In Today’s Stock Options for Dummies discussion, we aim to explain basic terminology about online trading.

To that effect, we are going to use options as a vehicle to convey some basic concepts to an audience that is not too familiar with trading in general and options trading in particular.

Such is the goal of today’s discussion titled Stock Options for Dummies.

Table of Contents

Stock Options for Dummies: Why?

Too often, I hear people around me say they wish they knew about the stock market so that they could make money.

Even more so when I mention that I trade options.

Their perception of trading options is that it is even more dangerous than trading stocks.

That is true.

Therefore, one must Learn To trade Options just like any profession that provides a revenue.

The stock market has been around for 227 years thus proving that it is not going away any time soon.

Most people invest passively through their Employer 401(k) each year.

Their money go into investment account put together by just the few professionals who have mastered the skills to design investment portfolio.

Our aim here is to share information about the market to demystify this idea that only the few can be knowledgeable about it or even profit from it.

Stock Options for Dummies: Who Is It For ?

Here are the basics.

The New York Stock Exchange as of the research of this paper has 7883 stocks.

We generated below two views displaying the distribution of these stocks based on the first Letter of the stock and the number of letters in each stock.

The Letter “C” is the most common first letter for a stock in the US market.

There are 640 such stocks starting with Citibank (ticker: C)

It is closely followed by the Letter “S” and the Letter “A” with 626 and 590 stocks respectively.

Only 36 stocks start with the Letter “Y” making it the least popular first Letter in all the traded stock as of today.

Of course, this number will fluctuate over time as new stocks are issued (primarily through Initial Public Offerings: IPO) or simply by name changes as was the case recently for VRX that became BHC.

I remember a story in Peter Lynch’s One Step Up on Wall Street about the number of Letters in a stock name.

It was of the tune how he liked 5 Letters stocks.

Well, Do you know how many of those there are in the market today ?

The pie chart below give us the Answer to that question.

There are only 212 stocks (or 3%) with exactly five Letters.

The majority of stocks have 4 Letters (58% more precisely) followed by 3-Letter stock with 36% of total.

Stock Options for Dummies: The Semantics

In just a couple of paragraphs above, assuming you managed to be captivated until this point, you have learned quite a few things about the stock market.

Next, we are going to take you through some basic terminology of stock options in order to start familiarizing yourself with the semantics.

Should you consider taking up on this profession later on, the terminology will no longer represent a barrier to entry.

What is a stock option or an option?

I will spare you the Investopedia’s definition we provided in an earlier chapter.

All you need to know is that it is something (a financial instrument) that is related can be traded.

How ? its value is a function of the variation of the stock it is defined by.

Some stocks we just reviewed in our opening sections will have options or will be called optionable.

That’s means that you and I can trade options on them.

Just as a reference, of the 7883 stocks we enumerated above, only 4188 are optionable.

The Market Makers (the brokerage firms) decide what stocks they want to write options on.

What is Options writing ?

Well, a stock option is just a creation from thin air.

So writing an option means deciding to sell that product.

Once the Market Makers do that, then retail (people like you and me) can do the same or buy with the hope of selling them at a higher price.

Options Strategies or Types

We will keep to the basics here.

In case you would want to really dive into it.

The types of options to trade depends on whether you think the stock (known as the underlying) will be going up or down.

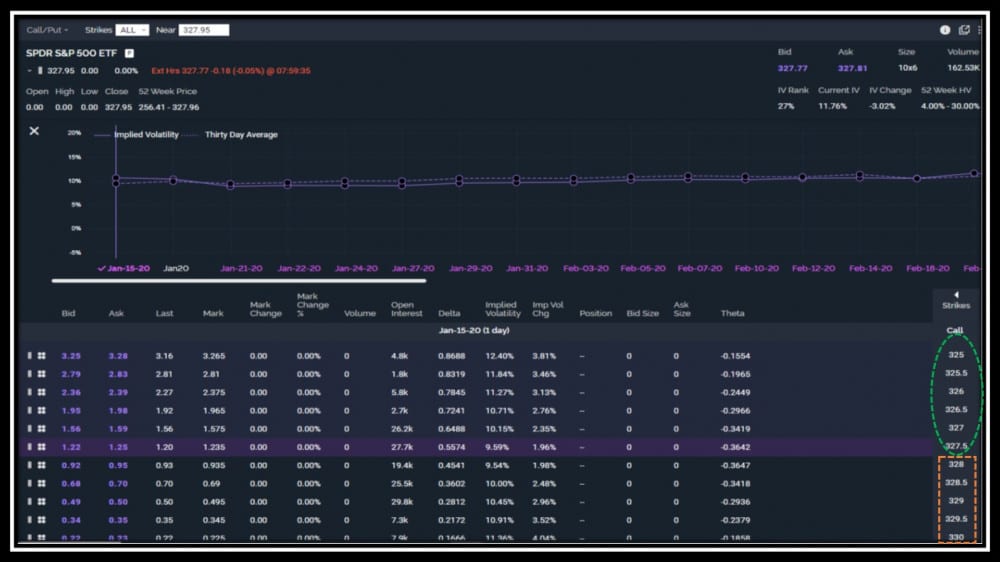

The basic strategy for an upward direction is a CALL.

