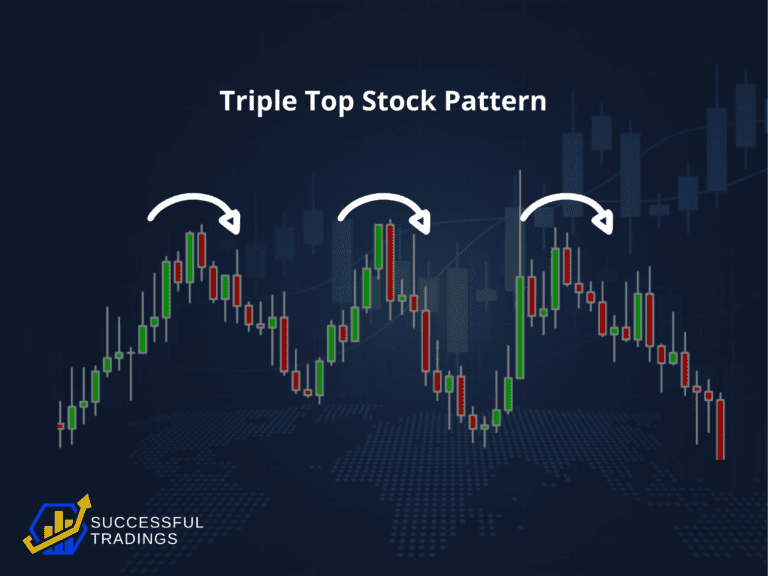

As we continue our trading education series, today I’m going to share what I’ve learned about Triple Top Stock Pattern.

It’s basically one of the fundamental patterns used by traders in the technical analysis of stocks.

We’re going to look at how this pattern is detected, how it works and how traders use this to their advantage in their trading pursuits.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

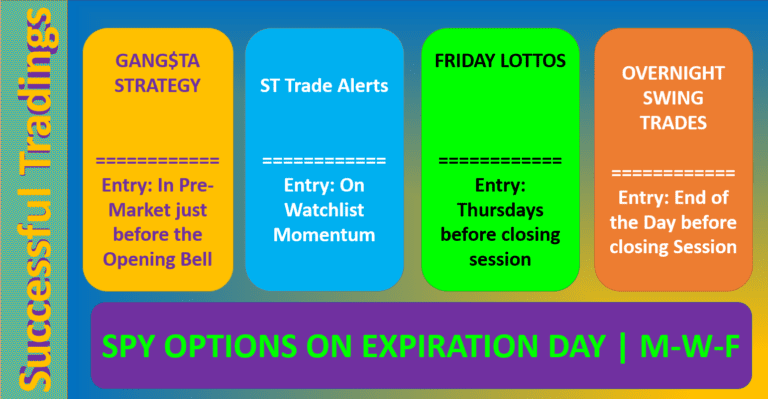

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/