Are you looking to profit from the next meme stock to mirror the recent run of AMC, GME or WEN ?

Before you do, allow you me to take your through the recent stock market meme trend.

Are meme stocks trading a real opportunity for investors or a big distraction from more serious catalysis ?

Table of Contents

How To Profit From Meme Stocks Trading

The word “meme” has a French root that means same, similar or identical.

A common French phrase that uses this word is “Je voudrais la meme chose” which translates to “I would like the same thing”.

From this definition, we can extend the definition of meme stock to copy cat stock.

In recent years, social media “memes” have become a source of entertainment and distraction.

The concept is about re-editing an image or small video to poke fun at someone or something.

The above stock market meme illustrates two different approaches to investing.

On the top, the buy and hold investors end up with a more luxurious boat than those who could not sustain the sell off and thus sold in panic to preserve their investments.

What Is a Meme Stock

Meme stocks are stocks that have gone through hard times and then staged massive rally because of speculative positions by bears and bulls.

The value of a stock is often derived from the fundamental of its operation as well as forward looking metrics.

So when a stock goes down like GME, you can understand it as future prospects of revenue, customer growth and ultimately profits are not too rosy.

Quite often the reason for this could be because the technology that company uses is outdated or the competition is just too fierce.

More commonly if a company sells a product that is not is high demand well that does not bode well for that company long term prospects.

Such was the case for GME and AMC stocks.

The first one sells video games in a digitalized era where everything is available online at the fingertips on everybody.

The other one was hit by the pandemic that brought lifestyle changes with social distancing and all that ensued.

Very few people would venture into movie theaters albeit we all could have used the distraction during these trying times.

How did Meme Stock Frenzy Start ?

The description above does not address other force at play in the stock market.

And that is high level of specualtion.

You may be familiar with the more common buying speculation.

However, there is the bearish equivalent of that :

It is called short selling.

Short Selling Gone Wrong

Short selling consists of borrowing a stock from someone who has it and selling it in the open market.

Typically your broker owns stocks to facilitate transaction liquidity.

Imagine you study a company and think that its future is not looking all that good.

Your conclusion may that be for the above mentioned reason or else.

Your plan is to buy back the shares you sold at a much cheaper price later.

Then you will return the borrowed shares to the original owner.

To make it plain here is an example on how Short Selling works:

- You borrow XYZ stock at $100 and sell it at that price in the Open stock market

- Some time passes by and XYZ stock is trading at $80

- You then buy it at $80 and return it to the person you borrowed it from

- Your profit is ($100 – $80) = $20 not counting the Interest you paid to the lender

In case you are wondering, Short selling is perfectly a legal activity or investment technique.

Of course it is highly speculative.

Because what is the stock you short never goes down and instead start going up ?

Short Answer: Your Losses can be infinite.

Here is how.

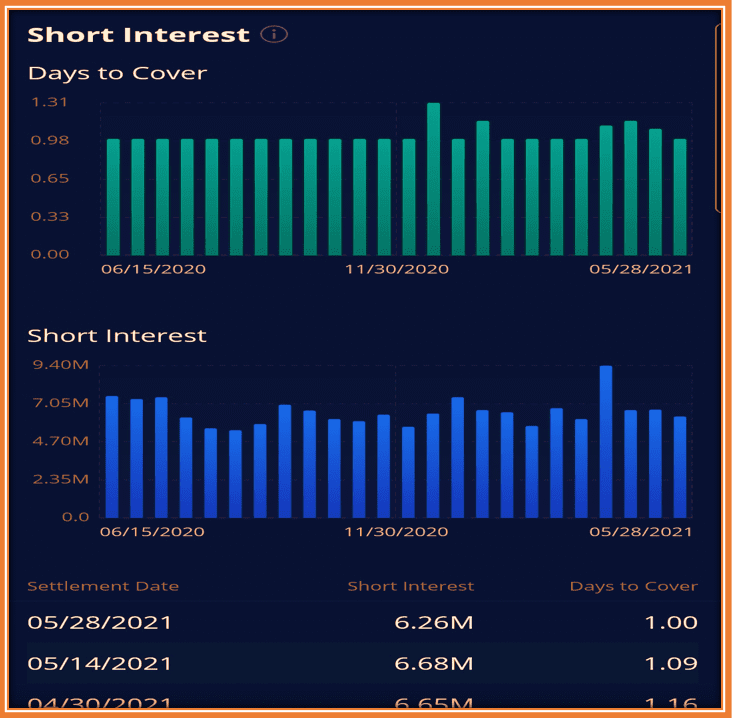

High Short Interest on GME

Because you need to buy the stock back in the open market at whatever the going price is.

