“A blindfolded monkey throwing darts at a newspapers’ financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

What about a gorilla? In this Gorilla Trades Review, we are going to do an in-depth analysis of a stock picking company fronted by a secretive gorilla.

Burton Malkiel famously claimed the above statement in his book, A Random Walk Down Wall Street.

But can a gorilla beat the brilliant minds of Wall Street just like what Malkiel hypothesized with monkeys?

Scout this service and find the answer in this Gorilla Trades Review in 2020!

Table of Contents

Gorilla Trades Review: What is GorillaTrades

GorillaTrades is primarily a stock picking service that has been in the market for 21 years, starting in 1999.

We say primarily as it also has options picks & express options and small stock cap alerts.

But they caution their subscribers that the former services are for aggressive investors/traders who are not afraid to take higher risks, and the latter is a bonus service.

The newsletters are sent twice a day. The first one is sent midday and the second at night every 6 PM ET every market day.

The afternoon newsletter summarizes what is happening in the stock market while the second provides analyzes the days stock pick/s.

The Gorilla picks stocks based on 14 technical parameters and ignores fundamental indicators, two are unrevealed and the remaining twelve are:

| MACD | Is a two-component indicator based on two exponential moving price averages. |

| Volume | Is the force that drives the market. It is the volume that indicates the meeting of supply and demand at a specific transfer price. |

| Moving Average | It is used to smooth out short-term fluctuations and depict the underlying trend; the longer the time period used in the calculation, the longer the term of the trend depicted by the average. |

| Money Flow | Measures the flow of money into and out of a stock. |

| OBV | Is a widely used indicator that shows accumulation and distribution action. |

| Volume/Price Trend | Is a short-term indicator best used for signal confirmation. Volume/Price Trend is computed as an exponentially smoothed average of the ratio of a percentage price change and the percentage of volume above and below-average volume. This indicator is very sensitive to changes in price action. |

| Volatility | Is a measure of the fluctuation in price over a specified period of time. The indicator is expressed as the annual percentage change in price which provides a relative basis for examining volatility |

| Volume Oscillator | Is the difference, in percentage terms, between two different exponentially smoothed averages. |

| SK-SD Stochastic | The SK component is typically a 3-day moving average of the stochastic ratio SK is again averaged over the same number of days to obtain a double smoothed average ratio called SD. |

| Relative Strength Index | Is a measure of the relative strength of the average upward price movement against the average downward price movement. The index signals overbought and underbought conditions. |

| Accumulation/Distribution | Is a single value indicator that weighs buyer dominated volume (accumulation) against seller dominated volume (distribution). It is computed as a running total of weighted volume. |

| Velocity | Is a momentum indicator which measures the rate of change of price using least squares methodology. The indicator is calculated as the slope of the line that most closely approximates the data over the period of time specified. |

Gorilla Trades Review: How Does The GorillaTrades Stock Investing System Works

It looks through 6000 stocks for stocks that meet every one of the 14 different technical parameters before they make explosive upward moves.

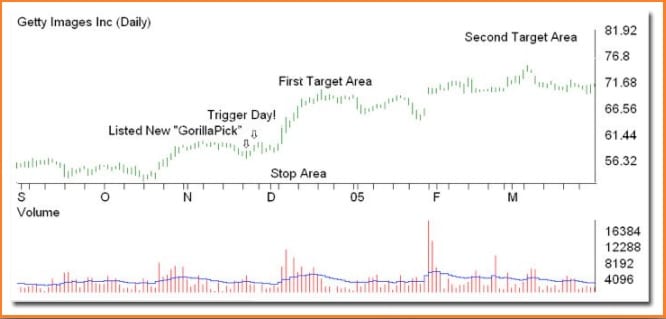

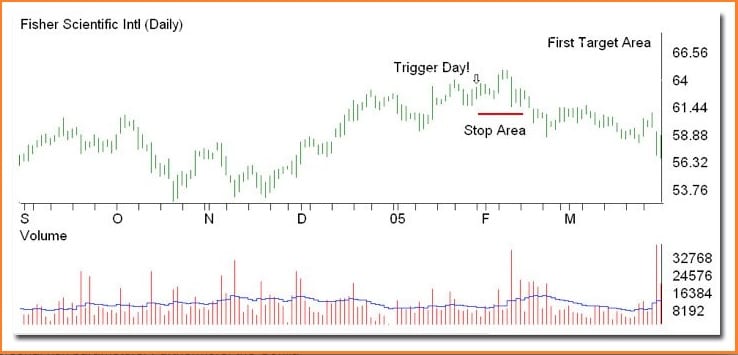

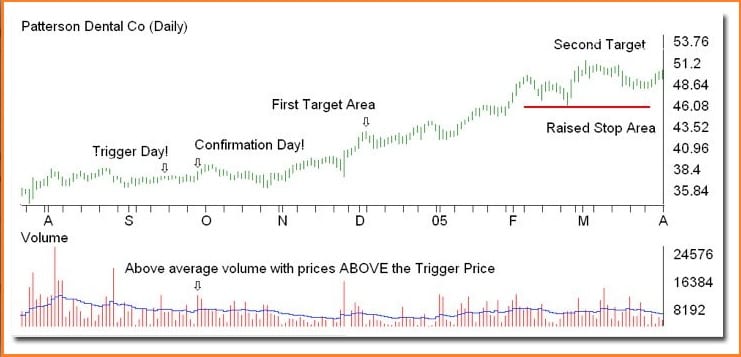

Included with each GorillaPick, is a stop loss level, a first target, and a second target which work together to eliminate the guesswork and the time-consuming effort involved in successful stock investing.

The first target may take a few days, or a few weeks to be achieved.

Subscribers are advised to sell 50%-75% of their position at this target, depending on the overall market environment for diversification.

The second target may take a few weeks or a few months to be achieved.

On average, only one or two stocks that the Gorilla finds are listed for potential purchase each evening, however, not all of these will enter the portfolio

Trigger Price

The new picks are only “potentially” for purchase is that a new GorillaPick must trigger to be considered for purchase.

To trigger, a stock must trade above the HIGH of the day, on the day before its initial listing in the nightly email. Note that this is its day’s high, not the closing price.

