QQQ Options recently introduced daily Options just like its SPY counterpart.

The prospect of being able to trade cheaper options contract on QQQ ETFs should excite many day traders.

In this Day trading Tutorial, we will share our step-by-step strategies on how we can now day trade QQQ Options for big profit.

Table of Contents

How To Trade QQQ Options | What is QQQ ETF

QQQ is an Exchange Traded Fund (ETF) launched by Invesco on March 10 1999.

The Fund investment strategy seeks to match the performance of the NASDAQ-100.

Despite the fact that QQQ focuses on growth, it also pays a dividend with a yield of 0.52%.

Therefore, this makes this ETF quite attractive to the for the growth seeking investors.

Top Holdings in QQQ ETFs

The first thing you will learn about QQQ top holdings is how it is Top heavy.

This means that just a handful stocks in QQQ ETF account for the lion share of the overall fund.

| Company Name | Ticker | %Asset |

| Apple Inc | AAPL | 11.2% |

| Microsoft Corp | MSFT | 9.52% |

| Amazon.com Inc | AMZN | 8.74% |

| Tesla Inc | TSLA | 4.02% |

| Alphabet Inc Class C | GOOG | 3.98% |

| Facebook Inc | FB | 3.96% |

| Alphabet Inc Class A | GOOGL | 3.6% |

| NVIDIA Corp | NVDA | 2.89% |

| PayPal Holdings | PYPL | 2.39% |

| Comcast Corp Class A | CMCSA | 1.96% |

From the table above depicting the Top 10 holdings of QQQ ETF, we can see that 10 stocks account for 52.2% of QQQ assets.

That is quite a disparity for a fund tracking 100 stocks.

Even more, the Top 5 made of AAPL, MSFT, AMZN, TSLA and GOOG represent nearly 38% of QQQ holdings.

This means that as these 4 or 10 leading stocks trade so will the overall QQQ fund.

What is this significant ?

Because investors in any one of these stocks can use the QQQ fund to diversify their portfolio.

The advantage of diversification is of course to minimize the Risk of bad performance of one given stock.

What Are some of Good Alternatives to QQQ ETF

If you are purely a stock investor, a good alternative to QQQ ETF is the leverage ETF TQQQ.

This non dividend fund correspond to three times the daily performance of the NASDAQ-100.

Which means that if the NAsdaq-100 gains !%, TQQQ gains 3%.

The opposite is also true as well.

When the losses on Nasdq-100 translates the 3x on TQQQ.

The main advantage of trading TQQQ stock over QQQ is that it is a much cheaper stock.

Meaning you need less capital to trade TQQQ should you have limited capital in your trading account.

Day Trading QQQ Options | What is New with QQQ Options

Tech stocks through QQQ or TQQQ ETFs have largely outperformed most of the other sectors in recent years.

TQQQ has gained 450% from 2019 to 2021.

Better yet, even after the impact of the COVID-19 pandemic in M1rch 2020, QQQ and TQQQ have rallied to unprecedented highs.

That is great for investors who were already in the market.

How about those who may just be looking to get in ?

Or those starting with limited capital and cannot afford to buy the expensive tech stocks such as TSLA, NVDA or NFLIC which are now above $500 a pice ?

The answer may well be trading QQQ Options.

Option trading as you know requires much lesser capital than stock investing.

Trading QQQ Options on Closer Expirations

Prior to the Early May new introduction of more expiration days for QQQ options, traders only have the opportunity to trade weekly options.

Now, QQQ Options offer three expiration each week on Mondays, Wednesdays and Fridays.

Just like SPY ETF. For SPY, these intermediary options were introduced in 2018.

We have been taking advantage of this on how to Trade SPY Options for Profit.

With these new opportunities for QQQ Options, we are even more excited to the prospect of making money day trading QQQ options.

Is it better to Trade QQQ than SPY Options

Multiple weekly expirations provide the flexity for day traders and swing traders to better manage their investment Risk.

