Still not sure when to trade call vs put option in 20201 ? Look no further.

In this tutorial, I will take you through the process on how to make this determination once for all.

Through the many examples we have traded, you will discover our secret on how to trade puts vs call options and profit consistently.

Table of Contents

CALL VS PUT Option | What Are Calls and Puts

Before I dive into this discussion on Puts vs Calls option, let me share my history with trading calls and puts.

Since 2016, I have been trading calls and puts every day on my trading accounts.

If we assume that in average I have taken five (5) trades a day, that makes it easily over one hundred (100) trades a month.

I took into account that the market is open an average of 20-22 days each month.

So for a given year, we are talking 100 x 12 =1200 trades each year.

Multiply that by six (6) years and you get a good perspective on what this article is sourcing from.

The Encyclopedia Definition of Puts and Calls

I am certain you are not looking for a simple definition from Encyclopedia of what Puts and calls are.

By now, you may have read from Investopedia or somewhere else than a call option gives you the right to purchase 100 shares of the underlying stock.

That is great and all but so what ?

Sure, you may be interested in buying share of a stock using calls but in my six (6) trading calls, I have never actually used that method to acquire shares.

On the other hand, a put option give you the right to sell the underlying stock at the chosen strike.

Before you trade a call or Put option, you need to have three (3) things.

First, the underlying stock you want to trade. That is the obvious one.

Then, you must select and Expiration date.

The lastly the strike Price.

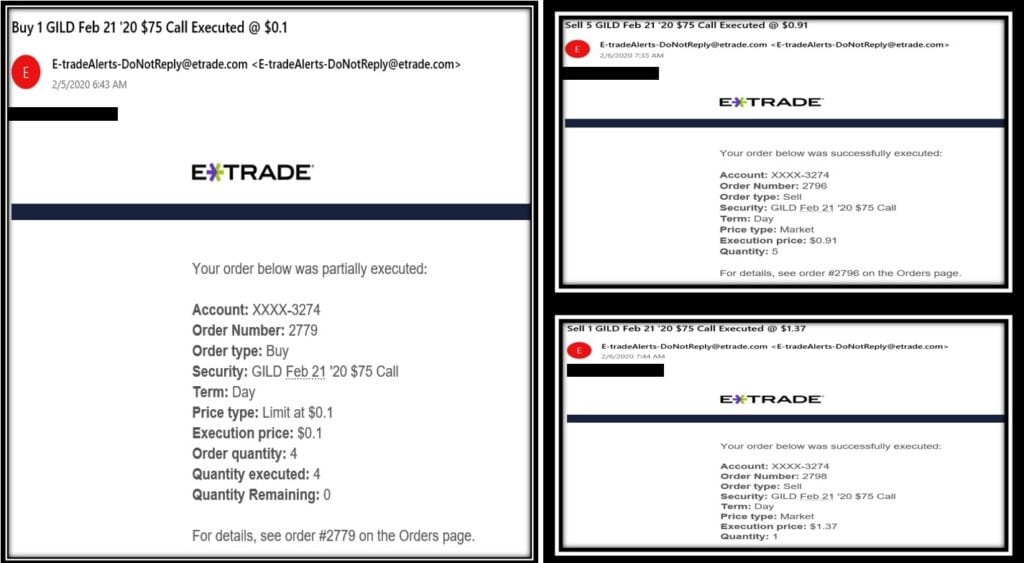

Our Buy and Sell ticket above clearly illustrates this.

GILD : This is the underlying stock we traded call option on.

February 21 2020 : This is the Expiration Date of our Call option.

How To Easily Pick a strike Price of a call or Option ?

This question will occupy you for a while if you are an option beginner trader.

Thankfully for you, I created an 8 minutes video to easily answer it.

Solution: Watch our video below and then download the Excel spreadsheet we are using that video for free !

Practical Trading of Calls and Puts

Calls are Puts are derivatives that take their value from the movement of the underlying stock.

This a call of APPL stock or GILD stock as shown in the illustration above, you will make money when AAPL stock goes up or when GILD stock goes up.

If I were to stop there, then you may be thinking that I have left the most important part of trading Calls and Puts out.

Yes, I am fully aware that the Greeeks also do influence the price of call and put option.

However, I purposely do not want to make this a full blown discussion on the Greeks.

Therefore, I will only briefly touch on two important ones.

Call vs Put Option | The Greeks of Put and Calls

There are five variables known as the Greeks in call and put option trading.

They are called the Greeks because they carry their names from the Greek Alphabet.

As a side note, did you know that my first name has a Greek origin ? True Fact 🙂

But I digress.

