Motley Fool is an investment and finance company declaring it outperformed the S&P 500 three times for over two decades.

With this Motley Fool Stock Advisor Review, we are going to do a thorough analysis of this service offered by the company.

Going deep to look for answers that burn such as, is the service reliable and do the stocks they pick double or even triple throughout the years?

With the biggest question: Should you fork over your cash and subscribe to their newsletter?

Join me in uncovering what makes it tick in this Motley Fool Stock Advisor Review.

Table of Contents

Motley Fool Stock Advisor Review: What Is Motley Fool Stock Advisor

Motley Fool Stock Advisor is the premier newsletter service offered by The Motley Fool.

The company has a history of 27 years and is based in Alexandria, Virginia and still going very much strong.

The flagship service, the Motley Fool Stock Advisor is a subscription service that provides you with stock picks and analysis each week.

The service, aptly called Stock Advisor, emails subscribers 2 new stock picks at the start of each month along with the why and how they picked the particular stocks.

Together with the stock picks, you will also receive the Ten Best Stocks To Buy Right Now List.

Which details the recent stock picks and why they are still relevant and show great potential.

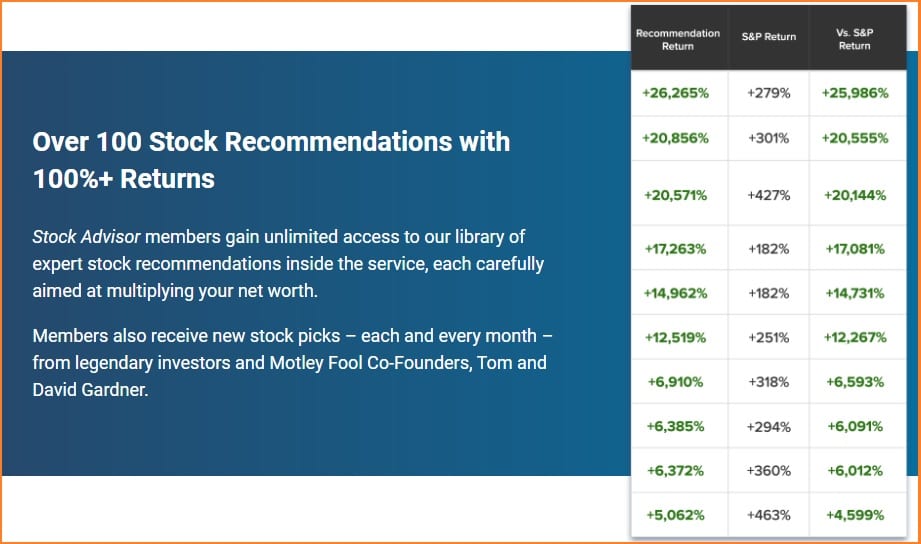

Impressive Performance

Upon opening their website, I admit I was impressed by looking at the graph showing they beat S&P 3-to-1.

Boasting it is 336% versus the 79% returns from the S&P 500.

For example, your initial investment of $2000 the return will be $6000.

Motley Fool Stock Advisor Review: Who Owns Motley Fool

The brothers David Gardner and Tom Gardner are the founders of Motley Fool.

During the early years of the company, it published a series of messages online promoting a nonexistent sewage-disposal company.

Funny Beginning

It was an April Fool’s joke designed to teach a lesson about investing in penny stock.

As the name suggest, it is inspired by the court jester in Shakespeare As You Like It.

With a purpose of making the world, smarter and richer by providing outstanding business and investing advice — with a decidedly Foolish bent.

The Gardner Brothers also published a bestselling book called The Motley Fool Investment Guide in 1996.

In April 2002 was the year Motley Fool launched the Stock Advisor program.

In January 2019, the company amassed $147.7M for funding.

How To Make Money with Motley Fool Stock Advisor

The stock picks they provide are a good companion with your own research on what stocks and companies to invest into.

I say this clearly because yes, The Motley Fool has been around for a long time but since you are investing your money.

You should first study the fundamentals of investing and not blindly invest in stock picks.

You can make money following any one’s advice as well as lose a fortune following any one’s advice.

You must own the decisions yourself.

