One of the most important tools you need to succeed as an investor is the right information. To make well-informed investment decisions per time, you need to stay updated on the latest market trends and investment newsletters. And, you don’t just need the right investment information; you need to get it timely enough too.

This is where subscribing to investment newsletters comes in handy. Apart from providing useful information, some newsletters also offer tips and recommendations on the right investment moves for their users. We’ll show you the top 10 best investment newsletters you can trust for the investment information you need.

Table of Contents

Best Investment Newsletters – How Investment Newsletters Work

Investment newsletters primarily provide information about investment commodities such as stocks and their different markets. Most of these financial markets are driven and influenced by various kinds of information, and it might take some hard work to find these information.

Investment newsletters make these important information handy to investors and everyone interested. So, if you subscribe to the right newsletter, you will minimize the stress of sourcing information by yourself.

While some newsletters offer information and services on various markets, many others focus on some particular niche. So, one newsletter may cover the stock, forex, and crypto markets, while another may just specialize in stocks.

What To Consider When Choosing an Investment Newsletter

To be sure you’re choosing a suitable newsletter, there are certain criteria you should have in mind. These factors include:

#1. Suitable and Feasible Recommendations

Before you subscribe to any newsletter, find out the kind of services they offer and whether they match your investment goals. Do not just follow a newsletter because they seem good; ensure they’re suitable for your style.

For instance, if you’re a short-term trader, it might not be useful to follow a newsletter that offers long-term trading tips, and vice versa. If you are trading with small capital, it might be risky to follow the investment recommendations of a newsletter for high capital investments.

#2. Trusted Success History

Virtually every investor desires to beat the market and earn high returns. To achieve that, look for newsletters that have a proven track record of success. They should not just tell you what to invest in; they should also tell you why, backed up with verified data and stats.

#3. Affordable and Profitable

Of course, you would not want to break the bank for newsletters. Look for the ones that offer great services at affordable rates. Check for transparency in pricing too, so you wouldn’t have to battle with hidden charges later.

Now, let’s consider the top 10 best investment newsletters and why each may be suitable for you.

Top 10 Investment Newsletters #1. The Motley Fool

To put it simply, the service presents you with some investment suggestions on a regular basis. Consequently, the purpose of this evaluation is to assess whether or not the stock adviser is a good investment of your money.

Perhaps the most notable thing about the Motley Fool is their tested and trusted long track for success. As state on their website, recommendations from the Motley Fool Stock Advisor have been beating the market since 2002.

Key Features of Motley Fool Stock Advisor

Once you become a member, you will have access to a wide range of tools. They will assist you in making informed investing decisions. For example, you will have access to a variety of current and historical top stocks that are worth investing in.

The average stock pick from the Stock Advisor has returned over 590% while the Rule Breakers have returned over 300%. This means both of them have outperformed the S&P 500 for some years now.

Investment Knowledge

The stock adviser members-only site is a swarm of activity, and it’s easy to see why. There is a wide selection of instructional information available on this page. It can assist you in making smarter financial decisions.

As you are well aware, education is a very vital component for any trader who wants to maintain their abilities.

It is easy to learn about new investing techniques while also obtaining ready-made stock recommendations through the Fool’s tools and resources.

Built-In Alerts and Stock Management Tools

Stock Advisor at Fool.com offers more than just investing advice; it also offers other services.

And today, owing to the incredible power of contemporary technology, it is feasible to build a one-of-a-kind portfolio of equities if you join a mutual fund. On some websites, this portfolio means a watch list, which is a similar concept.

Collaborative Environment For Increased Productivity

This group is quite well-managed on the Stock Advisor website.

This may not be the busiest chatroom available on the market. But it surely attracts a reasonable amount of attention and participation.

How The Motley Fool Works

The Motley Fool provides information and recommendations on long-term investment ideas and strategies. They offer two popular newsletters: the Motley Fool Stock Advisor and the Rule Breakers.

The Motley Fool Stock Advisor recommends stocks of companies that are well established with proven results such as Tesla, Amazon, etc.

The Motley Fool Rule Breakers helps you identify stocks that have a high potential for future growth. It’s a long-term-based newsletter, so you can invest in those stocks and be sure you’re going to earn high returns in the long run.

Both packages showcase strong transparency too. They do not just show you their picks, they also provide factual reasons why they make the choices. And another perk is that you can reproduce their results by yourself.

Pricing

Both the Motley Fool Stock Advisor and the Motley Fool Rule Breakers cost $99 for the first year. That’s about $1.90 weekly, and that’s quite a fair price for the trusted high-quality service they offer.

If you find this newsletter attractive, you can watch the the video review below.