What is Theta in Option Trading

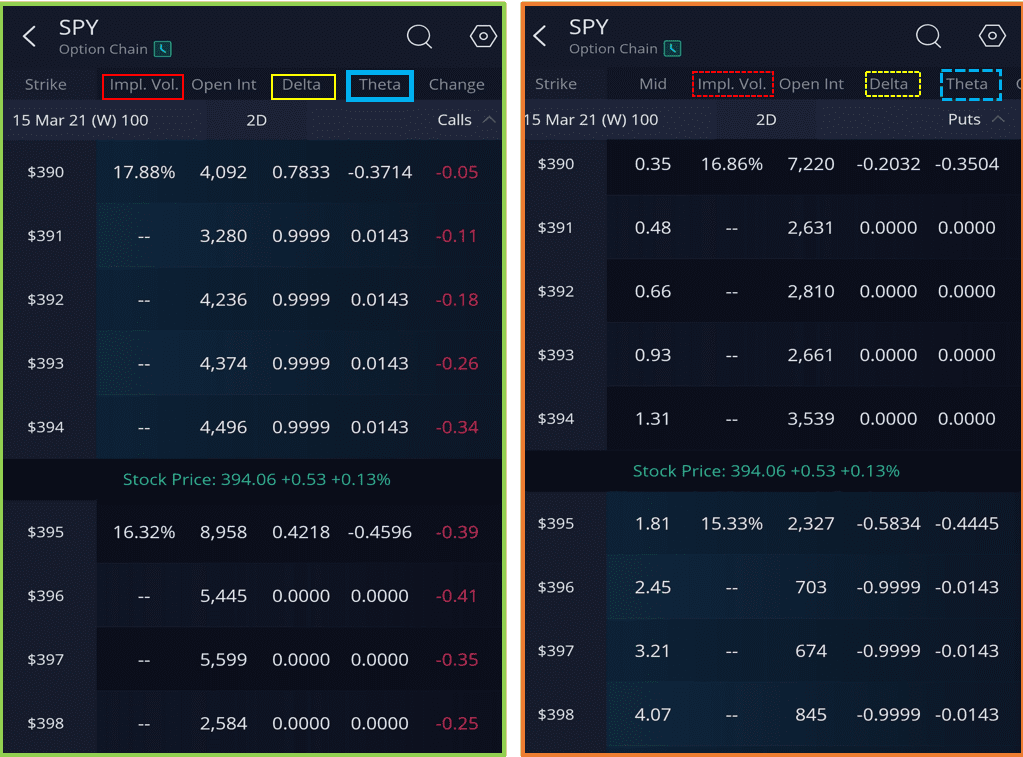

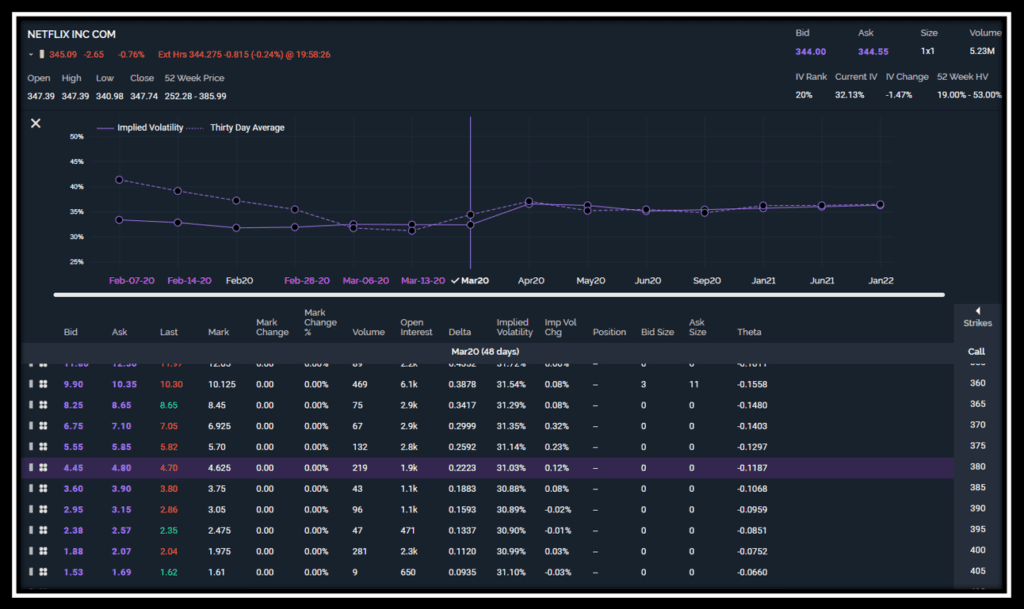

You need to known about Theta (highlighted in blue) as the most important Greek variable in option trading.

