With the slogan “Options for the Rest of Us”, OptionsPlay is an options trading tool established in 2012 by Mark Engelhardt.

OptionsPlay has been under the radar for a few years as there are little to no reviews online.

But does it deserve more attention and does it truly deliver what it promises?

And can it be considered as one of the best option trading tools?

Read this OptionPlay Review and see for yourself if it is worth the price tag that it demands.

Table of Contents

What is OptionsPlay?

OptionsPlay provides trading analytics that allows beginner traders to understand the data and create their own investment strategies.

By using the platform and relying on the information it provides.

This tool supplies newbies and pros alike all the relevant information they need to make a decisive move about a trade.

OptionsPlay combines equity analytics and options data in its modern workflow.

It helps option traders to pinpoint the probable trading opportunities and call their attention to prospective stock options trade ideas and strategies.

What Are The Features of OptionsPlay?

Daily Play Ideas

OptionPlay is established on the numerous ideas that trading opportunities emerge every day in the market.

And how an expert or a beginner trader can utilize that information to gain an advantage in the current market trends.

Daily option ideas are based on bullish or bearish ideas with specific quantitative technical & fundamental security selection.

It is emailed at 6 AM EST every day and for options you’re watching, it can be accessed through portfolio for intraday movement.

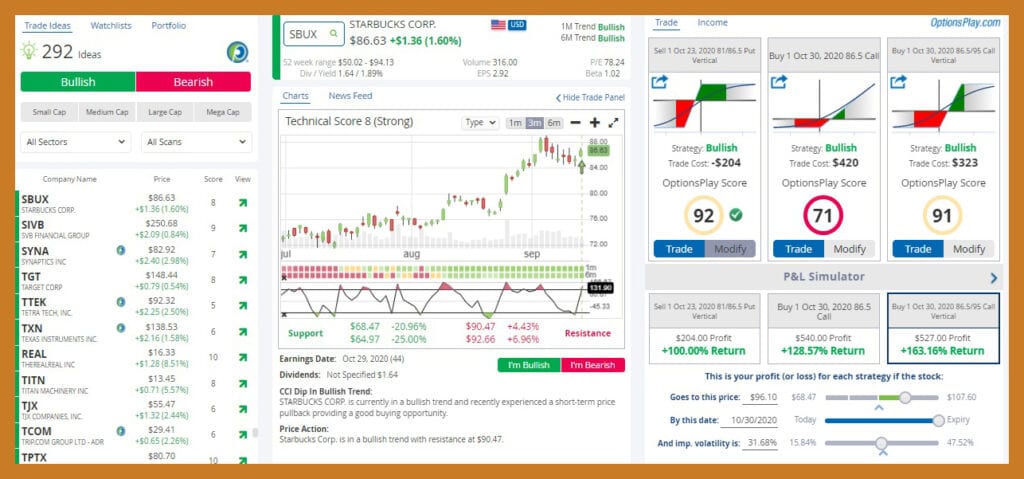

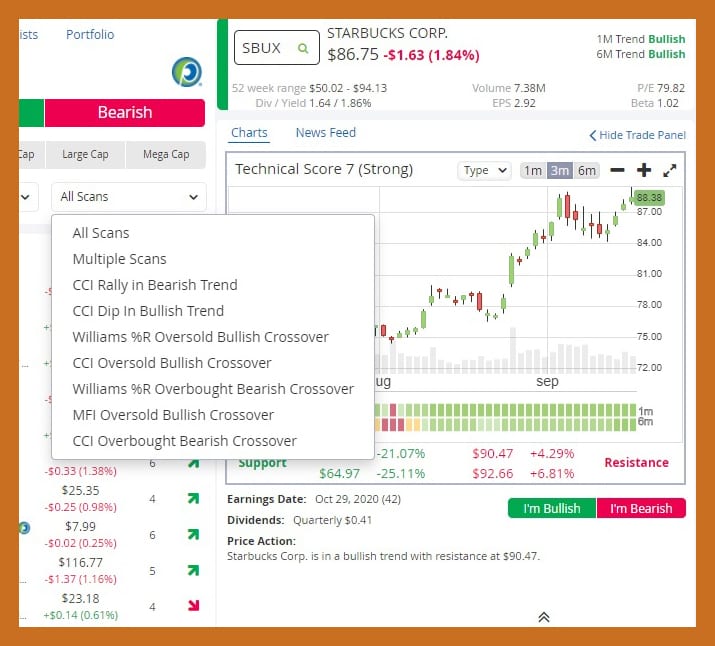

OptionsPlay has seven scanners integrated into the platform to assist traders in honing in on the most promising industry.

A technical score ranging from 1-10 is seen in the charts panel of the stock.

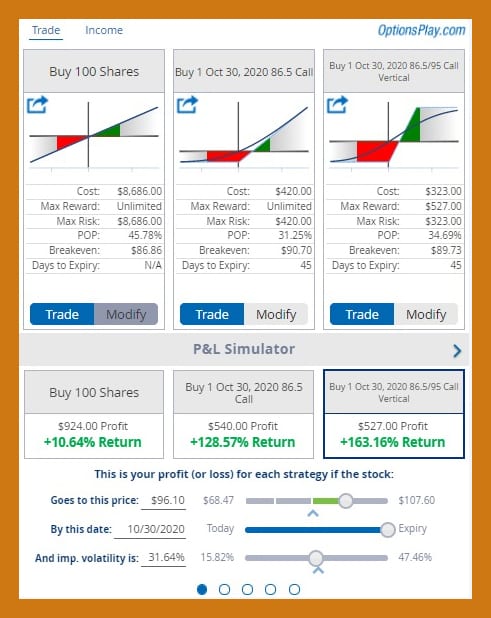

Three Options Strategies

OptionsPlay suggests three strategies that you can choose from and tweak according to your needs.

With each strategy, the trading tool clearly details the list of information per strategy:

- Cost

- Max Reward

- Max Risk

- Probability of Profit

- Breakeven

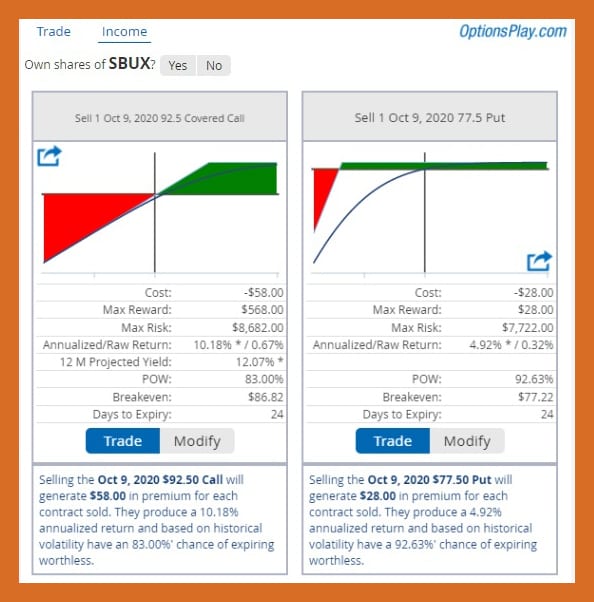

Call or Put Income Strategies

Another powerful feature of OptionsPlay is that the platform generates two income strategies:

- Call Strategy

- Put Strategy

Every Monday at 10:30 am, OptionsPlay scans S&P 100 markets.

The tool scans to see where you actually have the highest returns across the board sorted on annualized return.

And that is done with one simple click in the Income button in the right-side panel.

OptionsPlay Technology Platform

With its beginner-friendly interface, OptionsPlay delivers a breath of fresh air for investors who are stuck with complicated options trading tools.

The tool removed away options chains so you can visually see starting points.

You can compare different strategies side by side and find strategies you want to trade.

