The CAN SLIM investment strategy is a massively popular investment system that combines fundamental and technical analysis to find the best growth stocks.

In this Investors Business Daily Reviews, we are taking an in-depth look of Investors Business Daily features, its pros and cons, and how you can make money out of it.

The publication has been around since 1984, starting from a daily newspaper and finally adapting into a weekly newspaper and daily online publications in 2016.

But has the service degraded through time, and can they justify the price that they tag their products with?

Find the answers in this Investors Business Daily Reviews!

Table of Contents

Investors Business Daily Reviews: What Is Investor’s Business Reviews

Investor’s Business Daily is a leading all-in-one platform for stock investing education, international business, finance and built upon CANSLIM investing methodology.

The financial and news company started in 1984 as a daily print news publication but later developed into a weekly service, aiming to release daily content on their IBD Digital website.

The CAN SLIM is a

Bullish strategy for fast markets, with the goal being to get into high-growth stocks before the institutional funds are fully invested. CANSLIM stocks cannot be bought and held as much of the value is being priced in for future growth, meaning any slowing in the growth trajectory, or the market as a whole may result in the stock being punished.

OBJECTIVE: To discover leading stocks before they make major price advances. These pre-advance periods are “buy points” for stocks as they emerge from price consolidation areas (or “bases”), most often in the form of a “cup-with-handle” chart pattern, of at least 7 weeks on weekly price charts.

Investopedia and Wikipedia

The stocks that CANSLIM make up seven characteristics that top-notch stocks often display before making their biggest breakouts.

| Current quarterly earnings | Per-share, current earnings should be up at least 25% in the most recent financial quarter, compared to the same quarter the previous year. Additionally, if earnings are accelerating in recent quarters, this is a positive prognostic sign. |

| Annual earnings growth | Should be up 25% or more over the last three years. Annual returns on equity should be 17% or more |

| New product or service | This refers to the idea that a company should have continuing development and innovation. This is what allows the stock to emerge from a proper chart pattern and achieve a new price. |

| Supply and demand | A gauge of a stock’s demand can be seen in the trading volume of the stock, particularly during price increases. |

| Leader or Laggard | O’Neil suggests buying “the leading stock in a leading industry.” This somewhat qualitative measurement can be more objectively measured by the Relative Price Strength Rating of the stock, designed to measure the price performance of a stock over the past 12 months in comparison to the rest of the market based on the S&P 500 over a set period. |

| Institutional sponsorship | Ownership of the stock by mutual funds, banks and other large institutions, particularly in recent quarters. A quantitative measure here is the Accumulation/Distribution Rating, which is a gauge of institutional activity in a particular stock. |

| Market Direction | Categorized into Market in Confirmed Uptrend, Market Uptrend Under Pressure, and Market in Correction. The S&P 500 and NASDAQ are studied to determine the market direction. During the time of investment, O’Neil prefers investing during times of definite uptrends of these indexes, as three out of four stocks tend to follow the general market direction. |

What it means is that you buy a stock before their big breakouts and have a 3:1 target for profit:losses. For example, you sell winners at 20% and your losers at 7%.

This is done to reap maximum gain and minimize losses.

Advantages and Disadvantages Of CANSLIM Method

As you can with the CANSLIM criteria, it is excellent in a perfect word where it is a bullish market for high-growth stocks.

The strategy does not bode well for the CANSLIM stocks when there is a market downswing as those are the ones that brutally plummet.

Investors Business Daily Reviews: Who Is The Founder Of Investor’s Business Daily

William O’Neil is the inventor of CAN SLIM strategy, which is the fruit of his research at Harvard Business School.

O’Neil applied the research from his database and made it available to the public and thus Investors Business Daily Reviews sprung forth in 1984.

He is a graduate of Southern Methodist University with a degree in Business and accepted into Harvard Business School in 1960.

O’Neil was a stockbroker at Hayden, Stone & Company, where he created an investment strategy that made early use of computers.

He bought a seat on the NYSE at age 30 and became the youngest at that time ever to do so and in 1963; founded William O’Neil + Co. Inc.

William O’Neil + Co. Inc developed the first computerized daily securities database and sold its research to institutional investors and tracks over 70,000 companies worldwide.