Theta measures Time Decay of the Option. Each day that you are are holding the call or put option, it loses a value by Theta.

By definition, options are supposed to expire worthless at expiration if the underlying stock does not move.

Some bad news for options buyers like you and me.

In average, the market makers (people and institutions ) from whom we buy calls and puts from win 66% of the time, meaning the options we buy expire worthless. That is a hard fact yet it is still worth trading them.

The second most important Greek is Delta (inside yellow rectangle) .

Even though I do not personally use it in my decision to trade call and put option, you have to know that it is the probability of stock price reaching the corresponding strike price at Expiration.

Different Meanings of Delta in Call and Put Option

Let’s break this Delta concept down a bit here.

On the above image, the current price (the market is closed as of the writing of this paper) for SPY is $394.06.

The left view depicts the SPY Calls expiring on March 15 2021 while the right hand side shows SPY Puts with same date Expiration.

If you did not know , please register that SPY has Expiration on every Monday, Wednesday and Friday.

It is the only stock (ETF actually) that features 3 weekly Expirations.

Meaning #1 : Probability of Being In the Money

Let’s pick the $390 row on the call side (left view).

The corresponding Delta reads 0.7833.

The unit is dollars. So that is 78 cents.

How should we read this ?

It simply means that SPY March 15 2021 390 Calls have a 78% probability of closing above 390.

This makes sense intuitively because the current price is $394 , over $4 higher.

Conversely for the Put option side on the left image, the $390 Put expiring on March 15 Delta is at -0.2032.

This means that there is only a 20% chance that SPY will close below 390 on its expiration day.

Some traders heavily rely on the Delta to pick their strike price.

Here is the main Take away for you .

The higher the Delta of a call or Put option, the higher you will pay to buy that option.

Meaning #2 for Delta in Calls and Puts Options

The other way you will be using Delta while trading Calls and Puts is to predict the appreciation of your contract when the underlying stock moves by a certain amount of dollars.

The Rule is as follows.

if the underlying stock moves by “N” dullards, multiply Delta by N and add the result to the previous price of the option before that N dollar move.

This will give you a good approximation of your contract.

This knowledge is useful for stock gaping in pre-market for profit taking or when ones wants to enter a position following an overnight gap.

Implied Volatility in Call and Put Option Trading

Though not an official Greek, The Implied Volatility (IV) in my eyes is even more important than all the Greeks combined !

Why ?

Because this is the market makers love to manipulate to get make money off of undisciplined traders.

I said earlier than the price of Call and Put option is mainly derived from the movement of the underlying.

The reason for mainly is because of the Greeks but even more so due to Implied Volatitltiy.

This happens mostly around Earnings or any type of pending news.

For that, we have devoted a full strategy on how to go about avoiding the massacre and trading Earnings in a unique and very efficient manner.

Now that you are a little more familiar with call and put option, let’s discuss if this is for you.

Call vs Put Option | Who Should be Trading Calls and Puts

At the origin call and puts were not meant to be traded as stand alone instruments.