The obvious benefit for QQQ options traders is the availability of cheaper premium on option contracts.

This means you will need even less money to trade QQQ options now that we have closer expiration dates.

Instead of picking a relatively out of the money strike price for Friday expiration, now an option trader can pick a closer to In the money contract without having to spend as much.

Pros vs Cons of Trading QQQ vs SPY Options

The trade off between the cost of option contracts and time is just as good now for QQQ as it has been for SPY options.

Which brings the question: Would you rather day trade SPY Options or QQQ options ?

I am using day trade because the big gains usually happen when these ETFs make big moves on any given day.

You will be able to benefit from both SPY and QQQ equally assuming their daily moves are identical.

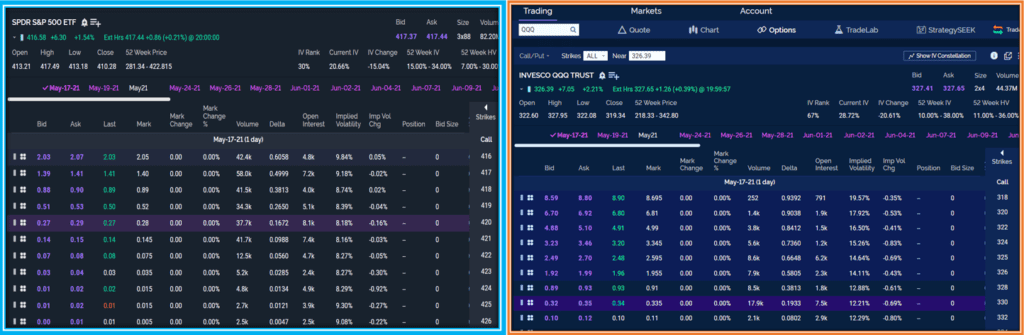

QQQ Option Chain vs SPY Option Chain

In order to answer the question on QQQ option vs SPY Option now that they both offer intra week Expiration, let’s study their respective option chains.

We want to see if there is any difference from a cost perpective.

In order to do so, you will need to select the same expiration Day: the chrt above is showing MAy 17 Expiration.

Then, for the same Delta (probability of reaching that strike price), we then compare the cost of SPY Options 29cents vs 35 cents for QQQ options.

Day Trading Strategy for big Gains on QQQ Options

Now, before you jump to any conclusion, you can clearly see that the 19% delta for the QQQ 330 Calls options has a higher probability of being in the money.

Besides this is just one day of comparison.

The more accurate test is to measure the average true range for both SPY and QQQ and normalize them to the price of the stock.

Here is the result of that research over the last 4 years.

What Is The Best Day to Trade QQQ vs SPY Options

In order to answer the above question, I studied QQQ and SPY daily price action from 2018 to 2021.

I measured the move from the Opening price to the High and from the Opening price to the low of the Day.

There is a great deal the above summary table of results is telling us.

- From 2018 to 2021, QQQ daily moves on the bullish and bearish side are about 20% higher than SPY.

- The Best Days to trade QQQ Calls are by far Wednesday and Thursdays

- On these 2 days, QQQ in 2021 moves are 30% higher than SPY variations: 0.80% vs 0.62%

The information from this research also helps traders choose the correct strike price for both QQQ and SPY ETFs especially when Day trading their respective Options.

0.9% move on current price of QQQ around #25 is about $3.