He has also written bestsellers such as How To Make Money In Stocks and 24 Essential Lessons for Investment Success and The Successful Investor.

Investor’s Business Daily Features

Once you log into the main page of IBD, you will see the main tabs below the Investor’s Business Daily logo. There is the Today’s Market that shows the snapshot of all the indexes.

Top Stories contain the freshest news and Research Tools which depicts other IBD products of such as Leaderboard, MarketSmith and SwingTrader.

Stocks On the Move shows stocks making big price moves on unusually heavy volume, a good way to keep track of stocks to add or remove on your own watch list.

These are the key features of Investor’s Business Daily:

Market Trend

This feature keeps you trading in sync with the stock market by giving you IBD’s exclusive market analysis, extra-large market charts, and psychological indicators that may signal key changes in stock market direction.

This is useful if you want to make sure that your portfolio mirrors with the latest movement of the market and whether you should be aggressive or scale back and be conservative.

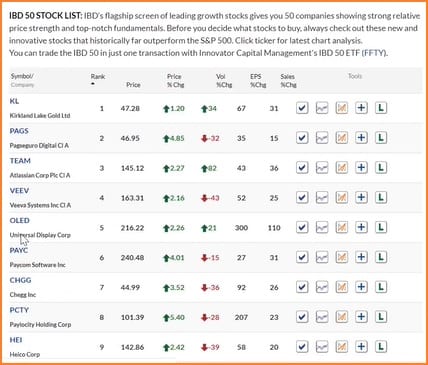

Stock Lists

This feature lists IBD’s recommended stocks based on CAN SLIM method, it lists their selection of strong stocks that could be ready giant returns and reach excellent performance.

This is beneficial if let’s say you want to look for fresh stocks to invest or trade, you can look into the IBD 50, or their other lists to cater to your needs.

You can also look through their stock lists and make your own personal watch list based on their recommendations.

Research

In the research tab, there are tons of tools to look for stocks, funds, ETF’s or options that meet your criteria.

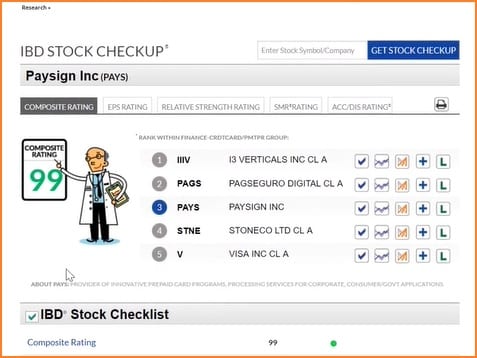

The tools that we are going to highlight in are the IBD Stock Checkup and IBD Charts.

IBD Stock Checkup lets you “diagnose” your stock’s health based on CAN SLIM criteria.

In the photo below, we used PAYS as an example. It has a 99 composite rating, which means it is among the best stocks according to the CAN SLIM method.

News

This section features the latest news, which you can sort through sectors such as Retirement, Technology and Economic news.

This is great if you like to monitor the latest’s news that might shift the market of each sector you are interested.

Videos

These sections feature educational investing resources and IBD webinars, Technical Analysis and so much more.

This feature along with Learn is the ones we liked best, as we believed that educating yourself instead of blindly investing in the stock picks is more beneficial in the long run.

Learn

This is the educational database of Investor’s Business Daily, wherein you can learn how to apply the CAN SLIM in your own investing or trading strategy,

If you are a beginner investor, you will definitely love this section as it is filled to the brim with instructional videos like How To Find and Evaluate Stocks and How To Read Stock Charts.

What Are IBD’s Other Products

IBD Live

This is an interactive broadcast where IBD’s stock pickers, analysts and portfolio manager watch the market action and discuss the day’s top trade ideas.

This is useful if you want to hear live expert commentaries of what is happening in the market day.

MarketSmith

The keystone of MarketSmith is the stock chart. In it, you will also see forming patterns alongside suggested buy, sell and profit-taking points.

With each stock’s chart, it enables you to see the latest fundamental data, streamlining your stock research.

Leaderboard

Leaderboard combines powerful investing tools to help you plan stock trades. With this tool, you will get IBD’s top stock picks and full trading plans so you know what to buy, when to buy and sell.

