It has been a year since QQQ Options have introduced intra week expirations.

Once the sole privilege of SPY options, Trading QQQ Options with Mondays, Wednesdays and Friday’s expiration has provided more opportunities for day and swing traders alike.

My intent is to show you step-by-step how you can leverage Day Trading QQQ Options in 2022 and beyond to take your Trading to the Next Level.

Day Trading QQQ Options | What Is QQQ ?

Invesco Powershares is the official name of the Exchange Traded Fund you know as QQQ or the Q’s.

The name comes from QQQ founder Invesco, Ltd, an American investment management company based in Atlanta Georgia.

It mainly tracks the performance of the NASDAQ-100 securities.

What draws my interest into this fund recently is the introduction of intra week options trading expiration.

Before I get into those details, allow me to set the stage with a few interesting characteristics about the QQQ ETF.

Trust me, it will be worth your time to indulge into this preface.

QQQ Top 10 Holdings

Maybe like me, you have stumbled recently in the Invesco Powershares advertisement campaign.

When a big institution like QQQ’s parent decide to make to world know about their product, you know it want to go mainstream.

As a result, QQQ recently sponsored the Coach Trophy at the 2022 Womens NCAA Chanpionship Game 🙂

All of this is to let you know QQQ is getting a lot of attention these days in the media.

Therefore, the fund is attracting more and more investors each day.

Especially, when you take a look at the Top10 Holdings in the Table below.

| SYMBOL | Weight% | |

| AAPLE | AAPL | 12.8 |

| MICROSOFT | MSFT | 10.2 |

| AMAZON.COM | AMZN | 6.8 |

| TSLA | TSLA | 3.9 |

| ALPHABET INC | GOOG | 3.9 |

| GOOGL | 3.7 | |

| NVIDIA | NVDA | 3.6 |

| Meta Platforms (Formerly Facebook) | FB | 3.2 |

| Broadcom | AVGO | 1.9 |

| CISCO | CSCO | 1.9 |

Why Does QQQ Composition Matter?

