In this modern age, trading stocks is much easier than ever because of many different trading apps. To help you find the best one, we are going to review the top 7 best apps to trade stocks.

Go through all of the features including the fee and commission to select the best one according to your needs.

Table of Contents

WeBull

Webull provides a one-of-a-kind community experience and simple-to-use trading tools that will appeal to the majority of youthful investors. It, however, lacks the trading instruments and functionality to compete with leaders of the market, which also provide $0 in stocks and ETF trades.

Who’s Webull for?

Webull is a self-directed investment and trading platform that appeals to intermediate and expert investors and traders.

Short-term and active traders who want to save money on fees may take advantage of its commission-free structure, which is much less expensive than charges charged by other online brokers.

Despite the fact that the Webull platform’s intuitive features and style may look sophisticated for beginner traders, the platform is nevertheless easily understood. It also provides fractional shares to its clients, allowing even the smallest accounts to participate in the most expensive equities.

Features

Desktop Platform Overview

The desktop platform Webull is the same as the online version. The flexible layout is easy to use due to its widget boxes drag and drop. You can modify it easily.

It contains preset lists like Hot ETFs and important screener and screener capabilities. The fact that novice traders looking to get into the market could simulate a trading strategy using Webull’s online, desktop, and mobile applications.

Web platform charting

Webull provides a standard line of charts comprising many different kinds of graphs, suitable drawing instruments, 50 technical indicators, capacity to add hotkeys, and grid designs, for comparing numerous charts.

On the online platform, we found the charting to be clear and simple to use, and the desktop version was virtually similar.

Market replay

Users may watch time-lapse video replays of stock charts, which is a feature that is exclusive to Webull.

A replay of the previous day’s price movement, although more instructive, provides traders with a unique viewpoint that cannot be obtained from any other broker.

Webull’s Commissions and Fees

Webull, like its major rivals, does not charge a commission on stock transactions in the United States, nor does it charge a fee to establish or maintain an account.

Nonetheless, fees levied by the SEC and the FINRA are applicable.

SEC fees.

There is a $13 fee for a net of $1,000,000 in principal on stock transactions alone, with the $0.01 minimum charge per share.

FINRA fees

On only stock sales, the trading activity fee (TAF) of $0.000119 for each share will be chargable, with a minimum charge of $0.01 and a maximum charge of $5.95.

E*trade

E*TRADE was founded in 1982 and was one of the earliest online brokerages in the United States. Some of the company’s features include $0 transactions, two outstanding mobile applications, and the Power E*TRADE platform, which is ideal for newbies, active traders, along options trading.

Who E*TRADE Is For?

For more than a decade, E*TRADE has focused on engaged, active investors as well as high-net-worth individuals with a minimum investment of $100,000. Despite being a top 5 broker in several areas last year, especially in options and trading, E*TRADE’s standing among more active investors has been strengthened as a result of the fee reduction.

The Power E*TRADE platforms are available on both desktop and mobile devices, providing the customers with powerful options analysis as well as strategy-building capabilities.

E*TRADE has maintained a high ranking among the top online brokerages for beginners, owing to its extensive resources and user-friendly interface. E*TRADE, like other major online brokerage firms, offers plenty to offer investors of all experience levels.

Features

Options trading

Power E*TRADE is a great choice for casual and active options traders since it provides the ideal combination of convenience, superior tools (screening through StrategySEEK, scanning through LiveAction), and smooth position management.

E*TRADE has done a great job of bringing new investors into the game by designing Power E*TRADE, which allows you to master options trading without breaking the bank.

Charting

Power E*TRADE’s charting engine is provided by Chart IQ, a third-party supplier of HTML 5 charts highly rated by users.

Panning and zooming are very fluid, and there include an inbuilt Trading Central (Recognia) technical analysis tool as well as 114 extra technical indicators and 32 sketching tools to choose from.

Futures Trading

As with options trading, Power E*TRADE offers a fantastic experience when it comes to trading futures contracts.

Multiple futures ladders may be run at the same time, orders can be sent out quickly and easily due to the Quick Trade widget, and maintaining positions is as simple as it is with options.

E*TRADE Fees

In order to participate in the $0-commission revolution, E*TRADE now charges no commission to trade stocks, ETFs, and the majority of mutual funds.

Options contracts are priced at $0.65 per contract, which is the industry norm, but the price lowers to $0.50 per contract if you make more than 30 transactions each quarter.

Futures contracts are priced at $1.50 per side, which is less expensive than TD Ameritrade, E*TRADE’s largest rival. Although E*TRADE offers lower margin rates than TD Ameritrade, they are still quite costly compared to Vanguard’s rates.

EOption

eOption is quite clear about who it wants as a client and how it plans to fulfill their needs: options traders who know what they’re doing want to switch to their platform and save money on options transactions.