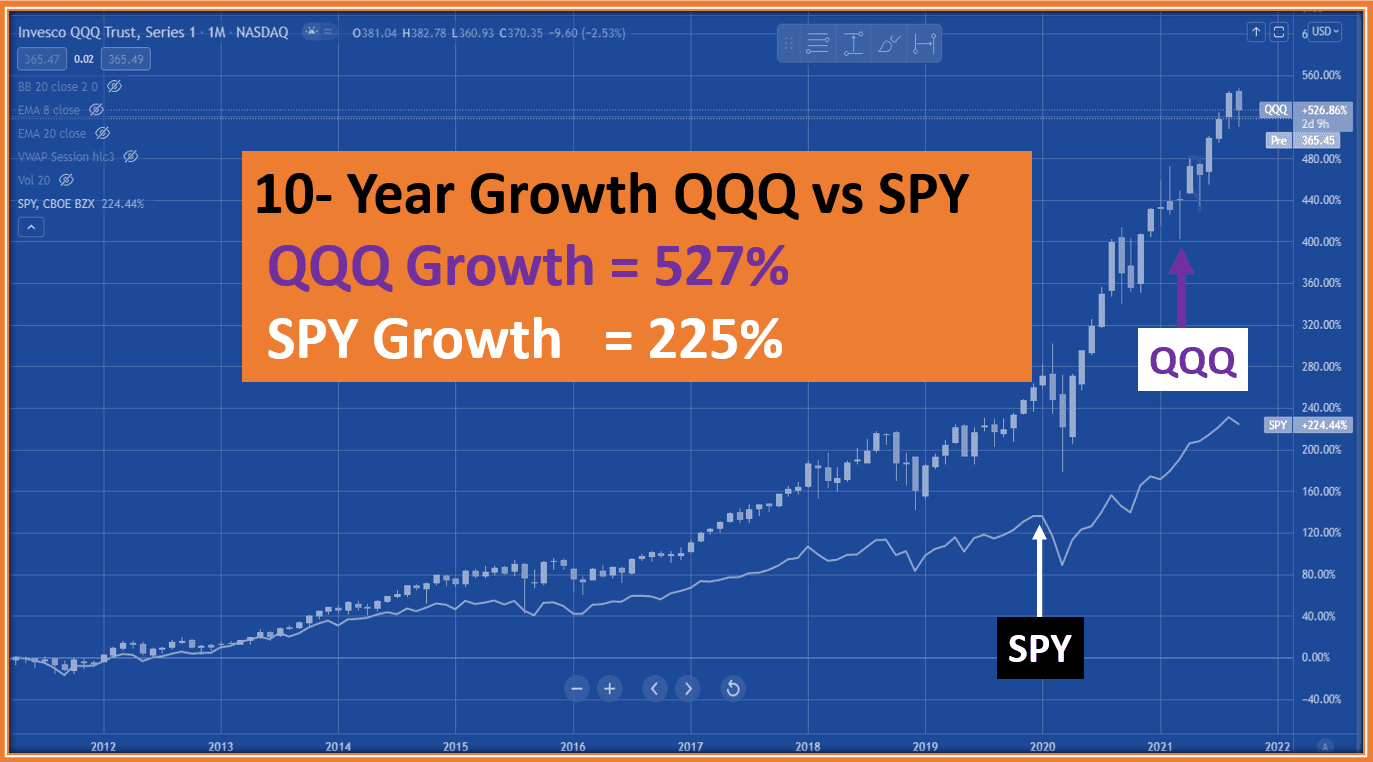

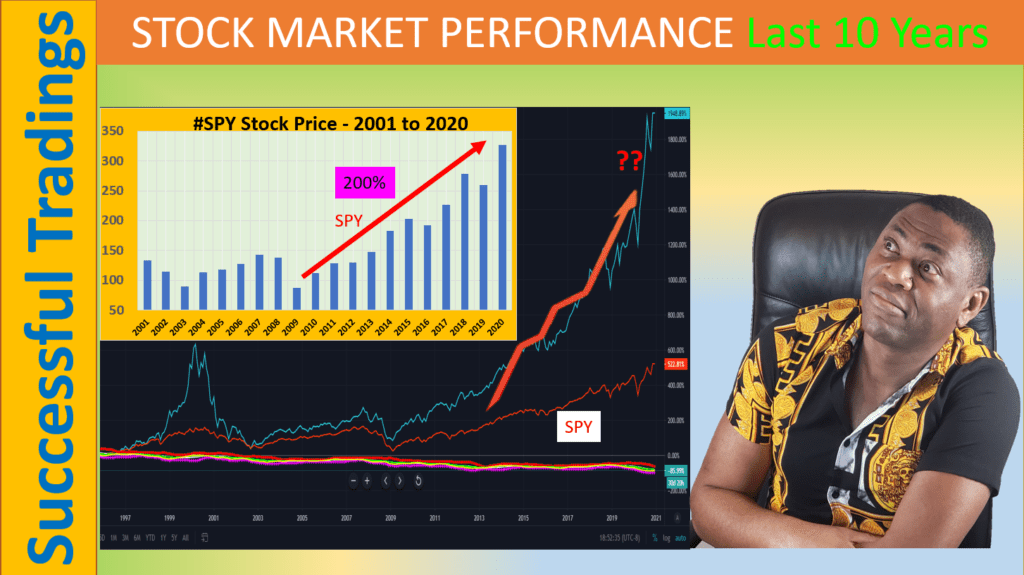

Also, we can simply look at the performance of SPY vs QQQ over a long period of time to derive which one of the two ETFs gives us the best opportunity to make money trading options.

According to the chart Over the last 3 years, QQQ returns are almost 100% higher than and SPY gains from the period of 2019 to 2020.

QQQ Options Pay More

Which means that for an options trader, albeit through day trading of QQQ options, it is far most advantageous to day trade or swing trade QQQ options instead of SPY weekly Options.

