In this article, we are going to look at the hot topic: Is Fundrise A Scam

In our previous article of Fundrise Investment Reviews, we discussed what is Fundrise.

Its pros and cons, and whether you should invest in it.

But as I was scouring for details about the real estate investment company.

I found a few pieces of information that are worth mentioning that could potentially affect your decision.

Read this Is Fundrise A Scam article before you invest!

Table of Contents

Is Fundrise A Scam?: How Fundrise Work ?

In Fundrise Investment Reviews, we learned that Fundrise is an online real estate investment company.

It is essentially crowdfunding that allows unaccredited investors to start investing in real estate.

Fundrise opened the barrier of needing huge capital that average investors might not have.

With such a low initial fee of $500, it was a smashing idea back in 2012.

Is Fundrise A Scam: The 2016 Fundrise Scandal

In February 2016, Michael McCord was fired under the allegations of criminal extortion.

According to this SEC filling, MacCord attempted to extort over $1 million and demanded an increase in his shares of stocks of the company..

Benjamin Miller, Fundrise’s CEO, contacted authorities and hired an independent accounting firm.

In order to further investigate the two fraudulent real estate deals that MacCord claims to be.

In a statement, Fundrise said:

Over a month ago, we terminated McCord after what we believe to be a criminal extortion attempt, where McCord threatened to hurt the company by making wild accusations unless we agreed within two hours to pay him nearly $1 million and give him more stock in the company. We took immediate steps to protect our investors by reporting the matter to the Securities and Exchange Commission and the police department, as well as by opening our books to a top-10 independent accounting firm.

To which McCord disputed and sent an email to The Washington Post which states:

The extortion allegations are baseless, and nothing more than a pathetic deflection attempt from the real story. On February 8, 2016 at 10:00 a.m., I repeated my concerns about what I believed constituted serious fraudulent behavior at the company to Benjamin Miller, CEO, and told him that I would not participate in it. We exchanged severance proposals without agreement.

By 11:00 a.m. and without any further communication from anyone, the company constructively terminated my employment by removing me from their website, discontinuing access to essential information systems, removing access to critical company files, and terminating email access.

I have been and will remain willing to fully participate in any legitimate investigation by the SEC or other authorities. The outpouring of support I’ve received from people both inside and outside of the company has been incredible, and I’d like to thank everyone who has reached out.

Michael McCord is a certified public accountant and former senior associate at the accounting firm KPMG.

He declined to further comment on the nature of the alleged fraud.

Is Fundrise A Pyramid Scheme?

Digging around in Reddit, I found a thread asking if Fundrise is nothing but a Ponzi scheme.

So first things first. What is a Ponzi scheme?

A Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors. The Ponzi scheme generates returns for early investors by acquiring new investors. This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers.

jpierce4 1 year ago

I invested $500 in Feb. I simply asked to have it back after the waiting period. Somehow it went from $520 to $480 and said I had to wait 60-90 days then an ominous “and there’s no guarantee you’re getting it back.” The customer service person told me it was like buying a house. No, sorry, you’re holding my peanuts ransom. Glad I did not donate more.

Also the language. “Offering circular” sounds a lot like Tom Delonges “To the stars.”

To which someone replied:

lawn_meower 1 year ago

I think you are confused about what a Ponzi scheme is, and your outrage is misplaced. Yes, real estate is illiquid, but our investments are backed by real assets as opposed to debt, and they’re not as volatile as stocks. You have to wait because that’s just how real estate works. The documentation on their site is really clear and upfront about that, and it’s actually a big selling point.

Besides, with the kind of regulation involved and real-world appreciable assets that you can literally touch with your hands, I just don’t see how it could be faked, or why anyone would go to such elaborate lengths to do so. If they wanted to scam people it would be way easier and much more lucrative to do it with cryptocurrencies.

I have to agree to the commenter since Fundrise deals in real estate, and it is inherently illiquid.

Plus, considering that eREIT is not publicly traded, which gives the term illiquid a whole new meaning.

The company also explicitly stated that there will be a 5% fee for liquidating your investment at that time of posting.

Click Here to Read My # 1 Top Scam: 1450 Club Review

What Are the Fees in Fundrise ?

Fundrise has the right to charge you other fees that may come up such as:

- Management fees – there is a quarterly asset management fee equal to one-fourth of 0.85% of REIT assets. Or at some point up to 1%.

- Origination fees – origination fees up to 2% on each transaction.

- Special servicing fees – a fee paid to the manager for any non-performing asset.

- Disposition expenses – when selling an equity investment, the expenses are charged against the REIT to reimburse the managers like reimbursement of non-ordinary expenses and employee time required to liquidate an equity investment in real estate.

Several fees have been waived or reduced temporarily while others haven’t been taken against but could be in down the road.

FUNDRISE | How Much Can you Make ?

Fundrise fund manager

has the authority, in its sole discretion, to limit redemptions by each shareholder during any quarter, including if the manager deems such action to be in the best interest of the shareholders.

Non-traded REITs like Fundrise have been known to suspend redemptions when lots of investors want to sell.

Fundrise further shared:

from fool.com

The fees and potential gates on redemptions are designed to avoid a scenario in which investors want to liquidate in a down market, forcing the company to sell assets at a discount and lock in losses for shareholders who remain. Investors who buy shares of its REITs should be cognizant of the fact that they may not have the ability to sell their shares of its REITs when they may want to.

