In this tutorial, we will share numerous examples of how to safely day trade Spy Options for Profit on expiration days.

We do this with different techniques.

One of which is by using to the Dark Pool Prints for 100% profit in less than 30 minutes.

Impressive you may think. But the truth is that Day Trading SPY Options can lead to much bigger payouts.

Want to find and learn how you can do it yourself ? Keep reading below.

Table of Contents

DAY TRADING SPY OPTIONS: WHAT IS AN ETF ?

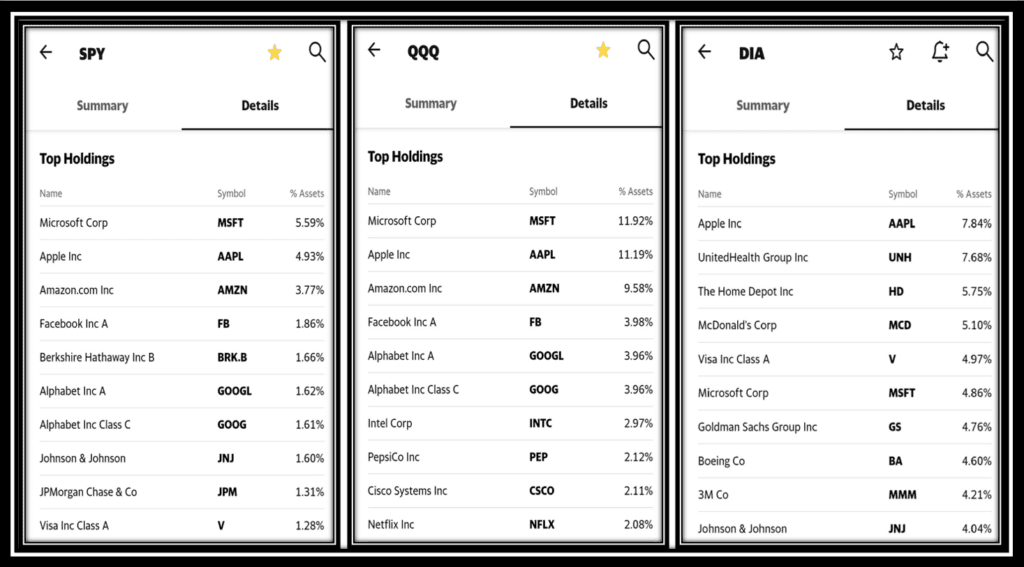

SPY, QQQ and DIA Top 10 Holdings

For Option Trading beginners, SPY is the market biggest Exchange Traded Fund (ETF).

It is a mix of 500 of the most important US companies.

It aims to capture the heartbeat of the overall market.

Other ETFs are more focused on specific sectors of industries.

Below are the three big ETFS that leads the US markets: SPY, QQQ and DIA.

This means that these are the ones you will hear the media report on when talking about the status of the market.

When the overall market is bullish, SPY trades in the positive territory and vice versa.

We can notice a company like Apple account for 4.2% of SPY, 11.6% of QQQ and 6.2% of DIA.

Why is this important ?

APPL Vs SPY ETF Correlation

This means that whenever Apple stock (Ticker:AAPL) is leaning heavily in a certain direction, so will these three ETFs.