For downward direction, PUTS are the simplest strategy.

I like how Trader Travis uses the animals Bull and Bear analogies to described Calls and Puts.

Sellers and Buyers

From the names Bull and Bear come the adjective Bullish and Bearish.

This refers to traders who believe a stock will be going up or down respectively.

So, a bullish trader who buys call options can say “I am Long calls”.

For the traders who buy Put options on a given stock, they will be referred to as being Long Puts.

The key thin to understand in this process is that whenever a trader buy options, another trader (yes Market Makers are traders as well) takes the opposite side of that trade.

So if you are making money on your options calls for instance, this means that the seller(s) of those calls are losing money.

The way is work for each side is like this.

The sellers get the money at the beginning of the trade.

That is theirs to keep if the trade evolves in their favor over the time of the trade.

Otherwise, they get to cut their losses anytime the trade is going against them by buying the same position they sold at the beginning of the trade.

This last action is called closing your position.

The time of trade is from the moment buyers and sellers enter the trade to the expiration of the stocks option.

Standard expirations are every Friday for most stocks. Some stock have only monthly expirations on the third Friday of the month.

ETFs like SPY now have expiration on Mondays, Wednesdays and Fridays.

Yes, this is very recent (2018) .

It brings good opportunities for traders to make money fast but also for Market Makers to profit from.

Stocks options are sold in a quantity known as number of contracts.

This quantity varies from one to as may as a trader wants or is able to find a seller of.

CONCLUSION

We gave you a brief overview of the US stock Market as it stands in the Fall of 2019.

The naming of basic options strategies took us through some very basic strategies.

Our hope is that this entry level introduction to stock options will help you with the furtherance of your knowledge on How To Learn To Trade Options.

I hope you found this discussion valuable for your trading methodology.

If you would like to increase your knowledge and further your understanding of these concepts, may I suggest this similar article.

If you would like see how we put this information in application to make money trading Options, click here.

Please leave us your thoughts, comments, experiences or questions about this content so that we can continue to tailor it to your needs.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Ha, this was a really good read. I am one of the dummies in the stock market. Like those you have met before, I too have always wanted to trade stocks or options at least but I have not been able to. I feel like it will be a very big privilege to give it a try. Thank you very much for sharing how the stock market is in USA right now. I have learnt from this.

Welcome Henderson,

Glad you appreciated the content.

See you next time.

It is a very good thing to see that someone that has helped me to explain all about the stock options. I have indeed enjoyed this post with all the information here and I was able to learn a couple of things myself. I didn’t know so much about the US stock too so that is another thing I should be grateful for. I hope to see you write on some more as well.

Hello John,

Thank You for stopping by. Glad to hear that you are learning about Us stocks.

Am very delighted seeing this post right now, stock trading has been good trading that i I’ve always been looking up to learn because I really don’t have the basics knowledge of it yet, so it’s available for the people in the USA only? then am gonna get it opened soon because I really have a great passion towards it thanks so much for this post

Hello Rose,

Thank you for your question. What part of the world are you trading from ?

Our experience is mostly with US stocks. We presented some reviews that track International markets as well

maybe you could leverage those tools where you are.

Let us know how we could help you any further.

I’d like to participate in options trading with my spare money. I got some bonuses from my boss this pre-Christmas season and another set of bonuses to come during Christmas time and after the new year. I’m thinking of investing these year-end bonuses in stocks, and it just so happened that I learned today the idea of options trading. For a person like me who’s not yet rich, how much money should I allocate for participating in this trading?

Hello Gomer,

You can certainly learn to trade options with a Demo/Paper account.

When you are ready to go Live, the initial capital is not that high.check out these recennt examples

of actual trades we analyzed to see how long the starting capital can be in options compared to stocks.

Hope this helps, Have an Awesome Thanksgiving Holiday.

Thanks a lot for summarizing such an amazing content about stock options.

I just learn a lot of new informations you write here. The US stock is unbelievable. I would like to start to trade stocks or options even if i don’t have enough knowledges. Do you know if it exist a training or a demo version to see how things works?