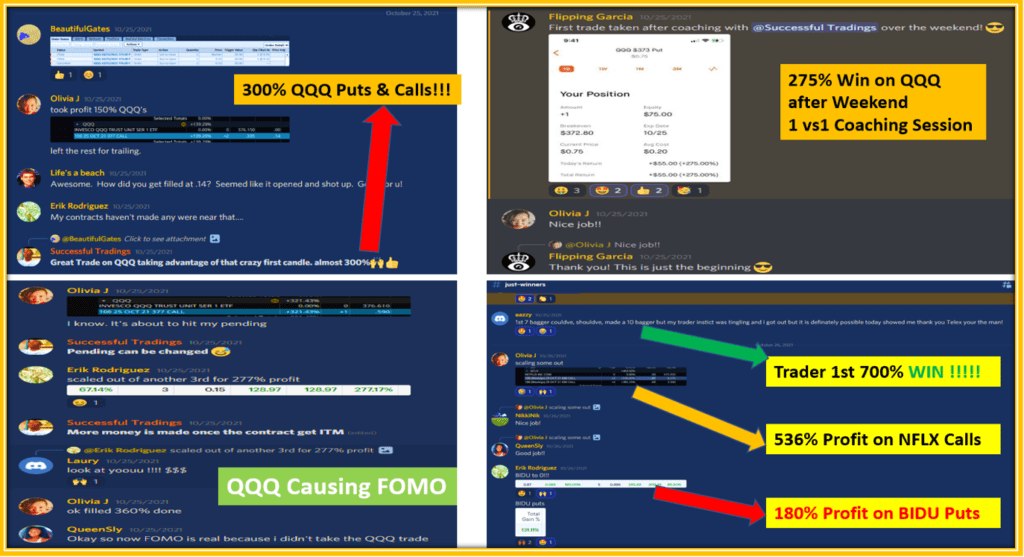

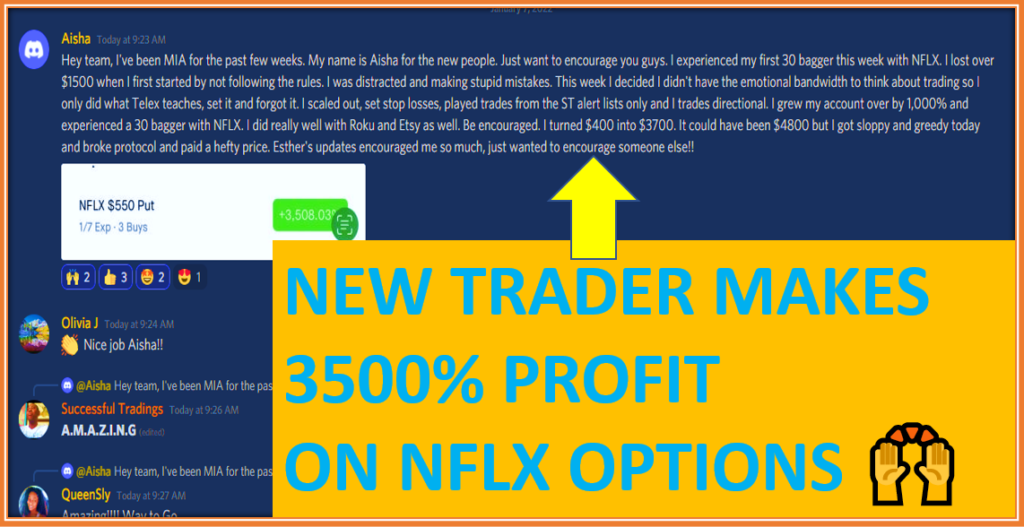

More recently, calls and puts have become a quick way for investors with very little capital to trade some of the high prices stocks.

They provide a good way to grow a small account.

Beware of Calls Obsession

Here is my piece of advice to beginner traders.

I have traded with over 100 traders over the last year.

During the 1 vs 1 coaching sessions, high was my shock to discover than a great deal of traders have never traded Put options.

Then I remembered my own path in the early stages of my trading journey.

It is very easy to get enamored with the idea that the market can only go up.

