If you are new to online trading, let me preface by telling you that Stocktwits.com is to the stock market what Facebook is to Social Media.

Stocktwits.com platform is becoming the one stop shop for all people with a vague interest in trading.

Consequently, that makes it more and more difficult for serious traders to get something useful out of the tool.

Table of Contents

StockTwits Rising Interest

Since its creation by Howard Lindzon and Howard Macbeth in 2008, the platform has not stopped growing.

According to Google’s trend chart below, the five-year interest for Stocktwits.com has risen while the search interest for the Wall Street Journal has consistently declined over the same period.

What is such an attraction all about ?

Above all, the service is free so anybody can just create an account and start publishing.

The original objective by the founders was to create a platform for traders and investors to share ideas.

If you have an idea or opinion on any stock, you can share that on a space exclusively reserved for that stock.

SPY Stocktwits Room

The SPY StockTwits page is one of the most popular on the platform due to the Popularity of the US Leading Index.

Most traders know that SPY is the heartbeat of the market so by getting a sense of what goes on with SPY, they can interpolate to the individual stocks.

At least, in theory.

Not all the stocks are strictly 100% correlated to SPY every time.

More to come on this later on another discussion.

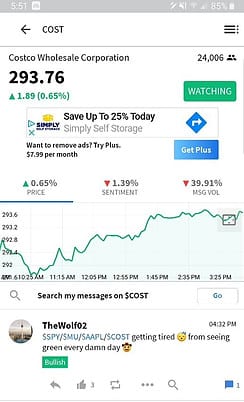

Below is an example for the Costco stock (Ticker:COST).

How Is Stocktwits Setup?

The page for each stock displays the most recent quote on the top left-hand side.

On the top right-hand side, it tracks the number of people currently following this stock (24006 as of this writing is not that high compared to the likes of Apple and AMD).

With each comment, you have the option to declare if you are bullish or bearish.

The summary of the bearish and bullish posts is provided by the sentiment indicator.

This is updated as new posts on the stock come in. Next to the sentiment is the message volume.

You can chart the price, the sentiment and the messages’ volume individually by just selecting it.

The picture above is showing the price of the stock over the most recent trading hours.

Is StockTwits Worth Your Time?

Posts can be simple messages’ like the one just below the chart or they can be a combination of text and images.

The setup is or should I say was actually quite nice for sharing of trade ideas.

However, over the years, it has morphed into this mix or Twitter and Facebook where everything goes.

The preponderance of ads and the proliferation of services has recently (third quarter 2019) forced the management to launch a paid subscription without ads. The price is $7.99 per month.

I am not sure yet if I will be making the jump to the paid membership side.

And here is why.

StockTwits: The Bad and The Ugly

The vast majority of content you will witness on the platform nowadays is of little value for the serious trader.

I hate to have to take you through this but here are some recent samples I gathered.

I did not have to go back in time or do any search of any kind.

These are all recent messages’ captured from the platform as I was preparing my research for this tutorial.

For lack of a better method, I will go ahead and try to summarize them into my own categories.

The Humorist Types

I am not exactly sure what is end goal for this one. I may have found humor in it initially but on second thoughts, not so much. What is your take ?

The context was went the news came out that Boeing (Ticker: BA) will stop production of the Max series plane.

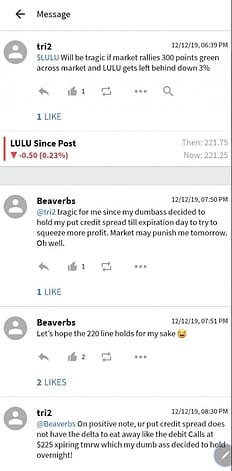

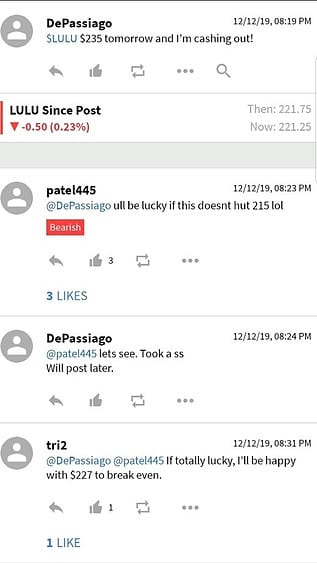

The Self Pity Post

It may be therapeutic to commiserate over a bad trade? Not sure how this trader will grow from this activity and learn how to become a Successful trader.

