Protecting your gains in stocks and Options trading is a very powerful technique.

In this tutorial on how to Use Trailing Stop on E*TRADE, you will learn how to easily do that so that you can start growing your account consistently.

Table of Contents

How To Use Trailing Stop On Etrade | What Is a Trailing Stop ?

A trailing Stop or more precisely a Trailing stop order is an order that will execute only when your predefined condition is met.

Many traders have contacted recently on this confusion topic.

It usually goes something like this.

Hey, Telex, I cannot close my position on E*TRADE because the platform is saying that I do not have it.

9 times out of 10, the reason for 10 is because there is a trailing stop order already in place.

Many traders seem to forget that a Trailing stop is a condition order.

Background Story on Trailing Stop YouTube Video

Therefore, once you put one in place, you cannot go and try to close the same position before canceling your previous (conditional) order.

If you are a beginner trader, this concept of Trailing stop may be tricky at first, but it is not.

True Story: A trader from Florida contacted me a few months ago after researching tutorial on Trailing Stop on YouTube.

He could not find anything satisfactory.

His request was for me to teach him how to use Trailing stop in general.

So, I showed him on ETRADE (that is the platform I use) how to use Trailing Stop% and Trailing Stop $.

At the end, the trader suggested that I make a video on this topic because there were not that many good ones.

I wish I would have recorded our Live session.

Nevertheless, I recorded a video on that day on YouTube title: How to Use ETRADE Trailing Stop percentage vs Trailing Stop $ on Power E*TRADE.

A week ago, another trader Mr. Charles from Texas joined our Discord group on his appreciation of that video alone!

Yet, I told him I still needed to write a full tutorial on successfultradings.com blog.

Here we are 🙂

How To Use a Trailing Stop Order to Close a Position

The concept of trailing stop means you are tracking the evolution of the price.

Imagine you are trading a stock you bought at $100.

Then the stock move bullishly in your favor to 110.

So now, you are making $10 profit per share.

If you want to be able to get as much profit as possible without risking some of the money to have already made, then you can use a Trailing Stop to track the price movement of that stock as it goes higher.

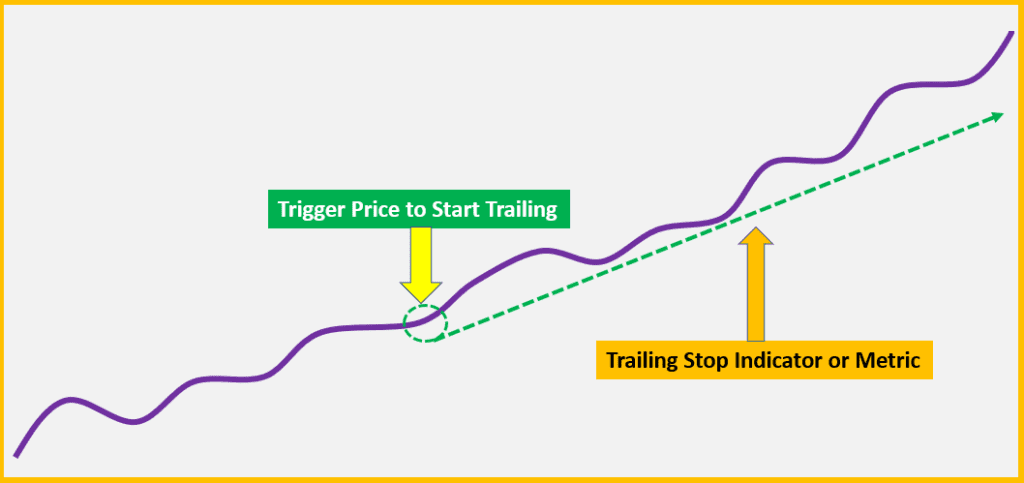

Below is a view that depicts the scenario of a Trailing Stop to help you protect your profit on this trade.

In our example of a stock purchase of $100, the trigger price would be $110 to start trailing.