Sometimes new picks take longer than one day to trigger. As long as a new pick trades above its Trigger Price within FIVE sessions of its initial listing, it is considered having “triggered.”

However, if a new pick does NOT “Trigger” within five sessions, it expires and will NOT be considered for purchase.

If a pick gaps higher, through its “Trigger Price” on an opening print, this opening price is then considered the trigger price of record for the new stock in the GorillaTrades portfolio.

Gorilla Trades advises subscribers to not purchase potential stock picks that have more than 5% above its trigger price.

Even if the upward gap is a sure sign of strength, for them the upside potential is simply “less attractive”.

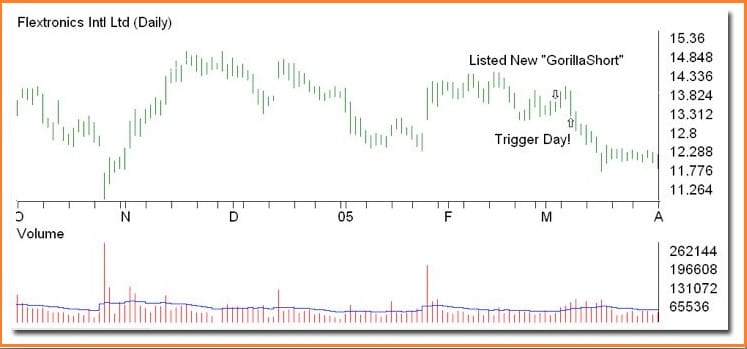

GorillaShorts and Trigger Price

The exact opposite “Trigger Price” rule applies, simply substitute “low price” for “high price.”

A GorillaShort has five sessions to trade lower than the low of the session prior to which it was first listed, in order to be considered as “triggered.”

All new triggered GorillaPicks and GorillaShorts are reported in the evening email.

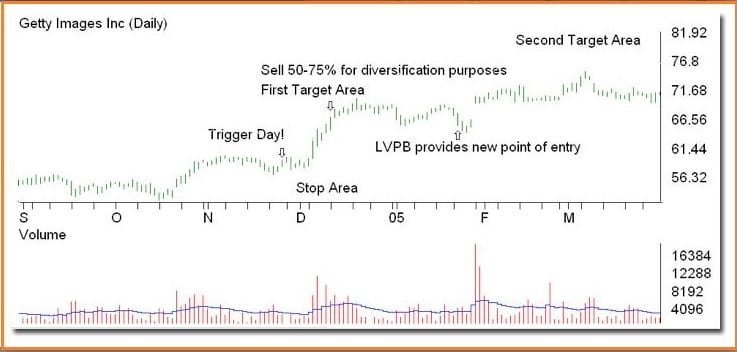

First Target

As GorillaPicks achieve their first target, a portion of the position is suggested for sale.

Subscribers are alerted of this percentage, which varies on overall market conditions.

The Gorilla advises subscribers to sell 50%-75% of their position at the first target, while the remaining portion is left to grow towards the second target.

If the amount of capital available to you is limited, you may decide to sell 75% at the first target. However, if capital is not an issue, you may decide to only sell 50% at the first target.

The remaining portion is left to grow. The excess capital is advised to purchase new GorillaPicks or to add to some of the strongest, proven, top-performing positions.

Second Target

They advised subscribers that GorillaPicks rarely achieve second target because their stop levels are reviewed and raised weekly.

When a pick achieves its second target, it is usually because it has gapped through the target on an opening print.

GorillaPicks will remain in the portfolio until they achieve the second target, show any significant weakness, or reverse their upward trend.

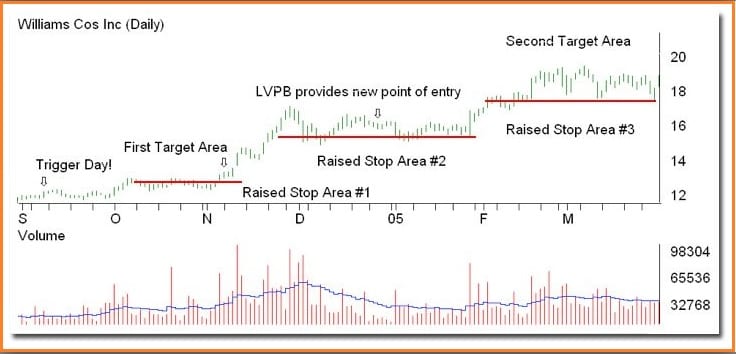

Stop Loss

They review stop loss levels routinely and raise it as GorillaPicks appreciate in price. GorillaPicks that have confirmed will have much tighter stop levels than GorillaPicks that have triggered.

Raised stop loss levels are communicated to subscribers weekly, via the Trader’s Notes section in each of the Gorilla’s Monday evening email.

This means they alert you when you have to pull the plug on a particular pick, saving from incurring massive losses from their stock picks.

Confirmation Day

The Confirmation Day is a concept that aims to help subscribers avoid “false” stock moves that trigger a pick on only the illusion of strength.

Some subscribers enter at the Trigger Price (high risk, but potentially higher returns), while others enter upon confirmation (lower risk, but lower potential returns).

Basically, Confirmation Day is a point where Gorilla Trades think the pick is a stable upward trend and will not do a breakdown.

The criteria of a Confirmation Day are:

- A GorillaPick must CLOSE higher than its previous close AND higher than where it opened.

- A GorillaPick must CLOSE higher than its trigger price.

- A GorillaPick must meet or exceed its specific volume level area.

Risk Rating Tool

A high Risk Rating usually defines a highly volatile stock.

A 5-rated GorillaPick, appears very strong, its high Risk Rating alerts subscribers to the fact that it has a greater potential of producing a considerably larger loss.

Since these stocks have larger targets, they will have “looser” stops.

Remember, a higher Risk Rating figure may provide more volatile price action, which could result in larger targets OR losses.

GorillaPicks with lower Risk Ratings usually take longer to achieve their projected goals but provide the least amount of potential trade risk.