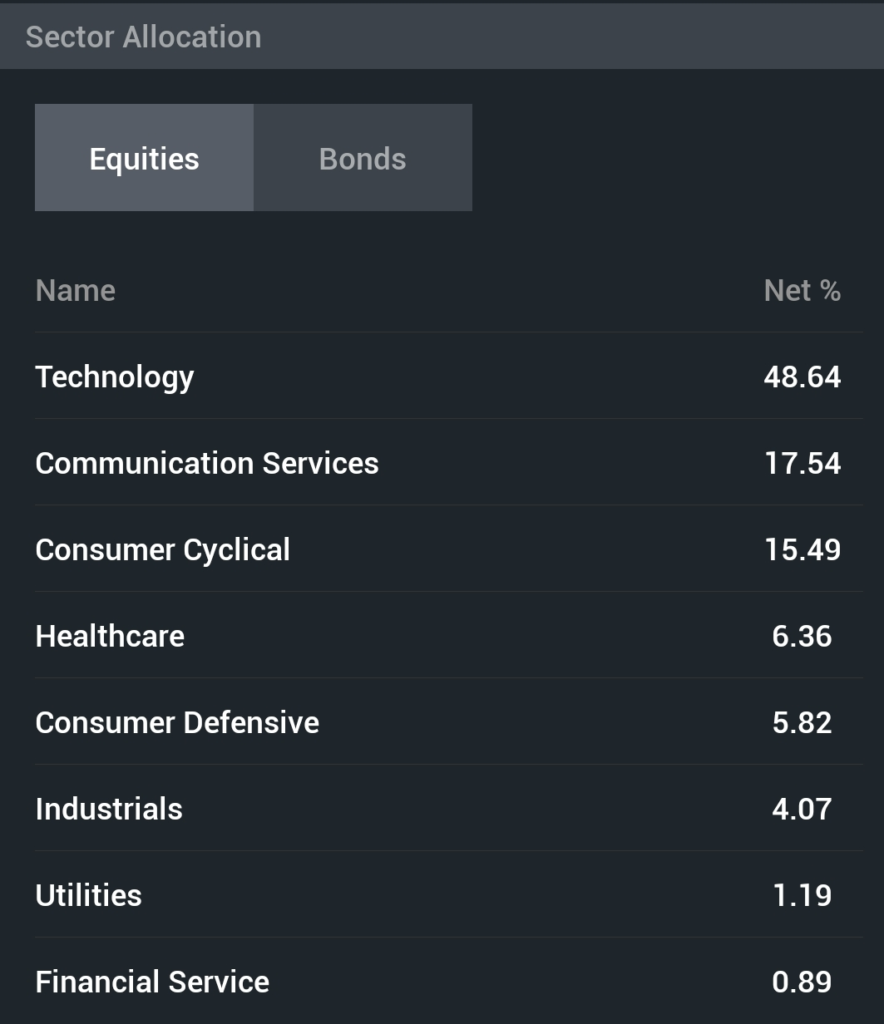

In order for us to answer this pivotal question about the composition of QQQ ETF, let’s bring in one extra set of data.

That is the below figure that depicts the sector allocation for QQQ.

From the above view, since almost half of the equities in QQQ ETF comes from the technology sector, the price of QQQ is mostly determined by the movement of its technology stocks.

What are those stocks you may ask?

Look no further than the Top 10 holdings we just shared earlier.

So, NASDAQ-100 has 100 stocks yet its Top 10 accounts for 52% of the weighting.

Consequently, it is no surprise then when one of these Top 10 (really the Top 8 are the big boys since they are also the same Top 8 for SPY)

moves, QQQ moves accordingly.

We explained and provided recent great examples in Trading Options After-hours discussion.

In summary, QQQ movement is driven by 8 stocks that every serious trader ought to know about.

What Is QQQ Performance ?

Another consequence of the composition of QQQ is that since the technology companies have witnessed astonishing growth over the last 10 years, that has benefited QQQ investors a great deal.

The likes of TSLA or NVDA have returned over 2000% between 2016 and 2021 alone.

As a result, both have gone through 4:1 split recently just to keep affordable to new investors.

Day Trading QQQ Options | Master Level

I have been day trading QQQ Options since 2014.

Since I start coaching in traders in 2020, I am amazed how often I got the question:

How often do you trade QQQ Options.

I usually smile and nonchalantly answer: As much as I breathe…

It all starts in the pre-market for me.

QQQ Pre-Market Analysis

I host a Live Day Trading QQQ Options show on my YouTube Channel.

