The Best Trading journals are important for everyone who is serious about becoming a master of the marketplace. Keeping a trading journal is similar to keeping a diary about your life as an investor.

Many people use journals to preserve thorough notes of their business transactions. These commonly-used materials are extremely helpful to traders of all skill and experience levels.

Trading journals are a very personal resource.

Thus, the level of detail varies considerably from one to the next. Some traders simply keep track of their entry and exit positions and the outcome of their trades.

Why You Need Best Trading Journals?

Keeping a trading journal is one of the most underappreciated actions by forex traders, both newcomers and seasoned veterans alike.

It has the potential to be a significant instrument in your trading career. Here are some of the most compelling arguments in favor of using forex journals.

Keep Track of Your Progress

Trading over extended periods of time makes it difficult to recall all of the transactions you made just from memory, making it much more difficult to maintain track of your overall trading performance.

You won’t be able to see whether or not your selected trading methods are lucrative or whether or not you achieved any of your trading objectives.

On the other hand, a trading journal allows you to keep track of your trading actions and progress conveniently.

Increase the Effectiveness of Your Trading Methods

Keeping a comprehensive record of your previous trading actions is important in the forex market.

This information is extremely useful since it allows you to identify your own trading strengths and limitations.

Examining your longer-term data can assist you in determining whether or not you are adhering to your trading plan and whether or not that approach is effective.

Identifying and tweaking the approach that is not lucrative over the long run is simple if your long-term track record is not profitable.

Analyze Trends and Patterns

To ensure that your transactions are secure and safe, it is best to do so as soon as possible after opening or completing your trades.

The specifics will still be fresh in your mind while you’re writing down the overall market patterns, which will be helpful. What is the significance of this?

When you gather your notes on the patterns, you may be able to adjust your Risk.

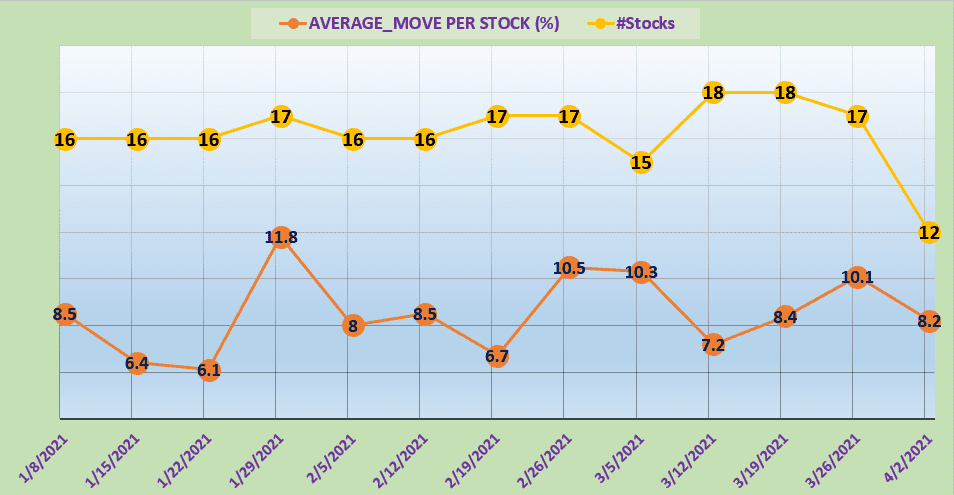

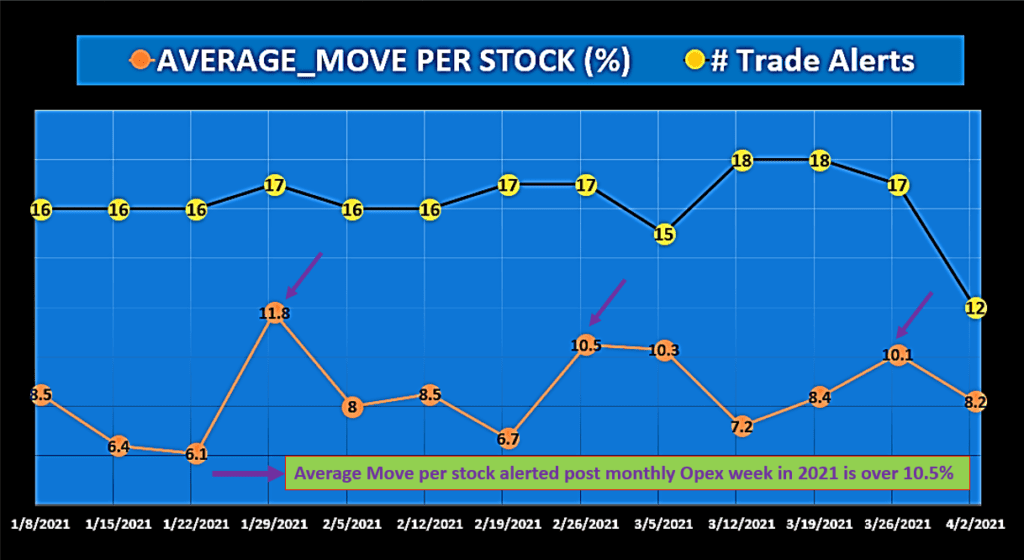

The chart above illustrates just how to Successful Trade Alerts average move per stock tens to dip below their normal average on the third week of options expiration.

Instead of the usual 8% or more, the average move per stock comes down to by a good 25%.

Therefore, we know that on this third week of each month, we can lower our strike price and risk less money as well.

