Have you ever wondered about learning how to Trade Stock Options ?

We offer a practical guide on how to successfully do that despite the odds.

Table of Contents

How To Trade Stock Options: Beginner’s Guide

Regardless of anyone’s background, the internet has made it possible nowadays to gain access to numerous markets across the globe within the comfort of one’s house with a computer and an internet connection.

Trading Books To Get You Started

The best first thing one can do before embarking on this journey is to gain knowledge, more knowledge and further knowledge.

For that, I would suggest these books by those who have walked the very steps you are about to take.

In no particular order even though the first one is a MUST:

- Pit Bull : Lessons from Wall Street’s Champion Day Trader by Martin Schwartz

- Reminiscences of a Stock Operator by Edwin Lefevre

- One Up On Wall Street by Peter Lynch

- The Intelligent Investor by Benjamin Graham

Just in case one might be wondering about the correlation between reading some rather old books and Trading Stock Options in today’s markets.

Yeah, Stock Operator is a 1923 novel.

The Intelligent Investor was first published in 1943.

Old Knowledge is Still Pretty Good

I have a two-fold answer.

Firstly, perspective is very a valuable thing and secondly, the “game” remains the same.

Only the tools may have changed when it comes to Trading Stock Options.

More to come on this in subsequent Chapters.

Here is the Video Summary of the Full Article.

How to Trade Stock Options: The Benefits of a Good Foundation

Armed with the concepts from these Options Trading books, I was able to gain a better understand of the market.

As a result, I can stay focused about the end game and focus on what really matters most.

Consider the time spent on reading part of your warm up.

For those in athletic fields, it is a given that no great performance has ever been achieved without proper warm up.

Pro-athletes we admire can attest of the necessity of this phase of their routines prior to performing at the peak levels they have accustomed us to.

After the reading of the books, we shall next tackle take on setting up online accounts.

Yes plural for the very reasons explored below.

HOW TO SET UP ONLINE ACCOUNTS

This process comes with finding a good stock trading platform.

Until a week or so ago, price was one of the factor in making this decision.

Creating a Trading Account 101

The good news is that all majors brokers (E*trade, Charles Swab, Fidelity, TD Ameritrade) now have zero commissions on equities and Options trades.

That is music to the ears of all over-traders (I was one!) and all traders in general because commissions could accumulate and could lead to reduction in Net Profit.

Therefore, a good broker is defined by the platform it services its customers and the slight cost to trade options contracts.

But first, I strongly suggest selecting a broker that offers a Paper account.

In the below video, we are comparing two such platforms in this eOption App vs eTrade Review.

Yes, a paper account where one can practice and setup simulated trades in order to validate one’s methodology.

We shall devote a whole section on this concept later.

How to Pick a Trading Platform

For now, any broker that can provide a Level 2 Options account (ability to buy and sell Calls and Puts) with a paper account will do the job.

E*TRADE just happens to be the one I signed up with.

Actually, It was called OptionsHouse back then in 2016 and ended up being bought by E*TRADE.

As a bonus, it would be helpful if the broker of your choice provide self-paced free education on trading Stocks Options through self-paced material or through regular webinars.