Long-term investors and novices will be turned off by this deep discount strategy, while active options traders will benefit from cheap fees and quick executions.

Who eOption Is For?

eOption is aimed at options and stock traders that participate in the markets on a regular basis and who are confident in implementing their options strategies, according to the company.

The firm’s options costs are competitively priced, which appeals to traders who trade in large volumes. Just to put it another way, eOption doesn’t have many bells and whistles, although it will let you trade a large number of options for a cheap cost.

Features

Paper trading

For investors who are new to trading (and particularly options trading), eOption offers an appealing feature: a free paper trading tool that is accessible to everyone, including those who are not customers of the company.

This provides investors with $100,000 in virtual cash to utilize while they study and assess trading ideas, test methods, actively monitor the performance of a simulated portfolio, and establish a watch list – all without putting any real money at risk.

Low options contract fee

Many brokers no longer charge a basic commission on options transactions, requiring traders to pay just a per-contract fee, which is typically about $0.65 per contract on most exchanges.

When you trade options with eOption, the cost is $1.99 plus a 10 cent per-contract charge. In other words, investors who regularly trade four or more contracts in a single transaction will come out on top when they do business with eOption.

Margin rates

Take notice, margin traders: eOption offers some of the most competitive margin rates accessible. At the end of 2020, account balances were based at 7.75% at a base of less than $25,000. If you have a balance of $250,000 or more, you may get as little as 4.75 percent interest.

eOption Commission Fees

- Prices for options are $3.00 plus $0.10 per option.

- Listed stocks: $3.00 per share for market.

- Stocks (foreign): $39 per share

- Extended-hours stocks: $25.00 (plus $0.003 per share for each additional 5,000 shares).

- Mutual funds are priced at $14.95 per share.

- Bonds: $5.00 each bond for the first 25 bonds, $3.00 per bond for each subsequent bond

- Orders placed with the assistance of a broker will be charged an extra $6.00.

Robinhood

Despite the fact that all online brokers now provide $0 stock and ETF transactions, Robinhood’s lack of trading tools as well as research puts it at a disadvantage in comparison to the rest of the market.

Who Robinhood Is For?

Robinhood is best suited for first-time investors who want to trade in tiny amounts, such as fractional shares and cryptocurrencies, and who don’t want to spend much time doing research beyond looking at what other people are doing with their money.

The general simplicity of Robinhood’s app and the website makes it incredibly simple to use, and the fact that it charges zero fees appeals to investors who are very cost-conscious and trade in tiny amounts.

Having said that, the offers are very rare in terms of research and analysis, and there are significant concerns regarding the quality of the trade executions themselves.

Features

Trading tools

Trading tools and features are limited compared to category leaders on Robinhood’s website. For instance, charts are essential, with just four accessible technical indications.

In the meanwhile, TD Ameritrade provides more than 400, and TradeStation offers over 300. TD Ameritrade and Charles Schwab provide their own live broadcast with in-house specialists throughout the day.

Fractional shares

The greatest power of Robinhood found in its simplicity. For instance, its recurring investing feature allows you to invest a set dollar amount on a regular basis, such as once a week.

Similarly, Robinhood will automatically reinvest any earned dividends on stocks or ETFs when you activate Dividend Reinvestment (DRIP) in your account, provided that its associated symbols promote a fractional share trade.

Commissions and Fees

How Robinhood makes money

It’s a free service for Facebook (FB). In order to avoid charging a membership charge, money is generated through gathering your user information and selling advertisements. In the case of Robinhood, it is also a free service.

However, Robinhood will sell your order flow (the right to complete your transaction) to wholesale market makers instead of selling advertising. Robinhood is thus not really free. In the world of $0 trading today, almost all brokers except Fidelity have the same practice of taking money for order flows (PFOF).

Robinhood Gold

Robinhood Gold was a bad bargain in our tests. It costs $5 per month to receive Morningstar reports, streaming quotations for Level II, and margin trading (which charges 5 percent annual interest).

Competent TD Ameritrade, E*TRADE, and Charles Schwab charge greater margin rates but provide much superior inventory research, commercial tools, client support, etc., for the same $0 per inventory market pricing.

Futu Moomoo

Moomoo is another excellent Robinhood option. This is an excellent trading platform if you’re looking for clever trading in depth. It provides both novice and experienced traders outstanding trade tools and possibilities, including sophisticated charting, pre-and post-market trading, worldwide business, research and analysis tools, and most popular free Level 2 quotations.

Who is MooMoo for?

Moomoo has been developed as a smart trading platform, and investors may also benefit from cheap costs.

This mobile trading platform has effectively structured its sophisticated features in 1 app. For novices and seasoned traders, it is free and simple to use. A range of research tools may help you make intelligent investments.

