Since its creation in 2017, FlowAlgo has been the leading Options Flow platform.

Recently, more and more FLowAlgo alternatives have surfaced as direct competitors.

In this Tutorial, we bring you the Top 10 FlowAlgo Alternatives with emphasis on what makes each one of value to the traders.

Table of Contents

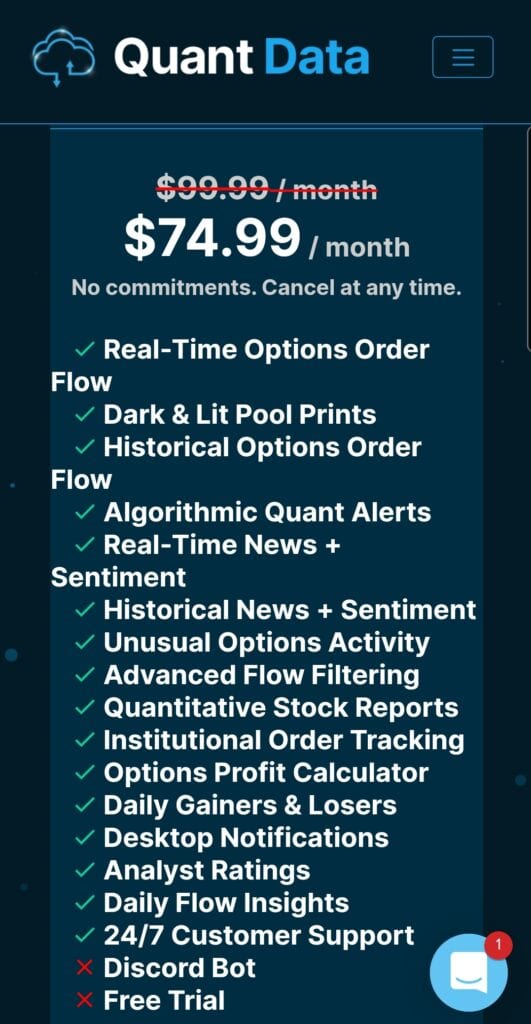

Top 10 FlowAlgo Alternatives | The Standard

In any business, you know that that you have a great product when your competitors try to emulate your offers.

Such has been the case for FLowAlgo recently.

I have been (and continue to use) Flowalgo since September 2017 when it first launched.

The value this tool brings to retail traders is unmeasurable.

The Obvious Edge

You may know by now that FlowAlgo provides traders with Live Option Flow trades that big institutions (known as the Smart Money or The Big Sharks) are trading.

The gameplan for retail traders is as simple as follows.

If the Smart Money is willing to put so much risk on an option trade, chances are they know something upcoming that will drive the value of that option price higher.

Therefore, retail traders can follow the Smart Money and benefit from these Option Flows.

The Potential Snare of FlowAlgo Option Flow

There are corner cases in the above scenario of following the smart money that can lead retail traders astray.

One such instance is that one can build an option trade with multiple legs.

Example, a call and a put., also know as a strangle where one of the leg is the primary position and the other leg is the hedge or protection.

Assume that you happen to be following the wrong leg of that trade.

Consequently, you may loose money by the time you realize your misfortune.

Hence, I have always taken the Option flow side of FLowAlgo with a caution since we do not have a full visibility of the Smart Money entire trade.

How Can FlowAlgo Help your Trading?

Often traders forget about the equities side of FLowAlgo.

The tool provides stock transactions on which the SMART Money invests much higher amount of money than on the Option Flow.

By my experience, this is where you will find the hidden gems.

You can benefit from the Equity print of Flow Algo by waiting for the stock to pick a clear direction after the print.

The rule is as simple as if the stock is trading above the price of the transaction, we are bullish and if the price is below the price of the transaction, we are bearish.

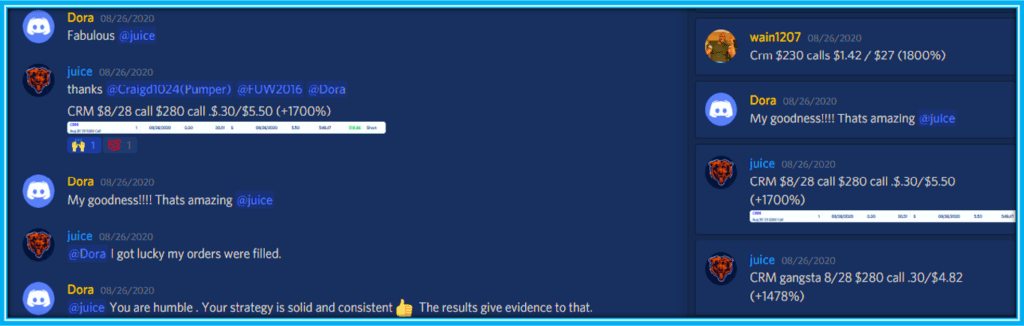

CRM 1800% Gains in Less than 24 Hours

On October 25, 2020, just an hour before Earnings, CRM stock posted a 7Million Equity print from Flow Algo.

