The brokerage industry was taken by a storm in the US in early October 2019.

Within a span of 2 weeks, all major brokerage firms announced the cancellation of the well coveted fees.

Now begs the question for new and veteran traders, how to pick a Stock Trading Platform.

We intend in the next few minutes to provide some guidance to help traders in the search of a new broker.

Table of Contents

Stock Trading Platform: How To Choose ?

Let’s examine the financial impact on the brokerage firms from dropping their commissions on equities and options in early October this year.

For a stock trading platform to forego its commissions, the revenue impact is can be quite significant.

That number ranges between 6% to 32% for the big three: Charles Schwab, E*Trade and TD Ameritrade.

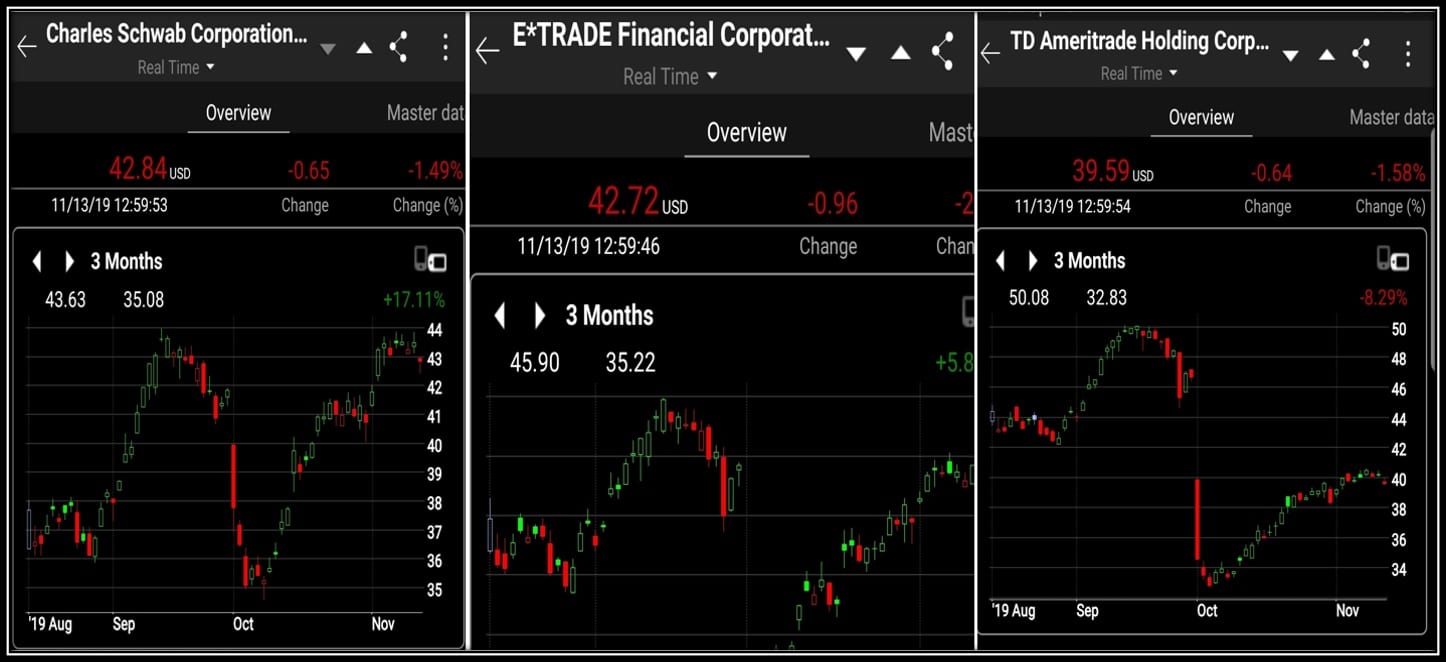

Judging by the market initiation reaction (see charts below) to these announcements, one cannot help wonder how these platforms will try to make it up.

It is quite interesting to me that a mere month after the sharp drop in their stocks prices ( each lost over 20% in a span of 3 days) , they all have almost fully recovered !

The three companies are trading at similar or higher prices than prior to these announcements.

By the way, that 3 day rule is absolutely to be integrated to the list of Best Trading Strategies.

So then, does the Smart Money in Wall Street know something that the rest of us are not aware of as we shall remain in the Dark as usual ?

Time will tell.

For the time being, let’s figure out how to navigate the field of online brokerage firms.

Stock Trading Platform: What To Expect

One thing we know is that these companies clearly have other ways to generate revenue from our trading activities.

One of the most obvious one is the interest on the Cash Balance on our account.

