Webull Options trading has been lacking for a long time.

Finally, the platform has decided to step up to its many customers requests and introduce a slew of features in 2021 including Options Tradings.

By the end of this tutorial on How to Trade Options on Webull App or Desktop, you will be equipped with the knowledge to set up your Webull options trading App or the Dashboard, access the training course offered on the App version of Webull, take advantage of the Community and most importantly how to make money by leveraging some of the new advanced features of this growing trading platform.

Table of Contents

How To Trade Options On Webull | Mobile App, Desktop or Desktop App ?

For years, Webull traders have been asking for Options trading to be included on the trading platform.

It took Webull until 2020 to make this possible.

The main reason I can think of is to stay competitive in the battle of the Millennials it is engaged with Robinhood.

Currently, Webull only provides trading in a few countries and I know that most of European countries do not have access to Webull.

Nonetheless, Options Trading on Webull is now available and it comes with a great deal of bells and whistles.

Which Webull Platform is Best For You ?

The first action you must take during the signup process is to determine what type of account you will be setting up.

By that I mean a Cash account vs. Margin account.

I published a short recent short video that explain the benefits of each so that you are fully educated to pick the one that fits your current needs.

I recommend that options trading beginners start with Cash Only account and later on can switch to a Margin account.

The second decision you will need to make in trading Options on Webull is to choose your platform.

Webull offers 3 choices for that.

You can trade Options from your mobile phone through the Webull App.

This option is very advantageous for traders on the GO who require limited data or information to enter and exit trades.

The app version of Webull is intuitive enough with minimal learning curve.

How To Access The Options Chain on Webull Mobile

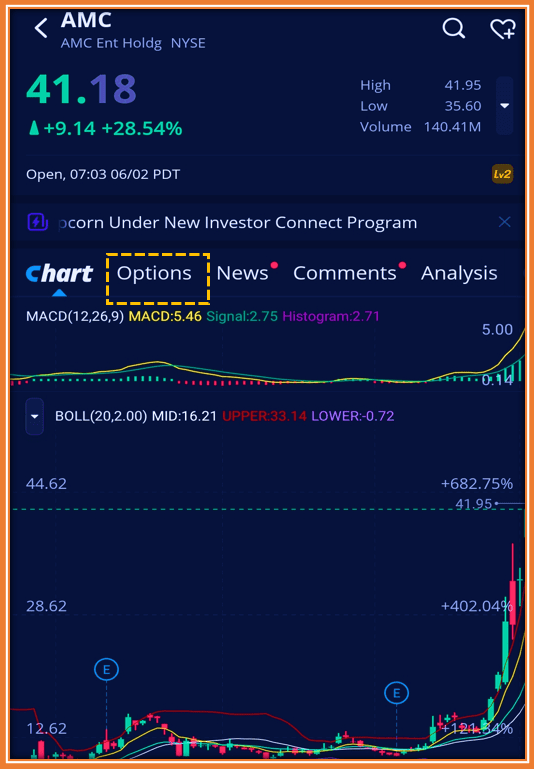

In early June, Webull App changed its interface to make it easier to access the option chain.

Now, when you select your stock, you have access to the chart as usual but the second choice is Options.

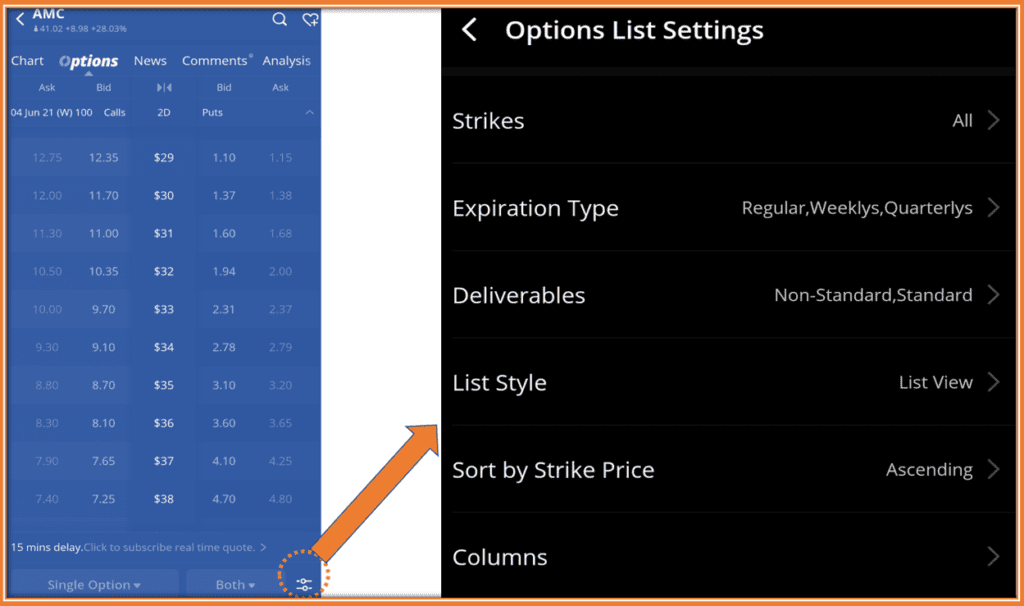

Here is a view for the very volatile AMC stock.

Once you click on the highlighted Options menu , you directly gain access to the option chain.

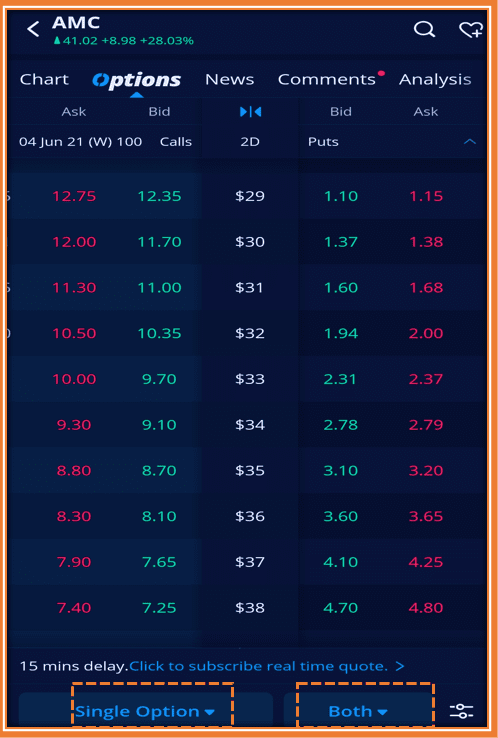

With the recent update of the Webull App, you have to decide on how to view the option chain.

