If one fails to plan, then one must be prepared to fail.

In the article titled How To Trade Options for Beginners, we intend to show you what it takes to plan and Master Trading Options as a Beginner.

Table of Contents

How to Trade Options for Beginners: ALL THAT SHINES IS NOT GOLD

If you want to know as a trader a sure validation why you should not be in a given trade, ask yourself this question : Why did I take this trade ?

Should the answer be any one of these (feel free to add your own on this sample list)

- My Doctor got a tip from his friend over the weekend

- The short pundit on the TV was screaming louder than usually on his Bullish view on this stock

- My wife’s hairstylist second cousin removed used to work for this company

- It is the future and they enjoy a great position in their industry

- The stock is too cheap. Or its variant, this stock is already too expensive.

- My wife’s hairstylist second cousin removed works for this company

- (insert yours anything you can think up here)

While all the above may well land you in a winning trade for that day/week/month, chances are none of them can be used as a consistent entry criteria into a trade and therefore is a sustainable strategy in order to become an expert on How to Trade Options.

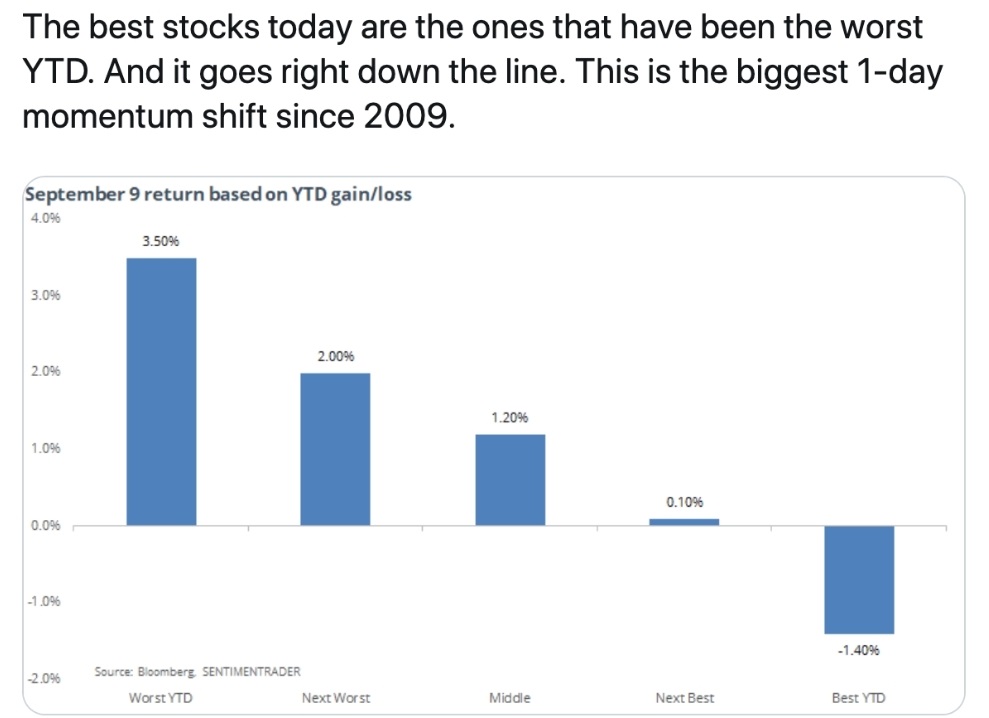

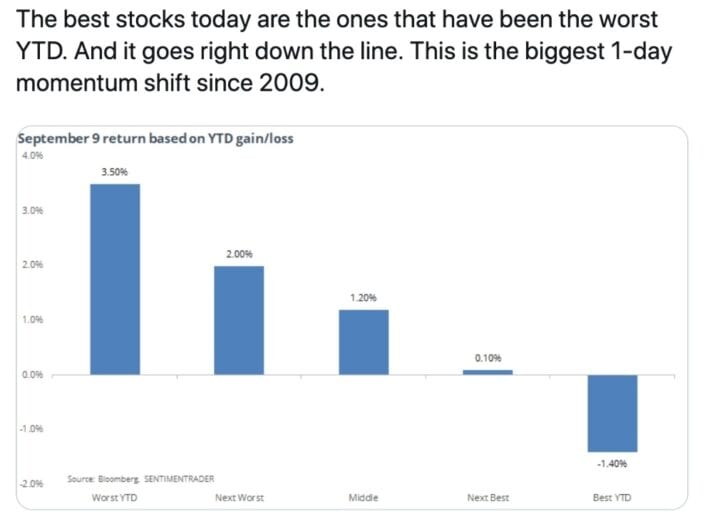

The market is known to have sudden momentum shifts.

Here is an example illustrated by the picture below.