There is also a paper trading function with real-time data if the investing experience is to be simulated before all things are done.

When it’s convenient for you, Moomoo enables you to invest. You can start trading whether you travel or go home by synchronizing personalized settings on various devices. Moreover, no minimum deposit is available to establish an account.

Features

Advanced charting

Moomoo offers personalized amazing graphical capabilities, including basic graphics like bars, hollow candles, full candles, lines, mountains, and sophisticated multigraphs with more than 50 technical indicators, including the VWAP that can even please day traders. All-time periods are available from 1 min, 5 min, to 1 year.

Smart orders

It offers access to advanced stock orders for pre and post-market trade, including stop-limit orderings and trailing stop-loss orders and up to 40 transactions simultaneously.

Longer trading hours

Moomoo does have the longest time to trade with rivals. You may hop back and forth once the news releases from 4 AM until 8 PM EST.

Commission Fees

Moomoo commission rates for your US, Singapore, and Hong Kong businesses are among the most competitive prices available. Moomoo charges, for example, just 0.03 percent of the transaction value for SGX equities and US$0.0049 for US stocks.

At a minimal commission charge of €0.99 for US inventory, HK$3 for HK inventory, and €0.99 for SG inventory, even lower than those of Tiger Brokers and Interactive Brokers (IBKR).

A minimum price of US$1.99 for US stocks is charged for Tiger Brokers, whereas the IBKR charges at least US$1 for U.S. stocks and US$2.50 for Singapore stocks.

SoFi Automated Investing

In terms of stock market brokerages, SoFi Invest is one of the top options for first-time investors.

Even though SoFi’s app is less feature-rich than some of its larger competitors, this also makes it easier to browse and comprehend if you don’t have a lot of prior expertise in the financial markets.

Who is SoFi Automated Investing for?

SoFi Invest is the ideal option for first-time investors. Who are seeking a straightforward method to get start in the world of investing.

SoFi does not need a minimum deposit to establish an account. So, even if you don’t have a lot of money to invest, you may get start with SoFi.

If you already have other SoFi accounts, SoFi Invest is a fantastic alternative to consider. This is due to the fact that SoFi makes it quite simple to transfer money between SoFi Money and SoFi Invest accounts.

Features

Broad range of low-cost investments

SoFi clients can choose from ten different portfolios based on their risk tolerance and investment objectives.

Each portfolio comes with a diversified selection of low-cost exchange-traded funds (ETFs). That provide exposure to U.S. stocks, developed international stocks, emerging markets, high-yield bonds, and Treasury bonds.

Budgeting and financial planning

SoFi is a standout in this category. All clients get unrestricted access to the financial advisors employed by the firm at no additional cost.

A fiduciary standard, which requires them to act in their best interests, applies to these advisers. Who are Certified Financial Planners (CFPs) with the Series 65 certification (or comparable qualification).

They are also noncommissioned advisers, which means that they do not get any compensation for recommending certain trades or activities.

Savings with a high rate of return

SoFi provides a high-interest savings account, similar to those offered by competitors Wealthfront and Betterment.

SoFi Money is a checking and savings account that pays 0.25 percent interest yearly and is insured up to $1.5 million by the Federal Deposit Insurance Corporation (FDIC), which is six times more insurance than the average bank account.

It also has no account fees and provides an unlimited refund for ATM costs each month, which is a rare find these days.

Fee and Commission

SoFi Invest makes much of the fact that it charges no yearly management fee. On the surface, this appears to be a highly attractive alternative to its competitors.

In comparison, Vanguard Digital Advisor, a fully automated Robo, charges about 0.15 percent of assets under management. While the cheapest level of service on Ellevest is $12 per year, according to their website.

In addition, those rivals either do not provide access to financial advisors or charge a premium for that service if they do.