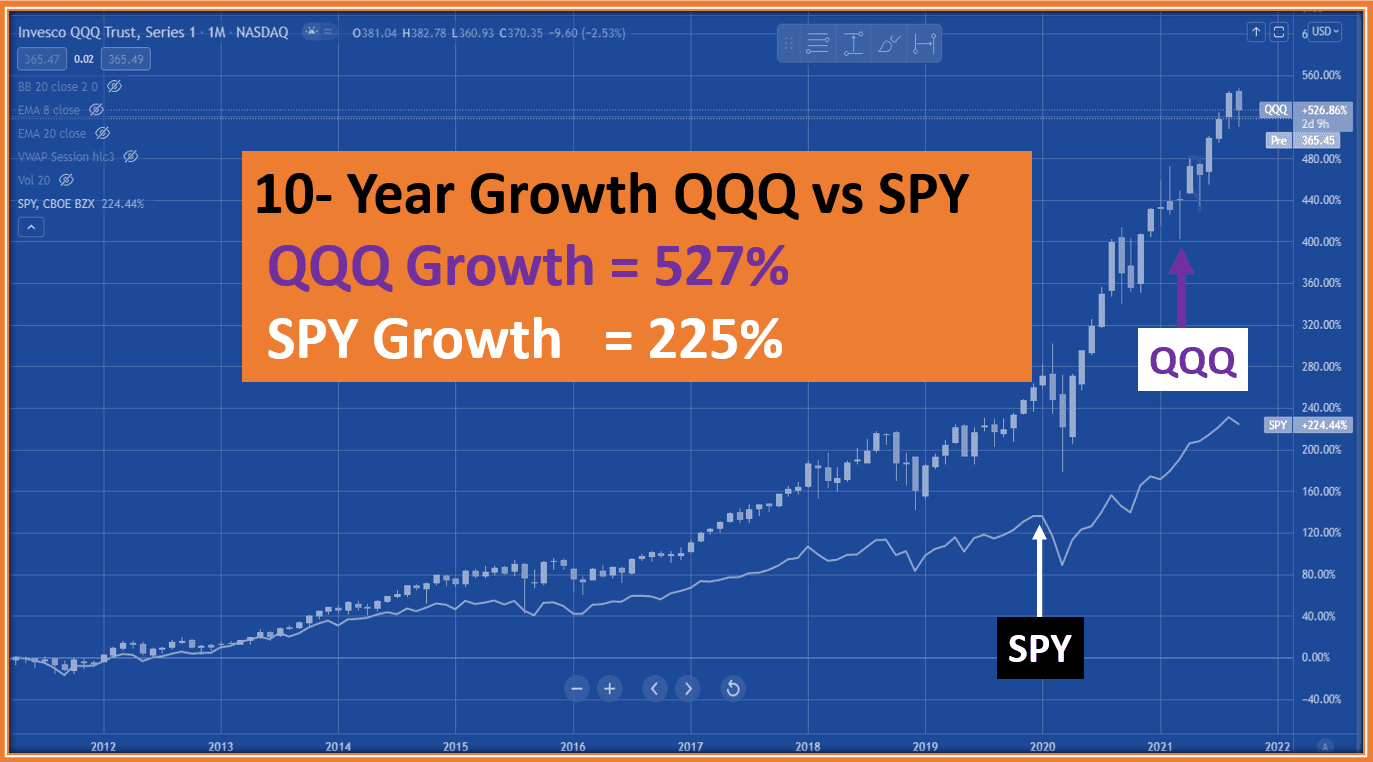

More particularly the one where Apple’s representation is the highest. That will be QQQ.

The reverse of the above statement is even more true.

Nowadays, ETFs have become the primary vehicle on how money is injected and removed from the market.

I know this through the heavy volumes of trade I see on FlowAlgo everyday.

So, whenever SPY, QQQ and to a smaller extend DIA are being bought by big money, the lion share of that money will go to the stocks with the biggest representation in these ETFs.

What does this mean ?

Which Stocks Move SPY The Most ?

Let’s use SPY as an example.

Every time SPY is bought for “X” millions, per the chart above, 4.3% of that goes into buying Microsoft stock (Ticker: MSFT).

Following that logic, almost 4.2% of that will be devoted to buying Apple stock while 2.9% will go into buying Amazon stock.

The impact of this reality is that only a handful of stocks really move the market.

Those stocks are the ones you see in the tables in the last column percentage assets.

As a consequence, a strong correlation always exists between these ETFs and their stocks with highest percentage assets.

Let me leave you with this recent headline from Yahoo Finance.

The truth is that I did not have that info from Yahoo Finance when I started this post ?.

Funny how this information just perfectly matches the content of this section.

Correlation between AAPL and SPY

A correlation study between Apple and SPY or QQQ is bound to be very high.

Similarly, the correlation coefficient between Boeing (Ticker:BA) and DIA should be above 0.7.

If you are not familiar with Correlations studies, no worry.

When in a hurry, I usually like to use this online tool for correlation analysis.

But, it is limited because it only works for stocks and not ETFs.

To remedy that, I also perform the analysis manually.

I will be publishing a Video Tutorial on how to generate Correlation studies between stocks and ETFs in the near future.

For now, let us dive into what brought you here: Day Trading SPY Options. Shall we ?

