I started trading in 2015, and since 2019 I’ve been coaching traders. The single most common question I hear is simple yet powerful:

👉 “Should I go passive or active with my investments?”

The truth:

- Over 85% of active fund managers underperform the S&P 500 across a 10-year span.

- Most retail investors fall into the same trap, chasing hype and missing compounding.

- Still, millions pursue active strategies because of the thrill and potential.

So, which approach is right for you? Let’s break this down step by step with real examples, data, and personal lessons from my trading journey.

Table of Contents

⚡ What Is Active Investing and How Does It Work?

Active investing requires investors to make frequent decisions about buying and selling securities. Additionally, active investors conduct extensive research to identify undervalued stocks or market timing opportunities. This approach demands significant time commitment and often involves higher transaction costs due to frequent trading.

When I began in 2015, I defaulted to active investing. It felt powerful to “beat the market.”

Active investors believe they can outperform broad market indices through careful analysis and strategic decision-making. Furthermore, they may focus on specific sectors, individual stocks, or employ various trading strategies.

Consequently, successful active investing requires deep market knowledge, analytical skills, and emotional discipline.

What active investing looks like:

- 📈 Stock Picking → Identify “winners” before the crowd.

- ⏰ Market Timing → Enter/exit on signals, news, or gut feel.

- 🛠️ Tools → Technical analysis, options, scanners, earnings plays.

- 👨💻 Commitment → Long hours of research, daily monitoring, discipline.

Pros of Active Investing:

- 🚀 Big upside potential on individual trades.

- 🎯 Ability to hedge or pivot quickly in volatility.

- ⚡ Total control of your money.

Cons of Active Investing:

- 💸 High costs → spreads, commissions, and short-term taxes.

- 😰 Stress → emotions drive bad trades.

- ⏰ Time drain → it’s essentially another job.

Example:

In the 2020 crash, I hedged with puts, cut exposure, and later rotated into growth stocks during the rebound. It worked, but it demanded constant focus and strict rules.

🌱 What Is Passive Investing and Why Many Prefer It

Passive investing flips the mindset. Instead of fighting the market, you own it.

Passive investing focuses on buying and holding diversified portfolios that track broad market indices. Instead of trying to outperform the market, passive investors aim to match market returns while minimizing costs. Furthermore, this strategy requires minimal time investment and reduces the emotional stress associated with frequent trading decisions.

Index funds and Exchange-Traded Funds (ETFs) serve as the primary vehicles for passive investing. These funds automatically diversify holdings across hundreds or thousands of securities, reducing individual stock risk. Additionally, passive funds typically charge much lower fees than actively managed investments, which compounds benefits over time.

What passive investing looks like:

- 📊 Broad ETFs → SPY, VTI, or QQQ.

- 💵 Dollar-Cost Averaging (DCA) → Consistent monthly contributions.

- 🔄 Dividend Reinvestment (DRIP) → Dividends buy more shares automatically.

- 💸 Low Fees → Expense ratios stay microscopic.

The beauty of passive investing lies in its simplicity and proven long-term effectiveness. Moreover, this approach allows investors to benefit from overall market growth without requiring extensive financial knowledge. Consequently, passive investing has gained tremendous popularity among both novice and experienced investors.

Since 2015, I’ve observed how passive investing has democratized wealth building for average investors. Furthermore, the strategy removes emotional decision-making from the investment process, which often leads to better outcomes. However, passive investing does require patience and long-term commitment to realize its full benefits.

Pros of Passive Investing:

- ✅ Proven long-term performance.

- ✅ Low costs → compounding stays intact.

- ✅ No daily stress.

Cons of Passive Investing:

- ❌ You ride market crashes fully.

- ❌ No chance to outperform indexes.

- ❌ Less exciting — patience is the name of the game.

Example:

A simple $10K in SPY in 2015, untouched, still beats most traders today. That’s the quiet superpower of compounding.