I quickly shared that information with the traders in our Discord Channel.

Less than 24 hours following the after-hour Earnings release and the huge gap up of CRM stock, we all enjoyed huge profits on CRM calls we traded before the market close.

Traders made even more money with the confirmed direction using our 10-baggers Trading System .

Some of the gains ranged from 1478% to 1800% as depicted on the view below.

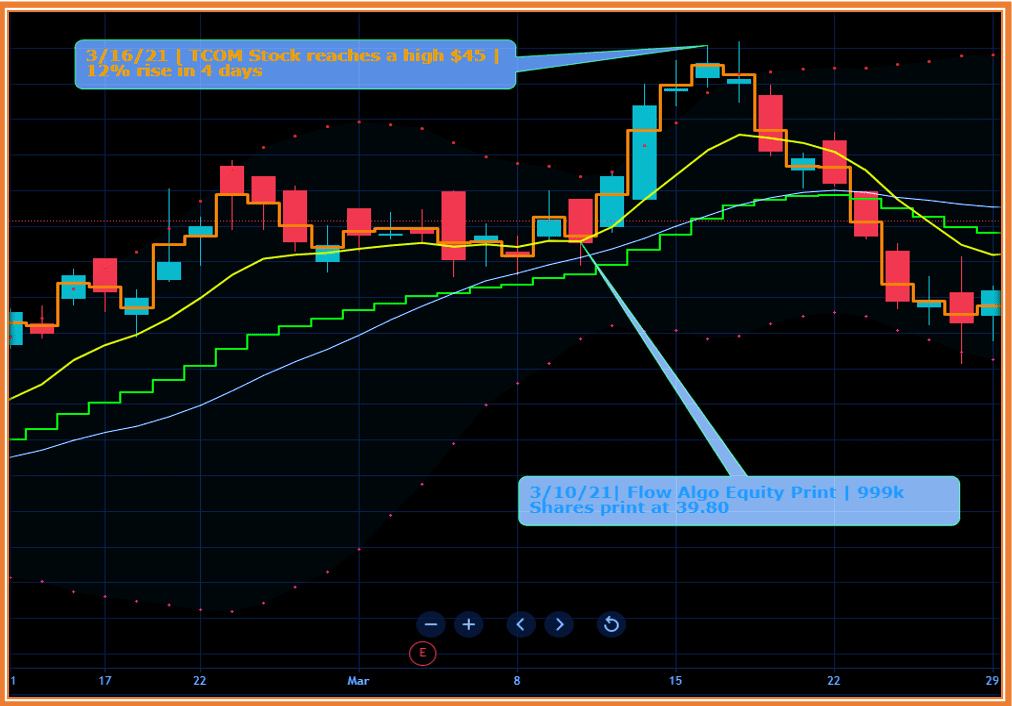

TCOM Stock 12% Rise in 4 days

On our FLowAlgo videos Playlists on YouTube, I have been featuring multiple examples of Flow Algo Equity prints leading to massive gains in Options Trades.

Here is another recent such example with TCOM Stock.

Following a 999k shares equity print, the stock rose 12% in 4 days as shown the TradingView Chart below.

The options payouts were huge.

I traded the 42 Calls expiring MArch19 because the stock only offers monthly expiration.

