The dividend yield of a stock is an estimate of the return on a stock investment that is derived only from dividends. In this article, you will learn what it is and how to calculate dividend yield.

Table of Contents

How To Calculate Dividend Yield | What is a Dividend ?

It is the distribution of a part of a company’s profits to shareholders.

How Do Dividends Work

Dividends are paid out in addition to any increases in the value of the business’s stock, and they are intended to compensate shareholders for their investment in the company.

Companies in some industries are well-known for paying dividends, and dividends are more prevalent among established businesses that can afford to retain a portion of their profits rather than reinvesting them entirely back into the company.

Companies may pay exceptional, one-time dividends, or they may pay dividends on a regular basis, such as once a quarter or once a year, depending on their financial situation.

Preferred Stocks Advantage

One of the major advantages of preferred stock is that it pays regular dividends on a consistent basis, although common stock may also pay regular dividends on a consistent basis.

Dividend payments, on the other hand, are not guaranteed, in contrast to bond interest payments.

When the economy is in a bad state, companies may force to reduce or even discontinue dividend payments.

What is Dividend Yield?

What is dividend yield?

The dividend yield of a company is the proportion of profits it pays out in dividends each year for every dollar invested.

For example, if a company’s dividend yield is 7% and you hold $10,000 of its shares, you would receive a $700 yearly payment or $175 in quarterly installments if you held the stock for the whole year.

Companies, on the other hand, often pay dividends depending on the number of shares you hold rather than the value of the shares you own.

As a result, dividend yields change in accordance with the current stock price of the company.

Many stock research tools provide you with the most recent dividend yields, but you may also compute dividend yields manually if you want.

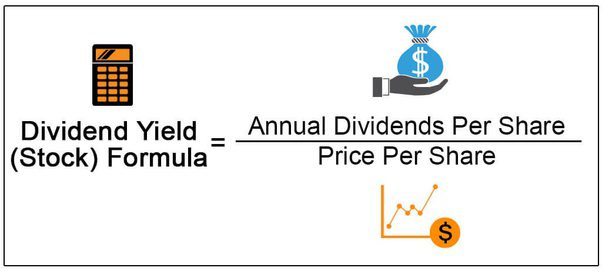

How To Calculate Dividend Yield?

If a stock’s dividend yield isn’t expressed as a %, or if you’d want to determine the most recent dividend yield percentage, you can use the dividend yield formula for determining the yield percentage.

Divide the annual dividends paid per share by the price per share to arrive at the dividend yield.

Dividend Yield = Annual Dividends Paid Per Share / Price Per Share

A dividend yield of 3.33 percent would be achieved. For example, if a company paid out $5 in dividends per share and its shares were now trading at $150 each.

There are a number of different methods for determining a company’s yearly dividend payout:

Annual Report

The yearly dividend per share is generally disclosed in the company’s most recent complete annual report.

Most Recent Dividend Distribution

To calculate the annual dividend, multiply the most recent quarterly dividend distribution by four to obtain the quarterly dividend payout for the previous year.

Trailing Dividend Method

A more detailed view of companies with fluctuating or irregular dividend payments may be possible by adding the four most recent quarterly payouts together to obtain the yearly dividend payment.

Please keep in mind that the dividend yield is rarely constant.

It might vary even more depending on the technique you employ to compute it.

What Is the Importance of Dividend Yield?

One of the most important reasons to understand dividend yield is to assist you to choose which stocks will provide you with the best return on your dividend investment dollar.

However, there are a few additional advantages to consider.

It is simple to compare stocks based on dividend yields

For income investors, it is important to analyze and pick stocks depending on which companies offer the greatest dividends per dollar of invested capital.

A less useful statistic is the absolute amount of dividends you get per share.

Because the stock values of different companies might fluctuate considerably.

Companies A and B, for example, both pay an annual dividend of $2 per share on their common stock. Company A’s stock, on the other hand, valued at $50 per share.