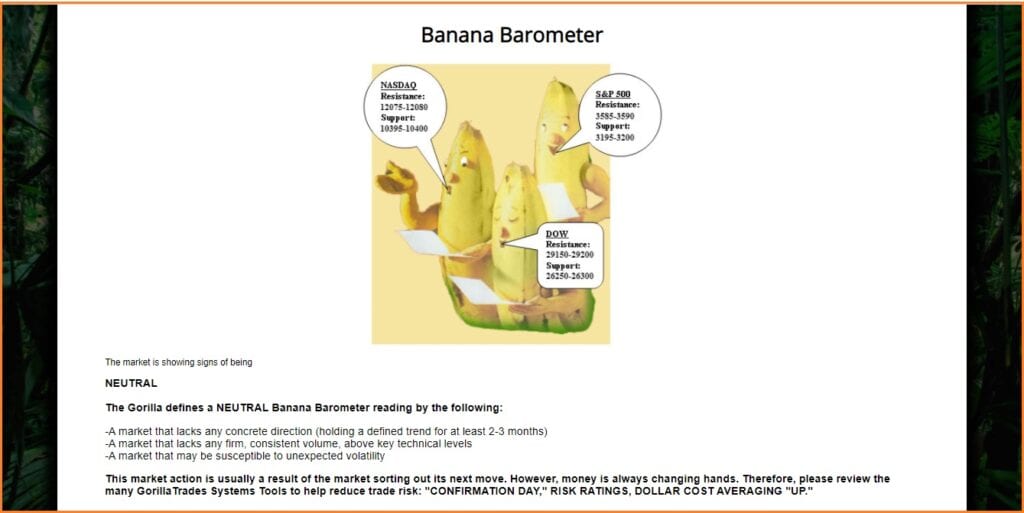

Banana Barometer

A feature of the website that gives a broad overview of the market environment. It lists near-term support and resistance levels for the three major indices.

This feature is useful if you want to keep track of market’s movement against the stock picks provided by Gorilla Trades.

Light Volume Pullback

The LVPB list is used to alert subscribers of GorillaPicks in the current portfolio that have achieved their first target, but are now experiencing a non-damaging decline in price.

This is an opportunity for subscribers to potentially jump back into strong continuation patterns that may have a high probability of future advancement.

Many of these picks are chosen immediately after a clear, short-term trend reversal has occurred. These stocks are exhibiting strength, regardless of the overall market environment.

This area may provide the opportunity for a high probability entry.

Whether using this tool to initiate new purchases or add to existing positions, they recommend concentrating on second target goals, while always carrying an exit strategy based upon your personal risk tolerance.

Return to Risk Ratio Tool

This enables subscribers to quickly scan through the current portfolio to identify those picks that are exhibiting strength greater than the market itself or are experiencing a non-threatening pullback.

A larger RTR number indicates that a GorillaPick is closer to its stop-loss level than its second target.

It can also detect picks that are experiencing a mild pullback. A smaller number indicates that a GorillaPick is closer to its second target than it is to its stop-loss level.

These picks are exhibiting strength versus the overall market.

The higher the number, the greater the risk that a GorillaPick may stop out, but the losses incurred will be small in relation to the potential rewards. The smaller the number, the less risk there is that a GorillaPick will stop out. The losses incurred may be larger in relation to the potential rewards.

As taken from GorillaTrades website

Special Situations Radar Screen

The picks that appear on this special radar screen is a “bonus” to the GorillaTrades service. I

Additionally, the market cap of these stocks can sometimes be VERY low and they can be quite volatile.

They advise that only the more aggressive subscribers should consider these picks

If you wish to enter this position, note that they do not offer any guidance on these small stock picks.

How Are The GorillaPicks Generated

After the market closes each day, GorillaTrades uses its proprietary software program to scan all of the stocks in all three major markets, while eliminating all stocks under $5. The Gorilla looks forward to these small stocks one day being able to meet his rigid criteria and making his Daily List. GorillaTrades is not a web site that hypes penny stocks! While these stocks one day may prove to be big winners, the Gorilla does not believe that buying these stocks proves to be lucrative, until they are over $5. Next, this complex software program scans through thousands of stocks looking for only those stocks that match each and every one of the numerous technical parameters of the Gorilla’s proprietary formula. This formula is known only by the Gorilla. If a stock does not match all of his criteria, it does not make the Gorilla’s list. While most stocks that appear on the Gorilla’s list are well-known companies, the Gorilla does not look at any fundamental aspect of the companies, for his list. If a stock that the Gorilla personally owns makes the list it is disclosed with an asterisk next to the selection. This has absolutely no bearing on whether a stock makes the list or not. Each day the number of GorillaPicks will vary depending on the overall market conditions. On some days, this list may not contain a single stock and on other days, it may contain as many as three or four stocks.

As taken from GorillaTrades website

Who Owns Gorilla Trades: Who Is The Gorilla

The Gorilla is Kenneth “Ken” Jay Berman, the founder and CEO of GorillaTrades. He is a graduate of the University of Michigan and featured Yahoo Finance, Nasdaq and Forbes.

Prior to founding GorillaTrades, Ken was Vice President of Investments at both Smith Barney and PaineWebber, and claims to have more than $100 million under his management.

He also claims that in his previous work, he was able to turn $25,000 into $5.5M within just 18 months,

After successfully implementing his trading system, thus, the GorillaTrades service was born.

GorillaTrades Features

Latest Gorilla Pick/s

This section features GorillaPicks that are waiting to be triggered, and picks that have already triggered.

For example, the photo below depicts the new potential pick Halozyme Therapeutics Inc. (HALO).

The list shows the trigger and confirmation price for the stock, the volume, the first and second target, the stop loss, the risk rating and dividend yield, if any.

This feature is helpful if you want to quickly sweep for any new trading or investing idea that you might consider.

