Several trading platforms provide free stocks to customers through their websites and mobile applications.

Those who are interested in receiving some of the most popular stocks in their portfolio for free can examine the services listed below to see how they can obtain free stocks to start their investing journey.

Table of Contents

Top 5 Brokers for Free Stocks

To achieve financial independence, you must make smart decisions, be determined, and put out significant work.

However, we may also benefit from a little good fortune working in our favor. As a result, knowing how to invest in stocks is essential. However, why not enlist some Top 5 Brokers for Free Stocks to get us started by obtaining some free stocks.

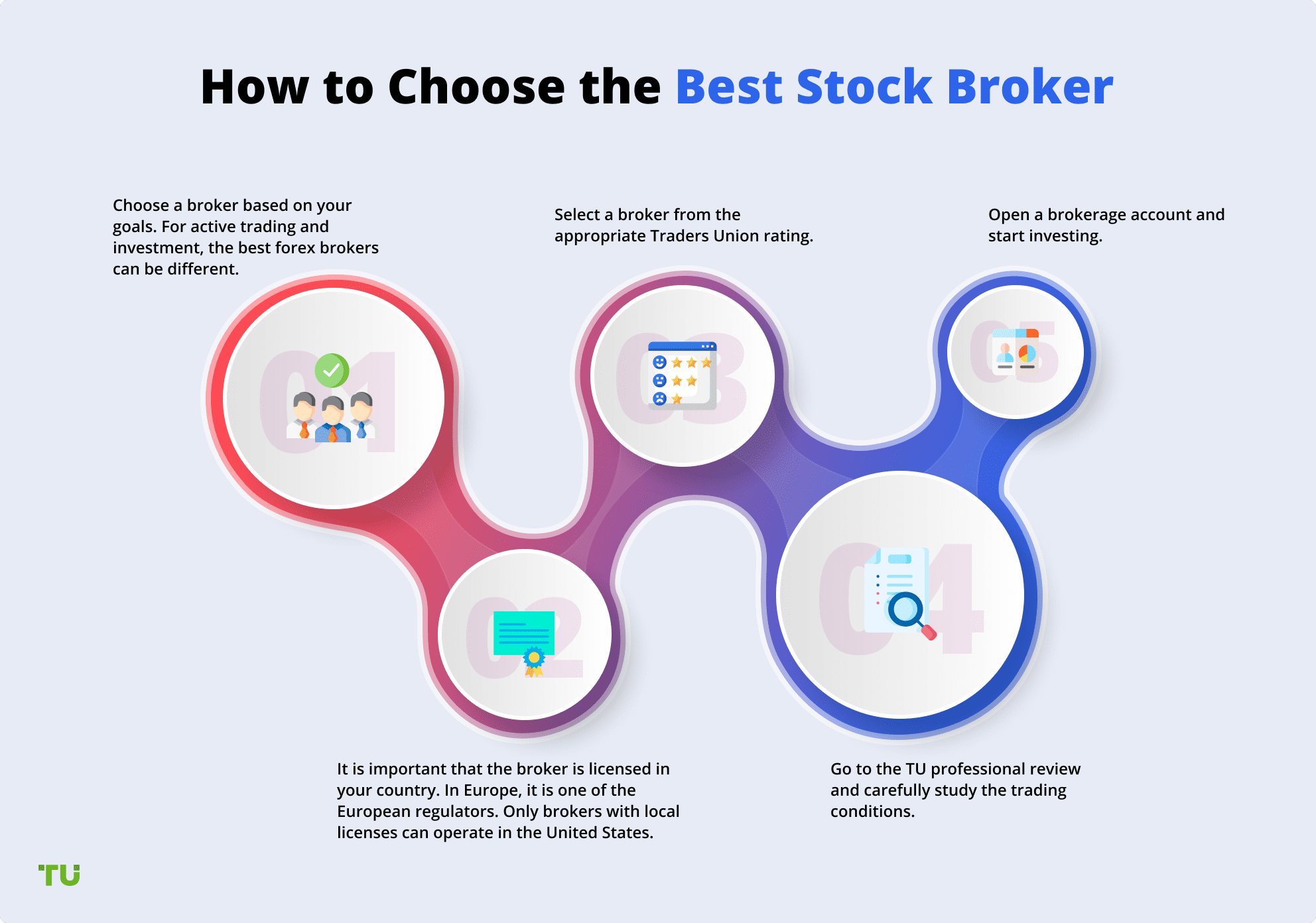

Finding the best brokers with the specific requirements that you may have is not an easy task.