Day Trading SPY Options Using The Stock Whisperer App

Since 2018, SPY now has Options Expiration on Mondays, Wednesdays and Fridays.

That makes this SPY Options very liquid to trade and opportunities are always around the corner.

Day Trading SPY Options Intraweek

That is a curse and a blessing for traders because instant gratification and the Risk to over trade are two big snares prowling around.

IF you want to learn How to Day Trade SPY Options for Profit, it is imperative to control your emotions and stay disciplined throughout the course of a trading day.

Day Trading SPY Options for 100% profit is a great achievement by itself but being able to be disciplined until the last couple of hours in the trading sessions can yield even better results.

Here is a great Exhibit of our Day Trading SPY Strategy for 1000% Profit in Less than 1 hour.

Yes, Check it Out !

We were able not to fall prey to any of the two and waited for the right moment to partake into the trade below.

After the long holiday weekend, trading resumed on Monday Dec 2 2019 with a small gap up.

Spy opened the pre-market session at $315 from $314.60 close on November 29, 2019.

By the opening Bell, SPY was trading at $314.59.

So, a really flat open from previous close was our setup.

Day Trading SPY Options Strategy: Entrance Criteria

We have not traded SPY for options in a long time.

Reason For the Trade

So we needed strong confirmation that this trade was worthwhile.

We discussed in The Stock Whisperer App review about the importance of Dark Pool.

Dark Pool helps traders determine the overall direction of the market (and other securities) so that we can enter the appropriate trades.

Well, on Monday, December 2, 2019, after 15 minutes, SPY felt below a major support level of 314.4.

As shown on the below Daily Dark Pool Whisper sent by Stephanie Kammerman before the Open of the market, it was time to take a bearish trade.

Sometimes, the publisher of The Stock Whisperer uses the SPY Stocktwits when her App is going through upgrades.

She is able to leverage the popularity of SPY in Stocktwists to further increase the reach of her services.

We entered the bearish trade with a simple Put.

Confirmation of The Trade

The second confirmation for taking this trade came from the DAX at -0.7%

We shared a while back how we like to monitor correlation between the US markets and international markets.

We do this using the Investing.com mobile App.

Here you can find the daily correlations between SPY and DAX the German index, for each year, from 2016 to 2019 included.

During US pre-market on Monday, the DAX broke below recent major support.

It was trading well in the red at around -0.7% after a sharp reversal from earlier gains.

Day Trading SPY Options on Expiration Day: Exit Criteria

The Risk of Trading SPY Options on Expiration day is that it does not leave any room for greed.

You know, that little instinct inside our minds that take over sometimes (hopefully just sometimes) .

Yet, Trading SPY on Expiration remains one of the Best Way To Trade SPY Options for 10-Baggers Option Profit .

Let us use this short video (Duration: 4min30s) to analyze our exits as well as other details about this successful trade.

Day Trading SPY Options For a Living | Easy Step-by-Step Strategy

Any great option trading strategy has to prove itself by being easily repeatable.

In other words, a successful strategy must provide consistent profit in all type of market scenarios.

In the above example, we shared how the Darkpool technique was able to provide quick profit trading SPY Options.

Day Trading SPY Options for a living a certainly a methodology one can adopt to become a successful options trader.

The question we have to ask ourselves is this : Can you repeat it over time ?

How To Day Trade SPY Options For Profit Consistently?

The reason for the question is because if the answer is yes, then it is possible to Day trade SPY Options for a Living.

Wouldn’t that be great ?

Certainly the Dark Pool strategy offers that possibility.

The only concern is that there might not be enough opportunities (situations) to apply that methodology.

Though to be honest with you, I have consistently seen enough Darkpool prints on SPY and QQQ to fully take advantage of that technique.

I should also mention that Live prints on standard stocks will work as well provided we are patient to wait for the direction to be shown.

In those situations, the trade will go over multiple days and can yield very generous profits .

Back to SPY Options on Expiration Day, the best technique is to wait late into the day.

How late you may be wondering ?

Day Trading SPY Options Late On Expiration Day

The most consistent strategy to trade SPY for Options for a living requires plenty of Patience.

On Mondays, Wednesdays and Fridays, we know that SPY Options are set to expire.

Therefore, the later we go into the session, the cheaper the SPY options contracts become.

