Understanding the Option chain is a crucial step for all option traders.

The sooner you will master this skill, the closer you will be to avoid beginners mistakes and quickly enter your trades both of which can lead to more money in your pocket.

That is exactly what I am going to show you in this tutorial.

At the end of this lesson, you are going to be equipped with all the necessary skills to help you successfully navigate option chains without fumbling on any trading platform.

Table of Contents

What Is an Option Chain: Overview

Anyone new to options trading must sooner or later overcome the emotions of placing that first trade.

This is done by coming face to face with an option chain for the first time.

I do not know about you, but getting around it can be a bit overwhelming.

What we are going to discuss here is pretty much platform agnostic.

Option Chain Chart : The Basics

Most of the main features are available on all stock trading platform.

I just happen to use this one that I have ranked the best of all in 2019.

I have used platforms where just getting to the option chains was a battle on its own.

That is why I like this platform a great deal.

The options chains are straight forward in a single view as shown on the view below.

The very first thing to choose in order to view an option is the expiration date.

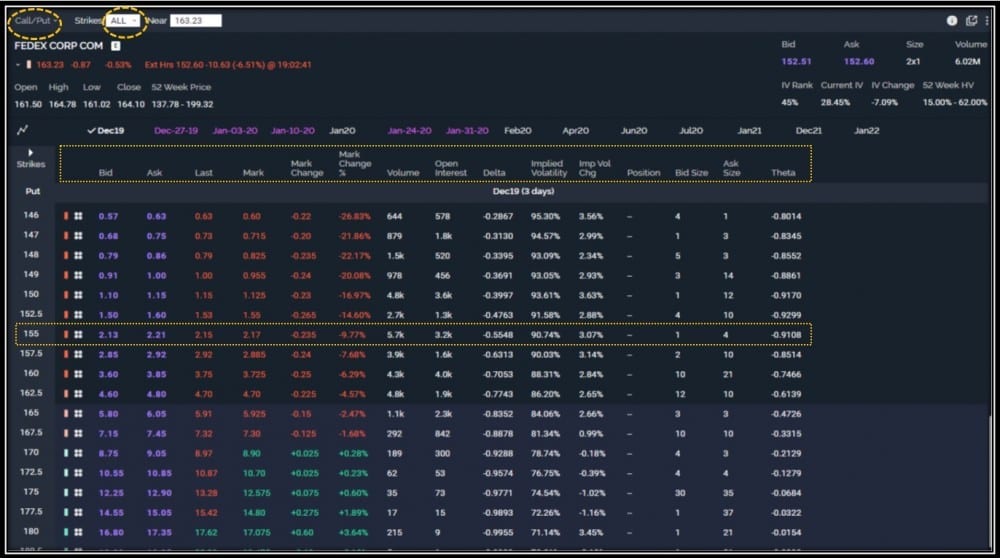

In the above view depicting the FDX Option chain, we have selected the Dec19 (read December 20 2019) expiration.

Weekly vs Monthly Option Chains

Most options are weekly as you can as depicted above and therefore carry the corresponding Friday expiration date along with the year.

However, for the options expiring on the third Friday of the month, the day is omitted thus leaving the expiration date with only the month and the year.

In other words, Jan20 expiration is the third Friday of the month of January in the year 2020.

This means the Jan20 options expire on Friday, January 17, 2020.

How To Read an Option Chain: Calls vs. Puts Sides

After that, you can view the price of options for different strikes for the expiration you have chosen.

Before we go any further, let’s point out the Implied Volatility chart I captured on top of the these Options chain for FedEx (Ticker: FDX).

I did so because FedEx Earnings Release was just a few hours ago after the Market Close.

The Implied Volatility for the week of December 20 is over 80% whereas its thirty day average is around 40%.

Option Chain Explained

Implied Volatility is a measure of the expected movement in a stock.

The higher it is the more movement ( the direction is unknown) is expected.

More importantly, the higher the Implied Volatility the more expensive the options are.

The Market Makers ALWAYS spike this metric up before Earnings and drop it right after.