But with the help of our list of the 5 best brokers for free stocks, you can find what platform is best suited for you and get started with it.

Webull (2 Free Stocks)

Consider Webull to be the “new kid on the block” in the online brokerage industry, having only debuted in 2018. Free stock trading apps, as well as free trades in exchange-traded funds (ETFs), options, and cryptocurrencies, are available via the company’s mobile app or desktop website.

In other words, you will not be charged fees for any trades you choose to execute in your portfolio.

How to Get Free Stocks From Webull

The Webull platform has opted to provide new users with the option to receive two free shares of stock worth up to $2,300 ($11 – $2,300) when they sign up for the platform.

To be eligible for this possible bounty, you must first join up, open your account within 24 hours, then make a minimum $5 deposit into your account.

If you do, Webull will provide you two free shares of stock in exchange for your participation.

Public.com ($10 bonus)

The Public.com is yet another commission-free investment software that caters to Millennials and Generation Zers who are interested in investing in accordance with their social preferences and in the company of like-minded others.

The stock trading app has a feature that is becoming increasingly popular among younger investors who may not have enough money to purchase some of the more expensive stocks all at once: fractional investment.

How to Get Your Free Stock from Public.com

The site provides a free $10 sign-up incentive for making an initial deposit, as well as the option to send free stock gifts (fractional shares) to referrals you make.

If this sounds like a promising investment app, create an account and make a small initial payment to determine whether or not the app fulfills your requirements.

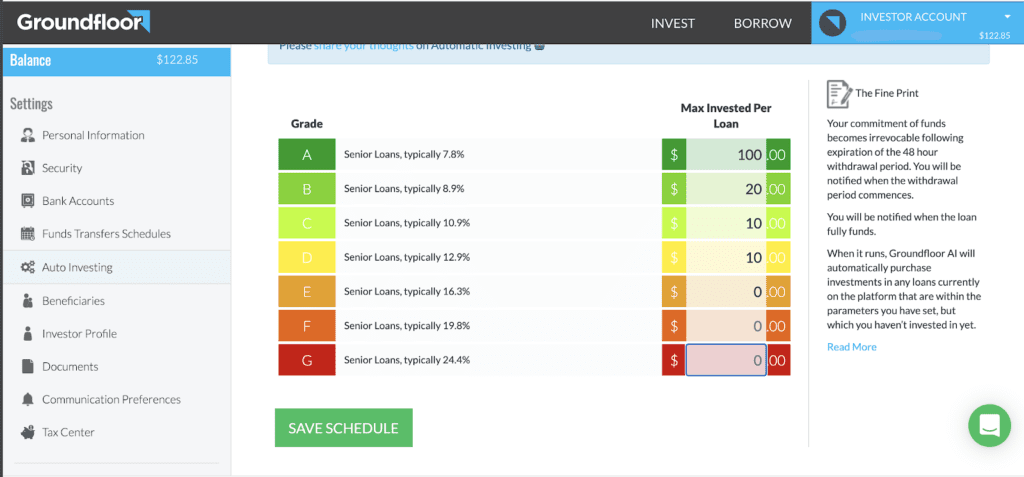

Groundfloor ($20 bonus)

In comparison to the other investment platforms featured above, Groundfloor is a unique sort of platform. Groundfloor serves as a crowdsourced real estate investing platform that focuses on debt investments in residential and commercial properties.

The platform primarily focuses on acquiring fixer-uppers, completing necessary repairs and renovations, and then reselling the property for a profitable return.

Groundfloor provides funding for short-term residential real estate loans and compensates the platform’s investors for the interest they earn on their money by lending them to the platform.

How to Get Your Free Bonus from Groundfloor?

Groundfloor is offering a $20 bonus to new customers who sign up for their service and make their first investment. To be eligible for your bonus, you must sign up, link your bank account to your account, and deposit a minimum of $10 into your account within 30 days.

Once you contribute to your Groundfloor account, you will be eligible to receive your $20 investment credit bonus.