7 Best Trading Journals

TraderSync Review | Best Trading Journals Overall

The extensive range of capabilities available through TraderSync has the potential to enhance your trading results dramatically.

You may get even more value out of your trading journal using the platform, which analyses your trades and generates informative insights.

When Was TraderSync Launched?

The platform created in 2014 by a group of programmers who, at the time of its creation, spent countless hours studying about trading and completing courses.

In the end, they realized they needed a tool to assist them in keeping track of their deals.

How Does TraderSync Work?

The built-in trade simulator allows you to experiment with different trading methods without having to lose any of your hard-earned money.

This function alone has the potential to save you a significant amount of money over time.

Overall, we believe that TraderSync is a fantastic all-around solution for just about every trader to consider.

However, because the free version has some restrictions, you will need to subscribe to the program every month to use its full capabilities.

Because of its arsenal of technical analysis capabilities, TraderSync makes it simple to fine-tune your trading approach as you go.

Furthermore, the AI feedback makes it simple to identify and exploit beneficial patterns in your transactions.

Features of TraderSync

The capabilities of TraderSync intended to support the platform’s three primary functions: journaling and backing up your transactions, identifying trading trends, and providing actionable feedback to help you improve your trading results.

Charting Feature

The trade management platform has a number of useful charting capabilities that allow you to keep better track of your inputs and exit points, as well as chart targets, test stop-losses, and other features.

An intraday charting tool is available, which enables traders to monitor price action changes on a minute-by-minute basis and accurately adjust their stop losses.

Analytics and feedback

TraderSync is home to a plethora of analytical tools that may assist you in improving your trade management and identifying crucial moments in a variety of circumstances.

If you wish to do a manual analysis of the trade, you may submit screenshots and make notes to help you remember the facts of the transaction.

It will also be possible for the trading journal to create automatic trade-specific statistics, such as a depiction of critical insights such as return per share/contract, total return, risk, and so on.

Sharing Feature

It is entirely up to traders to submit their trading results, ideas, custom data (returns, trade size, screenshots, notes, and so on), performance reports, and other information.

In this approach, you can easily provide access to your mentor or trading peers to the features of your trading style and receive feedback on areas where you may improve or where you stand out from the crowd.

Reporting features

TraderSync can create reports that are easy to comprehend and visually appealing, allowing you to get valuable insights from your trading activities.

There are over ten distinct reporting tools available in the trading journal, allowing you to have all you need to assess your performance from any perspective at the tip of your fingers.

How To Subscribe to TraderSync?

The pricing, which is the crux of our TraderSync review, let’s discuss it.

TraderSync has one of the most flexible pricing plans in the niche of trading journal software, and this is a key differentiator.

Which of the four trading account tiers you select determines the fee that you will pay.

In order to determine which is the ideal option for you, it is necessary to evaluate how each matches your trading requirements, style, and preferences.

The following are the TraderSync offerings from which you can choose:

- Basic Account – free

- Pro Account – $29.95 per month

- Premium Account – $49.95 per month

- Elite Account – $79.95 per month

All paying accounts are eligible for a seven-day free trial period.

Here is a comprehensive overview of the features available on each account to assist you in making your decision.

The gist of it is that you may add an infinite number of trades for each of the payment account types you choose.

How to Cancel Your Subscription for TraderSync?

To cancel your subscription for TraderSync, go to your Profile, select Account Plan, and then select Cancel Subscription from the available options.