We have been able to share SPY option trading success stories focusing on the last 2 hours on Expiration days.

You must also know that you can trade SPY Options after hours for an extra 15 minutes.

This means that there is no need to rush into closing your position at 4PM eastern.

Quite often, we have recorded significant additional gains trading options after hours.

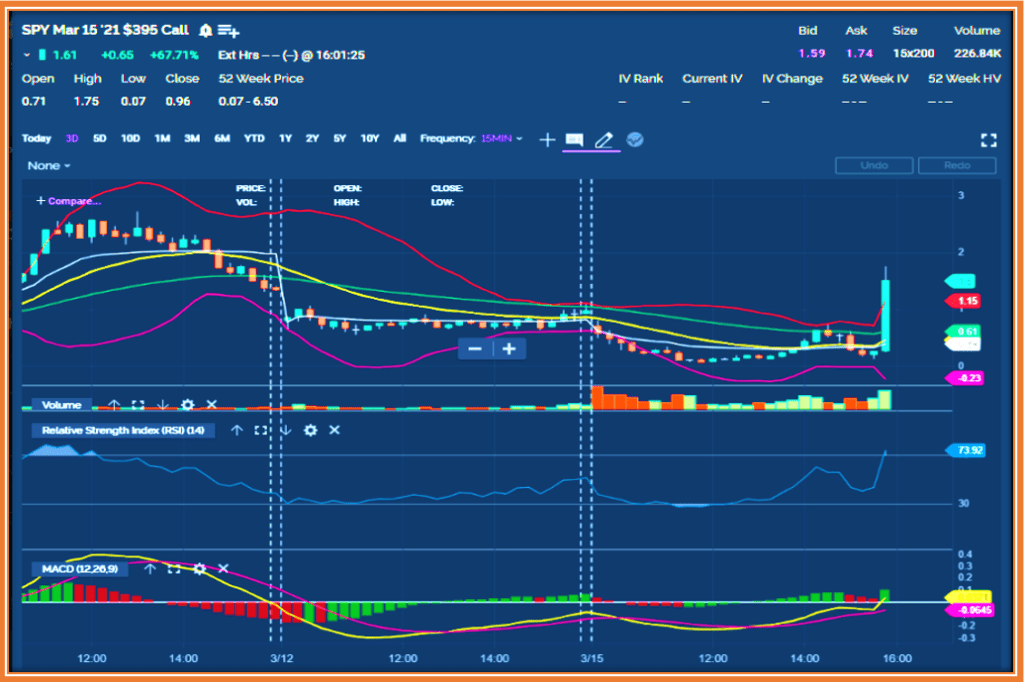

Here is an example of such a trade on SPY 340 Put Options I bought at 2:08PM EST.

The cost per contract on those above view is 2 cents.

Yes, which means $2 is all it took to get into a contract.

Less than an hour later, the same SPY Options were worth as high as 24 cents per contract.

This is what we call a 10-Baggers Option win.

Which lead me to the next big observation of this SPY option trading review.

How To make Money on SPY Options

I have be telling traders in our Discord room that we do not need Big money to make money in Options trading.

This SPY Option trading Strategy does not require thousands of dollars.

Therefore, your Risk is always very low but your returns will be big.

Here are the steps you can apply to day trade SPY and make consistent profits.

Step # 1. Focus on Mondays , Wednesday expirations

Step # 2. BE Patient and Focus on the Last 2 hours of Trading. The later the better since we can trade SPY Options in after-hours anyways.

Step # 3. Structure the SPY Options Day Trade as per the Detailed video below to increase your probability of Profit

Here is Video Video for Step #3 detailing how to structure SPY Options Day Trades on Expiration Day.

You can start with very small account and grow your account with this strategy.

In a short time, you will be able to start scaling up by trading bigger size contracts.

FINAL THOUGHTS On Day Trading SPY Options

We shared this SPY case study where we were able to trade SPY options for over 100% profits.

We used the Darkpool prints level to ensure of the direction of the trade and quickly profited from it.

You will discover than 100% gain on Options can be fairly standard as you discover How To Make Money Trading SPY Options.

This day trade of SPY options could have yielded a little be more than what we cashed in if the trader was willing to accept volatility.

We will strive to bring you these use cases proving that Trading SPY Options for a Living is not just a myth.