SwingTrader

Swing Trader gives you trade ideas handpicked by IBD experts plus full trading plans.

With this service, you need not research stocks on your own to trade as it provides you a curated list of stocks that you can choose from.

It also has an exact trade set-up that includes an exact buy zone, profit goal and a stop-loss.

How Can You Make Money With Investor’s Business Daily

You can use the data they provide as a guide on which stocks to invest or trade, or you can analyze the CAN SLIM method and apply it on your own trading strategy.

Remember, we are recommending it as a guide not as a be-all and end-all of stocks that you should get as you must still exercise due diligence to validate that the CAN SLIM system works for you.

What People Say About Investor’s Business Daily

Here are reviews we found in Better Business Bureau, which are mostly complaints:

They offer you a bunch of “free trials” then charge you $170+ without any sort of heads-up.

Brandon 06/28/2020

We have not received the delivery of the paper for three consecutive weeks. We were not permitted to have carriers phone number or speak to a supervisor We wish to have reliable delivery service of the weekly IBD paper. Despite assurances each time we call to advise IBD that we have not received our paper for three consecutive weeks, nothing has gotten any better. I was advised I could not speak to a supervisor, that the problem was with the delivery service, but they were not permitted to give me the number. If they have unreliable delivery service, it is their responsibility to correct it.

Desired Outcome

We wish IBD to provide a dependable delivery service and to adjust our account for the missing papers.

8/14/2020

BD engages in deceptive advertising. They double bill, against my permission and continuously refuse to cancel my subscription. I signed up for trial offer for $5.41 in May, 2019. They double billed the $5.41 on 5/29/2019, and they continue to refuse to remove it. They billed $31.34 on 6/24/2019 and again on 7/2/19. I called to cancel my subscription and they continue to refuse to honor it. They’ve continued to bill ****** every 9 days before increasing the price to $37.83 on 10/01/2019, against my permission. They’ve billed me $37.83 on 10/30/2019, 11/29/2019, and again on 12/23/2019.

Desired Outcome

Refund and forward to law enforcement

01/14/2020

I have a subscription for paper delivery and website. The paper rarely gets delivered. I have called them numerous times. No relief. Been a fan of IBD in the earlier years but their lack of customer service is atrocious. I have not received the paper (weekly only now) consistently from the beginning of the year (XXXX). I have had to call them numerous times to get it started again. There is no way to discuss this with them via email or chat. Their “customer service” email link only states I will have service extended another week. Well, you need consistent info to be able to invest properly. An additional week of NOT getting something does no good.

Desired Outcome

I want consistent weekly delivery. If that is not possible, then I want a full refund.

06/11/2018

I called the company to end my membership before it expired on 02/22/2017. But the company keeps charging me the membership fee until now. On 01/25/2016, I joined the membership of the company’s investment service. The monthly membership fee is $28.95. Before my annual membership expired on 02/22/2017, I called the company to state that I decide to cancel my membership and will not renew anymore. After the phone call, I thought the company would handle my request as I expected, and I did not pay attention to it anymore. Recently (03/08/2018) when I looked through my credit card statement, I saw surprisingly that the company still charges me the membership of $28.95 every month. So I called their customer service immediately on that day. The customer service told me that they do not have any record of me calling to cancel my membership. He only agreed to refund my membership fee for the last three months, instead of the whole period from 02/22/2017 to now (03/03/2018). I am very surprised and angry that they do not even keep the record of me calling them to cancel my membership around 02/22/2017. That is very unprofessional. In fact, I never visited their website and used their service ever since 02/22/2017 when my annual membership expired. Their IT department should be able to check this and prove what I said is true.