This does not mean that you cannot make money trading SPY options for a living but the results of this study simply implies that there even MORE money to be made trading QQQ Options.

QQQ Trading Strategy Review

Hence, I did not waste anytime in the first week of May after the introduction of QQQ Options intra week expiration days.

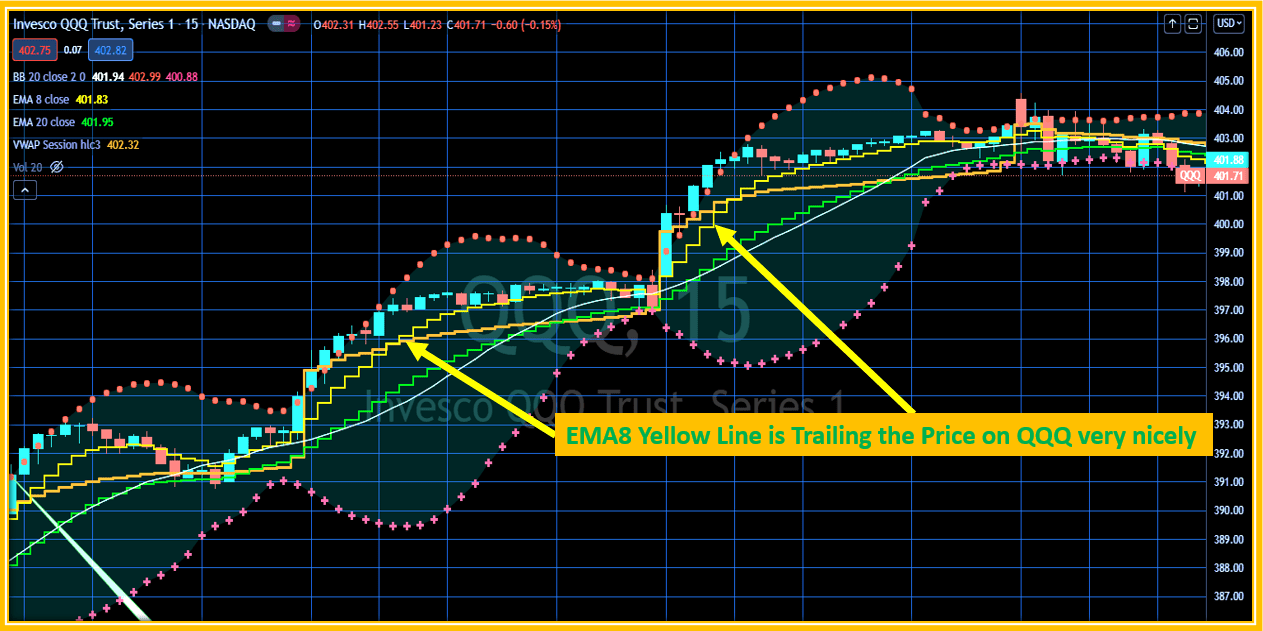

Based on my long history with the SPY weekly options strategies, I can tell you that the same methods will lead you to trade QQQ options for big profit as well.