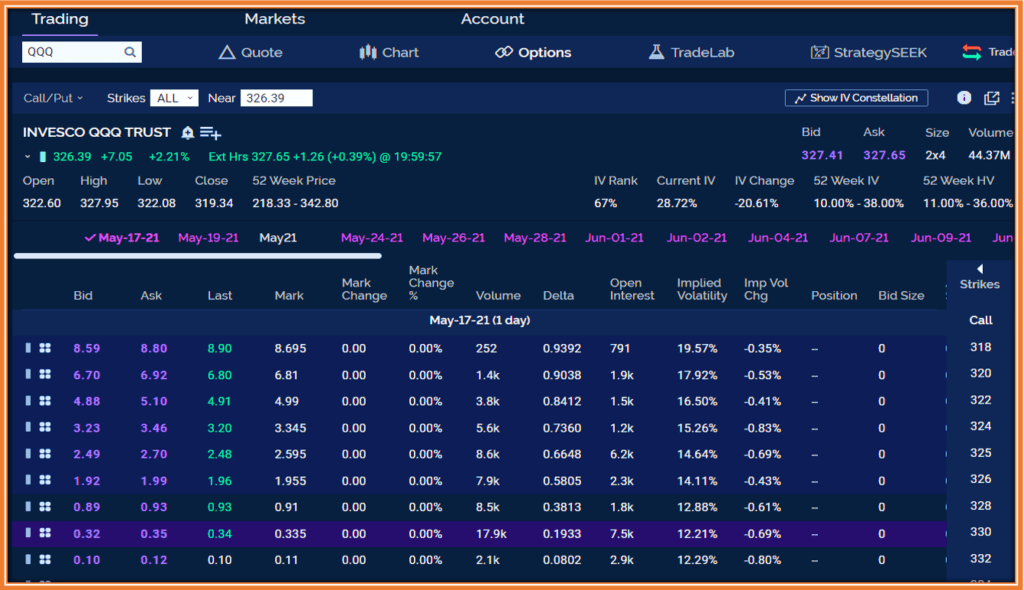

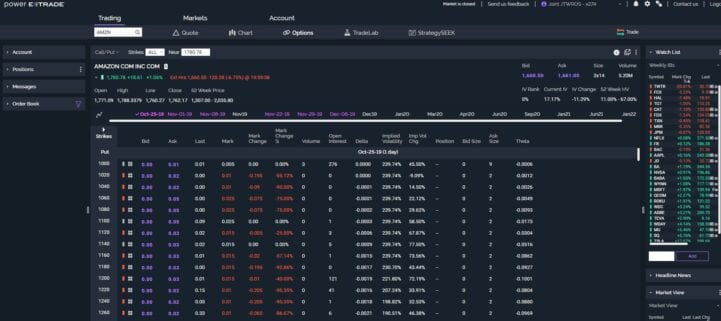

Once you have access to a platform, you should spend time to get yourself acquainted with the tools.

Trading Chart, the User Interface, a Trading Lab of some sort, Scanner, alert features and notification mechanisms.

Below is a view of the E*TRADE platform as it stands at the time of this writing.

What is the FINRA Rule 4210 ?

As part of setting up an online account, brokers sometimes tout the Margin feature of the account.

What is A Margin Account ?

A margin account provides the flexibility to increase the trader’s Buying Power (BP).

Let’s consider an example where trader Joe or Joanne opens up a brand new account with an initial deposit of X dollars.

Joe’s Margin account will provide Joe with a Buying Power of 4X to 6X dollars,.

Therefore making Joe/Joanne feels as if he/she actually has deposited 4X to 6X dollars.

This is one Leverage brokerage firms can provide.

There is sometimes a minimum amount Joe/Joanne needs to deposit in order for this feature to come in. Typically, $2000 can be such minimum threshold.

Now, to engage in day trading (activity of buying and selling the same security in the same trading day),

FINRA (formerly National Association of Securities Dealers, Inc. or NASD) Rule 4210 (Approved by the Securities and Exchange Commission on February 27 2001) imposes that one must maintain at least $25000 in a margin account.

If not, such trader is restricted to no more than 3 round-trip (Buy and Sell count as one round-trip) day trades within five consecutive business days.

When this rule is violated, your broker will automatically set your Account as a Pattern Day Trader.

You will get a message that you have infringed the Pattern Day Trader Rule.

How To Get Around the Pattern Day Trader Rule

In case one does not have $25000 to start an account, one cannot do much of day trading ?

Yes, You Can. And this is how.

Cash Account vs Margin Account

You simply call your broker and ask them to remove the margin feature of the account.

As a result, the account becomes a Cash Only account where it is possible to Day Trade Options.

Of course, the amount of Cash a trader deposits determines its initial Buying Power.

However you will no longer have to worry about Day Trade restriction while you build up your account.

Once above $25000, it will make sense to switch it back to a Margin account.

Who Are the the Players in Online Trading

At this stage of your Online Stock Trading Basics Learning, It is important to review the big Picture.

For any trade in the market, there are always two sides of the trade.

Stock Market Makers

Just like buying a house type of transaction.

There is the Seller who desires to sell at the highest price and the Buyer who aims to buy at the lowest price.

In the world of stock and options trading, Market makers are those who write the Options.

These are usually big banks like Goldman Sachs and some brokers like the very one providing the platform you may be trading on.

In this last instance, talk about a conflict of interest (…)

You vs Market Makers

The point here is that the Market Makers control the Bid (price at which Buyers want to buy) and the Ask (price at which Sellers want to Sell).

The distance between the Ask and the Bid (Ask – Bid) in dollars is the Spread.

Very Liquid Options tend to have very small Spread (less than 5 cents) whereas not so liquid Options tend to have bigger Spread (15 cents and above).

The liquidity of a stock Option is proportional to its volume.

The volume directly impacts the Open Interest (number of contracts currently held).

CONCLUSION

To Sum up, we offered you a path on How to Learn to Trade Options as a beginner.

It starts with basic readings essentials and setting up a demo/paper trading account.

Then setting up a non-restricted (regardless of your initial capital) live options trading account.

Next, we shall tackle on the very instrument we seek to trade by answering the question: What is an Option ?