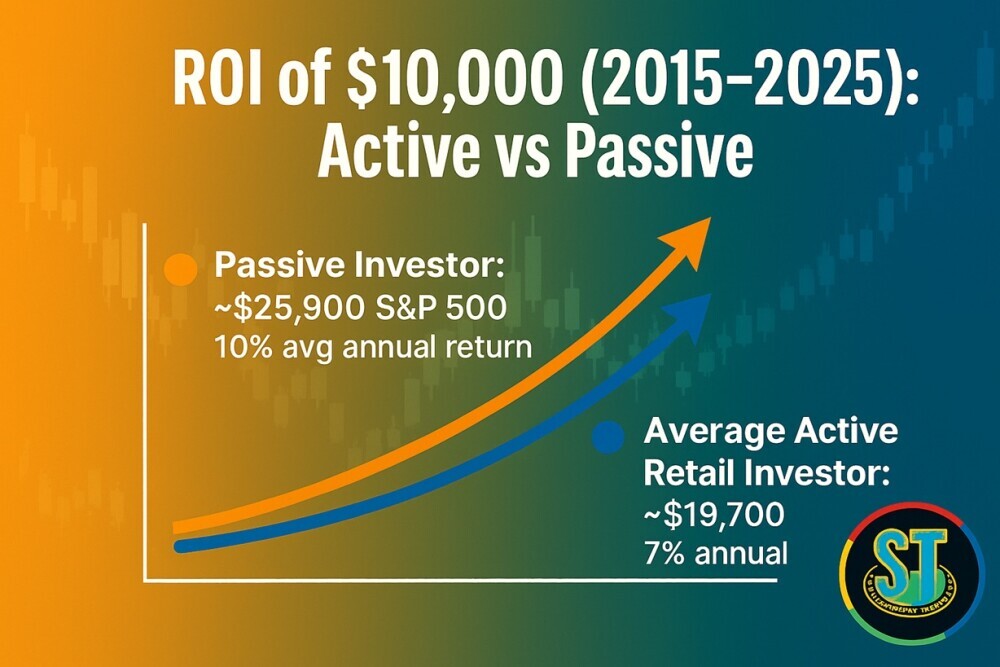

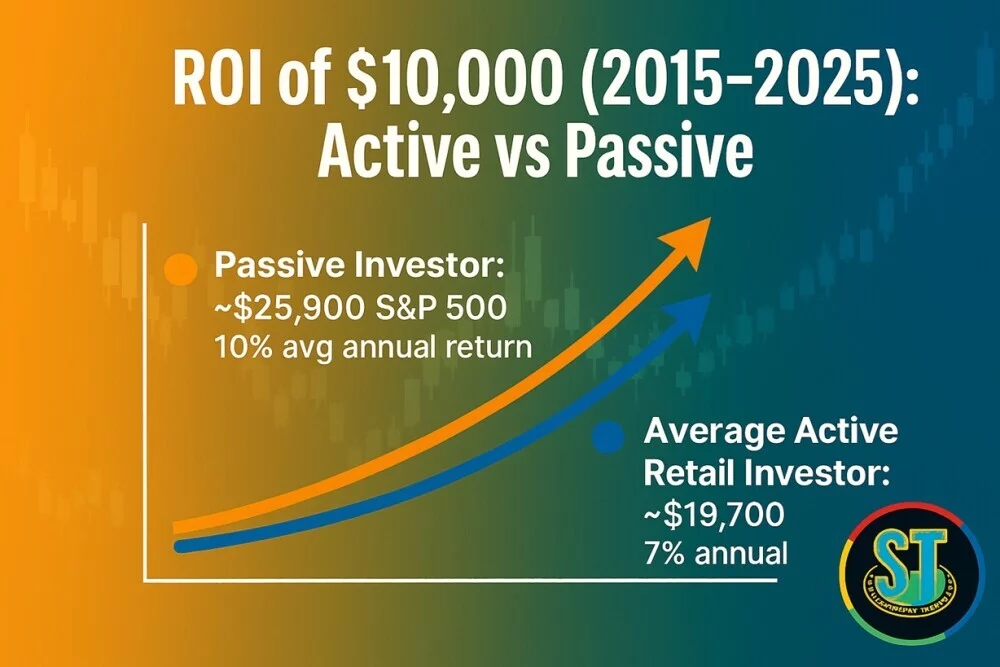

📊 Infographic 1: ROI of $10,000 (2015–2025)

- 🟠 Passive (10% annualized) → ~$25,900

- 🔵 Active (7% annualized) → ~$19,700

The potential rewards of active investing can be significant for skilled practitioners.

