Let’s face it. Learning a new skill in any domain can be quite a challenge.

Let alone for an activity as complex as online trading.

In order to make it less scary for beginners, we are offering this entry level tutorial centered around Best of Options trading for “Dummies“.

Table of Contents

Options Trading For Dummies: The Plan

The most important piece of advice I can offer beginners is to stay away from stocks just before their Earnings.

Rather, we recommend you wait after the Earnings are announced.

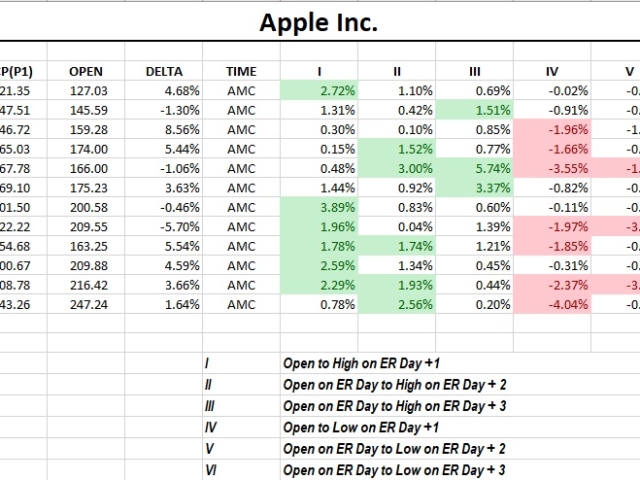

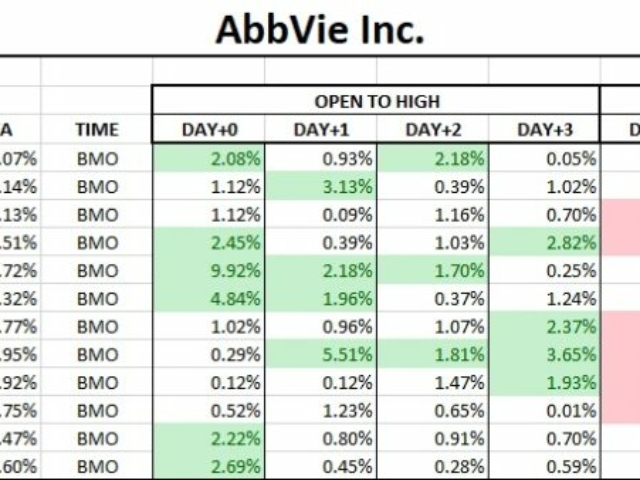

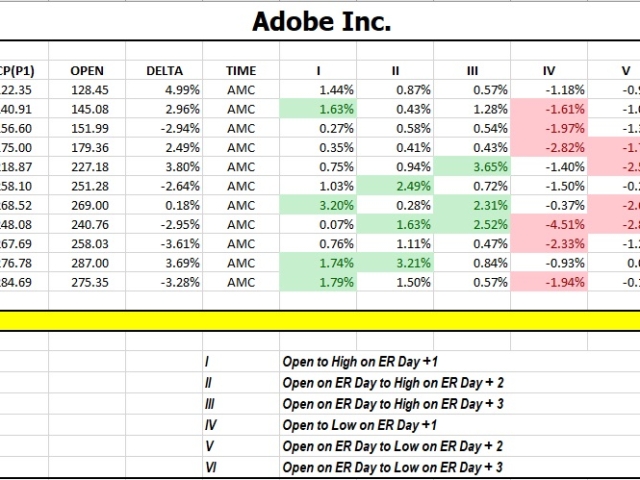

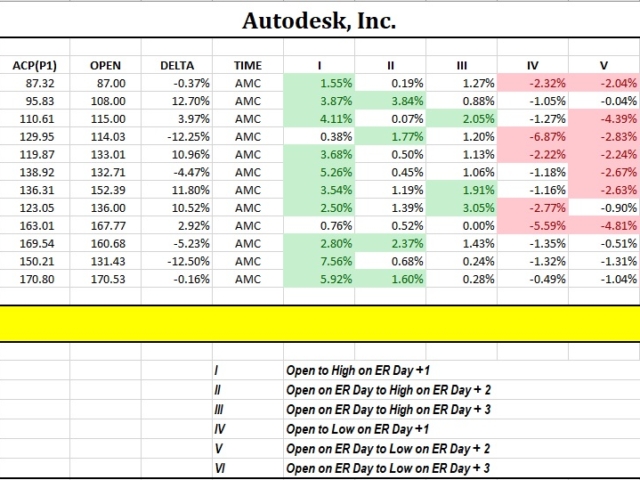

Then use this gallery of Post Earnings History to trade between the day after and the third day.

