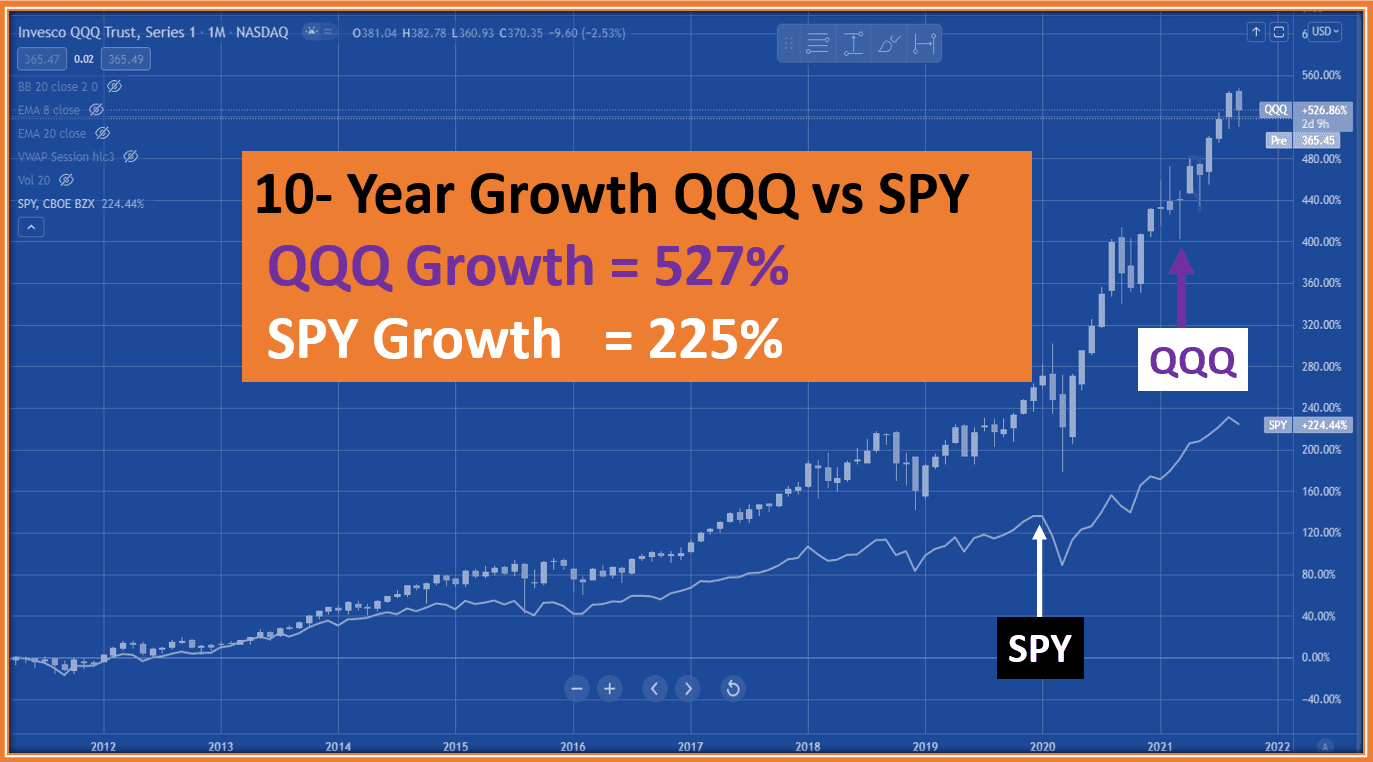

The goal of this discussion on SPY Trading System is to show you winning methods you can use this year to successfully trade SPY.

The biggest Exchange Trading Fund in the US markets has enough volume and liquidity to make it an attractive vehicle for both bullish and bearish Day/Swing traders.

Table of Contents

SPY TRADING SYSTEM: OVERVIEW

What is SPY ?

