You have heard about Option trading.

Maybe you have even taken the steps to try to understand ho w you can profit from it yourself.

However, you are yet to fully graph how to go about it.

In this tutorial, I will explain Options Trading as you would explain a new concept to a child.

Table of Contents

Options Trading Explained: What Is a Stock Option ?

In this second option trading tutorial, we will explain Options Trading once for all so that you will not have to guess anymore about all the the myriad of questions.

An Option is a financial instrument derived from a given stock that trades on the Stock Exchange.

The origin of Options Trading can be explained by the need for investors to minimize risk or hedge.

Throughout the years, options have become fully pledged financial instruments.

A stock Option gives its buyer the right (but not the Obligation) to buy or sell a stock at an agreed price and date.

How To Explain Option Trading “To a Child”

Often option trading is considered too complex.

But it does not have to be.

We ought to be able to explain option trading to child without him or her rolling their eyes back to you.

Call options is a bet that a stock will increase in price.

Put Options is a bet that a stock will fall.

Let’s suppose Trader Jack thinks that stock XYZ will rise from its current value of $50 to $60 within the next month.

Then Joe can purchase the following month calls on the XYZ company. Jack will need to determine 2 things before buying XYZ calls.

- The date of Expiration : the date of Expiration of Jack’s right to purchase XYZ stock

- The Strike Price : the price at which Jack will be purchasing XYZ stock

These two factors (we will introduce other technical factors later on) will mostly influence the cost of the Calls Jack is willing to purchase.

Most Important Parameter in Option Trading | Time

The more time left on an Option relative to its Expiration date, the more value is has.

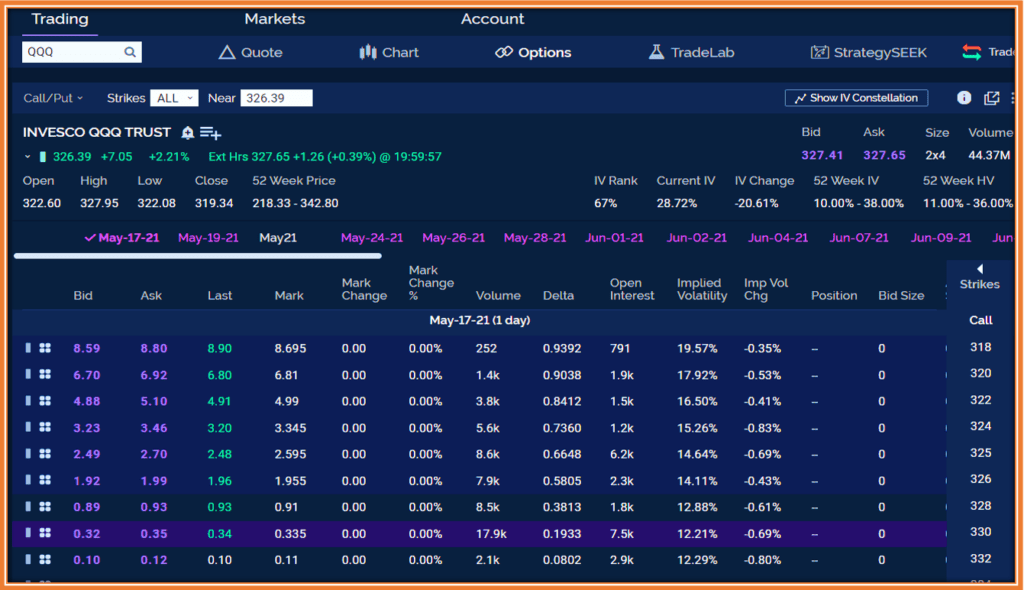

Options have weekly expiration and monthly expiration.

Some ETFs (Exchange Trade Funds) have daily Expiration now.

Once in possession of the Option, the trader can sell is at any time before the Expiration date (at least in the US, as it is a bit different in Europe).

Two popular type of trades to consider:

- Scalping which consists of holding the Options only for a very brief period of time (a few minutes, a few hours) depending on market conditions and

- Swing trading which consists of holding the position for a few days or even weeks depending on the time left before its expiration

Options Trading Explained: Stocks vs Options ?

