The stock market has a wide range of trading after hours.

But did you know that you can trade Options after hours for big profit.

In this article, we bring you a step-by-step guide on how to partake in After hours Options trading and live to tell your friends about it.

Table of Contents

After Hours Options Trading | Option Trading Market Hours

The NYSE market has different open hours for the stocks and options.

Let’s first examine the standard hours of operation for regular stocks.

What Are Options Trading Market Hours?

The question about the stock market being open on weekends is quite popular.

They answer is NO.

The US stock market is closed on weekends even though for avid traders, the cryptocurrencies markets are open 7 days a week – 24h around.

The US stock exchange opens each weekday ( Monday through Friday) at 930 am Eastern time and closes at 4pm EST except on holidays..

Because there are three time zones within the continental US so for those on the west Coast, this means waking up relatively early at 630AM.

I am one of those since I even host a Live day trading pre-market Analysis as depicted in the video below.

What is the Best geographical location to trade from ?

In our Discord group of traders, we have traders from all over the world.

Some are in Singapore where the market will open in the middle of the night.

Others are in Europe (London , Paris or Bruxels) where it is the middle of the afternoon at the open.

If I had the choice right now, I would rather be trading from that part of the world.

I had the opportunity to do so while in Africa for two months in 2020.

That schedule was pleasing to me because you actually will have time to wake up , perform others tasks because embarking in a very long trading session of 6.5 hours.

By contrast, most Asian markets do include a break/pause during their trading day.

That is quite nice in order to enable traders to quiet their minds and start fresh in the afternoon.

What is After Hours for the stock market ?

After hours trading is the time after the market has closed for regular hours.

Extended Hours Trading

Most commonly, After hours is referred to inside your broker trading platform as Extended hours.

Which bring the question, which brokers allow extended hours trading.

The main ones Robinhood, TD Ameritrade, E*TRADE and Webull have extended hours trading for all stocks.

For stocks, this starts at 4PM Eastern time all the way to 8PM Eastern time.

We could also consider the timeframe before the market opens as after hours.

Typically, traders can start trading with most brokers at 7am Eastern Time meaning 2.5 hours before the official opening of the stock market.

This window of trading is known as pre-market.

Drawbacks Of Trading Outside of Regular Options Markets Hours

If you want to trade stocks outside of the regular trading hours, you need to be prepared to face the folowing challenges.

- Getting the Right Quotes: The price of stocks is determined by the aggregation of price across multiple exchanges. This is assumed to be fairly routine process when all exchanges are opened during regular trading hours. Once the markets closed, there is no guarantee that the after hours prices will hold when regular hours resume. Some veterans traders can use this to their advantage to spot cheap entries especially during Earnings seasons.

- Orders Types Restrictions: This may not be a big deal for most traders as conventional wisdom suggests that Limit orders are the way to go most of the time. If you want to buy or sell stocks after hours, your orders must be Limit Orders as all other types of orders are not permitted.

- Not Enough Liquidity: You need to understand liquidity as the number of people buying and selling a stocks. The more traders are interested in a given stock, the easier it is to change hands at a fair price. Since they are always less traders involved in after hours, liquidity can be a big problem for certain stocks during after hours. The issue ultimately will lead to the next and most important problem for you.

- Bad Fills at higher prices: I am sure by now you have heard of buy low and sell high. Getting a bad fill means that you did not buy low enough and thus your chance of maximizing your profits are much lower.

Because of the above reasons, even if after hours happen to be the best convenient time for you to trade, it is wise to assess all risks before putting your money on a stock at not so good entry price.

What Are the Best Brokers for After Hours Trading

If you are a night owl type of trader and must absolutely know what is happening in the markets as early as possible then the following brokers will keep you on Top of your investments.

Futu Moomoo may not be that well known yet but this newcomers provides international markets perspective starting at 4AM EST all the way to 8PM EST.

At 4AM EST, you wil lget a great insight of European markets.

I like to use the DAX as an early indicator how the NASDAQ and SPX500 may perform.

The correlation between US markets and Europe is trough this German index.

Similar to Futu Moomoo is Webull trading App in terms of after hours availabilityfor trading.

My only negative remark on Webull App in pre-market is the inaccuracy of the volume for certain stocks.

I also use E*TRADE later on in pre-market when I need to look at the option chains to make early entries for our Gang$Ta strategies.

Can you Trade Options in Pre-Market ?

Pre-markets goes from 7am Eastern time to the Opening bell at 930am Eastern time.

In pre-market, traders have the opportunities to get stocks at a cheaper price should a stokck be trending with bullish momentum.

However, the drawback is often the lack of liquidity and one can run the risk of crossing the spread.

This means that the difference between the bid and the Ask this too big to ensure an easy buy or sell.

During this window of trading, options cannot be traded.

Nonetheless, traders can initiate options trade that their brokers will put in a queue and ready to be traded starting at 930am Eastern Time.

Can you Trade Options in After hours

All options stop trading exactly at 4PM Eastern each Day Except for the ETFs.

ETFs are Exchanges Traded Funds.

You can trade Options after hours on ETFS all the way to 4:15PM Eastern Time.

The main ETFs that you can trade are SPY, QQQ, IWM and DIA.

My personal favorite is by far SPY because it presents us a unique opportunity to trade its Options for profit on Expiration Days.

