Trading stocks on margin entails borrowing money from a broker in order to make a transaction. But is it worth trading on Margin? Let’s find out.

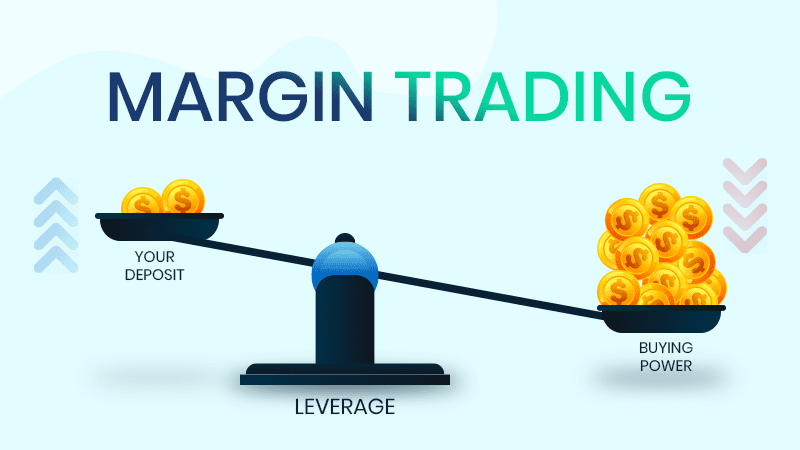

A margin account improves purchasing power while also allowing investors to utilize someone else’s money to raise financial leverage by borrowing money from other investors.

Margin trading has a higher profit potential than regular trading, but it also carries a higher level of risk.

Table of Contents

Is It Worth Trading On Margin | What is Margin Trading?

Buying stock on margin implies borrowing money from a broker in order to make a transaction. As a result, you might consider it a loan from your brokerage.

Margin trading permits you to purchase more stocks than you would ordinarily be able to do. A margin account is required in order to trade on margin.

This differs from a traditional cash account, in which you trade with the money that is now in the account. To create a margin account, your broker will acquire your signature.

The margin account may be included in your normal account opening agreement, or it may be a completely different arrangement from your standard account opening deal.

A minimum initial investment of $2,000 is necessary to open a margin account, however certain brokerages may ask for a higher amount. The minimum margin is the amount of money that you put down as a deposit.

How Does Margin Trading works?

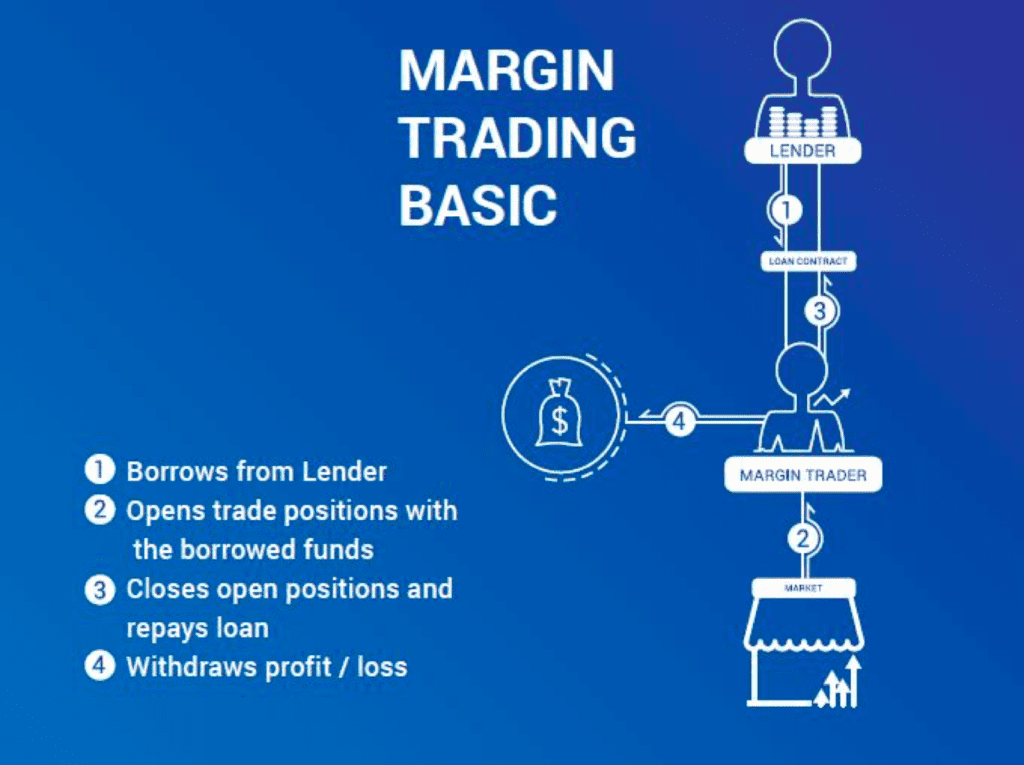

Observing how margin trading could play out in the real world is the most effective approach to learn about its complexities.