Groundfloor is also offering a $100 bonus for every $5,000 you deposit and invest into your account until July 31, 2021, as an additional incentive to sign up. The highest amount of money you may receive from this incentive is $1,000.

Robinhood (1 Free Stock)

In particular, index funds, stocks, and options are available through Robinhood.

Choose Robinhood as your brokerage, and you can rest certain that you are putting your money into a company that has paved the way for commission-free trading to become the norm in the financial services sector.

The need for many brokerages to offer free trades on specific assets in order to remain competitive in the market has heightened in recent years.

How to Get Free Stock on Robinhood

Similar to the other Robinhood alternatives discussed in this post, Robinhood provides an incentive in the form of a free stock worth between $2.50 and $200 if you sign up for the service.

One in every 250 chances of receiving a free stock from Berkshire Hathaway (Class B), Apple, or Facebook, and one in every 150 chances of receiving a free stock from General Electric or Ford, according to the service’s terms and conditions.

SoFi Invest (1 Free Stock)

This program allows you to keep track of your money and exchange it when you want to make a profit. The program, which is the newest offering from the SoFi financial wellness platform, provides free trading on stocks, ETFs, cryptocurrencies, and other financial instruments.

You can choose to be an active trader by selecting stocks on a regular basis, or you can choose to be a passive investor by using the site’s automatic investing service.

How to Get Your Free Stock on SoFi Invest

A free sign-up bonus of $5 to $1,000 is available to you when you create a Wealth account with SoFi Invest and make an initial deposit of at least $100.

Summary of Free Stocks Offering in 2021

| Broker | Free Stocks | Bonus Cash |

| eOption | Yes | No |

| Futu MooMoo | Yes | No |

| GroundFloor | No | $20 |

| Robinhood | Yes | No |

| Webull | Yes | No |

| Public.com (Matador) | No | $10 |

| SoFi Invest | Yes | Yes |

Top Brokers that offer No Free Stocks – Worth Considering

Finding the best brokers with the specific requirements that you may have is not an easy task.

But with the help of our list of the 5 best brokers for free stocks, you can find what platform is suitable for you.

Fidelity Investments – Best Free Broker for beginners

Currently providing services and reaching out to more than 32 billion people around the globe, this platform is a jackpot for investors.

Not only is this platform known for its quality research, professional services, and a wide range of trading tools, but it gives the added benefit of using it for absolutely free.

Moreover, Fidelity provides a quality user experience that is simple to understand and use but does the job effectively.

Not only does it provide value and quality across its website, but it also offers services in the mobile app as well.

When Was Fidelity Investments launched?

Fidelity was founded by Edward C. Johnson II as a private financial services company named the fidelity management and research company.

It is still a privately held firm, with shares held by workers and the Johnson family.

How does Fidelity Investments work?

With the effective tools research and financial education that they provide on the platform, Fidelity Investment work by helping you organize.

It allows you to make a decision regarding your research investments giving an industry-leading analysis, then it aids in managing and organize a plan to pick and scroll through your choices.

It is the reason Fidelity is one of the top 5 brokers for free stocks.

Features of Fidelity Investments

Owing to a strong blend of instructional information and a comprehensive mobile app, Fidelity is a top pick for daily investors, even amateurs.

Additionally, it will help you gain some expertise and use your research and education in finances for trading, that too for absolutely free. Following are the most valued features of Fidelity.

Stock investing feature

There are no restrictions on the amount or price of the overall trade in the stock investing feature, with no extra costs for trading equities worth less than one dollar.

Mobile Trading Feature

In addition to its mobile trading app, Fidelity offers Net Benefits for payroll and Fidelity Spire, a financial planning and goal-setting tool.

Moreover, the mobile trading system by Fidelity is well-designed, bug-free, and provides investors with a great experience. It highly ranks for its customizable dashboard and other unique features.

International Trading

This trading feature lets customers exchange shares from 25 different countries in several exceptional currencies using their fidelity account.

How will you benefit from Fidelity Investments?

The website of Fidelity Investments online platform is professional and not difficult to understand, making it an excellent location for beginners to gain investing experience and jumpstart their financial education.

Moreover, no additional fees in contrast to other features. Fidelity does not take payment for order flow (PFOF), which is rare in the business.

However, clients can place stock transactions at a reduced cost. Fidelity is the only broker that offers this service.