#2. Mindful Trader

The Mindful Trader is a short-term based investment newsletter that recommends daily stock picks based on data-driven analysis. The company owner, Eric, claims to have invested several years of research and cost to develop the strategy you can now trust.

This newsletter recommends day-trading which normally takes within 5 to 10 minutes to follow. They also offer short-term buy-and-hold investment ideas which usually last for a few days.

How Mindful Trader Works

The Mindful Trader releases about 3 to 5 ideas daily. The newsletter delivers its content to the users via mail. The mail usually contains the perspectives behind the content and the investment plan for each day.

The Mindful Trader also tries to keep a good level of transparency as the outcome of the stock picks since it started is displayed on the website.

Pricing

Access to the Mindful Trader Newsletter costs only $47 per month.

Best Investment Newsletters | #3. Finimize

Finimize sends you short summaries of financial news in their top two stories of the day known as the Daily Brief.

The newsletter does not explicitly make you buy any particular stock. Rather, it provides you with information so you’ll be able to make your own decision.

The Daily Brief newsletter is usually not more than 500 words and is free.

However, if you subscribe to their premium plan, you’ll have access to a more robust service. This service features advanced offers such as detailed daily reporting, premium meetup, an audio version of their content, and other perks.

Pricing

You can access the Finimize Daily Brief for free, but a subscription to the premium services costs a charge of $79.99 per year. You can have a taste of what to expect from the premium service through their free 7-day trial.

#4. Trade Ideas

The Strength Alerts index newsletter offered by Trade Ideas provides you with 5 new ideas for your trades every Sunday. They supply these trade ideas from their model portfolio using their advanced statistical analysis and high-performance algorithm.

One major benefit of this newsletter is that you will get the alerts for the trade delivered to you on Sunday ahead of a new trading week. The trading information they supply is based on the expert analysis of Michael Nauss, an experienced Chartered Market Technician.

They also provide a question and answer session where you can learn more about their services.

Pricing

The TI Strength Alerts index newsletter costs only $17 per month. The company also provides a free Trade for the Week newsletter for their subscribers.

#5. Forbes

Forbes newsletter has gained massive popularity and usage due to the wide range of services it offers. Since 2000, Fines Investor has reportedly performed three times better when compared to the S&P 500.

How Forbes Newsletter Works

Forbes does not offer a general investment newsletter. Rather, it divides its service into different categories such as stocks, Options, Funds and ETFs, Income and Safety, Economic Analysis, etc.

Each of these newsletter categories has an expert who writes them. So, it provides an easy way to leverage the expert knowledge of experienced investors and analysts. Another great benefit is that it allows you to choose and focus on your particular area of investment interest.

Pricing

The cost of the newsletter subscription varies with different categories. Different payment plans apply to different categories too. So, you can decide to subscribe quarterly, annually, monthly, etc., depending on what’s available for the category you want.

The pricing ranges from as low as $18 to as high as $995 depending on the payment plan. It also features the Forbes Elite Investor plan which costs around $499 monthly, $4,995 yearly, and $9,550 bi-annually.

#6. Nate’s Notes

This is one of the most trusted newsletters due to its long years of consistent performance, dating back to its introduction in 1995. It is run by Nate Pile who was one of the earliest investors that recommended Apple stocks to investors way back in the ’90s. It is a very viable option for high-tech stock investors.

How Nate’s Notes Work

The newsletter takes a review of the biggest indexes in the stock market such as the DJIA (Dow Jones Industrial Average) and the S&P 500. It then shares ideas and recommendations based on this review.

Nate’s Notes also reviews the stocks featured in their model portfolio. The portfolio features a category of stocks with less volatile prices of shares. These stocks are known as the “core stocks” and Nate usually recommends investors to invest more in them.

Nate’s Notes usually advises investors to buy stock picks with higher growth potential relative to their prices. It refers to these stocks as “First Buys”. Also, the newsletters prescribe a “Strong Buy” price point for each portfolio – a buying point with the highest return potential.

Pricing

The Nate’s Notes newsletter subscription costs $289 per year.

#7. Fidelity Investor

If you are interested in Fidelity Mutual Funds and mutual funds in general, this might be the best pick for you. The Fidelity Investor newsletter keeps you updated on what you need to know to become a profitable mutual funds investor.

How Fidelity Investor Works

The Fidelity Investor newsletter gives more attention and emphasis to the managers of the mutual funds instead of the mutual fund names. Fidelity mutual funds are actively managed, so the assessment of the manager matters a lot. The better the manager, the higher the chances of the mutual fund performing above the market.

Pricing

For the first 6 months, you’ll have to pay $34.95 to access the newsletter. Subsequently, the cost is $229 per year.