The worst year-to-date stocks performed the best on Sept 9 2019 whereas the best year-to-date stocks had the worst yield for the same day.

The statistic are clear on this profession : less than 2% of day traders are profitable on a yearly basis.

One of the main reason for this is what we highlighted in this article.

The need for instant gratification tends to cloud some beginners of the necessity just like in any profession to spend time gathering and honing the necessary skills to be successful in Day Trading Stock and Options.

We can integrate the sum of these acquired skills over time into a Methodology or Strategy as shown in the next session.

How to Trade Options for Beginners: The Methodology

In the epic Biography Pit Bull I recommended in this earlier discussion to the new entrants into this profession, Champion Day Trader Martin “Buzzy” Schwartz reveals in Chapter 2 – The Plan – how he became confident about his trading after adopting the “Magic T” as his primary Methodology.

It is this methodology that will be the answer to the question we asked above : What is my reason for being in this trade.

Because the Methodology strategy confirms that all the conditions were met for that trade.

We are talking here about the entrance criteria certainly, but such Methodology must also include profit taking levels and exit levels when the strategy turned sour.

In case you may be wondering the need to exit a position that was confirmed by a proven entry condition – well – nothing is perfect especially in today’s volatile market where a simple tweet can derail your day in just a few minutes – More on this later.

Contrary to conventional wisdom, very successful traders are the ones who actually know when to take a loss and move on to the next setup. In the words of “Buzzy”, they have learned to divorce their EGO from their trades.

Tracking Your Performance

A proven Methodology is one we can test and validate over different types of markets (bull , bear and sideways).

Proprietary firms run back tests over at least 3 years to validate the effectiveness of any strategy before launching it Live.

In our scenario, the demo (also know as Paper account) we strongly recommended earlier will serve that purpose though over a much smaller time frame for back testing.

We shall tackle later on the difference in time frames.

Just to set expectations, any back test that can show a success rate over 60% is actually quite good.

It is enough to get us where we want to be.

Even after adopting a Methodology, constant measurement of the results is a must as it provides opportunities for adjustments that will lead to process improvement through Risk Management for example.

If a Methodology proves to be a winning one over a solid period of time, one can imagine being able to take more risk by trading bigger sizes for instance.

These are details that will help grow your business as you continue to Learn to Trade Options.

So just like the companies you are trading have quarterly earnings results, regular performance evaluation of your trading business is a requirement no matter how well you may think you are doing.

The Routine of Day Trading Stock Options

This would lead the trader into a set of routine tasks void of any emotions.

Trading at this stage after identifying one’s methodology should have this simple code below:

IF (condition c1) is met

THEN (Take actions a1, a2, ..an)

ELSEIF (condition c2) is met

THEN (Take actions b1, b2, …,bn)

ELSE

Do NOTHING

ENDIF

The “beauty” of this is that we will automate all of these instructions on most trading platforms.

Therefore there is no room for THINKING !

Yeah, that is the big takeaway for this chapter.

Trading is best when done without any thinking behind it.

But that requires preparation in order to get to that level of simplicity.

Traders are not longer emotionally reacting to the markets but rather just adapting and adjusting with the market flow.

I would leave you with this about the above revelation on automating entries and exits in the market.

Over 60% of the volume in the Stock market today comes from computers.

High Frequency Trading is the name for this.

So who do you think will be faster in executing a trade ?

You and me with our 10 fingers or Powerful fast machines that know where the market is going before it even get there ?

How TO Achieve CONSISTENCY in Options Trading

We show that Success in Day Trading Stock Options comes through consistency.

The ability to repeat the same System/Strategy/Methodology over and over.

After all, it is well know that in any activity, Professional repeat the process until they cannot get it wrong.

On the other hand, “amateurs” are content to do it just to get it right once.

Just for kicks, what do you think the (a1, a2, ..an) and (b1, b2, …bn) are ?

Leave your response in the comments section and we shall pick up from there in our next episode.

CONCLUSION

In this discussion, we provided important steps on How to Trade Options as a Beginner.

Consistency is the ultimate step in the path to making it full time as a professional trader.

Further chapters will equip you with the tools (A good Trading Platform is the Foundation) and practical examples to get you the confidence needed.

TBP | Becoming A Successful Stocks and Options Trader

Email:Telex@Successfultradings.com

Facebook: facebook.com/telex.tbp.7

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Thank you for this informative post.

I’ve been looking into various investment options and stock option trading is one possibility I’m interested in learning more about.

I’m just not sure how to go about it. It seems like everywhere I turn there’s a fool-proof tool here or a subscription option there and do on.

I’ll admit, instant gratification is a condition I suffer from at times and, being new to all of this, not seeing immediate results, makes me second-guess myself.

I guess coming up with my conditions list would be a good place to start.

