We are reviewing this week Option Trading Strategies we use to make money online and what we learned about them.

Table of Contents

Option Trading Strategies: WDC Puts

This is Earning season which make it a great time for trader to find favorable setups they can take advantage of.

.We are strictly picking stocks to trades from our Watch List.

Western Digital has been a prominent member of our Watch List for years and a perfect candidate for both Day trades and Swing trades.

The Setup on WDC

Today, we are sharing the trade we took after Earnings Release (ER).

In fact, 99% of the time, we do not gamble on Pre-ER because it is not worth it.

Because there are far more safer Option Trading Strategies to make good money after the results are announced.

Earnings report came Wednesday after market close and the stock immediately plunged.

At one point, WDC was down almost 11% in After Hours from $62 close to below $55.

Then it settled down around -7.5%.

By the time end of Pre-market Thursday, a small gap up occurred from $55 to $57.5 with heavy volume in pre-market.

Yet no significant price move between 8am EST and 9:30am EST.

I was determined to trade it either direction because of the heavy volume: this is a good reason here for trading Post Earnings.

So I waited until the price dropped below $57 and enter Nov 1 54.5 Puts for 33 cents per contract.

Each contract controls 100 shares so my actual cost per contract was $33.

Option Trading Strategies on Entry

Unlike the trade on AMZN last Week, the cheap nature of these Western Digital Puts enabled me to buy 4 contracts.

This setup is known as a Classic Momentum Short : A gap down on heavy volume that continues in that direction.

This was a stress free trade as one can see on the timeline of it duration.

I bought 4 Puts Contracts at 6:34 AM EST

Option Trading Strategies on Exit

This is the (almost) perfect illustration of a scaled exit on a Day trade. Below are my Sell Orders from left to right.

- 9:34 AM EST : Buy Order (See above) at 33 cents

- 9:36 AM EST : 1st Exit on 2 Contracts at 70 cents : 110% gain in 2 minutes !!! Yes.

- 9:40 AM EST : 2nd Exit on 1 Contract at 87 cents : 160% gain on this one Contract

- 9:55 AM EST : 3rd and Last Exit on 1 contract at $1.16 : 250% on this one Contract

So, in the span of 21 minutes, my position generated a Net Profit of : $ 200 or 150% from the original risk.

Nice, you think right ? these Puts I sold were worth $2.80 before the end of the closing day !!!

CONCLUSION

This trade generated a net profit of $200. However, much more money could have been made in this trade.

So I left money on the table on this trade.

We will address this topic later.

I hope you enjoy the review of this trade. Should you have questions, please leave me your thoughts on this trade in the comments section below.

How would you have reacted if you were in my situation in this trade ?

The Setup on FCX Calls Options Trade

Freeport-McMoran Copper &Gold Inc (Ticker: FCX) is a tiny $10 stock I discovered this year.

What makes this stock attractive for Options trading is the fact that its option are cheap with Low volatility while the stock itself can be quite volatile.

So, FCX has been in my Watch List on which I run my IB report.

Yesterday Thursday October 31, my favorite signal on the IB report alerted on FCX.

That was the reason for me to setup this overnight swing trade.

To be totally honest, there was another indicator for this trade. That is pure observation of how the stock has been trading on each day recently.

Yes, a lot of stock have pattern that they like to repeat.

In that sentence, the “They” is not for the stock but really for the computers (Algos) that control these stocks.

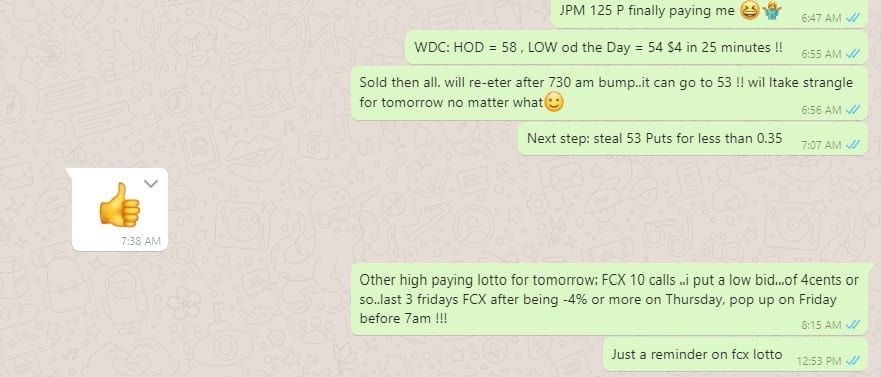

Below, is an excerpt of an exchange with my buddy Piti 🙂 on Thursday just before the closing of the market.

The above exchange took place after I had exited the Western Digital (Ticker: WDC) trade I described above.

The Entry into the Trade

I automated my entry for calls at the lowest possible bid I was comfortable with : 3 cents per contract.

Why did I choose the calls instead of the Puts ? Remember the exchange above with Piti where in recent Fridays, FCX has moved significantly on Friday morning.

So this was a Lotto play with a defined of $45 !!

Below was the entry execution. My entry was filled while I was driving into my office.

I clearly remember laughing to myself when the alert came on my phone. True story.

I was mostly amused by the facts that I had entered into 15 contracts. Typically, 10 contracts per position is my limit to avoid the fees.

My broker charges me 35 cents per contract. I have been a customer for many years so I was able to negotiate that rate a few years back.