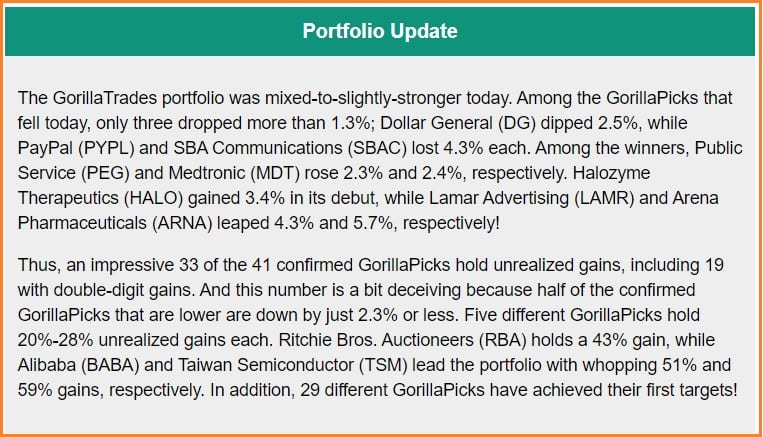

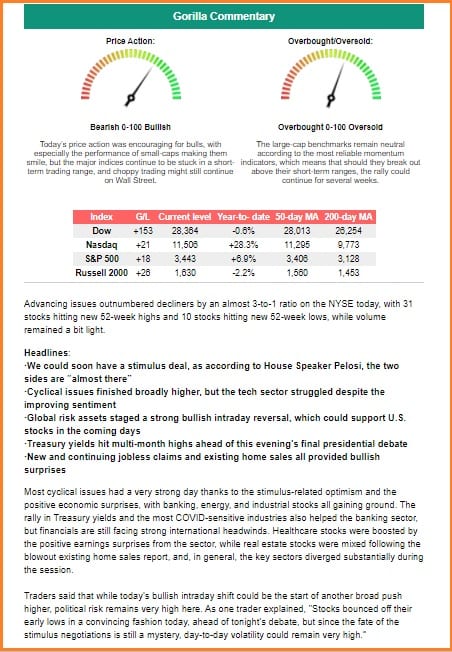

The Gorilla’s Latest Nightly Report

This is the email that is sent you at night and is the key feature of GorillaTrades that also contains new alerts.

This feature contains the ticker symbol of the stocks that have been added into the Watchlist that day, and the stocks that have been given a “buy” signal.

This helps you narrow down the stocks to keep tabs on and alerts you if you should purchase a stock. In addition. you will also get a big picture perspective regarding the movements in the major stock markets.

This email also contains a Portfolio Update which tackles the changes in the stocks that are in the Gorilla Portfolio and a Gorilla Commentary that highlights what The Gorilla says about the indexes movement.

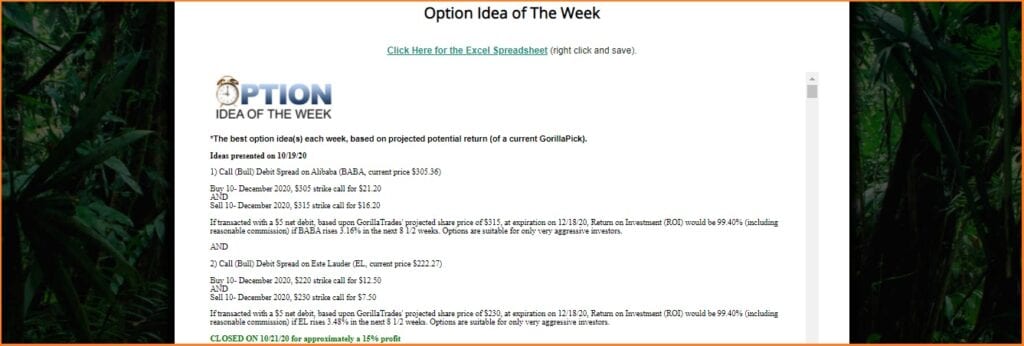

Gorilla Option Picks & Express Options

They caution that the Option Idea of the Week and the Express Options are for very aggressive subscribers, who are open to additional risk in exchange for a potentially greater rewards in a very short period of time.

This is a great feature for those who take the adage “The greater the risk the greater the reward” by heart.

In the above example of BABA and EL Options, the parameters are clearly specified. This is different with the Express Options, as they leave this to you to execute on your own.

You will have to use your own discretion to determine the exact entry and exit points of each trade.

When reviewing new trading ideas for purchase, pay the price that coincides with your desired exit strategy; consider patience during volatile market periods.

These are the instructions for the Express Options:

- Purchase options after the stock has confirmed within the GorillaTrades portfolio, IE: Use Confirmed Stocks Only.

- The investment size will vary based on your available capital as well as the cost of the underlying stock, as the price of the stock will affect the price of the options.

- Buy in the money calls that expire three to four months out. For example: Let’s say it’s July 1st, your target expiration date would be sometime in October or November.

- For this strategy, it is preferred to purchase “in the money” calls that are closest to the current stock price. For example: If the current stock price is $102, you would look to purchase in the money calls with a strike price of around $100 (or as close as you can get to the current $102 stock price). The further “in the money” you go, the more expensive the calls become.

- You will have to set your own price targets, and exit strategy for each individual trade. A less aggressive target gain could fall within the 10%-20% range, while a very aggressive target could fall within the 50%-100% range. For example: if your target gain is 10% and you purchase an options contract for $5, you would look to sell your position once the options price rises to $5.50. If your target gain is 50% and you purchase an options contract for $5, you would look to sell your position once the options price rises to $7.50.

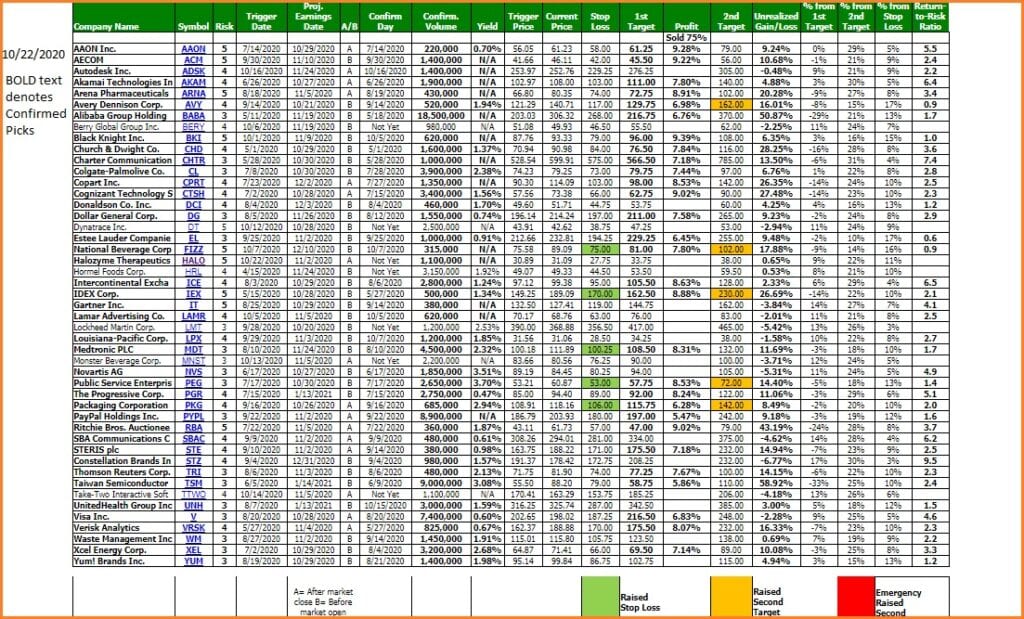

The Current GorillaTrades Portfolio

The GorillaTrades Portfolio consists of the list of stocks that have hit their “trigger price” and have hence been given a “buy” signal by the Gorilla.