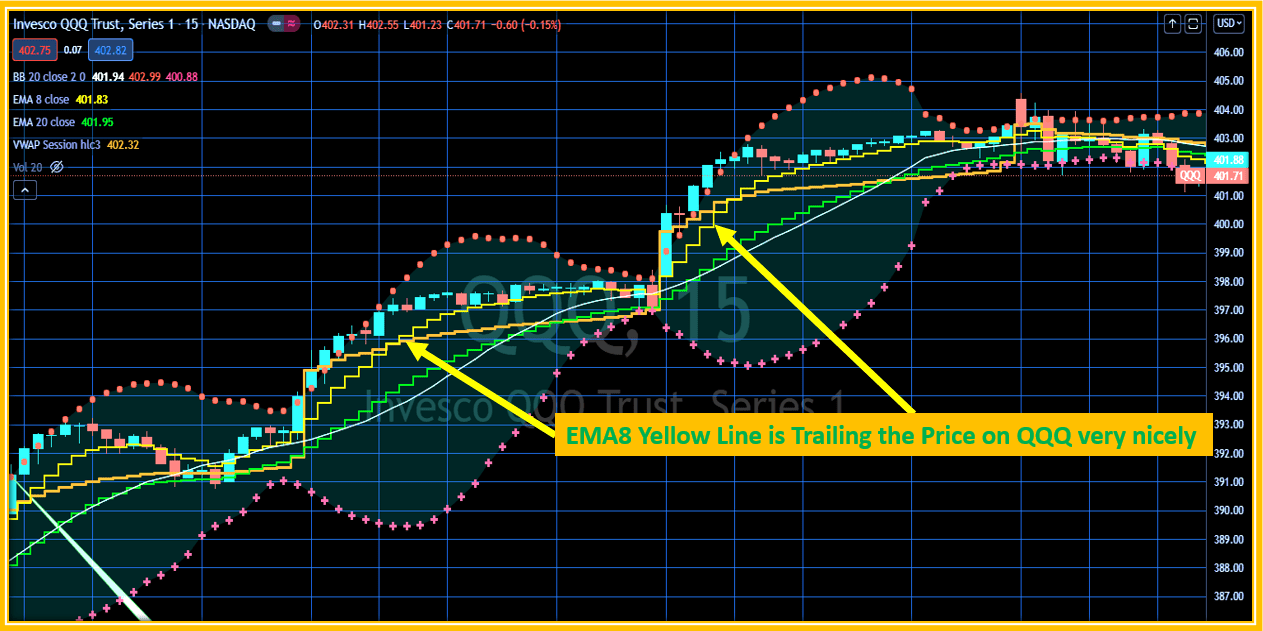

During the pre-market technical analysis, I break down the QQQ stock chart.

I provide a full analysis of how traders like you can take advantage of the constant volatility in this ETF.

Here is the most recent Live Day Trading QQQ Options stream.

Trading the QQQ Options Strategy

There are two QQQ options strategies I can teach you master like many traders in my discord Room have done.

The first one revolves around the early part of the trading session.

You can scrutinize this strategy in this free tutorial titled: How to Trade QQQ Options for big profit.

It still works.

The second QQQ Options strategy will be discussed further below.

My below YouTube video provides further details and showcases the study that validates our strategy.

Leave me a comment in the comments section of the video about your experience trading QQQ Options like many traders have done.

How Much Money Do you Need to Day Trade QQQ Options

The Answer to this question is very simple.

$5, $10 are enough to get you started in trading QQQ Options.

The following question you have for me is most likely, how much money can you make trading QQQ options with $5 ?

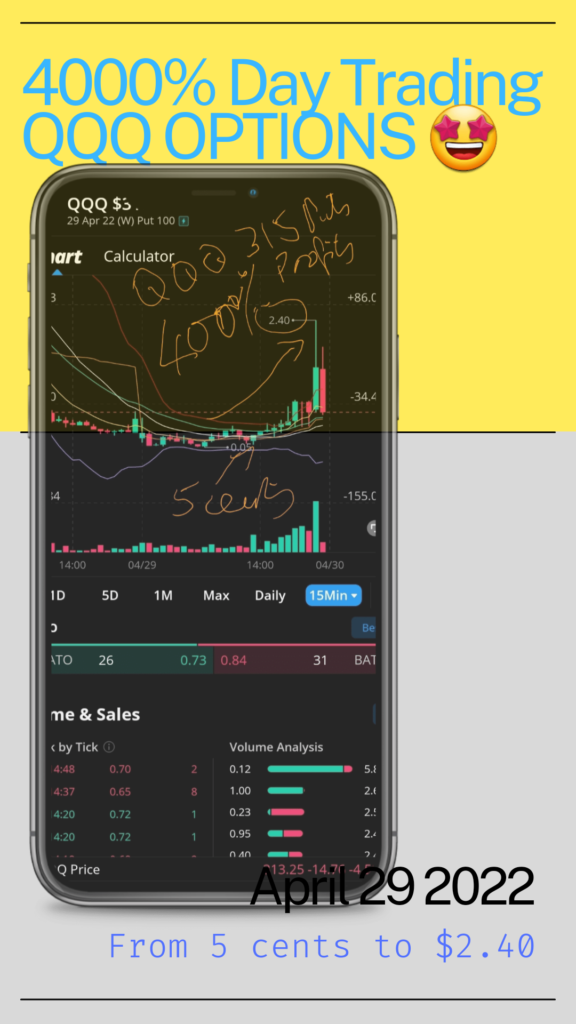

Answer: On April29 , 2022, you could have invested $5 in QQQ 315 Puts and make over $240 in less than 2.5 hours.

Inside the Mind of QQQ Options Day Trader

Trading QQQ Options vs TQQQ Options

In case you are wondering about TQQQ vs QQQ Options, let me put you at ease.