With your short position, the higher the stock goes the more you loose.

In the case of GME, a group of retail traders in reddit called r/WallStreetBets noticed that the volume of shorts was unusually high.

You can find the short interest on any stock using the Webull Analysis tab on the Webull App for instance.

Here is what it looks like for NVDA stock.

The data is published every two weeks along with the accompanying days to cover chart.

The reddit r/WallStreetbets group got organized very quickly.

They propagated this inform through social media so that more traders could join their movement.

Their objective was to take on the short seller and force the later to covering at very high price for the stocks.

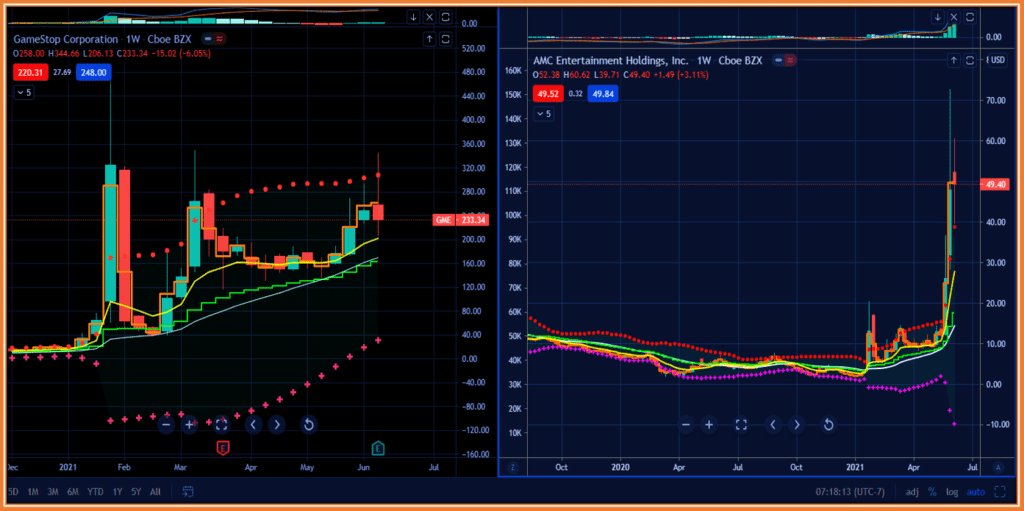

What ensued was an extraordinary rally that took GME stock from $65 to $483 in just 5 days of trading .

Basically, that was the birth of meme stocks.

Why Are Meme stocks Growing ?

Galvanized by this great success, these traders set their eyes on other stocks to duplicate the same results as on GME stock.

Remember how I used the word copy cat earlier at the beginning of this discussion ?

Now, it all make sense what has been transpiring in the the stock market meme where any stock has the potential to rally big based on short selling volume and the number of retail traders interested in it.

More and more retail traders are attracted by the dream of becoming millionaires through meme stocks.

Why ?

Well , I failed to mention that the 52-week low for GME was $3.77 prior to that spike to $483.

This means that if you had $1000 invested in GME stock from $4, you would have multiplied that by up to 120 thus turning it to $100000 in less than a year.

This is the new Wallstreet dream for many.

This is the reason why so many on social media are joining the movement on a wide range of stocks whose fundamentals doe not command such high price.

Everyone is aware of its but in the name of speculation, money is being poured into these meme stocks day in an day out.

How To Identify Meme Stocks

In case you are just now joining the band wagon or wondering how you can get started, the following sections will definitely bring those answers.

Are all Meme Stocks Equal ?

My observations have been that not all meme stocks are equal.

I have seen a number of stock spike briefly but failed to sustain the rally GME or AMC stocks have had.

Therefore, you ought to keep that in mind as you partake in this endeavor.

Where To Find the Next Meme Stock

In trying to identify stock meme, I have come up with a simple detailed video.

The video Tutorial leverages the Finviz Screener.

You will learn how to setup very simple filters to help you decipher stocks opportunity within the stock market meme niche.