Stock Options (there is also Binary Options we will not be addressing here today) are attractive because they are cheaper than the stock they are derived from also known as the Underlying.

One option gives its holder the right to 100 shares of the Underlying stock.

Why Is Buying Option More Profitable than the Stock Itself ?

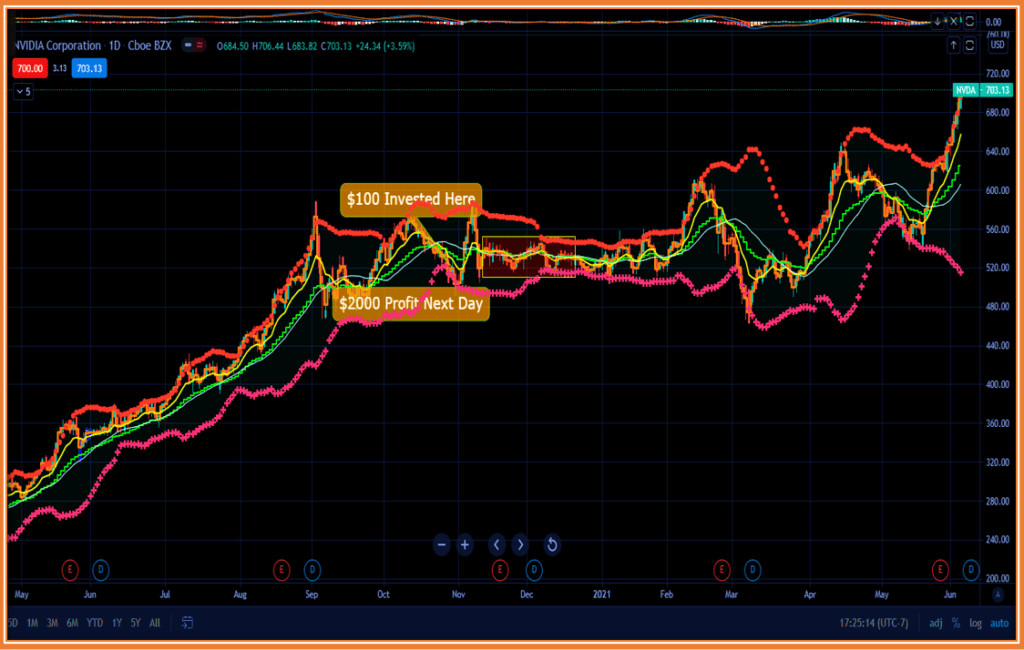

Stocks like Apple (NVDA) , Netflix (NFLX) or TSLA are too expensive for most beginner traders with small accounts.

So, in order to acquire 100 shares of such stock, one must come up with over $50000.

Whereas if a trader purchases let say NVDA Calls with an expiration date that is still in the future, that trader could exercise (exercise their right to buy it at the strike price) their AAPL calls Options today and thus saving a great deal of money.

This method is really more like an investment.

For reference, here is the daily chart for Apple stock over the last 12 months plotted using TradingView charting tool.

Our goal in trading Options vs Stocks as outlined in Trade Stock Options discussion is to make money from the price movement of the underlying security and typically over a short period of time.

Why Isn’t everyone trading Options

Typical expiration will be weekly (dangerous to trade) or monthly even though intent is to be in the trade for a much shorter period of time.

Price moves from one thing and one thing only : Supply and Demand.

We do not care about the fundamental of the company we trade.

The Lack of understanding of Options trading is what makes most traders stay away.

However, with the proper knowledge, there are plenty of Options trading strategies traders can leverage to generate income or complement other type of investments.

Options Trading Strategies For Beginners

Stock Options strategies can be as complex as needed.

For the Purpose of this discussion, we shall simplify it to Calls, Puts, and the combination of these two that can be called Strangles and Straddles.

Also, we will position ourselves as the Buyer of the securities meaning we will purchase them from Market Makers.

Simple Option Trading Guide

Note that it is quite possible for someone to become a Market maker (writing Calls or Puts) but that requires certain requirements not addressed in here.