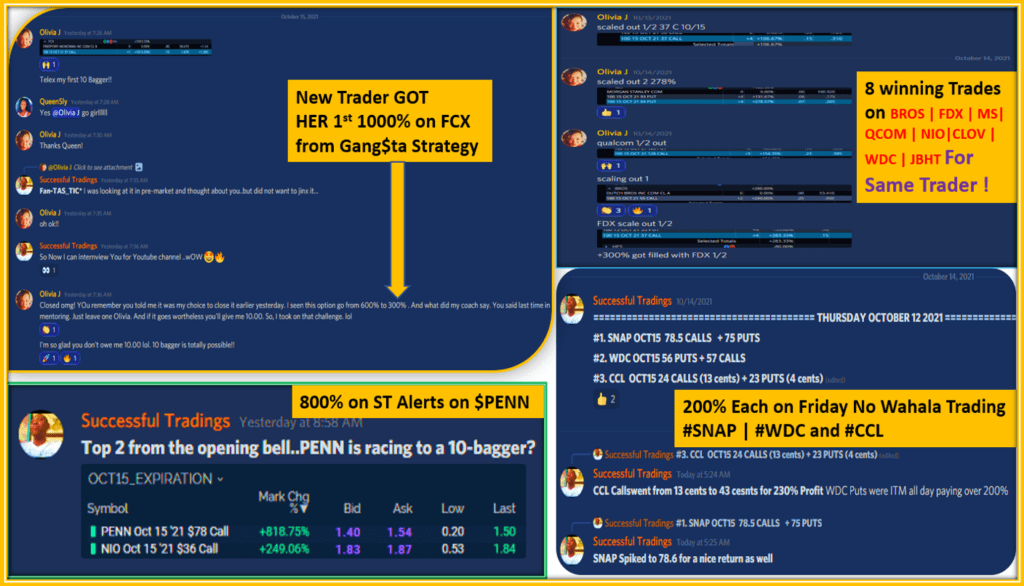

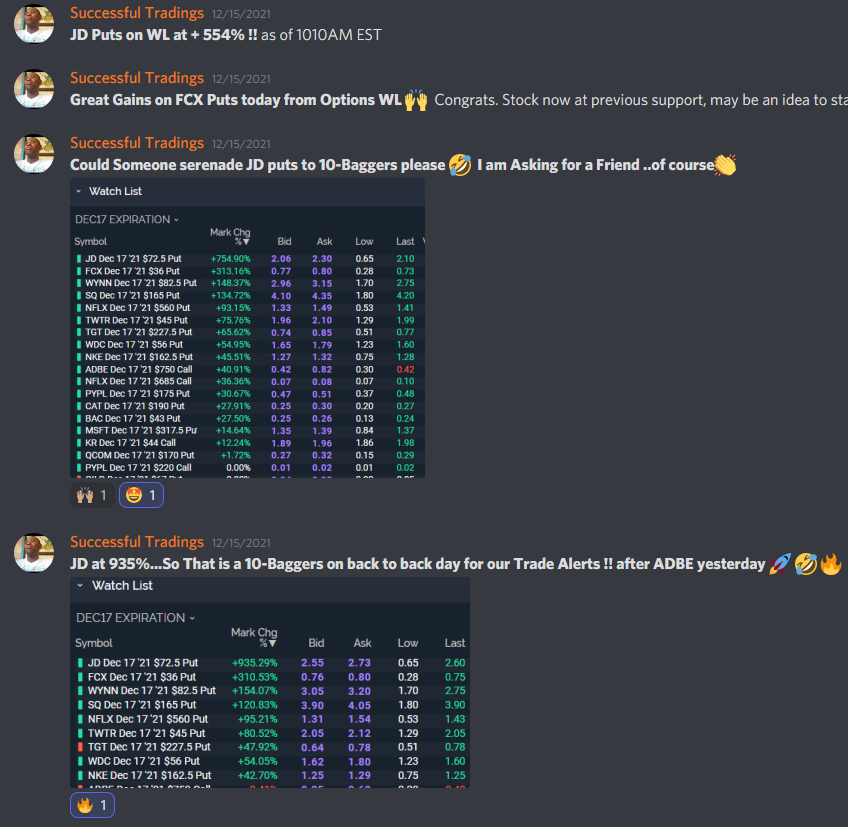

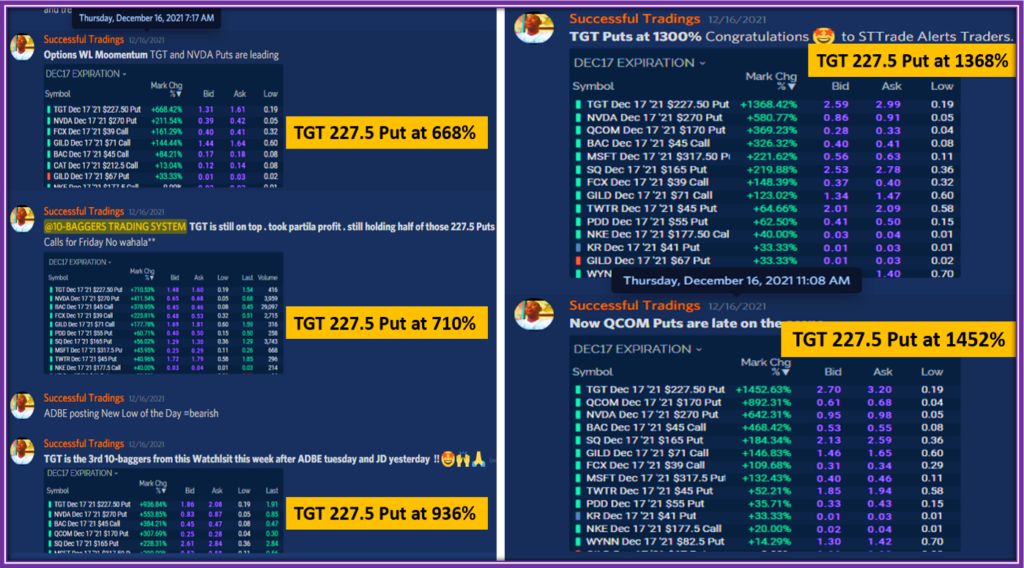

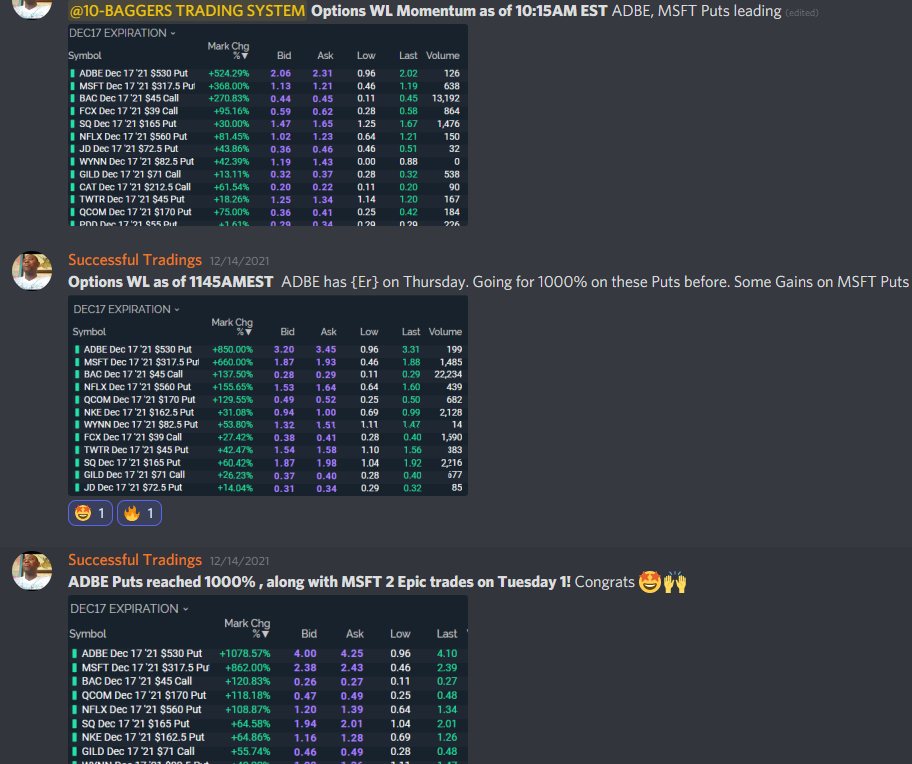

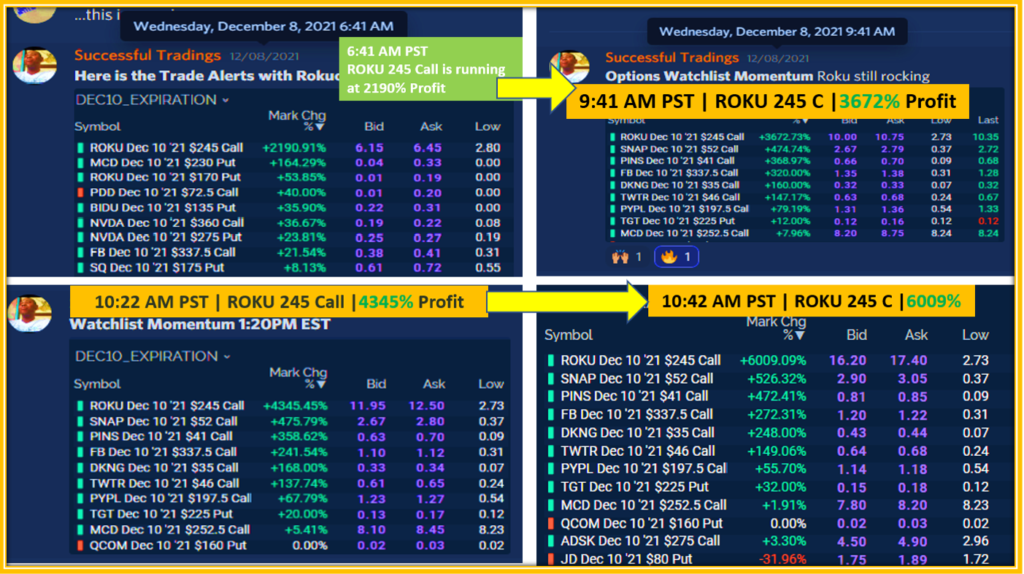

Related Video: How We Made 1000% On Multiple Options Trade Using The Gang$Ta Strategy

On the bottom left, you will choose your strategy from Single option, strangle, straddle, vertical, butterfly, condor , Iron condor.

I have mine set to Single Option as shown below.

Then, on the right, you will select to see Calls, Puts or both simultaneously.

In my other options trading Apps, I always like to view calls and puts next to each other.