Next, I will share my first three trades on QQQ Options using the new Mondays and Wednesday expirations.

Best Option Strategy for QQQ Options

One of the best day trading strategies I use to make money consistently trading options is called the Gang$ta trade.

On May 4, QQQ ETF gapped down by -0.8% and triggered an entry for 322 Puts expiring on the very next day which was a Wednesday.

Day Trading QQQ Weekly Options for 900% Profit

I host a Live Day trading Pre-Market Analysis weekdays on YouTube.

On May 4 2021, we shared this trade Live with the audience.

The idea was to take advantage of the gap down and execute the Gang$ta day trading strategy.

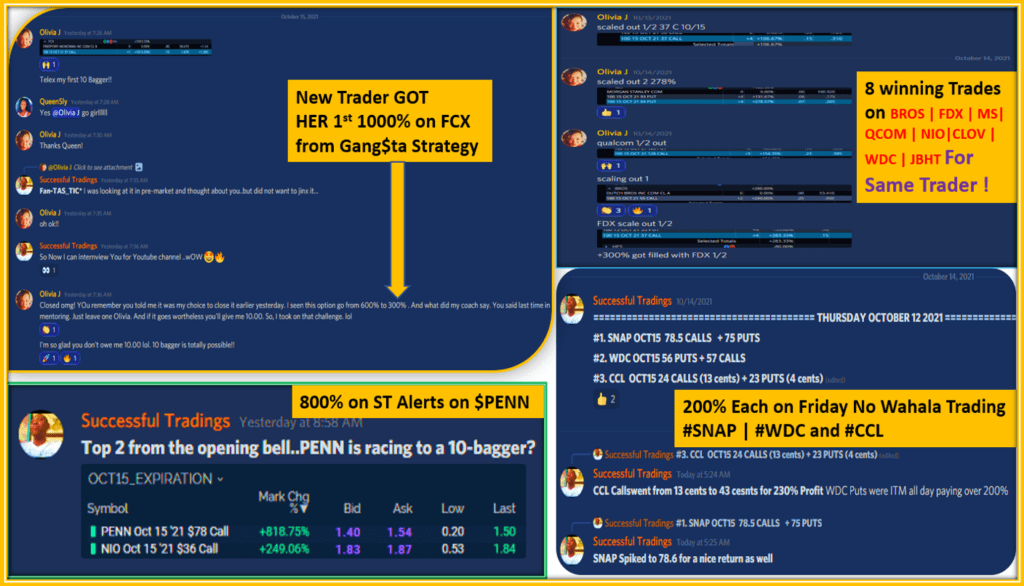

The trade worked out to perfection returning 900% gains on the pts side.