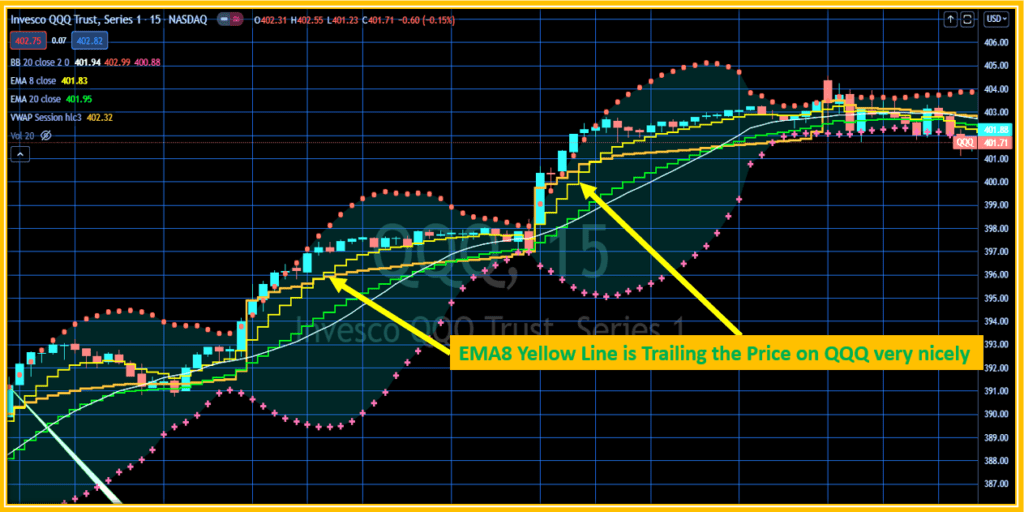

You will trail with a metric or a technical indicator: Moving Averages are good trailing indicators as depicted on the first chart with the 15′-minute chart of QQQ.

How Does ETRADE Trailing Stop Work for stocks?

ETRADE allows you to use the ETRADE Trailing Stop percentage and ETRADE Trailing Stop $ for stocks.

This means that you can specify your Trailing Trigger (this can be a technical indicator if you are doing this manually) as a percentage or as a raw dollar amount.

In either case, the concept is fairly straightforward.

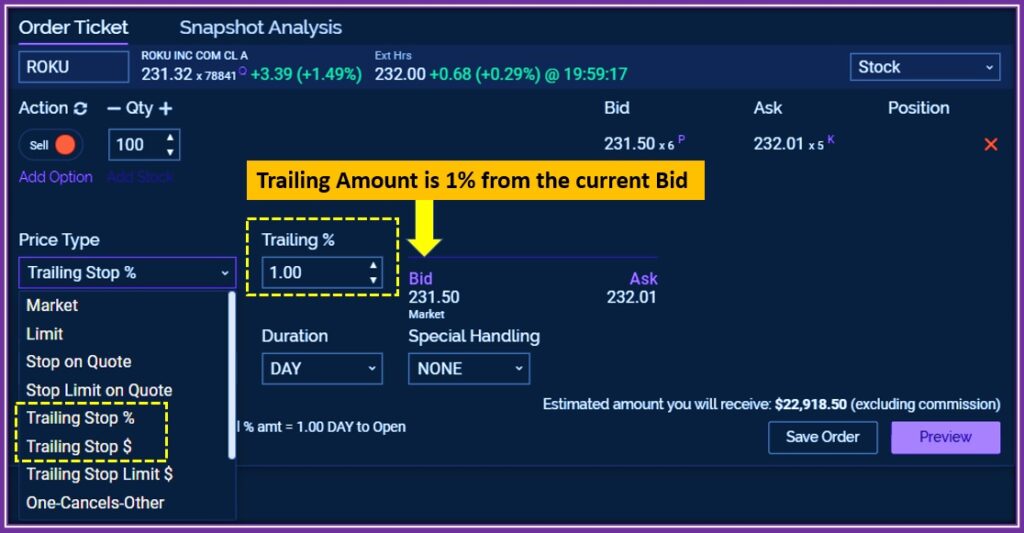

In the view below, I selected the ETRADE Trailing stop percentage for Roku Stock.

ETRADE Trailing Stop Percentage vs. ETRADE Trailing Stop $

Remember that the Trailing Trigger is dynamic which means that it is updated as the price changes.

Here is how it is calculated.

- The initial Trailing Stop Trigger is calculated as the [Current BID – Trailing amount (in % or $)]

- We are always trailing in reference to this BID price

- As the BID price goes higher or Lower, the Trailing Trigger is updated

Since the current BID is 231.50 and we are trailing 1% from it, that means that our Trigger for execution will be when the price reaches 231.50 – 1% of 231.50 = 231.5 – 2.315 = 229.185

Therefore, as long the price of the stock continues to go up from this starting point, you will be making more profit.