Pros

- All plans are eligible for a 7-day risk-free trial

- It is possible to trade stocks, futures, currencies, and options

- Interactive charts and artificial intelligence capabilities

Cons

- Elite subscriptions are subject to higher pricing

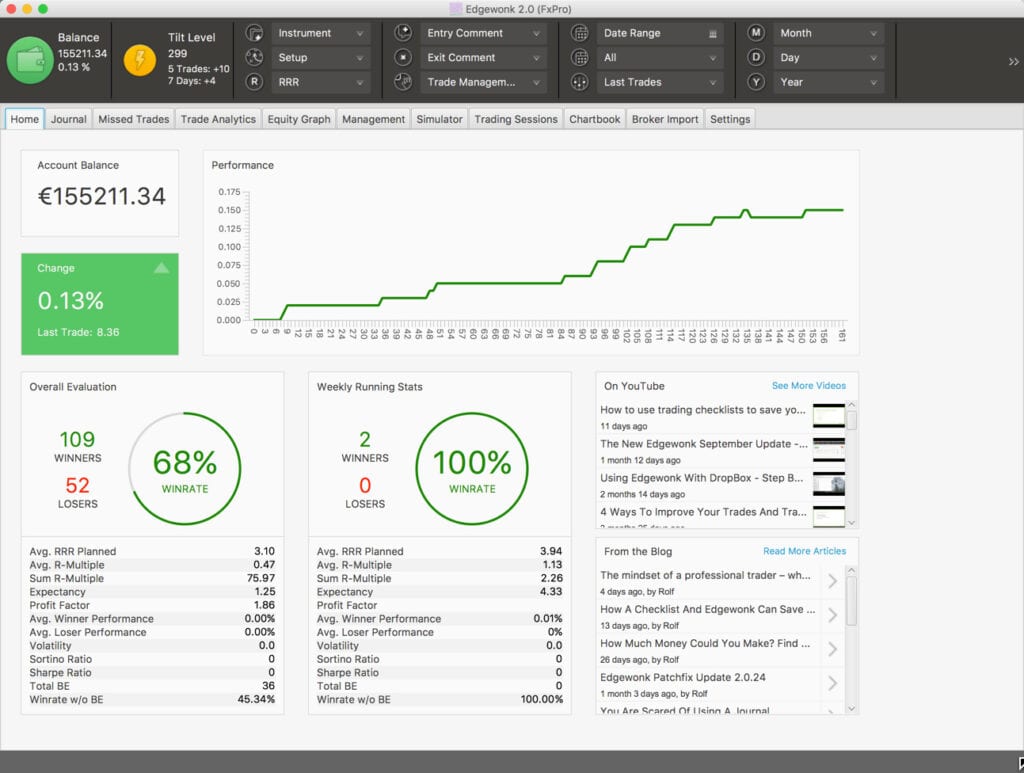

Edgewonk Review | Best Trading Journal Software for Beginners

This is, without a doubt, the best-designed trading journal software currently on the market right now.

We appreciate the fact that it is simple to use and quite useful.

When Was Edgewonk Launched?

Edgewonk first launched in 2015.

More than a trading journal, Edgewonk, a sophisticated data-driven trade analysis tool that you can use to make better trading decisions.

All of your trades in all currencies and markets across the world are kept track of by you.

How Does Edgewonk Work?

EdgeWonk is a pretty simple program that works extremely well.

First and foremost, you must import your trade data.

There are virtually all trading software programs, including cTrader, Interactive Brokers, MetaTrader 4, NinjaTrader7 and 8, Saxobank, generic Excel imports, and many others.

cTrader is the most popular trading software.

The first feature we’d like to highlight is the simulator that comes pre-installed.

It is possible to determine how future-proof your trading technique is with this tool.

And, of course, this may go a long way toward ensuring that you are prepared for various scenarios.

When it comes to using trade journals, one of the most common difficulties users have is that there is simply too much information being transmitted at any same moment.

Because EdgeWonk comes with filters, you won’t have to worry about how your journal responds to you.

Apart from that, we are completely smitten with the overall style and layout of this specific journal.

Additionally, it provides you with the opportunity to attach screenshots to each one of your entries, which you may use to visualize your trading performance.

Features of Edgewonk

The features of EdgeWonk are now the focus of our EdgeWonk review, so let’s get to it.

Beyond being a well-organized trading journal, the site is also fully loaded with sophisticated features. Let’s have a look at some of the more intriguing examples:

Entry and Exit Optimization

The program will begin evaluating your trades as soon as you have uploaded the necessary information.

It will then come up with a better plan for timing your entry and exits in order to maximize your profits.

It will also provide you with recommendations on the sorts of orders to employ, as well as where to place your stop orders, among other things. The aim of this is to assist you in increasing your success rate.

Trade Simulator

Our EdgeWonk review would not be complete without mentioning the trading simulator function.

It is quite beneficial when performing back tests.

As soon as you enter a sample of trades that is statistically significant, you may run simulated scenarios and portfolios.

You will be able to observe what outcome you would have obtained if you had traded on specific signals, time periods, and other factors in the past.

Testing your approach in a variety of circumstances can assist you in determining how resilient it truly is. This will assist you in staying updated about whether or not it will be able to resist market shocks or operate well in various circumstances.

Trading Classifiers with Advanced Technology

The Advanced Trade Data tab, as well as its classifiers, are two features that significantly distinguish the EdgeWonk journal from the competition.

Once your transaction information has been entered into the system, it will search the data for macro events and other potential patterns that have happened in the time period around the trade.

The President of the United States or the Chairman of the Federal Reserve, the Governor of a central bank, corporate earnings, global trade wars, and other such events are examples of market-moving events.

How To Subscribe to Edgewonk?

It costs $169 for a yearly membership, and there are no other subscription options available. Visit www.edgewonk.app/register to subscribe to Edgewonk.

How to Cancel Your Subscription for Edgewonk?

It is possible to manage your subscription and even schedule cancellations using the customer site.

Please keep in mind that once you cancel your pro journal, you will no longer have access to any of the features available.

You will also lose access to any and all trade screenshots and notes that you have made.

You will not be able to retrieve the journal that was canceled.

Pros

- Keep track of your trading results.

- Make use of your trade data analytics to your advantage.

- Increase the effectiveness of your trading activity.

- Back test your approach to see how it would have succeeded in a variety of different situations.