Consider the following scenario: Jerry has $5,000 in cash on hand, and he wants to purchase a stock that is worth $100 a share. He proceeds to purchase 50 shares of the stock.

One year later, the stock price has increased to $120 a share, and Jerry chooses to sell all of his remaining shares for a total of $6,000.

Jerry generated a $1,000 profit on his initial investment, resulting in a $1,000 profit. Generally speaking, this is how the stock market operates.

But first, let’s go back to the beginning of the narrative. Following margin regulations, Jerry could put down $5,000 and then borrow an additional $5,000 to purchase 100 shares of the stock he was interested in buying.

Jerry would gain $12,000 if he performed that leverage trade and then sold all of his shares a year later at the same $120-per-share price, resulting from that margin trade.

Jerry would wind up with a little less than $2,000 in profit after he pays back the $5,000 he borrowed (plus interest) on his loan.

That sounds fantastic, doesn’t it? Not so fast, my friend! Keep in mind that while your winnings are larger, your losses are also larger—this is the downside of margin trading.

A decline in Stock Price

What if the stock price dropped to $80 per share after a year and Jerry decided to sell and take his losses?

Even if Jerry was able to sell all 100 of his shares for $8,000, he would still be required to repay the $5,000 he borrowed (again, plus interest).

After subtracting this amount from his initial investment, Jerry is left with less than $3,000, which indicates he has taken a $2,000 loss. Yikes. If he had just continued to invest his $5,000 in 50 shares, he would have only suffered a loss of $1,000.

Buying on Margin

Purchasing stocks on margin is similar to borrowing money from your broker in order to purchase shares.

The use of margin increases your prospective returns, both for good and for worse, and it is critical for investors to grasp the implications and potential ramifications of doing so.

First and foremost, borrowing money on margin entails paying interest to your broker on the money you’ve borrowed.

For example, at Fidelity, the interest rate on margin balances up to $24,999 is 8.325 percent. With the maximum rate being $24,999. Consider the difference between that rate and the possible yearly return of 9 % to 10 % on stocks.

You’ll quickly see that you’re taking on the risk, but the broker is reaping the profits to a significant extent.

In order to take advantage of margin, you must be concerned about your net profit margin. Which is the amount of money left over after paying interest. And which will be less than the amount of money gained through investing.

Investors should also be aware that brokerage firms have initial margin requirements, also known as minimum margin requirements. It requires the investor to deposit a certain amount of money into their account before they may borrow money.

To utilize margin at Fidelity, you must first deposit $2,000 into your account. The margin requirement for purchasing an individual stock is 50 percent. Which means that if you wish to purchase stock worth $10,000, you must put up an additional $5,000 in equity.

In addition, there are maintenance margin requirements of at least 25 % equity. Which would apply when account values decrease. And that rate may be modified based on how the account performs and overall market volatility, among other factors.

Margin Call

When you have a margin loan that is still owing, your broker may issue what is known as margin call. Which is particularly useful if the market swings in your favor.

When you receive a margin call, your broker may require you to either provide additional funds or sell positions that you presently hold in order to meet the call. If you are unable to cover the call. Your broker will sell your positions in order to make up the difference.

However, if your broker begins to sell off your positions, that broker isn’t concerned with your tax status, your assessment of the company’s long-term prospects, or anything else other than meeting the call.

If the market turns against you in a significant way. For example, if the business whose stock you purchased on leverage went bankrupt and the shares became worthless. You’ll still responsible for the money you borrowed.

What are the Benefits of Margin Trading?

The following are some of the benefits of Margin Trading:

The opportunity to leverage assets

In order to enhance the amount of your investment, you may buy stocks on margin and use the value of the assets you currently own to leverage the size of your purchase.

If the value of your investment grows, you will be able to potentially increase your returns as a result of this strategy.