Should the stock price come down by 1% from the last BID price, you Trailing stop order will triger.

Your stock position will be sold at the Market price.

This is very important to know. We will address this in the subsequent paragraphs.

Some traders prefer the Trailing Stop$ because it does not require any other calculation like the Trailing% to convert into money.

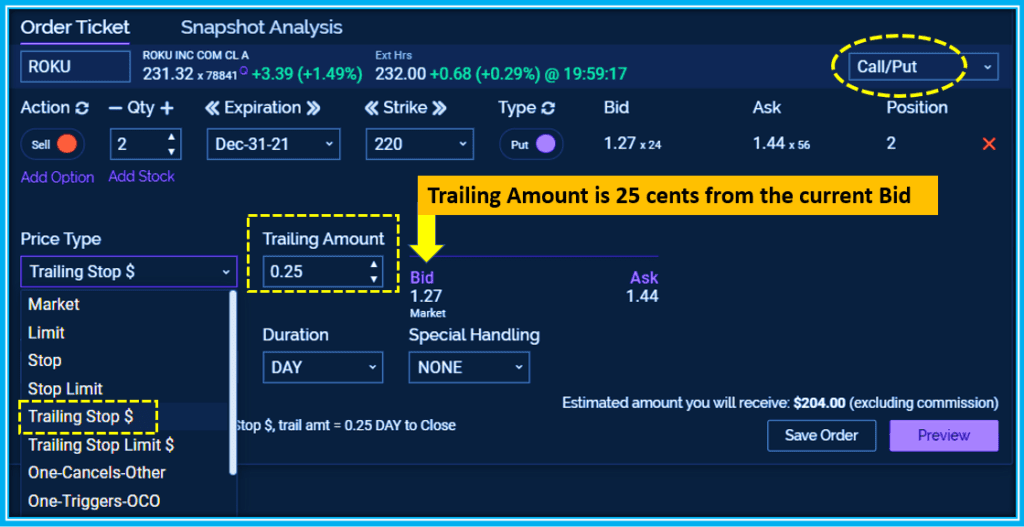

How To Use ETRADE Trailing Stop on Options

In order to use the ETRADE Trailing stop on Options feature, you will have to choose Trailing Stop$.

ETRADE does not offer the Trailing Stop percentage on Options.

Not sure exactly why.

I can only suspect the fact that option prices are decimal number thus it can avoid confusion for some traders to deal with percentages.

In the above view, I am setting up a Trailing Stop for 2 Roku Puts contracts.

I want to trail 25 cents away from the BID.

At the start here, my trigger is: $1.27 – 025 = $1.02.

Therefore, if the price drops to $1.02 right after my setting the Trailing stop, it will trigger and my contracts will be sold at the market price.

Whatever that price is.

Yes, we do not know the execution price of a Trailing stop order.

It can be well above the trigger price just as much as it can be lower than the trigger price.

What I am looking for here is for the option contract to continue going higher such that the trigger price.

How To Use a Trailing Stop Order to Open a Position (Buying)

Some traders use the Trailing Stop for buying positions.

This is not common but can be done in a similar manner.

An example of scenario could be you want to go long on a stock.

You are waiting for it to confirm its bullish direction.

Hence, you will trail the price until the Ask price to become greater than a certain price level.

In such a case, the trail amount can be the difference between that price Level ( VWAP or EMA8 re good examples) and the current price.

When Can You Use the ETRADE Trailing Stop

Most traders employ the Trailing Stop to close (sell) positions they are already making some good profit on.

It is an easy way to manage a position once you have already taken some partial profit and looking to make more money.

Also, for traders who may not be in front of the screen to manage their positions live, Trailing Stop re a good way to track the action.

It should be noted that a Trailing stop can works just as a standard static Stop loss when the position goes against you.

What Is a Good Trailing Stop Percentage on Options

More and more traders have been asking me in my Discord Room how to implement Trailing stop percentage or Trailing stop amount in dollars ($).

In order to help options traders to find a good Trailing Stop percentage, I created the table below as a reference guide based on the Reference price of the option contract.