But Company B’s stock valued at $100,000 per share.

In contrast, Company B’s dividend yield is just 2 percent, implying that Company A may be a superior investment for income investors in comparison to Company B.

Increasing dividend yield indicates the company is financially healthy

Generally speaking, when a business chooses to increase its dividend—and, as a result, its dividend yield—this indicates to investors that the company is doing well because it can afford to distribute a greater portion of its revenues to shareholders.

Generally speaking, older, more mature companies in established sectors are more likely to pay regular dividends. Moreover, to offer higher dividend yields than younger, less experienced companies.

Meanwhile, newer, faster-growing companies are more likely to reinvest their revenues for future expansion. Rather than paying out a dividend to shareholders.

Dividends increase the value of your investments

Your investment gains the benefits of compounding when you reinvest your dividends. Rather than cashing them out every year or quarter.

Compounding effects have the potential to significantly increase your profits over time.

According to a recent analysis from Hartford Funds, reinvesting dividends has been responsible for 78 percent of the overall gains of the S&p; P 500 from the beginning of 1970.

The Risks of Investing in Stocks with High Dividend Yields

A high dividend yield is not always a favorable indicator of a company’s health. In fact, an unusually large yield may be a warning sign that something is wrong.

Is High Dividend Yield Always better?

This might occur for a variety of causes, including:

The stock price of the company has just dropped precipitously.

If the price of a company drops dramatically but the dividend did not reduce, the yield on the stock may appear to be high.

Illustration

Consider the case of a company with a stock price of $60.

And a $2 yearly dividend per share paid out on each share.

If the stock’s price falls below $20, the dividend yield more than doubles to almost 10% of the stock’s value.

This yield may appear to be quite attractive at first glance. But upon closer inspection, it indicates that the company is in serious difficulty.

As seen by the company’s share price’s precipitous decline.

This indicates that a dividend cut or cancellation may be on the way in the near future.

The company is seeking to entice investors by offering a large dividend payout to them. Some companies attempt to raise their stock prices by raising their dividends. In order to attract new investors to their shares.

Some investors may want to purchase shares as a result of the high dividend yield. It will cause the stock price to rise.

However, if the company is not financially sound and cannot afford to maintain the larger dividend payments.

This dividend payout—and the resulting gain in stock value—may not be sustainable.

Stocks with the Highest Dividend Yield

High dividend yields are possible in dividend aristocrats, which have continuously increased their dividend distributions over decades.

As well as companies in the following industries:

Utilities

Electricity and water companies, in general, payout large, steady dividends.

Even natural gas companies have historically paid out dividends that were pretty large and consistent.

Consumer Staples

Companies that provide consumer staples frequently have dividend programs that have been in place for a long time.

In reality, many of the dividend aristocrats are companies that manufacture basic staples.

Telecommunications

Companies that provide telephone and internet services frequently pay out large dividends to their shareholders.

Energy

Companies that provide energy frequently offer greater dividend yields.

This is due in part to the fact that many are MLPs, which require to distribute all of their income to shareholders in order to preserve their tax-favored status.

Real estate

Real estate investment trusts (REITs), like master limited partnerships (MLPs), must transfer virtually all of their income to shareholders in the form of dividends in order to maintain their tax-exempt status.

FINAL THOUGHTS

When a security’s dividend yield is measured in relation to its stock market value per share, it is known as the dividend yield (also known as the dividend payout ratio).

The dividend yield formula, in other words, determines the proportion of a company’s market price of a share.

More specifically, paid to shareholders in the form of distributions.

When analyzing stocks for investment objectives, a high dividend yield can be a useful metric to consider.

However, it is not necessarily indicative of a successful business.

Always go beyond the figure at a single point in time, and make sure to take a long-term view of the industry.

And the company’s dividend yield in addition to the number.

The fact that there is some regularity and that it is not simply a one-time fluke is important to know.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/