Stocks in the Portfolio have strong momentum pushing their price upward and you can consider buying these stocks.

You can also filter these recommendations using your own criteria and their GorillaTrades Portfolio Screener that you can view in a Web or Excel format.

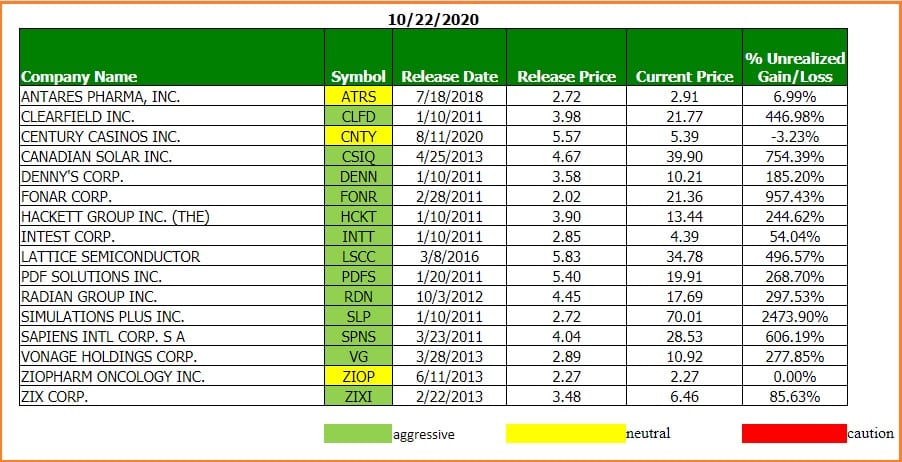

The Current GorillaPicklets Portfolio

The GorillaPickelts Portfolio consist of a portfolio of small-cap stocks that have been given a “buy” signal from the Gorilla.

Small-cap stocks alerts are a bonus service provided as part of your GorillaTrades subscription and are very rare picks that are held until their long-term uptrend is violated.

The above photo shows small cap stocks recommendations but again the initiative is till left up to you because there are no further instructions for this portfolio.

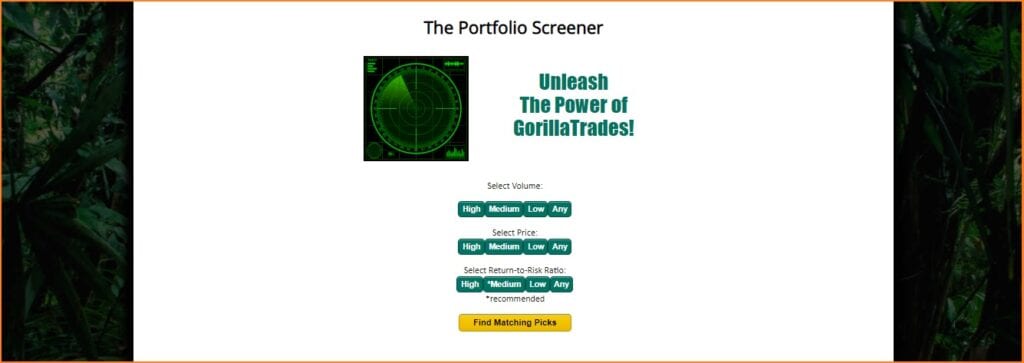

GorillaTrades Porftolio Screener

This feature lets you screen stocks that are in the Portfolio which meets your criteria. As you can see, the screeners are very limiting as its only volume, price and return-to-risk ratio.

Menu Of Ideas

This feature is an organization of various stocks that could be considered at anytime for purchase under the GorillaTrades System.

You can find this inside the evening email as well as the Gorilla website, and each idea contains explanations of its benefits.

These ideas can be tailored to the market environment and customized to your personal trading style, and the needs of your portfolio.

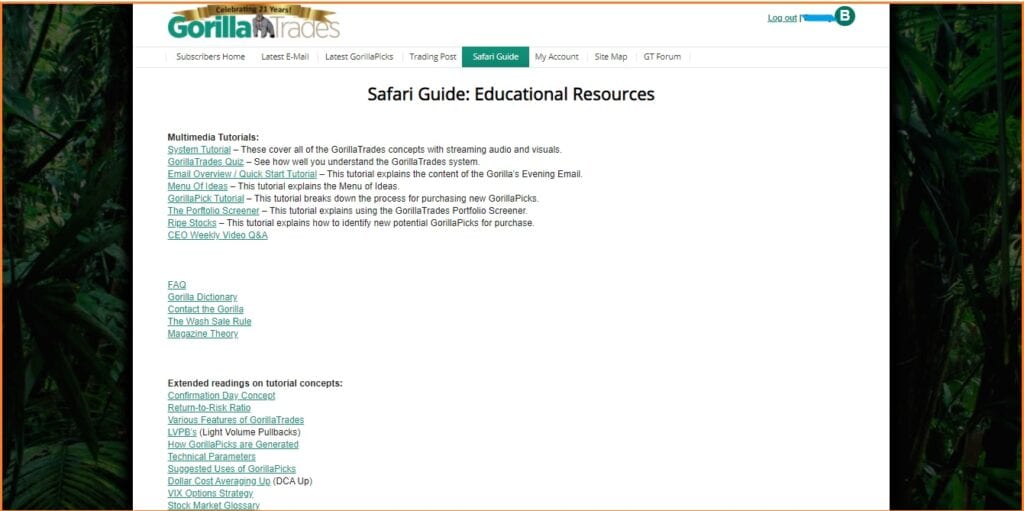

Safari Guide

GorillaTrades dub their website as “The Safari”, which if we might say is quite fitting. The Safari is the “map” of the website and the educational resources.