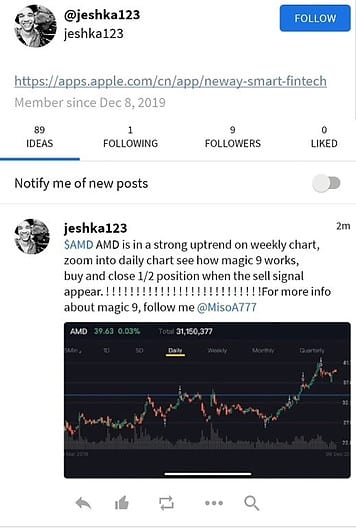

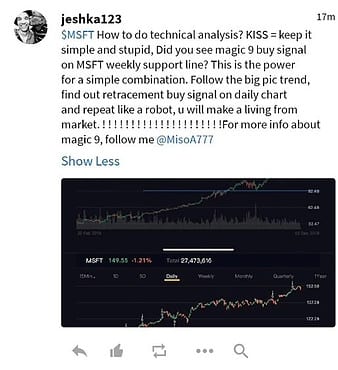

The Spammers

At first sight, the following is a nice post with a chart describing a technical analysis of some sort.

But after further review, it is SPAM..and here is how you will uncover SPAM 100% of the time. The post on multiple stocks with high frequency and with the same message.

They ted to have very brand new accounts with very few followers.

Just like in other social Media platforms, each comment or post can be liked by others in the community.

The message can also be re-shared or forwarded to others. The above post was less than a week old and had not like.

Furthermore, here is the very next post on a different stock with the same copy-cat text.

Thus confirming that the user is simply spamming the board in an effort to promote a new service.

The platform allows you to block spammers and report them to the IT department.

If you ever find yourself devoting time to this activity during your trading, I let you be the judge how efficient you are bound to be on your primary objective.

The Crystal Ball Forecasters and their Idols

Very few can predict the direction of any stock.

Even the most successful traders like the one on the Top picture are often humbled by the market.

On the day of the comment, apple stock never came close to that price.

Nor in any of the subsequent days.

You can check it out 🙂

Last but not least, the Political Agenda are abundant

What can politics possibly do to make a trader successful?

Yet, day after that, you will come across quarrels on this platform on how such as such president is or was better for the economy.

I do not know about you, but I am pretty sure my trading account has very little correlation with who the Commander in Chief is. Don’t you think ?

Here is a sample video highlighting all of Stocktwits.com in its splendor and horror.