SPY is the Exchange Traded Fund (ETF) for the Standard and Poor 500 (S&P500).

This weighted index represents the biggest 500 companies in the US.

A bigger Weight is given to the companies with the biggest market capitalization.

That is how Apple and Microsoft ended up accounting for almost 10% of the growth in the S&P500; over the last decade.

Yeah we are in 2020 at the time of this writing 🙂

The huge popularity of SPY can be seen across different platforms.

SPY TRADING SYSTEM: SPY STOCKTWITS GROWING POPULARITY

According to Google’s trends, the worldwide web search interest of Spy Stocktwits has surpassed the household brand stock Apple (Ticker:AAPL).

This happened two years ago and it is not looking to reverse anytime soon.

Just to give you an idea, inside Stocktwits.com, there is a counter for each stock that represents the number of people watching it.

Here is the chart comparing SPY popularity to some heavy brand name stocks. SPY only trails very popular stocks of Stocktwits AMD, Netflix, Amazon and Apple.

AAPL Stocktwits popularity can be explained firstly by its worldwide brand name.

Over the years, the iconic company has gained followers through its products, services and innovations.

Influence of AAPL Stock on SPY

AAPL Stock Price growth is another reason for the huge success of the AAPL Stocktwits room.

It is filled with early investors who have developed an emotional attachment to the stock from their regular usage of Apple products.

Furthermore, Apple Stock is in the Top 3 holdings of the three US major ETFs SPY, QQQ and DIA as we showcased in this Post.

In trading terms, having a position on SPY means you are basically tracking Apple Stock for the most part except on rare instances.

SPY Stocktwits has three times more followers than Roku, a stock than gained over 360% in 2019 !

Yahoo Finance 2019 Stock of The Year number of watchers is more than 7 times lower compared to SPY Stocktwits watchers.

Markets Makers leveraged this rising popularity in 2019 and introduced additional expirations day for SPY options.

Why IS SPY So Loved By Options Day Traders

Unlike other ETFs (QQQ, IWM and DIA or XOP just to name a few), SPY is the only one with three weekly expirations.

SPY features Expiration Days on Mondays, Wednesdays and Fridays ( Just like all the the most Stocks).

What is this a Big Deal ?

It simply means that for that traders have more opportunities to take advantage of the movements (known as volatility) of this instrument.

In the video below, we share our step-by-step approach on how we take advantage of SPY on Expiration Days: Mondays, Wednesdays and Fridays.

The leverage comes from the fact that time is a major factor in options pricing.

Therefore, with closer expiration dates, options become cheaper and thus many traders can participate.

This in turn provides great liquidity for options traders.

One of the immediate consequences is that the Spread on SPY options are the lowest you will ever see.

The Bids and Asks for most Strike is 1 cent. Yes, it is that close most of the time.

SPY Trading System: Why Is SPY a Great Option Trading Instrument

Since this ETF by definition measures the health of the US economy through its biggest companies, its volatility reflects the general sentiment of the market.

We know how much sentiment can fluctuate on news of any sort.

As an Option trader, you will have many opportunities to benefit from this volatility without taking that much risk each time thanks to the many expirations as we explained earlier.