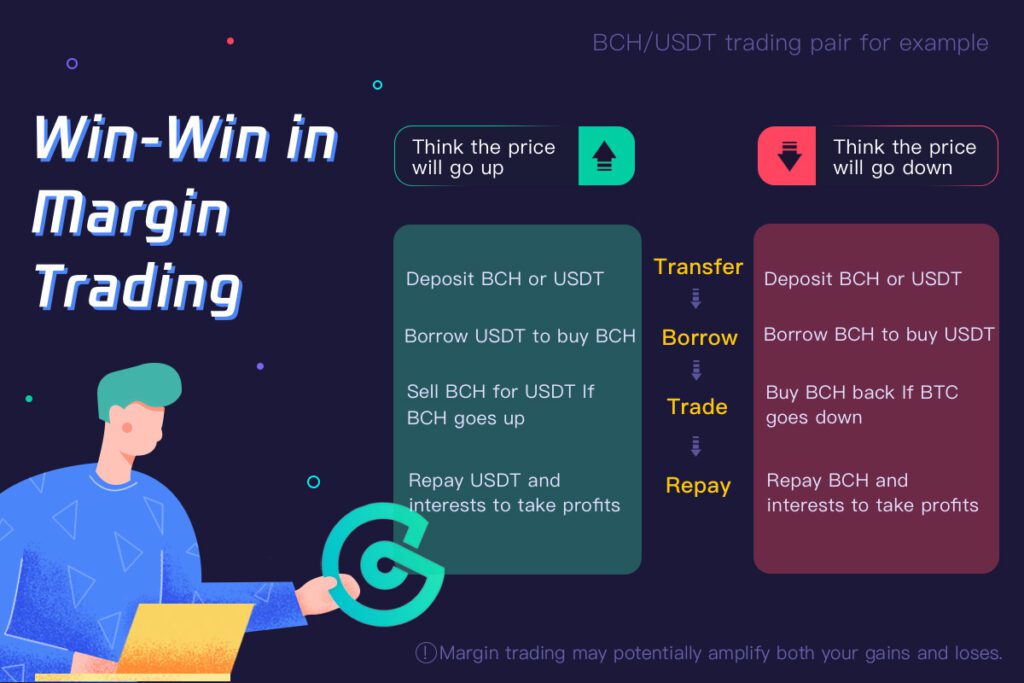

The ability to profit from share price declines

Short selling is a complex investment technique in which an investor attempts to profit from a decreasing stock price by selling shares at a loss.

You must first borrow shares of stock from a brokerage business in order to sell a stock short. This requires that you have a margin account approved by the brokerage firm.

After borrowing shares, you sell them and then repurchase them at a later period at a cheaper price. Assuming that the price has dropped.

Your profit would be equal to the difference between the proceeds of the initial sale and the amount necessary to purchase back the shares.

The capacity to diversify a portfolio

If your portfolio contains a significant block of stock from a single company. Such as a current or previous employer, you may be placing too many eggs in one basket and risk losing your investment.

The use of your shares as collateral for a margin loan. On the other hand, maybe possible through the use of a margin account.

Once you get the loan funds, you can invest them in other investments. Rather than selling the stocks that you originally purchased with them.

A significant unrealized capital gain and the desire to maintain it that way might make this method particularly advantageous.

A flexible line of credit

A margin loan can be taken out at any time once your account has been approved for margin borrowing. You will not be required to submit any extra paperwork or applications.

It may be advantageous to have immediate access to cash in a variety of situations, such as when you are jobless, when you have an unexpected medical cost, or when you require a rapid means to access cash for any other reason.

If your brokerage account includes a checking account, you may simply write a check to cover the transaction.

Interest rates are at historic lows

With a margin loan, you will be subject to interest charges in the same way that you would with any other loan.

As a result, because margin loan rates tie to the federal funds target rate. Your interest rate may be lower than what you would pay for a credit card cash advance or a loan. Particularly if you have a big amount.

It is possible that margin rates are competitive with rates on home equity loans. But without the hassle of paperwork and application costs.

Flexibility in terms of repayment

As long as your debt does not exceed your margin maintenance requirement. You are free to choose your own repayment plan for your loan.

Interest that is tax-deductible

The interest that accrues in the account may use to reduce taxable income in the future. For further information about your specific tax position, consult with your tax expert.

Participation in advance option strategies

Being approved for both a margin account and options trading gives you the ability to make sophisticated options orders on stocks, ETFs, and indexes, such as spreads, butterflies, and uncovered options on these instruments.

What are the Risks Associated with Margin Trading?

The concept of putting lipstick on a pig isn’t something we’re going to do here; margin trading is a pretty bad idea. This is a terrible concept. Debt is already a bad investment in and of itself—but attempting to invest with debt? That takes dumb to an entirely new level.

One of the most widespread misconceptions is that billionaires gained their fortunes by taking large financial risks with their money.

When Trading On Margin Goes Wrong

Wrong! While it is true that virtually all investments include some level of risk, millionaires keep their risk-to-reward ratios in line by sticking with tried-and-true assets that have a proven track record over a lengthy period of time.