Here is a Time Stamp of the video to help through its navigation:

00:00 Intro of the video

01:38 Finviz Screener for Day Trading

03:07 How to trade Gangsta Trade

07:28 Finviz Screener For Swing Trading

11:12 Finviz Screener For Meme Stocks Trading

15:05 #SAVA Stocks

Our List of Best Meme Stocks For Month To Come

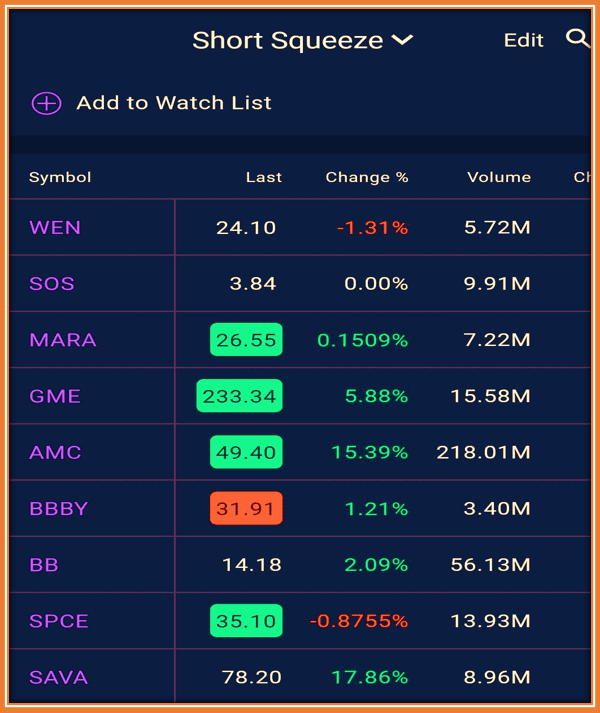

You can start by creating a watchlist of Meme Stocks from the results of your screening using the above video.

Here are some of the stocks we have in our Short squeze meme stocks.

My suggestion is to create intraday alerts for them such that you ready to day trade them whenever one of them starts trending.

Given the large volatility in these meme stocks, my daily alerts are set at least for 3-4% moves intraday.

By doing so, you will avoid some of the fake moves these stocks are known for.

Have you noticed how new meme stocks keep popping each week recently ?

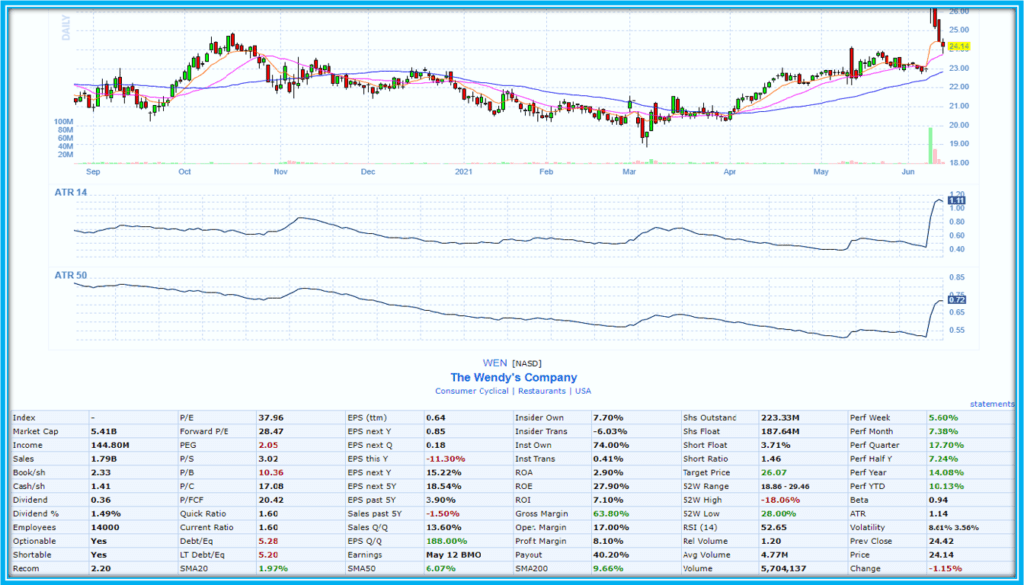

The latest one to gain momentum is Wendy’s (Ticker WEN).

Should You Buy Wendy’s as a Meme Stock ?

Wendy’s stock trades in the consumer cyclical sector.

Provided the world does not come to an end, sooner or later , consumers will resume the previous habits.

Investors may then realize this and start rotating money in other assets that the proverbial technologies stocks.