Best wishes.

Hello Nimrodngy,

Thank you for the appreciation of our publication.

Yes, we recommended here that beginners open a new Demo/Paper account.

We also recently published the Top 5 Brokerage platforms where you can open such a Demo account.

Let us know if you have further questions.

Have a wonderful Day.

I love your article. I just started reading a book called Options Trading; The Complete Crash Course by Warren Ray Benjamin. I’m kind of slow on this. So far I’ve learned the difference between call and put and a few other terms. Yet, I remain confused. I believe your site is ideal for someone who is trying to learn these things. I’ve only invested in cryptocurrencies so far, and that’s quite a bit different. I’m looking forward to studying more of your articles as I try to learn all about the stock market.

Ho there Neo Cat,

Glad to read that you have found this article helpful in your learning of the stock options.

We have more beginners tutorials coming tailored to help people like you.

Thank you for your encouraging feedback.

Thank you for writing such an informative post about stock options. I think it is just the lingo that scares people away, I know I am one of them. Thank you for making this so simple and easy to understand. I cannot wait to read more about stock market on your next post. Will join your email list.

Hello Nuttanee,

Glad to read from you as you are enjoying these options trading courses.

See you next time.

Hey Telex, You are doing a great job for learners. I am learning about stocks. Your articles are very helpful for me. I am trying my best to get the same point you are offering here. I enjoy while learning because you listed everything step by step. I like your article and share it with new traders also. Do you have any best beginner guide for me?

Thank you Parveen

Hello Praveen,

We are thankful for the positive feedback on the content

We provide here for beginners like yourself.

Maybe you should check out one of our earlier post to

to evaluate our guide to Options trading for beginners.

Good Night and talk to you later.

Extraordinary! I really like your post. I am studying in the world of trading so I can understand more, plus your explanation is very clear. This is the perfect website for me who wants to learn the world of trading. Because I really think about allocating my 401k to several types of investment.

Related to your writing that talks about US Stocks First Letter. Is there any influence with the performance of the stock? Thanks

Good Morning Kylie,

Thank you for stopping by and leaving us such a positive critique on this post.

Regarding your question, I am yet to perform a correlation study between the first letter of a stock and its performance.

Maybe that is something for me to consider in the near future.

For now, the value of that remark was purely to help ease beginners in increasing their knowledge of the stock market with basic information.

Hope this answers your question. Happy Holidays season.

Hello; I want to like what I read on this post but I am not sure if it is recorded effectively in my brain. ‘Stock Options for Dummies’ I confess I would love to learn about the Stock Market but I am not grasping as I want to. Do you think that anxiety is preventing my progress in learning and holding me hostage as a Dummie? I will have to revisit this post to reinforce what I learn today.

DorcasW

Good Evening DorcasW,

Thank you for stopping by and engaging with us on the content of this article.

We sincerely appreciate you for that.

I think you are right. when venturing into the unknown, we all have this tendency to hold back a bit.

But just like anything new, after we get to taste it or get our feet wet, the learning process usually get much easier.

So my recommendation is for you to take the first steps into the trading area which obviously you are very interested in.

Let me know how we can further assist you in your new endeavor.

Hi, Telex.

Thanks for sharing the Stock options for Dummies. This is really a new term for me and I would love to spend considerable time to learn about Stock options. Do you have some series on the training of stock options on youtube? How much time do you suggest to a beginner to learn all the basics of Stock Options?

Warm Regards,

Gaurav Gaur

Hello Gaurav,

How is New Year’s Eve 2020 treating you in my favorite city Hyderabad ?

Thank you for leaving this positive feedback and allowing me to answer your questions.

Regarding a series of Tutorials on YouTube, yes, we do have that in place. May I suggest you search in YouTube under the name “Successful Tradings” and all of our hands-on video lessons are stored there.

Also, within our main site, we created this Page strictly devoted to videos so that the readers can just do the theoretical learning of stocks options trading and see the practical side of it in one place.

As for the time needed for beginners to learn the basics through online education, it really will depend on each person ability, past experience with the stock market concepts and schedule.

May I recommend you start at your own pace since this training is self-learning and if you come across again roadblock, please post a question on the corresponding article and we will be glad to answer it just like we are doing for your questions today.

Merry Christmas and Happy New Year.

Great information for a newbie, Do you have to have a Stock broker to invest in the Stock Market?

Hello,

Yes, most of it done online nowadays.

All the major ones in the US just dropped the commissions fees in early October.

Thus making it really attractive to trade with any of them.

They offer the trading platform and even free education sometimes.

Check out this review ofthe Top 5 we shared: Top 5 Best Stock Trading Platforms