Nevertheless, statistics show that most active investors fail to consistently beat market averages over extended periods.

Therefore, investors considering this approach should honestly assess their capabilities, time availability, and risk tolerance.

👉 Every year, the gap widens because fees and timing mistakes eat active returns.

📉 The Maya vs Chris Story

Maya (Passive Investor):

- Bought S&P 500 ETF in 2015.

- Added $300/month via DCA.

- Reinvested dividends.

- Stayed calm through crashes.

Chris (Active Trader):

- Tried to time markets.

- Paid high trading costs.

- Sold late in 2020 crash.

- Bought hype stocks in 2021 bubble.

Outcome in 2025:

- Maya: consistent growth, higher portfolio.

- Chris: more stress, lower net wealth.

👉 Lesson: Discipline outlasts adrenaline.

💸 Why Costs and Frictions Matter

Active investing typically involves higher costs due to frequent trading, research expenses, and management fees. Additionally, active investors pay brokerage commissions, bid-ask spreads, and potential tax consequences from frequent transactions. These costs can significantly erode returns over time, making it harder to outperform the market.

Hidden costs erode wealth:

- 💰 Expense Ratios → 1% active fund vs 0.05% ETF.

- 💰 Spreads → frequent trades = constant tiny losses.

- 💰 Taxes → short-term gains taxed at higher rates.

Passive investing generally offers much lower expense ratios, often below 0.20% annually for broad market index funds. Furthermore, passive investors incur fewer transaction costs due to minimal trading activity. Therefore, the cost advantage of passive investing compounds over decades, resulting in substantially higher net returns.

Throughout my coaching experience since 2019, I’ve helped clients calculate the true cost of their investment strategies.

Moreover, many investors underestimate how fees impact long-term wealth accumulation.

Consequently, even small differences in annual fees can result in tens of thousands of dollars over a 30-year investment horizon.

Math Example:

- $100K at 9% = $560K in 20 years.

- $100K at 8% = $466K.

👉 $94K lost to frictions.

🛡️ Risk Management for Both

Active Risk Management:

- 📉 Stop losses.

- ⚖️ Max 1–2% risk per trade.

- 📊 Hedge with puts or shorts.

Passive Risk Management:

- 📊 Diversify across sectors.

- 🔄 Annual rebalancing.

- 💰 Emergency fund buffer.

👉 Whether passive or active, risk control is survival.

Time Commitment: How Much Effort Each Strategy Requires

Active investing demands substantial time commitment for research, analysis, and portfolio monitoring.

Additionally, active investors must stay current with financial news, earnings reports, and market developments.

This responsibility can easily consume several hours per week, making it unsuitable for busy professionals.

Passive investing requires minimal ongoing time investment after initial portfolio setup.

Furthermore, passive investors typically rebalance their portfolios quarterly or annually, requiring just a few hours yearly.

Consequently, this approach appeals to investors who prefer focusing on their careers rather than managing investments.

During my trading journey since 2015, I’ve spent countless hours analyzing markets and individual securities.

However, I recognize that most investors lack the time or inclination for such intensive involvement.

Therefore, passive investing offers an excellent solution for time-constrained individuals seeking long-term wealth building.

The time savings from passive investing can be redirected toward career advancement or other valuable activities.

Moreover, this approach eliminates the stress of constantly monitoring portfolio performance and making investment decisions.

As a result, passive investors often achieve better work-life balance while still building wealth effectively.

📈 When Active Actually Wins

While passive dominates, active shines in certain cases:

- ⚡ Earnings seasons → volatility = opportunity.

- 📉 Bear markets → hedging saves capital.

- 🔎 Niche sectors → early plays in AI, EVs, biotech.

Example:

In 2023, traders spotting NVDA, AMD, META early in the AI boom crushed benchmarks — but required guts and skill.

🔀 Why a Hybrid Works Best

The smartest plan I teach: Core + Satellite

- 80% → passive ETFs for compounding.

- 20% → active sleeve for growth + learning.

👉 Get stability and excitement.

📝 Step-by-Step Starter Plan

For Passive Investing:

- Open a low-cost brokerage.