- A cost-effective option that requires only a single payment

Cons

- Long-term investors may find this investment unsuitable

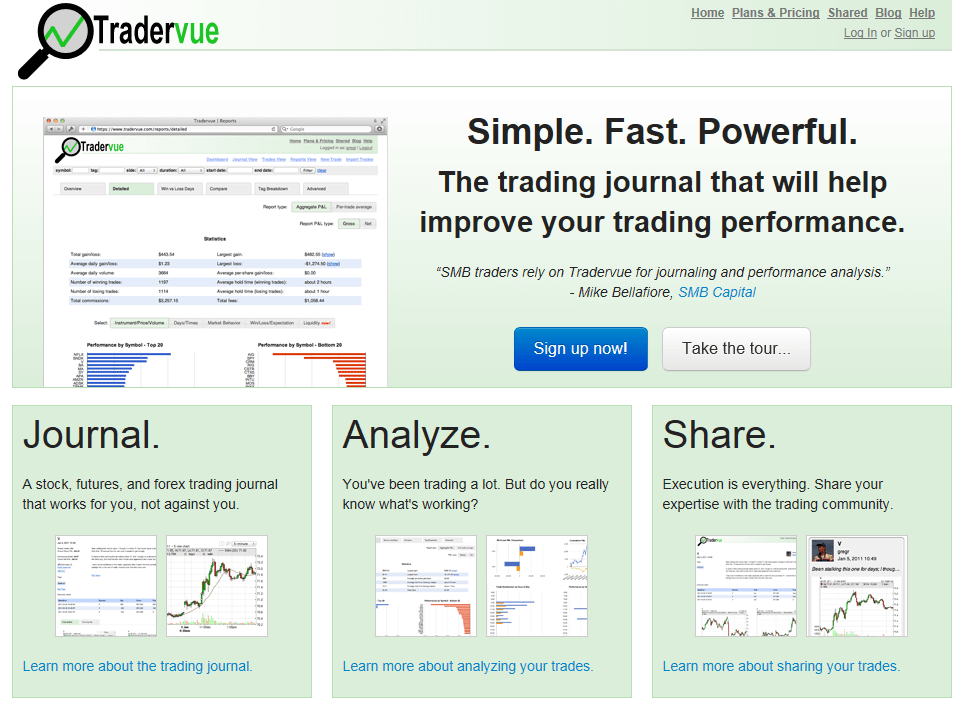

TraderVue Review | Best Trading Journal Software for Experts

Our next best trading journal is moving on quickly, none other than Trader Vue, which comes up at number three on our list. It has been in existence since 2011 and appears to be growing in strength over time.

One of the things we appreciate about this platform is that it allows you to start without paying anything.

Yes, you read that correctly. You may use their free tier to make up to 100 stock transactions each month without having to worry about being charged a penny.

When Was TraderVue Launched?

Founder Greg Reinacker established the company in 2011, developing it to a platform that supports 100,000+ traders.

Over the course of 2020, growth in trading was turbocharged — both in terms of active trading activity, and new trading accounts established — and things haven’t slowed down this year.

How Does TraderVue Work?

We believe that TradeVue represents the best value for money among our building’s budget-conscious consumers.

The long-term development potential of EdgeWonk, as well as the comprehensive features of TraderSync, remain our top picks.

Even though TraderVue is still in business, their daily journal summary report is as good as ever.

Yes, they do present you with a performance report at the end of the day, which includes information on trading statistics and a profit/loss graph.

Tradervue makes it easy to keep track of your trading history by allowing you to import trades automatically from your brokerage account.

If you want to improve your trading skills, having all of your trading histories in one place and being able to look through them is handy and beneficial.

You may even post the deals you’ve made with other traders in order to obtain feedback, or you can use them as a model for giving advice to others.

Features of TraderVue

We’ve arrived at one of the most crucial sections of our Tradervue review: the platform’s features and capabilities.

It is possible to categorize them into three types: journaling, analyzing, and sharing.

Let us take a look at each of them individually.

Journal Features

It is possible to import trades for a variety of asset classes into Tradervue, including stocks, futures, and foreign exchange.

You may make use of a number of different capabilities provided by the program.

Take, for example, the automated price charts that are generated. In your trading diary, once you’ve entered a transaction, you may produce and examine charts on a variety of periods (ranging from 1 minute to weekly intervals), along with the buy and sell points.

Also, you may write trade and daily notes to make it simpler to analyze a particular transaction when you come back to it in the future.

You may also tag and filter your deals to better organize your history and keep everything in chronological order.

Once you’ve completed this step, you’ll be able to quickly organize, filter, and evaluate your transactions with a few simple mouse clicks.

Analysis

The report and analysis capabilities on the Tradervue platform are the cherry on top of the cake.

Tradervue automatically generates charts with all of the trade inputs and exits highlighted based on the data that has been supplied.

Both intraday and multiday reports may be generated by the platform using various parameters.

Feature for Sharing

Last, but certainly not least, you have the option of disclosing your trading history and performance information to other members of the trading community.

A number of options are available through the social networking platform function.

The first step is to decide whether or not to publish your transactions and inform others more about your strategy, including whether or not you followed through with it and what happened as a result.

It’s important to disclose not just your profitable transactions, but also your unsuccessful ones.

Not every trader is a winner, and you will always gain more knowledge from your lost transactions than you would from your winning deals.

How To Subscribe to TraderVue?

Our Tradervue review would be incomplete without discussing the financial aspects of the platform.

The Tradervue journal is available in three different pricing options: free, silver, and gold.

Here’s a little additional information about each of them:

Free Plan

Includes a basic journal with 100 stock or ETF trade entries every month for the duration of the subscription.

You have the ability to produce both summary and comprehensive reports on your trades, as well as to share your trading history with others.

You may also benefit from automated price charts that are shown on different time periods.

It takes only a few seconds to activate using your email address and password.

Silver Plan

Aside from all of the features included in the free plan, the silver plan adds unlimited trade entries, more than 100 advanced reports, MFE/MAE statistics, multiple trading accounts, and a host of other services for a monthly fee of $29 (plus taxes).

Gold Plan

This package contains all of the capabilities of the free and silver plans, as well as risk tracking and reporting features, exit analysis, liquidity reports, and other useful tools and information.

The gold plan has a monthly cost of $45 dollars, which is a good deal.

How to Cancel Your Subscription for TraderVue?

You can easily cancel your subscription to TraderVue, by logging into your account.

However, keep in mind that terminating a membership will result in a subscription credit being credited to your Tradervue account for the unused portion of your paid subscription.