That is one of the main trick the Market Makers utilize to take advantage of these Earnings events to benefit from the uneducated traders.

In order to view only the Calls or Puts side of the chain, a navigation button is usually available.

After selecting the one on the right (your platform may have a different way of accessing calls and puts), the Puts options chain will be unveiled as follows:

E*Trade platform gives you the ability to select from basic options (Calls and Puts) to more advanced ones.

You can do so using the drop down menu on the Top right-hand side.

How To Navigate an Option Chain On E*TRADE

You also have the ability to display the number of strikes suitable to you. I believe one can select up to 40 different strikes.

I am showing ALL in the above picture.

The columns just below the expiration dates are adjustable.

Let’s describe them in their order of apparition using the highlighted values for the Dec2015 Puts.

- The Bid and the Ask are the price at the close: buyers were bidding at $2.13 while sellers were offering at $2.21

- The Last column reflects the price of the most recent trade of these options

- The Mark stands for Market Price: It is the halfway between the Bid Price and the Ask Price

- The Mark Change and The Mark Change% represent the variation between the current price and yesterday close in dollars and percentage respectively

- The Volume is the number of contracts sold today and is updated in the Live trading session

- The Open Interest is how many contracts are currently being held. It is updated at the Session open

- Implied Volatility Change reflects the change in Implied Volatility between Present time and yesterday close

- Position is populated with the number of contracts the traders currently own – I had none

- Bid Size and Ask Size are the number of contracts traders are bidding for and offering at any time

I purposely left aside two variables because they ARE very important and thus deserve a section of their own.

How To Read Option Chain Greeks

Delta and Theta are Greek letters! What in the world does Greek have to do with Options trading?

I know right ? Must you become fluent in Greek in order to master Options chain ?

No, not at all. Thank the (Greek) Gods. Pun intended.

How To Read Delta On Option Chains

There are actually five main Greek variables in the pricing of Options.

We shall focus only on Delta and Theta today as we aim to keep this lesson as basic as possible.

The variable Delta has two main use cases.

Firstly, Delta measures the change in the option if the underlying stock moves by $1.

For our above Dec20 155 Puts, the delta of -0.55 implies that if FedeX is to move down by ONE Dollar,

the cost of this Option will increase by $0.55.

How important is this ?

Well, it clearly helps traders determine the potential value the option should the stock move just by $1.

However, there is another interpretation of Delta.

What Else Does Delta Greek Tell You ?

The absolute value of Delta measures the probability of being In the Money at the Date of Expiration.

Yes, because as you can read above, Delta is negative for Puts. That is ALWAYS the case for Puts.

Conversely, Delta is ALWAYS positive for Calls.

