As we continue our trading education series, today I’m going to share what I’ve learned about Triple Top Stock Pattern.

It’s basically one of the fundamental patterns used by traders in the technical analysis of stocks.

We’re going to look at how this pattern is detected, how it works and how traders use this to their advantage in their trading pursuits.

Table of Contents

What Is A Triple Top Stock Pattern

The Triple Top Stock Pattern is a type of chart pattern that traders use to predict the reversal of a stock’s price.

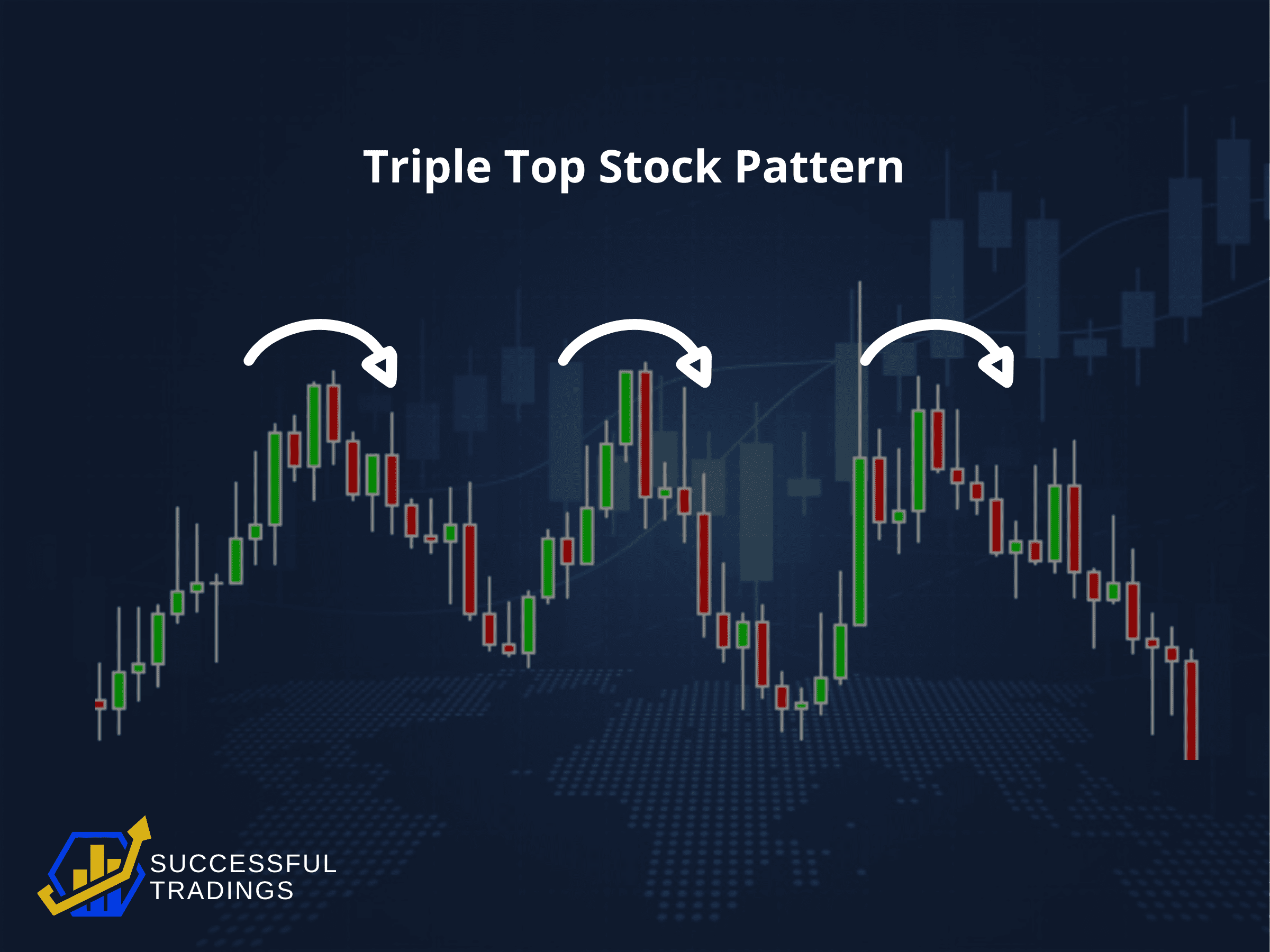

Why triple top? Because it presents itself in the form of three peaks.

A Triple Top Stock Pattern signals that the stock has stopped rallying. A “rally” pertains to a period of sustained increases in the prices of stocks.

This pattern also signifies that lower prices may be on the horizon.

Below is how a Triple Top Stock Pattern looks like:

The Triple Top Stock Pattern may occur anytime, but it must appear following an uptrend, which makes it a rare pattern.

So basically, these are the elements that need to be present in this pattern:

- Prior trend must be an uptrend

- There should be three peaks (or highs)

- Lowest point of the pattern marks support break, which completes the pattern

The opposite of a Triple Top is a Triple Bottom (obviously), and we will talk about that in another article.

How A Triple Top Stock Pattern Develops

I’ve also learned that the Triple Top Stock Pattern is basically a reversal pattern. It usually takes three to six months to form.

As a Triple Top Stock Pattern develops, it can take the shape of a Double Top and other patterns as well. If you’re a trader, you have to combine the Triple Top with other indicators. This is to confirm the bearish crossover after the final high.