Moreover, it may then be used to purchase a new subscription in the future if you so choose.

Pros

- Trading journal and trading social networking tool that is simple to utilize

- Advanced capabilities to assist you in analyzing your trade history are available

- Flexible price choices are available, with a free plan for 100 stocks included

Cons

- The monthly subscription amount accumulates to a higher amount

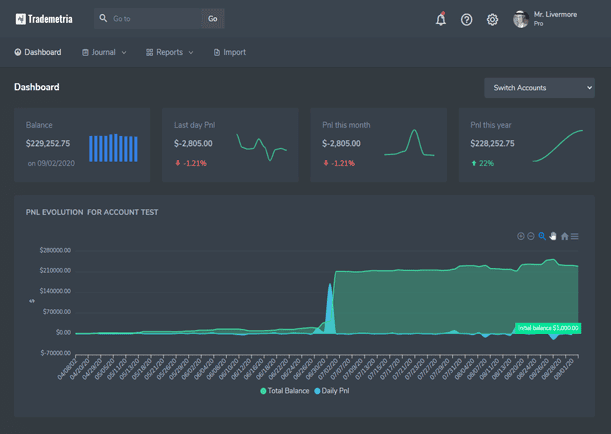

Trademetria Review | Budget-Friendly Best Trading Journal App

Although Trademetria has a large number of functions, the monthly fee is extremely cheap.

It is a particularly appealing choice if you trade with more than one broker since it allows you to integrate with numerous brokers simultaneously.

Trademetria may not be the ideal option for day traders due to its delayed quotations, but it provides everything most traders want to be successful.

When Was Trademetria Launched?

The Trademetria was launched in 2016.

The platform offers all of the important features, ensuring that you have everything you need to analyze your transactions and enhance your online trading performance at your fingertips.

How Does Trademetria Work?

The Trademetria trading journal ticks many of the most essential boxes when it comes to being an inexpensive trading journal with a comprehensive feature set.

To improve your trading strategy, perform better trade analysis, and keep more structured trade notes, you may make use of Trademetria’s tools and features.

Furthermore, the free edition of Trademetria includes a robust feature set, allowing you to get a lot more out of this trading tool without having to sign up for a premium membership.

There are certain limitations to Trademetria, but it is an excellent all-around solution for many traders.

Features of Trademetria

The platform offers a wide range of features and capabilities that may be beneficial to both novice and experienced traders and investors.

The trade notebook provides you with the ability to:

Maintain a record of your trading activities

Users can take advantage of a beautifully designed and simple-to-use trade history monitoring tool that includes everything from individual and daily trade entries to image attachments.

To better represent the circumstances surrounding a particular trade to adding trade remarks and descriptions to the trade history database.

Examine the results of previous projects

You may sort and filter your trades by a variety of criteria, including date, instrument, applied strategy, instrument rankings, and more.

Additionally, you may watch the increase of your equity over time and produce sophisticated reports on your intraday performance and trading outcomes.

Multiple accounts are being monitored for a variety of metrics

The diary includes over 30 critical indicators that, when taken together, help provide a full picture of your trading habits, goal monitoring, and how it influences your trading performance, among other things.

For example, if you want to track your open PnL or compute risk factors such as profit factor or R-ration of your portfolio, you don’t have to log in to the platforms of all of the brokers with whom you trade.

Trademetria consolidates all of your positions into a single screen and generates a summary of your overall performance for you to review.

What is Trademetria Pricing?

The most appealing feature of the solution is the variety of payment options available, which makes it a universal tool for all sorts of traders. The platform costs are separated into three categories: free, basic, and professional.

It costs $19.95 per month for the Basic option and $29.95 per month for the Pro option.

Annual payments are eligible for a 30 percent reduction, which reduces the rates to $169 and $249, respectively, if made in advance.

All you have to do is visit Trademetria and subscribe to the package you like.

How to Cancel Your Subscription for Trademetria?

Customers have the option to cancel their subscriptions at any point.

You may cancel your subscription by logging into your account and clicking on the Cancel Subscription option in the Account Plan section.

Pros

- Tracking the performance of your trading operations

- A platform that is web-based and can be accessed from anywhere in the world.

- Functionalities for advanced analytics are available.

- Included are real-time quotes.

- Supports equities, options, futures, FX, cryptocurrencies, and contract for difference (CFDs).