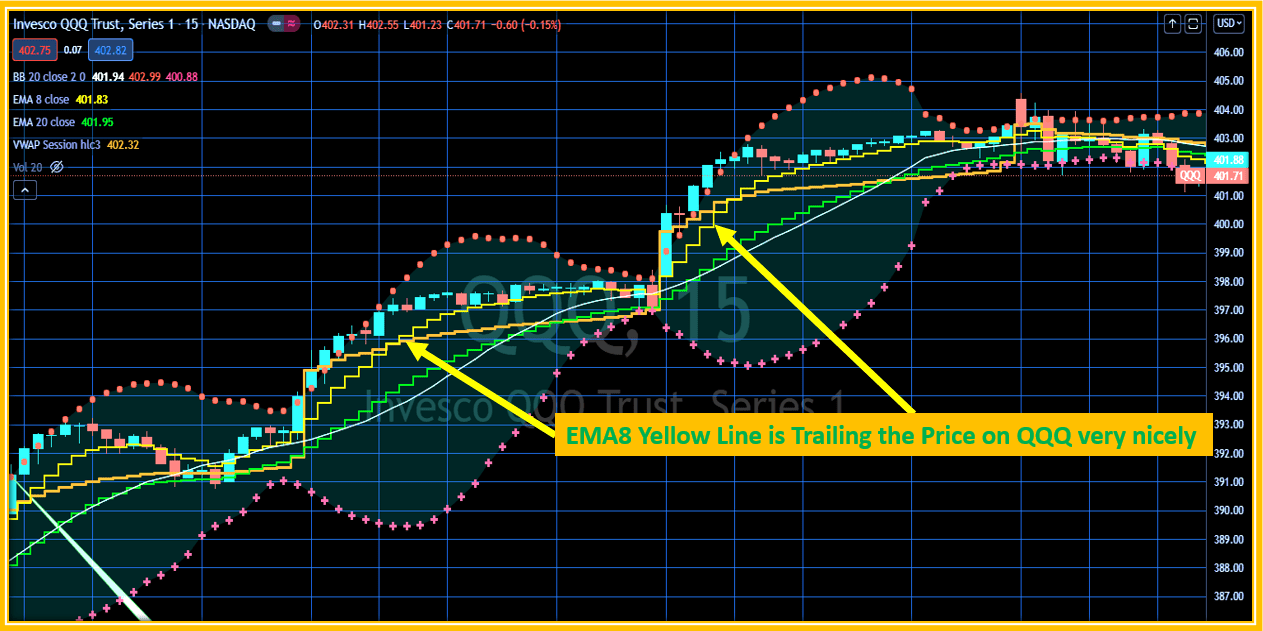

The weekly chart below from TradingView.com should help us understand the volatility of SPY since 2018.

The length of each candle is the distance between the Low and the high for than week.

Meaning that big candles represents a greater volatility.

In 2018, the average SPY weekly volatility was 3.1% versus 2.3% in 2019.

In Options trading, 2% over 5 days can translate into a substantial gains.

HOW CAN YOU BENEFIT FROM THIS KNOWLEDGE ?

I remember reading in “Pit Bull”, Lesson’s From Wall Street Champion Day Trader by Martin “Buzzy” Schwartz How he used to hammer SPY.

This is what he meant. When the market is volatile, the quickest way to accumulate gains is through SPY.

“Buzzy” was giving us accounts of his trading exploits in the late 70s and early 80s.

Four decades later, this remains true.