Top 10 FlowAlgo Alternatives | Cheddar Flow The Challenger

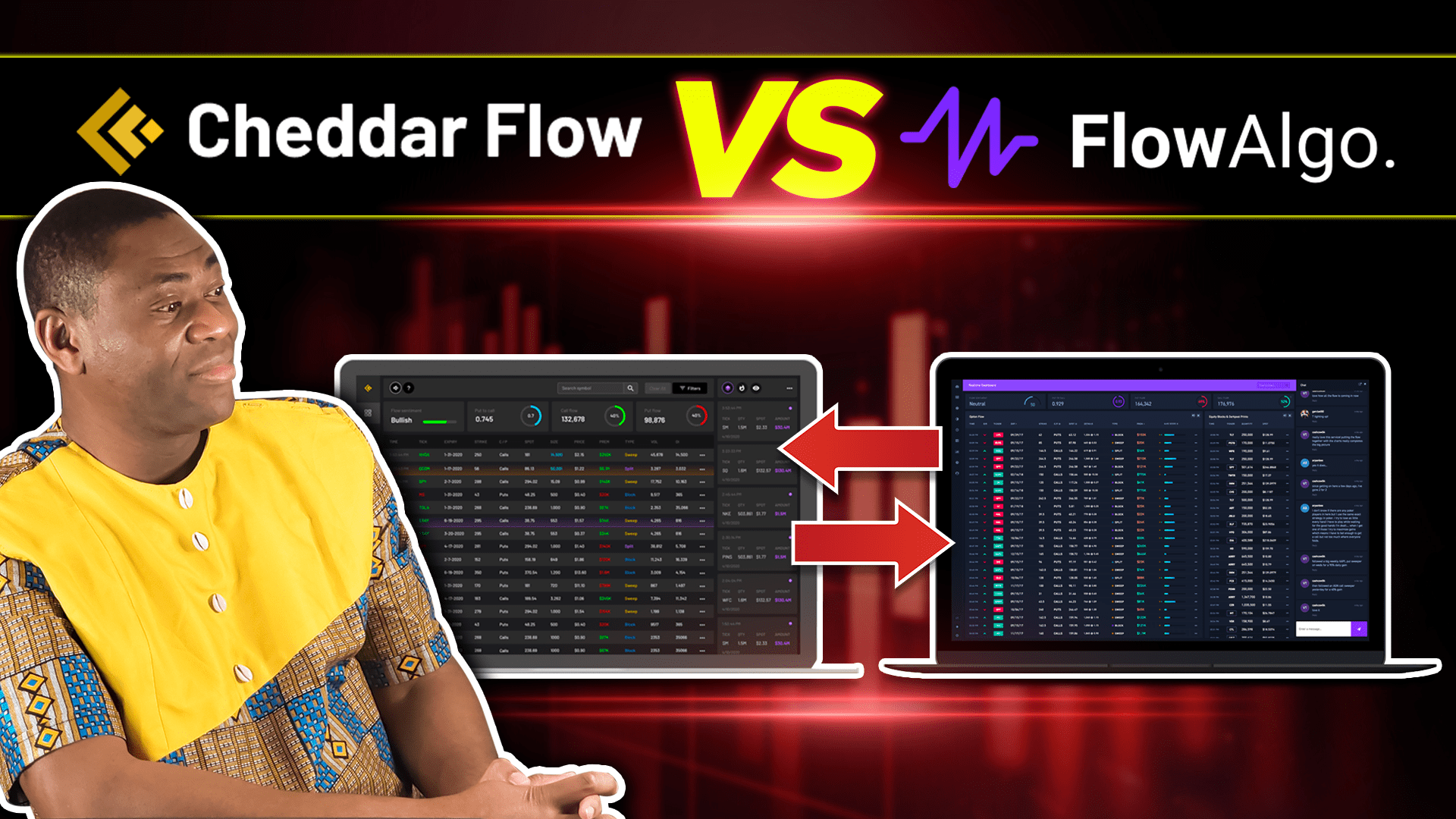

Cheddar Flow is a clear Copy of FlowAlgo as we summarized in the video comparison on our YouTube channel.

The price difference may lure you into Cheddar Flow but at the end of the day, the layout and features do not offer a superior value compared to its predecessor.

Check out the video for a full insight into Cheddar Flow offerings.

Number 2 Alternative To FlowAlgo | Blackboxstocks

Blackboxstocks is certainly the most active in social media.

The feedback I usually get from traders is the User Interface (UI) not being all that friendly.

In the Cheddar Flow vs Blackboxstocks article, we take a side-by-side measure of the two closest FLowAlgo Alternatives.

The video summary review of Blackboxstocks vs Cheddar Flow is shared below for your education.

FLowAlgo Alternative # 3 | TRADEUI

Tradeui comes with a little bit more variety that the previous two competitors.

It ambition is too provide more than just Option FLow to the retail traders.