- Buy SPY, QQQ, or VTI.

- Automate monthly buys.

- Turn on DRIP.

- Rebalance yearly.

For Active Trading:

- Start small.

- Use clear setups:

-

- Opening range break

- VWAP reclaim

- Swing trading earnings

- Journal every trade.

- Risk max 2%/trade.

- Stop if discipline slips.

📊 Infographic 2: Passive vs Active Checklist

Active investing typically involves higher volatility and concentration risk due to focused positions.

Additionally, active investors may experience significant losses during market downturns if they’re poorly positioned.

Furthermore, emotional decision-making during volatile periods can lead to buying high and selling low, amplifying losses.

Passive investing spreads risk across hundreds or thousands of securities, reducing the impact of individual stock failures.

Moreover, broad market diversification provides protection against sector-specific downturns or company-specific problems.

Consequently, passive investors experience smoother returns with less dramatic swings in portfolio value.

👉 Use this to check your personality fit.

The risk profile of each strategy depends heavily on implementation and investor behavior.

Furthermore, active investing can be less risky when combined with proper risk management techniques. However, most individual investors lack the discipline and expertise necessary for effective active risk management.

Throughout my decade in the markets, I’ve witnessed numerous investors suffer significant losses from concentrated active positions.

Therefore, I always recommend proper diversification and risk management regardless of investment approach.

Moreover, investors should never risk money they cannot afford to lose in active trading strategies.

🏦 ETF Examples

Best Passive ETFs:

- SPY → Tracks S&P 500.

- VTI → Total US market.

- QQQ → Tech-heavy Nasdaq 100.

Active Funds Often Disappoint:

- Expense ratios above 1%.

- Underperform simple benchmarks.

👉 That’s why Buffett says: “Most should just buy the index.”

Tax Implications: How Each Strategy Affects Your Returns

Active investing often generates higher tax liabilities due to frequent trading and short-term capital gains.

Additionally, short-term gains are taxed as ordinary income, which can significantly reduce net returns. Furthermore, active investors may miss opportunities for tax-loss harvesting due to wash sale rules.

Passive investing generally provides more tax-efficient outcomes through buy-and-hold strategies that generate long-term capital gains.

Moreover, index funds have low portfolio turnover, resulting in fewer taxable distributions. Therefore, passive investors often keep more of their returns due to favorable tax treatment.

Tax-advantaged accounts like 401(k)s and IRAs can shelter both strategies from immediate taxation.

However, the tax efficiency of passive investing becomes more important in taxable investment accounts. Furthermore, passive investors can implement tax-loss harvesting strategies more effectively due to their diversified holdings.

Since beginning my coaching practice in 2019, I’ve helped numerous clients optimize their investment strategies for tax efficiency.

Moreover, the tax benefits of passive investing compound over time, significantly enhancing long-term wealth accumulation. Consequently, investors should carefully consider tax implications when choosing their investment approach.

📉 Case Studies in Detail

2020 Pandemic Crash:

- Passive → Rode crash down, but recovered with market.

- Active → Hedgers protected portfolios, panic sellers lost big.

2022 Inflation Spike:

- Passive → Lost value during high rates.

- Active → Rotated into energy, commodities, defensive plays.

2023 AI Boom:

- Passive → Benefited through indexes.

- Active → Early buyers of NVDA, AMD, META massively outperformed.

Emotional Aspects: Psychology of Investment Decision-Making

Active investing can trigger strong emotional responses due to frequent gains and losses. Additionally, the fear of missing out (FOMO) and greed can lead to poor investment decisions. Furthermore, active investors often experience analysis paralysis when faced with too many investment choices and market information.

Passive investing helps remove emotional decision-making from the investment process. Moreover, the set-and-forget nature of index investing reduces anxiety during market downturns. Therefore, passive investors are less likely to make costly emotional mistakes that can derail long-term financial goals.

The psychological benefits of passive investing extend beyond just financial returns. Furthermore, investors experience less stress and can focus on other important life priorities. However, passive investing requires patience and discipline to stay the course during market volatility.

