Due to recent audience reaction to this series of articles on How to Learn to Trade Options, I think the layout of the order of the articles is important to follow.

The goal is to take the reader (especially a newbie trader) from the beginning to the final stage of this process.

Here is the outline in order to get the most out of these free tutorials on how to learn to trade Options.

- Trade Stock Options: Easy Guide How To

- Options Trading Explained: The Truth Is out There

- Options Trading for Beginners: Psychology 101

- How To Trade Options for Beginners

- How To Trade Options: Finding Your Methodology

- Online Options Trading: The Rise of FlowAlgo

- Learn How to Trade Options: Easy Calendar Guide

- This Very One You Are Reading Now

- How To Choose A Stock Trading Platform in 2019 (Can be Read after the first One really)

While the above discussions focus more on the “theory” of Options trading, a more hands-on weekly series can be found under This Week Top Options Trades.

Here is where we share our weekly trades while still educating our readers on the techniques they need to become a Successful Stock Options trader.

Table of Contents

LEARN TO TRADE OPTIONS: The Routine

One such technique is to develop a routine for your trading career.

I am sure as most of us, you do have others activities that occupy your time.

So, if one is motivated to Learn How to Trade Options, one must devote the necessary time as it is for any new activity.

It has been my experience that I trade perform when I have great preparation.

When I am rushed, F.O.M.O (Fear of Missing Out) takes over: this is not good.

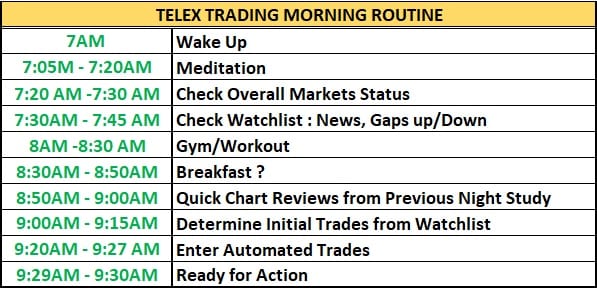

It is important to write down our schedule before the market opens.

One good way to do this is to start backwards.

930AM – Market Open: So write down what needs to happen and when so that when the screen of your computer flashes green and red numbers, you are not like a deer caught in the headlights.

Trust me, you do not want to freeze on the opening bell with opened positions if you carried some overnight.

Here is an example of such schedule: you can take it an insert your own “before market activities”.

LEARN TO TRADE OPTIONS: ACQUIRING A DISCIPLINE

I do the “Check the overall markets’ status” with the Investing.com App .

It involves looking at international markets’ as well as US markets’ (futures,commodities and bonds mostly).

If you are interested to find out more, let me know below so that I can introduce you to correlation studies performed by Jason Strimpel on his financial platform.

I reside in California so the times given are Eastern Standard Time.

This means that I have little room for distractions like taking phone calls.

Remember, “Buzzy” reaction to Audrey’s friend calling their house while he was preparing for War ?

That is how I feel when getting ready in the morning before the bell rings.

The above schedule would not be complete if I did not mention the necessity to journal your trades.

This activity should be accomplished preferably right after the market closes.

Also, some type of technical charts study is required anytime before the next day session depending on your methodology.

MASTERING PATIENCE

The stock market will absolutely test your patience and your resolve.

Let me give you this.

There are 5 trading days with 6.5 hours each in a week.

Well, though stocks do move, it is my experience that during half of these hours, nothing meaningful happens other than Theta eating up the Options value.

How to recognize a sideways market or position ?

What should you do about it ? How about the distractions from social media ?

Such and such tweeted that XYZ stock is in a bullish pattern.

None of that will make us money day in and day out.

We ought to stick to our own tested and validated methodology !

So what will you do the rest of this time ?

Jump into another position because of boredom and the need to feel busy ?

This behavior leads to over-trading and there is only one outcome to that: Account drawdown.

Because there are numerous head fakes throughout the course of a trading day, us traders cannot afford to follow each and every move.

The best analogy I use on myself is that I am some kind of fisherman in the market.

And this fisherman goes only after certain type of fishes.

A bit like Jeremy Wade on the TV show Rivers Monsters.

His interest is only on that type and does not pursue any other type.

This is where the next habit is key.

CONSISTENCY

Doing the same thing over and over develops familiarity and with it comes a sense of comfort.

It is far better for a trader to become a specialist rather than a Jack of all trades and Master of none.