Thanks again,

Scott

Hello Scott,

Even the most successful traders will tell you that they did not start up as winner. It is a process that when learned correctly, can prove to be very rewarding in terms of the lifestyle it can provide.

Feel free to reach for any specific need you may have. I am sure i will be able to point you at least in the right direction.

The 2% statistics is very worrying. With nothing guaranteed in the market, some of us find it hard to trade on a slow path. I guess that is what contributes o the fewer chances of succeeding in trade options. I always assume that trading is a matter of luck. I am surprised that there is a winning strategy involved that could be tested for years. I am not so familiar with trading stocks but I hope to master this in the near future. Thank you for your insights.

Hello there, 2% is small in percentage but quite respectable in raw numbers because anyone who put a tiny amount in the market is considered a trader.

I understand how it can be scary from the outside but when armed with the right knowledge, it is actually quite feasible. We aim to prove that through this process.

I do agree that understanding ourselves is important before making any planning on our trades. But most of the time, hesitation will appear and chances will be missing if we think too much. Every decision before each trade has miracle psychological effect on us. What kind of changes in our mentality during and after the trades? All reflects what kind of person we are. Maybe it is an essential process to become mature. Maybe someone finds the trade very challenging. Maybe some people will discover that they are not suitable to stay in the stock market. Is it the whole process we know ourselves?

Thanks for your information.

Dolbe

You are welcome.

I like yours opening statement: “If we fail to plan, then we must be prepared to fail.” It indicates how crucial it is to adopt a strategy and sticking to it no matter what emotions arrise during the trading. Rinsing and repeating a wining strategy. Once we have arrived to that level, trading could be done without “thinking”.

I don’t know what a1, a2 an, b1, b2, bn are. I’ll stay tuned for your next article to learn about it.

How long should we test a strategy to discover if it’s a winning strategy? You said that a 60% strategy could be considered a winning strategy so now I already know what to look for but am not sure how long should I test it.

Thank you Henry.

The very expression you used “Rinse and Repeat” is often used in the trading community.

Are you a trader ?

Our next discussion will entirely be devoted to strategy validation. We will keep you appraised when it is posted.

The problem most people have about business is that they lack the quality and full knowledge of how trade. One major thing that should be taken so serious is consistency because it is the key that follows all the conditions you’ve mentioned earlier. There’s a saying that what you do over and over everyday, it’ll be a very understandable part of you, the you’ll be able to discover it’s in and out. Thanks for sharing this educative article.

I agree KingAndrea,

Instant gratification is not a rewarded trait in the market.

Have a great day.

Hello Telex, I must saz that this article is very helpful and informative. I heard so many things about stock options but honestly, I never wanted to give it a try because of a lack of knowledge. You explained everything so well, I am glad you focused on beginners as I am a total beginner when it comes to trading. I will definitely study more this article.

You are welcome Danijel,

There are many like you out there looking for an entry into options tradings.

We aim to provide that knowledge through these series of option trading tutorials.

Trading stock is one field of study on its own and sincerely, it takes some people like forever to get it right. It’s best foe beginners to understand at that Rome wasn’t built in a day so it all depends on how much patience and consistency you can invest in it. I love how you’ve explained the conditions, they’ll help people understand and learn the proper ways to engage in trading. I’ll share this to my friends.

Hello Wildecoll,

Thank you or the comment.

Glad you found this information valuable enough to share with your friends.

Hi, I liked this article and found it to be a great read. I like the excuses you listed for choosing which stocks to buy. I appreciated your advise that only 2 percent of people are profitable on a yearly basis.

that s great advise.

I recommend buying and holdin US index funds. You can use the website wealth ti.ple. which is a DIY robo investors. Thanks

Hello Jake,

Take for stopping by.

Glad you found the post useful

I am a beginner and I have been looking for an introductory guide as this and before this post, I hadn’t found it. I didn’t know that around 60% of trades were done by powerful machines. It will take some time to compete with them.

A trader must rule out emotions from his trades. That sounds so difficult for me. Are there famous traders that are women?

Greetings Ann,

Studies have shown that women tends to have

Better performance in the stock markets compared to their

Males counterparts.

We will be publishing an article focusing on

This reality in the upcoming weeks.

Stay tuned by subscribing so that you

Are first in line when it is posted.

Enjoy you Day.

Hi! I have always wanted to become a trader. But nowadays there seems to be so much information online that it’s easier in a way but also hard to find good basic posts with the fundamentals.

I really don’t know what a1, a2, an or b1, b2 or bn are.

Id like to get to that level of simplicity were I don’t think for each trade. Instead, I just apply a system.

Thank you very much for helping me see things in perspective.

Thank you Abel.

I appreciate your stopping by to give us

Thoughts on the article.

Glad to see that it was of great value to you.

See you next time.