Desired Outcome

I request the company to refund the membership fee they charged me from 02/22/2017 to the present (03/08/2018). The total amount is $28.95 *12 = $347.4

03/14/2018

I have subscribed for trial subscription for 1 cent/month. I called and ended the subscription before trail period. They have been charging ~$29/month I have subscribed for trial subscription for 1 cent/month. I called and ended the subscription before trail period. They have been charging ~$29/month since then. I called them again today after finding out they have been charging. They said they will return two months but not 3rd month. I said I need all three months then ******* the customer representative said go dispute thru your credit card if you need three months. There is no log or confirmation email when I call. I have to trust their records and they just lie on the face that they have no records of me calling and ending subscription. I don’t know how many citizens they cheat this way. This is simply fraud. Please see my original trial period subscription, that I ended promptly RECEIPT: Investor’s Business Daily Invoice #: ********* Payment Date: 10/25/2017 Payment Amount: $0.99 Payment Method: MasterCard ******** Billing Info: _____________ ***** **** ************** Hampton, VA *****, US Shipping Info: ______________ ***** **** ************** Hampton, VA *****, US Order Details: ______________ Product Name Qty Price Discount Subtotal and Taxes Total IBD Digital, 1 Month 1 $0.99 $0.99 $0.00 $0.00 $0.99 Totals: ——- Sub Total: $0.99 Shipping and Handling: $0.00 Grand Total: $0.99

Desired Outcome

Full refund of my four months.

02/05/2018

In Reviews.io in which they have a total of 808 reviews, which are usually glowing:

“IBD is the only periodical that I receive that has educated me in a way that has really helped my trading account to appreciate in value. As a novice trader, I very much appreciate the manner in which the technical aspects are explained in a fashion that has enabled me to make smarter decisions in choosing stocks that interest me.”

Michael 3 weeks ago

“IBD is the only periodical that I receive that has educated me in a way that has really helped my trading account to appreciate in value. As a novice trader, I very much appreciate the manner in which the technical aspects are explained in a fashion that has enabled me to make smarter decisions in choosing stocks that interest me.”

Andres 1 week ago

“Short, concise, and relevant.”

Ingrid 1 week ago

“Really good info and recommendations.”

Melody 2 weeks ago

“EXCELLENT STOCK MARKET-RELATED DATA”

David N 2 weeks ago

“They teach you about the market. I have learned so much in a few months than in 20 years.”

Ed 2 weeks ago

“IBD is in a category all by itself. . I had a subscription to IBD for 24 years and it is the most superior investing publication-service on the market. I attended two IBD seminars taught by founder WO and was lucky enough to have lunch with WO at the second seminar. This publication changed my life and has taught me more about investing than all MBA classes I had in Grad school on investing. If you study the concepts diligently and apply them according to the IBD recipe you will do well. I rarely ever recommend anything but IBD is so outstanding you should give it a try. IBD will not rip you off but the IBD recipe requires substantial study and hard work. There are no free lunches. WO should be nominated for a Nobel Prize.”

Brian 2 weeks ago

I joined Swing Trader on May 21, 2020, and am quitting on Sept. 30. I have compulsively entered every trade (missed about 2-3 trades) including shares, my transaction price and amount, the alert price, my profit/loss, Swing Trader profit/loss based on their alert price, my delayed buy impact amount, my delayed sell impact amount (combining delayed buy and delayed sell impact = $20,515 loss), my projected ARR (12.5% profit), and Swing Trader ARR (from 5/21/20, 62.7% profit). I have a son who is an expert in constructing Excel spreadsheets and he helped me with this. I estimate that my transactions based on the alerts (both the app and Gmail invariably come in within 2 seconds of each other) are carried out within 2 minutes of the alert in most cases, maybe 10% an hour later.

I am disappointed that Justin Nielsen did not respond to 2 friendly emails from me. I think that their success has gone down since Mike Webster left. I think they should stop trading for a while since the market is in correction. Analyzing their trading exit dates, from 9/4-9/24, they had 17 losing trades and 4 profitable trades. That is unacceptable. Some of the reviews have missed the point that Nielsen and I guess Chris Gessel delay 30 minutes after the alert before making any transactions in their personal portfolios. My son astutely made a suggestion that they should have a hedge fund that we contribute our money to, and pay a fee to them for doing the trading at their alert prices. They would make money from us, and our performance would be significantly better.Cannon Dilworth 3 weeks ago

Live the Charts on Market Watch.GIVES an unemotional view of the price action.Plus find the Stocks to watch based on Volume to be a very good source for new ideas”

Shelby H 7 months ago

“IBD does the heavy lifting when it comes to gathering both fundamental and technical information and any stock you are interested in. It would take an individual hours to gather that information. IDB presents it at a glance. Superb.