Sometimes, we may think that by taking numerous trades, we increase our probability of winning.

Let us use a Baseball analogy here.

The best hitter in the game have batting average between 0.300 and 0.400 ?

Well in our Path to Learn To Trade Options, if we can have 50% (0.500) winners in average, that will be quite good.

If you are perplexed, here is why.

Recognizing a loosing trade quickly is a fantastic skill because the that means only a fraction of the risk is gone.

If we enter a trade with the exit criteria that it should not lose more than 33% for instance,

we will have 66% of the capital left every single time on all of our losing trades.

Now combine that with the winners that happen half of the time and you are set for great success.

I have to mention that even in winning trades, there are nuances.

Going for the home runs (to keep the baseball theme) may not prove efficient.

Taking singles is the proper way to build consistency.

Such discipline does not come overnight, it can take time.

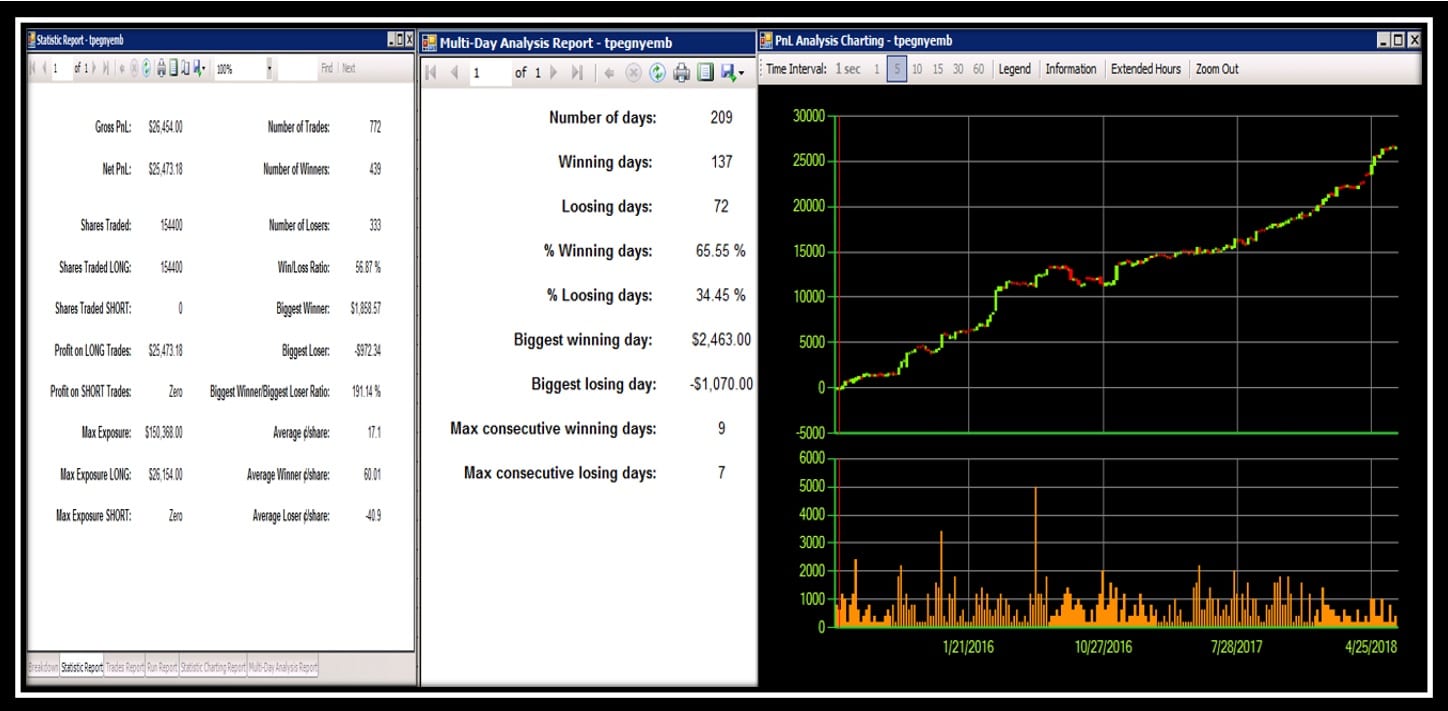

Another example of consistent disciplined is what is described in the short video below.

Being aware of our aim makes it easier to achieve while solely focusing on our methodology.

Most of us get into trouble by taking ill-advised position driven by the emotions of the moment.