And for the newbies who are looking for an option trading tool that can make learning options trading easier.

Often than not, a first look in the platform can make or break your decision in choosing it.

Fortunately, it is streamlined to cater to a wider range of option traders.

The trading tool platform is divided into three panels:

Left: Trade Ideas, Watchlists, and Portfolio.

– Bullish and Bearish stocks and to select what size of the company.

Center: Stock Information, Charts, and News Feed

– Technical Score of an underlying stock on a particular Earnings Date, Dividend, the stock trend, and Price Action.

Right: Trade and Income

Several built-in options that you can look into to further research about an underlying stock. These are:

– Profit or (Loss) of each strategy based on price, date, and implied volatility;

– In Plain English so that a beginner trader can understand the concepts and terms more per strategy presented;

– Risk and Investment calculator that reflects max loss depending on the strategy risk and how many shares you can purchase.

And the equivalent number of option contracts respectively;

– Trading Range Simulator which you can customize;

– Edit Legs.

OptionsPlay Education

OptionsPlay Education is a core tool to help you understand options better.

This is a full video library of options webinars to teach you how to implement best practices.

And use the strategies to make full use of the platform.

It is every Thursday at 4:15 PM EST.

Trading Platforms Integration

eOption Adoption of OptionsPlay

eOption now offers practical solutions for daily trading strategies, risk management, portfolio management and so much more in a convenient add on.

With its inclusion, eOption rocketed its engagement with the self-directed investor segment, strengthening client acquisition and elevating retention rates.

Nasdaq Dorsey Wright Integration

On March 25, 2019, OptionsPlay was integrated into Nasdaq (NDAQ) Dorsey Wright, a registered investment advisory, research, and model portfolio business.

The consolidation enables clients of the NDAQ Dorsey Wright Research Platform to access educational materials and strategic insights based on the options market.

Nasdaq Dorsey Wright and OptionsPlay teamed up to expand the range of advisors who utilize options.

The tools integrated into the NDAQ quickens advisors’ access to the tools to incorporate options data into their strategies.

It also widens the advisor’s knowledge of the potential gains of using options for their clients’ portfolios.

Tony Zhang Vision

Tony Zhang is the Chief Strategist at OptionsPlay.

He is an expert in capital markets and a derivatives specialist.

Zhang spearheaded the industry in promoting education for all market participants.

Tony carried OptionsPlay and built the product suite, bringing it to market for both institutional and retail markets within just 18 months.

“Advisors are expanding their reach for sources of income, information and insights to serve their clients, and options can be an important key to that expanded capability,” said Jay Gragnani, Head of Research and Client Engagement at Nasdaq Dorsey Wright. “Our collaboration with OptionsPlay is instrumental in making options more accessible to the investing public as well as expanding our research offering to our clients.”

What Makes OptionsPlay Platform Stand Out?

OptionsPlay delivers advantages for varying levels of traders.

For stock and option traders, OptionsPlay data and charting provide a straightforward analysis of market trends that aids in making a decisive selection.

OptionsPlay offers both DailyPlays and precise information of the profit opportunities for any equity in the USA for the active options traders.

And for the stockholders focused on leveraging their own stocks, OptionsPlay presents them a solution for optimal income strategies.

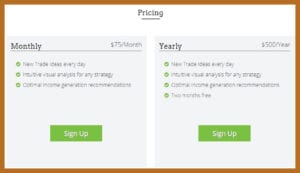

HOW MUCH DOES OPTIONSPLAY COST?