The features ranges from:

- Market Overview

- Realtime Option Sweeps

- Unusual Option Flow

- Technical Setups

- Sweep Setups

- Insider Activity

- Real Time News

- Free Discord Room (Normally at $35/month)

All of this from the initial Trader plan will cost you $85/month.

While we appreciate the extra features Tradeui comes with, some of the are not related to the primary mission of telling traders where the Smart money is putting their money.

Here is our detailed Tradeui Review video.

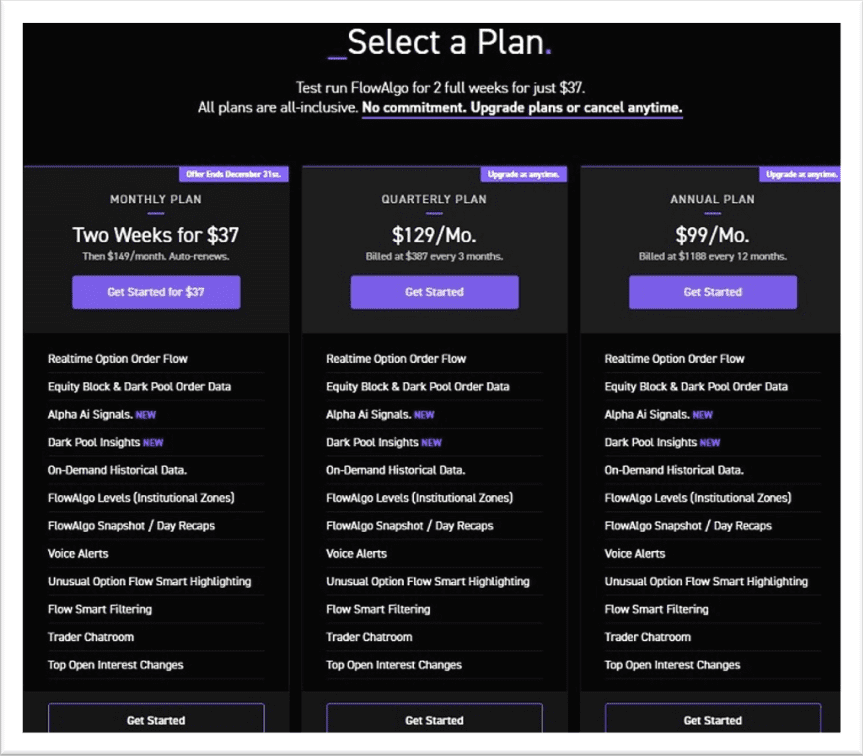

QUANT DATA vs FLowAlgo

Quant Data brings retail traders Real-time Options Order Flow as well as Dark Pool and Dark Prints.

It offers three plans you can select from.

- Standard – $75/month

- Professional – $106/month

- Discord Bot – $149/month

FlowAlgo Free Alternative | AIDED TRADE

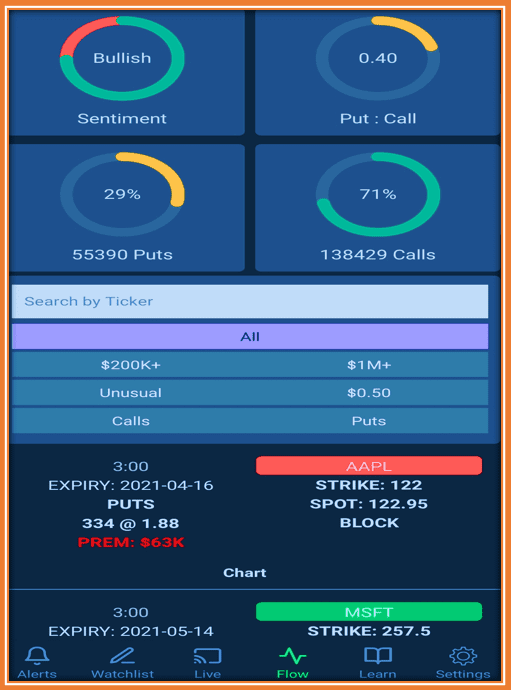

Aided Trade is a FlowAlgo free alternative you can download on your mobile App.

The mobile App is available for both Android and iOs users.

It features a group of traders who want to better themselves and create a community of educated investors.

You will learn live by asking questions to other like-minded traders while tracking the Live Options Flows.

Inside the Options Flow tab of Aided Trade, there is now an icon to open a chart for that stock.