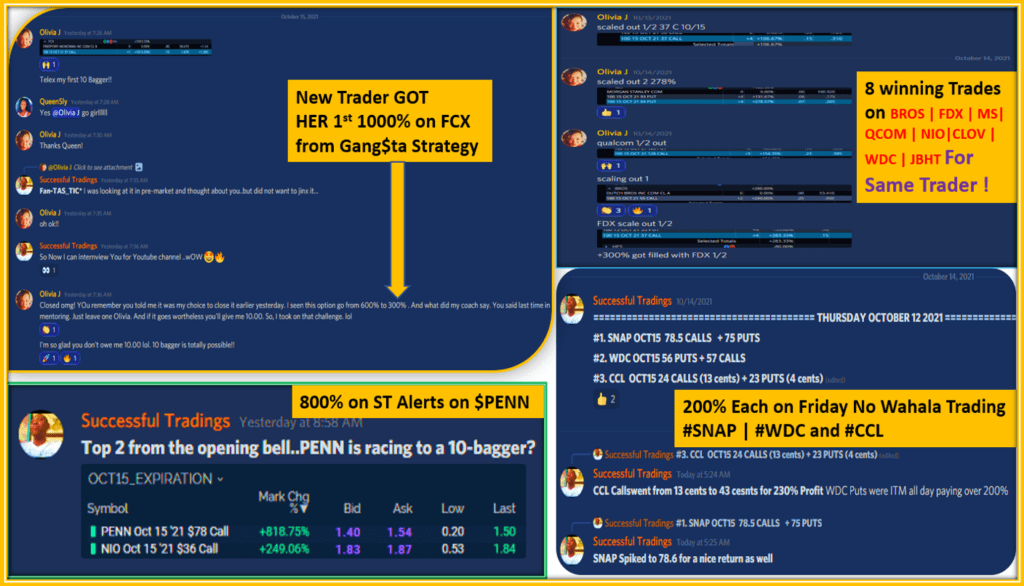

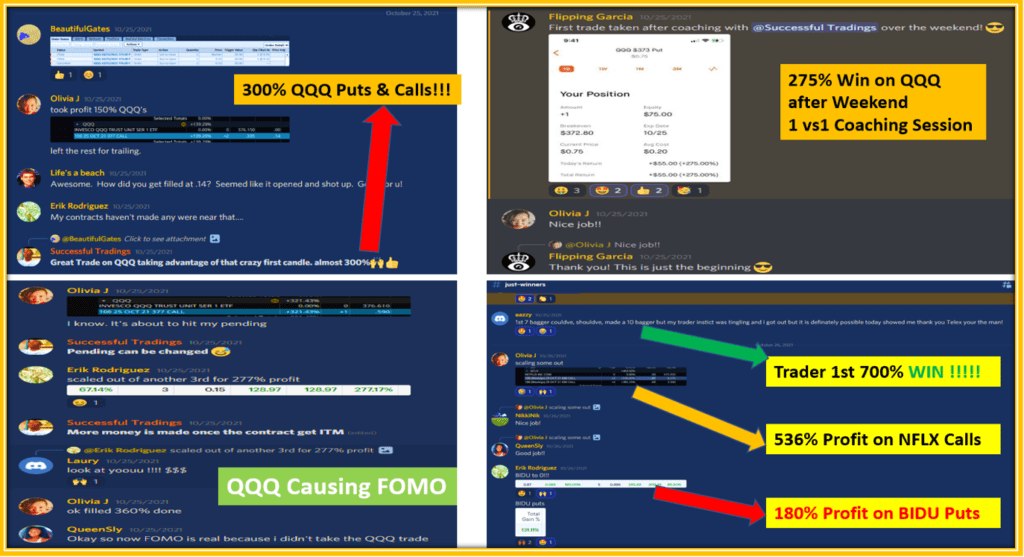

Below is a video example on How I leveraged this very SPY Trading System to generate 850% Profit !

2020 is an Election year. Which means that political rhetoric will be adding fuel to the headlines.

Consequently, volatility is bound to be even greater than the above number over the last two years.

Your SPY Trading System should start with what the big boys are doing as they throw large amount of money on SPY.

The data from FlowAlgo reveals how big institutions trade the Dark Pool with specific trade codes.

The series of codes 503, 504, 505 are what they used for trades that are routed across the Atlantic.

These are reported the next day typically. Where SPY is trading in regard to the Dark Pool levels gives a clear direction for your trades.

By my experience, The love to splash in the opposite direction just to throw other traders off but with patience, confirmation come and you are able to benefits from this knowledge.

SPY DAY Trading Strategies

Day Trading is a good way to take advantage of the volatility.

In 2019, the common theme was “Buy the Dip”.

Whenever SPY would drop, sooner or later, computer will buy it up the majority of the time.

A recent article showed that the strategy to buy at close and sell at the open yielded over 25% in 2019.

I believe that it is absolutely true.

Here is an application of that technique late into the trading session that yielded over 1000% in less than an hour !

Numerous times, SPY and other indexes will gap up for no apparent reason other than the computers wanted it that way.

So in this scenario, bullish swing traders had the advantage.

What Are SPY Trading Hours ?