- OptionsPlay offers one month of free trial

- Select a monthly fee of $75 or yearly subscription of $500

KEY TAKEWAYS

These are the key takeaways that you can keep in mind when you decide to try out OptionsPlay:

Pros

- OptionsPlay’s platform features an intuitive interface that beginner traders wouldn’t feel intimidated

- The data analytics are conveniently stored in one page without you clicking various buttons to get the information that you want

- Numerous built-in features that make your journey as a successful option trader more effective and efficient

- There is clear-cut information about the income strategies that are presented

Cons

- Its Price may be expensive for some people after the first-month trial

- There are only three strategies presented per stock per time

- The guidelines for the computation of the scores are unclear as well as the category for the technical scoring per stock

- Some experienced options traders may find OptionsPlay lacking

FINAL THOUGHTS : OptionsPlay Alternatives

OptionsPlay indeed offers a new perspective on the option trading tools field.

As some trading tools can be confusing, the tool presents analytics in a way that beginners or seasoned traders find it clear and easy to use.

Limited Returns

Newbies or professionals will definitely appreciate using OptionsPlay.

However, you may feel like some traders that the returns on OptionsPlay trades are not quite satisfactory to you investment goals ?

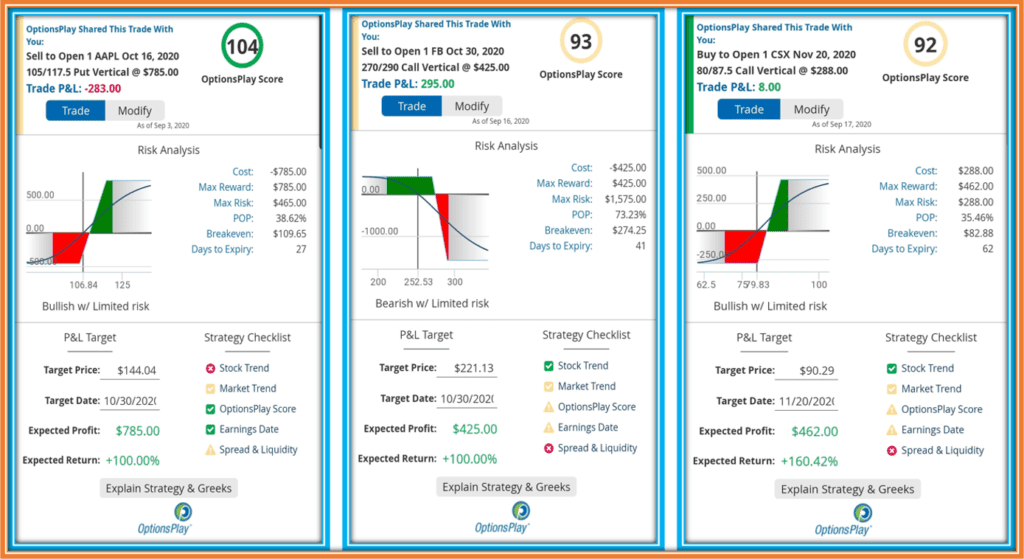

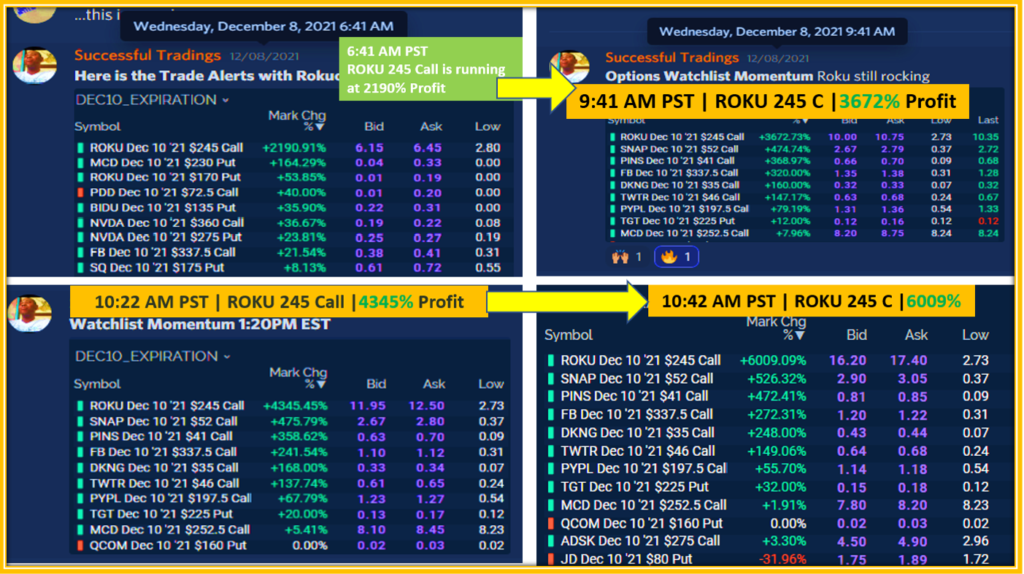

Let’s take a look at the Risk reward of some current trades as depicted in the chart below.

The Risk Reward ratios of the above three trades on AAPL, FB and CSX are respectively 0.59, 3.7 and 0.62.

What is the big deal with this you might be wondering ?