There is no obvious advantage in trading TQQQ options over QQQ options.

If anything, the higher implied volatility on TQQQ makes its options slightly more expensive.

QQQ ATR

In your quest to master QQQ Options trading, you will need a solid understanding of the Average True Range (ATR) indicator.

Thankfully for you, I have created this free Tutorial on how to calculate ATR in excel.

You will be able to download the spreadsheet I use in the video below to showcase how to use the ATR.

However, you really do not need to calculate it as it is a standard bottom indicator that comes with many stocks charts.

The typical ATR value for QQQ is between $4 and $5 but the recent high volatility has brought it all the way above $8.

QQQ CALLS vs PUTs

For my permabulls (a trader who is ALWAYS bullish) out there, the key to making money trading QQQ Options is not to have any bias towards calls or puts.

I often tell the traders I coach in my Discord room that our opinion about the direction of QQQ stock does not matter one iota.

What is most important is our abilitytoread the chart properly.

As such, if the setup is bullish, we trade calls, if it is bearish we trade puts.

Here is a nice video on how I made 1000% Day Trading QQQ Calls and Puts on the Same Day.

Sometimes, if it is going sideways, well then, we just Patiently wait on the sidelines.

Now, I have to give you what I have observed so far with intra week QQ options trading.

Puts pay more than Calls.

This is true for all stocks, but the phenomenon is further exacerbated on QQQ options.

The reason is because when the market is going down, Implied volatility goes up big time.

QQQ Options Price on the Option Chain

Traders often ask me if I buy QQQ options contracts based on Delta.

The short answer is not really.

On the QQQ Options Chain, my only concern is the Implied volatility.

Usually, when the market is bearish like in the first quarter of 2022, QQQ options price for calls are 2 or 3 ties less expensive than puts.

This clearly correlates our remarks above concerning the Calls vs Puts payout.