Motley Fool Stock Advisor Features

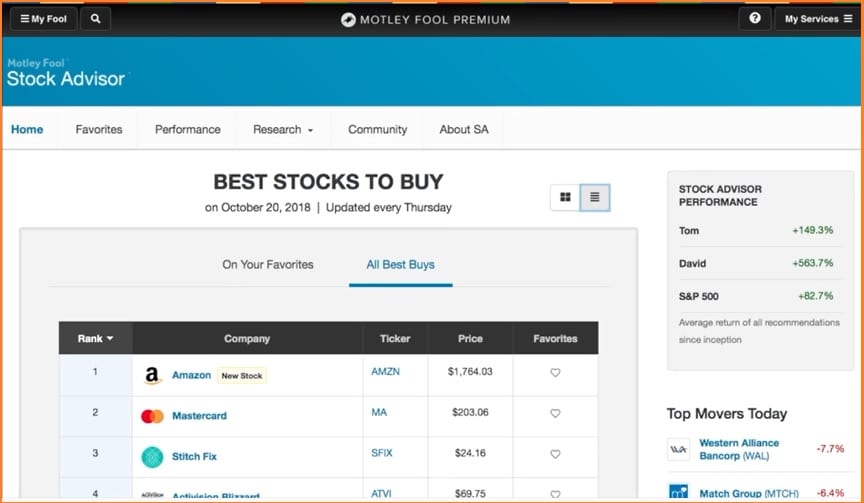

Monthly Stock Picks

The monthly stock picks are the key feature of the Motley Fool Stock Advisor.

Subscribers will be presented two new US stock recommendations every month via email and onsite.

This feature is like having a cheat sheet that tells you all the hot stocks that you should invest into.

If you are not the kind of investor who likes to look at charts, graphs or do not have the time to investigate stocks.

This feature includes not just the current but the historical stock picks as well.

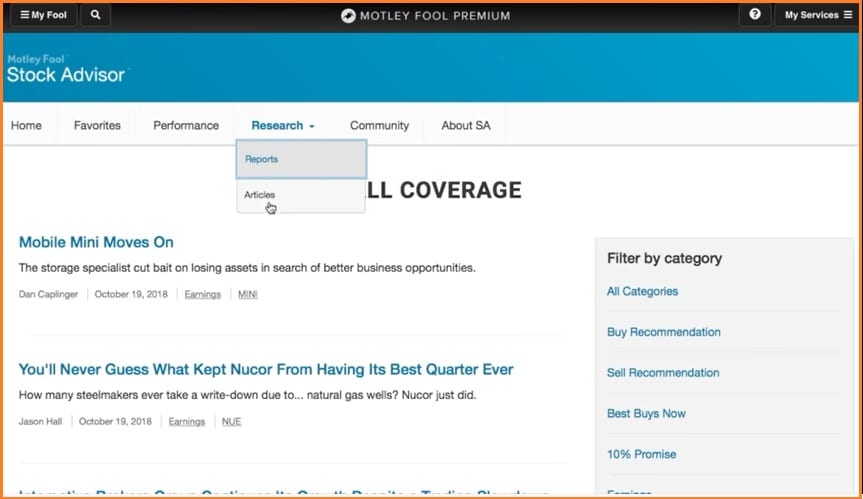

Stock Research

The stock picks that Motley Fool offers are analyzed and reviewed extensively.

All the information pertaining to the stock picks are also in the website itself.

Making it a lot easier if you want to find out the reasons of Motley Fool for selecting such stocks.

It also presents numerous trending topics that have a significant effect on the stock market.

This page is useful in creating that bridge between investing and innovative and trending topics that are happening in our society.

Investment Education

This feature is the one I like the most in the Stock Advisor.

As someone who wants to know more about trading, having that pool of knowledge readily available is something I cherish.

Being a subscriber enables you to have access to Motley Fool’s education resources related to finance and investing.

This section also has articles relating to the Fool methodology that the Gardner brothers uses to research the stock picks.

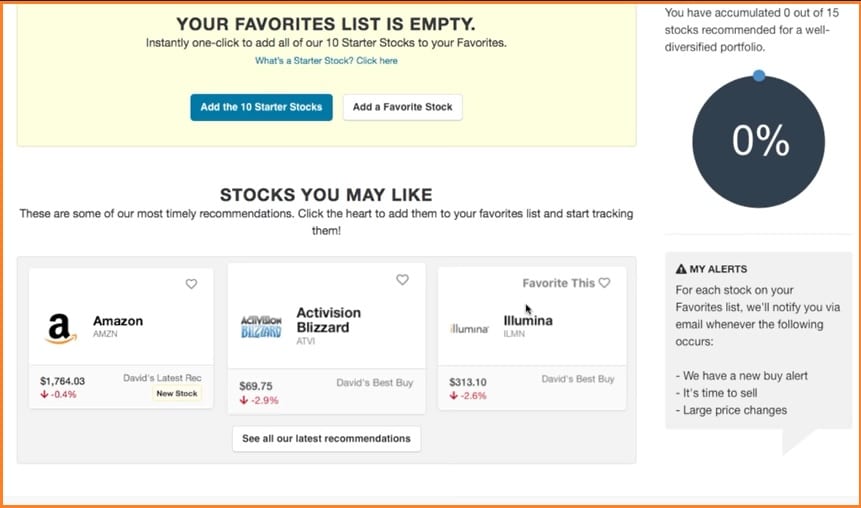

Favorites

This feature will track stocks that you are interested, plus it will alert you when three economic events occur in your stock.