There is little 15 minutes window after the rest of the market closes when SPY can be traded.

Very few traders may know about this.

So a good technique to add to your SPY TRADING SYSTEM is to wait for the last 30 minutes of the session and follow the trend with the assurance that you will close the position in that 15-minute window or hedge if you intend to carry it out for a swing trade.

SPY Seasonality

There are tremendous option trade opportunities on SPY for those who pay attention to seasonality.

I have conducted several such studies and they tend to work about 66% of the time. No bad at all.

As new ones will be forming in 2021, I will be bringing them to you through our 2020 Option Trading Tips discussion.

FINAL THOUGHTS ON SPY TRADING SYSTEM

I explained Why SPY is the perfect option trading security to generate a TRADING SYSTEM around in 2020 and beyond.

Several successful option trading strategies were provided to take advantage of the Volatility in this Election year as the market is bound to react to the multiple headlines.

I hope you found this discussion valuable for your trading education.

Consider Taking your trading to the next Level this year by leveraging our proven and consistent strategies.

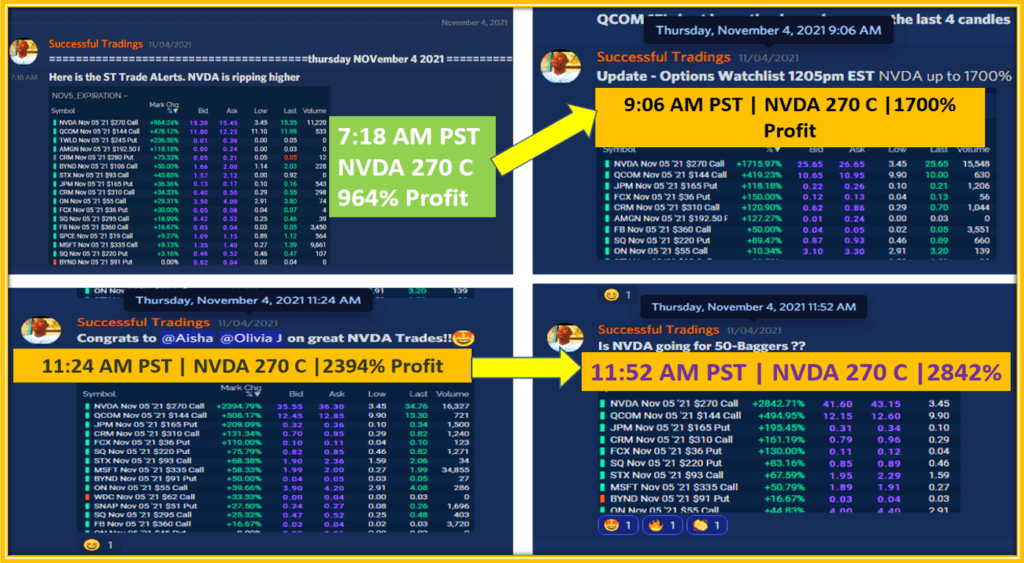

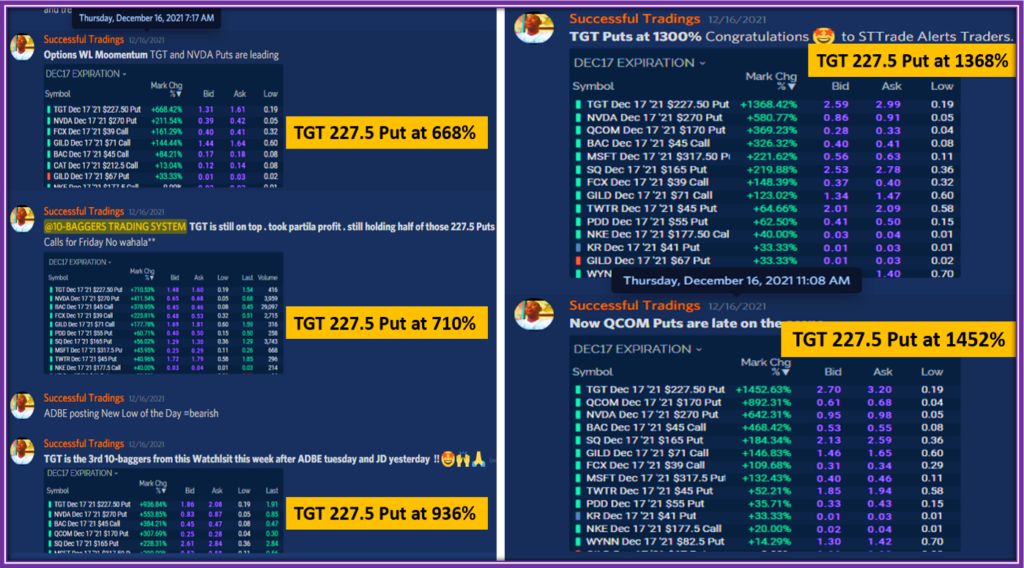

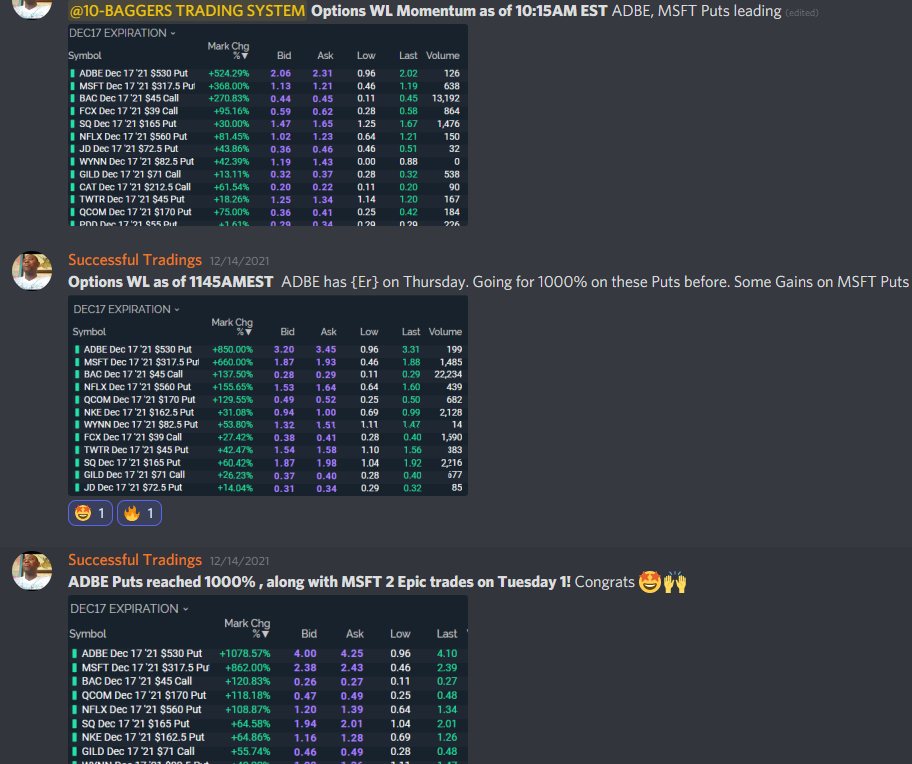

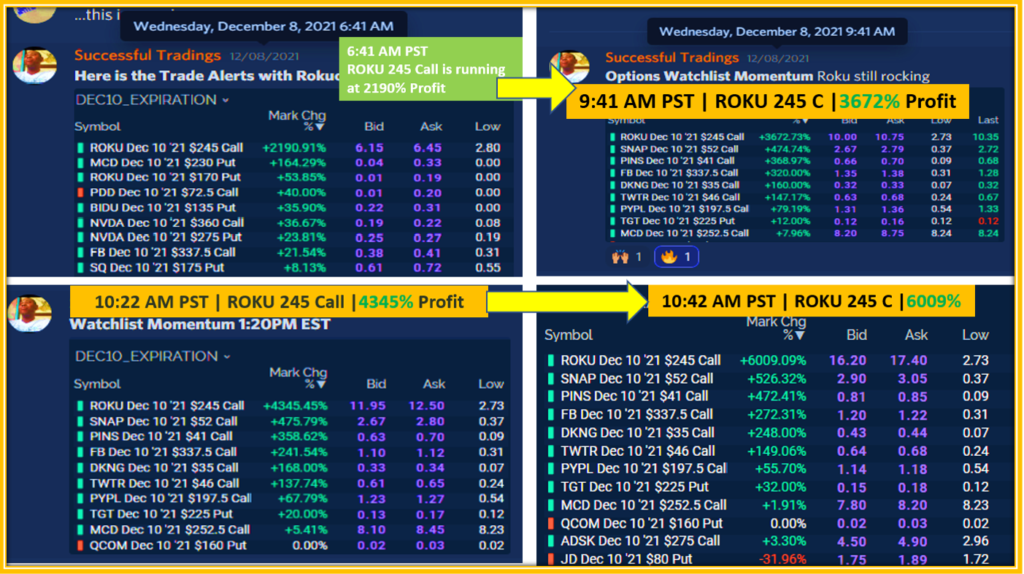

If you would like see how we put this information in application to make money trading Options, check out our New Offer: The 10-bagger Trading System.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