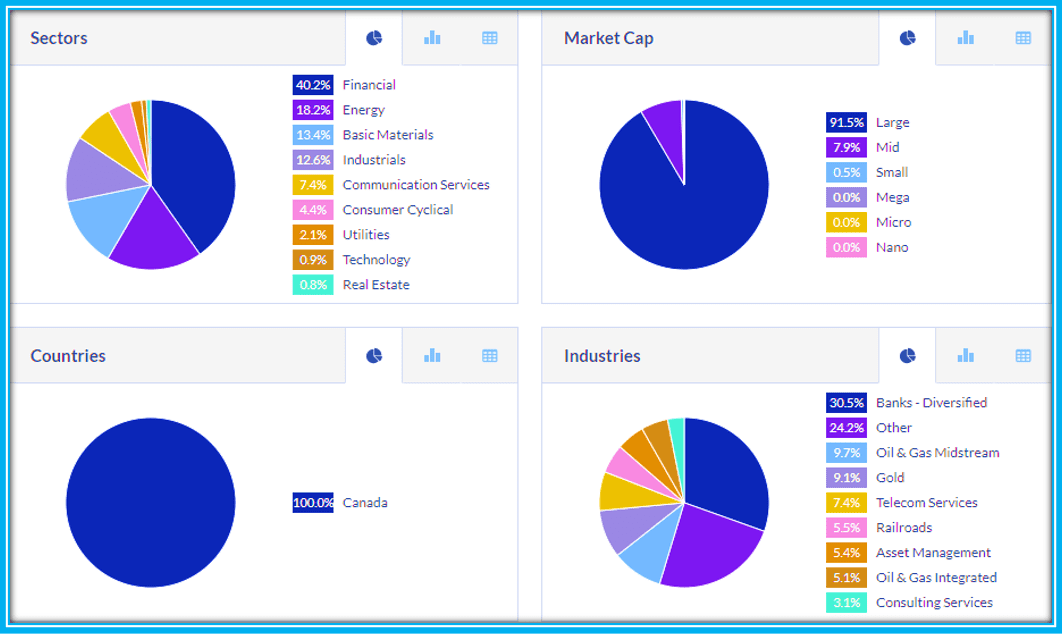

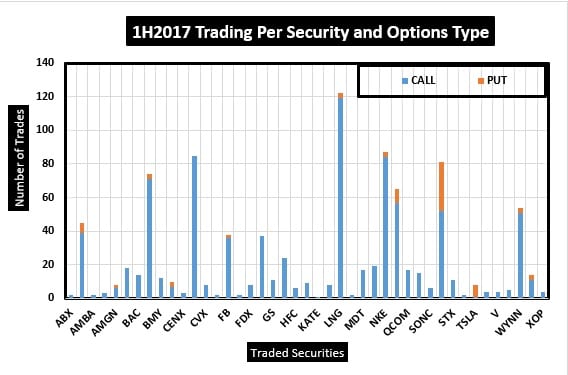

I charted my trades on 22 stocks.

On every single one of them, over 90% of the positions were Calls as shown on the picture above.

The moral of the story is that you cannot simply pick to trade call options alone.

Why Trade Put Options ?

If you decide to go that route as many do, you will be missing on a great deal of opportunities.

Stocks are meant to fluctuate up and down and as a trader, we ought to be open minded to these fluctuations.

Put options actually serve as a good way to hedge on the stocks that we own.

Imagine you hold a stock for long term.

While it may take that stock a few months to reach your desired target sale price, you can benefit from the small fluctuations by risking very little.

NFLX, NVDA or TSLA are trading over $500.

It may be difficult to trade these on a small Portfolio.

Anybody can trade call and Put options on these and make enough money to be able to afford these high price stocks.