I really think this layout minimize the potential of making a mistake when you are in a hurry to get into an option position.

Should you to so, Calls will be on the left side and Puts on the right hand side.

Webull Options Layout

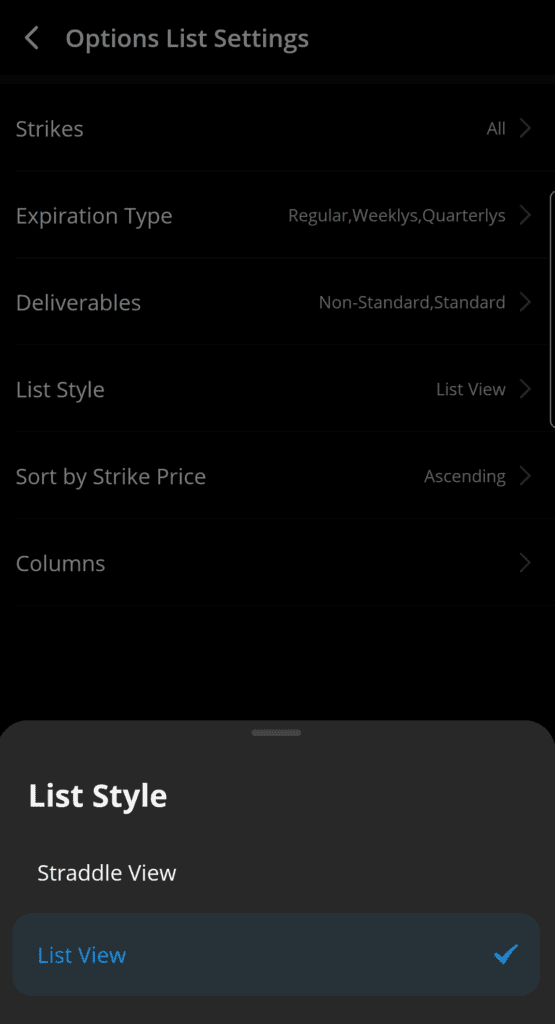

Here is how you can change your Webull options chain layout.

On the bottom right hand side of the option chain, click on the icon with 2 horizontal lines as shown in the image above.

This will lead you to the below Webull Options Chain settings.

On this Webull options List Settings, you will be able to modify, select and customize the options chain as you like it.