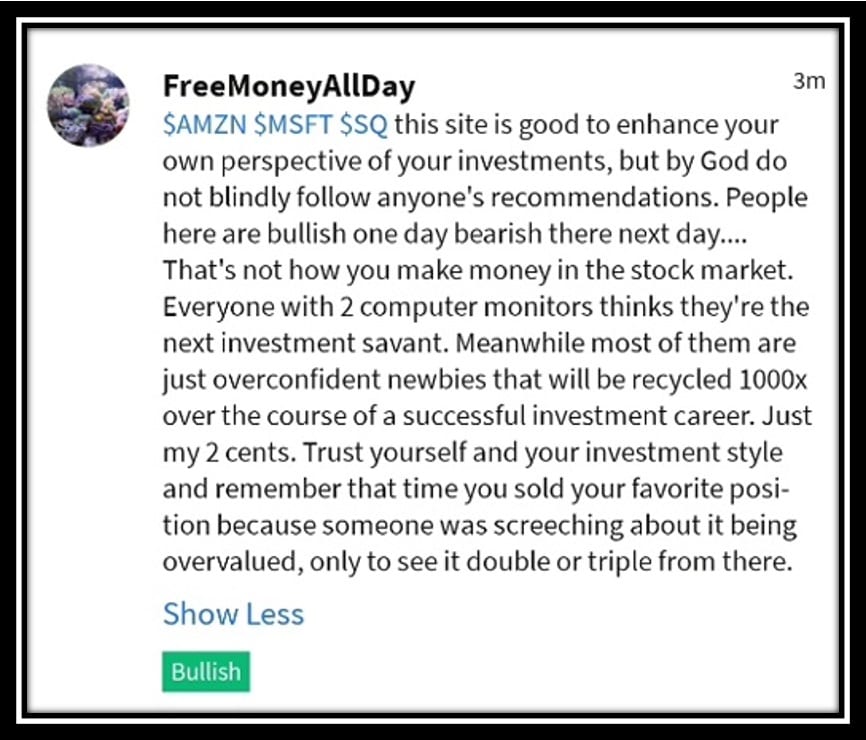

But all is not garbage because from that to time, you will come eye to eye with this type of post.

I call it the He_She_Gets_It Post.

This person clearly understands the big picture and knows how to go about using this medium.

I am fully aware that trading can be lonely or even boring on certain days.

Hence, the need of entertainment or distraction is a constant lure.

If you are a beginner trader (I know even some well seasoned traders falling prey to this trap) looking for that silver bullet to get that elusive edge in the market, looking around in StockTwits is certainly not be the way these days.

Rather, let me share some good takeaways you can successfully implement today in your trading.

How About a Better Usage of Your Time ?

Instead of roaming through Stocktwits pages to find your next trade idea, may I suggest you use the time to master the Top 3 ways of finding trades.

1. The Top to Bottom Approach

The technique consist of starting from an Exchange Trading Fund (ETF) like SPY to isolate its sectors.

Then drill down into a specific sector to find individual stocks that have strength or weakness.

I will be showcasing this very method with a perfect tool for this task in an upcoming review.

2. Unusual Volume

Remember how we described the entrance criteria into this MCD trade ?

That was because of very unusual high volume on that day.

You can set up such analysis on the daily charts of your watch lists.

Or better yet, use the automation of your trading platform to alert you of volume spikes.

3. The Trend Is Your Friend

This is one of the saying I hear again and again. Well, one good reason is because it is true.

When a stock is trending in any direction, there is a force driven that trend thus making it quite easy to sport and follow until the trend changes.

Here are the basic trends:

Higher Highs and Higher Lows: this is an uptrend pattern where the stock is posting higher prices while retreating at a much lower pace.

Here is a detailed video on how to recognize a bullish trend since most day traders love trading Calls more than puts anyway.

This can be used on any time frame you want either for day Trading or Swing Trading.

Lower Highs and Lower Lows: On the other end of the spectrum from the previous one, this trend is bearish.

Puts are used to benefit from this type of pattern.

Here is an excellent illustration below.

After fully mastering the above techniques, then you can share your analyses and findings on StockTwits to aid your fellow traders.

Day Trading 1 vs. 1 Coaching Session

If you are serious about options trading in 2022 and beyond, what a better way to take the right steps towards your success.

