Learning How to Trade Options as a beginner does not have to be as complicated as you may have heard.

In this step-by-step guide, I will show you how to get started with a very solid foundation on Options trading.

Ready to find out about how to trade options like a pro?

Let’s get into the details.

Table of Contents

How to Trade Options: What Are They?

Put simply, options are contracts that give you (i.e. the trader or bearer) the right to buy or sell at a pre-set price before or when the contract runs out.

There is zero obligation to sell or buy, you are simply handed the right to do so.

Basics Of Options Trading

You can purchase these options like any other asset — using an investment brokerage account.

It’s fairly simple, but to be worthwhile, you must understand what you’re doing.

They are a great way to enhance your trading portfolio.

Not just because the contracts tend to be much shorter but also because they add protection, leverage, and income.

How to Trade Options: How Do They Work?

Essentially, all you are doing here is figuring out the probability of future price changes.

That’s the basic premise.

The buying price changes depending on how likely something is to happen. In short, the more likely, the more you’ll pay.

Importance of Time in Options Trading

Alongside the likelihood is time.

If an option is due to end relatively soon, it will have far less value.

Why? Because the closer a contract is to the end, the less chance it has to move.

For example, a three-month option contract is more valuable than a one-month value because there is more chance for the price to move in your favor.

As you can probably imagine, volatility plays a role here too.

If there is a lot of uncertainty surrounding the odds, bigger movements can occur, which increases the chances of huge changes.

How to Trade Options: The Basic Step-By-Step Guide

Step One: Know the Account Requirements

In this aspect, opening a stock trading account is easy

When you’re opening an options account, you have to prove you know what you’re doing and produce more capital.

Why? Because predicting lots of different things takes a great deal of skill and knowledge that you must display before brokers will hand you permission.

Step 2: Choose the Direction of the Stock

We’re going to keep this simple.

- If you believe that the price of an option will rise, you buy a call.

- If you believe that price will drop, you buy a put.

Options traders leverage technical analysis to determine the direction of the stock they want to trade options with.

Here are a couple of free tools I would recommend.

I have trading and teaching options trading to people like yourself since 2016.

| Best Charting Tool for Technical Analysis | I Tradingview or Finviz Best for Options Traders |

| Webull Charts | How To Use Webull Charts |

Step Three: Predict the Degree

Let’s give you an example:

If you think the current price for a $50 stock is going to increase to $75 at a certain point in time, you need to buy a call option with a current price of less than $75.

Equally, if you think it’s going to decrease from $50 to $20, you need to buy a put option with a price above that $20 mark.

Here is a clever technique on how to go about choosing a strike price for your options.

Step Four: Consider the Timeframe

All contracts in options trading have an expiration date.

This is the final time you can utilize the option.

Unfortunately, you can’t just magic up a date.

Instead, you have to look at the ones that are given to you in the chain for your specific contract.

They can range from years to months (even days to weeks!).

But be careful with the short ones; they are usually best left alone unless you’re a very experienced trader.

How to Trade Options: The Risk

Stock and forex markets bring a load of slippage and price gaps along with them.

But you won’t have that problem here.

In options trading, the risk is capped.

Limited Risk

You cannot lose more than the cost of the option you’ve purchased.

Plus, you can (sometimes) get an even better ROI than you first thought.

How? Because you simply don’t know what you’re going to get.

It’s said to be a 4:1 risk-reward ratio which you just can’t find on any other market type.