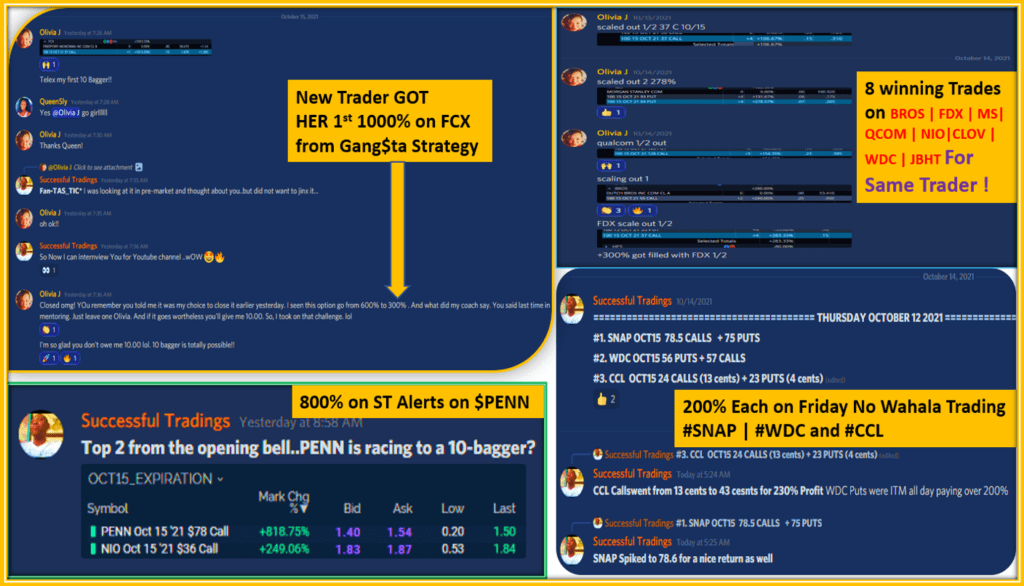

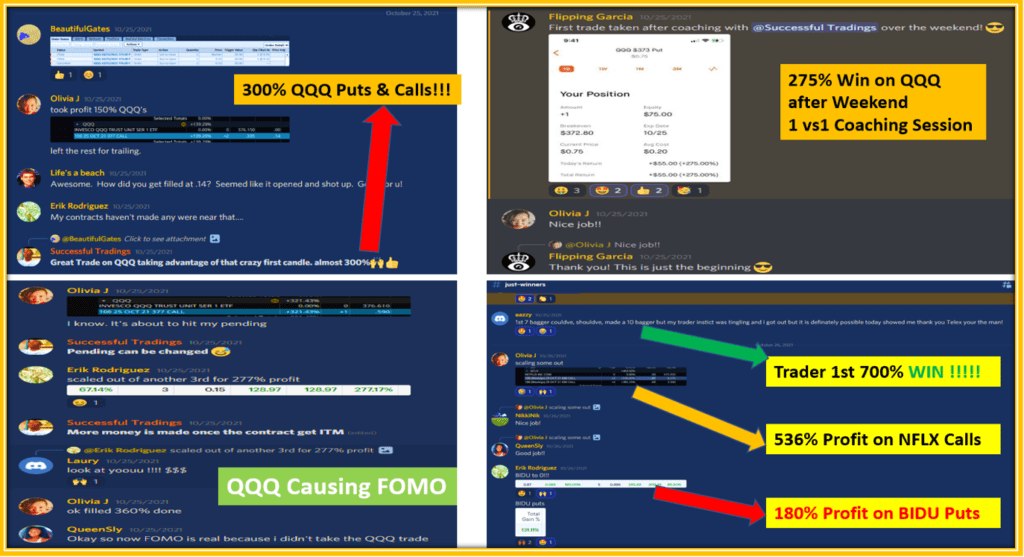

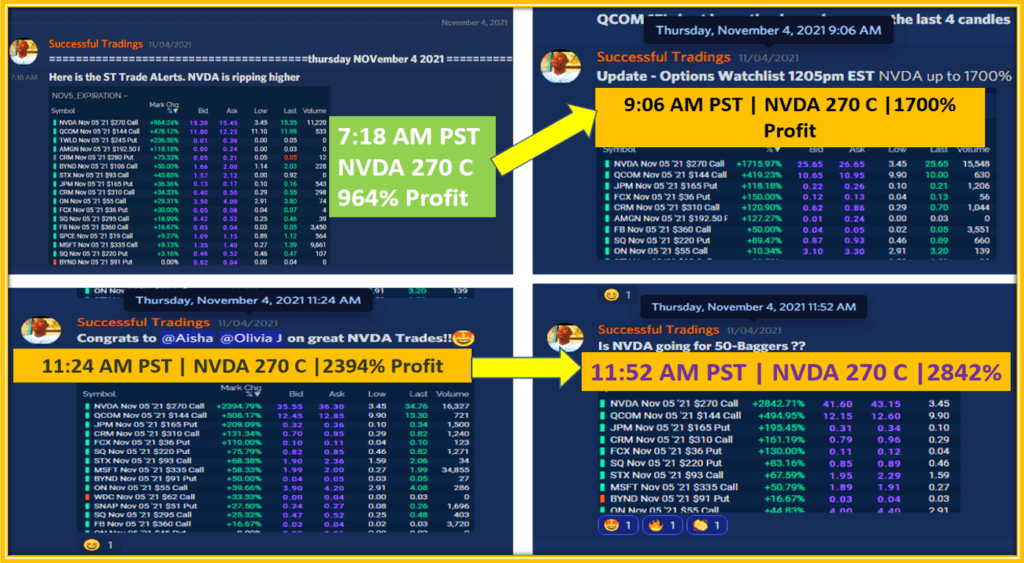

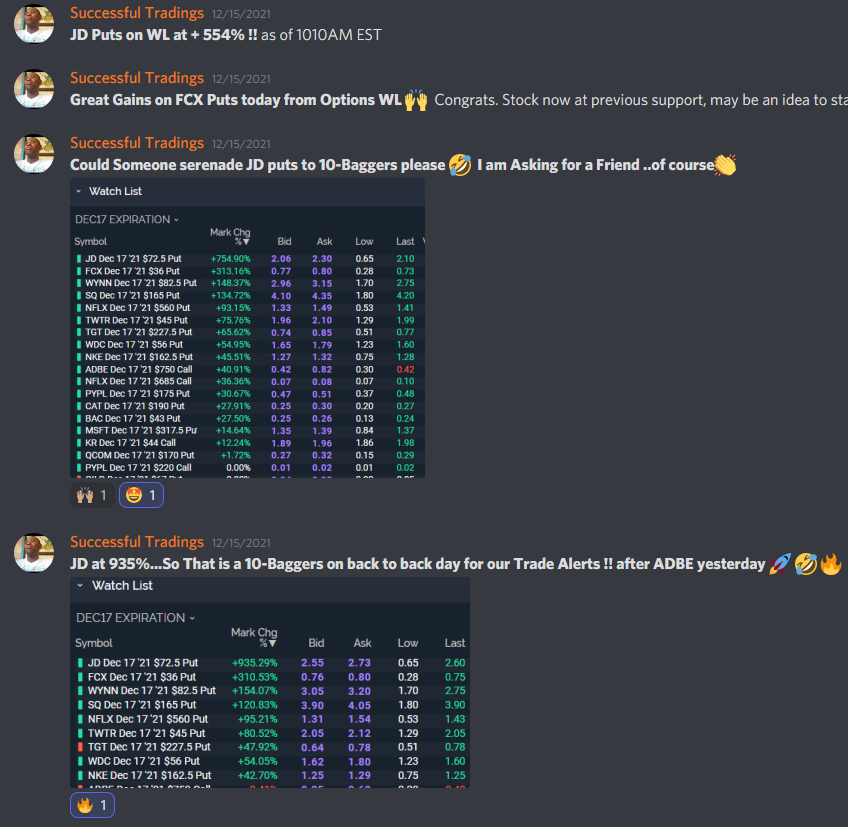

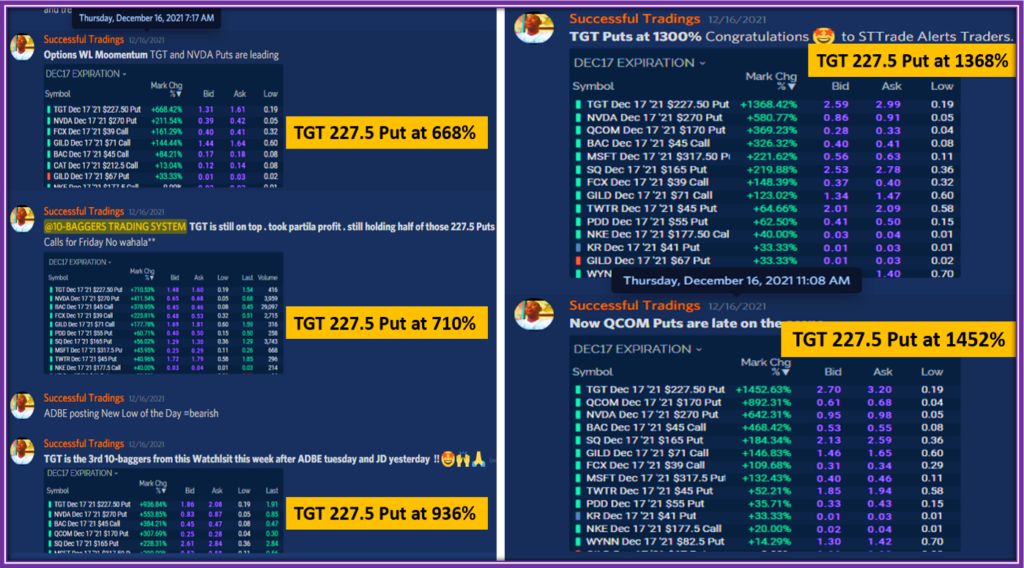

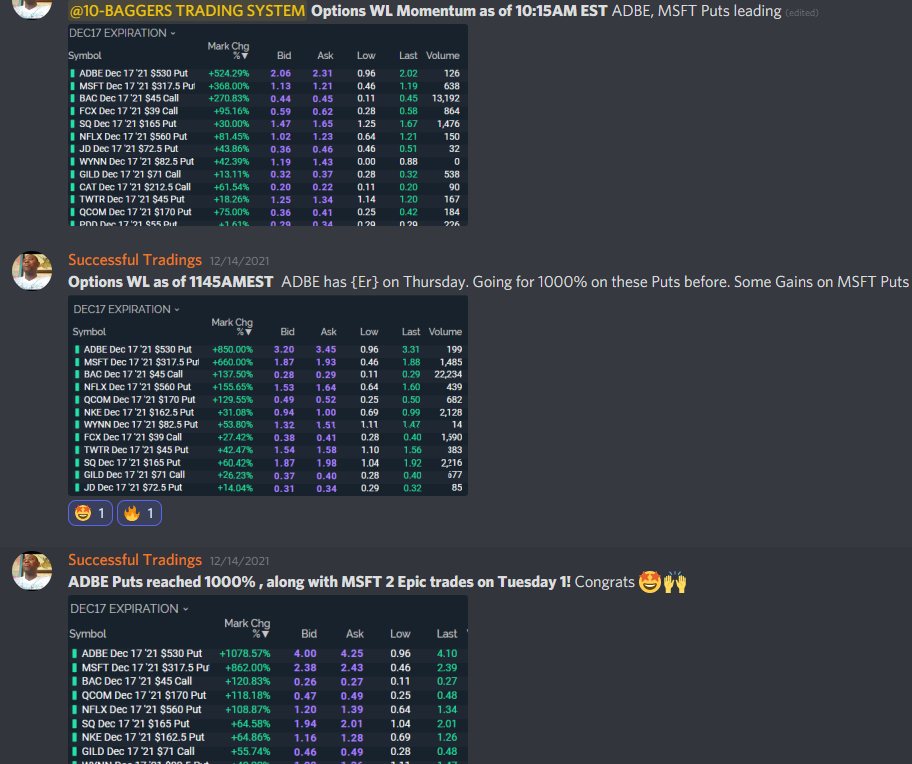

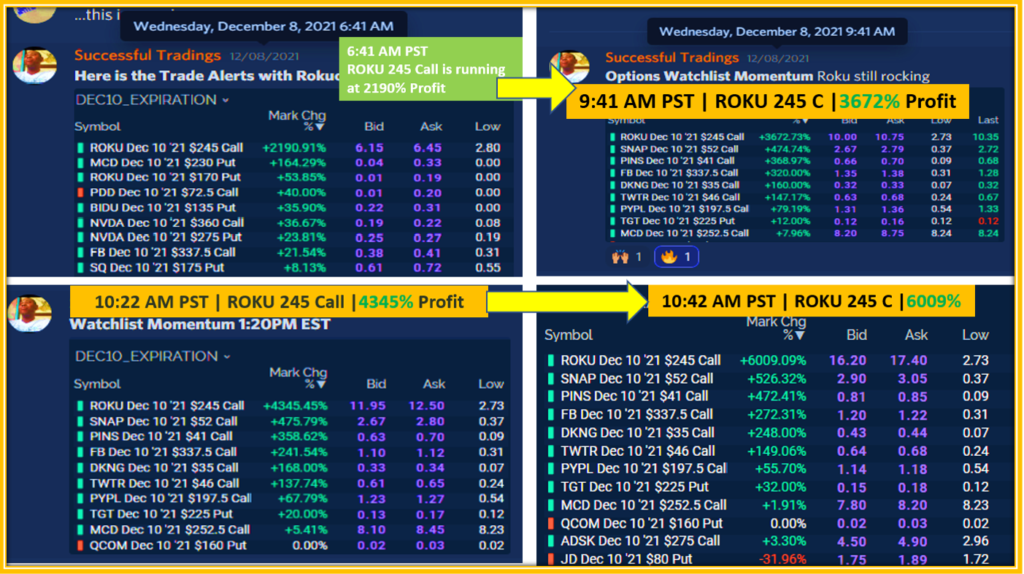

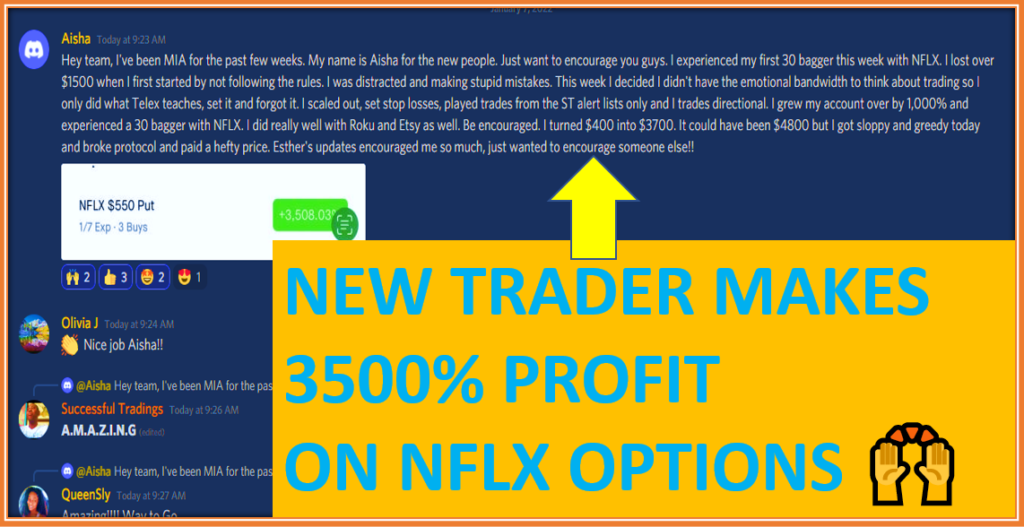

QQQ Options Trading Successes

In a recent 1vs 1 Coaching session with one of the traders in my Discord Channel, I revealed how I have been tracking the behavior of QQQ options that has solidified our second trading strategy of QQQ options.

Should you be interested in this information, please ask me when you subscribe to my discord Channel.

There are two ways to get access, one is through my YouTube Premium Membership.

The other is by becoming a member of the 10-bagger trading System with ALL the Advantages it provides.