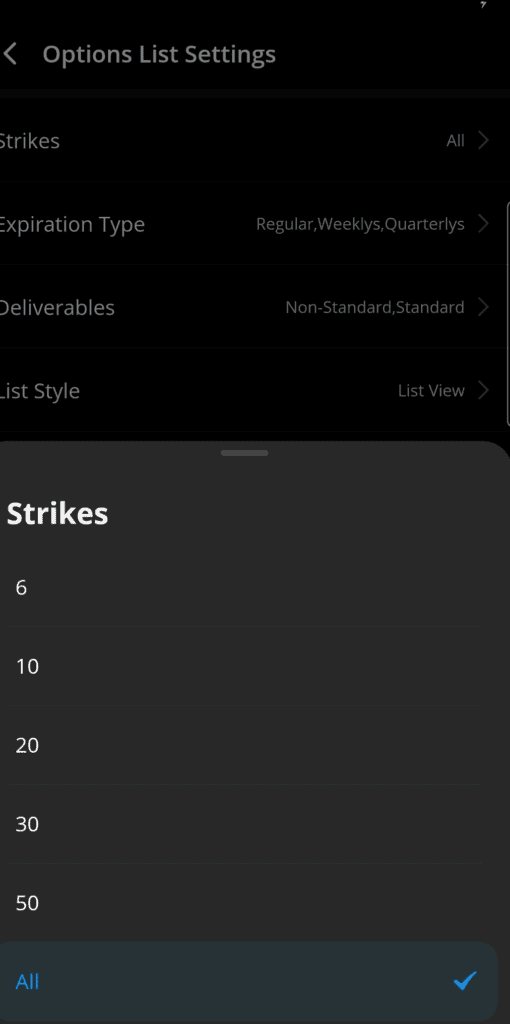

How To Show More Options Strikes Prices On Webull Mobile

I often get this questions from beginners traders in our Discord room on how to see more strikes prices on the options list of Webull.

Well, the answer is through the options list settings menu above.

If you select Strikes, then you have these multiple choices to pick from.

I always set my preference to “ALL” so that I can access all available option strike price offered on Webull Mobile App.

Often nowadays, certain stock can run up so quickly and catch Market makers “unprepared”.

We have witness that in 2021 with the likes of meme stocks #AMC, #GME, #AFRM just to name a few.

In those scenarios, market makers had to create and add new strike price overnight on the option list.

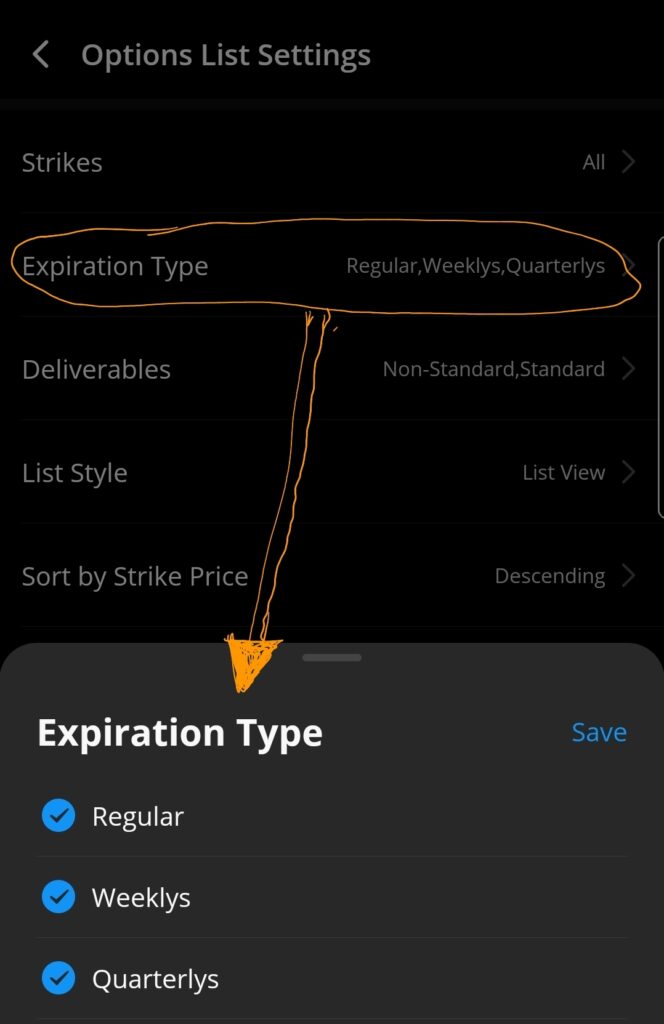

How To Select the Expiration type on Webull Options Chain

The second choice from the Webull options list settings is the expiration type

On this menu, the three choices are :

- Regular

- Weeklys

- Quaterlys

My recommendation is to select all of them s that you always have access to all the available expiration dates.

Most stocks will have weekly options expiration dates.

However, this can change anytime as market makers decide to offer more frequent expirations.

What is The Deliverables Option on Webull Options Chain ?

American Options are defined such that one contract controls one hundred shares of the underlying stock.

This is the standard deliverable in case you decide to exercise on option contract.

Same is true should you be assigned as well.

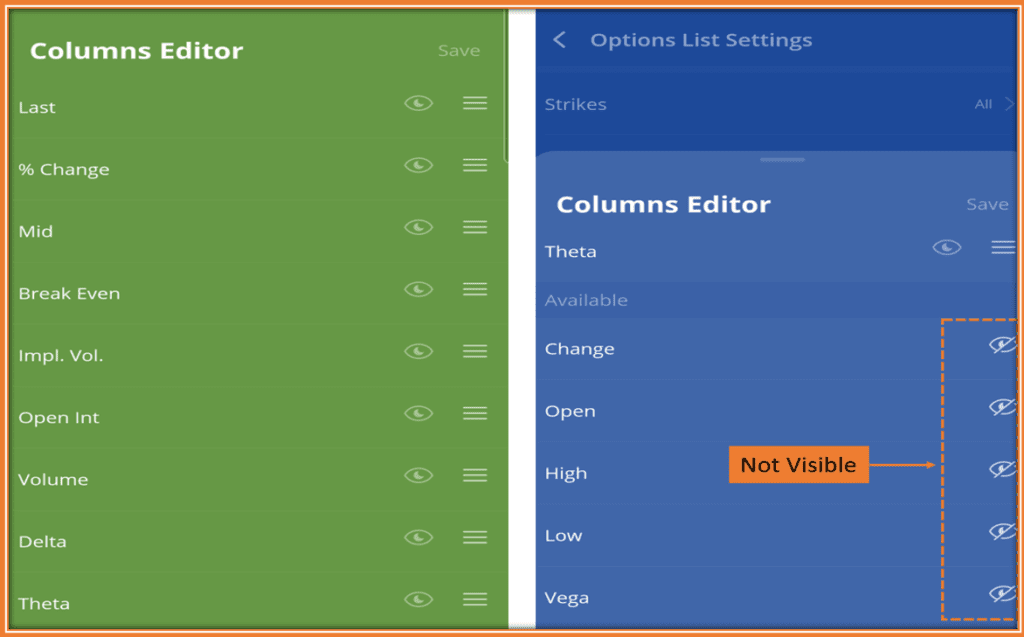

How To Change The Columns of Options Chain on Webull

You have control over the information you want to display on your Webull option chain.