- FULL DETAILED TRAILING STOP EXAMPLE ON ETRADE ON LIVE TRADE

- IT IS A CONDITIONAL ORDER

you are telling the system to execute this order when a condition is met. Example> You bought 1000 Contracts of QQQ DEC31 408 Calls @ 0.50 then, contract went to 1.05 so you are making 0.55 of profit

or 110%.

You want to protect this profit but want to ride it for more - You initiate a Trailing Stop with 25 cents as trailing amount.

- WHEN IS THIS CONDITIONAL ORDER ACTIVATED?

BID =1.04 <<<====>>> Calculate the initial Trigger = Current bid – Trail_amount

ASK =1.10

- WHEN IS THIS CONDITIONAL ORDER TRIGGERED?

Initial_Trigger= Initial_Bid ($1.04) – 0.25 = 79 cents

At some point: BID price is going to change and the TRigger

will automatically update !!

IF BID= $1.5 ===> then Our Trigger become $1.5 – 0.25 = $1.25

- WHEN IS THIS CONDITINAL ORDER EXECUTED ?

it is excuted when the price retreat by 25 cents from the dynamic trail - HOW IS THIS CONDITIONAL ORDER EXECUTED?

This order is ALWAYS EXECUTED AT THE MARKET PRICE !!!

As a reminder, the reference price is the initial bid price of you contract at the time you are activating the Trailing stop.

Example: If the contract is worth $1 Bid and 1.04 Ask price, you reference is that Bid price of $1.

That is the price you will be trailing from.

The table below gives you the % to trail by as a function of the reference Bid price of your option contract.

| Reference Bid Price | Suggested Trailing Stop% | Suggested Trailing Stop Amount ($) |

|---|---|---|

| Less than 15 cents | 50% | 7 cents |

| Less than 30 cents | 40% | 12 cents |

| Less than $1 | 25% | 25 cents |

| Between $1 and $2 | 20% | 30 cents |

| Over $3 | 15% | 40 cents |

| Over $4 | 10% | 45 cents |

| Over $5 | 5% | 50 cents |

In conclusion, a good stop loss percentage if a function of your risk appetite. While it is okay in stock trading to use a percentage between 2% and 5%, in options trading, a good trailing stop percentage will vary between 5% and 50% depending on the cost of the contracts. I typically use a trailing stop percentage of 30% in trading weekly options.

Risks Of Trailing Stop Orders

Over the years, I have heard my share of horror stories with Trailing Stop Orders.

Quite often, these are due to lack of understanding about Trailing Stop orders.

Here are the few instances where you can be vulnerable to a Trailing Stop.

Stock Splits

If you happen to have a Trailing Stop on a long-term position, a stock split will definitely affect your Trailing Stop Trigger.

Here is how.

Using recent example of stock splits for AAPL and NVDA.

Both were 4:1 split meaning that the price was divided by 4 overnight.

The very next day, the new BID price – Trailing amount would have immediately triggered the execution of that order.

Join Our 10-Baggers Trading System Today | Click Below

When a Stock is Halted

Similarly, when a stock is halted for trading, there is a great uncertainty where it will open after the halt.

Hence, you should be carefully with Trailing stop in this scenario.

After a Stock Gap Up or Down Overnight

Overnight Gaps up and Gaps down can change the BID price significantly.

If you are holding a stock that gaps down, there is a very high probability your Trailing stop will trigger.

Of course, it makes sense for it to trigger.

The issue is the uncertainty of the sale price after the order is executed.

All Trailing Stop order are executed at market price which means that there is great uncertainty about the execution price every single time.

Very Volatile Stock Market

A very volatile market or stock is vulnerable to Trailing stop order.

Such is often the case for cheap stocks or penny stocks.

I try to reduce this possibility by trading stocks that are at least $15.

This should not be a deterrent for you to trade some affordable stocks out there but just be aware when setting up Trailing top order in those instances.

Lack of Liquidity

Lack of liquidity is when there is market for the stock you are trading meaning there is no bid.

Imagine then what can happen especially at the open for such stocks.

It will be very difficult to set a Trailing stop amount in this case.

Step By Step Video on How to Use ETRADE Trailing Stop

In this video, I showed you how to use ETRADE Trailing Stop percentage and Trailing Stop dollar amount from my trading platform ETRADE.

Hopefully, your feedback will be as positive as for the many who have enjoyed it so far.