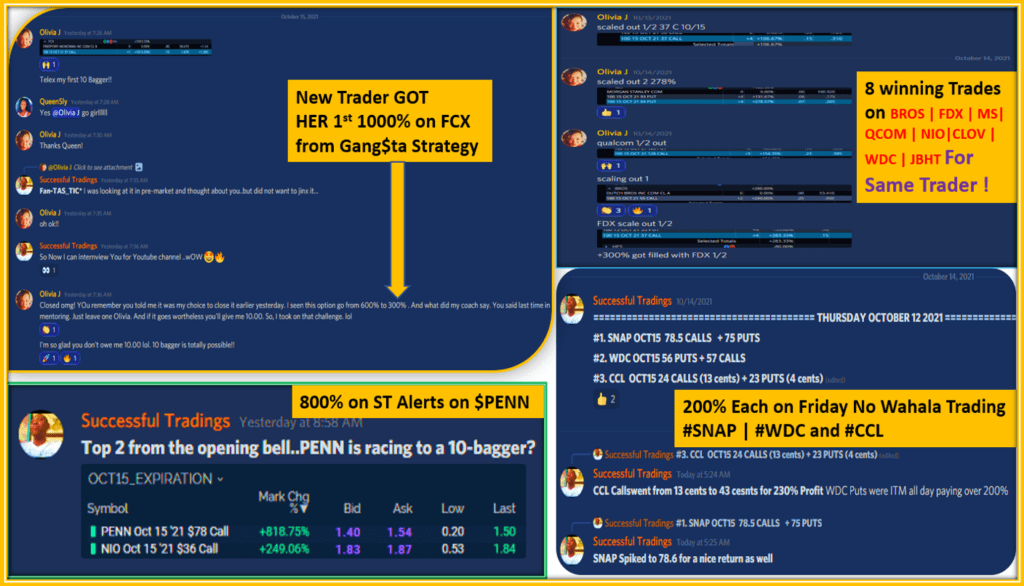

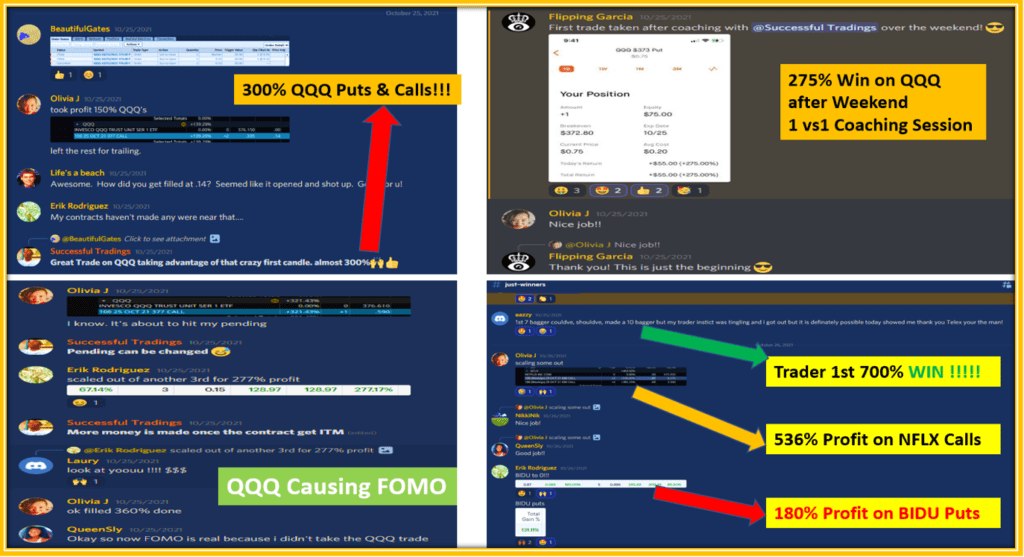

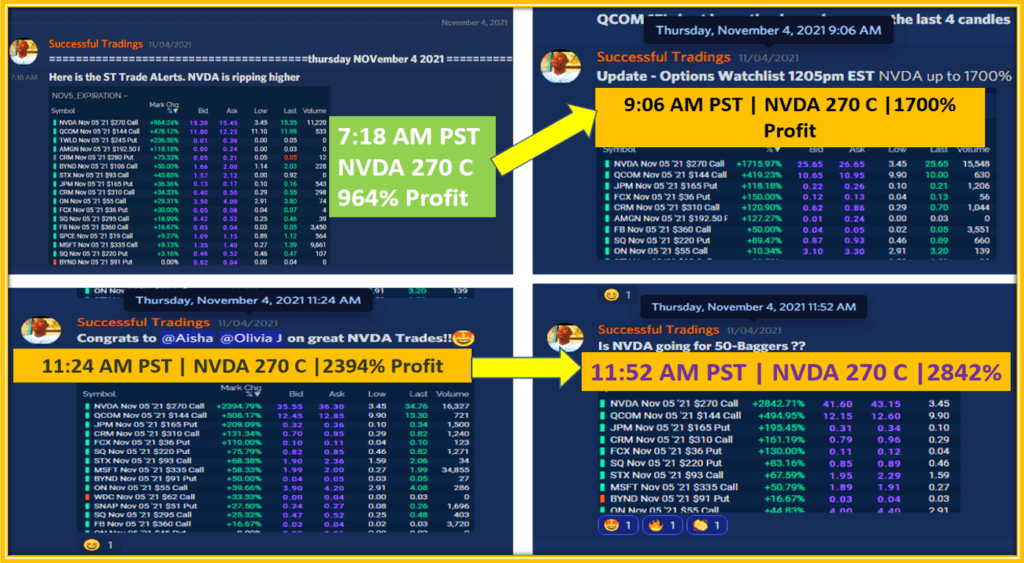

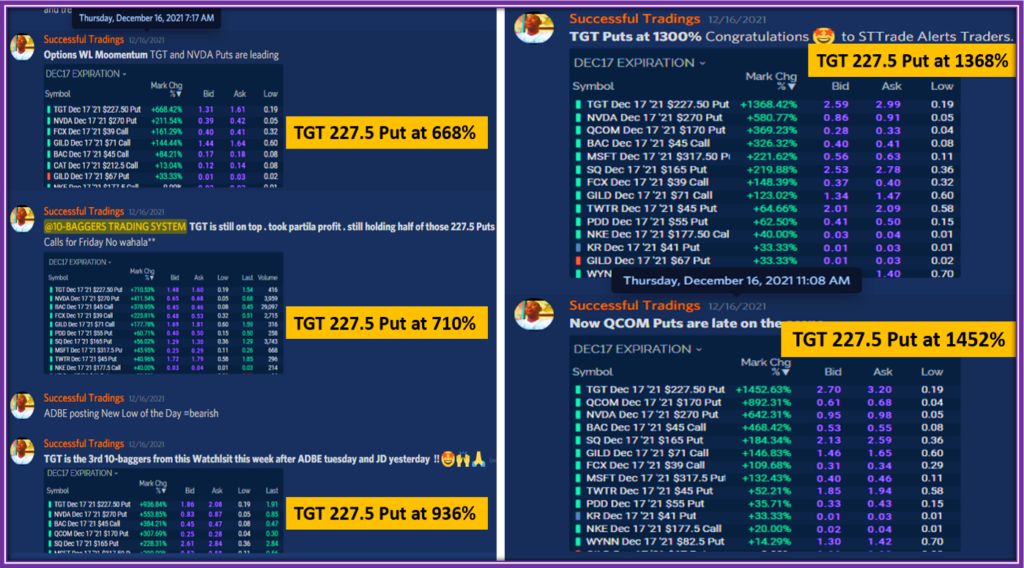

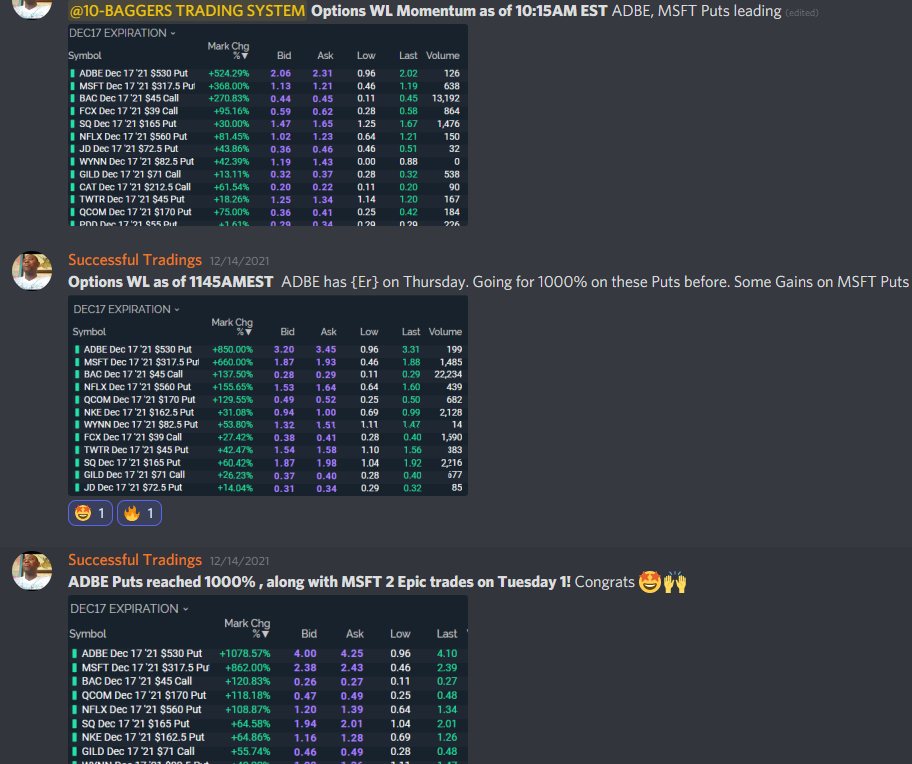

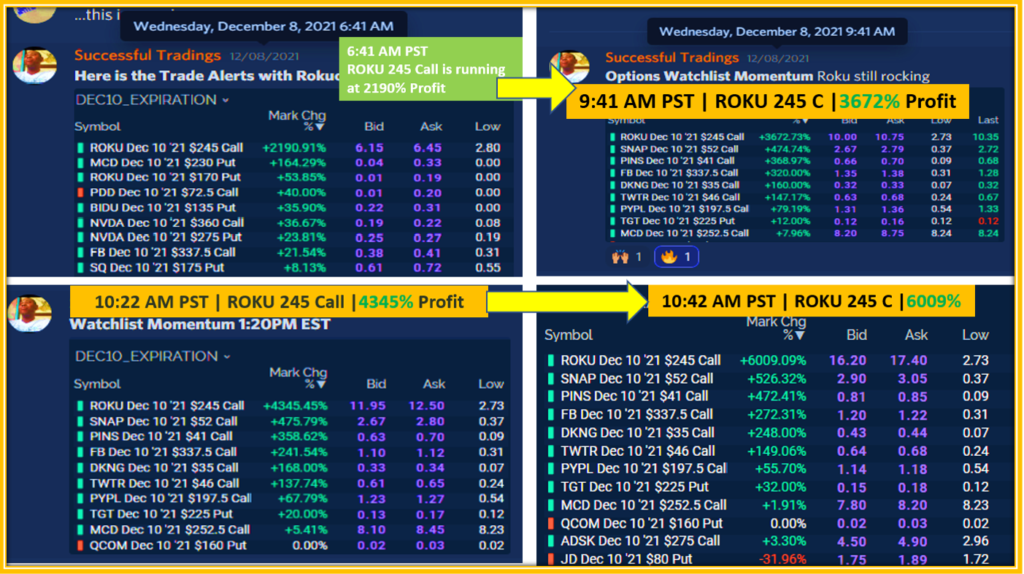

How Much Can You Make Trading Options

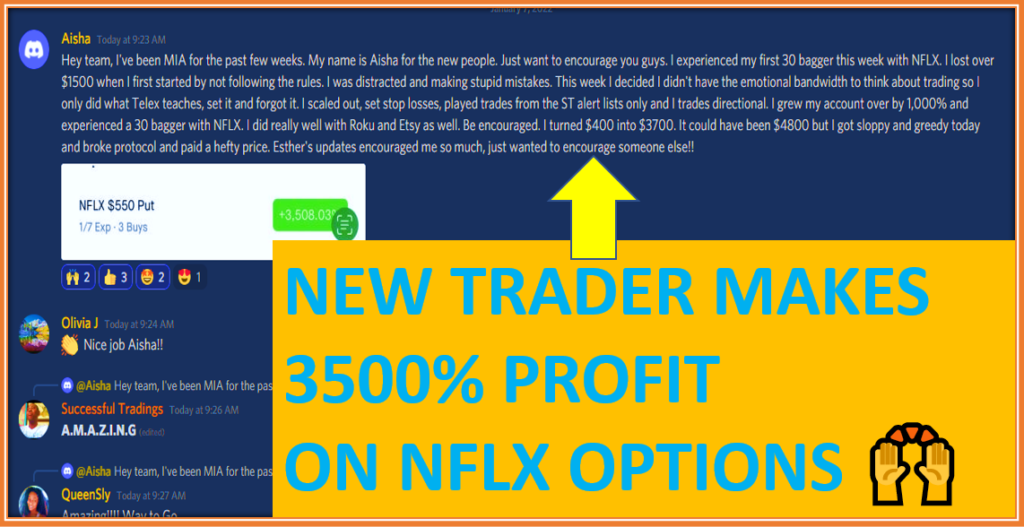

I am here to tell you that you do not need thousands of dollars to make big money trading options.

The other important question I get from newbies is how long is take to make money trading options.

Contrary to what you may have read, should you learn the right system, you will be able to get great results quite rapidly.

Here is a video from my YouTube channel depicting great options trading profit.

Which Platform Can You Trade Options with

The choice for an option trading broker is very important.