A Call option is considered when one expects the stock to go up

A put Option is considered when one expects the stock to go down

A (Long) strangle is a Call and a Put with different strike prices

A (Long) straddle is a Call and a Put with the same strike Price

Are All Stock Options Equal ?

We already know that Stock Options have different Expiration times.

Some Stock expiration are only monthly while most have weekly expiration dates.

What is an Option Expiration date

Traders like to stick with certain set of stocks sometimes known as Watchlist.

This helps them become very familiar with the way a specific stock behave thus providing an edge in knowing when to enter and when to exit a particular position.

The price of the Stock also influences the cost of its Option outside of movement.

Amazon (AMZN) is a a stock that trade over $3000

That price of the Options are way more expensive that Apple or NFLX.

This means there is a barrier to entry for trading certain Options.

This can lead one to wonder: How much capital one needs to start trading options ?

Well, the short answer is as little as $5.

Cost of Trading Option Has Gotten Cheaper

There is $0 commissions on trade since early October 2019 across all major brokers.

Therefore, the cost of buying an option becomes the cost of the contract plus the cost of the option itself.

Options can be bought for as little as 1 cent per contract.

Since that is for the control of 100 shares, the actual price for that option is $1.

One can take calculated risk with a relatively low budget.

Especially close to the expiration date of the options.

Because by their nature, Options will lose value as the expiration is nearer.

Where Can You Practice Option Trading ?

If you are a beginner trader who is looking to practice options trading, you will need a demo/Paper account.

Most brokers nowadays do offer a free practice account that traders can reset indefinitely.

E*TRADE trading Platform is one of the easiest options trading platform for beginners.

It comes with a free demo account after you create you account online.

This process takes less than 15 minutes.

Here is our recent video comparing E*TRADE vs Webull (this one does not offer an option demo account yet).

CONCLUSION

We just completed the definition of a stock Option.

We introduced the basic set of Options one can trade without restriction (Call, Puts, straddle and strangles) .

Next, we will explore some technical aspects of stock Options.

What makes one attractive over another one.

In the meantime, let me know on the comments section below how in depth you think I should go in the exploration of the technical aspects of Trading Stocks Options.

Suggested Resources

#1 : The #1 Trading Tool You Don’t Want To Miss In 2020

#2: Get Our Free Daily Market Recap Videos on YouTube

#3: What You Need To Get Your Options Trading Career Started

TBP | Becoming A Successful Stocks and Options Trader

Email:Telex@Successfultradings.com

Facebook: facebook.com/telex.tbp.7

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Hello Telex, I heard that stock options is actually a much quicker means to making money in trading and though I am yet to begin it, I really fancy the chances of trading stock options but also, I heard about the too much risks that are associated with it. You have really simplofid everything for me out here. Thanks so much for sharing this post

Hello Rodarrick,

We purposely decided not to talk about the potential gains at this stage because our main focus is to educate the traders about skills needed.

No doubt, opportunities are abundant is such a volatile market and soon, we will be showcasing how to take advantage of them.

Thank you.

Hi Telex, I have been interested in trying to make money with stock options, but I just never got the courage to do it because of fear of losing money. I like this post because it is actually giving me an education on what are really stock options and you break it down in a way that is easy to understand. In the future, I might try and invest in these stock options and I have bookmarked this post and website to use as a reference to help me out if I decide to try it.

Thanks for the great information and keep up the amazing work!!!

Thank you for your comment,

We have so much more coming on here . Take a look at the initial articles on some recommendations you already can take actions on today.

Keep visiting as we are constantly adding new material to help people like you with the training they need to take their trading to the next level.

See you soon.

Yeah I’m still confused haha. I’m exploring the world of trading stock options but it’s a LOT to learn, at least quickly. I probably shouldn’t want to learn quickly though as I might just be making my money disappear quicker too 😉

I’m looking forward to the rest of this series, it’s very informative and I love that you are telling the truth about trading stock options, good work.

Thank you for your comment.

I believe in any endeavor, one must learn the skills needed to succeed.

Options trading is no different to let’s say learning to play the guitar or the piano

and we have emphasized enough the Necessity for beginners to master their skills through a paper account

before going on a live platform.