Throughout my trading career since 2015, I’ve learned that emotional control often determines investment success more than analytical skills. Moreover, investors who can maintain discipline during market turbulence typically achieve better long-term results. Consequently, the psychological advantages of passive investing shouldn’t be underestimated in overall strategy selection.

Market Timing: The Challenge of Buying Low and Selling High

Active investing relies heavily on market timing and the ability to identify optimal entry and exit points. Additionally, successful timing requires predicting market movements, which even professional investors struggle to accomplish consistently. Furthermore, research shows that most attempts at market timing result in lower returns than simple buy-and-hold strategies.

The difficulty of market timing becomes apparent during periods of extreme volatility or uncertainty. Moreover, investors often sell near market bottoms due to fear and buy near market tops due to greed. Therefore, even skilled active investors can struggle with timing decisions that significantly impact their returns.

Passive investing eliminates the need for market timing through consistent dollar-cost averaging strategies. Furthermore, this approach automatically buys more shares when prices are low and fewer shares when prices are high. Consequently, passive investors benefit from volatility rather than being harmed by it.

My experience coaching investors since 2019 has shown me that market timing is one of the most challenging aspects of active investing. Additionally, even when investors make correct predictions about market direction, poor timing execution can still result in losses. Therefore, most investors benefit from strategies that don’t depend on timing market movements.

Diversification Strategies: Building Resilient Portfolios

Active investing allows for concentrated positions in select securities or sectors that investors believe offer superior opportunities. However, this concentration increases portfolio risk if those positions perform poorly. Additionally, active investors must constantly monitor and adjust their holdings to maintain appropriate diversification.

Passive investing automatically provides broad diversification through index funds that hold hundreds or thousands of securities. Moreover, this diversification spans different sectors, company sizes, and sometimes geographic regions. Furthermore, passive investors don’t need to research individual holdings since the index methodology handles security selection.

The diversification benefits of passive investing extend beyond just stock selection to include automatic rebalancing. Additionally, index funds maintain consistent exposure to different market segments without requiring investor intervention. Therefore, passive portfolios remain well-diversified even as market conditions change over time.

Professional portfolio managers spend considerable resources on diversification analysis and risk management. However, individual active investors often lack the tools and expertise necessary for proper diversification. Consequently, passive investing provides institutional-quality diversification at a fraction of the cost and complexity.

Show Image

Hybrid Approaches: Combining Both Strategies Effectively

Many successful investors adopt hybrid approaches that combine elements of both active and passive investing. Additionally, a core-satellite strategy uses passive index funds as the foundation while allocating smaller portions to active investments. Furthermore, this approach provides diversification benefits while allowing for potential outperformance opportunities.

The typical hybrid portfolio allocates 70-80% to passive index funds and 20-30% to active investments. Moreover, this allocation provides stability from the passive core while generating potential alpha from active positions. Therefore, investors can participate in market growth while maintaining some control over investment decisions.

Successful hybrid strategies require clear guidelines about asset allocation and rebalancing procedures. Additionally, investors must resist the temptation to increase active allocations during periods of good performance. Furthermore, regular review and adjustment ensure that the portfolio remains aligned with long-term objectives.

My coaching experience since 2019 has shown that hybrid approaches work well for investors who want some control but recognize the benefits of passive investing. However, successful implementation requires discipline and a clear understanding of each strategy’s role within the overall portfolio.

Building Your Investment Portfolio: Practical Steps

Beginning investors should start with a solid foundation of passive index funds before considering active strategies. Additionally, emergency funds and debt reduction should take priority over investment account funding. Furthermore, investors should contribute enough to employer retirement plans to capture any available matching contributions.

The process begins with determining appropriate asset allocation based on age, risk tolerance, and investment timeline. Moreover, younger investors can typically accept more risk and volatility than those approaching retirement. As such, asset allocation should evolve over time as circumstances and goals change.

Dollar-cost averaging represents an excellent strategy for building positions in both passive and active investments. Additionally, this approach reduces the impact of market timing and helps build consistent investment habits. Furthermore, automatic investing through payroll deduction makes the process effortless and systematic.

Regular portfolio review and rebalancing maintain desired asset allocations as market values fluctuate. However, frequent changes can incur unnecessary costs and taxes, so quarterly or annual reviews typically suffice. Therefore, investors should establish clear rebalancing criteria and stick to their predetermined strategy.

