Wondering about what is Betterment Investing? You have come to the perfect place.

Betterment is one of the pioneer Robot advisors, having begun in 2008 with an aim to make investing less expensive and difficult for everyone.

Betterment has been one of the most popular robot-advisor platforms for more than a decade, competing directly with Wealthfront, one of a rising number of automated investment alternatives.

Table of Contents

Betterment Investing – Quick Summary

Betterment being one of the best Robot-advisors has a lot of benefits, and features. Let’s take a look at some of the distinguishing aspects of Betterment in the table below:

| Minimum Investment | $0 |

| Fees | Digital – 0.25%/year; Premium – 0.40%/year |

| Accounts | • Taxable • Joint • Traditional IRA • Roth IRA • Rollover IRA • SEP IRA • Trusts • Non-Profit • 401(k) Guidance |

| 401(k) Assistance | ✔ |

| Tax Loss Harvesting | ✔ |

| Portfolio Rebalancing | ✔ |

| Automatic Deposits | ✔ Weekly, Biweekly and Monthly |

| Advice | Human Assisted |

| Socially Responsible | ✔ |

| Fractional Shares | ✔ |

| Customer Service | Monday to Friday from 9:00 am-6:00 pm (ET) |

Who Should Use Betterment?

If you want to start serious about saving for anything substantial, such as a home down payment, student fund, or your own retirement, Betterment is an excellent choice of the automated investment adviser.

A portfolio of low-cost exchange-traded funds (ETFs) and mutual funds is designed by Betterment’s algorithms to fit your risk tolerance and particular objectives.

Betterment, in contrast to Wealthfront, does not need a minimum initial investment to get start with the platform.

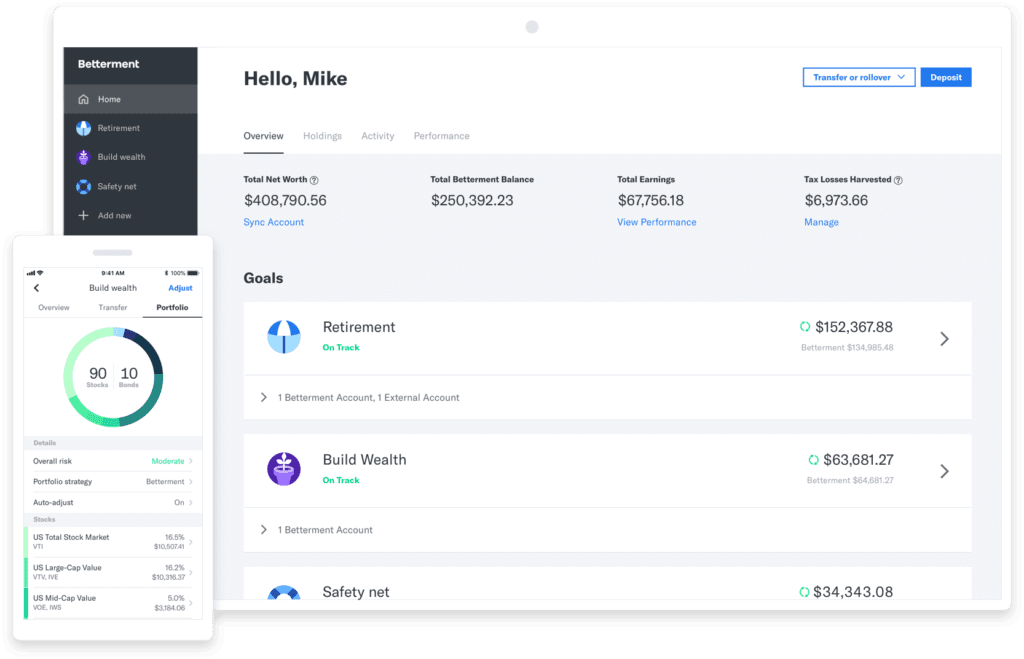

There are two levels of Betterment service accessible to clients with balances greater than $100,000: Betterment Digital and Betterment Premium, both of which offered as an option for consumers with balances greater than $100,000.

Annual management fees charged by Betterment Digital and Betterment Premium are 0.25 percent and 0.40 percent, respectively. Betterment’s team of financial advisors will provide you with limitless, complimentary services if you choose to upgrade to a higher service tier.

In addition to selecting the appropriate investment portfolio for each of your goals, setting up an account is quite easy. Improve your investment performance with financial advice from a financial professional.