The Triple Top is considered to create a reliable sell signal, especially if the pattern develops following a significant rally. That’s what makes this pattern worth studying.

Here’s a video I found that explains the basics of the pattern in understandable terms:

Okay, now I know that this pattern occurs when the price of a stock creates three peaks at nearly the same price level. What else do I need to know?

Well, I’ve also learned that the area of the peaks is called resistance. The pullbacks between the peaks are called the swing lows.

After the third peak, if the price falls below the swing lows, the pattern is considered complete and traders watch for a further move to the downside.

Is Triple Top Bullish or Bearish?

In a previous article, I’ve learned that a Bearish reversal pattern happens during an uptrend. Also that it signifies that the trend may reverse, causing the price to start falling.

By this definition, we can say that the Triple Top Stock Pattern is Bearish.

Trading A Triple Top Stock Pattern

Once the price of a stock falls below pattern support, I’ve learned that some traders will enter into a short position, or exit long positions.

The support level of the Triple Top Stock Pattern is the most recent swing low following the second peak.

When the price falls below the trendline, the pattern is considered complete and traders will then expect a further decline in price.

On top of this, traders will also watch for heavy volume as the price falls through support. Volume should increase showing a strong interest in selling. If it doesn’t, the pattern is more prone to failure

The Triple Top Stock Pattern provides an estimated downside target equal to the height of the pattern subtracted from the breakout point. Sometimes, however, the price will drop much lower than the target.

What It Means When The Pattern Appears

Basically, the mindset behind the Triple Top Stock Pattern says that buyers are getting worn out or they’ve lost the energy to push the price higher.

This could also indicate that the sellers are starting to become a little bit pushy and assertive.

They’re essentially ready to pay the higher price. Thus, it becomes sort of a stalemate between the buying and selling power.

That makes the Triple Top Stock Pattern a more powerful reversal pattern. This is because by the third failed attempt to break above resistance, more sellers realize that buyers are not very forceful. Also, that they won’t be able to push the price higher.

As a result, they step in more assertively and ultimately they can drive the price lower.

Why This Pattern Is Important

We know that a Triple Top Stock Pattern indicates that the price action is unable to break through the higher peaks.

A trader’s simple technical analysis will show that after multiple failed attempts to trade higher, the stock is unable to find buyers around the higher price range.

Traders will then consider the price to be overvalued, and the pressure to sell the stock increases.

Technical traders will understand that the price is unable to rise above the resistance level and therefore have no business holding onto the stock.

Investors who currently hold the underlying begin selling, new traders also jump in and short the stock. This ultimately pushes the price down below the lower trendline. Here, the stock breaks down, fueling the selloff.

Triple Top Stock Pattern In A Real-Life View

We can look at how this pattern can play out in real-life events. The first impact is that it puts pressure on all those traders who bought during the pattern to start selling.

Now if the price can’t rise above resistance, there is limited profit potential in staying with that stock.

When the price falls below the swing lows of the pattern, selling may intensify further.

Former buyers can end up exiting, losing long positions, while new traders jump into short positions.

This is what usually goes down, often triggering the selloff after the pattern completes.

Here’s a sample of an actual Triple Top Stock Pattern via TradingView:

What I’ve Learned

In summary, here are the things I’ve learn about the Triple Top Stock Pattern:

- A Triple Top Stock Pattern is formed by three peaks moving into the same area, with pullbacks in between

- It is considered complete, indicating a further price slide, once the price moves below support level

- A trader will either exit long positions or enter short positions when the pattern completes

- The estimated downside target for the pattern is the height of the pattern subtracted from the breakout point

Obviously, a pattern will not work all the time.

For example, a Triple Top Stock Pattern will form and complete, causing traders to believe the stock will continue to decline in price.

But in some cases, the price recovers and moves above the resistance area.

CONCLUSION

The Triple Top Stock Pattern is very rare compared to other chart patterns. However, it has the potential to offer traders great profits when it shows up. It’s a very reliable price formation that a lot of traders would recommend to be traded on.

The intrinsic value of a Triple Top Stock Pattern trading strategy is that it gives you the chance to enter a new trend right from the start.

Check out our review of one of the most popular trading tools out there.

We have more educational articles coming! If you would like to leverage our knowledge, take the first step today by making your Appointment online!

With Successful Tradings, you get:

- Free Coaching

- Free Chat Live on our Blog

- Free Daily Alerts on our YouTube Pre-Market Analysis

- Free Option Education on this blog and our YouTube Channel

- Free Interactive Discord Room to Share Ideas with Other Traders

- Our Awesome trade Alerts

- Weekly Videos Performance Review

- Innovative Day Trading Option Strategy – GANG$TA Trades

- Quantitative Earnings Analysis

Interested? Setup your FREE 30-Minute Consultation with me today!

Thoughts? Share your comments below!

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Interesting triple top stock pattern. I have learned something new today. But I have a question if you don’t mind. What do we do after spotting this pattern? Do we buy it? And it seems that we will still need to analyze the fundamentals of the company whether it is worth investing?

Greetings Richard,

Thank you for leaving us your question.

The beauty of Technical analysis is that there is no need for fundamental analysis for the trader to make a decision.

A triple Top is a bearish setup so it is traded by shorting the stock or buying Puts.

Hope this helps.