Historically, that is where most of the safest trades will be found.

Best of Options Trading For Dummies: The Execution

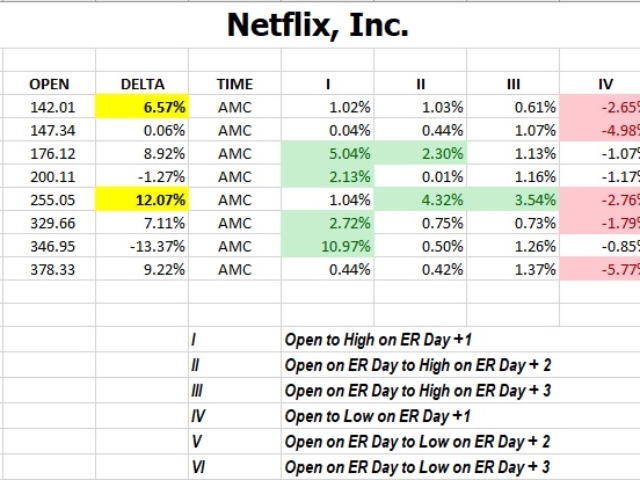

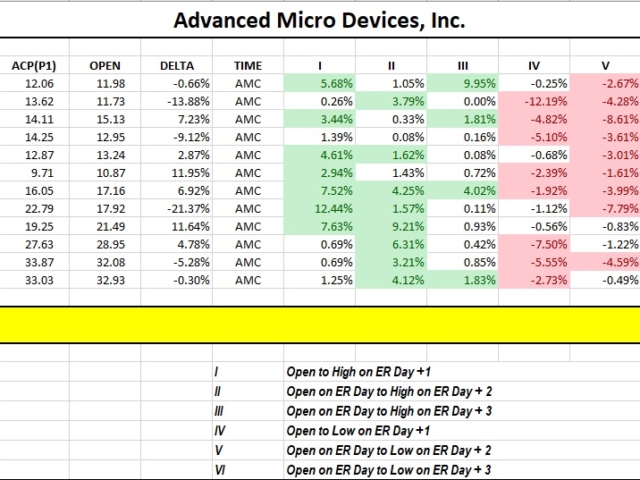

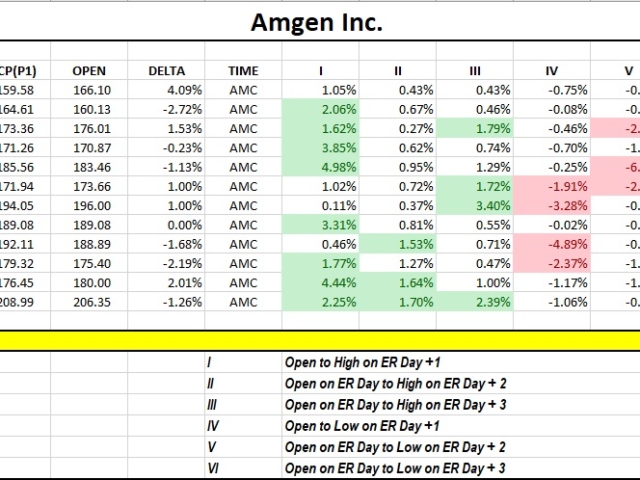

Here is the Gallery of my current Watch List with their Post Earnings Performance since 2017.

Stocks Post Earnings Performance History

The guiding principle is to always follow the trend.

If nothing else, this data should definitely help isolate opportunities of trade.

How so ?

By looking at the historical trend, you can spot stocks that more likely to move.

For each stock in the gallery, I am providing the percentage change between the Open and the High and the Open and the Low.

This is available for the three days following the Earnings of that stock.