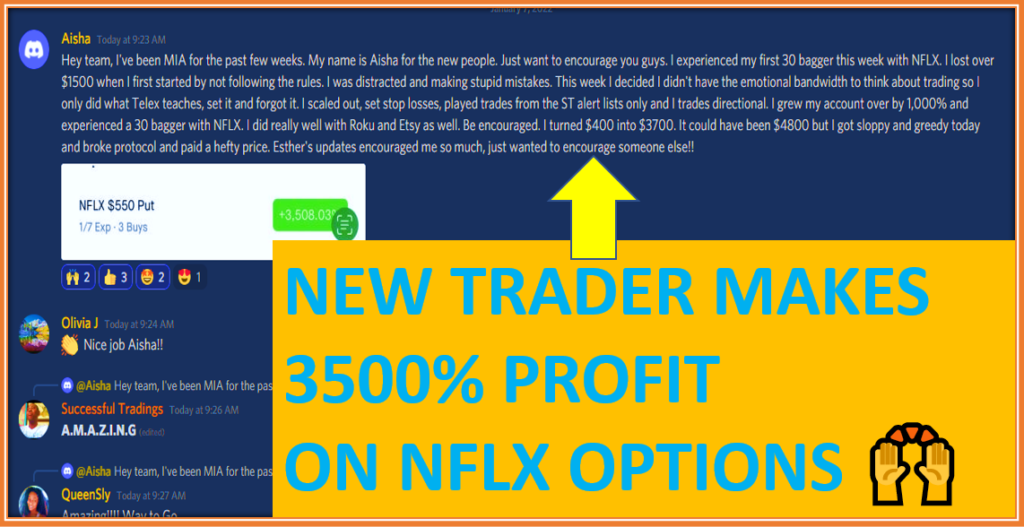

Here is the screen capture from our Discord room showing 400% after 90 minutes of trading.

Here are further examples on how to make money day trading QQQ Options consistently.

You too can start trading QQQ for a living by learning the skills many options traders are using in my Discord room.

Click on the image below to find out more today.

QQQ Weekly Options Second Big Wins

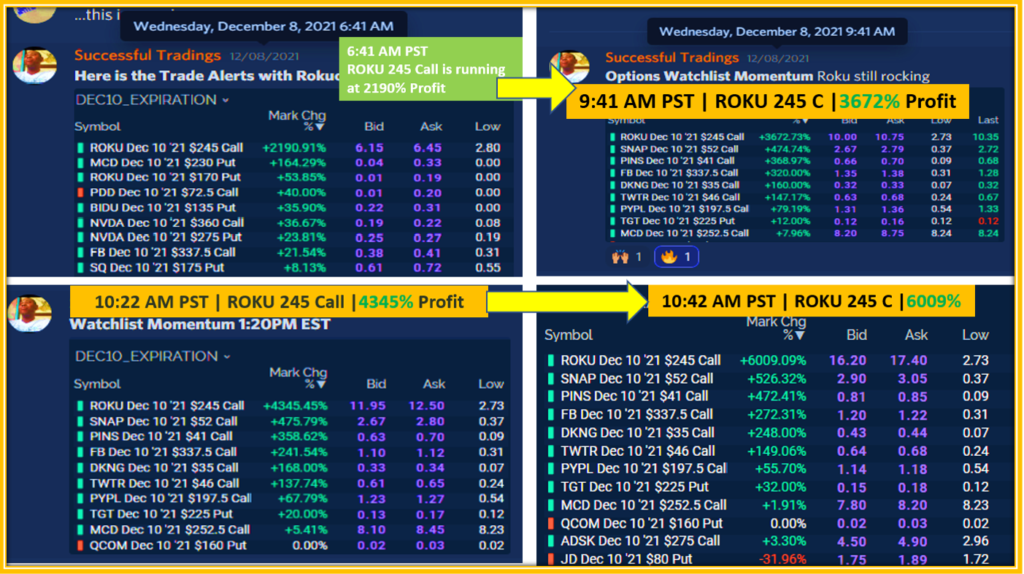

Most retail traders are still on the fence when seeing these type of results on options trades.

The traders within Successfultradings Discord room know better.

10-Baggers Trading Channel

These occurrences have become a common thing to the point where I started joking that I should r-brand Successfultradings YouTube channel thee 10-Baggers Trading Channel.

Here is the video review of that 900% profit on QQ options.

May I suggest after watching it to go through the playlist devoted to the 10-Baggers to convince yourself it is possible to day trade QQQ Options for Big Profit such as this one.