Here are some of the insights you will come to learn about Day Trading QQQ options.

Best Day to Trade QQQ Options

The best Day trading for QQQ Options are without a doubt the Expiration Days: Monday, Wednesday and Friday.

QQQ is not the only ETFs to enjoy such “feast.

Of course, SPY started it in 2018, then QQQ continued in May 2021 and IWM join them in October 2021.

However, I have published free Tutorial on how QQQ Options are better than SPY options.

I did not have to go that far to find a flagrant example of how lucrative Day Trading QQQ Options on expiration is.

On April 29, 2022, the picture below shows how we turned $5 investment into $240 in less than 3 hours.

This explosive return of over 4000% is NOT an isolated occurrence.

You can check the numerous posts in my Discord room where we even created a room named “The QQQThat Pays Us”.

True story.

Best Hours to Trade QQQ Options

Here is the reveal of our second QQQ Options trading strategy.

Each day, the closing hour provides great opportunities to make good money day trading QQQ options.

In those last 60 mins, a $2 move on QQQ stock on Expiration Day is sure to generate 100% profit. on options.

Combined with the fact that QQQ options trade after hours for 15 minutes, you can further increase your profit as illustrated in the above options chart on Apr 22.

On that day, QQQ 326 puts went from 5 cents to 86 cents in the last 30 minutes to close the regular session.

An additional $1 of gains was added on Top during the 15-minute after-hours session !

Thus, making it an overall return of over 3500% !

QQQ Options YouTube Videos

Sometimes, I shy away from making QQQ YouTube videos.

Frankly because the time I invest in doing them does not match the number of viewers.

Most traders do not believe in a video titled: 1000%, 2000% Day Trading QQQ Options.

Because I do not have any other titles but these to state the lucrative opportunities on how QQQ Options Trading.

Notice I did not make one for neither April 22 or April 29 massive gains.

You will have to be content with this third one of the series.

FINAL THOUGHTS ON DAY TRADING QQQ OPTIONS

I provided a step-by-step guide on how today trade QQQ Options by leveraging the intra week Expiration.

QQQ Provides a great deal of opportunities for disciplined traders who want to make a living Trading QQQ Options.

If you are serious about learning about Options Trading today, click below to get started today with an Education that will be Life Changing.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/