Brent C 7 months ago

In Quora:

The answer is a resounding yes. There is so much valuable information in every IBD issue and very often it is very pertinent and reasonably brief.

I don’t want to sell IBD, so will let you visit their website and perhaps try them out using their always available discounted rates for newbies.

IBD’s CANSLIM method is quite effective, as is their scoring. It is rooted in a well-balanced combination of Fundamentals and Technicals.

They often have coverage of individual companies and sectors. They publish “Start of Day” and “End of Day” market observations and commentaries.

Their website allows you to quickly set up Portfolios of your stocks.

IBD rate and rank sectors and then companies within the sectors. Very effective.

How to use IBD effectively?

a) They are a “Buy High, Sell Higher” methodology, and mindset. Most people initially have trouble with that, as these stocks tend to have high valuations. Case in point – They picked up a lot of Cloud stocks before they took off – NOW, SHOP

b) They don’t provide a Hedging model, IBD is mostly focused on going long (buying). However, you can short they rank low and then hedge yourself if you so prefer

c)They believe in Momentum Investing and often, those stocks carry a lot more risk of sharp slides. However, they will comment on the markets, if they are getting overpriced with falling volumes, etc. One must take all the factors into account. In case the momentum is dying, it is best to ease in when in doubt instead of rushing in.

d) Their method of Investing often demands exiting positions before the losses become too big. That is a good thing always, using stop losses. However, this soon becomes trading instead of investing. A lot of small losses add up fast if one is not careful.

e) They have a lot of subsidiary services, like Leaderboard, which is pretty expensive for their value add. However, if you can negotiate a good deal with them, some of these services are quite effective, IMHO.

f) The way to succeed in Investing / Trading is having a lot of high-quality knowledge, I believe IBD lives up to that promise.

Hope that helps. Good luck.

Kumar Narain June 29, 2019

While I agree with their philosophy, in theory, I haven’t made any money using their buying/selling/timing methods. My experiment has been to compare the performance of 3 IRA accounts: one in which I invest using IBD techniques, another with “counter investments” like Precious Metals, Energy, Bonds, and Value stocks, and a third that’s all in a 2035 Target fund on autopilot. So far the IBD account has performed the worst over 2 years, after my having been in and out of about 40 “leading” stocks recommended by IBD. The poor returns on the IBD account include having bought into big winners like The Trading Desk, Alibaba, and Amazon. Below are the main flaws I’ve experienced with these methods:

Many, many of IBDs stock picks -even the ones with outstanding financial performance- decline in price from their buy points for no reason discernible to an amateur investor, especially in earnings season. These stocks can report RECORD earnings, beat estimates, and still gap down on earnings 5–20%.

The stocks that do rise only do so while the S&P is also rising. Buy 10 leading stocks in a “buy zone” during an uptrend: 4 will decline 8% and get cut, 3 linger at +/-2% and 3 achieve gains of 20%, triggering profit-taking based on IBD methods. Average these out, and you’ll get about the same return as an S&P Index fund over the same time frame.

Gains (from the few winners) take much longer to realize than losses (from the many losers). So if an uptrend is short-lived, you will realize losses very quickly but no gains. You must understand your tolerance for early losses before embarking on this. If you buy stocks in an uptrend that in 4 weeks moves to correction, you will have to decide whether to eat the losses on stocks that have already declined, or hold them not knowing how low the bottom will go. Believe me many of their “confirmed uptrends” leave you in this predicament.

I find their recommendations focused on lagging indicators. So AFTER the stock starts doing well, it goes on the Leaderboard. AFTER the market gets weak, they tell you to move to cash. AFTER the stock gaps up they tell you to buy. AFTER sector rotation occurs, they tell you to get out of that sector. AFTER a stock starts hemorrhaging they remove it from the Leaderboard. I feel like their recommendations don’t take you to where the market is going, only where it’s been.

While the Thursday PodCast does feature some interesting guests, most of them have made their fortunes in Growth Investing during or after a stint on Wall Street. I haven’t heard a single amateur investor like me (even with a finance background which I have) using IBD with any more success than just buying an Index Fund.