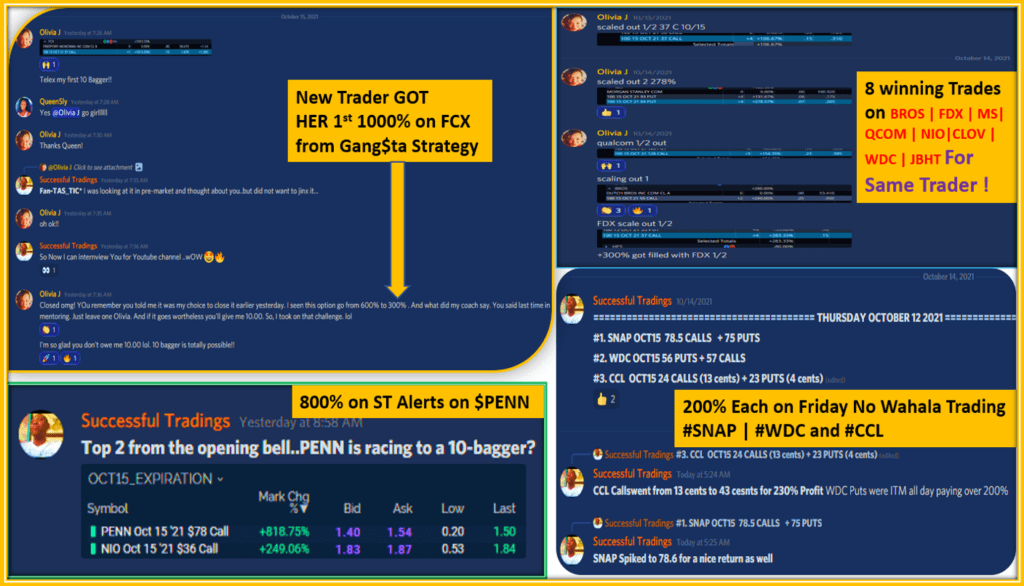

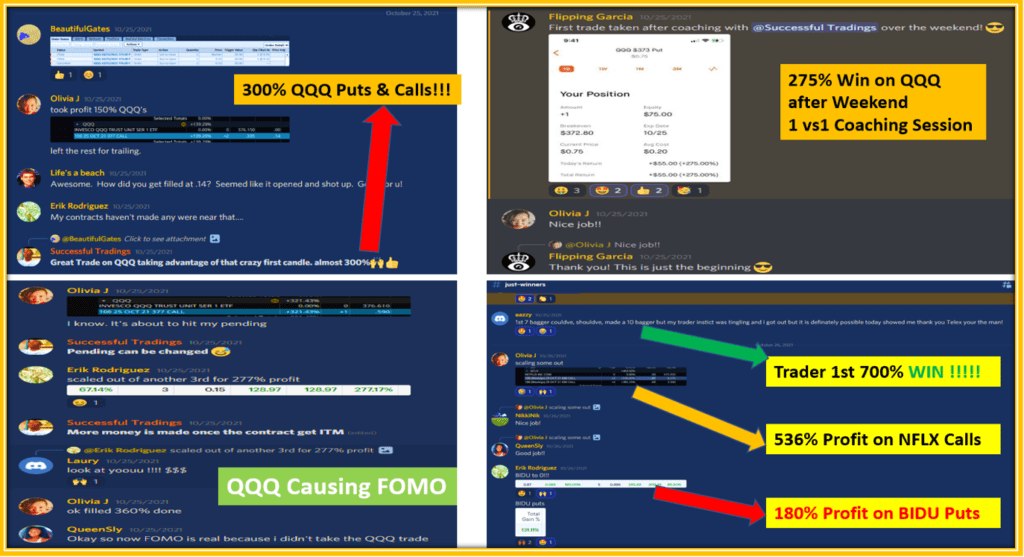

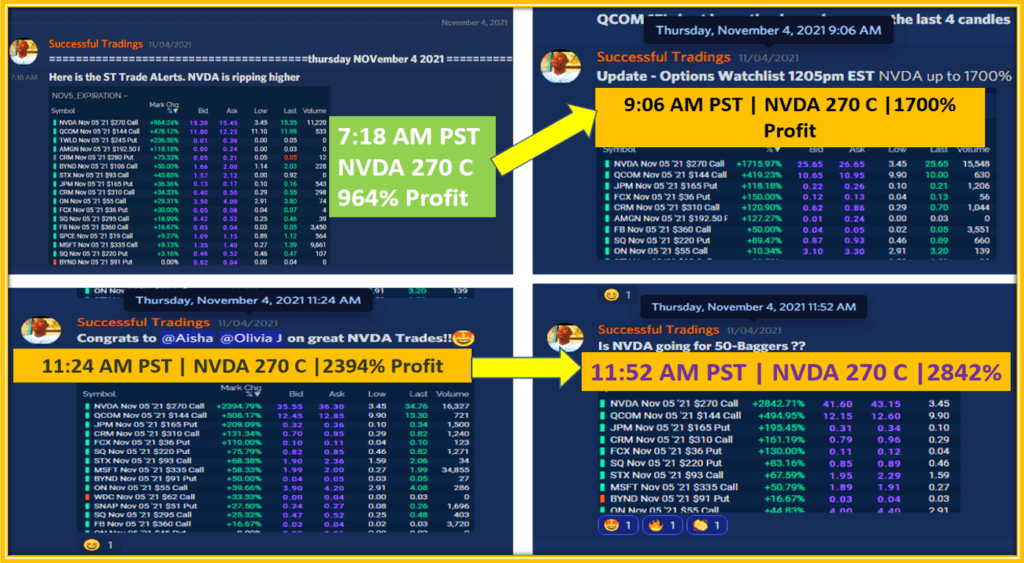

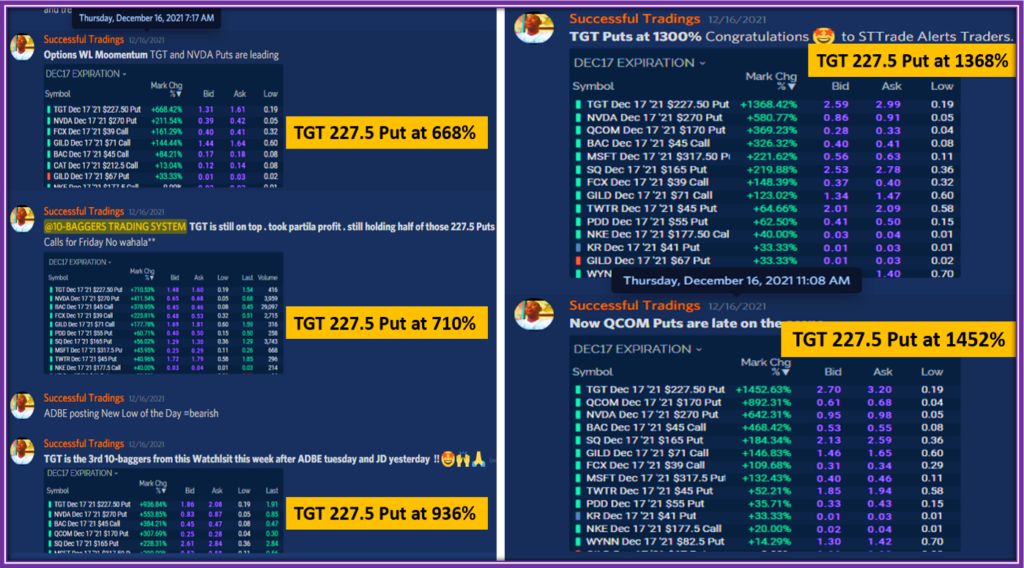

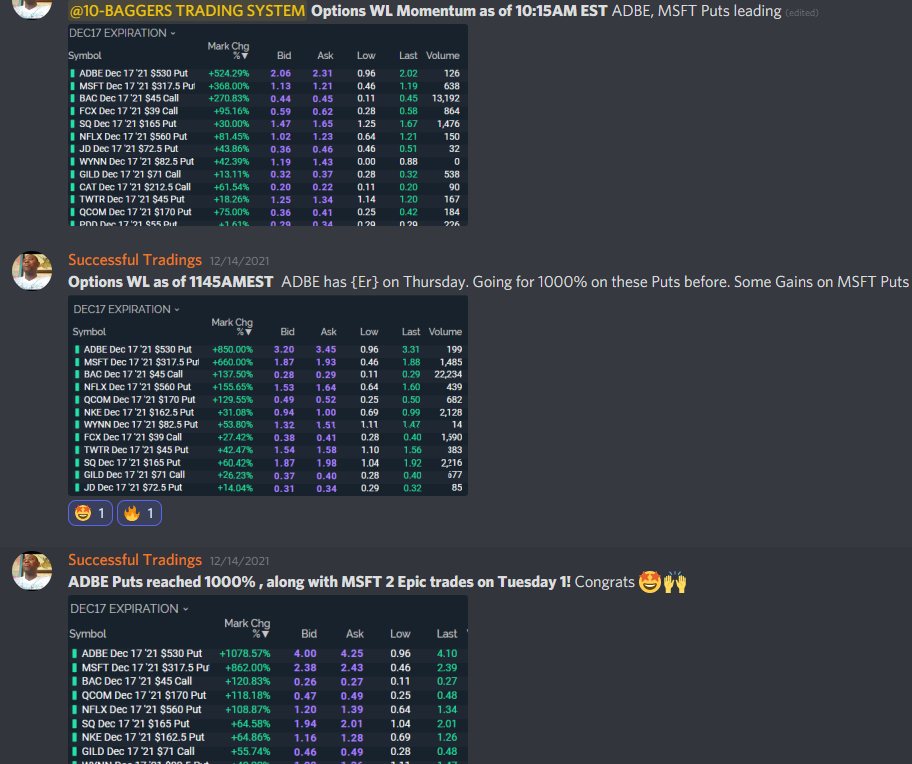

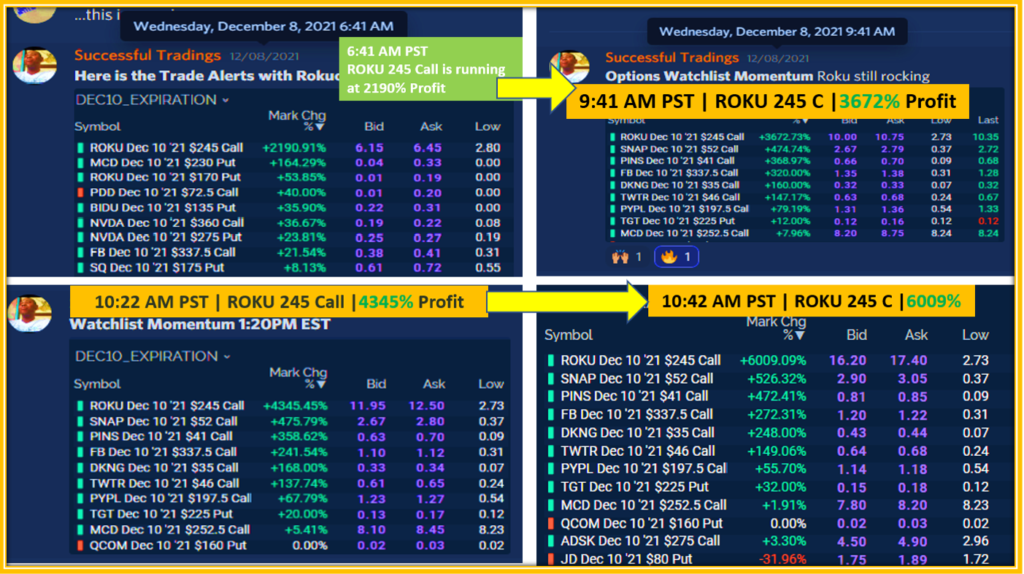

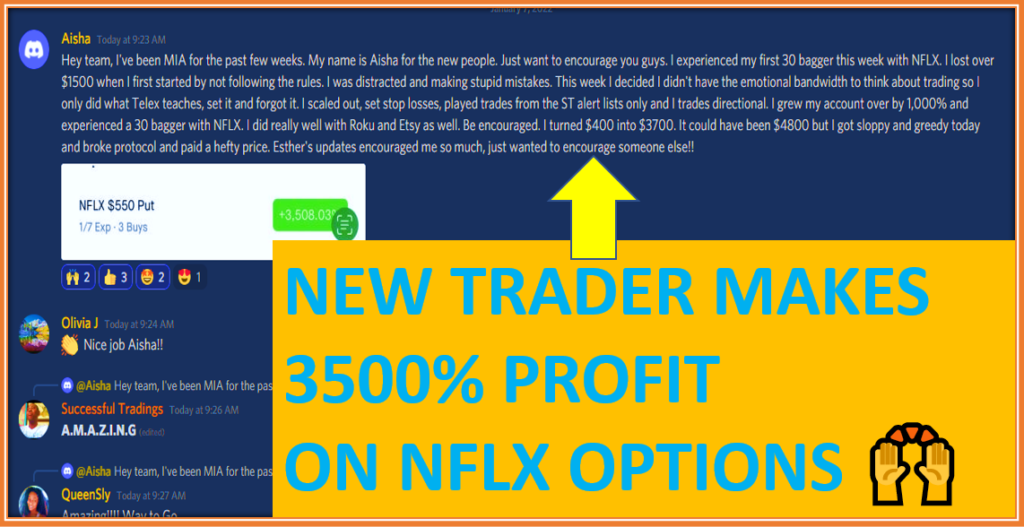

I have been coaching traders since 2020 with some A.M.A.Z.I.N.G results.

You can check out our options trading success stories as depicted on my YouTube channel.

Below is a slideshow of recent results traders like you have obtained.

FINAL THOUGTS ON STOCKTWITS

Stocktwits has been around for a while and it is not going anywhere anytime soon.

However, it represents a snare for newcomers who may be drawn to this platform in search of trading ideas.

Beginner traders must be aware of this potential pitfall and rather focus on efficient ways ON SPY Stocktwits to improve their trading skills.

We shared a few such techniques that can be easy applied towards the furtherance of the traders’ abilities.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