Here you can find multimedia tutorials, FAQ, Gorilla Dictionary and extended readings on tutorial concepts.

This is handy if you feel lost and want some help in navigating their safari.

GorillaTrades Forum

The Forum lets you connect with fellow GorillaTrades subscribers. GorillaTrades started out as a newsletter but has now grown to include a forum section.

Here, you can ask something about a specific stock pick, strategize with fellow members, or just chill and chat with like-minded individuals.

What People Say About Gorilla Trades

The single review we found in BBB:

I’ve subscribed to Gorilla Trades for going on two decades. I wholeheartedly recommend this organization! The only regret I have is that I took a decade to test the waters. I would be far ahead had I just done what they had told me to do. These silverbacks are pure gold. They have passed every one of my backchecks, suspicions, and personal investigations. When I think of them, I think of Robert F. and his wonderful poem, Nothing Gold Can Stay, and worry that even perfection will end…Nature’s first green is gold, her hardest hue to hold. Her early leaf’s a flower; But only so an hour. Then leaf subsides to leaf. So Eden sank to grief. So dawn goes down today. Nothing gold can stay…and I cry at the thought. I love these guys!

JOHN V 4/20/2020

In YouTube:

Subbed to this picks service for 1 year. In bull markets they do the best. In congested markets they do so-so. In bear markets do horribly

jsun Proter 2 months ago

Be very cautious of this company. They do not negotiate on anything and if you don’t do what they want then they take you off of their mailing list.

Brian O 5 months ago

Yeah I want to echo your point about Berman’s lack of transparency. A quick Google search will show he’s been challenged to provide some kind of proof regarding his bio. On the other hand, the service has been around for a while so it must be providing a lot of value to subscribers.

Miguel Flores 2 months ago

FYI, Just in case anyone is wondering whether to sign up for these guys and if it’s worth it, I can tell you from experience, they are pretty damn good and accurate. You can’t go wrong. They also beat Zacks recommended plays as well as a few others guru’s

Harry D 1 year ago

In Investimonials:

The strongest stocks in the universe are filtered for you and delivered nightly via email for your consideration. The rules of engagement are pretty simple and can be modified depending on your style. Buy the recommended stock when the trigger price engages OR reduce your risk by waiting for volume to confirm the move. Whatever method you employ, do not try to be cute (wait for the stock to pull back after it engages, etc). Rather, take a measured approach and purchase the stock you are comfortable with and be mindful of the risk parameters. Gorilla Trades does the work for you; mind your stops and trust the process. If past results are any indication, do NOT pass up the special situation picks or “pick-lets”. Although they are smaller cap and more volatile, they really are an added bonus to the service (as are the weekly option suggestions).

Jjclark611 June 2017

I have tried MANY services over the years, and I have found a few that were OK. But GT is the only one I have stuck with, and for good reason! When I first started using the system in the early 2000s , I tried to outsmart the system by buying picks in aftermarket or premarket to try to get ahead, leaving me with picks that quickly reversed course and produced losses. But after I actually started following the gorillas recommendations, I have never looked back. Look-not every pick will be a winner. LOSSES HAPPEN. I have incurred MANY losers over the years, but with GT my profits ALWAYS outweigh the losses. As a matter of fact, as I write this review I currently have 17 different stocks that gorilla recommended over the last 5-6months that have double digit profits. hrg +14% aapl +17% incy +33% alb +11% tsem +25% dd+11% nflx +17% swks+23% lrcx +18% avgo+27% wal +33% …. And the list goes on. If you want to fact these numbers, go right ahead they list all of their trades – WINNERS & LOSERS for all subscribers to see

This is not my opinion, these are the facts. Truth be told, I decided to post my experience with GT after my nephew was duped into trying some “fool proof” investment strategy, which advised him to bet big… And ultimately, he lost big.Hopefully this review will steer a few investors away from the “get rich quick” programs that promise big returns and DON’T follow through. GT worksJsnydertrades March 2017

Was using another service during the last correction on 01/2016-02/2016 and I lost a moderate sum of money, which made me sick to my stomach and gun shy trading for the time being I started using GT and I am happy to say I made up the losses I sustained. Plus I covered my subscription cost and maintained a reasonable return even though this is a tough market that seems to lack volume. This is an excellent simple service. I have made errors using the system. I let my emotion get involved and I was shaken out of some positions that a week or two later reached their first target. I missed out on a considerable profit. I know now to trust GT. Just follow the tips, set your stops, and achieve success with GT.

People who complain, I assume think every trade will be a winner, but that is an unrealistic expectation. You will have many winners with GT as long as you follow the tips and use confirmed picks, but don’t get me wrong, some will be losers also. The service is easy to use.

The education does not teach you how to trade with a broker, but it teaches you how to use the system. It is important to follow the guidelines.

I have used systems such as vectorvest (too expensive), action alerts (long term positions with no stops implemented), leaderboard (an expensive and small number of picks), but I do like IBD. Out of them, all GT is the simplest, get your evening email, research potential picks, wait until they trigger, and confirm, sell 75% at your first target.

I love the service and I make more money with it than without it.April 2016

Started trading with Gorilla a few years ago and hands down still the best. Some people don’t understand how to use it but that is unfortunate. Nothing works 100% of the time but Gorilla will get you up there. Take your time with it and it will make you money soon enough.

Alexnamel November 2015

Finally an advisory service that gives you pics early enough to actually take action on them. Nothing more frustrating to receive notification of a trade, and by the time you get your order in, most of the move is over. The pics here are timely, and thus far, for me, have been profitable.