#8. Kiplinger

Kiplinger is suitable for investors who love the conservative investment approach. It is the best for you if you want to engage in low-risk investments with moderate rates of return.

How Kiplinger Works

Kiplinger offers both a print magazine on personal finance and digital newsletters. The sectors that the services cover are investing, saving, wealth building, and taxes.

In keeping with its conservative investment style, Kiplinger offers a newsletter known as Kiplinger Investing for Income. This package aims at helping you earn between 4% to 6% cash yield on annual basis.

Pricing

The personal finance magazine, including both the digital and print versions, costs $29 yearly. You can also opt for a bi-annual subscription for $39 annually.

#9. AskFinny Newsletter

Learning about investments and financial analyses can be challenging sometimes. The complex nature of the information and calculations involved can be overwhelming, especially if you are a newbie.

This is exactly what AskFinny seeks to solve for you, breaking down complex concepts into easy-to-understand terms. So, the newsletter is a perfect fit for investors who are looking to learn and do investing by themselves.

Main Features

The advantages and disadvantages of purchasing or selling individual stocks, exchange-traded funds, and mutual funds.

Each analysis is accompanied by a Finny Score, which is not a suggestion to purchase or sell. But rather a visual depiction of the balance between the advantages and disadvantages of the subject matter.

Compare Stocks, ETFs, and Mutual Funds

A side-by-side comparison of two stocks, ETFs, or mutual funds of your choosing. Allowing you to compare important financial statistics such as historical performance, expense ratios, valuation, profitability, and other financial characteristics.

Alternatives and Comparables

It compiles a list of equities, exchange-traded funds, and/or mutual funds. They are comparable to the ones you are contemplating investing in.

Top Stocks

A compilation of the stocks that have made it onto “best of” lists. Organized into popular categories such as dividend stocks, bargain stocks, wealth generators, and so on.

How AskFinny Works

The AskFinny newsletter is also known as The Gist. The newsletter aims to help the subscribers become profitable investors by providing information on the latest trends on money and investments. Subscribers receive The Gist two times a week – every Tuesday and Thursday.

Apart from the newsletter, AskFinny also offers an app for stock analysis. The app provides answers to FAQs on finance, tools for stock investment research, and general investment guides.

Pricing

While the AskFinny app costs $8.33 per month, you can access the newsletter and other resources for free.

#10. Zack’s Profit From the Pro

Zacks Profit From the Pro sends its subscribers timely information on notable market developments every morning. According to the website, there are over 800,000 subscribers who enjoy this offer. And, the most beautiful part of that this service is totally free.

As an added advantage, subscribers of this newsletter also get the renowned “Bull Stock of the Day” with a reputation of making as much as an average profit of 25.60% yearly.

Key Features

A large number of stock screening and backtesting tools are available on the market, each of which claims to be unique in some manner. This may cause you to question whether or not this specific service is appropriate for you.

In order for you to understand what it is suitable to provide, we will need to look at some of its most important characteristics.

Stock Screener

First and foremost, the major goal of this program was to make it as simple as possible for investors to identify the best companies with the greatest potential for long-term development.

As a result, it revolves around a stock screener that includes hundreds of characteristics such as income statement components, dividends, earnings per share growth estimates, and many more.

Results of the Screener

As soon as the screener findings are presented, you have the option of going further and analyzing them with heatmaps and scatter plots.

The fact that the heatmaps are colored according to how the platform evaluates the stocks that show in your screener results is an important component of the heatmaps’ functionality.

If only they had been coloured in accordance with your screen specifications, they might have been more useful in assisting you in the execution of your trading plan.

The Graphs and Diagrams

By utilizing the charting features of the platform, you may show virtually any essential data that you need.

Some of the data elements that you may chart are your stock’s revenue, Net Margin, Return on Equity, Cash Flow, Earnings Per Share, Price to Earnings Ratio, and many more.

Pricing

This newsletter is absolutely free. However, subscribers can also pay to leverage other services from Zacks such as the Zacks Premium for $249 monthly, or the Zacks Mutual Fund Rank as depicted in the video below.

Other Top Investment Newsletters To Consider

Profitly by Tim Sykes

This newsletter made its way among the Top 10 Best Investment Newsletters.

A multi-package program called Profitly claims to train upcoming practices on the best practices for maximizing their winning streaks when trading volatile currencies and commodities.

Profitly – a multi-package program designed to teach upcoming practices how to maximize their winning streaks when trading volatile currencies and commodities.

Timothy Sykes and Michael Mosseri came up with the idea for the firm, which they founded. Timothy is the one who came up with the idea for the platform, inspired by his own trading experiences.