- API and PnL Simulator

Cons

- Recurring costs

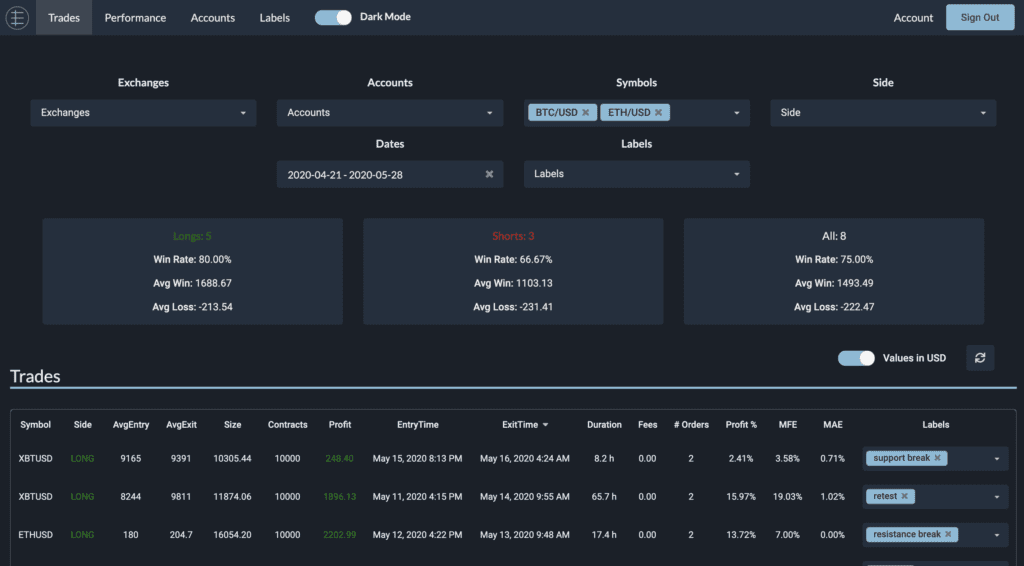

Edgesheet Review – Best Trading Journal Software for Forex and Crypto

In addition to being a crypto-only trading journal, Edgesheet will instantly import your transactions from BitMEX, FTX, Binance Futures, and Bybit through API integration.

Edgesheet is a straightforward and straightforward user interface that allows you to monitor numerous accounts, see your trades with all essential statistics, open charts that show your exact inputs and exits, and do a few other things.

When Was Edgesheet Launched?

Edgesheet was launched in early 2020. Comparing Edgesheet to Coinmarketman, which I will discuss in more detail later, which is arguably the most significant competitor to Edgesheet in the cryptocurrency trading arena, Edgesheet has less functionality.

It is designed on the principle of simplicity, which is reflected in the pricing, which is only $19.99 per month.

Edgesheet founders are software engineers Goncalo Lopes and Carmen dos Santos from London, England.

How Does Edgesheet Work?

Edgesheet, in my opinion, is a fantastic journal for anyone who wants to have a fundamental understanding of their or her crafts and industries.

Those who deal in cryptocurrency will find Edgesheet to be an excellent choice because it allows them to keep a journal that automatically imports all of their transactions and tracks crucial data.

In addition to being a crypto-only trading journal, Edgesheet will instantly import your transactions from BitMEX, FTX, Binance Futures, and Bybit through API integration.

Features of Edgesheet

The following are some of the features of Edgesheet:

All of your trades in one convenient place

Check your open positions and trading history to see how you’re doing. With full-featured charts, you can analyze any trade.

Statistics and performance metrics may be used to keep track of your trading strategies. Formulate, test, iterate, and refine your competitive advantage.

Support for Multiple Accounts

Binance Futures and Bybit accounts may be linked together so that you can keep track of your whole portfolio in both USD and BTC modes. Prepare your data for individual analysis by filtering it.

Trades, accounts, and exchanges should all have labels assigned to them.

What is Edgesheet Pricing?

You can easily subscribe to Edgesheet by visiting their official website.

You will get the free 14-days trial and afterwards, it will cost you $19.99 per month.

The monthly recurring price for Edgesheet fully automated trading journal software is attracting a great deal of interest.

How to Cancel Your Subscription for Edgesheet?

To cancel your subscription, go to your Edgesheet account and cancel your subscription.

If you face any difficulty, you can contact their customer support as well.

Pros

- All of your trades in one convenient place

- Support for Multiple Accounts

- Affordable in terms of pricing

Cons

- Limited features as compared to other trading journals

- Not suitable for professionals

How to Contact Edgesheet Customer Service?

You can reach out to Edgesheet support via email: admin@edgesheet.com

Alternatively, Edgesheet provides their social media account on twitter: EdgeSheet Trading Journal (@EdgeSheet) / Twitter

What are Edgesheet Users Saying about EdgeSheet Experience

Edgesheet on its twitter account re-tweeted this feedback from a very satisfied user.