Yes, it is just as legal as what happens with the Cash we have in the banks not doing much for us but helping the banks increase their own cash flow sheets.

They often turn around and charge heavy monthly fees for account maintenance.

Back to our brokerage firms : if not interest rates from our Cash Balances, they can use their clients’ stocks to lend to other traders who partake in Short Selling.

It is again completely legal in US markets.

The third way for online stock trading platforms do benefit from their customers is by trading against them ! Most of them are the market makers.

Therefore, they control quite a bit of the activity of the market.

They know how many positions are open on any given stock and thus can take actions that are beneficial to them alone.

I alluded to this in this piece awhile back how this obvious conflict of interest does not seem to bring closer attention to such a practice.

Get More Out of your Stock Trading Platform

Before you sign up for any online stock trading platform from this point on, the best piece of advice I can give you is to compare them.

You will be using the list of features below to rank through this fair process.

That way, you will be certain that your choice matches your current needs.

Nothing precludes you at any time from switching when you find yourself wanting to enter different types of markets.

Here is in order of importance according to my experience, the must have items when choosing your trading platform.

- The platform must allow options trading

- The platform must have a Robust Mobile version typically an App

- It must offer free Web based Education especially if you want to know how to learn options trading options

- Inquire about to the ability to simulate Option Trading Strategies

- How early do they give access to Pre-market ?

There are other items such as s Foreign markets, Futures or Cryptocurrencies that will really depend on each trader appetite.

I did not forget the need for a good Charting Tool like the one we recently reviewed here.

Is Your Platform Holding You Back

Once you become a customer and establish a trading pattern, I suggest you call the customer service to negotiate

a reduction on your fees per contract if you are like many of us who trade stocks options very frequently.

A stock trading platform will never call you up to say: “Look, we see that you have been spending a lot of money with us and for that, we are offering you a reduction on these fees”.

These fees could (still can) accumulate to the point of eating up your Profits.

It is up to you the trader to use this as a bargaining argument in the negotiations.

Some of them typically will meet you half-way at least if you start really low.

The reason for this is because the cost of bringing in a new customer is much higher than the revenue the will be forfeiting from your higher fees.

A few years back, I was able to get a price of 35 cents per stock option contract with one the big three I mentioned above by simply using that technique.

I still enjoy that price today even though the general public was paying almost twice as much until the recent announcements in early October.

Conclusion

We shared that the brokerage industry has become more competitive than ever before.

Some are even predicting that some consolidations are bound to happen in order for them to survive long term.

Just like it happens in real Estate from time to time, the trading market is now a trader’s market.

Next, I am going to apply these guidelines and reveal to you my Top 5 Best Stock Trading platforms.

I hope you have enjoyed this article. Please do leave your thoughts in the comments section.

Also,to avoid missing out on our next post, please leave us your contact below and you will receive an alert whenever we share new information here.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

But which stock trading platform would you recommend the most for a total beginner? Obviously I have heard of Charles Schwab, E*Trade and TD Ameritrade but I have no idea which one is the most newbie friendly. I’d like to dip my toes in the water to get my feet wet before any big dives into the unknown but I feel trapped by paralysis by analysis. Can you point me in a direction? Would be very helpful. Thx

Greetings Julzdk,

Please be patient with us as we will be revealing our # 1 online stock trading platform in the very near future.

Thank you for your comment.

Telex.

Thank you for sharing such an informative post, I think I have been a victim of a wrong trading platform, I used to trade but the problem was when it comes to withdrawal process, see of the platforms operates well upto the point where you want to make a withdrawal, they make hard, next to impossible to withdraw and due to this effects I had to quit, but having gone this post I believe I got some important tips to look at before registering for any trading platform.

which stock trading platform would you suggest for me?

I believe you can be trusted for this, because you are well informed about them. Thank you for sharing this post, I am going to subscribe to your newsfeed to learn more about this stock trading platform.

Thank you.

Thank you Joy for your comment.

Educating retail on some of the practices in the stock market today is one of our main goals.

So I am glad to hear that you were able to take advantage of that through this article.

Since you subscribed to our news feed, you will have the prime honor to find my # 1 online stock trading platform in our next post. Hint: It is one of the Big Three mentioned in this post 🙂

Until then, Take care.

Telex.

Hi there, thanks for putting out this article for the public I think it would be of great help,

i just have 1 or 2 question on the topic I general……1.What kind of account can I open and what is the commodity to trade on

2.Do I an intensive knowledge to trade?……..3.Does the Brokerage Provide Investment Research or Other Perks?

Hello Ben,

We provided guidance here for newcomers on how to setup a new account.

