FOMC Meetings provide opportunities for day traders to make moeny.

You can leverage this full study of market volatility around FOMC Minutes.

My aim is to help day traders, swing traders alike to maximize their profits by properly learning how to trade FOMC Meetings.

My goal is to update you here with our FOMC Trades in our Discord Room going forward.

Here are the most upcoming dates. You can click on a date to go directly to that section.

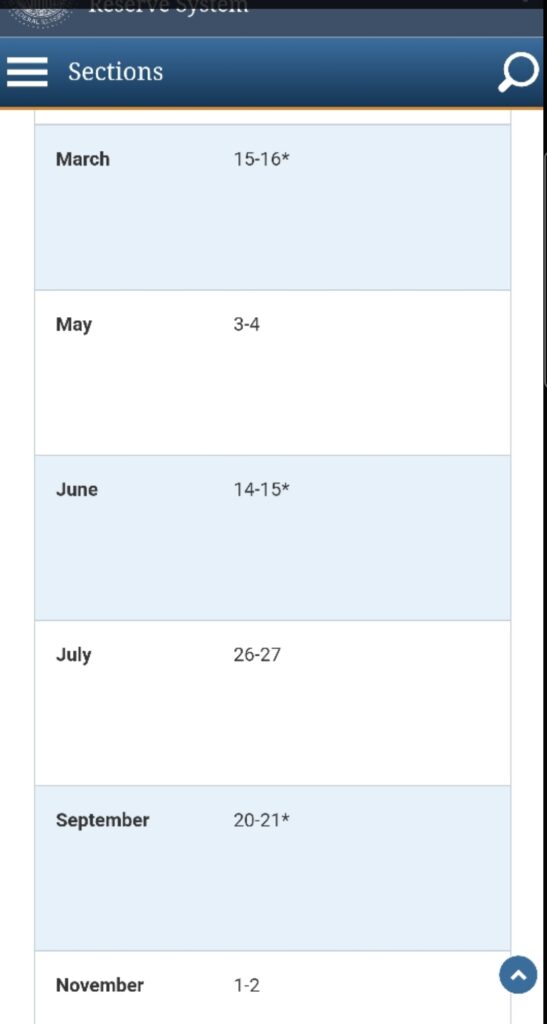

FOR 2022: MARCH 15-16 || MAY 3-4 || JUNE 14-15 || JULY 26-27 || SEPTEMBER 20-21 || NOVEMBER1-2 || DECEMBER 15

Table of Contents

How To Trade FOMC Meetings | What Is FOMC ?

I have been trading since 2014 and FOMC meetings by far provide the single one day highest volatility in the markets.

For options day traders, this is a great opportunity to make great profit in a very short time.

What Is FOMC Role?

FOMC stands for Federal Open Market Committee.

It was created in 1933 by the Federal reserve. The members determine the economic policies to ensure an efficient market.

The main role of the FOMC is to determine the interest rates and set the gauge for a measured inflation.

In recent years, these decisions have made the markets very volatile.

How Often Does the FOMC Meet

The FOMC set a yearly calendar for 7 to 8 meetings.

Here is the schedule for 2022 for example.

Some of the meetings (with an asterix next to the date) indicates that there will be economic projections data provided.

When Is The FOMC Meeting

The FOMC Meeting is a 2-day event starting on Tuesday that is concluded on Wednesday with the interest rate decision announcment.

Interest rates have been flat from 2018 until March 2022 when Fed Chair reveal the 25-basis point increase.

FOMC MEETING TRADING

At 2PM Eastern time on the second day of the FOMC Meeting (this is always on a wednesday), traders receive the FED decision on interest rate and others economic statistics.

The only thing that matters is the market reaction to that interest rate decsion.

But that is not all.

30 Minutes later, starting at 230PM EST, the Fed Chairman holds a Press Conference with a statement followed by questions.

Here is a chart of our favorite ETF QQQ on how it reacted exactly at that interest rate announcement at 2PM EST.

Should You Trade During the FOMC Press Conference

From the 15minute chart above, we can see that volatility jumps off at 2PM EST.

By my experience, the initial direction of the market is very often not the right one.

This is called a head-fake in day trading.

That is exactly what transpired on March 16 2022 with the big red candle and price posting a low of the day below the Bollinger Bands.

Beware of FOMC Head-Fake

Therefore, if you are a beginner trader and have not witness market reaction to FOMC before, you may be in for a big surprise.

Otherwise, you should absolutely take advantage of the violent reaction of the stock market to FOMC during the Press Conference.

Every single word the Fed Chairman pronounces is interpreted by the Algortithms with a buy or sell signal.

More Interest Rate Hikes to Come in 2022 and Beyond

HOW TO TRADE FOMC NEWS

With the FOMC decision on interest rates, certain stocks should fare better than others.

At least on paper, one would understand that if the cost of borrowing money goes higher, companies with good financial records ought to be benefit.

Banks And Financial Stocks

Who better to benefit from higher interest rates than the banks that actually provide loans to businesses ?

Here are the banks we like to trade when interest rate are higher:

- Wells Fargo (Ticker : WFC) is a $50 stock that provides a great opportunities for options traders

- Bank Of America (Ticker: BAC) is another cheap stock with a nice Option chain traders can benefit from

- My third pre-feered bank to trade is JP Morgan -Chase (Ticker: JPM) even with its higher price in the $150’s.