So while I’m not throwing in the towel yet, I’m not convinced, and can’t provide an endorsement for IBD.

Ryan Overbeek September 27, 2019

I think I’d keep it in my armor. I find the stories on the stocks helpful when I combine it with my own timing and position management rules.

A word of caution – I have come to realize that IBD’s talks about stocks as if it is describing a party full of celebrities. It makes you feel like that is the only way to party. And if you do not have that stock in your portfolio, then you are missing out. Reading it can create that FOMO that can be very expensive to your portfolio. Therefore, unless you have that method to pick and manage a position, I would not follow on any idea. They do have some portfolio management rules, but I have found that they are not enough or out of touch most of the time with what the market may be offering at that time.

When I started in investing Ibd was the publication to go to. It had the stock lists based on William O’Neil’s CANSLIM. Yet I did not make any money with it. I agree with the other answer; it is absolutely impossible to hold these stocks through earnings. If you scour the Ibd sponsored meetup groups, you will find many individual investors do research and share ideas that improvise on IBD’s stock selection. That can be helpful but the word is still out there on whether the returns are significantly higher than buying a leveraged or actively managed ETF’s for the amount time that you would hold a stock pick from any of their list.

For the amount of work involved in finding that rocket ship is so high that the returns better be phenomenal. And that rocket ship I have only found in hindsight with IBD. Nonetheless, there is something to be said about that as well.

Sanjay Parekh May 25

I have come to realize that IBD’s talk about stocks as if it is describing a party full of celebrities. It makes you feel like that is the only way to party. And if you do not have that stock in your portfolio, then you are missing out. Reading it can create that FOMO that can be very expensive to your portfolio. Therefore, unless you have that method to pick and manage a position I would not follow on any idea. They do have some portfolio management rules but I have found that they are not enough or out of touch most of the time with what the market may be offering at that time.

Himanshi Rajpal October 19

If you’re a full time stock investor with many millions under management, then yes. They have good information on the stocks that are growing fastest. But their recommendations have to be taken with (more than) a grain of salt, since they’re based purely on momentum. Their “method” of trading based on charts is useless.

Charles Grayball June 29, 2019

In my opinion, absolutely not.

First, they charge $35 per month. Are you making at least that much based off what they give you? Highly unlikely. You can get the same information for free from many other sources.

Also, whatever you do, don’t sign up for any trial runs, etc. It’s a scam.

David Collins May 22

In a good market, it is wonderful. In a bad market, it lines the bird feeder. One of a kind….there are pearls there that I cannot find elsewhere. I recommend it charts to most investors versus fundamentals and technicians – just charts.

J Smith August 25

In Reddit:

I recently decided to get into investing and trading. I was looking at a few services to help understand and grow quickly in both fields. I tried the IBD newsletter for the last few weeks. I also decided to try Marketsmith and this is where I saw something odd. I was using IBD for chart pattern identification and help me develop and understand technical analysis. I planned to use it as a crutch to make some money and understand CANSLIM faster. The weekly release stocks near the buy zone wherein they tell you a list of stocks that are about to break out of the cup and handle pattern and at what price should you get in.

Now market smith is another product that is far more expensive at $150 a month and also gives you a set of stocks that are near their buy point. A list of stocks that have broken out and are fast approaching their sell price. It also gives you a lot of ratings and fundamental data with a click of a button.

The first glaring difference is in terms of the stock lists which are very different. The ones posted on the IBD newsletter seem to go nowhere or move very slowly. Currently, AMD has been on the list forever. And AMD is not the only stock as most if not all stock on the Stocks to By list haven’t broken out or a breakout over weeks. Market smith on the other hand actually gave recommendations every day and has had multiple stocks breakout per day basis. In short, you will get really slow-moving or low priority information on the newsletter compared to Marketsmith.

Now last night there was an article to get into Paypal on the IBD newsletter as it had the potential of going further for those who missed out and add for those who followed the original recommendation, but on MarketSmith, you have reached the sell zone. So in short the newsletter subscribers will buy into the stock while the Marketsmith users will sell and rake in the profits. Now, this reminds me of the pump and dump schemes that flow around penny stocks. Of course, since it’s a company like Paypal your downside is heavily protected but just looking at the quality of the information provided feels like a scam

The really infuriating portion is that they actually charge a decent amount of money for their newsletter/ site access. It feels like you pay for getting second hand and second quality information.