Key Features and Workings

Keep track of your trades

Profitly’s exclusive trade monitoring technology painstakingly records and tracks each and every one of your deals in minute detail. After you’ve accumulated a little amount of trading experience on Profitly, you’ll begin to see patterns forming in your trading history.

Traders’ Viewpoints

Taking the time to examine your trading history might provide you with valuable insights into your trading approach.

With a little effort, you can discover your most effective trading strategies and develop your trading strategy around those skills. This information might also assist you in identifying and correcting errors.

Set up a connection with your brokerage account

Profitly is a subscription-based service, which means that you must pay a monthly charge in order to use it. Then you can start blasting your way to the top of the leaderboard by setting up a profile, connecting your brokerage accounts, and posting your trades.

Stansberry Research

It is a monetary information and software provider that operates on a subscription basis. People who are self-managing their portfolios can benefit from the platform’s practical investing advice and analysis.

It is one of the Top 10 Best Investment Newsletters.

Key Features and Working

The Total Portfolio

It is a hedge stock portfolio model, and it is called the Total Portfolio. It makes use of around 40 different stock suggestion types.

Each stock is selected from a pool of stocks that includes companies from developing markets, growth stocks, safe income stocks, and small-capitalization stocks. The Total Portfolio is a conservative investment strategy.

In terms of portfolio size, Stansberry advises a minimum of $100,000, withholding periods ranging from one to three years on average.

The Income Portfolio

The Income Portfolio is oriented at providing monthly income and can contain up to 30 assets at any given time, depending on market conditions.

The stocks, bond funds, and fixed income bonds that are recommended are usually income-producing investments such as dividend-paying equities.

The Capital Portfolio

This portfolio explains the Capital Portfolio by Stansberry Research since it is their entry-level offering. Once again, this is a cautious investment portfolio.

The Capital Portfolio focuses on gold stocks, foreign companies, real estate, biotech, and energy firms, among other things.

The usual holding time is one to three years, and they recommend that investors have at least $100,000 in their portfolios. In addition to the Capital Portfolio, subscribers will get access to seven other publications.

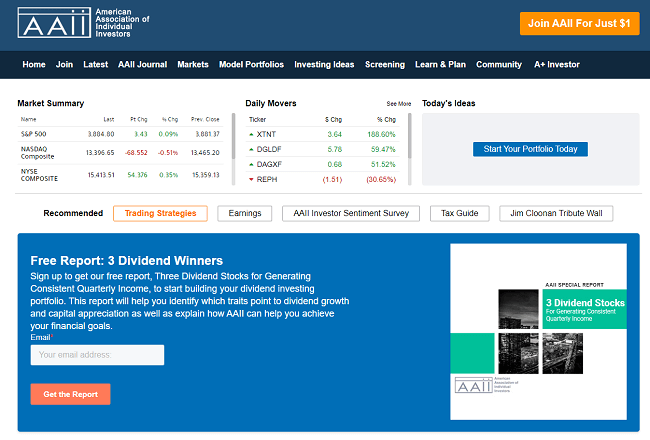

American Association Of Individual Investors ( AAII) Income Investing

Dividend Investment is a service provided by AAII that takes care of a lot of the research and analysis when it comes to income investing. It is one of the Top 10 Best Investment Newsletters.

In order to target dividend-paying stocks that combine yield and asset quality, the services employ a proprietary stock-screening and selection technique developed by the company.

Key Features and Working

AAII Tools

MyPortfolio+, Stock Screen Power Rankings, the A-F Stock Grades Screener, Stock Upgrades & Downgrades, Top & Bottom Performing Funds, and a Fund/EFT Screener are some of the investment tools available through the AAII website.

All of these resources are available in the AAII’s My A+ Investor Toolkit, which is free to use.

Portfolios of the AAII

The AAII’s Model Portfolios are among the most widely available tools that the organization provides. The AAII Model Shadow Stock Portfolio is one of the most popular products by the company.

Moreover, they created the Model Shadow Stock Portfolio in order to provide the greatest possible return on investment. While requiring the least amount of time and effort.

In fact, the Model Shadow Stock Portfolio has beaten market benchmarks by a factor of four over 20 years.

Education and Involvement with the AAII

Education and community activities are two of the most significant benefits of membership in AAII. Webinars are one of AAII’s educational options.

The Webinars are video lectures that cover certain elements of investing, like dividends, that are not available in the book. The AAII provides a variety of Webinars, including The Individual Investor Show.

Many of these Webinars are suitable for investors who are less interested in appealing elements of investing, such as taxes.

CONCLUSION

Information is key in the world of investment, and it can be very tasking to source the information yourself.

By subscribing to the best investment newsletters, you can get these important information delivered right to you. From this list of top 10 best investment newsletters, you can find and subscribe to any that suits your investment needs.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/