Several Fidelity mutual funds have no expense ratio, compared to Vanguard funds which help save money.

It makes Fidelity among the top 5 brokers for free stocks.

How to Start Investing with Fidelity?

Pick a combination of investments that is both diverse and well-balanced, and think about the degree of risk you are willing to accept.

Taking into account the investment time frame is also necessary. After that, just go on to the fidelity website and click on the open an account option displayed in the menu bar.

There are different types of accounts that you can open mentioned according to the type of investment plan you want to opt for. Fill in the details, and there you go!

- Brokerage Account

- Cash Management Account

- Brokerage and Cash management

- The fidelity account for business

How to Cancel Your Subscription for Fidelity Investments?

Call their customer service to cancel your Fidelity Investments account subscription. In the meantime, A representative will be happy to assist you. They’ll need your account number and other client details.

Pros

- No fee banking and a wide retail service

- Holding a self-directed brokerage account requires no account service fees or other hidden fees at Fidelity

- It allows you to start trading with any trading budget without worrying about trading expenses.

- Mobile Trading options

Cons

- It may charge some fees at the time of trading opening concerning non- fidelity mutual funds.

- Some other charges include the foreign exchange wire cost.

Charles SCHWAB – Best Research in trading investment

The Charles SCHWAB is a full-service brokerage and among the top 5 brokers for free stocks. It works by combining both brokerage and banking services with the clients and offering debit cards that don’t charge even while doing foreign transactions.

When Was Charles SCHWAB launched?

Since its founding in 1971 by Charles R. Schwab, the firm has grown to become14th largest company in the U.S. Founded in San Francisco, California.

This investment firm offers a comprehensive range of services. There are more than 11 million investors in Schwab’s $3.56 trillion assets under management.

How Does Charles SCHWAB work?

It works by providing the same level of functionality of the mobile app as its desktop counterparts.

It is highly rated because investors of all types can benefit from it. One of the most rates feature of this broker is the Edge application.

Moreover, they offer a single trading ticket along with Other commodities like long and short options, stocks and shares, mutual funds, and other derivatives.

If you’re looking to invest, Charles Schwab offers two different online trading platforms. You may choose any one of them to invest in.

Features of Charles SCHWAB

Fees and Commission

It does not require a commission or a minimum transaction.

Additionally, a stock trading at zero levels, choice trading, and ETFs are all available through Charles Schwab at zero to minimum cost.

Although the commission charges may not be so low, it’s worth it for the extensive services they provide.

Research Tools

Google assistance, free magazines without any costs, along with a wide array of investing screens, is a huge plus.

It provides extraordinary research tools along with business stock ratings and reviews from a market edge, credit Suisse and Morningstar as well.

It is one of the reasons Charles SCHWAB is one of the top 5 brokers for free stocks.

How will you benefit from Charles SCHWAB?

Online trading platforms, banking facilities, client reach, and customer service are all areas where Charles Schwab ranks higher than its rivals.

A self-directed, comprehensive investment destination, Schwab is better suited to active investors. Option transactions and advice services are better handled by their brokerages.

By using Investors working at different levels can find a wide range of tools and programs available to them.

How to open a Charles SCHWAB account?

You will require at least a $1,000 investment in your account after opening an account with Charles Schwab that is functional, be it a personal or joint trading account.

However, there is no price or any maintenance fees or penalty for an account that is not actively used.

Furthermore, there is a requirement to have at least 100 dollars in your account to keep it functional, but it can be waived if you make an automatic monthly transfer/deposit of at least $100 into your account each month.

How to Close a Charles SCHWAB Account?

To cancel your subscription, there are 50 dollar fees that you may have to pay down the line. However, you can cancel your account anytime by contacting their customer service.

Pros

- Streetsmart Edge helps you keep efficient records of your trading investment history.

- Can easily buy multiple mutual funds within one platform.

- There are a lot of in-house sector assessments on its investment screens, which are quite thorough.

- You may customize its Streetsmart edge platform with a powerful ETF panel.

- The cost of the service is very low after a year.

- 0% charge for portfolio management by a seasoned professional.

Cons

- Cash-sweeping isn’t automatic, and the website isn’t accessible.

- The transaction fee fund’s commission.

- These are not the lowest margin rates in the industry.

- The cryptocurrency exchange is not available.