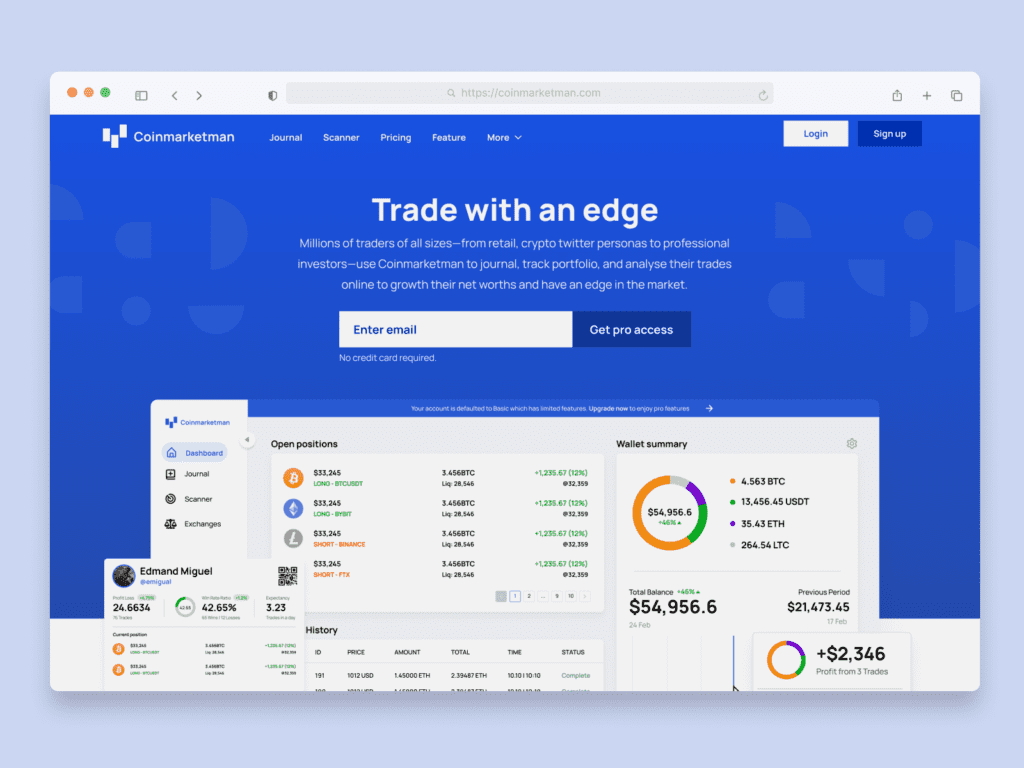

Coinmarketman Review | Best Trading Journal Software for Crypto

Our next Trading journal is Coinmarketman, which is likely to be a more popular alternative among traders owing to their more active marketing approach, attempts to elevate the concept of journaling to a completely different level.

When Was Coinmarketman Launched?

Coinmarketman was launched in mid-2017.

This sophisticated crypto tracking program can help you take your bitcoin investment to the next level.

How Does Coinmarketman Work?

As with Edgesheet, they are a crypto-only journal, although they provide a few more exchanges when compared to the latter.

You can import trades from Bybit, Bitmex, Bittrex, Deribit, Coinbase, and Binance, among other cryptocurrency exchanges.

A simple journal like Coinmarketman is not what it claims to be; it is actually a platform that performs much more than simply integrate your trades through API.

All of your metrics are meticulously monitored; you get real-time price tickers, a grade for your performance, and more.

The fact that they are quite active and continually improving their product, which is already extremely strong, can be seen by their activities.

Features of Coinmarketman

The following are the features of Coinmarketman:

Trade auto-sync

Coin Market Manager’s main benefit is that it allows you to quickly import deals from popular crypto exchanges with the press of a button, thereby giving you the opportunity to track all your coins in one location.

Multi-cryptocurrency tracking

Never make the same mistake again. Gain unparalleled insight into the turbulent cryptocurrency market in real-time.

Use the FIAT watchlist to monitor your preferred FIAT/crypto pairings across various crypto exchanges. The net worth that you have shown on connected exchanges and wallets is increasing.

Better understanding your crypto investment

For each exchange, there’s no longer a requirement to log in in order to see your cryptocurrency.

You can keep track of your whole crypto assets using Coin Market Manager. You can examine your whole portfolio balance, including your profit and loss, as well as the number of coins you have in both BTC and USD.

How To Subscribe to Coinmarketman?

Simple Portfolio overview, Real-time pricing, 1 account per exchange, and live browser tab balance are all included in the free Basic Plan. Sign up from their website to start using it.

Active traders may profit most from their premium subscription plans:

Pro Plan: Break-even data, unlimited trade updates, automatic trading diary, and in-depth account analytics are included in the Pro plan.

Every month, it costs $41.66

Enterprise plan: For $49.99 per month, get everything in the Pro plan plus CSV downloads and reports.

You may try out Coin Market Manager for 7 days for free before committing to their plan.

How to Cancel Your Subscription for Coinmarketman?

To cancel your Coinmarketman subscription, log in to your account and cancel your subscription. You can also contact their customer support in case of any difficulty.

Pros

- The user interface is intuitive and straightforward.

- Keep track of all of your cryptocurrency in one spot.

- Techniques for refining your methods through the use of journals

- Advanced analytical techniques

- Uncomplicated to comprehend a chart of performances

- Keep track of all of your exchange deposits, withdrawals, and account balances.

- Balances in real-time, as well as total gains and losses

Cons

- There is no mobile app.

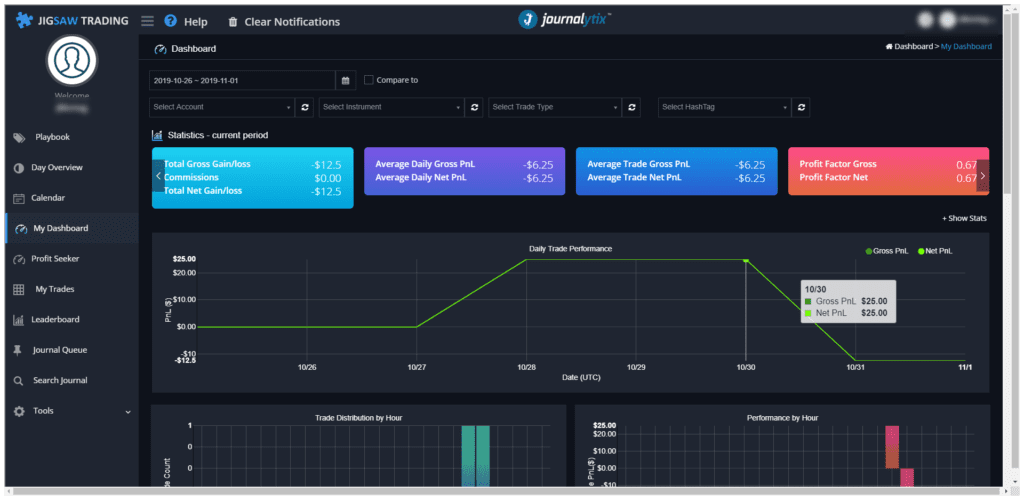

Journalytix – Best Stock Trading Journal Software

Jigsaw has developed a platform called Journalytix.