Given the free nature of this Aided Trade, you will have to strongly rely on the generosity of other traders to improve your skills.

Also, you can only become as good as the traders around you.

Which begs the question is Free really worth it?

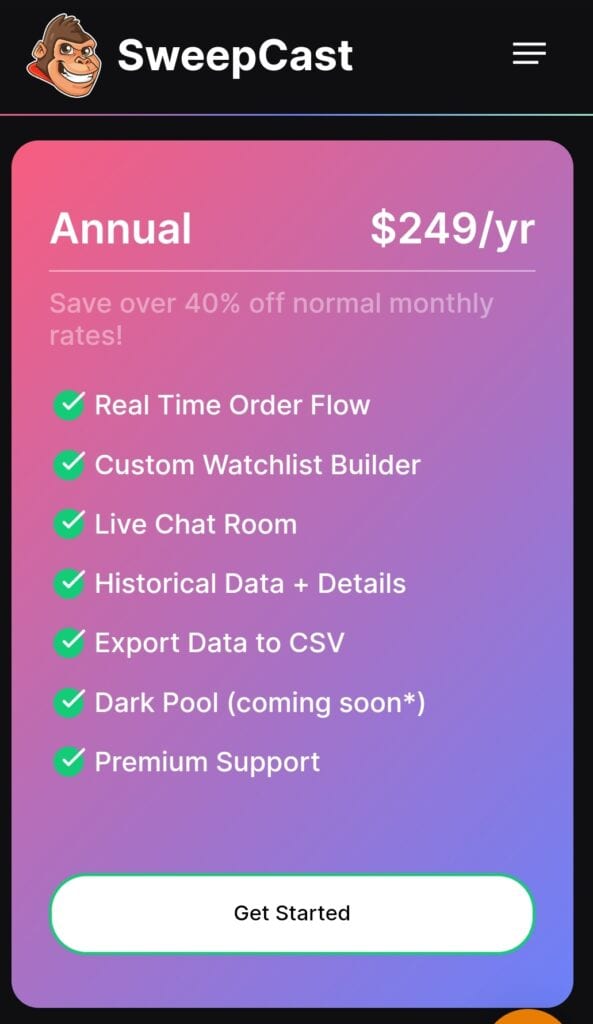

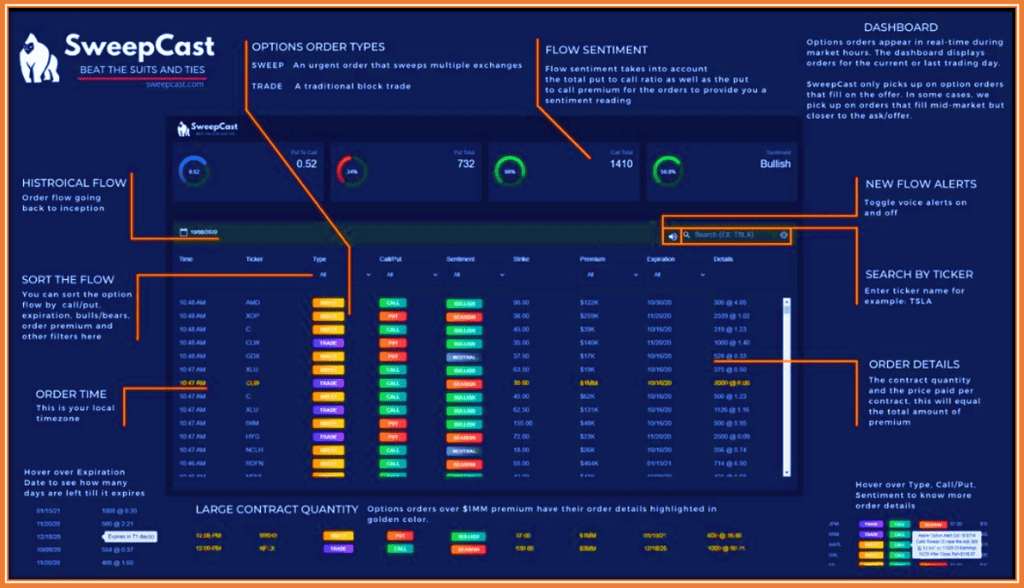

Sweep Cast vs FlowAlgo

SweepCast is another newcomer to the arena of Option Flow Algos.

They offer an annual pricing of $249/month which is 40% off normal monthly rates.