These events are: new buy alerts, large price changes and the right time to sell.

This feature is beneficial because sometimes there are moments when you are engrossed in something else.

And having that alert to notify you about the changes could mean making money or not.

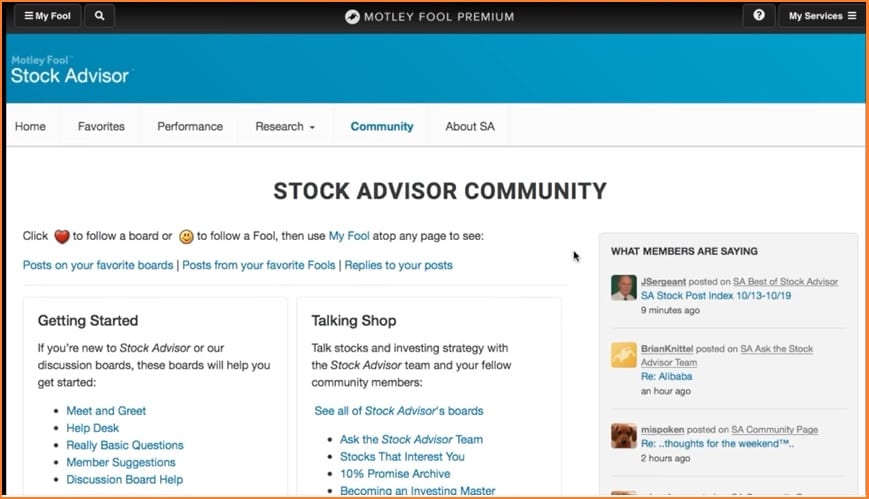

Community Forum

This is a feature where you can discuss stock and investing topics with other members.

In my opinion, having this feature which lets you communicate with other investors is a good thing.

Because it lets you share knowledge and compare each others methodologies which can greatly enhance you as a trader.

Also, let us admit that trading can sometimes be lonely with you staring at your monitor all day.

So this feature will connect you with like-minded people that you can bond with over stocks and finance in general.

Motley Fool’s Foolish Four

While Motley Fool has a long company record, not everything was rosy for the company.

In 1999, Motley Fool has instigated an investment theory called Foolish Four.

This idea was touted to let you “crush mutual funds in only 15 minutes a year” using a formula that find stocks forecasted to grow more than average.

Not So Great Mathematical Formula

You can imagine how things ended with this “mathematical formula”.

Ann Coleman from Motley Fool admitted that the Foolish Four method “turned out to be not nearly as wonderful a strategy as we thought” in 2000.

This resulted in the company losing 80% of its staff and closing operations in Germany and Japan which has since been reestablished.

What People Say About Motley Fool

These are a few reviews in Better Business Bureau:

Robert H 09/24/2020

Off and on for many years. I like some changes others not so much

IntlWaters 08/17/2020

These guys are the original straight shooters. They have made my retirement possible. If you are looking for investment advice without all the BS and trepidation about hidden fees, front-running stocks, etc., etc., you’ve come to the right place.

James 07/03/2020

Do it, you won’t regret it. Been following these guys since the late 90s, Should have taken all their recommendations.

Shirley L 07/07/2020

My Portfolio went up by 350% since I joined The Motley Fool with their different services. I would not know any of those winner stocks that the had recommended if not from Motley Fool. Thank you Motley Fool.

Kevin L 07/08/2020

Motley Fool has made it much easier to make savings decisions with much more confidence!

Rick H. 07/08/2020

I think the Motley Fool holds more knowledge than any brokerage firm or other advice firm can give. Join, and you will not be disappointed.