We hope you found value in this SPY Day Trade review as we continue to showcase examples on How to Learn To Trade Options.

Let us know your thoughts on how you would have managed the ups and downs of SPY during this trade.

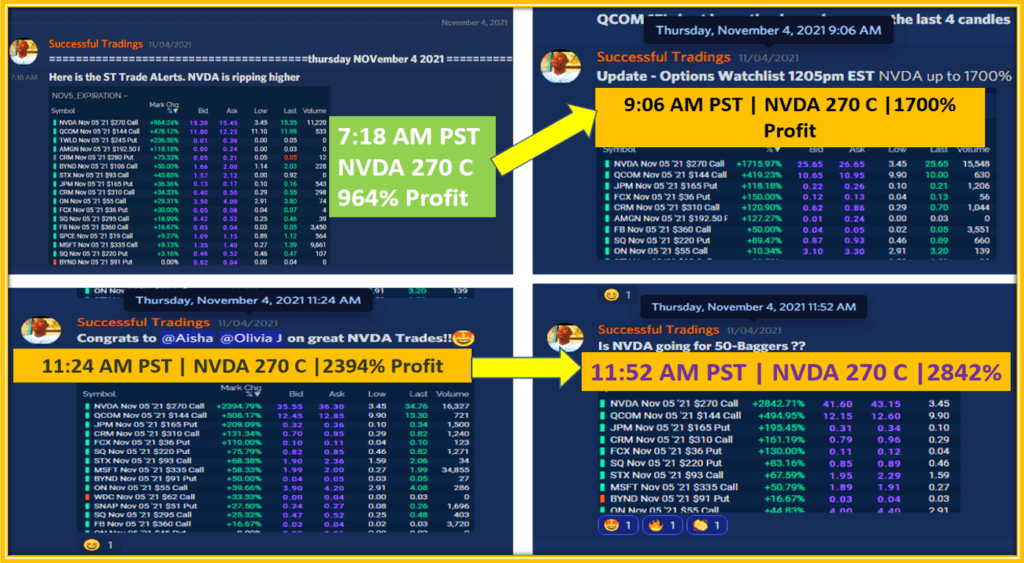

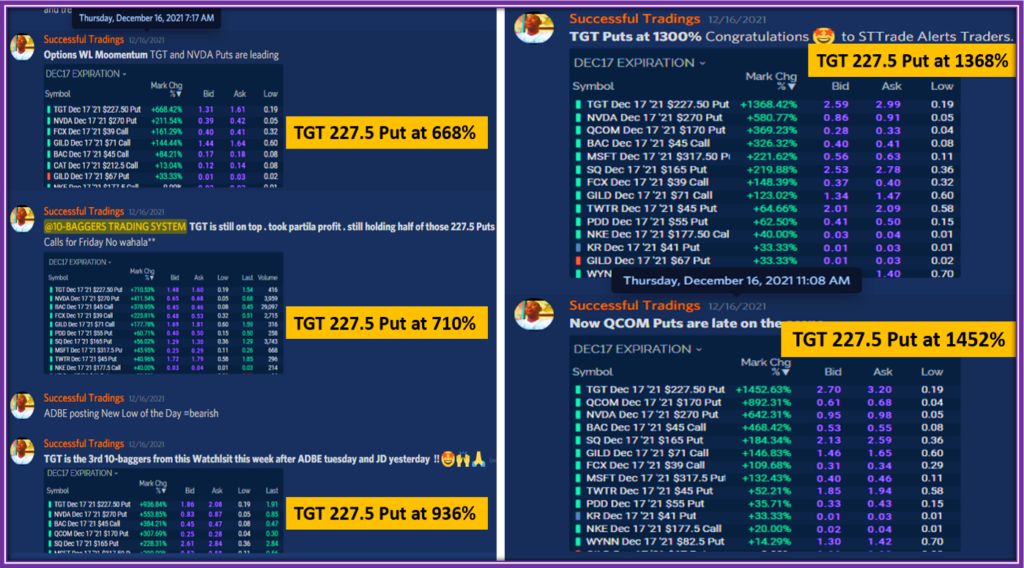

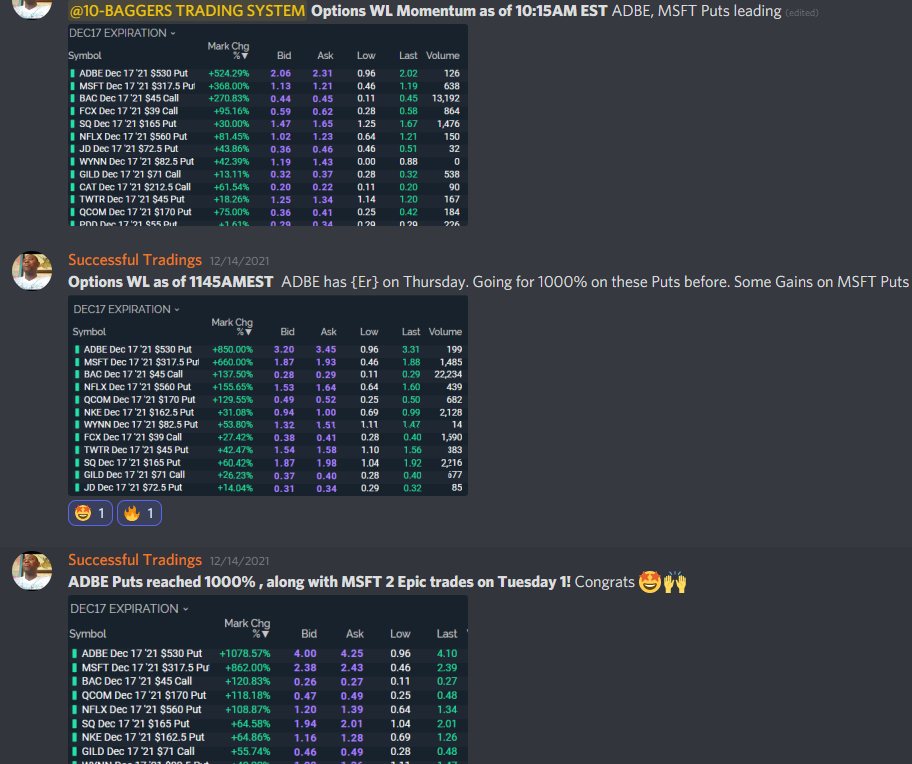

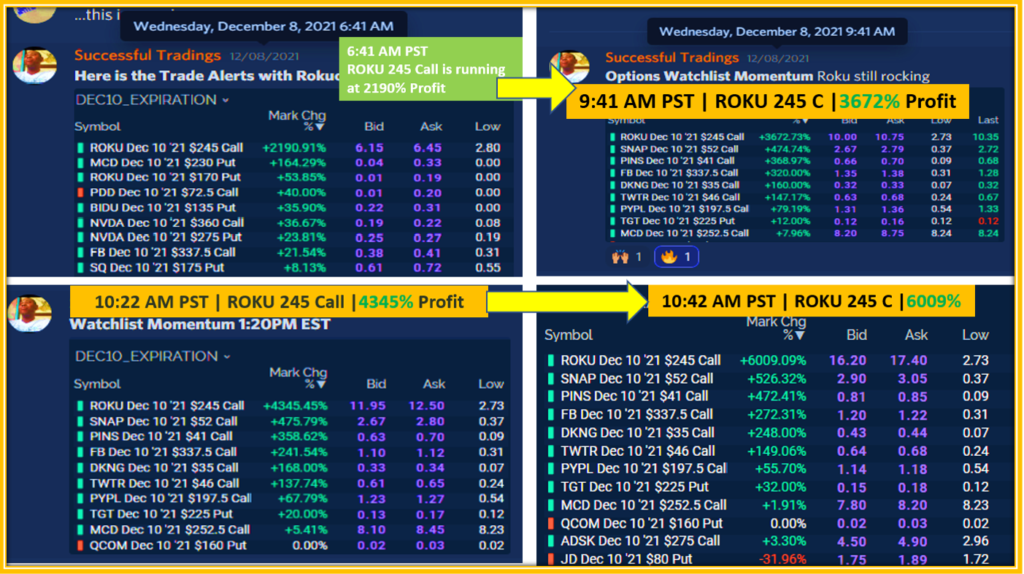

If you are a beginner or even an experienced trader who is looking to take their trading to the next Level, We invite you check out out brand New 10-Baggers Trading System Today for even more opportunity such as these depicted in this discussion.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Wow. This article shows me how much I have to learn before placing any money in the stock market. I’m going to have to do more research on the dark pool, Jason Strimpel tool, and the StockWhisperer app. You really know what you’re doing in the video you shared. I had a rough time following it. I’m sure as I get better at analyzing graphs and charts and listening to stock market news, I’ll be able to make a delicate start. Thank you for sharing your research.