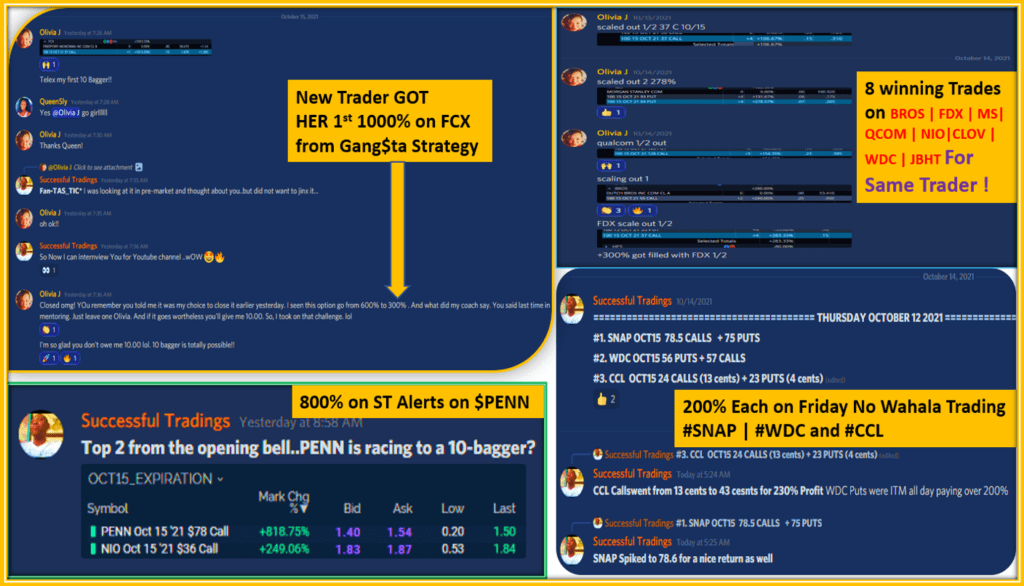

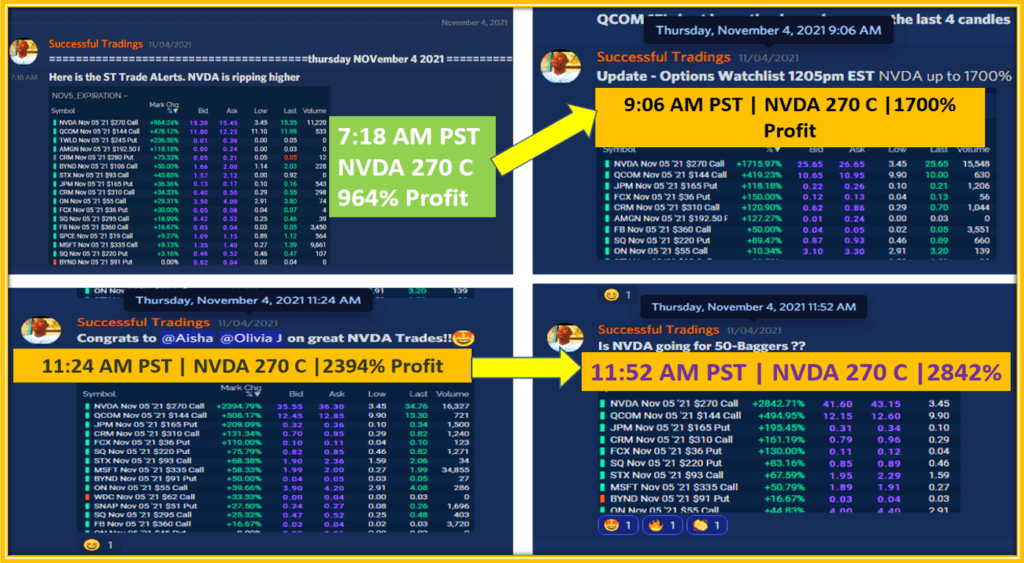

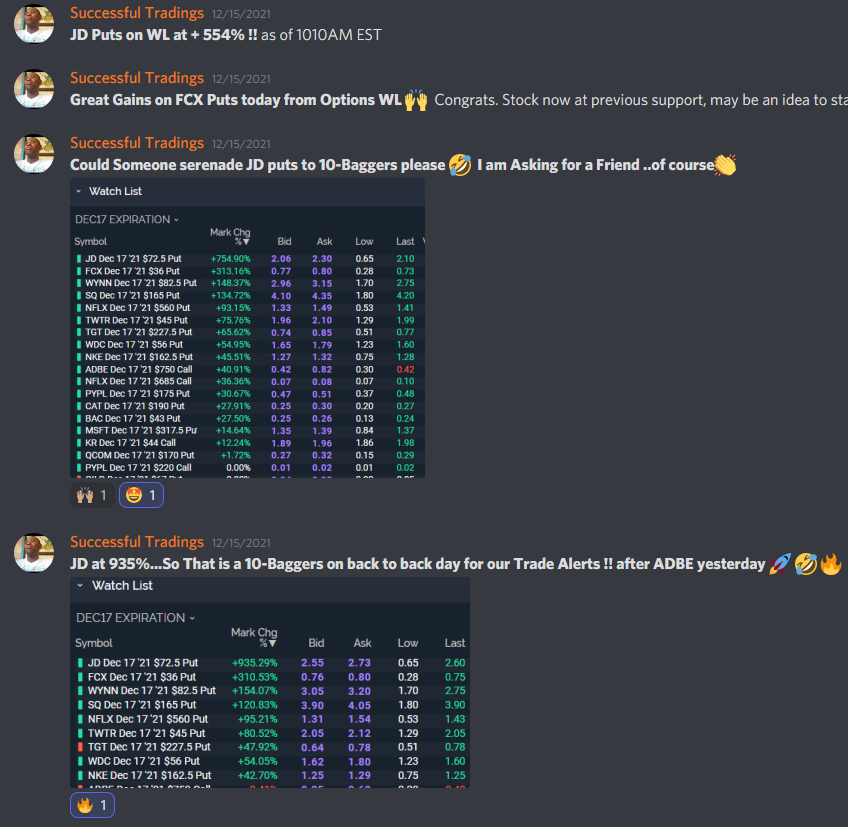

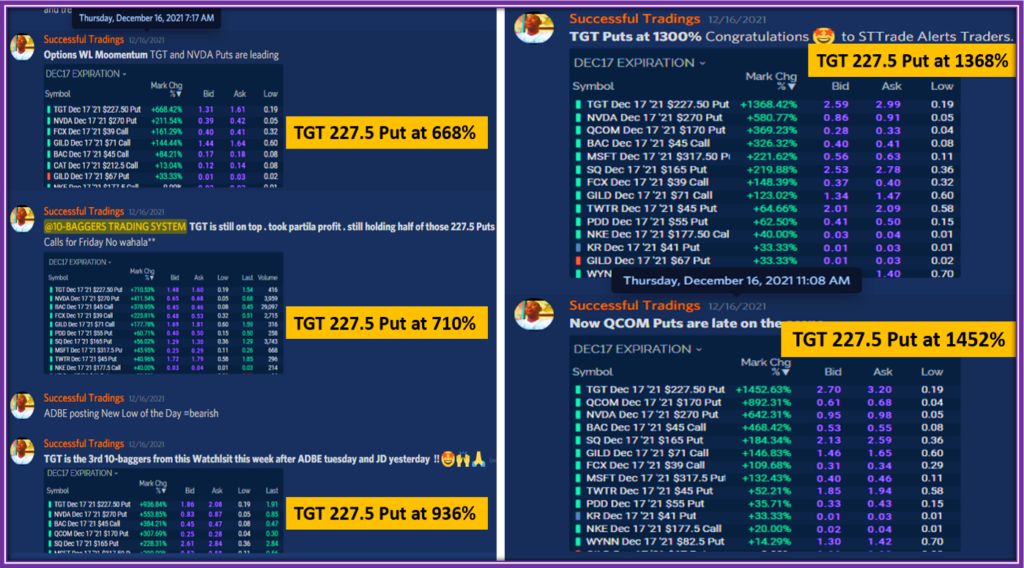

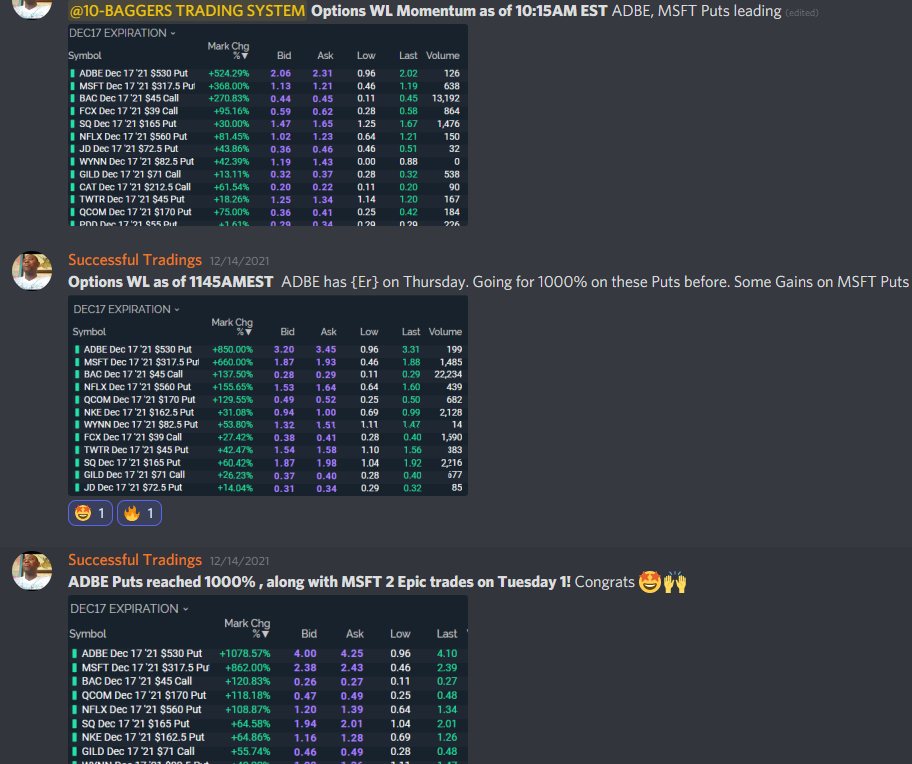

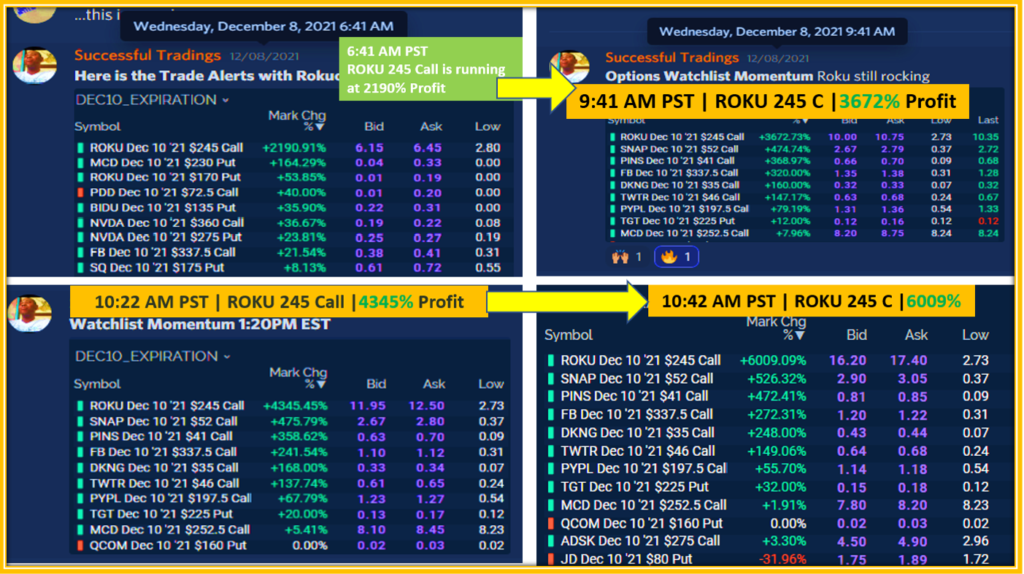

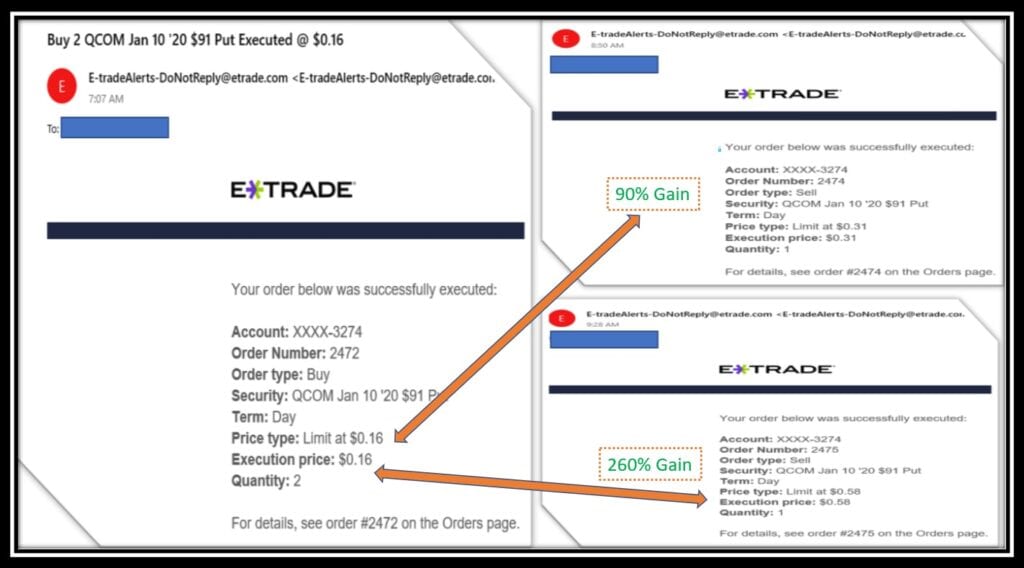

How Much Money Can You Make Trading Calls and Puts

I have seen some return in trading Calls and Puts options that are right to imagine.

One of the most famous example in 2020 is this NFLX 5000% gains .

There is one hidden secret than may change your mind on trading Calls vs puts options.

Did you know that Puts pay more than calls ?

Put Options Pay More Than Call Options

The reason why Put Options pay more than call options is because when a stock is doing down is goes faster than when it is going up.

Hence it takes less time for Put option to appreciate.

Since we have already established the importance of time in option trading, now we understand why Puts often provide bigger profit than calls.

A great way to keep track of the performance of your Calls vs. Puts option trades is to track them through a trading journal.

You are in luck because you can download our pre-populated free options trading spreadsheet for download.

Call vs Puts | Which is better in 2021