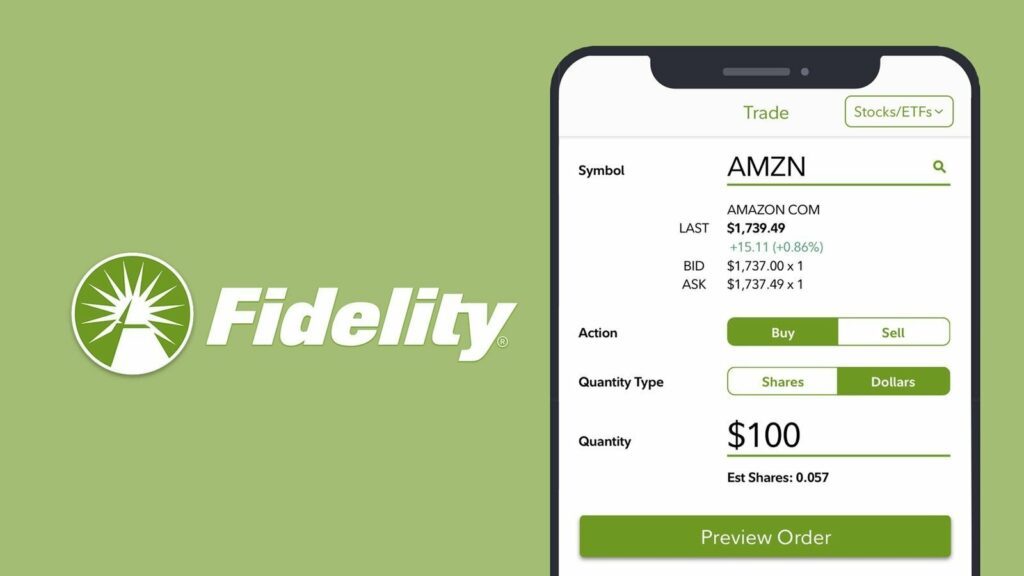

Fidelity

Fidelity Investments continues to grow and develop as a key player in the online brokerage industry.

For the second year in a row, Fidelity’s brokerage service earned the top overall ranking in Best Online Brokers Awards. As the company has continued to improve important components of its platform. While simultaneously committed to decreasing the total cost of investing for clients.

Who is Fidelity for?

Fidelity, being one of the largest brokerage firms in the United States, geared to cater to the needs of the great majority of individual investors.

When it comes to the ordinary buy-and-hold investor, Fidelity’s fully-rounded platform provides a large variety of tools. Moreover, research resources, and other resources, as well as a simple order entry process.

Fidelity provides Active Trader Pro, a downloadable application that includes streaming real-time data. Moreover, a customized trading interface for more active investors and full-time traders.

Despite the fact that Fidelity has comprehensively covered these two main areas. It is crucial to highlight that the company does not presently provide commodities or futures options.

Features

Mutual Fund Evaluator

The Mutual Fund Evaluator investigates each fund’s features in great detail. Although it has a tendency to direct users to Fidelity funds, this is not surprising given the platform’s design.

Options Screeners

The scanners powered by LiveVol include some built-in scans. As well as the possibility to make a custom scan if that is what you like.

If you use Active Trader Pro, you’ll have 26 predefined filters to discover options trading opportunities based on volume. Moreover, open interest, option contract volume (including volatility differentials), earnings (including dividends), and other factors.

A total of about 200 different criteria used to construct bespoke displays for you.

Fixed Income Screeners

Using the bond screener, fixed-income investors may weed out the approximately 120,000 secondary market securities. Those are now accessible based on a number of criteria, and they can then construct a bond ladder.

The yield table updates every 15 minutes and is based on real-time information. Although this scanner is versatile, the interface is not at all user-friendly.

Tools and Calculators

Fidelity provides a variety of tools and calculators to help you with anything from budgeting to evaluating your investing plan.

The Tools and Calculators page displays them all at once. They allow you to choose from a lengthy list of around 40 options.

One of the most important tools is a hypothetical trade tool. It illustrates the impact on your portfolio of a hypothetical buy or sells in the future.

Fee and Commission

In addition to zero trading charges and a variety of more than 3,400 no-transaction-fee mutual funds.

Fidelity also provides superior research tools and a cutting-edge trading platform. The fact that it offers zero-fee index funds and has a stellar reputation for customer service is just frosting on the cake.

Top 7 Best Apps To Trade Stocks – Quick Summary

Knowing the best apps for trading stocks is not enough. We have reviewed each and every best trading app in detail above. However, to quickly summarize the main points of every trading app we have devised a table.

Please keep in mind that it is possible not every app allows you to trade in crypto. Moreover, the same goes for the stocks and options. So, here is a quick summary of our review and you can easily make your decision based on it.

| Name | Can Tade stocks | Can Trade Options | Can Trade Crypto | Cost per Option Contract |

| WeBull | Yes | Yes | Yes | $0 |

| E*Trade | Yes | Yes | No | $0.65 |

| eOption | Yes | Yes | No | $1.99 + $0.10 per contract |

| Robinhood | Yes | Yes | Yes | $0.002 |

| Futu Moomoo | Yes | Yes | No | $0.65 |

| SoFi Invest | Yes | No | Yes | No Options Traded |

| Fidelity | Yes | Yes | Only Bitcoin | $0.65 |

The Bottom Line

Beginner investors should seek online trading Apps that are simple to use, have extensive instructional resources, and have top-notch customer service. Moreover, charge minimal fees, and require small minimum account balances, among other characteristics.

In our Best Trading Apps for stocks review, we select E*Trade as the winner because of its user-friendly interface. Moreover, emphasis on online education, and comprehensive trading simulation capabilities.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/