Betterment Digital users may purchase a 45-minute coaching session with a financial professional for $199, while Betterment Premium customers receive financial advice at no additional cost.

How Does Betterment Work?

You begin by providing Betterment with some basic personal information, such as your age, salary, and Social Security number.

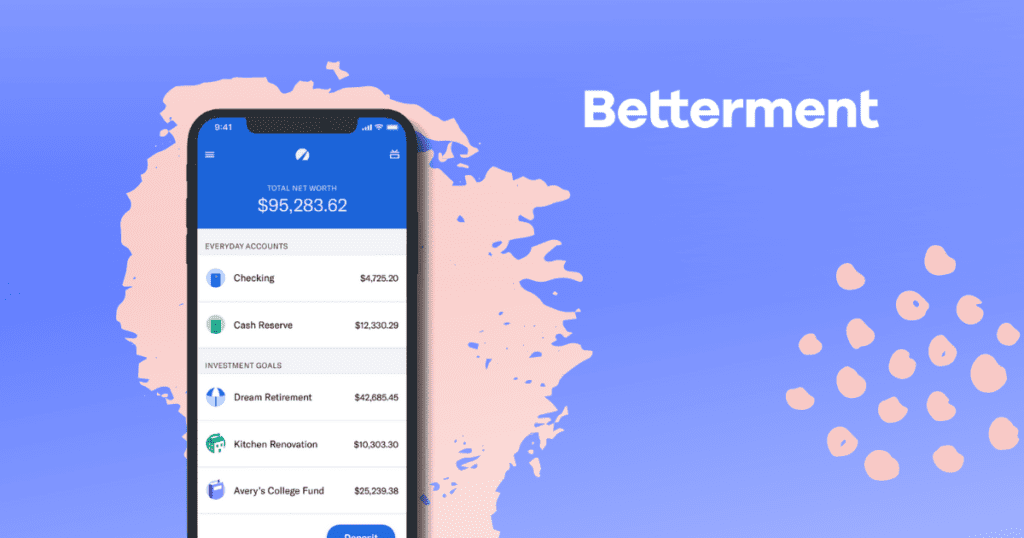

Then you choose one or more financial objectives, such as putting money aside for an emergency fund, long-term investing in a taxable account, or saving for retirement in an IRA (IRA). Traditional IRAs, Roth IRAs, and SEP IRAs are all options for you.

After linking your external bank account to the platform, you may fund your account by setting up one-time or regular deposits.

Betterment offers you a menu of tailored investment portfolios for each aim once you have entered your personal information and selected your objectives.

Improvement Portfolio” is the name to the default portfolio, which consists of exchange-traded funds (ETFs) representing around a dozen asset types.

Investing in socially responsible investments is available in six different portfolios (SRI). According to the type of objective you are saving for, the composition of each fund will vary.

If you’re seeking to save for retirement, Betterment will typically recommend that you invest in more equities. Bonds would make up the majority of your portfolio if your objective is to invest your emergency money.

Betterment’s Approach to Investing Your Money

As part of its investment portfolio diversification strategy, Betterment utilizes a plethora of low-cost exchange-traded funds (ETFs) that track established indexes.

However, depending on your profile and objectives, you may allocate to as many as 12 asset classes, depending on your situation.

According to your objectives, the exact asset allocation you receive, or the percentage of your portfolio that goes into each fund, defined by your assets allocation.

In the case of an emergency fund portfolio, which contains money that needed in the event of unexpected financial troubles, equities account for around 15% of the portfolio and bonds account for 85%.

For a 35-year-old investor, a general investing fund comprises 90 percent equities. This is money that will not be needed for a long time.

The risk tolerance of some rival Robo-advisors is determined by a series of questions you answer. Betterment creates the basic Betterment Portfolio, which is the default pick for the average investor based on your age, income, and investment objectives.

The majority of their money will direct toward equities, with the allocation divided across asset classes such as large-cap U.S. stocks, large foreign companies, and so on, for that 35-year-old.

In addition to the Betterment Portfolio, the platform distinguishes itself from other Robo-advisors by providing you with a variety of bespoke portfolio alternatives to pick from:

Socially Responsible Investing

Environmental, social, and governance (ESG) aspects are screened out of companies when investing in Betterment’s SRI option, which invests in ETFs using benchmarks that screen out companies that are not ESG.

Goldman Sachs Smart Beta

To aim to achieve outsized returns while keeping expenses down, this portfolio employs various diversification methods in an attempt to do so.