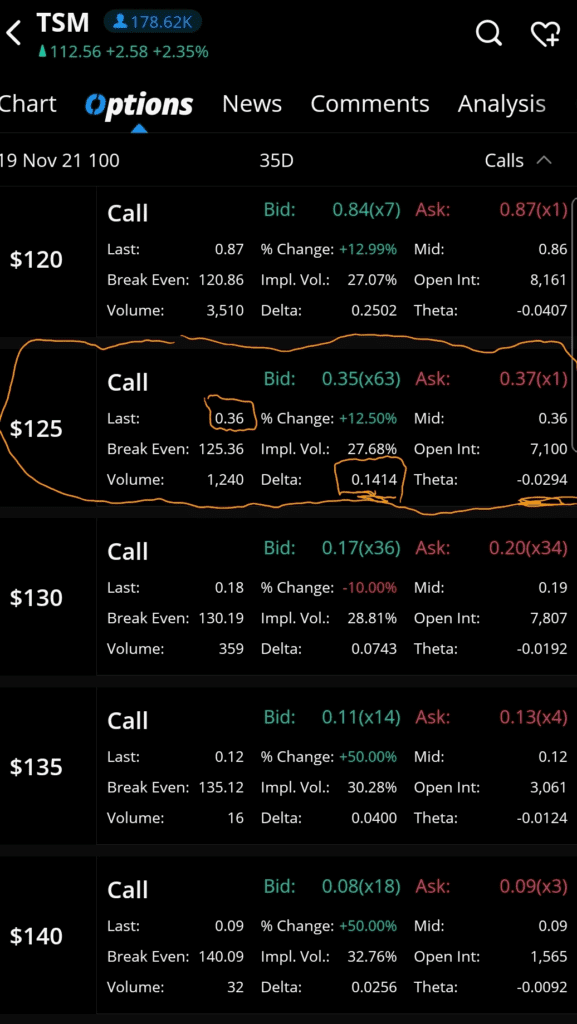

You may hear traders say: I am buying 20% Delta Calls or Puts.

They way to understand this is that there is a 20% chance for those options to be In The Money.

As for Theta, it represents the impact of time on the price of options.

Stocks Options are decaying instruments.

This means they lose their value as times passes by.

Time Impact on Option Price

Each, day, the option lose value by an amount proportional to this Theta variable.

In our example, the value of theta is -0.91. This means that each day, that 155 Put Option will lose $91 !

Scary, isn’t it ? Yes, time is the “silent” killer in Options trading.

This is done through Theta. That is what makes Theta the most important Greek variable for traders to keep in mind.

Of course, the loss in Theta or time is compensated by the movement of the stock.

In summary, the big take away is that the price of the option increase by Delta if the stock moves favorably by $1 and Theta decreases the price of the option every day No Matter What.

Now, you may better understand why we arrived at our conclusion in the best Day to trade options.

How To Use an Option Chain in your Trading

Choosing the correct expiration date is very important because the further away the expiration, the more expensive the options are.

For the same strike price, options that expires in a week are much cheaper than the ones than expires in two weeks.

How To easily Choose a Strike Price on an Option Chain

The flip side of this argument is that the price may not reach your strike price by the date of expiration meaning you are more likely to lose money by choosing closer expiration with an incorrect strike.

To help traders take the guessing game out of this important aspect of option trading, I created this short video below to easy pick a strike price on any option chain.

Common Mistake to Avoid on an Option Chain

If you have been trading option for a while like me, sooner or later you are likely to make this mistake using an option chain.

That is buying calls while or you meant to buy puts or vice versa.

A good technique to use to avoid buying calls in lieu of Puts and vice versa is to use Delta.

Remember, Delta is ALWAYS Negative for Puts and Positive for Calls.

In case you end up making the mistake (many traders do this regularly for different reasons) of buying puts instead of calls or the opposite, the most important thing is to realize that quickly.

Your choices are either to simply sell the option and purchase the correct one.

On the other hand, you could also just create a straddle which comes with the peace of mind as long as the underlying stock is moving.

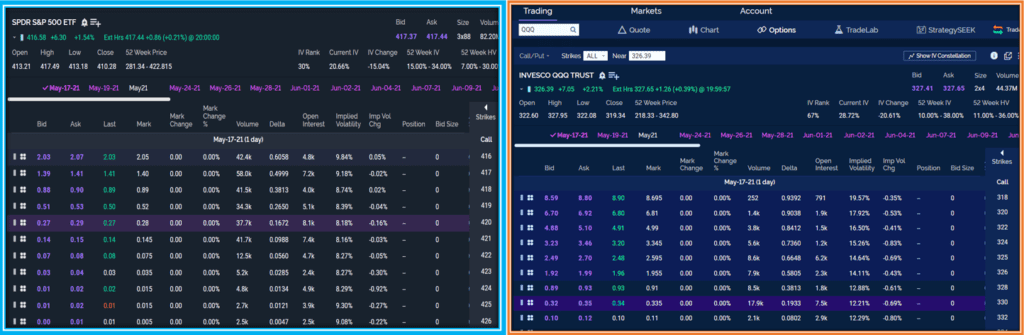

Popular Options Chains to Study

To finish, I am suggesting some popular Options chains with enough volume year around no matter the expiration.