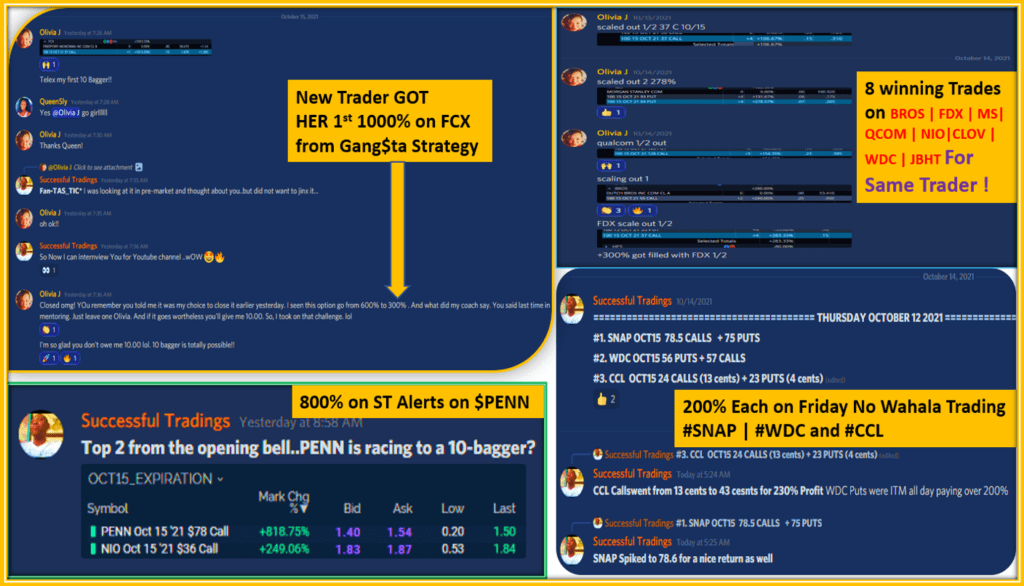

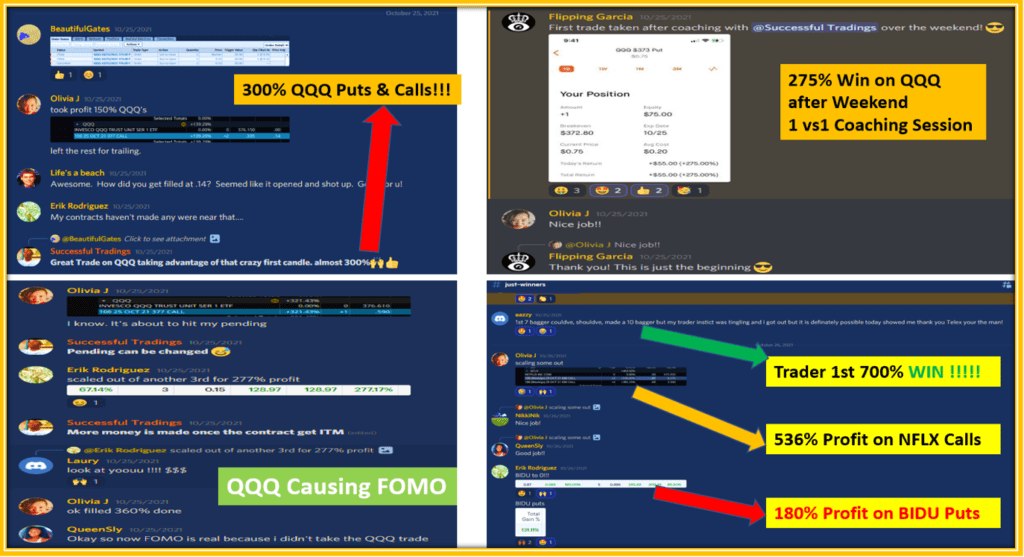

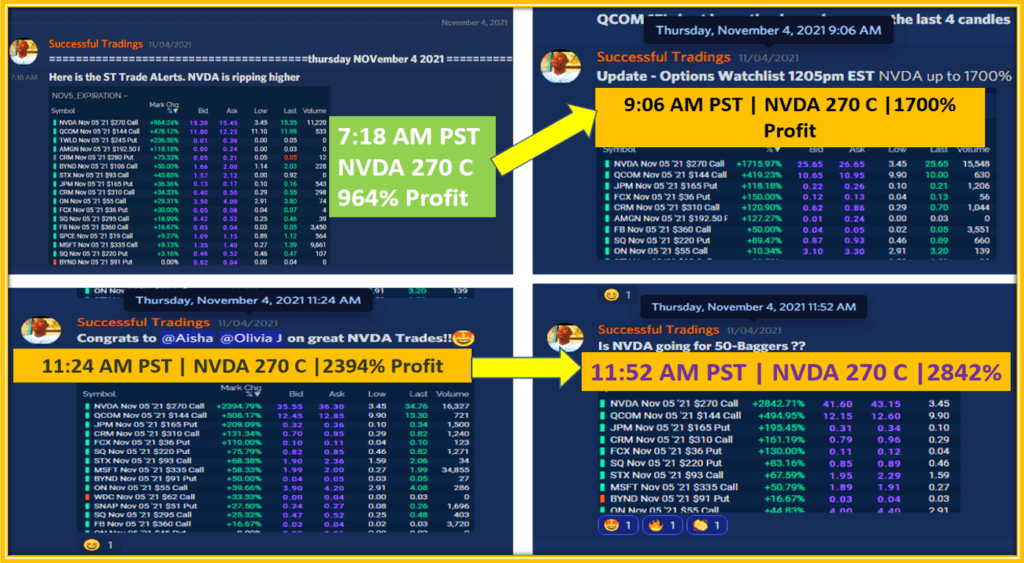

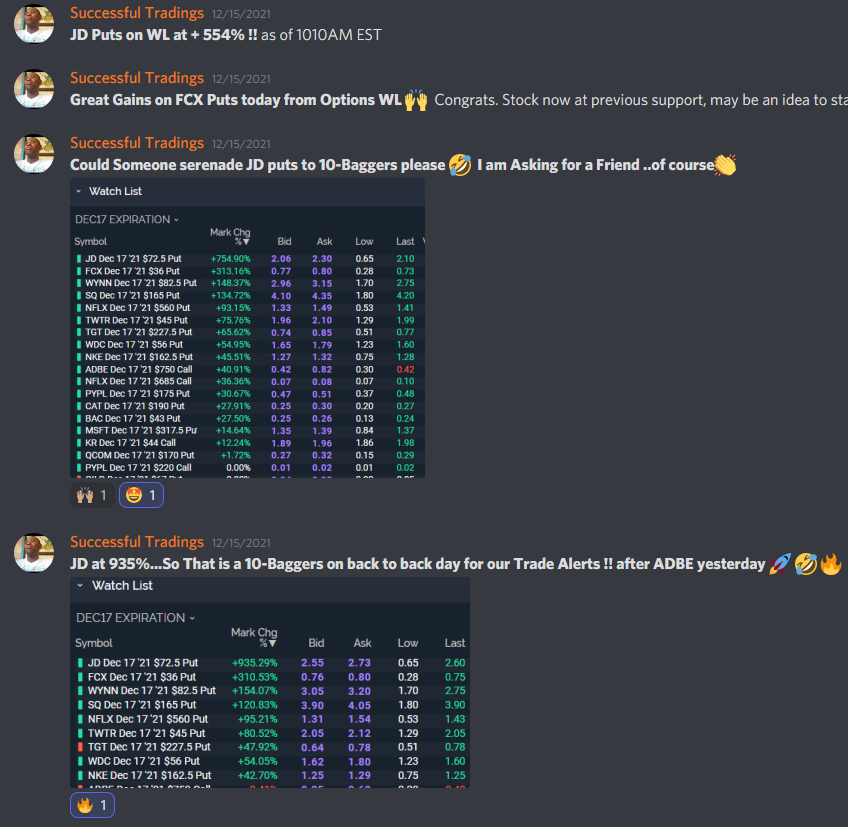

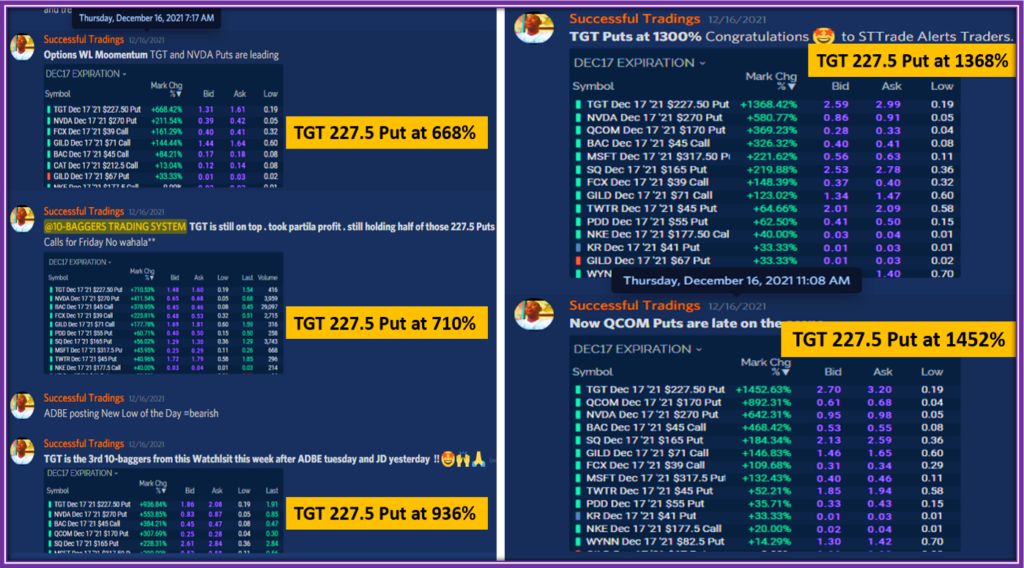

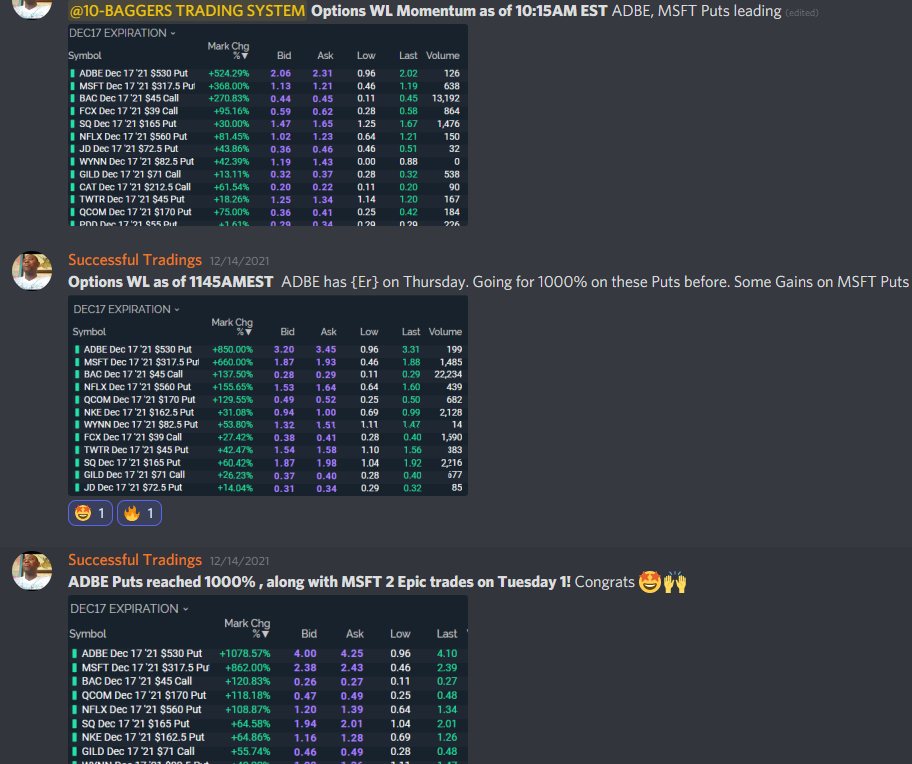

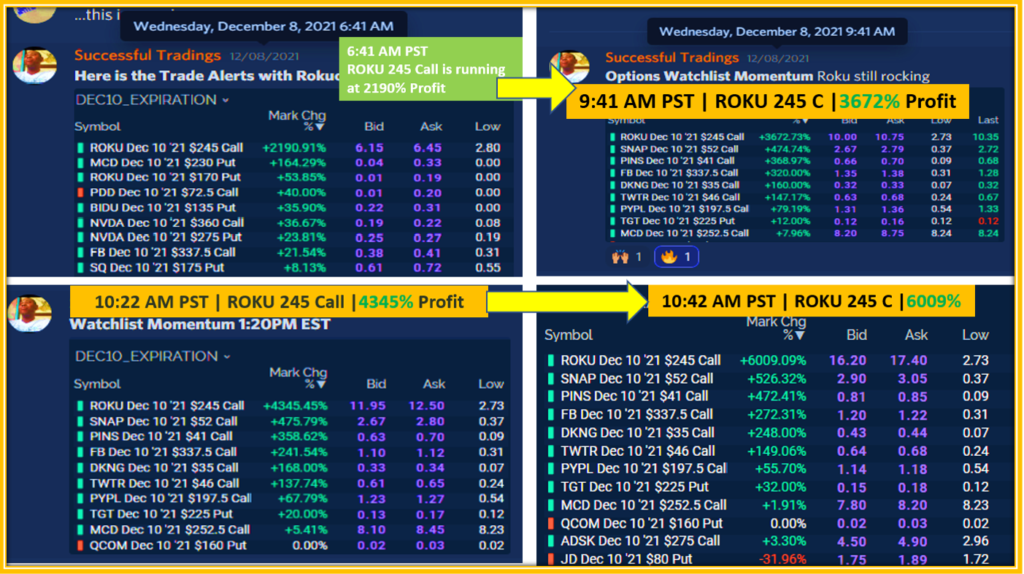

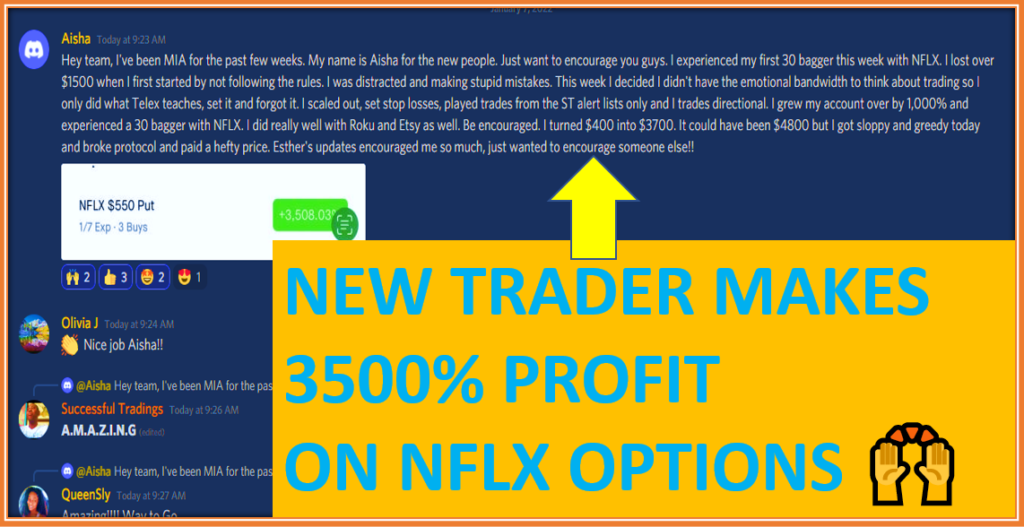

Traders in my Discord Room have been leveraging this technique recently to make 10-Baggers profit trading options.

Good Alternatives to Trailing Stop Loss

If you do not want to setup a Trailing Stop order because of some of the limitations above, you can resort to setting up other conditional trades.

In ETRADE, you can setup a limit order that is triggered based on your predefined conditions on the price of the stock.

The advantage of this method over the Trailing Stop is that market makers do not get to see your order.

It is highly believed that market makers love hunting for Stop Loss so that they can stop traders and then move the price in their desired direction.

Best Trailing Stop Strategies

- ATR Trailing Stop mt4

- Binance Trailing Stop

- Successfutradings.com Trailing Stop Loss – TBD

Webull Trailing Stop Loss

Webull Trailing stop feature is not fully complete yet.

TBD. Coming out soon.

FINAL THOUGHTS on ETRADE TRAILING STOP LOSS Percentage and $

Now that you have mastered how to protect your profit with trailing stop, allow me to introduce you a great way to consistently reach those profit you will need to protect.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/