BlackRock Target Income

A well-diversified bond fund for investors who wish to produce a consistent source of income over the long term.

Flexible Portfolio

The asset class weightings given to you in the default Betterment Portfolio can be customized using this option.

While the Betterment Portfolio is mostly comprised of low-cost Vanguard and BlackRock iShare offerings, the Socially Responsible, Smart Beta, and Target Income portfolios all employ ETFs with greater expense ratios than the default Betterment Portfolio.

In addition, you may link additional accounts, such as your 401(k) or outside IRA, and Betterment will estimate how close you are to meeting your retirement objectives.

Key terms of Betterment You Need to Know

Robo-advisor

Betterment is a Robo-advisor, referred to as an automated investment service or an online adviser in some circles.

Robo-advisors, who utilize computer algorithms and smart software to design and manage your investment portfolio, is far less expensive than hiring a human, are a financial advisor to meet with you in person.

Fractional Share

Investors can acquire stock or other assets based on a dollar amount they choose rather than the price of a complete share when they purchase fractional shares of stock or other investments.

This may be especially helpful for investors who are dealing with a small amount of money. But who want to construct a portfolio that is highly diversified. Betterment purchases fractional shares, ensuring that there is no cash available in your portfolio.

Tax-loss Harvesting

Investing in tax-loss harvesting is a technique that can help you minimize your capital gains taxes considerably.

It is common practice in taxable accounts to sell failing assets in order to offset the profits from winning investments.

Betterment offers tax-loss harvesting, but it does not offer stock-level tax-loss harvesting (also known as direct indexing), offered at Wealthfront and Personal Capital, among others.

Some investors may be able to save even more money on taxes by using direct indexing.

Expense ratio

An expense ratio is a fee imposed by mutual funds, index funds, and exchange-traded funds (ETFs) that is calculated as a percentage of your investment in the fund.

For example, if you invest in a mutual fund with a 1 percent cost ratio. You will have to pay the fund $10 each year for every $1,000 you have invested.

These costs, if they are excessive, can have a substantial impact on the performance of your portfolio. But the expense ratios of the funds utilized in Betterment portfolios are modest.

The expense percentages are payable in addition to the management fee that Betterment charges.

Fees and Expenses Associated with Betterment

Customers who simply use digital services pay 0.25 percent in management fees per year. With the price increasing to 0.40 percent per year if they subscribe to the premium plan.

The digital charge for Betterment assets above $2 million may reduce to 0.15 percent per year. Specifically, on the part of the balance that exceeds $2 million.

You will have to pay 0.30 percent of the sum over $2 million if you choose the premium plan. The underlying ETFs are subject to annual management fees ranging from 0.07 percent to 0.15 percent.

Even though you may use Betterment’s financial planning and account consolidation features without paying a fee. You can shift a portion of your funds into an investment account on a regular basis.

There are no costs relating to canceling an account, sending a cheque, or sending a transfer.

- The Monthly cost to manage a $5,000 portfolio: $1.04 ($1.67 for Premium)

- Monthly cost to manage a $25,000 portfolio: $5.21 ($8.33 for Premium)

- Monthly cost to manage a $100,000 portfolio: $20.83 ($33.33 for Premium)

How to Cancel Betterment Subscription?

In order to close your Betterment account, follow these instructions:

- Log in from a web browser

- Select “Settings”

- Tap on “Accounts”

- Click on the three dots to the right of the specific investment account(s) you wish to close.

Pros

- Account creation is quick and simple.

- Portfolios are completely transparent before funded.

- It is possible to link external accounts to individual goals.

- You may create a new goal at any moment and keep track of your progress with relative simplicity.

- Change the risk level of your portfolio or move to a different type of portfolio with relative ease.

- A two-way sweep is available through the checking and cash reserve functions.

Cons

- Planners are continually persuaded to finance a Betterment account.

- The basic package charges $199–299 for financial planning.

- Socially responsible portfolios use ETFs (ETFs).

- No margin lending, secured loans, or portfolio borrowing alternatives.

Conclusion

It is possible to utilize Betterment in a variety of ways. You may sync all of your financial accounts to obtain an overall view of your assets without investing. You can invest in one of their portfolios, or you can construct a Flexible Portfolio. Based on some of your own criteria.

When it comes to taxable accounts, the goal is to optimize after-tax returns through the use of tax-loss harvesting. Moreover, portfolios may rebalance as needed.

Betterment is primarily a goal-oriented platform. Moreover, users have access to a wide range of planning tools as well as a plethora of knowledge and guidance.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/