This means that the most attractive stocks to consider for Options trading in these three days are the ones with the biggest percentage move in either direction.

I would go even further and share the results of stock simulations I have completed over the years.

It may be common sense that after a stock has a strong momentum in a given direction, it usually continues that momentum on it s first day Post Earnings (ER).

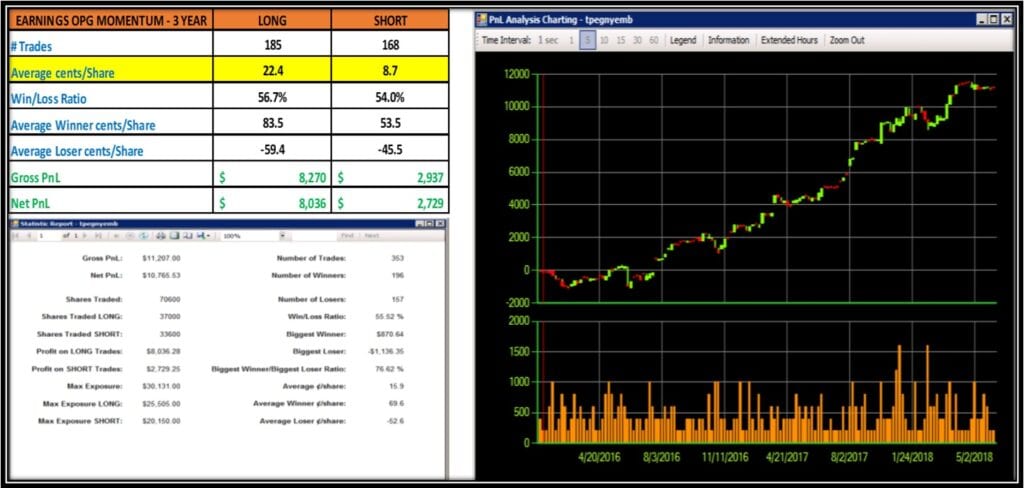

Here is a simple simulation for Momentum trades on each direction:

- If a stock is trading Up 8% or more after ER, the Momentum Long buys 100 shares up to a limit of 2%

- If a stock is trading Down -8% or more after ER, the momentum Short buys 100 shares up to a limit of 2%

- We applied some filters about the daily volume in order to address liquid stocks only. Minimum daily volume was 200000 shares

Almost 57% of the trades were winners for the Momentum Long vs. 54% of winners for the Momentum Short over a period of almost three years.

IT is important to remember that these results are for trading stocks, not stock Options.

Also, the simulation is strictly for the Day after the Earnings.

The relevance of this data is to show you the opportunities that exist even on simple momentum trades after the Earnings.

Below is a video detailing our Full Quant Analysis approach to trading stocks after Earnings.

Should you master this strategy, you will definitely become a graduate of Options trading for Dummies series of tutorials.

As you already know by now, a stock that moves a great for options traders who can benefit from the moves while risking smaller capital than if they were to trade the stocks.

BUT WAIT: THERE IS MORE

Momentum trades are not the only type of Post Earnings trades.