One can easily do this by going into the columns Editor as shown on the view below.

Webull option chain offers 14 parameters you can add to help you in trading options on Webull.

These options trading parameters range from the Last Price, the %Change, the Implied Volatility, Open Interest, Volume, Delta, Theta and Vega as listed in the view below.

Therefore, this is the place where you can decide on which ones of your favorite options Greek to display.

On the above view, the left hand side (green) are the parameters I have selected to be visible from LAst price to Thea decay.

Whereas on the right hand side (blue), the columns editor is listing other available parameters that are currently NOT visible on m y Webull options chain.

It is possible to change the order of the parameter by using the slider on the right side of each one of them.

Sliding it lower or higher will decrease or increase the position of the corresponding parameter.

In my current view above, Option Last price is the first listed column followed by %Change of the price.

2 Webull Options Layout| List vs Straddle View

Once you have your desired options trading parameters using the process described above, the final decision is to determine how will the above information be displayed.

Webull Mobile Option chain offers two choices.

You will get them when you click on List Style.

The classic List view most of us have been accustomed to for ages is quite popular because this is how the majority of brokers displays the option chain information.

However, the newly introduce Webull option chain Straddle View is really growing one.

Instead of scrolling on my mobile phone to the right to see the multiple columns we described in the previous section, this new view display a nice summary of all the parameters for a given strike price in one shot.

Take a look below and let me know if this is not more attractive than the traditional column view.

At a glance, all the important option parameters are visible.

My main interest is on the last price and the two option Greeks I use Theta and Delta.

The break even is nice to have but is not really a deal breaker if you do not select it.

Often, I like to pay attention to the Volume vs. Open interest of an Option strike because this can provide insight into someone (a big institution) conviction about the direction of the stock.

At this stage, there is only thing left before you can trade options on Webull mobile.

That is selecting a strike price you would like to trade.

How To Select A Strike Price on Webull Options

I have two techniques I use to select a strike price.

Each one of my method has its merits based on your budget and flexibility.

How To Pick a Strike Price Using the ATR Technique

I have to remind you that the prior step to this one is of course to pick an Expiration date.

The guidance for expiration date is quite simple.

The More time between now and your chosen expiration date, the more expensive the premium of that contract will be.

The trade of here is time or probability of making money versus the cost.

Once the date is determined, the process is as follows:

- Determine the Number of Days (N) between now and Your Expiration Date

- Find the Average True Range (ATR) of the Underlying Stock

- Multiply the ATR by N

- Add the result to the current price of the Underlying stock for calls

- Or Subtract the the result from the current price of the Undelaying stock

- This will give you your Strike Price for Calls or Puts

Below is the step-by-step video when I explain this ATR technique to pick an option strike price.

You can even download the Automated Excel Template I use in the above video to Calculate the strike price.

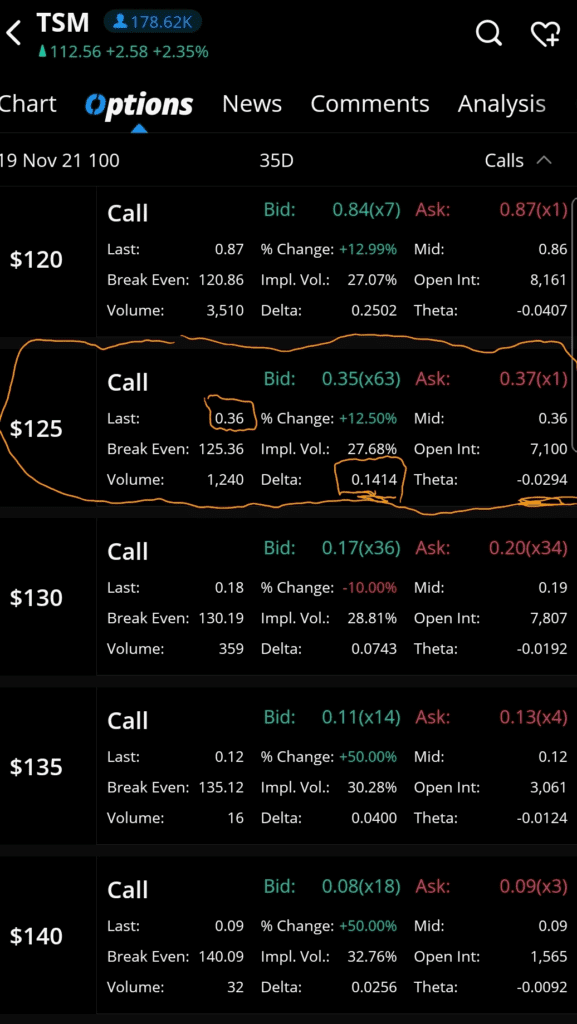

How To Pick a Strike Price Using Delta Technique

This second approach to easily pick an option strike price is for capital limited traders.

It leverage the Webull option chain Straddle view we discussed earlier.

The idea here is that you want to trade option contract that cost less than Delta.

Delta ranges from 0 to 1.

On the Webull option chain, once you choose your expiration date, you want to select a strike price that has the best Delta to Theta ratio in absolute value.

Typically, you want to ratio to be greater than 2. The higher the better.

On the TSM NOV’21 125 Calls view above, Delta is 0.14 while Theta is -0.029 which yield a ratio in absolute value of 4.8.