If you are familiar with Jigsaw, you can be confident that Journalytix will be a genuine experience.

Their systems, which mostly focus on futures (but also allow you to record forex, CFDs, stocks, and cryptocurrency). Moreover, provides a comprehensive performance tracker with a built-in calendar and audio news feed.

When Was Journalytix Launched?

Journalyix was launched in 2018 by Jigsaw.

The tools highlight trends in trading data that assist traders determine what is working and what isn’t for them.

How Does Journalytix Work?

Leaderboards, group discussions, group analytics, and a management dashboard are all features that are exclusive to the Journalytix software platform.

Aside from that, they collaborate with a number of legacy futures brokers and futures funding businesses.

So, if you are involved in the futures trading industry, you may find yourself utilizing the Journalytix platform.

They are a good option.

However, as a classic retail trader, I would look at either Edgewonk or Tradersync as a next step on list.

Features of Journalytix

The following are some of the features of Journalytix:

Dashboard for Trader Assistance

“Day Overview” combines a real-time audio news feed, economic release warnings, real-time economic news announcements, profit, risk and P&L charting.

All in one place to ensure that you are always aware of how your day is progressing, how it compares to your typical day, and what events are shaping the days’ action.

Journalytix “Day Overview” combines a real-time audio news feed, economic release warnings.

Tagging and Journaling in the Workplace

Trade information is immediately transmitted to our computers within seconds of opening or canceling a position on your trading platform.

A pleasant, unobtrusive notice will provide you with 1-click access to the journal for that position, where you may – voice dictate notes (130 languages allowed), classify the trade, add free-format hashtags and attachments such as screen images or videos, and much more!

Dashboard with Advanced Analytics

Analyze your trading history to understand what is truly affecting your profit and loss – both positively and negatively.

Trade types and free-format hashtags you added to positions may determine which instruments, when the open positions, and what trading habits are truly driving your bottom line.

Playbook

Because nothing is guaranteed to perform all of the time, your playbook serves as a store for knowledge about your trading rules as well as which market circumstances are most appropriate for each setup.

How To Subscribe to Journalytix?

You can easily subscribe to Journalytix packages by visiting their website. Moreover, you will come across the following packages:

- 14 DAYS FREE, then $47 per month

- First 14 Days Free, then $399 per year

- $47 per month

- $399 per year

How to Cancel Your Subscription for Journalytix?

During the first 14 days, you won’t have to pay anything.

Alternatively, you may cancel the recurring payment via PayPal before the 14-day period expires if you do not wish to proceed.

If you want assistance in canceling your plan, please contact them and they will assist you.

Pros

- Dashboard for Trader Assistance

- Advanced Analytics

- Tagging and Journaling in the Workplace

Cons

- Limited features as compared to TraderSync

Best Trading Journals Software Summary

To help you decide what is the best trading journal software that fits your current needs best, here is a comparative table summary.

| Trading Journal Software | Primary Market | Supported Exchanges | Pricing | Mobile App | Free Trial Period |

| Edgesheet | Forex, Crypto | BitMEX, FTX, Bybit, Binance Futures | $19.99/month | Yes | 14 days |

| EdgeWonk | Stocks, Options | cTrader, IB, Meta Trader + more | $169/year | Yes | N/a |

| TraderSync | Stocks, Options | NYSE, Nasdaq | $29.95/month | 7 days | |

| Journalytix | Futures, stocks and Crypto | Binance, NYSE, CBR, Nasdaq | $47/month | Yes | 14 days |

| Coinmarketman | Crypto | BitMEX, Binance, Coinbase, Bybit+ others | $42/month | No | 7 days |

| Trademetria | Stocks, Futures, Crypto | Binance, Coinbase, NYSE, Nasdaq | $19.95/month | Yes | N/A |

| TraderVue | Stocks, Options | NYSE, Nasdaq | $29.95/month | Yes | N/A |

EdgeWonk vs Tradersync

Despite its very attractive yearly pricing, EdgeWonk did not receive too many accolades from the users we surveyed.

In this head-to-head comparison of EdgeWonk vs Tradersync, the latter came ahead in a landslide.

No need for a recount 🙂

EdgeWonk vs Tradervue or Tradervue vs EdgeWonk

Our social media panel survey in comparing TraderVue Trading journal software vs its EdgeWonk counterpart came in at 79% in favor of TraderVue.

Therefore, the edge clearly goes towards TraderVue.

Tradersync vs Tradervue

You cannot go run with either Tradervue or TraderSynch.

The decision here for us depends on your current level of expertise as a trader.

If you would like more information you can leverage in making your trading decision, then go with TraderVue.

Otherwise, TraderSynch is a great choice for a trading journal software.

Trademetria vs Tradersync

The edge in this review of Trademetria vs Tradersync has got to in favor of Tradersync for it is a more complete trading journal software.

FINAL THOUGHTS ON Best Trading Journals Software

There is no question that keeping a decent trading journal Software or App may help you move from being an average trader to becoming a top-tier trader overnight.

However, in order for this to occur, the journal must offer you with the tools and functionality necessary to complete the task at ha

The seven selections discussed above are all excellent, but you should take the time to examine their essential characteristics in order to choose which one is the most appropriate for your trading style.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/