For instance, revenge trading where we enter a position because that stock did not perform according to our expectation last time we trade it !! Amazing, isn’t it ?

But it happens and it should not be happening at all.

There are plenty of other fishes out we can go after.

We will discuss the full outline of a good methodology and show how it involves Exit strategies in losing trades and winning trades in an upcoming chapter.

CONFIDENCE

For me Confidence comes from repeating a process several times with the same positive outcome.

In their Journey to Learn To Trade Options, traders need this trait on different levels.

Let’s start from entering the position at the adequate price.

When we put in our orders, how do we know that we are going to get the fills without buying at the Ask price ?

Risk Management is an integral part of How To Learn to Trade Options.

Yeah, Smart Money can afford to buy at the Ask price because they are confident about the trajectory of the stock.

We showed you how to follow big money in this FlowAlgo review but what if the trade does not involve a flow from Smart money?

I typically enter my automated limit orders below the bid as I outlined on a recent trade on FCX.

Sometimes, I may need to adjust but most of the time, I get the fills because of my familiarity with the underlying stock.

Similarly on winning exits, how do we know that the target price we picked will be reached within our timeline ?

For me, it comes from the study of the charts.

Historical analysis shows that stock movements can be estimated through the Average Daily Range (ADR) or its closest variant the Average True Range (ATR).

There are other technical indicators such as the Fibonacci retracement.

Here is an example.

How about the signals from the methodology ? We need to feel confident in order to pull the trigger right ?

Nothing more frustrating for us traders than to sit on the sideline because we were afraid to jump in and the trade end up being a big winner.

Or worse yet, we start chasing the trade late when the move is already finished.

PERSEVERANCE

The old saying is ” If at first you don’t succeed, dust yourself up and try again” ?

The market can present us with unique challenges especially for beginners who have not yet witnessed the many variations of the markets.

In such a case, the temptation is to give up because of the initial lack of success.

But most successful traders (remember the first took books I recommend in here) struggled at their beginning.

That adversity is the price to pay to gain your full admission into the 2% ranks of winning traders.

To the beginners, I would recommend starting with small goals following the S.M.A.R.T mantra.

S is for Specific – M for Measurable – A for Attainable – R for Realistic and T for Timebound.

PASSION

In any walk of life, great things are always accomplished with Passion.

Passion it what drives us from the inside to do the things that we enjoy the most.

When we apply this to trading Options, there is a great deal that can be accomplished if we become passionate about this profession.

It goes without saying that performance is a major factor in reaching that stage.

But even we achieve a given level of success (as defined by each one of us), it is possible to work our way to the point where Trading becomes second nature.

Just like most religious people do not think twice about attending the gatherings to sustain their beliefs, traders ought to be able to develop habits that become rooted in them.

This interval drive can lead traders to discovering new insights in the market.

The lifestyle that this occupation brings is unique enough by itself to set up the lucky ones for greater accomplishments in other domains of their life or the life of other people.

CONCLUSION

We scrutinized 7 Habits to help motivated individuals to Learn To trade Options.

As in any endeavor, these skills cannot be forged overnight.

The first step consists of acquiring this knowledge.

The knowledge will trigger awareness.

Awareness combined with Preparation will create the desired results.

Please share your comments and questions below to help us continue to thrive to bring you this Guide on How to Become a Successful Options Trader.

Suggested Resources

#1 : The #1 Trading Tool You Don’t Want To Miss In 2020

#2: Get Our Free Daily Market Recap Videos on YouTube

#3: What You Need To Get Your Options Trading Career Started

TBP | Becoming A Successful Stocks and Options Trader

Email:Telex@Successfultradings.com

Facebook: facebook.com/telex.tbp.7

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Hello, telex, this is a very nice post on trading options and i like the way you have put out this post on how to trade it. I must say that it is very interesting to see this and I lie how you have outlined this post as well. I would love to know if it is possible to have a role model when trading options and also if it is possible to see their trades and model it based on theirs.

Hello my friend,

You bring up a very key point that we will be tackling very soon.

That is the need for a Mentor.

Having someone who has walked the path before

Is a tremendous source when pursuing excellence.

So, follow us below to receive alerts on our upcoming

Posts to find out our recommendations on choosing

A good Mentor.

Have great Day.

Hi Telex. You’ve provided some really good content here. I can tell you’re passionate about trading and really know your stuff.