Nowadays, this industry has become so competitive with the reduction in fees that traders really need to be aware of pros and cons for each broker.

Are All Options Trading Platforms Equal?

It is not enough to choose a broker just because they adverse commission-free trades.

The experience and ability to trade your strategies should be put first.

Favorite Options Trading Platforms

I have used the same options trading platform since 2016.

Not necessaraly because it is the best but it provides allthe features I need to run my options trading business.

Here is how I trade Options on the following two platforms:

- How I trade Options On E*TRADE

- How I Trade Options on Webull

If you are a beginner options trader, my recommendation is to start first with E*Trade because it is easier to setup.

How to Trade Options: The Bottom Line

Trading options isn’t scary if you know how to approach it as a business.

But remember, we have only covered the basics here.

To be in with a good chance of success, you must make sure you know exactly how to read options tables and analyze trends.

Since you have made it so far in your journey to Learn and Succeed how to trade Options, we would like to invite you to benefit from our Experience at Successful Tradings.

Get Started Today with Our 10-baggers Trading System Proven Methodology.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Thank you so much for sharing with us the step-by-step guide on trade options. Currently, the most popular method of forex trading is options trading. Many are succeeding by adopting this method which has the right direction at its core. I have no real experience with this method of trading but I am encouraged to see your article to do it. The basic idea you have given about trading options will help me to gain basic knowledge. My question to you is how do I know more details about this?

Hello,

Glad you found value in this beginner’s content on Options trading.

We have a series of Trading Tutorials on this blog as well as a full YouTube channel dedicated to the education of traders like yourself.

We offer One vs One coaching services as well where we tailor the content of the meeting to each individual trader.

Check them out and let us know which one works best for your trading goals.

Talk to you soon.

Excellent blog article. I really like this. Thank you for sharing.

Thank you,

I appreciate the feedback. Glad you enjoyed the content.

Bye.

Greetings,

We appreciate the feedback.

Do let us know exactly what you enjoyed in this content please.

Thank you.

Good work. I will come back to read more.

Thank you for stopping by.

Glad you enjoyed the content.

See you again soon.