E*Trade – Best Research in trading investment

The E*Trade may be the best option for people looking for opportunities to be part of initial public offerings (IPOs) and U.S. Treasury Auctions. It is one of the top 5 brokers for free stocks.

The following assets can be used to invest: a stock exchange-traded fund (ETF), mutual funds, futures, and bonds.

When Was E*Trade launched?

E*Trade was founded in 1982 by William A Porter by the name Tradeplus. The broker company has exponentially grown since then and owns great revenues. However, in 2020 the company has been acquired by Morgan Stanley.

How Does E*Trade work?

Not only can you get access to a premium E*TRADE Savings Bank account at a low-fee rate by using this broker company, but even the Securities accounts can be accessed directly from the savings account.

Moreover, the savings account offers an annual percentage yield of 0.05 percent. Max-Rate and E*Trade as checking accounts are also offered by this broker company, and there is no defined monthly charge for the account.

Features of E*Trade

Offering different Trading platforms

There are Two unique trading platforms, E*TRADE: E*TRADE Web and Power E*TRADE, used by the investors, respectively.

Neither Customer activity nor balance minimums are required for services.

This unique feature of E*Trade helps the users work with ease and comfort on both platforms as suited by their needs. It is the reason E*Trade paved its way to the top 5 brokers for free stocks.

Modern design and platform layout

Thanks to its current style and platform structure, E*TRADE broker is surprisingly easy to use.

With a single click, you may move between complex multi-legged options trading with a variety of pre-defined methods and futures trading.

Additionally, you may also identify possible investment opportunities using the Live-action function.

Mobile charting feature

Regardless of the variances, the depth of each mobile app varies from one another, but this broker company offers flawless and easy-to-function mobile charting features that can help you experience the web-based charting interface from your mobile.

How will you benefit from an E*TRADE broker?

You can benefit in many ways. You can get individual analyst ratings in addition to five different third-party research report alternatives for companies if you use this broker company.

Additionally, quick links to the entire analysis and fast report generation are an added benefit of using this broker. Live marketing situations and daily insights can help you manage your investment a lot.

All these benefits recommend E*Trade broker as the top 5 brokers for free stocks.

How to open an account with E*Trade?

To open your account, you need to decide which type of account you want to open in the broken company. There are two types of accounts that are suitable for people with unique requirements.

Brokerage Account – active traders who require zero stock fees.

Portfolio Accounts- includes personalization and consultation, and a fixed account payment is mandatory.

How to Cancel Subscription/ close an E*Trade account?

You can close your account both from the website as well as by using your mobile app. Click on the “Account Services” option and request the cancellation of the subscription.

You can contact customer service through the chat option to help you close your account as well.

Pros

- No ATM fees required; a budget-friendly option.

- Regulatory filing assures reliable service.

- Free streaming quotes

Cons

- Does not provide a market competitive experience compared to other brokers.

- The facility of live broadcasting is not present

Interactive Brokers – Top 5 Brokers for Free Stocks

Active traders are drawn to Interactive Brokers by the company’s inexpensive per-share price, powerful trading platform, a wide variety of trade-able assets, which includes a big number of international equities, and absurdly low margin rates.

Its newest product, IBKR Lite, allows investors to trade equities and exchange-traded funds (ETFs) without paying commissions. It is one of the top 5 brokers for free stocks.

When Was Interactive Brokers founded?

Famously known as an early investor in computer-assisted trading, Thomas Peterffy started Interactive Brokers in 1977 in Greenwich, Connecticut.

Moreover, Interactive Brokers has a global reach, with over 135 market locations.

How Do Interactive Brokers work?

IBKR Pro for professionals and IBKR Lite for beginners use are Interactive Brokers’ two major pricing plans, and respective Casual investors face difficulty working with this broker.

Moreover, due to the institutional investors and hedge funds, minimum commission fees schedules.

Features of Interactive Brokers

Quick Customer Support

You can take guidance from customer care anytime using email, phone messaging, or call anytime.

Moreover, this feature helps you stay in touch with It experts and professionals and keeps your experience smooth and free of complications.

Interactive Broker Offerings

With its unique specialty of providing interactive broker offerings, this broker helps you make the right decision at the right time and invest in the best way possible for your future plans.