Gina Y 08/18/2020

Articles seem heavily biased and written by short-sellers, despite the disclaimers. Never balanced. I think only fools would take Motley fool seriously. Get your opinions from many sources and not short-sellers who stand to profit from swaying your opinion

Aldo M 09/13/2020

I am an experienced investor with almost 40 years of experience, personally managing my portfolio with a substantial rate of success. I find a lack of objectivity in Motley Fool’s comments with a certain level of animosity against certain stocks. That lack of objectivity may lead inexperienced investors to a wrong decision. If you have the time to follow Motley Fool comments you can see that down the road, they even contradict themselves. Their comments are not a valuable tool for investors The company shall filter and correct the opinions from the different writers/contributors The motley Fool has in order to avoid false or wrong information provided in such articles, as well as the potentially biased opinions from some of their contributors.}

Tom V 08/03/2020

Excellent investment service, especially for growth-oriented stocks. I have benefited greatly from using the service for several years. I follow their recommendations and consider it one of my core investment services.

What I Like About Motley Fool Stock Advisor

Noting the fact that Motley Fool has been established for more than 20 years, it has a solid company record.

And during those years of service, they continuously improved and outperformed S&P 500 which I say is something that is no small feat.

Lastly is transparency, as the company lists all the historical picks since at the very beginning of their service.

So you would not have a hard time of back tracking stock picks from a certain time frame.

What Are Alternatives Or Competitors Of Motley Fool Stock Advisor

The top competitors of Motley Fool Stock Advisor are TheStreet by Jim Cramer, Benzinga by Jason Raznick, and of couse Bloomberg.

The difference between Motley Fool and TheStreet is the overwhelming nature and breadth of articles covered in latter.

Benzinga vs Motley Fool

While with Benzinga, the main difference is that Benzinga has a feature called squawk and the news are real-time.

Bloomberg on the other hand is a 24-hour financial news provider unlike Motley Fool who releases newsletters monthly.

We have a review on Benzinga Pro Price and one of Jim Cramer’s Real Money Subscription Cost, so go ahead and check it out!

Is The Stock Picks of Motley Fool a Pump and Dump?

The companies that Motley Fool presents are blue chips companies which are very difficult to pump.

Besides, pump and dump strategies are for small cap companies who are highly volatile and can change price at any time.

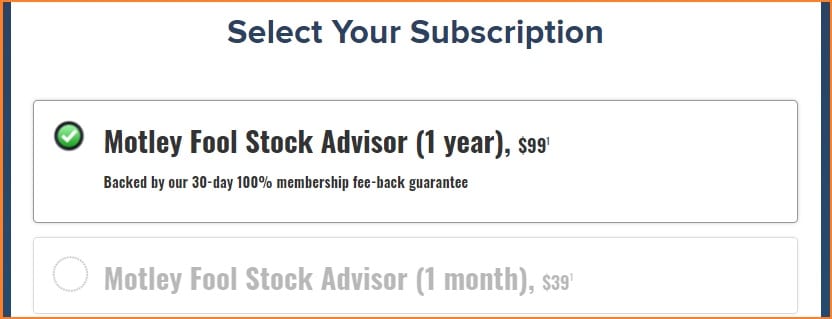

Motley Fool Stock Advisor Costs

You can go for a monthly program which costs $19 per month or go for the annual plan of $99.

Which I highly recommend since there is not much to fault.

Motley Fool Stock Advisor Refund Policy

This is the Refund Policy of Motley Fool as taken from their website:

Different Services (and sometimes specific offers) have different refund policies (including some that offer no refunds). Please review the specific terms of your offer before signing up as you are agreeing to be bound those terms. If you are unsure of your cancellation rights, please contact Member Support.

Please note that most refunds are only available to first-time subscribers. If you subscribe to a Service that allows for refunds beyond 30 days, and cancel (and receive a refund) and then subscribe again, you will not receive a refund after the first 30 days.

From time to time, The Motley Fool offers its premium services through third-party vendors. In such cases, the vendor’s refund policy would apply and may differ from your Service (or specific offer).

PROS And CONS

PROS

- Very Inexpensive

- Transparent

- Solid company track record

- The investment education feature is an excellent introduction to finance and trading

CONS

- Since it is not a daily newsletter, others may not find the information timely

- Short-term traders may not find the information useful as they gear it for long-term trading

Final Thoughts: Is Motley Fool Worth It?

Based on what we discussed in this Motley Fool Stock Advisor Reviews, I can safely say that Motley Fool Stock Advisor is not a ripoff.

It has been proving reliable information to aid investors in their trading and is a widely known subscription service.

They gear their stock picks for the long-term investors and is a significant starting point for new investors.

But then again, I discourage you from blindly trusting a stock pick, instead you can use their stock picks as a guide and then do your own research.