DaveB August 2015

I am a charter member of gorilla trades… ive been with the gorilla since the subscription started over 15 years ago. To keep it real simple… follow the system and you will make money. I have been in the market for over 30 years, ive made money in a up market and in a down market… one piece of advice to anyone who will listen: stay away from the sites with the outrageous claims. Any site that claims to have consistently beaten the market is full of it. save yourself the headache, learn from my mistakes… and STAY AWAY. With the gorilla, you don’t invest in every stock in the portfolio… ive only put my money in 3 of his recommendations so far this year and I have made more than quadrupled my subscription cost… UTHR, INCY, SKX… we are only in april folks

Dover1966 April 2015

I downloaded the Gorilla Trades spreadsheet of closed trades from 2003 until the end of 2011. The spreadsheet has about 12 incorrect cell entries in some 5000 round trip trades that I was able to correct by deduction. In addition, many of the individual stock gains/losses are in the wrong cells so I had to move those to the correct cells. There still seems to be about 100 gains/losses figures that are either missing or are still in the wrong cells. So, it has been a real chore to try to get accurate data from this spreadsheet. The biggest problem I had was trying to determine how many stocks were being held on any given day in order to calculate portfolio size and subsequently portfolio performance. Assuming an average portfolio size of 20 stocks with equal investments, I calculated the portfolio performance was up about 117% from March of 2003 until August of 2007. Then the portfolio went down about 22% until March of 2009. It has since appreciated about 13% until the end of 2011. During this whole time span, it has appreciated 89% or 7.5% compounded annually ( commissions not included ). So, the portfolio went down about half as much as the S&P during the financial meltdown in 2008. But it has not appreciated nearly as much as the S&P since then. In summary, it is hard to tell what the GorillaTrade system will do in future markets since there is no clear pattern of performance. It is a proprietary technology system that is probably being tweaked by the founder and thus giving the current lackluster performance. Their record-keeping is poor and they have not responded to any of the errors that I have identified in their spreadsheet. Basically, I do not like systems that are unknown and subject to the whims of the owner and cannot be modeled for expected behavior.

Jbowen28

Overall, ‘Gorilla Trades has a pretty good track record… if you follow their buy/sell alerts and keep stops in place, over time you should do all right.

Some of the daily info is really good… I only did the free trial… I figured most of the info. they sell I could have got somewhere else…

Good for beginners.

Worth the free trial for sure to see if it is for you !!!Miami_Dean December 2010

In Sitejabber:

I have been trading stocks for many years and never found a source of trades that consistently provided profitable results until I subscribed to Gorilla Trades. Now, with your stock recommendations, multiple profit objectives and stoploss price inputs, I am able to sell put options on your stocks and watch my brokerage account grow exponentially, week after week. Your record of winning trades is PHENOMENAL. This is not my opinion, rather a statement of fact. I am most grateful.

Irene A. July 28, 2020

I’ve subscribed to Gorilla Trades for 4 years, and have had consistently good results. I especially like the way the Gorilla provides buy and sell parameters and emphasizes in every communication the importance of risk management and the use of stop losses. If you want storytelling and your time wasted, the Gorilla is not for you. But if you want specific trigger and confirmation levels, requiring minimal time each day, you’ll find few better than the Gorilla.

Henry H. April 19, 2020

I found what I was looking for for years! An honest approach, clear rules, no fake. Constant professional contact with the system creator. Everything explained in the tutorial. I recommend it to anyone who dreams of building their own profitable portfolio of shares based on GorillaTrade. After two months of use, I’m at zero when it comes to balancing and I’m happy with it. In addition, there are interesting additions in addition to the main strategy

Piotr G. July 9, 2020

After a few bad experiences with other sites, I can say the Gorilla has overall met my expectations. While all stocks are chosen are not winners… their success rate is better than average. But what has really exceeded my expectation are the option picks. There have been some very nice recommendations. My only hope would be that they would offer the same type of communication via text for options as they do for the stock picks. Or at least offer a specialized options service

S.Y. January 25, 2020

I like the gorilla. You get the email each night, check out the latest stocks, and then buy whichever fits your needs. The options recs are a nice bonus too! Some people expect a service to be 100% spot on all the time, which isn’t realistic- not even for buffett. I follow the gorillas recs but still do my own DD and I’ve made money every year with the service. I’ve even recommended friends and gotten a reward for each referral. I recommend the gorilla!

Raymond H November 20, 2019

Their trade recommendations throughout this year have been a huge flop. They only provide bullish call spreads and recommend you invest 5k in each trade. So late last year when the correction happened i lost my shirt on their recommendations. The first problem is they don’t have a stop loss system. You have to manage your entry and exit points. All they do is send you a e mail when its time to close the trade.

The success numbers they publish are not realistic at all. If you include the amount of times you would exit when your stop losses are hit those numbers would be put to shame. Basically they don’t have an exit strategy at all -its a go figure out your own kind of thing.

Their customer service sucks as well-no phones just e mail. When i gave them a reality check they just stopped responding to my e mails (showing they don’t care).

Last quarter of 2018 when the correction was happening they were still recommending bullish trades. They are simply losers and you don’t want to pay somebody (even $499 for 2 years which is their lowest fee) to provide you with bunch of losers and no exit strategies in place.

Save your money please folks.Nizar A. June 27, 2019

Crisp and to the point market analysis and only the strongest stocks recommended for purchase. It can’t be much simpler than this! The Gorilla’s system has produced consistent results for me upon joining. Trust the process, be mindful of the stock’s trigger price, and stops and you’ll be on your way. Some of the strongest recent examples: MU, ABBV, CRUS all within 10 trading days! The 30-day no-obligation trial will help you see how it all works. Make sure to view the system tutorials for maximum understanding of the method. The special situation picks are icing on the cake and are value-added to this already remarkable service.

Joseph C. June 7, 2017

As stock picking services go, this has to be the worst. I signed up and in less than 60 days after following all the picks provided I lost over $3000. Every pick but 2 went down dramatically with most of them hitting the recommended stop loss. Please stay away from this service, they have no idea what they’re doing.

Steven T. November 20, 2016

I’ve been using Gorilla Trades since 2005. I gotta tell you, these guys are on point. Follow exactly what they show and do your own due diligence, you will make money. This year I havent lost on any trade. Made my clients money, and myself over $100,000 in commissions in 4 month. I love the Gorilla.

Gman F. May 15, 2015

tradingschools.org

On balance, I would probably not put too much credence on the negative complaints. This guy just doesn’t seem like a scammer. In fact, he seems like an honest and nice person.