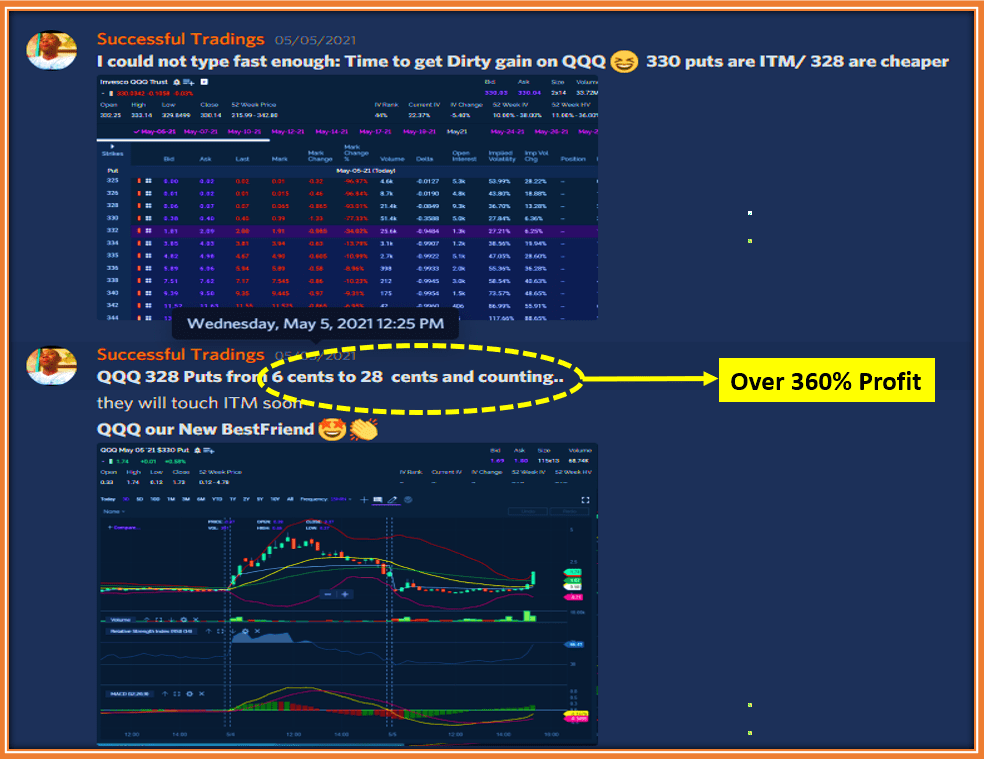

How To Trade QQQ Options for big Profit | Trade #2

After that Tuesday 900% profit trading QQQ options, we did not have to wait for long for the next big score.

This time, it was our end of the day on Expiration day strategy that paid us.

We have been using this option strategy successfully for years on trading SPY Options on expiration Day.

Now, we can employ it exactly in the same manner for day Trading QQQ options on Expiration days as well.

By now, I hope you are beginning to see a winning pattern here across our best options strategies.

They win big !

Trade # 3 Using QQQ Options in Day Trading

The third example of in our series of big winners trading QQQ options came on May 10, 2021.

Once again, it was with the gang$ta Day trading strategy.

Our Explosive Day Trading Gang$Ta Strategy

This is a strategy we use on gaps (in any direction) buy entering the trade in pre-market !

Yes, of course, options do not trade before the market opens but there is a secret in why we proceed in this mnaner.

Look at the time stamp on the image below from our Discord room.

In just 75 minutes, the QQQ 328 Puts options went from 15 cents entry to 90 cents.

Which means a whopping 500% return in less than 2 hours of work.

Not bad at all, isn’t it ?

The stock market provided multiple opportunities to make money trading Puts options on that day.

Awesome options Profit Consistently

You can see on the above view a fellow trader highlighting SPY 330 Puts massive gains from 1 cents to 4$ !

Yes, you read it correctly.

That represents over 39000% return or 39-baggers.

CONCLUSION

I was able to share to numerous examples on how to trade QQQ options for big profit by leveraging the recent introduction of intra week Expiration days.

I strongly encourage you to learn more from our Education Service so that you too can take your Trading to the Next Level.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/