practicing on the Demo/Paper Account before going Live on Power eTrade.

For our millennial traders out there always on the Go, Power E*TRADE comes with a very intuitive App version that will be with you anywhere you want to be (Euh,..did I just steal a Famous Slogan :-))

Here is a Video Tutorial on Power eTrade on how to place Options Orders.

How I Use Power ETrade Advanced Features

Power eTrade Scanners

The trading platform built in Scanners on Unusual activity, Volatility, Indicator, Oscillator that you can set up depending on your style of trading.

The best way to showcase all the built-in scanners is through this short video below.

Power eTrade TradeLab Analysis

Wouldn’t you want to know how much money you are bound to make when the stock in your Option Strategy reach a certain price by a given date ?

Well, Power eTrade TradeLAb can easily tell you that by just sliding your mouse vertically for the price of the stock and horizontally for the time in the future.

Before you take a trade, you can go to the TradeLab by selecting Build Strategy in the Picture above and a window Called Strategy Builder will Pop Up.

Then you can enter your Strategy ( it is possible to mix Stocks and Options). Just select Add Option or Add Stock.

After you save your strategy, a graphic window will come with your Risk Profile.

The information is meant help you determine your potential gains and losses depending on the price evolution of the underlying stock in your strategy.

In the above picture, we simulated 10 Options Calls contracts expiring July 24 2020 for a cost of 32 cents per contract.

The TradeLAb simulator is showing on your profit curve that should AMD stock reach $57.84, that strategy stands to generate $487.22 of profit.

The Maximum Loss on the position is the amount of Money we would be spending to buy those 10 contracts.

The break even point is for expiration Day and that price is at $59.22.

Below is a short demo on how to setup a Strategy inside the TradeLab.

How to Get a Chart of an Option Contract Inside Power eTrade ?

My favorite feature on Power eTrade Trading Platform is by far the ability to track the price of the Options I am trading.

Why ?

From the entry to the trade, it enables you to see if you pay too much for that contract.

We mainly trade weekly Options through our Subscription Trade Alerts.

So during the week, it is very important to get a good entry price.

Once in a trade, the chart of the Options helps you determine support and resistance for that option.

Yeah, just like you would do on the chart of the stock.

We teach our traders how to set up the same technical indicators we have on the stocks charts on the option charts as well.

Here is a recent video we made specifically for this purpose.

Power eTrade vs. Pro eTrade

Is Pro E*TRADE worth It ?

E*Trade offer and advanced trading Platform on top of Power e*Trade called Pro e*Trade.

This is their legacy platform before they bought Option House in 2017.

You will access and sign on to ETRADE Pro by using User’s existing ETRADE User ID and sign-on password.

The main features are not so different between the two so I am yet to utilize the Etrade Pro version.

I will be bringing you the nuances in the near future.

Power eTrade vs. ThinkOrSwim

We have some of our Traders in our Discord Room who use ThinkOrSwim trading platforms for Option trading.

I have always known that this platform was not intuitive for its users.

Though powerful, a trading platform ought to make it easy for beginners (especially) to quickly familiarize themselves with the basic features.

Also, its users have complained of many issues that have prevented them from trading for a full trading session.

This type of feedback make it weary recommend it as strongly as I would for Power e*Trade.

CONCLUSION

This full review of Power eTrade provided instructions on how to set up the Trading Platform.

It showcases its numerous features and we highlighted through videos Tutorials how we use Power eTrade platform to get an edge in Option Trading.

Suggested Resources

#1 : The #1 Trading Tool You Don’t Want To Miss In 2020

#2: Check Out Our Subscription Trade Alerts

#3: What You Need To Get Your Options Trading Career Started

TBP || Becoming A Successful Stocks and Options Trader

Email:Telex@Successfultradings.com

YouTube: https://youtube.com/c/successfultradings

Facebook: facebook.com/telex.tbp.7

Data Accuracy

10

Ease of Use

10

Education Training

10

Features

10

Alerts

10

This is very helpful

Thank you very much

Hello Sarah,

Thank you for the very positive feedback.

Talk to you later.

A very good review you have written here on this power e trade. I like your review and I feel it will be very good for me to try out the platform you have here. It seems like a good on where I would be able to do so much more. I’m happy with what I have learnt. Thanks for the very valuable information to make me a better trader.

Greeting Suz,

Glad to hear that the content was informative for you.

Have a great weekend.

Hello there, thanks for sharing this really wonderful information. I have so much interest in trading and it’s been really a good because I have done my research and it’s a great idea. I have been on the search to get a good platform to learn how to trade and seeing this one make me really happy. Cheers

Hello Justin,

We are thrilled by the fact that you enjoyed our review of Power etrade as it helps you in your decision to find the right trading platform for you.

Please let us know how we can help you further.

Thanks