Professional Usability

Although it may not be so appropriate for casual beginners, this broker is perfect for professionals because of its Over the top features, two unique platforms, and higher broker education ratings.

How will you benefit from Interactive Brokers?

It provides the widest range of foreign markets in the broker market. The unique ranges of account types can be utilized to invest strategically.

How to Open an account with Interactive Brokers?

Opening an Interactive Brokers account is an easy task. The customer service is top-notch, and as soon you log in to the website, they help and guide you to operate through the web content.

There are four steps to open your account.

- Completing an online form and filling in the details

- Selecting Account Type and installing their app

- Uploading document for verification purposes. These documents include a national id card, bank statements, and necessary files.

- Billing and investments

How to Cancel Your Subscription for Interactive Brokers?

Manage account option and changing the status of your account as closed.

Pros

- Zero commission by the broker

- Strategic execution of investment orders

- With a wide range of global access and a unique variety of assets, Interactive Brokers is a cheap broker to invest in worldwide marketplaces.

Cons

- Is not the best choice for beginners

- Less Handling and educational resources.

Merrill Edge – Best for Daily Trading

If you’re an investor who wants to handle banking and brokerage services in 2021, Merrill Edge is our top option. Because Merrill Edge offers zero-cost stock and ETF transactions, it has earned awards for Best Overall Client Experience and Best Client Dashboard.

This makes it one of the top 5 brokers for free stocks.

When Was Merrill Edge launched?

Merrill Edge, a self-directed trading business of Bank of America, launched in 2010 and had its headquarters in Charlotte, North Carolina.

How Does Merrill Edge work?

It offers an incredible, balanced contribution. Financial backers will see the value in Merrill Edge’s $0 exchanges, vigorous exploration, and solid client support.

Additionally, it works by giving limitless free ($0) stock and trade exchanged asset (ETF) exchanges to users without any significant commission.

Features of Merrill Edge

Commission and fees

Merrill Edge helps in getting stocks for free with zero to minimum commission charges. The fees of the transaction are also fairly low, and using this platform can enhance the chances of you getting free stocks.

Mutual Funds Trade Fee

Getting free stocks always becomes difficult because of the mutual fund’s trade fees demanded by brokers.

However, this broker platform charges zero to very minimum charges that too after a certain amount of period. This special Feature helps investors get their hands on free stocks.

How will you benefit from using Merrill Edge?

One of the most significant and different perks of using this broker platform is getting access to audio segments, including the Audiocast series and Merrill Perspective podcast.

Moreover, investors get in touch with live broadcasting and learn about the international market on a daily basis for free. Research and educational takeaways are a huge plus as well.

How to Open an Account in Merrill Edge?

After logging in to the Merrill Website, clicking on the red menu bar on the top would take you to the option of opening an account.

Moreover, the application page would require you to fill in the necessary details and chose the account type before you get start with the broker.

How to Cancel Your Subscription for Merrill Edge

To cancel the subscription and close your account, there are two options. You can either opt for closing your account temporarily or permanently and explain your reasons to the customer care representative. No fees charges to close the account if not in use.

Pros

- As a Preferred Rewards broker since 2014, the combination of banking and brokerage is fantastic in this platform,

- Includes savings boosts, credit card bonuses, investment discounts, and user-friendly segments that are attractive to investors

Cons

- Does not allow the trading of securities that trade over-the-counter.

- Restrained financial disclosure regarding client information.

CONCLUSION

Different brokers can help you with getting free stocks.

If you are looking for something to start with, Merrill Edge and Fidelity Investments can be suitable as they are the most user-friendly of them.

Moreover, they all have simple instructions to follow and are easy for an amateur to understand.

However, if you’re looking for a professional broker Interactive Brokers may be for you.

E*Trade, however, has a modern design and research authenticity. All of the brokers mentioned can help you get free stocks at minimal rates, but some may charge zero commission and debit card fees at the start.

This may be very beneficial for beginners who are just starting and looking for some experience using brokers.

The closing of an account is also possible by brokers and contacting the customer care service is the easiest option to do so.

One may opt for temporary subscription cancellation or permanent discontinuation. However, some brokers do charge some fees for closing the account permanently.

Before opening an account for free stocks in these broker platforms, one must look for miscellaneous charges, mutual funds free, minimum account balance to have the account functional, and other hidden charges to gain the maximum out of these platforms.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/