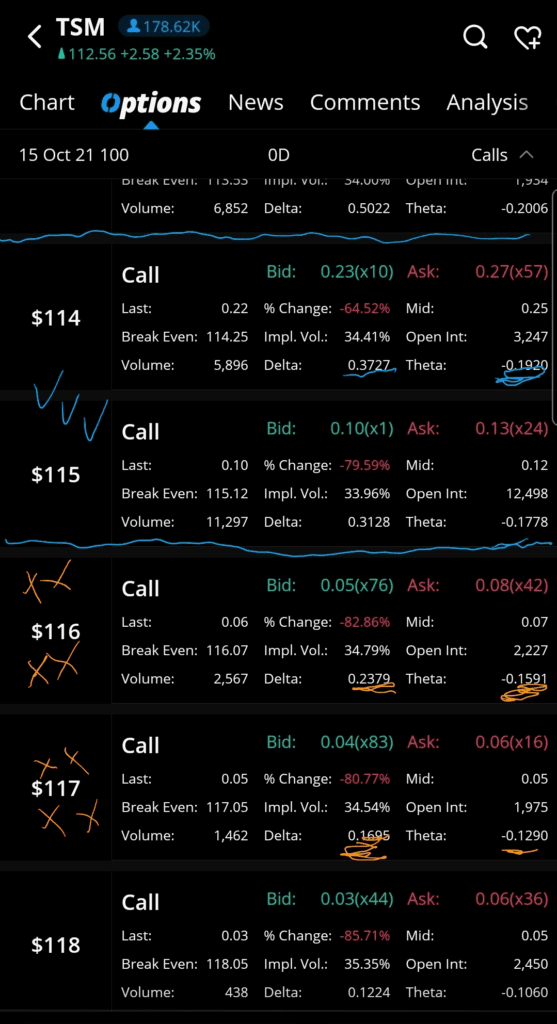

Here is an illustration of this Delta ratio technique on TSM OCT15 Expiration.

On the view above, all TSM options expire on Oct15 2021.

The 114 calls have a Delta of 0.37 with a theta of -0.19.

The cost for this 114 Calls is about 25 cents which matches our selection criteria.

Same observation is almost true for the 115 Calls.

On the other hand, the 116 and 117 calls do not quite have a Delta to Theta ratio above 2.

We will then select either the 114 call for 25 cents per contract or the 115 calls for 12 cents per contract.

By the way, Delta can be interpreted as the probability of being In the money at expiration.

Therefore, our Delta to Theta ratio ins weighting the probability of being ITM versus the Time decay of the option strike.

How Much Money Do You Need To Start Trading Options on Webull

Contrary to what many so-called experts publish out there, you do not need thousands of dollars to start trading options in general.

My best advice is first to find a trading platform with a paper/demo account where you can hone your skills.

This means you will not be trading real money initially until you are comfortable with what you are doing and confident about the strategies you want to earn money from.

Once you are ready to trade real money, there are very affordable options you can trade and make money consistently.

I have been trading such options for many since 2016 and I am still teaching traders how to make money trading options with very reasonable capital.

Here is an example of very cheap options paying over 100% this week.

| Symbol | Stock | Strike Price | Bid | Ask | Low | %Market Change |

|---|---|---|---|---|---|---|

| BAC Dec23’21 44.5 CALL | BAC | 44.5 | 1.03 | 1.05 | 0.47 | +131% |

| NVDA Dec23’21 240 PUT | NVDA | 240 | 1.02 | 1.05 | 0.14 | +263% |

| Roku Dec23’21 265 CALL | ROKU | 265 | 0.85 | 1.02 | 0.40 | +112% |

| WFC Dec23’21 50 CALL | WFC | 50 | 1.09 | 1.14 | 0.5 | +150% |

| FBDec23’21315 PUT | FB | 315 | 1.22 | 1.26 | 0.53 | +78% |

I took the above table from my Day trading trade Alerts watchlist for this week Expiration.

As such these trades are real Options trade you and most people can afford.

You can see four examples where the initial investment per contract is less than $50.

Therefore, even with just $500, you could trade several contracts of these options and still have money left in your account.

If you are serious about trading and wondering how much money you can make trading options, then I suggest you join my Discord Community today.

How To Trade Options on Webull App

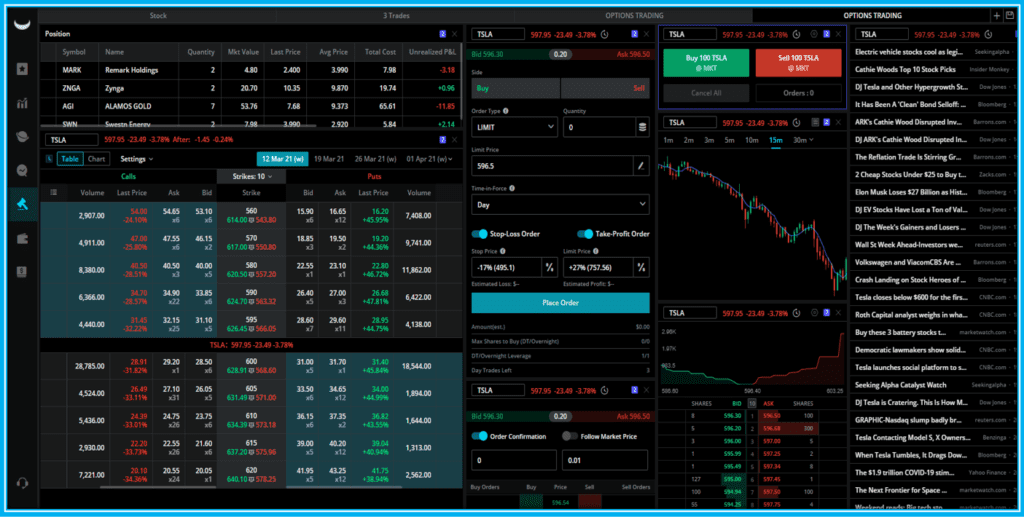

The most recent version of Webull Desktop is version 4.

You can download it on your PC in lieu of using the more direct browser based trading platform.

In my most recent research, I settled for the browser version since I can pin its window alongside the other application I routinely access.

By making this choice, you will need to setup your Dashboards once at the beginning and save them so that you are ready to trade each day with jsut a few clicks.

Now, you may be wondering why go through the trouble ?

The most obvious answer is the picture below.

Trading Options on Webull App is very comfortable even for beginner traders.

The view of the GUI below looks nice, doesn’t it 🙂 ?

The second reason is that you get to choose what you need for options trading on Webull in a single view.

This is done by selecting widgets and arranging them in a manner that is suitable to your liking.

Can you Paper Trade Options On Webull

Webull has done a great job with the paper trading account of $1 Million.

However, this does not apply to Webull paper trading options at all.

This feature alone or the lack therefore is a hinderance for many options trading beginners.

It will help a great deal of option traders when Webull provides the ability to paper trade options on this progressive trading platform.

Think of it as your self customized Options trading platform.

Because it is not obvious to Options trading beginners what they may need, I created this video tutorial below as a guide to setting up Webull Desktop 4.0.

If you take the time to invest 40 minutes of your time watching the full video, you will come out with the most needed education in your trading journey.

How To Trade Options On Webull | Does Webull Have Level 2

The one thing that is still lacking in Webull Options Trading platform is the absence of a Paper trading account.

Yes Webull account comes with a $1 Million Paper/Demo Account but that is only for stocks trading.

Many Option traders still need practice and back testing of their strategies before they go Live with real money.