Where would you suggest a beginner start when considering trading? I have never traded but I’m curious to know more. Is there a preferred trading type that you would recommend?

Any advice would be much appreciated.

Thanks mate!

Your friend,

Jacob

Greetings Jacob,

The outline in the introduction is a good beginner’s

Guide.

Each trader’s style will be determined by their

Personality. The market is full of opportunities for everyone

To find their niche and excel in it if they bring forth the passion

And desire to accomplish this.

Thank you.

Thanks for the informative article. I notices that you wrote that it is important to journal all of your trades? In my view, one can just go into your platform and view your past trades. What would be the importance of duplicating this process by journaling all of your trade?

Hello Ryan,

Thank you for stopping by.

Each trader needs to journal their own trades.

We are showcasing ours here in an effort to guide

our readers through this essential activity.

Hope this clarifies it for you.

So the quote ‘Failure to prepare, prepare to fail’ comes to mind after reading your article. Routine, preparation and consistency. You would think that these would be bywords for even those just starting out in the options trading arena. Sure, there is always going to be risk involved with any trading, if there wasn’t, then it would just be a glorified savings plan.

How you minimise the risk and maximise the gains is by following your seven steps. Being cold and calculating may sound uninviting but it has to at least be partly that way. Do the research. Be as prepared as you can be and then make the right decisions without having your judgement clouded by emotions.

Although having a small portfolio of stocks and shares, I am a novice and as such I will following the advice and going through the articles here, in the order they are recommended, giving myself the best odds moving forward.

Thank you for this neat summary of the article.

We are glad it helped you in your efforts to increase the value

of your portfolio.

Hello Telex, a very nice and well-outlined post you have given about trading. Truly trading isn’t something anyone can just jump into and except to get it right without proper guidance. Having a means of gaining education about trading or mentor to put you through it. Hard work is on factor that can keep you going in trading and like you mentioned, consistency cant be over looked when it comes to trading. Best regards.

Thank you Benson for the positive feedback.

Please follow us below to keep up with our upcoming articles as

we reveal more educational content for those who wants to Learn How to Trade Stock Options.

As a person who has traded stocks before, I can boldly say that it is something that one should calm down to do. I have heard about this trading stocks but I have never given it a try yet. This is a very nice post and I think that more people should give it a try out once they are able to understand all that it takes to trade it. Is there a difference between trading stocks and trading options?

Hello John,

Did you say that you have traded stocks before ?

Here is a link to one of our articles where we explain the advantages of Trading Options

over stocks: https://successfultradings.com/trading-stock-options-why-options/

Hope this helps.

Should you have any others questions, please feel free to contact us below.

Really useful post that can be used as an inspiration not just for traders but for anyone in general. Morning routine looks great – meditation and exercise scheduled. That is vital part of maintaining healthy mind in my opinion. And by scheduling them, there are no excuses left that there is no time.

I love how you mentioned perseverance – in times of ”instant everything”, we tend to give up too soon.

Thank you for this great read, I feel motivated after reading it!

Greetings Katja,

I am glad to read that you were able to find great inspiration from the content of this article.

Thank you for stopping by to leave us such a positive feedback

Enjoy your Day.

Thanks.

Many people do not understand that even with trading, there are some right attitude to work that must be had. For example, I think that if there is not hard work, patience, perseverance and passion in this work then being successful is very impossible. It’s good to see you switch from always talking about the theoretical aspect of option trading to some winning habits.

Hello Anderson,

How are you tonight ?

We appreciate you stopping by and sharing your experience with the rest of us on this topic.

You are right about the importance of the habits.

They theoretical side of trading can easily be learned, not so much the behavioral which leads to cultivating bad habits without even knowing it.

Then end result is bad results that can hinder the ability of a trader to progress and reach their goal of financial freedom.

Thank you for your time. Talk to you soon.

Wow! These are all the habits that I need to become a successful trader. Also, Thank you very much for listing hour by hour with activities to do.

I have failed with a considerable loss in this trading world. So I don’t want to repeat the same thing again.

But honestly, the most difficult thing for me is patience, consistency and confidence.

By the way, how long do you have to have these 7 winning habits so that I can also become a successful trader like you?

Hello Asmadi,

Thank you for stopping by and giving us your feedback.

Most of thee winning habits take years to master but knowing them is the key.

I remember I had to print the 7 habits next to my computer in order for them to become

second nature to me.

In due time, you will be able to get into those habits yourself.

I appreciate your time and Talk to you soon.