It may just be me but whenever the market is selling off or a stock is going down, I find it easier to trade.

Mainly because the resistance levels are fully known through the main moving averages.

Whereas in the bullish direction, resistance is not as easily defined once the price get passed those mving averages.

The bottom line is that we need to accept that it is very possible to trade the same stock on both directions and sometimes we make money in both direction.

Such was the case On March 3 2021 on this trade example out of our Gang$ta Strategy.

How and When To Trade Call Option

Within our Strategy at Successful Tradings, we teach how to recognize a bullish trend which leads to trading call options.

Our method simply rely on a single indicator for entry.

Here is its Full description on this brief video.

We have a full page dedicated to Call Option Examples.

The call examples supporting videos are always more popular than their Puts counterpart.

How and When To trade Put Options

We enjoy trading Puts so much we could not leave you without a similar step-by-step guideline on how to trade a bearish trend.

That is provided on this video below using again a simple simple indicator known as VWAP.

Put options examples are treated in details on a series of videos posted on this very blog.

Best Way To Trade Call and Put Options

A great deal of times, traders do not know the directions of the stock they would like to trade.

The best way in this situation is to combine both calls and puts.

When you do this, you form a strangle assuming you are using different strike price forthe same expiration.

If you are using the same strike price, that is a straddle and it cost more than the afford mentioned strangle.

The advantage of the straddle over the straggle is that you are almost guarantee that one side of the trade will be making money very quickly.

Here is a very short video on BABA that illustrates the power of this technique.

The subsequent video describes the broad approach into Swing trades.

The ones that we carry overnight for a continuation or reversal trade the next day.

The profit on the BYND Swing trade reached 2000%.

CONCLUSION

Trading Call vs Put option should not be like picking one against the other.

Instead, our ptions strategies ought to be flexible enough to allow to maximize gains in either direction.

We believe we have the perfect strategy for that known as the Gang$ta Trade and would like to extend the invitation for you to Master it today so that You Can take Your trading to The NExt Level in 2021 and beyond.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/