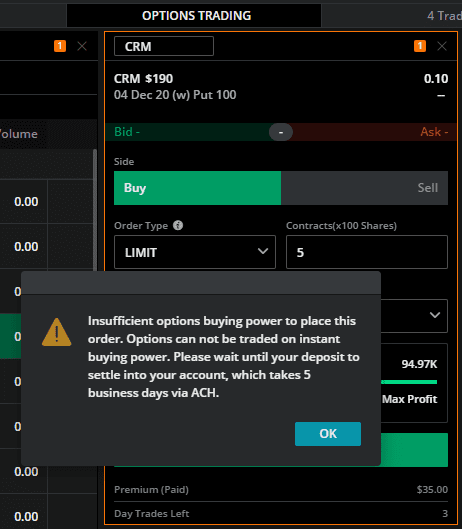

Webull Option Trading Restrictions

Apart of the above mentioned demo account, do not expect to options on webull right after your first initial deposit.

In fact, it may take up to 5 business days for your account to settle and it is only after that delay when Webull will allow you to trade options.

Also, you will have to wait a couple of days after a winning trades for your funds to settle.

Hence, do not be surprised by the message displayed in the above image in case you find yourself too eager to place your first option trade on Webull.

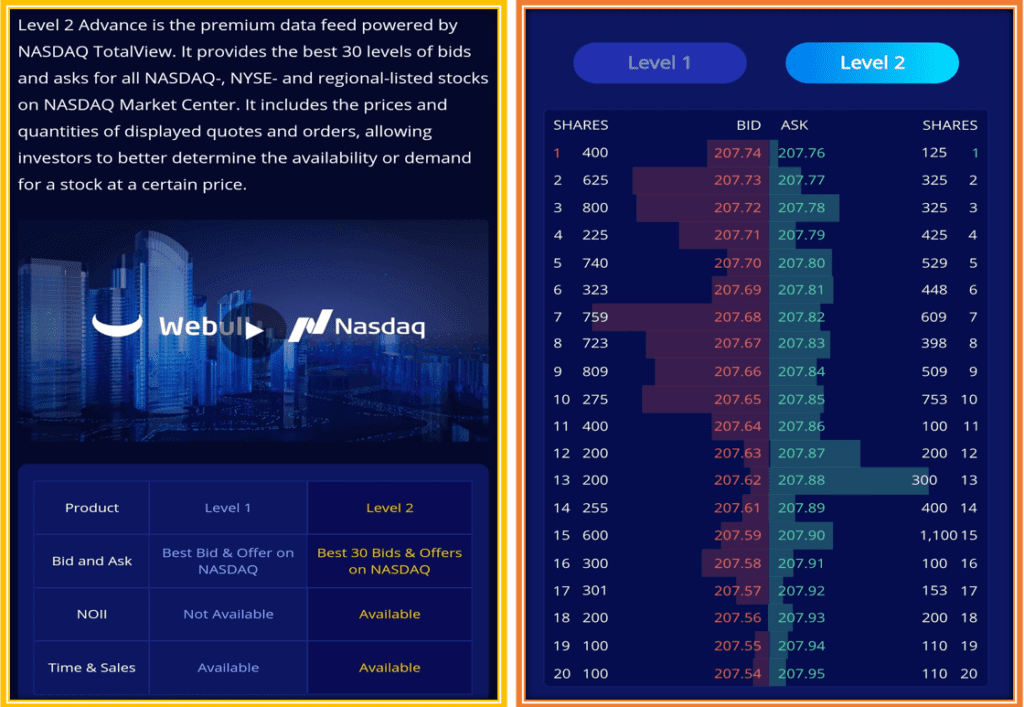

Level-2 Subscriptions

Ask any experienced stock and Options trader about one of the most important tools is trading and you will likely get the answer Level-2 data.

What is Level-2 Data ?

In trading, Level -2 data provides a view of the depth view of the outstanding orders (buy and sell) on the instrument you seek to trade.

Why is Level-2 data important ?

Because it helps traders determine the availability and demand of a stock for a given price.

This information is then used to provide confirmation about the potential direction of the stock.

Example, if a stock is in high demand for higher prices, traders can confidently enter bullish trades.

How Much Does Level-2 Data cost ?

As an introductory offer, Webull offers 3-month free Subscription to LEvel 2 Advance Data.

Then it costs $1.99 per month. You will need to Subscribe manually at the end of the 3-month free trial.

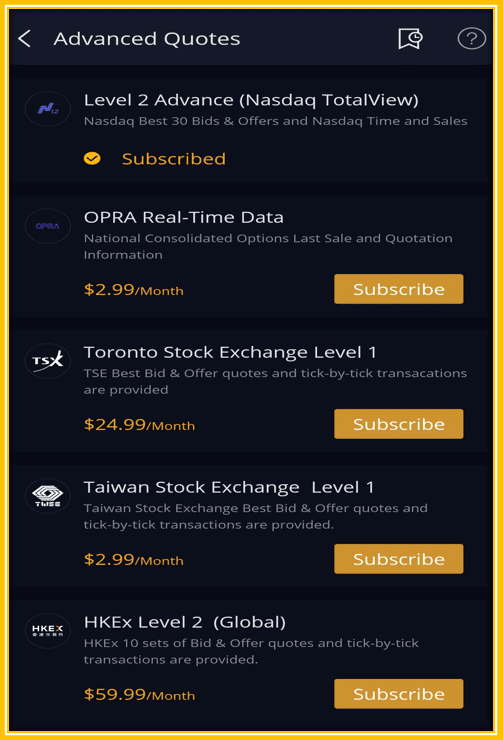

How To Subscribe to Level-2 Data on webull ?

From your mobile App, go to Menu > Select Advanced Quotes and the list of available products is displayed.

The image below provides a view of my current Subscriptions to Level-2 data on Webull.

Webull Options Trading | Education Resources for Beginners

Most traders on Webull are beginners thus they are seeking education not only on the platform itself but basic Options trading knowledge.

To help address this increasing need, Webull offers on tits mobile App trading platform a feature called Community.

Webull Community Benefits

The following sections or categories are available inside the Webull community.

- Streams

- Competition

- Top News

- 24/7

- Watchlist

Inside the Streams section is where you will find the most value.

Recently, Webull provides an incentive to go through the education to familiarize yourself with trading options and other instruments on their platform.

It is called “Complete the Beginners’ Course. It is a series of 7 courses.

One of them is an FAQ on Options Trading.

Webull Top Lists

The objective of the Top 10 Lists is to provide traders with the most active stocks and options.

Practically, you can use these lists as research to figure out which stocks to trade.

My best advice to join a proven system that will teach you consistent winning strategy so that your learning curve does not take multiple years.