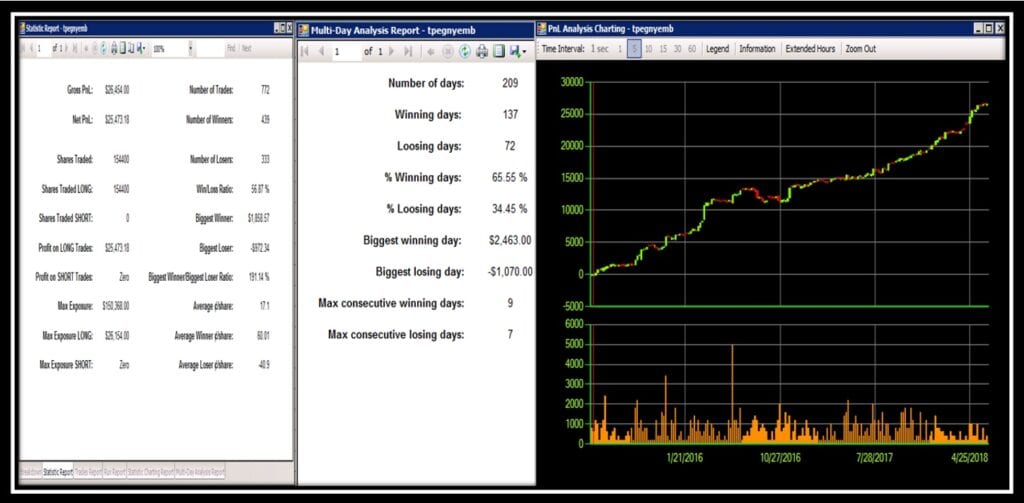

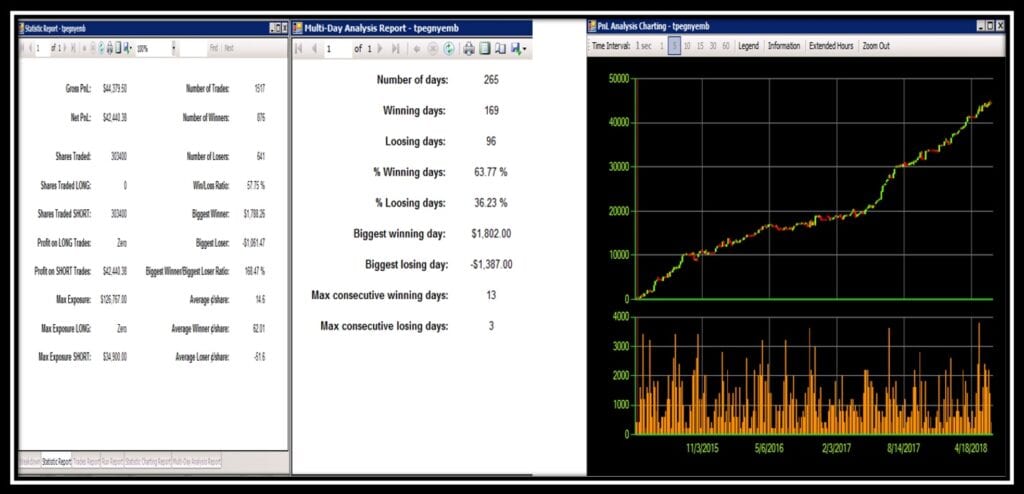

May I submit to you the results of a couple of Reversion trades.

- If a stock is trading between ]-3%;-0.5%[ after ER, buy 100 shares (Long trade)

- If a stock is trading between ]0.5%;+3%[ after ER, sell 100 shares (short trade)

- Analysis time frame from January 2015 to July 2018

Over three and half years, this strategy on stocks has almost a 57% winning rate by just focusing on the first Day after Earnings.

Similarly, the opposite strategy has almost 58% win rate with twice the umber of trades.

There is value in just that observation.

There were more opportunities with stocks that started initially trading Up between ]0.5%;+3%[ and ended up going the opposite direction.

The overall data on the Reversion shows that there are still plenty of winning trades available even when the stock does not display a major move Post ER.

BREAKING IT DOWN TO THE BEST TRADES

In this section, we are going to highlight our best stocks to trade post earnings.

By sharing some of the patterns we have observed over the years, we hope to give you an edge when it comes to setting up your post Options trades.

Of course, historical behavior is not a guarantee of future performance hence one should always take these studies with a grain of salt.

KROGER (Ticker:KR)

After each ER, this stock “likes” to take its time before beginning a movement in either direction.

Therefore, patience is needed for it to reveal its initial direction .

Of course, one can always strangle it. The expected daily more in either direction is typically $1.

On the second Day, the general pattern is a candle of opposite color to the first Day.

WORKDAY (Ticker:WDAY)

The expected move Post ER on this stock is about $10 for that day.

It may appear as a big move but that is less than 4% for this stock valued at over $300.

A Strangle may well be suited as well depending on how many days you want to have.

CONOCOPHILLIPS (Ticker: COP)

The main thing on this stock is its propensity to do head fakes.

Mostly, it will start trading lower before blasting to the upside. Jan 31 2019, July 30 2019 and October 29 2019 all had the same pattern.

CONCLUSION

We provided the historical performance of over 50 familiar stocks Post Earnings in this guide to options trading for dummies.