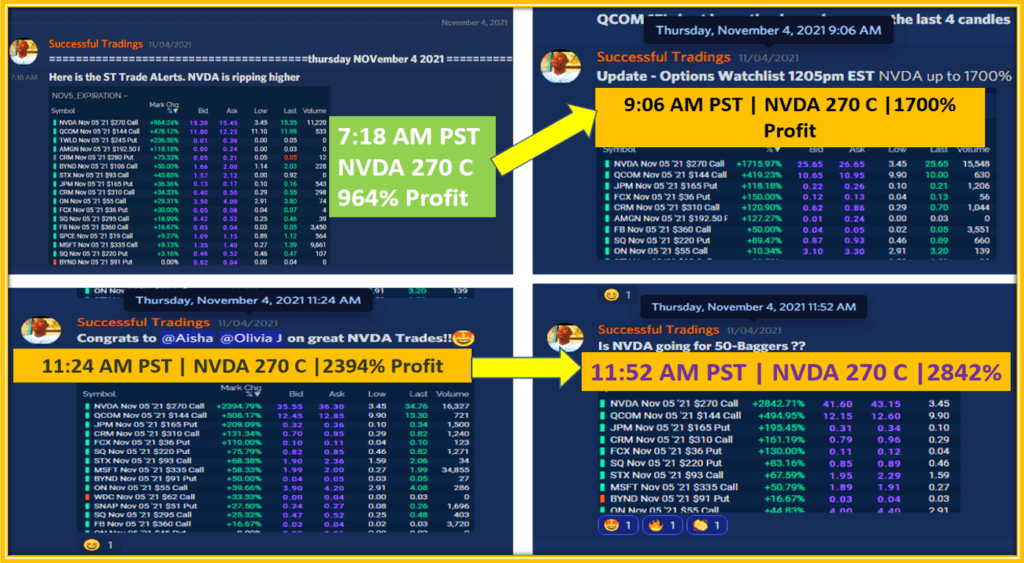

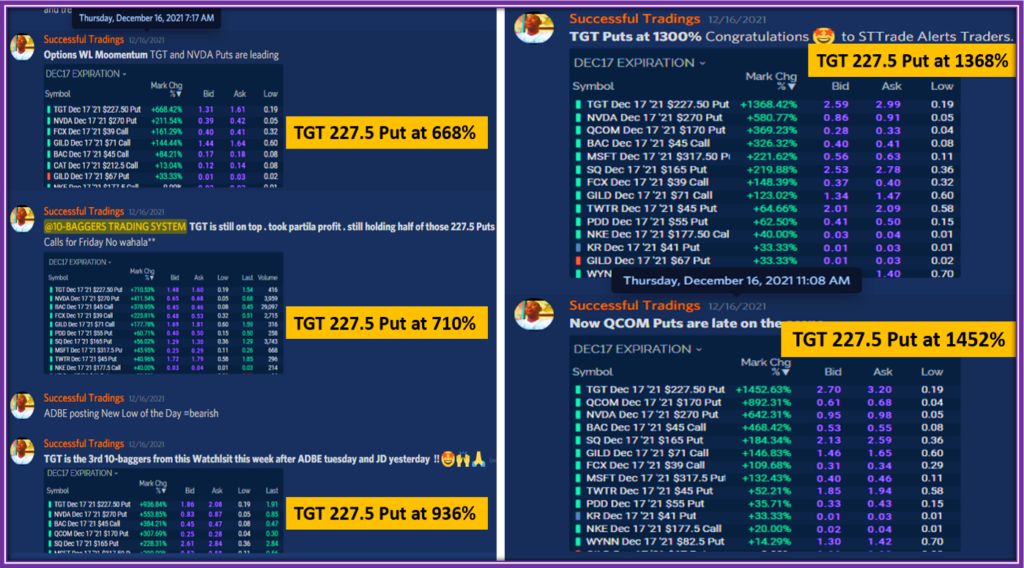

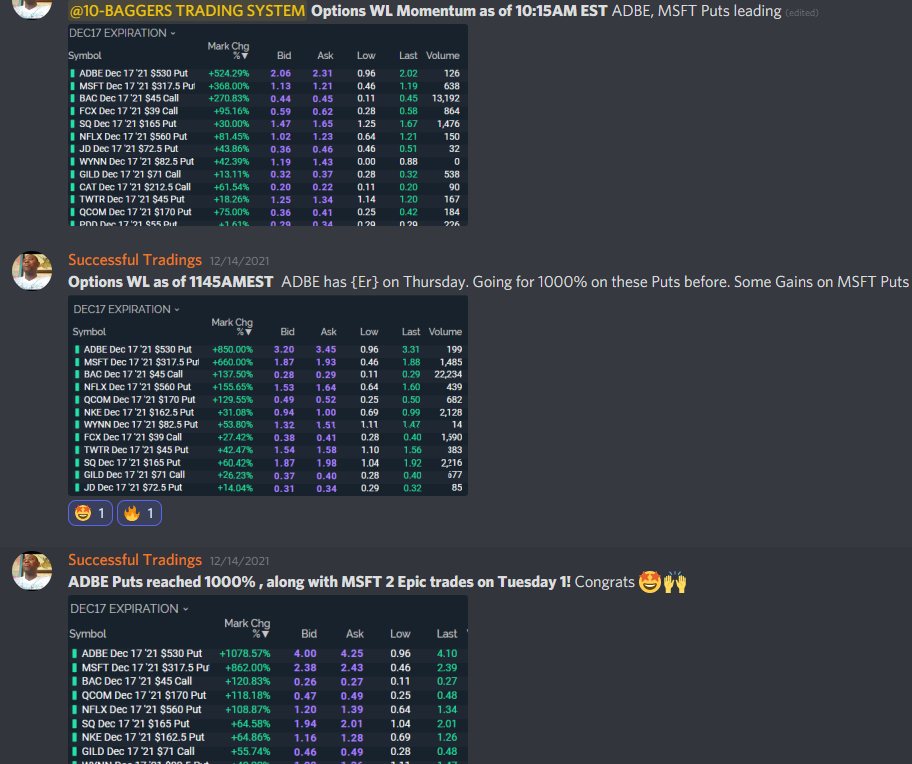

How About Successful Trading 10-Baggers Trading System

The CSX trade for instance will monopolize a good amount of capital for a long time (given the Nov20 Expiration) for an Expected rreturn of 160% oOnly.

I know what you are thinking right now.

Are you stunned by the remark that 160% is not that great of a return ?

Yes, that is correct. Besides, that is just the expected return on that trade.

Our research on OptionsPlay winning trades Returns % shows that the average is around 40-50%.

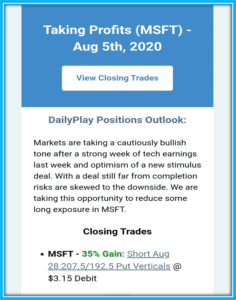

Here is a recent sample at the closing for a trade on Microsoft (MSFT).