Webull Paper Trading Competition

For the purpose of Learning how to trade on Webull, you can participate in the free Paper trading challenge to help confirm your skills and flatter your ego.

The main idea of the community is to provide chat rooms where traders can post their ideas, ask questions and grow together while learning the necessary skills to become successful traders.

CONCLUSION

Webull Options trading is a nice addition to the platform.

You can trade options on Webull App if you are on the GO or you can trade options on Webull desktop.

However, for many beginners it is still a daunting task to figure out the application while acquiring the basic trading skills.

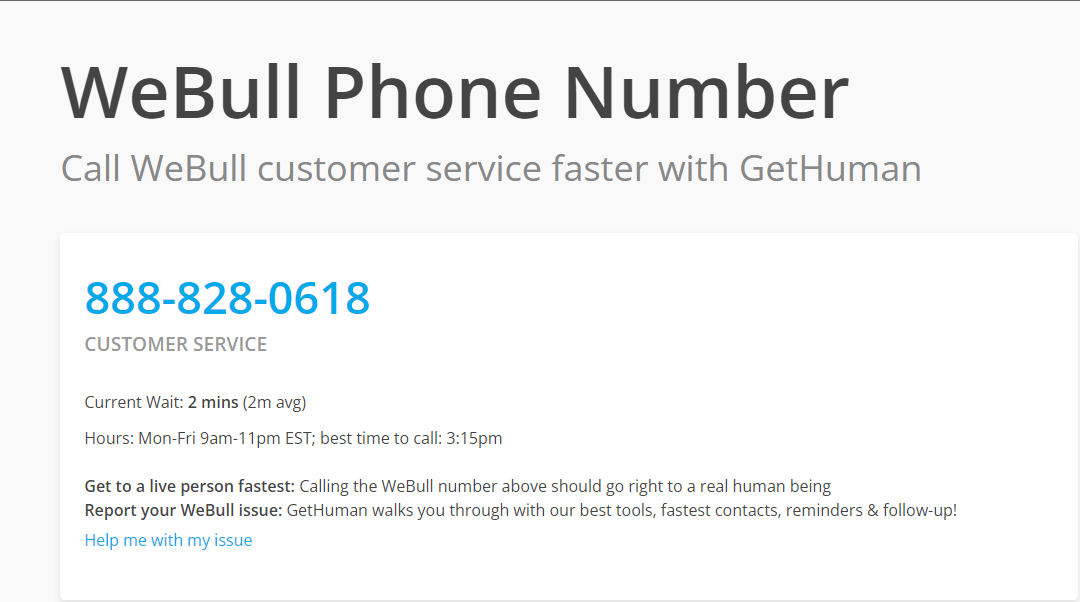

The one constant complaint in the multiple Webull chat rooms is the lack of customer service.

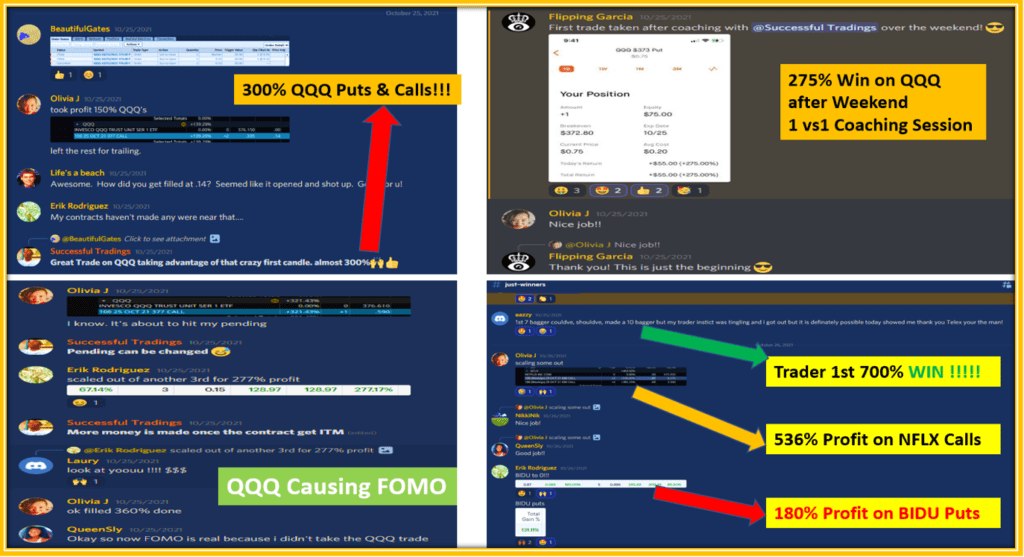

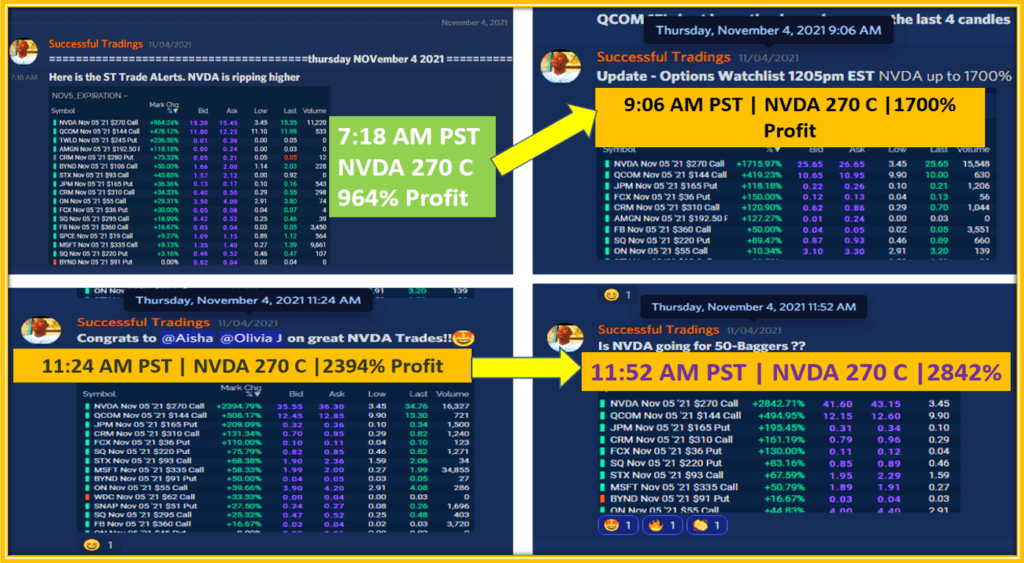

Should you find yourself in this situation, I strongly encourage you today to check out our 10-baggers education trading system.

This is the closest thing to a guarantee to Take your Trading To the NExt Level.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/