Hello Neko,

We really appreciate that you found this article helpful .

Let us know if there any specific content you would like us to focus more and we will make sure to deliver that next time.

Thank you for stopping by and leaving us a comment.

Good Evening.

Thank you for your post. It is another inspirational trade. Within minutes, you could double your money. You have such powerful weapon to gain your financial freedom.

I am excited about the potential opportunity, but I have never had any experience on option trading, though I have been trading stocks for many years. My focus is on ETF. Instead of trading, I would say that I am an long-term investor, since I hold my ETF for years. Comparing to your option trading, my ETF trading is a very slow process.

I would like to read book on option trading and to gain some basic knowledge on it. Do you have book to recommend for me to read?

It is kind of you sharing your live option trading with us, which stimulates my interest to pursue the potential opportunity.

Hello Anthony,

The best book we recommend is in our first article we published on this blog.

We have a full list of the books we think will be helpful for beginners.

Have you considered giving then a try ?

Hi! I learnt a lot from this trade. I would be willing to accept volatility and would have waited longer. But I also admit that that could be the inexperience way of dealing with trades. The pros usually follow a script were the main goal is not to make the maximum on each trade but to consistently turn positive numbers at the end of the day having gone through many trades.

Hello Ann,

Traders have this saying: “You cannot go broke taking profits”.

this means that as long as you have winning trades, leaving some money on the table is something that can be corrected with experience as you mentioned.

Thank you for providing your feedback on this article.

Hi! Trading SPY for 100% profit is an engaging title and it caught my attention. And you haven’t disappointed me. It’s a very simple and smooth way to trade. I’m glad I understood the overall concept.

I’m glad you also pointed out you used Dark Pool prints level. I’ll bear that in mind, thanks.

Holla Paola,

It give me great satisfaction to read that the article was clear enough to understand.

Maybe you should check out the post about the Dark Pool and let us know what you think ?

Thank you for stopping by. See you next time.

Thanks for this insightful review showing a day trading case study. It seems like Dark Pool was the most important tool you used for determining the direction of the market and deciding if your trade was worthwhile. Looks like I need to check out your StockWhisperer App review to learn more about Dark Pool. I’m pretty new to the world of day trading, so this article was definitely informative. Thanks!

Greetings Tucker,

Thank you for the finding value in this article.

Have you had a chance to read the one about the StockWshisperer App review ?

Let us know of your thoughts on what type of use cases you will like to see more.

Thanks

Trading spy for such a large amount of profit is really eye catchy and I see how you have aptly explained how to do this. You even made it better by adding a video. The dark pool, Jason Strimpel tool, and the StockWhisperer app are something that I feel I would need to do some more research on and learn more about. ThanKs Telex for showing me how to expand my profit. This is very helpful.

Good afternoon,

Thank you for the positive feedback.

Glad to see that you enjoyed our video explanation of this trade.

It is always encouraging to hear about readers who have found great help with this content.

See you next time.

In today’s article, you got my attention with the 100% profit in 30 mins, with the day trading SPY options. Now I know why these big names like Microsoft, Apple, Intel are always in the news when it comes to stock. Likewise your information on the entrance and exit criterias, I say thank you

Greetings Parameter,

How is Kampala this evening ?

Very excited to read that you learned something new today.

Thank you for stopping by and leaving us your feedback.

Hello,

Enjoyed your short video.

What Vendor are you using to display real time options charts?

Thanks,

Joel.

Greetings Joel,

Thank you for the positive feedback on our content.

I trade with Power Etrade and here is a video on how we to get that option chart Live

https://youtu.be/C4fAq3MwdmY

Enjoy.

Greetings are you still trading this way? I’ve been trading options a long time and know that it is fairly easy to score big here and there, but consistency is another thing. Do you have any long term results that you can share? Thank you.