WEN is still very cheap below $25 as of this writing.

The recent breakout may just signal the beginning of a bigger run .

Even with these high flying meme stocks, patience remain key.

From the above fundamentals, the short float is still below 4% though those numbers will always lag.

My current stand on Wendy’s stock is to remain bullish as long as it is able to recapture the EMA8 above $25.

If not Wendy’s as the next great short squeeze, how a bout SOS ?

IS SOS Stock Ready Join AMC and GME in Meme Stocks HOF ?

I just started the study of this very cheap stock currently trading below $4.

I will be adding constant analysis in the near future to help answer this question.

In the meantime, we are tracking it in our Watchlsit so should you.

Best Ways To Invest In Meme Stock Market

It is one thing to follow great trends in the stock market yet it is another one to divert from your main investment objective.

We can think of bitcoin or dogecoin recent rallies and the fortunes they created for some.

However, I can not help wondering if this meme stocks trading Frenzy will not end up as a distraction.

Are you Missing Out on Other Investment Opportunities ?

While you be busy searching for the next AMC or GME stocks, other investments are still present in the stock market.

How does one ensure that that there is a fine balance between the newest trends and the goals of ones portfolio ?

This is the risk many are willing to embrace just like the early adopters of crypocurrencies.

There is never a guarantee in any type of investment especially in some of these companies that are not fundamentally sound at all.

Should You Buy Meme Stocks ?

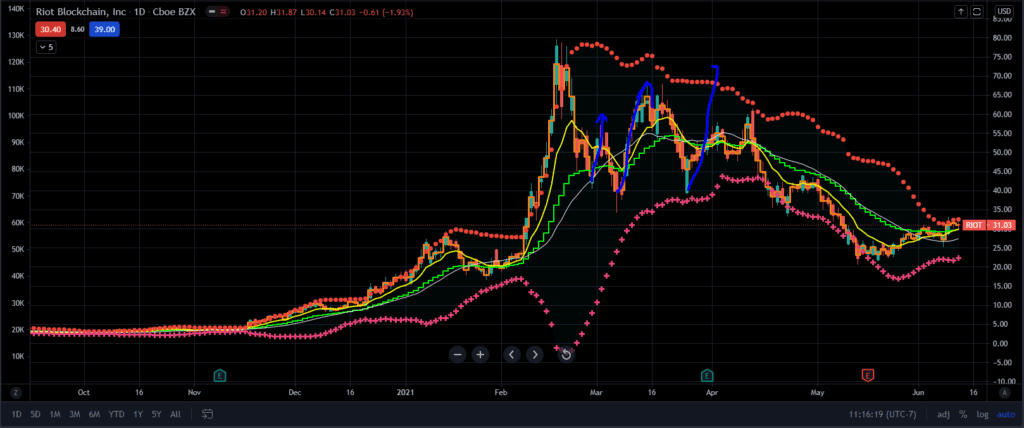

I was reading this past week on a thread of RIOT stock the story of a trader buying in highs $70’s.

The stock is currently trading around $31.

Could you imagine the emotional Rollo coaster so many are willing to submit themselves to through these meme stocks ?

How do you hold onto meme stocks that can fluctuate 50% in intraday trading ?

In the example of RIOT stock, that trader need to stock to appreciate over 140% just to salvage the initial investment.

An Alternative Way To Trade Meme Stocks

A less expensive strategy to get involved in meme stocks trading frency is through the use of options trading.

Most of these stocks offer weekly options that are usually very cheap before the market makers raise the Implied volatitlity.

while most traders are busy buying the stocks, you can benefit by waiting for the usual ralliees to take place.

Then realize that these rallies often fizzle.

Therefore, taking the opposite direction with cheap puts is how I have been able to day trade and scalp on GME and AMC stock recenlty.

The advantage of this strategy is that it does not ahve to take to much of your trading capital.

Also, there is not need to constantly spend time on stocks chat forums looking for catalysts to take the stock higher.

You will be surprise how much money one can leveraging volatility in options trading in this meme stock market.

CONCLUSION

We shared hw the recent meme stocks trading frenzy is sweeping the stock market.

As an investor, you will have to stay disciplined in order to avoid this recent trend and potential distraction from your main trading objectives.

As a result, we offer an alternative to this meme stock market through option trading.

In case you are a beginner trader, I strongly encourage you to consider our Option Trading Education System so that you can equip yourself with solid knowledge to help take your trading to the next level.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/