The Exit out of the Trade on Friday morning

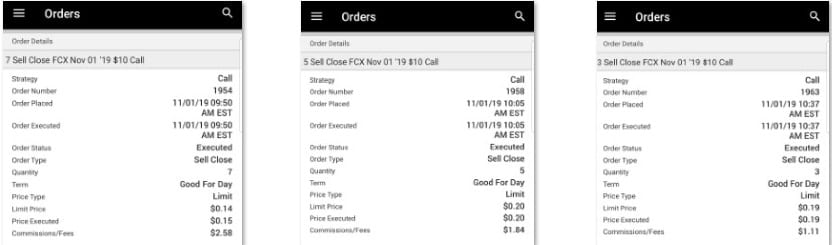

This was another almost perfect illustration of a scaled exit on a Day trade. Below are my Sell Orders from left to right.

- 10:59 AM EST : Limit Order Placed (See above) at 3 cents per contract – Filled at 11:36AM on Thursday 10/31

- 9:50 AM EST : 1st Exit on 7 Contracts at 15 cents : 400% gain

- 10:05 AM EST : 2nd Exit on 5 Contracts at 20 cents : 560% gain on these Contracts

- 10:37 AM EST : 3rd and Last Exit on 3 contracts at 19 cents : 530% on these Contracts

So, in less than 24 hours (overnight Swing Trade), my initial position of $50 ( I am including the fees) generated a Net Profit of : $ 206 or 412% from the original Risk.

There is a lot to unpack from this trade on FCX. From my reasons for the entries to the scaled exit.

By 1pm EST on Friday November 1 2019, those FCX 10 Calls were trading for 55 cents.

I made 400% or so on this trade but the trade went all the way to over 1600%.

If you are thinking , wait a minute, this is unusual or I hand picked this example: well send me your thoughts, comments below.

I will be glad to open your mind on the insights of Option Trading Strategies on Expiration Friday.

Hi. Thanks for this review. Like you have said, you shared what you learnt from this week’s trade. Every trade is a new opportunity to learn something new that would help scale up the next trade. I’ve heard about the ER Before now; well maybe because I’m a newbie. It’s cool

Hello, Thank you for the comment.

How long have you been trading ?

Did you check out the AMZN trade on 10/25 ?

Thank you for your post. I started my online business for a while now and am actively looking for money-making opportunities. I thought about stock trading, but never really take time to dig deep.

Your article may change me thinking. I particularly like your real-time trading process and results. In 23 minutes, you made $200. It is Amazing, I have been burning a lot of my dollars in my online business and so far I have earned nothing. I think it is time for me to think out of box. As matter of fact, your trading is also online business. Why don’t I take a look of this and do some practice.

It is kind of you sharing your real personal experience with us. This could be the way for me to gain my financial freedom!

Hello Anthony,

Thanks for stopping by. Yes trading stock options is an online business.

Before you jump into it, you need to ensure that you go through the proper tutorials

to fully understand the risks.

Thank You.

This is all very interesting to me, truly. I didn’t think you could actually win at this game on any level haha. I looked in to it a few times but never really saw anything that make a whole lot of sense to me. You however opened my eyes completely. I may play around with this a little bit if I can play with a little first. 🙂

Hello,

Thank you for stopping by. Glad t see that you learned something from our article.

Enjoy the rest of the Tutorials.

Thank you for the opportunity to comment on your site.

This is a subject I’ve spent some time on in the past as a novice trader. Currently, I’ve taken a pretty passive approach to investing and the stock market by way of Acorns and Robinhood because I really don’t understand trading well enough to go at it on my own; unfortunately, after reviewing your site I still feel the same way…too confusing.

One of the main issues I have is understanding the terminology well enough to have confidence ability to invest at a deeper level. You are obviously very well versed and understand this topic very well so,…what is the target for your readers? And… who is your target audience? Is it the novice trader just getting started?…the casual investor or the seasoned trader?

To me, it seems your target audience is the seasoned trader based on your assumptions with respect to your terminology and trading lingo. You have a wealth of information here and I’d to come back to learn your method but…I may need an introductory course first. Thank you!

I really appreciate your comment.

Let me answer the main question about the target audience please.

In these series of tutorials, our main target audience is Beginners.

Yes, why ? Take a look at the articles titles.

We want to guide our audience from A to Z in this process.

Our latest post is : Options Trading for dummies and we break down the Lingo

You mentioned.

Please do take the time to go through the material in

Hope you will be soon reconciled with learning.

Thank you.

VERY interesting indeed. I’ve been casually looking over your posts lately and think I should get more serious about it. You risked $50 and made $200, is that profit or revenue so the profit was $150? I’ve been too paranoid to try day trading stock options but your results are starting to make me change my mind.

Hello Kastanza,

Traders who take the time to master the skills for trading stock options really find this profession very rewarding.

Looking forward to helping you in your future knowledge acquisition.

Have a great day.

Wow! Awesome! I believe I can become rich through this platform. By the way, what is the minimum initial deposit? I want to try my luck here.

But first, I have several question related with your post:

1. Does trading options also use analysis both technically and fundamentally? If so, where do you use source from?

2. Do they have something like “margin call”?

Hello Ronnytan,

The platform I use and most of other platforms do not have any minimum deposit requirement nowadays.

The majority of day traders and swing traders strictly use technical analysis since the fundamentals of a company are mostly suitable for long term investors.

Meaning the fact that able has over $10 billion net income per quarter does not tell us much about where it will be trading a few hours or days from today.

For traders who trade on margin, of course, they are subject to margin call if the trade goes against them.

I recommended in one of the first article that beginners should avoid trading on margin and gave out a method on how to setup a brand new account to avoid this very issue. You may want to check out that tutorial here.

Thanks again for your questions. We really appreciate you taking the time to ask them. Talk to you soon again.