Greetings Mike,

Yes, SPY is at the front and center of our strategies.

We have been doing this for quite awhile now and consistency is definitely key. I do agree with you.

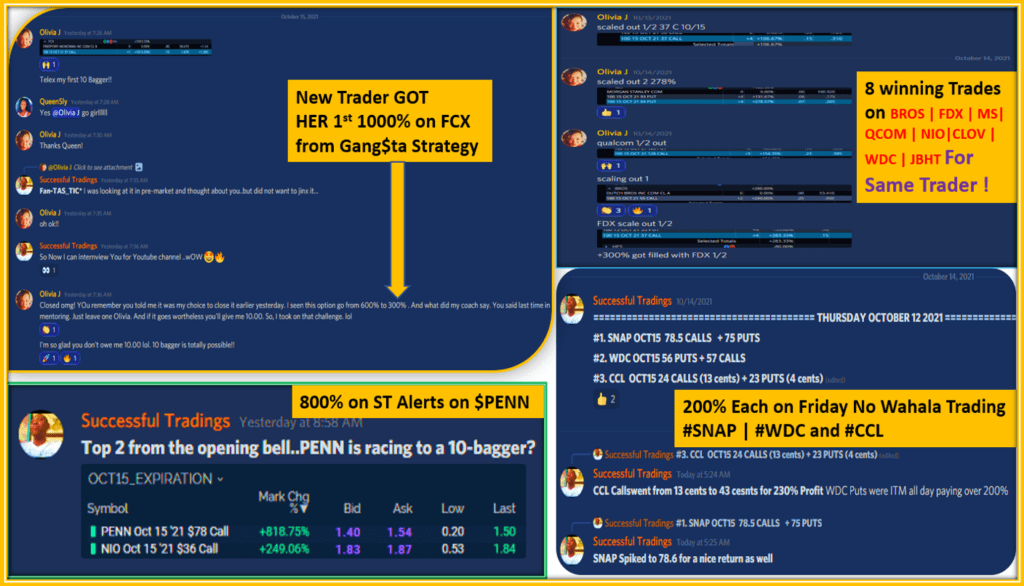

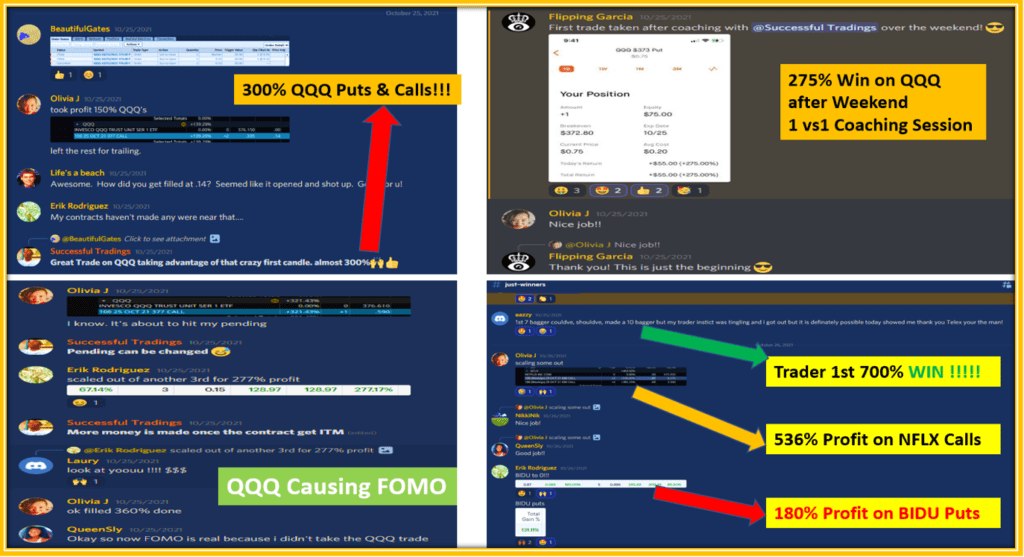

We have put together an Offer in 2021 to teach All of our consistent winning strategies in a system I call the

10 Baggers Trading System:

https://gangstatrades.samcart.com/products/10-baggers-trading-system

I will be describing All the benefits to you in our discussion this afternoon.

Looing forward to it. Talk to you soon.