Common Mistakes and How to Avoid Them

Emotional decision-making represents the most common mistake across both active and passive investing strategies. Additionally, investors often panic during market downturns and make impulsive decisions that harm long-term returns. Furthermore, chasing past performance or following investment fads can lead to poor timing and concentrated positions.

Active investors frequently overtrade their portfolios, generating excessive costs and taxes while reducing returns. Moreover, they may become overconfident after early successes and take excessive risks. Therefore, active investors should maintain strict trading rules and risk management procedures.

Passive investors sometimes make the mistake of trying to time their index fund purchases or switching between different funds. Additionally, they may become impatient during periods of underperformance and abandon their long-term strategy. Furthermore, inadequate diversification within passive portfolios can increase unnecessary risk.

Throughout my decade of market experience, I’ve observed that successful investors focus on controlling costs, maintaining discipline, and staying committed to their chosen strategy. Moreover, they avoid making dramatic changes based on short-term market movements or media headlines. Consequently, consistency and patience typically produce better results than frequent strategy changes.

Market Conditions and Strategy Effectiveness

Different market conditions favor different investment approaches, making strategy selection somewhat dependent on economic cycles. Additionally, active strategies may outperform during periods of high volatility when skilled investors can capitalize on price dislocations. Furthermore, bear markets sometimes provide opportunities for active investors to generate positive returns through short-selling or defensive positioning.

Passive strategies tend to perform well during sustained bull markets when broad market gains lift most securities. Moreover, passive investors benefit from staying fully invested during market recoveries that follow significant downturns. Therefore, passive strategies work particularly well for investors with long time horizons who can weather temporary volatility.

The current market environment in 2025 presents unique challenges and opportunities for both investment approaches. Additionally, factors like inflation, interest rates, and technological disruption continue to influence market dynamics. Furthermore, geopolitical tensions and regulatory changes add complexity to investment decision-making.

Since beginning my coaching practice, I’ve helped clients understand that no single strategy works optimally in all market conditions. However, consistency and long-term focus typically produce better results than attempting to switch strategies based on market predictions. Therefore, investors should choose approaches that align with their temperament and stick with them through various market cycles.

🎥 Video Recommendation

👉 Active vs Passive Investing Explained: Which Strategy Is Right For You?

See charts, strategies, and setups explained visually.

❓ FAQs (Expanded)

Q1: Is passive investing risk-free?

- No, markets fall. Diversification reduces but never removes risk.

Q2: Can active beat passive?

- Yes, but rare. Requires edge + discipline.

Q3: How much to start passive?

- As little as $50 with fractional shares.

Q4: Should I mix both?

- Yes, use passive core + active satellite.

Q5: How do taxes impact active?

- Short-term gains taxed up to 37% in US.

Q6: What’s the main risk of passive?

- Market crashes — but recoveries follow history.

Q7: Can beginners succeed active?

- Possible, but start passive first.

Q8: Which ETFs are best for long term?

- SPY, VTI, QQQ cover most investors.

Q9: Do active traders ever retire early?

- A few, but majority underperform indexes.

Q10: What if I panic sell?

- That’s why passive automation works better.

Q11: Can I use options in passive?

- Yes, covered calls enhance income.

Q12: Which builds wealth faster?

- Passive for most; active only if skilled.

🎯 Conclusion: Pick and Commit

After a decade of trading and six years of coaching, my conclusion is crystal:

- ✅ Passive investing wins for most investors.

- ⚡ Active works if disciplined, hedged, and skillful.

- 🔀 Hybrid = best of both worlds.

👉 Next Step 1: Learn More about passive investing strategies

👉 Next Step 2: Compare Index Funds vs ETFs

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

How much money do I need to start investing actively versus passively?

Passive investing requires minimal initial investment, often as little as $100 for many index funds or ETFs.

Some very low risk ETFS are : ULTY ($5.5 per share) TSYY ($8.15 per share) or NVDY($16 per share) and they all pay dividends !!!

Additionally, fractional shares make it possible to start investing with even smaller amounts. In contrast, active investing typically requires more capital to effectively diversify across multiple positions while keeping transaction costs reasonable.