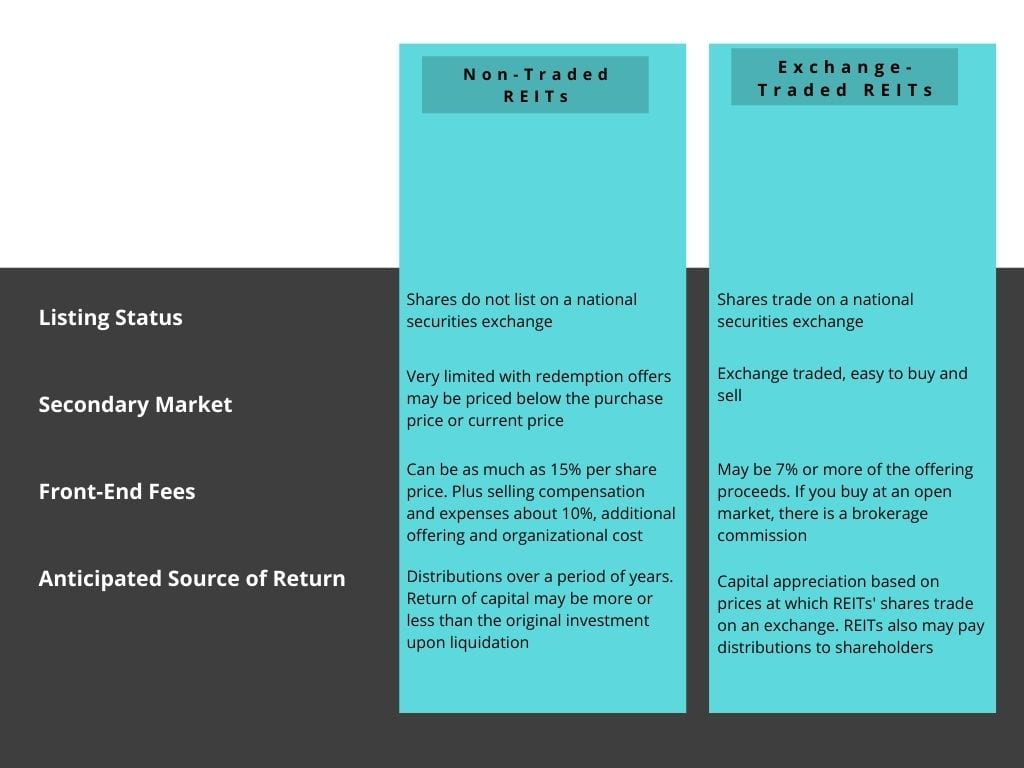

FUNDRISE VS . REIT

Most significantly, as the name implies, shares of non-traded REITs do not trade on a national securities exchange. For this reason, non-traded REITs are generally illiquid, often for periods of eight years or more. Early redemption of shares is often very limited, and fees associated with the sale of these products can be high and erode total return. Furthermore, the periodic distributions that help make these products so appealing can, in some cases, be heavily subsidized by borrowed funds and include a return of investor principal. This is in contrast to the dividends investors receive from large corporations that trade on national exchanges, which are typically derived solely from earnings.

PROS AND CONS

PROS

- Low minimum investment of $500

- It has low fees for managing your portfolio

- It has diversification in its roster of properties

- Quarterly dividends and redemption

CONS

- It is not publicly traded and Fundrise chooses which asset to invest in which means limited liquidity

- Dividends are taxed as ordinary income

- It is possible that liquidation will be denied

- Various fees may crop up during the management of your investment

VIDEO OUTLINE OF THIS FULL ARTICLE

Is FUNDRISE WORTH IT ?

Now that we know what is Fundrise Investment Reviews and presented various points in this Is Fundrise A Scam article.

We also explained what is Supplemental Income in our Fundrise Supplemental Income Review.

Yes, it takes a long time for an investor to see immense returns on their investment.

Early liquidation will also incur fees, as it is their way to safeguard against sudden market downturns.

Also, there are fees that are related to real estate investment that may crop up out of nowhere.

But I can say that Fundrise isn’t a scam in a way that they will just up and leave with your money.

Plus, bear in mind that it is a real estate investment and not publicly traded at that.

By the way, have you heard of The 1450 Club? Now that is a 100% scam.

Don’t fall for it! Start by reading our The 1450 Club Review.

Alternative To Fundrise

If you want a faster return on your investment, then start learning about options and options trading!

And what better way to do it than joining Successful Trading and our traders who win every day!

These are only a few examples of our traders who are making bank! And you could be one of them!

Is Fundrise A Scam? | The Lowdown

$500Pros

- Low minimum investment of $500

- It has low fees for managing your portfolio

- It has diversification in its roster of properties

- Quarterly dividends and redemption

Cons

- It is not publicly traded and Fundrise chooses which asset to invest into which means limited liquidity

- Dividends are taxed as ordinary income

- It is possible that liquidation will be denied

- Various fees may crop up during the management of your investment

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Even after reading your article, I’m still not convinced that Fundrise isn’t just some scam. I mean, I did read your 1450 Club review and they were definitely a scam….but I have tried joining different websites trying to get away from the 9-5 and nothing has stuck so far, so maybe I’m just too cynical.

Hello my friend,

I know how frustrating it can be when looking for accurate information on a product on the internet.

There are certainly some good products out there to help you with your quest to abandon the 9 to 5.

We really hope you will find one shortly.

Thank you for your Feedback and honest opinion on Fundrise product.