The biggest red flag is the supposed track record of turning $250k into $5.5 million in only 18 months. This is facially implausible. And it doesn’t pass the sniff test. In fact, it sounds ‘too good to be true.’ Besides, if you earned $5.5 million, why would you be peddling a $40 per month stock picking service? Ken would be doing the investment newsletter world a great favor by digging up that old tax return or finding those old account statements — I would love to write about the $5.5 million dollar trading history.

To me, the biggest red flag is the Bloomberg article that stated that Gorilla Trades is “performing far worse than the stock market as a whole.”

Thanks for reading. And thanks to Ken Berman reaching out to TradingSchools.Org to present his “side of the story” and explain the lack of FINRA information.

Overall, give the Gorilla a shot and report back. It’s cheap, and the dude is not a scammer.

Yes. Forbes created an article lambasting GorillaTrades in 2007, titled GorillaTrades Unmasked, in which Ben Steverman questions the credibility of the stock-picking service.

He says the data readily available from GorillaTrades “make it difficult to evaluate its true, long-term record.”

Stevernan was also questioning why GorillaTrades felt short in 2006 when even the broad S&P 500-stock index was up 12.8%

This is the biggest wrench that was thrown in the well-oiled machine that is GorillaTrades.

What We Like And Don’t Like About GorillaTrades

We really liked the how simple GorillaTrades is. No contention in this one. The data they present are easy to understand and are clearly posted in both the email and the website.

He also does not recommend messing with penny stocks as he does not see them as lucrative, unless the stock goes beyond $5/share.

This is a good thing because most of the stocks Berman recommends are expensive and difficult to pump.

Which led me to the tell you that Berman does not trade his own stock picks.

Please understand that the Gorilla does not actually purchase any of the stock or option ideas that are recommended by GorillaTrades, the Gorilla never trades his own recommendations.

Quoted from tradingschools.org interview with Ken Berman

Fishy, right? But if you also think about it, this may also be a good thing to avoid pumping his own recommendations.

However, the historical record of the stock picks are quite difficult to pinpoint because if you look over their record, to say that it is confusing is an understatement.

GorillaTrades record are open to the public and downloadable, so you can peruse it if you want proof.

What Are Alternatives to GorillaTrades

The alternatives that we can safely suggest are Morningstar Stock Investor and Motley Fool Stock Picks.

Both of these stock picks services are an institution and consistently beaten the S&P 500. An added benefit is that the two have a clear history of their stock-picking service.

Learn more about Morning Stock Investor and Motley Fool Stock Advisor by reading our comprehensive reviews!

GorillaTrades Pricing

GorillaTrades has a 30-day Free Trial. Afterward, GorillaTrades cost $499.95 for one year and $795 for two years subscription.

GorillaTrades Refund Policy

The first 30day (trial) period of any subscription is always free unless otherwise specified. Your credit card will not be charged until the 31st day of subscription service, and ONLY if you do not cancel during the 30-day trial period. However, only one free trial period is offered per person or address.

For those grandfathered into a monthly subscription: After your 30-day free trial period, you may cancel at the end of any monthly period, without any penalty or further obligation. However, there are no refunds on months already used.

For those with an annual subscription: After your 30day free trial period, you may cancel at any time during the 31st-60th day of your annual subscription. Upon cancellation, you may continue your subscription until the 60th day of subscription service. You will be refunded the FULL amount of your annual subscription less than the $69.95 processing fee. No refunds are offered more than 61 days into your annual subscription.

Refund policy for biannual subscription: After your 30-day free trial period, you may cancel at any time during the 31st-60th day of your biannual subscription. Upon cancellation, you may continue your subscription until the 60th day of subscription service. You will then be refunded the FULL amount of your biannual subscription less a $69.95 processing fee. In addition, at any time within the first year of your biannual subscription, you will be offered a refund on the second year of your biannual subscription. This refund will be determined by subtracting the current price of the one-year subscription and a $69.95 processing fee from the price paid by you for the two-year subscription. However, no refunds are offered after the first year of your biannual subscription.

Refund policy for five and ten year subscriptions: You may cancel at any time during the first year of your subscription and receive a refund of the pro-rated portion of your subscription remaining based upon your prior annual subscription rate less a processing fee of $69.95. However, no refunds are offered after the first year of your five or ten year subscription. Refund policy for lifetime subscriptions: You may cancel at any time during the first year of your subscription and receive a refund of your subscription price less the cost of the subscriber’s prior one year subscription rate and a processing fee of $69.95. However, no refunds are offered after the first year of your subscription.

As taken from GorillaTrades website

Pros and Cons

PROS

- Clear and straight to the point information that gives traders/investors actionable ideas

- Good for beginners, as you can easily grasp the data after joining the website

- Risk-free 30-day trial

- Berman does not trade his stock picks, therefore avoiding pumping the stock

CONS

- Confusing historical track record of stock picks

- May only be good during bullish markets

- Berman does not trade his stock picks even if most of the stock picks are blue-chip stocks

- Limited screeners

Gorilla Trades Review: Can A Gorilla Beat The Market?

In this Gorilla Trades Review. we scoped the safari and studied how the GorillaTrades work and its Pros & Cons.

The one good thing about this stock picking service is that it is absolutely easy to understand the information contained inside their newsletters or website.

Once you open the newsletter or log-in to your account, you can navigate the safari within less than an hour, and if you want more information, there is always the safari guide to look for answers.

The forum is a lively community as well wherein everyone seems to want to help everyone. This can tip the scale for those who like to socialize with other traders and investors.

The downside to this no-brainer approach is that it does not exercise due diligence. Here in Successful Tradings, we are advocates of doing your own research before you invest or trade a stock.

Again, this might be good as a primer or maybe a resource where you can get fresh ideas to trade or invest, but due diligence should still be exercised as what works for other investors/traders might not work for you.

It is your money you are investing or trading, and no amount of laziness or fear or learning should stop you from safeguarding it.

Thoughts? Leave them down below!

Gorilla Trades

$499.95 annually vs $795 bi-annuallyPros

- lear and straight to the point information that gives traders/investors actionable ideas

- Good for beginners, as you can easily grasp the data after joining the website

- Risk-free 30-day trial

- Berman does not trade his stock picks, therefore avoiding pumping the stock

Cons

- Confusing historical track record of stock picks

- May only be good during bullish markets

- Berman does not trade his stock picks even if most of the stock picks are blue chip stocks

- Limited screeners