This data is meant to help traders feel confident about the availability of trades after when a direction has been determined.

Then, we introduced four strategies plays: Momentum Long and Short and Reversion Long and Short.

I hope you found this discussion valuable for your trading methodology.

If you would like to increase your knowledge and further your understanding of these concepts, may I suggest this similar article.

If you would like see how we put this information in application to make money trading Options, click here.

Please leave us your thoughts, comments, experiences or questions about this content so that we can continue to tailor it to your needs.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Thank you for the post! It is suitable for me who is still “Dummies” in the world of option trading. And I admit, you have a good website for historical performance that can be used as a platform for taking positions.

But since I’m still a dummy, can you explain what is short trade, long trade, ER? Because I am still very confused in learning this new thing.

And oh yes, is it possible to get rich with trading options?

Greetings Ronnytan,

Thank you for stopping by to leave us your feedback.

Let’s start with your last question: yes, it is possible to get rich with stock options trading.

how can I be so sure you ask ? May i refer you to the first book i recommended here ?

As for the definitions that you asked for, we gave those in this article earlier.

May I suggest you take a look there and if you still have further questions, we will be glad to answer them for you.

Have a great evening my friend.

Wow this trading lesson is a very wonderful. I have been a able to learn so much from what you have written here about options trading. I see that if one sticks to the status quo and look at how the trades have risen and fallen in some time, one can easily decipher when the trade will either fall or go up. I also learnt some new strategies too. I will bookmark this and share it as well. Thank you!

Hello,

I am pleased to read about your learning your strategies through this discussion.

Please do let us know of your results after implementing some of this technique as

we plan on sharing them with your fellow readers.

Until then, talk to you next time.

Great article I have traded some stocks in the past but they have mostly always been on a whim. Mainly because I have never really understood them. However after reading your article and a few of your other articles on site,I am going to take another look and focus more on the historical data of each stock and dig a little deeper before trading again. Maybe my luck will be better.

Hello,

Glad to hear that the article enabled you to improve your understanding of Options trading.

Let us know if there is topic in particular you need us to cover more in details.

Happy New Year Down Under.

The world of stock trading is truly a fascinating one and I unfortunately have to consider myself in the “Dummy” category. This is a great introduction to the topic though and it has definitely piqued my interest in getting more involved. How long did it take you to get to where you are, as far as depth of knowledge? Are you self-taught or did you have guidance? I’m interested in your path. Thanks!

Hello Steve,

Glad to hear of your interest about this discussion.

I have been actively trading stocks and Options for a long while now.

I did not have the privilege of having guidance at first, then with my involvement with Proprietary firms, I was coached a bit further thus enabling me to now share the knowledge I have gathered along the way.

The goal of our publication is to help people like you by showing them How to Learn Options Trading for free.

So Let us know if there is anything you can do to assist you with that objective.

Thank you for your time and Talk to you soon.

Telex,

The title of your article was perfect in describing my relationship with stocks. DUMMIE. The only stock

I ever purchased was when I was employed at a company that offered stock purchases for their employees. I bought 10 shares for each of my children. Over the past 10 years, the dividends paid for the stock purchases (about $400) and the shares have gone up from about $35/share to over $150/share.

I am now retired and after such a success I figured on buying other stocks for me to enhance my retirement. Fortunately, after reading your article I realized I am a shock DUMMIE and need to learn a LOT more. I had to open a separate to get the definitions of too many terms used.

I have noticed on other sites that the writer highlighted words and when you would hover over the word a definition/explanation box would appear. This saved time and gave an explanation without having to look up the term. This might be nice for your site, especially since you are very knowledgeable on the subject. I will be bookmarking your site to read other articles and gain knowledge before investing in stocks.

Thank you for the information and for letting me see I was lucky in my stock investment for my children and am truly a DUMMIE when it comes to stocks.

Blessings,

Leo

Hello Mister Leo,

Thank you so much for the positive feedback.

We really appreciate it.

Your suggestion is actually a very good one and we are in the process of implementing it.

However, due to the technical aspect of options lingo, we were afraid that this would take time away from bringing readers like you the material you need.

We plan on providing a trading dictionary of some sort in the near future.

Thank you again and talk to you soon.