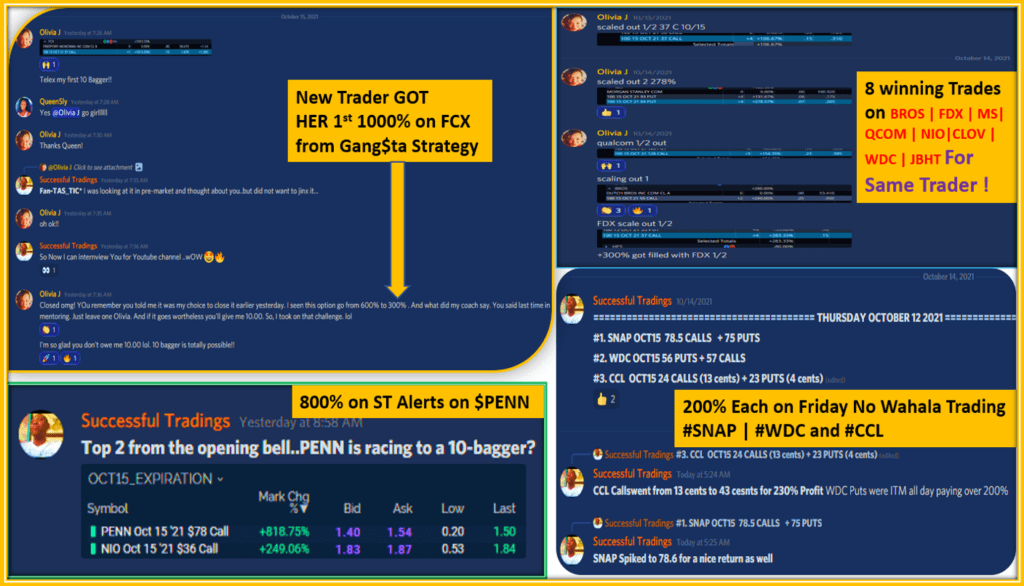

What if I told you that there is a New Trading Service where you can Risk Much Less for far Better Profit/Return % ?

Is this something you might be interested in to help increase your Trading Account Balance at a Faster pace ?