Also, this discussion clearly suggests the most affordable instrument to trade for beginners.

We have recently started a Series of articles published at the end of each trading week showcasing option trading strategies.

Lastly, it is crucial to choose a broker that provide investment Research.

Hope this helps.

Stock trading is a really “Tiny Ice” field. if you don’t know what you do, your money will very quickly get some fast “wings” and fly off your hands.

The competition is huge in the brokerage industry.

Having a good trading platform on your side and the most important advice from an experienced broker is, in my opinion, a must.

It is also obvious that many skilled traders make a fortune with stocks. Are you going to be the one as well?

Who knows?

Thanks for sharing the info.

Igor

Hi there Igor,

We aimed to provided the information to our readers who are in search of a trading platform.

Obviously, it is up to each individual to determine the risk for themselves as to what activity

they want to invest in.

Thank you for your time.

These are solid points to help someone pick a stock trading platform in 2019. I would guess that when there is a big industry shake-up, that people should reconsider what options make most sense in the new environment. I think that the strong competition in the market is going to help people get some great options with only a little bit of research.

Thanks for sharing! When do you think the industry is going to have a big change again?

Hello Aly,

This is certainly a great time to look for a a good broker.

In my experience, when such big measures are taken within an industry, one could expect Merger and acquisitions fairly quick. We shall see.

Thank you for stopping by.

Education….Education….Education…. Exactly what we all need. The bible says in Oseas 4:8 that he town died due to lack of knowledge. We need this information for new and better opportunities. Thank you oh so much for eaching us young ones!!! Now, lets place it into action! I’ll do more reading…

Greetings,

Thank you for visiting the post and leaving us

Your comment.

Looking forward to your next visit.

This makes the third article I am reading from your desk, I must say it’s been loaded with a lot of information; you have not kept anything back.

I have always wondered how brokerage firms make income, although I know for them to be in the business they must have ways of making a profit; in fact very huge profit.

Now I know clearly that they lend to other traders and even trade against themselves.

So grateful, kindly keep up the good work

Greetings,

Thank you for the positive and encouraging feedback.

We really appreciate it when a reader like yourself is able to learn and get answers from our articles.

Have a good evening.

Yes, that is true! One of my friends used to trade with the E-Trade platform for trading. If I’m not mistaken, he once told me at that time (5 years ago), that the initial deposit also determined the fee charged for each position taken (calls or puts).

So, I think it is also necessary to consider the initial deposit that will be made because the fee greatly affects the results of the profit (or increase the loss).

Maybe, Mr. Telex can share fee-related posts on this website?

I am happy with this website

Hello there Ronny,

Ronny, the commissions are really what was high for traders.

Since early October 2019, all the big brokers have eliminated the commissions.

The fees are very small per trade and do not eat up on gains that much.

Also, there is no minimum deposit required nowadays to start trading.

Things have really changed for the best from many years ago 🙂

Thank you for the positive feedback. Good Night.

Thank you for your checklist on how to choose great stock trading platforms.

I am new to this so I want to know if most stock trading platforms let you try them out for free first. I would not like to make a decision before trying out various platforms to see how versatile they are.

Also as far as free education goes, could you recommend a few that I could start with that would give me the best education as to the best methods to use when trading online?

Hello Michel,

How are you ?

All our posts are free education on online trading for you to use at your own pace.

May I suggest you check out the other articles we have shared for beginners ?

Regarding your question on trading platforms, yes, most of them offer a free paper/demo account

where you can practice before trading with real money.

Hope this helps. See you next time.

Hello Telex, you are very right. There are so many platforms out there and there is some serious tussle for which is the best. I like what you said that the trading industry is now a traders ground. One of the few mistakes I made when I started off is going through a wrong platform. I was hoping to see you recommend one very good platform for those who are looking to join so which would you recommend?

Hello my friend,

I knew you will be curious about my recommendation of the best platform.

No worries, I have listed my Top 5 best Trading platforms on this article.

Enjoy and let me know what you think.

Until then, see you next time.

Telex,

Trading is a business world and language all its own. I can appreciate as you have said the importance of learning and mastering the ways the “sharks” move the market.

And so, with the $0 commissions on trades since early October of this year, one has to wonder:

Where are the stock brokers going to make extra money off the traders?

Were there some new rules introduced that benefit the trading platforms?

Appreciate you,

JR

Hello JR,

Let’s not cry for the brokers !

Many of them still make money by controlling the Bid and Ask price on the trades.

Also, do not forget that most of the time, the people taking the opposite side of the traders are these very brokers.

So there you have it on how they will continue to benefit from traders despite the elimination of all commissions in early October 2019.

Thank you and have a great evening.