As for the fundamental analysis, Morningstar offers amazing in-depth reports on the stocks they follow for a fraction of the price.

For the IBD list of growth stocks, I believe there is an ETF from where you can get the list.

All in all, I believe if you want to use IBD, Marketsmith is the way. Although I have not tried their other products like Swingtrader or Leaderboard.

shehal_patel 6 months ago

Not a scam. I’ve used IBD products on/off for years. CANSLIM is the methodology …IBD is the company that provides analysis, ideas, etc. The IBD 50 has been well regarded over the years. This said stock on the list does not mean it’s a buy. The methodology supports buying strong stocks as they break out of a base on higher than normal volume (the higher the better). Waiting for confirmation will provide additional confidence. When applied correctly… the methodology works more than it doesn’t. This is not a long-term buy and holds strategy. More of a midterm trade. Each of the IBD services offers different areas of focus.

IBD Digital/weekly: news, access to the IBD lists, IBD ratings, and some light analysis. Mobile apps are weak, especially the iPad app…which is just the iPhone app with a 2x button to expand. Remember those? That what the app developers did 10 years ago when they did not want or know how to create an iPad or universal app. This ticks me off as the iPad is where I would most use it. If you pay the subscription… they ought to give you a properly functioning app.

Leaderboard: greater focus on the best opportunities now with deeper chart analysis

Swing Trader: shorter term, quick hits. Trades lasting a few days to a few weeks with lower profit goals and tight stops. In and out.

MarketSmith: premium-level service with excellent charting, ratings, a Journal. I used MarketSmith for several years. But it’s pricey. And my beef here is that it leaves out things from lower-level services that should be included at this price. Other services I’ve tried…

The Motley Fool is more of a long-term buy and holds house.

Gorilla Trades does a solid job as a swing trading idea service, somewhat similar to IBD’s Swing Trader.

IBD changed ownership a few years back. When they did.. they appeared to be cutting resources. They changed from a daily newspaper to a weekly but with daily information online and via the app through the IBD Digital subscription as well as some free information. I had some hopes that with the greater focus on digital that they would release a proper app. No such luck. Note… this is about the standard IBD app. The MarketSmith app is excellent.Claude Henry Smoot 5 months ago

It is a decent resource for growth, momentum stocks. The New America page had occasionally found a hot new stock before it became popular. There are small spaces dedicated to international IPOs, new mutual fund adds. The relative strength, sector, EPS rankings can all be valuable.

With all that, many libraries subscribe. Go there. Especially if you have a smallish account.

As a footnote, the world record for stock trading was accomplished using a variation of the CANSLIM method during the dot com bubble. Dan Zanger ran a small five-figure account to eight figures in two years. There are YouTube interviews.

RTiger 1 year ago

I subscribe. I’m still not sure if it’s worth it. I like their ratings and charts, and I read “the big picture” every day. I’d try it. You can get a free trial.

80percentofme 1 year ago

It’s just a pump and dumps for institutions to steal j6p money… If you follow their investment rules. They have you selling out of stocks at an 8% loss and I didn’t find the system useful. Being momentum Stocks high volatility around earnings announcements. It’s best to do your own research and use some of the investment tools on your own charting platform. Just my 2c worth. Never was happy with their over-hyped system.

Anonymous 1 year ago

What Are Alternatives To Investor’s Business Daily

An alternative that we can safely recommend are Morningstar Investment and The Motley Fool.

Both Morningstar and The Motley Fool are an institution in the financial industry and the stocks they recommend have consistently beaten the S&P 500.

The crucial difference with IBD versus Morningstar and The Motley Fool is that latter are geared for long-term buy and hold investors.

Read more about Morningstar in our Morningstar Investment Review and The Motley Fool Review!

What We Like And Don’t Like About Investor’s Business Daily

We appreciate that the CAN SLIM is a system that has been proven and worked for millions of investors.

This is an excellent strategy that will let you combine fundamental and technical analysis and remove emotions when you make a buy/sell decisions.