By taking a look at them, you will be able to compare the different option terms or Lingo that we introduced here.

| Stocks | Options Chains Rating |

|---|---|

| SPY and QQQ | A+ | Super Liquid spreads |

| FCX | X | AAPL | A | Good Spreads |

| AMC | AMD | NVDA | B+ | Sometimes Expensive |

| NFLX | Roku| TWLO | B | Spreads are High |

| WDC | C | Spreads can be too wide |

| TSLA | GME | D | Way too Expensive Contracts |

- AMD, SPY, QQQ, NVDA, FCX, X or APPL are good examples of option chains to consider in your study.

Just to name a few.

FINAL THOUGHTS ON HOW TO READAN OPTION CHAIN

We showcased how to read option chain using the E*Trade platform and introduced major variables such as Implied volatility, Delta and Theta.

Based on this tutorial and what you have learned before from these posts, I shall leave you with this question:

Should you buy a straddle in a single trade? Or a Call Option and then a Put Option separately?

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

An extremely informative post. I feel you have a very good knowledge of the topic and so was able to explain it to a newbie like me who had no prior knowledge of trading. After reading your post I feel empowered to try it out for myself.

Claudia

Excellent discussion of the topic which by all indications you are extremely familiar with! As a newbie who had never traded, I feel like I could used your discussion to guide me if I ever decided to try trading. I really appreciate how you made no assumptions and went into details. Thank you!

Claudia

Hello Claudia,

How is everything in Montego Bay ?

Glad to read that you found value in this training.

Thank you for stopping by.

Hello Telex, You explained very well. I don’t have much experience on stock trading. I am in learning phase. I learn few things. The importance of option chain and delta and theta uses. I already bookmarked your website. I will read more article on stock trading. I hope I will become a good trader soon. Good practice makes a man perfect. What you think Telex?

Thank you for sharing useful knowledge

Parveen

Hello Parveen,

Practice will lead you to mastery my friend.

Just keep your focus and before you know it, you will acquire all the skills you need.

Thank you for your time.

Happy New Year.

Hi! I really like your article. I had actually never even heard of an option chain before. You made it very clear and easy for me to understand. Being someone that is learning about stocks right now, your website is the perfect way for me to expand my knowledge. I look forward to continue reading your posts. Thanks for sharing!

How are you Rashaad,

So glad to know that you plan on coming back on these posts to further expand your

knowledge of Options trading in general.

Let us know if there is any particular area you would want us to focus more on.

Really appreciate you time. Bye.

Dear Telex,

I have recently started to learn about stock trading so your article means a lot to me. I found your article highly uplifting and educational.

The step by step walk-through you have provided is a greater help and it helped me in better understanding Information you shared on Implied Volatility is an eye-opener and thanks for sharing the trick. The images you added adds more value to this article. Information on Delta and Theta are very helpful.

Your article saved me a lot of time and effort. I have taken some great insights from this article and you have really given a lot of value here.

Greetings Paul,

We appreciate you taking the time to leave us a comment.

Your feedback is important to us as it helps us tailor the content to your needs.

See You next time.

I was thinking of getting into some stock trading after reading about its opportunity but came across something called Delta and was a bit clueless. So it’s a variable – that’s what it’s all about. I am taking the time to digest all the basics you are explaining here because it’s quite a lot. Just wondering, does stock trading sites come with free demo account like Forex for you to test drive?

Hello Cathy,

Thank you for your question.

Yes, most trading platforms come with a FREE demo/paper account.

We have ranked the best ones for 2019 in this article here.

You may want to check it out and find out the beat one for you.

Have a good night.

Thanks very much for sharing a glimpse of options trading. I am still a newbie in the stock trading world, so this give me some valuable insight about options trading. Is there any significant difference between stock and options trading, especially in the risk involved? Thanks in advance for the answer

Hello my fiend Alblue,

How are you doing ?

Thank you for the question.

The main difference between stocks and Options trading is the fact that Options are much cheaper to invest in.

This means that with a small amount of money, you can trade options whereas more money is needed to the trade the stocks.

Thank you for your time and see you soon.