The UI of Sweepcast reminds me very very much of FLowAlgo 🙂

Check it out and go to our FlowAlgo review here and tell me if I am mistaken.

Another FlowAlgo Alternative | Tradytics

Tradytics provides some valuable info especially with Earnings.

It offer a 7-day free trial then $49/month.

MARKET ACTION OPTION FLOW

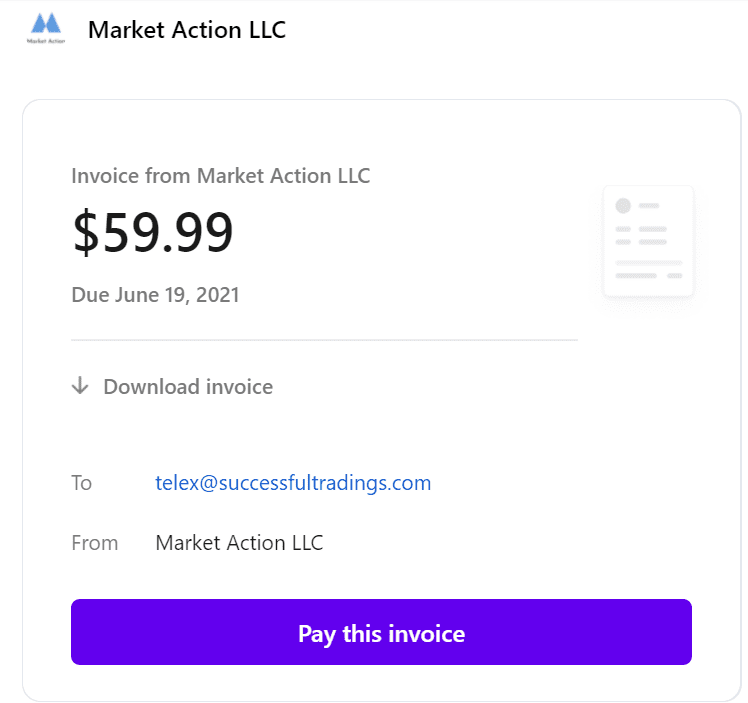

I did not even know about this FlowAlgo alternative until the company contacted me for a partnership.

Yes, imagine my surprise.

Thy email stated that they have been monitoring my YouTube channel.

More precisely my education videos on FlowAlgo to help retail investors.

A couple of month later, I received yesterday an invoice from Market Action.

Here it is.

At least that answers the question: How much does Market Action cost 🙂

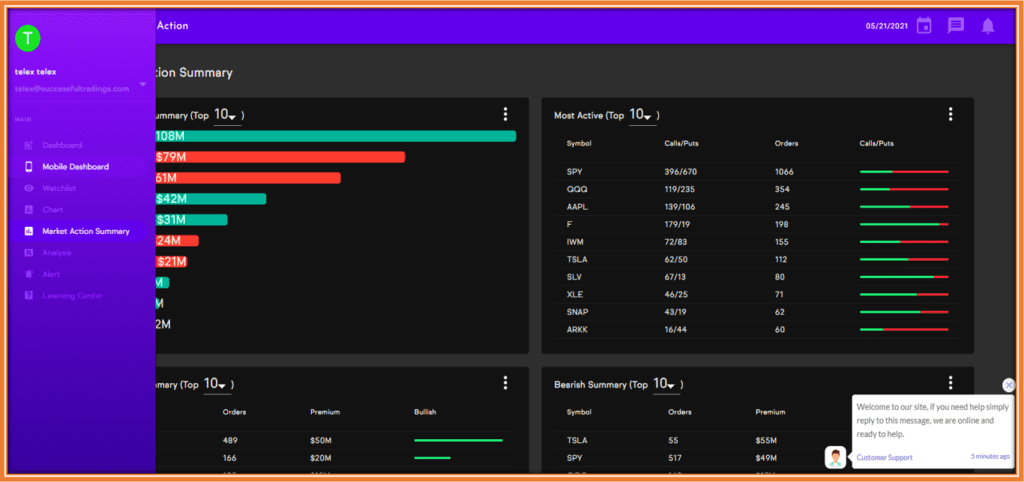

As for the features, here is what you will see from their website:

- Dashboard

- Mobile Dashboard

- Watchlsit

- Chart

- Market Action Summary as depicted in the view below

- Analysis

- Alert

- Learning center

If you a are an option trader beginner, the learning center is a good place to learn the Lingo of option trading.