hello, i really want to first appreciate your effort in putting this great website together and writing this article. up until i came across your article, i knew little or nothing about stocktwits. i heard about it a few times but with this review i have come to grasp of what it is all about. thank you very much for this post

Welcome Benny,

Glad to read that you have found value in this article.

Thank you for stopping by to provide us your feedback to us.

It is important so that we can tailor the content to suit your needs.

The article about the ” Stocktwists” looks nice. You give several information about trading ideas.Even my cousin sister recommender for me but I’m not interested in the Stocktwists but after seeing your article it gives more additional information to improve my trading skills and clear all my doubts. Thanks for giving the recommended information.and keep creating more articles for people use, your friend yoge.

– by yoge

Hello my friend Yoge,

How are you doing ?

I am pleased to read these publications are of great

help to you and your friends.

We will continue creating useful information for

you guys.

See you next time.

I have been buying and trading stocks for a couple of years now, and although I have a solid foundation I believe, I could always use more information. It looks as though if you sift through some of the extra stuff people put on StockTwits there can be a lot of useful information that I could use. I personally use Robinhood to do my trading, and although it is good for actual trading since there are no fees associated with it, I use the information from other sources to make my decisions in which stocks to buy.

Hi there Travis,

I am glad to read about your positive experience

with Stocktwits.

Wishing you great trades into 2020.

Good Night.

Hi Telex,

As a newbie I found your article really helpful and informative. This is the second article I am reading from your blog and I got great insights from this article.

You have provided a great walk-through on StockTwists and the images you shared are very helpful in my understanding. I will better stay away from StockTwists and use my time in more productive way by going with your recommended techniques.

Thank you for sharing this post. Its very insightful and enlightening.

Good Morning Paul,

It is a pleasure to read that you are learning so much from our articles.

Looking forward to your next feedback on your experience with our content.

Thank you.

Thanks for this information on StockTwits website. It’s good to know it is not the place to be for serious traders. They have certainly grown tremendously since 2008.

The concept of sharing ideas is great, but it being a free platform has seemed to dilute it. I would think that the paid membership would be more appealing to serious traders.

Thanks for categorizing the various groups to avoid on the site. I appreciate your valuable insights. All the Best.

Hello Joseph,

Thank you for stopping by and providing your positive feedback.

Have a good evening.

I wish I had found your site sooner. As new to trading, I had an account with Stocktwits. I cancelled the account due to misogynistic and pornographic posts. The site isn’t conducive to learning and intelligent conversation about trading.

I’d recommend paying for a professional trading room. Time is money and just because something is free, doesn’t make it valuable.

Thanks.