I’ve never heard of the SPY Trading System so this article was helpful in (a) learning that SPY exists and (b) understanding what SPY is. The information shared in this post is clear and concise and informational for those who may not necessarily know about SPY or how to use and trade it. Thank you so much for sharing!

Greetings JAsmin Rae,

I am so glad to read that you found this information about How to make a living Trading SPY.

Thank you for your time.

Looking forward to helpful in your future trading.

I wish I had come across this SPY strategy when I had the money. I lost over $250,000 in the Great Recession because I made foolish moves.

How do you handle the big market makers who deliberately take the market in the opposite direction just to take out amateur traders, only to reverse direction using the cheap money they collected to make even greater gains?

The small spreads are definitely a great advantage. This helps risk management. When you are day trading are you watching the screen constantly? Or do you have a process where you do not need to do that. When you make trades do you also ladder your trades?

Thanks for bringing this to my attention. Since I went of options I moved into Forex. With much fewer currency pairs and the ability to trade at any time provides flexibility.

I sincerely hope you are making money with this SPY strategy. I wish you much success.

Edwin

Hello Edwin,

Thanks you for your feedback and the questions.

Really sorry to hear about your past experiences with Option Trading.

There are two ways to handle the head fakes commonly known to us as Splashes 🙂 Yes it is the term.

The first one is to wait for Confirmation using the Dark Pool Level available in FlowAlgo.

The second method is to do a scaled entry by hedging.

What I mean by that is that you start with 25% of your allocated capital for that trade and setup a straddle or strangle.

After the run into the opposite direction, you can them add to the correct side.

This can really be lucrative for experienced traders who can then make money on both side.

I recently did such a trade with Apple. I should record a video illustration for this.

No need to watch the screen for me.

I setup alerts for my entries. Since all platforms have mobile Apps, you get an instant alert when you price is reached and you market order is executed automatically.

Same thing for taking profits. I used a scale exit technique where I start selling my winning contracts when I reach 100% gain, i will take 33% of the position off.

At 200%, I can take another 33% off and i will generally let the last third run if i still have time before expiration.

I showcase this technique in this trade.

The platform I used just started the ladder on Futures so for now, I am not able to use that on Options.

Hope this answers you questions.

Have a great week.

Thank you very much for this beautiful article. I read it & learn about many things. I appreciate your thoughts. Awesome article.

Thank you, Glad you enjoyed the content.