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Very good introduction to getting started to trade stock options, I like it. I’ve been researching stock trading for the last few weeks and often find it overwhelming. I’ve looked at the big boys, we all know who they are, and I’ve looked at new cryptocurrencies. Heck I have also looked into stock market investing apps like Acorn and Stash. I look forward to the future installments on your getting started on trading stock options series. Do you have a suggestion of what app you like the most? Thanks.

Hello,

When you say “App” do you mean the platform for trading ?

Most of them are web based and of course offer an App version as well.

E*TRADE has done a great job over the last 3 years – TOS (Think Or Swim)

and TD Ameritrade come to mind as well.

Hope this helps.

Thank you Telex for sharing those information on trading.There are so many scams out there that ,me I run away from this subject.But you tried your best to give detailed information to beginners like us.I will come and visit your site again to learn more about trading.Thank you so much for your article.It encourages me to learn properly before investing.

Hello EVA,

Glad to hear that the article was helpful to you.

I started just like you a few years ago and had to educate myself . So it is feasible.

It is a good educational post for beginners of options trading. I am a stock trader but have no knowledge of option trading.

A while back I read in the news how one apple option trader lost all his money which he saved to live through his entire life. That has scared me to death.

It needs good knowledge to start anything and more so when you play with your money. AS I understand you are options trading with the market makers. It needs intelligent strategies to win.

I do not want to have a margin account and it is nice to know you can do limited options trading with the amount of money you like to invest. Please let me know if my understanding is wrong. I look forward to learning more about successful options trading from visiting your sites in the future.

Great Anusuya,

You are on point with your understanding of the article. That is impressive.

How long have you been trading stocks ?

Hi there,

can you explain a bit more about what exactly trade options are? I got confused when I read this post. A few years ago I went into what I thought were trading options, but now I am not so sure.

I like that you can use platforms now that are free to use, and especially if they have the paper feature to practice. I had no success with this back then, but I am sure there are ways to become successful with it

Oscar

Hello Oscar,

This article is part of a series of Tutorials on Options trading that start here:

https://successfultradings.com/how-to-trade-sto…ns-for-beginners/

I am confident that by following it from there, things will be much clear.

Please let me know if you have further inquiries.

I agree that getting the best perspective on any type of business is fundamental. I would love to set my mind right before i start trading stock options. These insights are very helpful. Glad you have pointed out the need for some education or training from a broker. I was about to get discouraged by the $25000 minimum amount but you have explained well how it will still work. Thank you for these valuable insights.

Thank you Carol,

We are here to educate retail about ALL the aspects of this profession.

Feel free to follow us below through the social buttons: We will have a newsletter

coming soon for dedicated individuals who are eager to learn more.

Thanks

As an MBA fresh out of college, I found this interesting. They taught it to me but I need more insight and it is a topic I really would like to invest in! Thank you oh so much for this knowledge. I remember a friend would always talk to me about stocks and I had no idea what he meant.

Hello Linda,

How are you doing ?

I am glad to hear that this content help improved your knowledge on stocks options trading.

Have a great day.

Thank you very much for providing the beginner’s guide of options trading. I’m still a newbie in the trading world and currently researching which type of stock I want to invest. Any basic tips about how to find the best options trading platform, especially a beginner-friendly? Or do you happen to know a good options simulator to practice trading? Thanks

Hello,

Thank you for stopping by and offering your feedback.

We really appreciate that.

Regarding your questions, we recently published the best trading

Platforms. Maybe that will be a good starting point for

Your research ?

Telex,

When it comes to Dog and Horse racing, Casino gambling, if the owners weren’t able to manipulate outcomes, they’d be out of business. I greatly appreciate your understanding and knowledge in trading stock options. Thanks for sharing.

A knowledge base as foundation is important in any endeavor.

Can you share one gem that you mined from the four books recommended?

JR

Hello JR,

How are you doing today ?

Glad to hear that you found value in this discussion. Your feedback helps us focus on the right information for you the readers.

Regarding your question on a gem I gathered from the reading of the four books I recommended here,

that clearly will have to be from “Marty” Schwartz.

He said: “Always Ask yourself before taking a position: Do I really want to have this position ?”

That has been my motto ever since.

After that, you have to ask yourself Why ? Then How are you going to Manage the position.

If a trader can clearly answer these questions on every single trade, they will come ahead most of the time or at least live to survive and come to the fight the next day.

Thank JR for stopping by and adding your insights into this discussion. I appreciate that.

Telex, I am thankful that i stop by your videos and blogs. This is high quality, editing, and easy to understand. Thank you very much

Welcome Sarah,

I am glad you enjoyed the content on this article for beginners who would like to learn how to trade stocks options.

Please let us know how we can further assist you so that you ca Take your Trading to the NExt level in 2020 and beyond.

Talk to you soon.