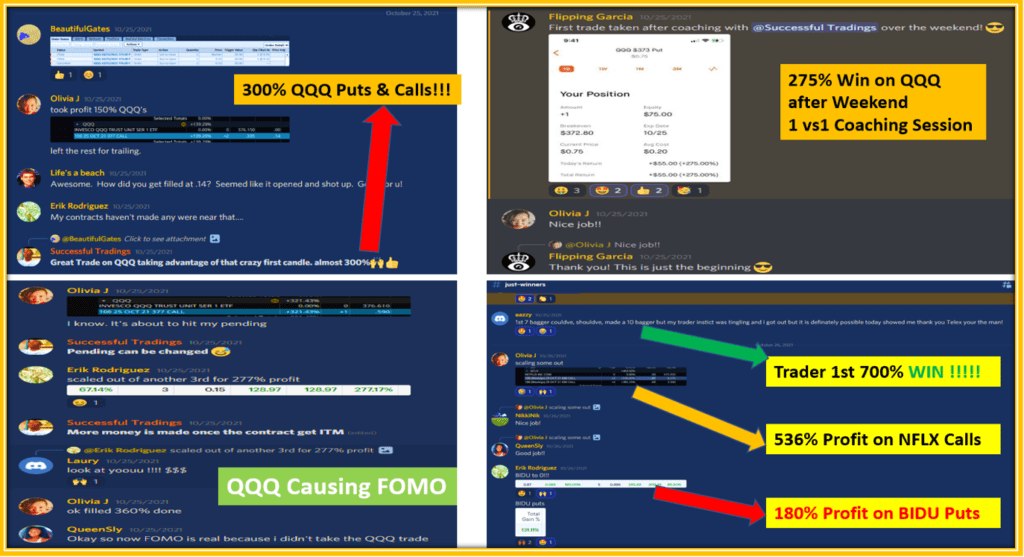

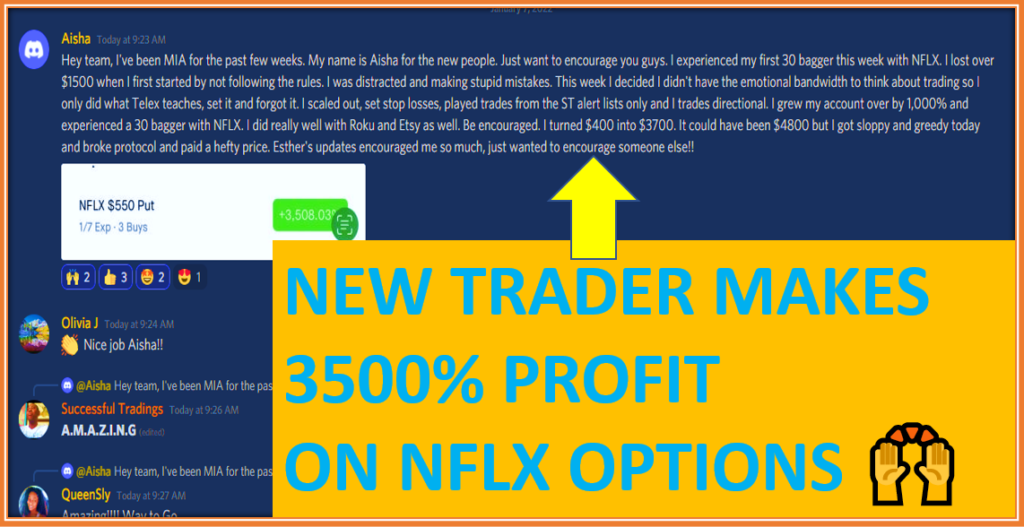

Many traders are already taking advantage of this as depicted in the recent Twitter Posts below.

If you ask @ThomasRihel1 how was his week , he will show you how his #trading went on the last day before long #MemorialDayWeekend with the like of $AAPL $FB or $MSFT ?#stocks #options #SuccessStory #Learntotrade #successfultradings #investing #investments pic.twitter.com/WSpyayY6xl

— Successful Tradings (@GangstaTrades) September 5, 2020

One of our #traders shared his wins yesterday: $TSLA $TWTR $FB $FCX $MSFT $AAPL $BYND. You don’t want to miss this anymore. Join us -> https://t.co/KcZIKtUhuZ and take your #trading account to the next level. #options #SaturdayNight #SundayMorning #markets #stocks #NYSE #cac40 pic.twitter.com/dC0v99Q3TW

— Successful Tradings (@GangstaTrades) September 6, 2020

$ETSY gangsta #trade worked good for one of our #traders today. You want to learn about our gangsta trading strategy? Join us -> https://t.co/KcZIKtUhuZ #education #markets #NYSE #trading #Stocks #OptionsTrading pic.twitter.com/LKl7eOeCJy

— Successful Tradings (@GangstaTrades) September 8, 2020

OptionsPlay

$75 per month

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Data Accuracy

9

Ease of Use

10

Collaboration

9

Features

9

-they want you to sign up for a free 30 day trial and when you do and go thru all there pre set up steps

every time you try and sign in it says your not verified and no mater what you do to try and contact them nothing happens.

well they must not really care much if they can’t solve a little problem and since

I’ve been trying to contact them for 2 days and they say they’ll get right back to me id hate to see if there was a real problem.

I think there under staffed and you’re nothing but a number and they must have lots of people dealing with lots of problems since they can’t even address getting my account verified.

Howdy John,

Sorry to hear about your recent trouble on their service.

Hope you are able to reach them and get things sorted out.

Please let me know how I can be of assistance.

I do Appreciate your feedback.