Are Higher Interest Rates For Tech Stocks

Common knowledge has it that tech stocks should be at a disadvantage with higher interest rate.

However, given the growth and amount of capital these companies already have, there is no clear evidence to me that you cannot trade these.

Au contraire, with options trading, should tech companies become bearish, we can easily benefit with puts options.

My recommended Top Tech Companies to trade during FOMC Meetings:

- NVIDIA (Ticker: NVDA) is by far the standard technology company with massive recent growth

- Block previously known as Square (Ticker SQ) has fallen below $100 briefly before a recent melt up

BEST ETF TO TRADE AROUND FOMC MEETINGS IS QQQ

I have stated previously that the FOMC Announcements are always on wednesdays at 2PM EST.

This means that there is 2 hours left for same day expiration for ETFs such as VXX, IWM, SPY and more importantly QQQ.

QQQ Study After FOMC Meetings Since 2021

I studied the reaction of QQQ for each FOMC Meeting since in 2021.

The chart is included on the Table below with my commentaries.

| January 17 2021 | QQQ FOMC Reaction starting at 2PM EST |

| March 172021 | QQQ FOMC Reaction starting at 2PM EST |

| April 28 2021 | QQQ Reaction to FOMC Statement Starting at 2PM EST |

| JUNE 16 2021 | QQQ Reaction to FOMC Statement Starting at 2PM EST |

| SEPTEMBER 22 2021 | QQQ Reaction to FOMC Statement Starting at 2PM EST |

| NOVEMBER 3 2021 | QQQ Reaction to FOMC Statement Starting at 2PM EST |

| DECEMBER 15 2021 | QQQ Reaction to FOMC Statement Starting at 2PM EST |

| JANUARY 26 2022 | QQQ Reaction to FOMC Statement Starting at 2PM EST QQQ head faked to the upside by up to $3 from 353 to 356.88. Then it reversed during the Press conference by posting three consecutive 15′ red candles for a low of the Day at 341. This means that you could have traded Puts from $356 to $341 in just an hour. The Payout on those options was huge. Clearly over 10-Baggers. |

| MARCH 16 2022 | QQQ Reaction to FOMC Statement Starting at 2PM EST QQQ head faked to the downside by up to $3 from 335 to 328.4 Then it reversed during the Press conference by posting four consecutive 15′ green candles for a high of the Day at 340.4. This means that you could have traded Calls from $329 to $340 in just under 90 minutes. The Payout on those Calls options was huge going from 3 cents to$1.27. Clearly over 10-Baggers. |

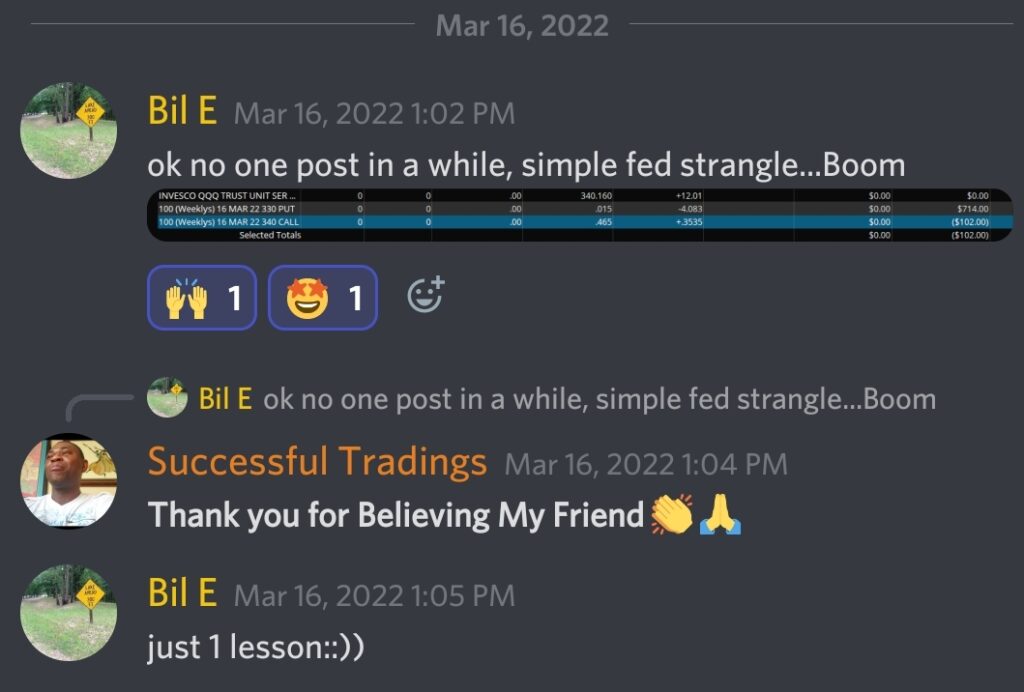

New Trader Makes 600% Trading First FOMC In Our Discord Room

Here is how a brand new trader leverage our FOMC Study on QQQ to make 600% profit on his first trade.

FINAL THOUGHTS ON HOW TO TRADE FOMC MEETINGS

I summarized how to trade options around FOMC Minutes with QQQ ETF.

Every serious trader should consider taking advantage of this strategy to increase their account profits.

||Source: Federal Reserve Committee

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/