A large portion of the millionaires in the world owe their fortunes to their plain old 401(k) and IRA accounts! The affluent individuals we know do not rely on debt—or, pardon us, “leverage”—to achieve their financial success.

Here’s the deal: every time you put yourself into debt in order to invest. You are putting yourself at risk of financial ruin, and it is just not worth it.

When it comes to margin trading, a few bad decisions might result in the loss of your whole portfolio.

Interests on Margin Accounts

Not only do you run the danger of losing your whole investment if your stocks take a plunge. But you must have to repay the margin loan you took out, plus interest if your stocks continue to decline.

Because of the interest payments and charges you must pay in order to execute your transactions. You might potentially lose more money than you initially invested in some circumstances.

Millionaires understand that accumulating wealth takes time and that there are no shortcuts to success. They don’t take needless chances with their money, and you shouldn’t either.

Failure of Margin Trading

According to media sources, a 20-year-old student in the United States committed himself recently after discovering a $750,000 negative balance in his trading account, according to the report.

The student was trading options through the use of an app that was popular among ordinary investors in the United States.

Interest Rates on Margin Accounts

You’ll be required to pay interest on the amount of the margin loan, just as you would on any other loan you’ve obtained.

Margin interest rates are generally lower than those charged by credit cards and unsecured personal loans; nonetheless, you should conduct your own comparison.

Based on a tiered schedule that is defined by the amount of margin loan taken out, the interest rate is adjustable. If you have a large amount, you will be charged a reduced interest rate.

| Debit balance | Margin interest rate |

|---|---|

| $1 million + | 4.000% (3.075% below base rate) |

| $500,000–$999,999 | 4.250% (2.825% below base rate) |

| $250,000–$499,999 | 6.575% (0.500% below base rate) |

| $100,000–$249,999 | 6.825% (0.250% below base rate) |

| $50,000–$99,999 | 6.875% (0.200% below base rate) |

| $25,000–$49,999 | 7.825% (0.750% above base rate) |

| $0–$24,999 | 8.325% (1.250% above base rate) |

Ways to Avoid Margin Trading Risks

- Consider establishing a cash buffer in your account to assist decrease the risk of receiving a margin call in the future.

- Take steps to prepare for volatility; structure your portfolio such that it can sustain large swings in the total value of your collateral without dropping below your required minimum equity.

- Invest in assets with high return potential; the securities you purchase on margin should, at a bare minimum, have the ability to earn more than the cost of the loan’s interest payment.

- Decide on a personal trigger point, and have additional financial resources on hand in case your balance reaches the minimum required to maintain your margin account balance.

- Pay down interest charges on a regular basis; interest costs post to your account on a monthly basis. So it makes sense to pay them down before they balloon to unmanageable proportions.

Alternative to Margin Accounts

A cash account is the only alternative to a margin account. A cash account is a kind of brokerage account in which the investor is required to pay the entire amount of money for the securities that are bought.

Quite simply, your money represents your purchasing power in a cash account. In order to trade, you cannot borrow money.

Keeping track of your settled funds and unsettled monies is essential while operating a cash account. Money has been collected.

Most of the cash collected from liquidation holdings over the past two days is included in the unsettled funds’ category. It becomes settled money once it has been settled.

It is not necessary to count day trades while using a cash account. With your settled money, there is no restriction on how many day transactions you may make.

Please bear in mind that trades are done in a cash account takes 2 business days for the funds to fully settle before they may be utilized to purchase and sell in the same account again. Two business days are added to the date of the trade.

When funds are used to acquire securities that have not yet settled in the account, it is considered a good-faith breach. Because of this, it is quite easy to obtain good-faith violations if you engage in day trading with a cash account and do not have sufficient settled money (GFVs).

Margin Trading – A Quick Summary

Here is a quick summary of Margin trading that will help you to decide whether it is worth it or not:

| Minimum Investment | $2000 (Depends on Broker too) |

| Benefits | • Maximized potential returns • Tax-deductible allowance • Advance trading options |

| Risks | • High chances of loss • Interest Expense • Chances of losing the initial investment |

| Best Margin Trading Platforms | • Capital.com • Interactive Brokers • Plus500 • Charles Schwab • Fidelity |

Conclusion

Margin trading entails a considerably higher level of risk than traditional investment. It is possible that you will lose even more money than you initially invested if the transaction does not go well for you.

However successful your trading is, interest costs on money borrowed might eat away at your profits in the long run.

Assuming that you are completely aware of the dangers and expenses associated with margin trading. It has the potential to improve your earnings and return on investment. It may also make it possible for you to invest in a wider choice of assets.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/