What throws a wrench in the system is that it is a strategy for a bullish market. In a good market the stocks in their lists will rocket, but in a downtrend, you can expect the worst.

What we also noticed is that IBD has a tendency of pushing customers to subscribe to their other products, which can sometimes feel like they are trying to nickel and dime you.

Investor’s Business Daily Pricing

Investor’s Business Daily offers a 2-month promotional period of $20 for its IBD Digital and costs $34.95/month afterward.

IBD Live offer 2-week free trial and costs $49.95/month for IBD members and $99.95/month for non-members.

MarketSmith has a $24.95 promotional period for four weeks, thereafter it is $149.95.

Leaderboard offer 2-week free trial and costs $69/month after.

SwingTrade offer a 4-week trial period and costs $69/month afterwards.

IBD Digital + Print offer a 4-week trial and costs $36.95/month thereafter.

Investor’s Business Daily Refund Policy

We reserve the right to alter this policy at any time, at our discretion, without prior notification. A pro-rata refund of the unused portion of a current Subscription may be granted at our discretion. You are obligated to pay the entire monthly fee for the month of cancellation regardless of when the termination was initiated during the month. Any subsequent refunds from a cancellation will be pro-rated based on a calendar month billing cycle regardless of the billing cycle selected during the initial registration, and any billing changes made during your subscription period for a Service. After receiving a cancellation notice, the Company will promptly process any refund due.

Credit/debit card purchases will be refunded to the card used for purchase. PLEASE NOTE THAT NO CASH/CHECK REFUND MAY BE MADE ON CREDIT/DEBIT CARD PURCHASES. If your termination or cancellation is the result of a violation of this Agreement, you may forfeit any refund amounts, in the Company’s sole discretion. For the Home Study Kit and other purchased goods, the product must be returned unopened in the original packing within thirty (30) days of purchase to be eligible for a refund.

Investor’s Business Daily website

Pros and Cons

PROS

- A proven bullish strategy that integrates fundamental and technical analysis

- Focuses on growth stocks

- Solid financial research platform

- The education suite is exhaustive

CONS

- A bear market wrecks havoc on the CAN SLIM stocks

- The system does not have a clear stop loss criterion

- Can sometimes feel like they are trying to nickel and dime you by shoving other subscription in your face “to get the full benefit”

Final Thoughts: Is Investors Business Daily Worth The Money?

In this Investors Business Daily Reviews, we learned what is the CAN SLIM strategy, and it works best in a bull market and is a proven system that works.

This is a rule-based system that gives you a slight statistical advantage and removes your emotions from your buy/sell decisions.

But just like any other system, it will not be a home run all the time. If you understand how the system works, your winners will be two to three times bigger than your losers.

The IBD 50 are for recommendations, not for you to blindly investing without doing your due diligence.

After buying the right stocks for you, it means you hold until it either hits a 20% profit or a 7%-8% loss, then you sell.

However, if you truly believe in the company, or if the price goes beyond 20% within three weeks from its break-out, you are supposed to hold the stock for at least 8 weeks and then wait for a sell signal.

Investor’s Business Daily CAN SLIM system works when done correctly. But as it is a bullish strategy, it does not do well in an indecisive trend or a bearish market.

Looking at S&P or NASDAQ irregular trend, that descent wrecks havoc on IBD’s system, so be picky about your buys,.

Using a smaller profit/loss targets, like 10% winners and 3% losers, or 15% winners and 5% losers would be smart.

Investor’s Business Daily works best when the indices are recovering from a downturn and is particularly good at telling you when the downturn is over and it is safe to buy stocks.

Go read our Investors Business Daily Customer Service article to see how IBD fared in the customer service department!

Thoughts? We’d love to hear what you think!

Investor's Business Daily

$34.95 per monthPros

- A proven bullish strategy that integrates fundamental and technical analysis

- Focuses on growth stocks

- Solid financial research platform

- The education suite is exhaustive

Cons

- A bear market wrecks havoc on the CAN SLIM stocks

- The system does not have a clear stop loss criterion

- Can sometimes feel like they are trying to nickel and dime you by shoving other subscription in your face “to get the full benefit”