Hope this helps.

Hello telex,ihave leads of stock options before but I have. It thought yet to give it a try. Having read this post though, I think that it will a good thing for me to give it a try out. I like the fact that you can give us the option to know more about this. Yes I will personally like you to go into the nitty-gritty of stock options. Thanks!

Hello Henderson,

Thank you for your input.

Please follow us below to make sure that you do not miss out our upcoming videos

and newsletter for those individuals ready to take their trading to the next level.

Thank you.

Truth be told, I was always afraid of trading stock due to the fear of losing badly.

But, funny enough, I recently just finished a chapter of this book “Rich Dad Poor Dad” that explored the topic of fear and why winners use the fear of loss as an inspiration rather than let it draw them back.

That drastically changed my mindset and brightened my horizon.

And before I knew it, I stumbled upon this post and I found myself reading through this article of yours on trading stock option with full concentration as I try to make sure I understand every bit of information and description of the strategies from the call to put, strangle and straddle.

Amazing how something that was once terrifying has triggered my curious minds, and this is what brings me to the following questions which I would love you to explore when writing your next post on the technical aspects of trading stock options;

Since you mentioned that you would explore what makes an option more attractive than another, I would like to know if that attractive or more like what makes it good to trade on also determine how long one should trade on it?

And could a once attractive option lose that value while one is still trading? And if does, what is the best way to handle the trade, is it to accept the loss and immediately put an end to the trade? Or is it better to be patient in case the value would rise again?

Also, could the same thing that makes the stock attractive to trade be a risk at the same time?

So sorry if my questions seem to novice-like as I mentioned earlier, I am still new to this, and it is your article and the way you explained it that triggers my interest.

Thank you very much, and I will be keeping a look for the next post to better enlighten myself!

Wow Tohin,

what a comment! You just inspired the content of our next article.

All of these questions you brought up MUST be answered and they WILL.

Please subscribe to our feed below so that you are alerted

of our next post which will be entirely dedicated to the essentials

concepts you brought for.

Just a little patience.

Thank you very much.

You know your stuff. I recently became interested in trading. I know a lot of people who won’t touch trading at all, but I am a trail blazer. You really explained things in a way where a person who is just starting out can understand it. I will bookmark your website and visit often, so that I can become well versed in trading. How would someone who is adamant about trading get in touch with a broker? Is a broker a mentor or are they totally different? Also, do you need a mentor or broker at all? I apologize for all the questions. I am very interested in trading.

Hello Miss Ferguson,

Thank you for the positive feedback on our article on options trading.

A broker is the company where you as a trader will open an account to trade.

A trader can/should have both a mentor and a broker. These are two separate entities.

We hope these answers are useful to you and looking forward to helping you in your future trading.

Whew, that was a mouth full. I have done normal trading in the past and was slightly interested in options trading. The problem was that it really didn’t make much sense to me and I thought it to be far too risky.

You made sense of it for me. Thank you for a really educational and insightful post.

Hello Arthur,

Thank you for the positive feedback on the content of the article.

We appreciate your time.

See you soon.

Awesome post, you’ve actually made it easier to understand the complex world of options and trading. Question for you, given how powerful options trading seems to be do you think that actually holding individual stocks is worth it or do you think it’s best to just get really proficient with options and trade them. Thanks so much!

Hello Judy,

Thank you very much for the engaging question.

I believe that it is important to diversify one’s portfolio.

Hence, having a portion of your capital devoted to options trading may provide

that mix to get more than the standard yearly gains the stocks provide.

Are you looking into Day or swing trading yourself ?

Hi Telex, thank you for this complete explanation. Previously, I had tried to trade binary options, but I ended up with a substantial loss. But there are some of my friends, who are also successful with the world of trading.

But since I think I am still a beginner, which one do you think is better if I want to focus on learning and make money?

I don’t want to repeat the same mistake a second time.

Hello Asmadi,

Based on my research on binary options, it is far better to learn how to trade stocks options.

You can learn the leverage options provide without too much risk at your own pace.

Hope this helps.

Thank you for stopping by and providing your feedback.