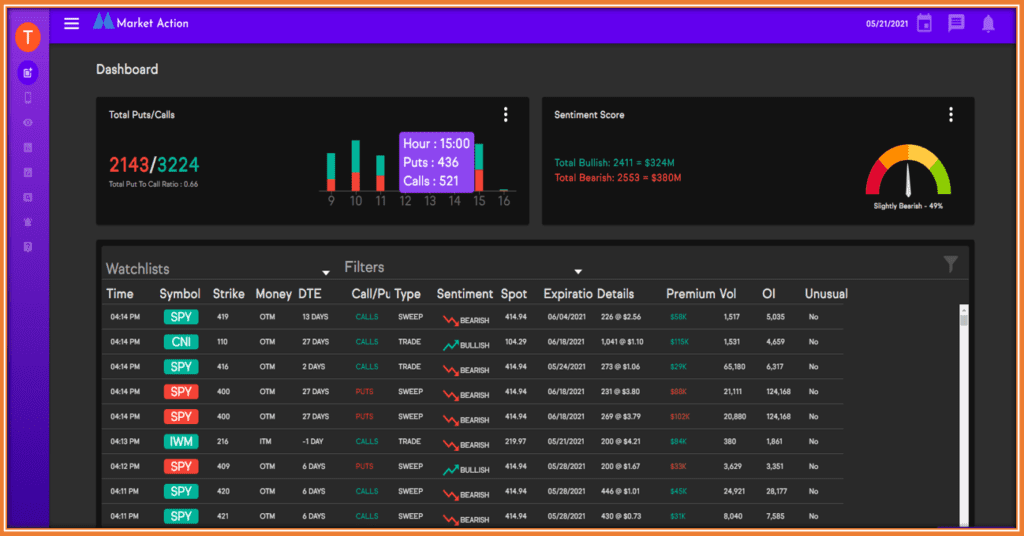

The main Dashboard displays the usual Puts/Calls ratio and an innovative hourly graph of Calls and Puts.

I still do not know why these tools think that a sentiment indicator is a help for option trading.

In my opinion, this indicator just adds into the confusion many traders are facing in their decision making.

The feature I enjoy the most is the Alert section.

It enables you as a trader to focus on specific stocks you are familiar with.

This is important because many traders have a tendency to be all over the place.

Is it much better to concentrate on a small watchlist of stocks (which you can easily set up and track)?

Video: Inside Market Action Live Features.

SUMMARY OF FLOWALGO ALTERNATIVES

In an effort to streamline your selection process should you decide to explore the various FlowAlgo alternatives, here is a full table comparing the most important features.

TradyTics vs Quant Data

I have been getting a lot of questions from traders comparing Tradytics to Quant Data.

They both Excel in their offerings of Option Flow.

The differentiation between Tradytics and Quant Data may simply come down to value proposition.

Traytics is at least33%cheaper than the basic Quant Data plan which means you can allocate more money to your actual trading.

| Equity Prints | Discord Room | Cost ($) | |

| FLowAlgo | Yes | No | $149/month |

| Cheddar Flow | No | No | $85/month |

| BlackboxStocks | No | Yes | $99/month |

| Aided Trade | No | Yes | $0 |

| TradeUI | No | Yes | $85/month |

| Quant Data | Yes | Yes | $75/month |

| SweepCast | Not Yet | No | $39/month |

| TradyTics | No | No | $49/month |

| Market Action | No | Yes | $59.99/month |

FINAL WORD: WHAT IS THE BEST OPTION FLOW SERVICE

After a full analysis of all these FlowAlgo alternatives, traders can easily fall into analysis paralysis as there is so much data coming out of these services.

There is also the risk to become “prisoner” of these tools by thinking that the only way to make money trading options is by using an Option Flow service.

I still maintain that the best Option Flow Service is the original One FlowAlgo itself.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Tradytics offers Hercules….It reveals DarkPool prints…..Tradytics also offer intraday and weekly bar charts on DarkPool prints for equities…Tradytics also gives detail Open Interest and GEX…BlackBox stocks is unique in that it allows you to graph DarkPool Prints on charts, kinda like Volume Profile…Coupling this feature (DarkPool) in BlackBox with Option flow is very helpful…But what all these platforms lack is implied volatility Studies…OptionsGeek not OptionsGreek, shows IV, Price Action, and Option Volume together…..

Greetings Anthony,

thank you for the insights into this Alternatives to Flowalgo.

Have a great weekend.