SPY options have 3 days of Expiration each week: Monday, Wednesday and Friday.

The rest of the stocks and ETFs feature expiration on Fridays only except for end of the quarters for QQQ, IWM and DIA.

How To Buy and Sell SPY and QQQ Options After Hours

SPY options are very liquid by nature because many traders are always trading them.

Then add to this the fact that on expiration days, options are always very cheap and we have a dream scenario to make money very late into the session.

The same strategies can also be used for QQQ Options now that traders have the opportunity t trade with closer intra-week expiration on Mondays, Wednesdays as well as Fridays.

You Can Buy SPY and QQQ Options After Hours

The profession of trading the stock market is just like any other discipline.

The time spend studying it will increase your knowledge to the point of becoming an expert and thus you can become a stock market genius.

One that can put together a strategy based on after hours study.

For now, let’s use share with one our very one strategy trading options after hours that is bound to make you look like a genius for your friends at least.

Should you decide to trade options in after hours, here is our main recommendation.

Step # 1. Choose an Eligible ETFs. We prefer QQQ Options on Mondays, Wednesdays and Fridays.

Step #2. You have an Extra 15 minute after the official market has close. You can either do an Option day trade on SPY or pick the next available expiration Day.

#Step 3. Apply our strategy detailed in the video below.

Voila.

Best Season to Trade QQQ Options After Hours

The reason why the ETFs such as QQQ and SPY move after hours is because their most important stocks are moving after hours.

Therefore, the best time to trade QQQ or SPY options after hour is when we know that there is a high probability their most important stocks will move on some news.

The highest probability happens to be during the 4 Earnings seasons depicted below.

That is: JAN15 to February 15 | APRIL 15 to May 15 | JULY 15 to Augst 15 | October 15 to November 30

The above image captures a recent example of how we made over 120 Trading QQQ Options after hours from 86 cents at close to $1.86.

Just in the April first week of Earnings, I have recorded in the table below the many opportunities to make money trading QQQ Options after hours.

| After Hours DATE | QQQ After Hours Movement | Reason for after Hours Volatility |

| April 19 2022 | QQQ from $346 to $342 | #NFLXEarnings [-20%] |

| April 20 2022 | QQQ from $341 to $343 | #TSLA Earnings [+5%] |

| April 26 2022 | QQQ from $317 to $313 | #GOOG Earnings [-6%] |

| April 27 2022 | QQQ from $317 to $321 | #FB Earnings [+13%] |

| April 28 2022 | QQQ from $328 to $324 | #MAZN Earnings [-10%] |

In case you are wondering which stocks make QQQ move the most after hours following their quarterly Earnings reports, learn more below about QQQ and SPY top Holdings.

After Hours Options Price

If you are wondering how to calculate option price after hours, the main thing to remember is that it is a very short window of trading.

So meaning the time decay is even more impactful.

As such, option prices after hours are extremely volatile.

This is a great thing when you are on a winning trade and making more money.

But it can be very disheartening when the direction suddenly changes in after hours and the price of the option with it.

Here is our Video on Options Trading after hours on ETrade featuring the option price violent volatility.

FINAL THOUGTS ON AFTER HOURS OPTIONS TRADING

We shared what is the best way to participate in after hours Options trading with our proven strategy on SPY on Expiration days.

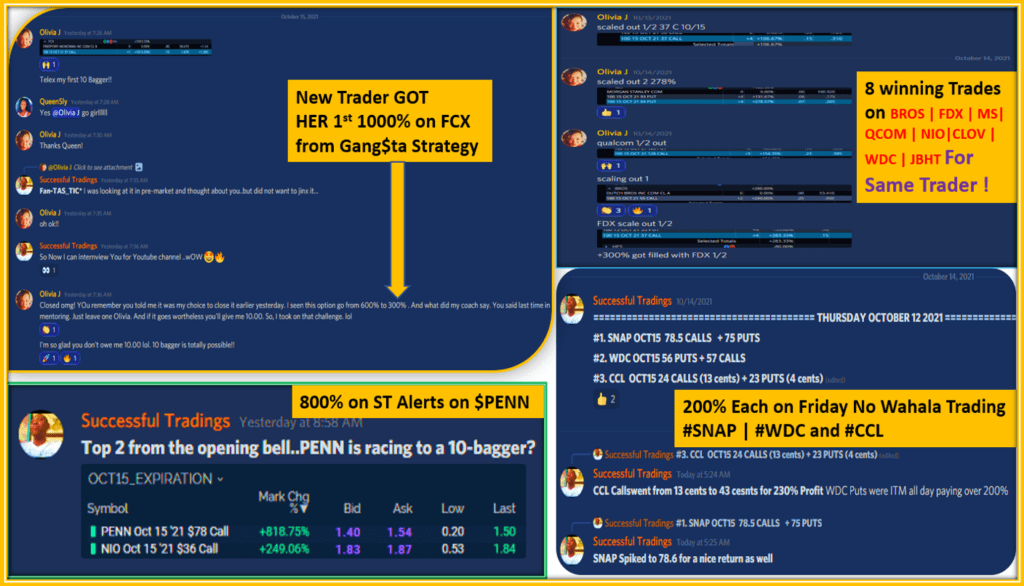

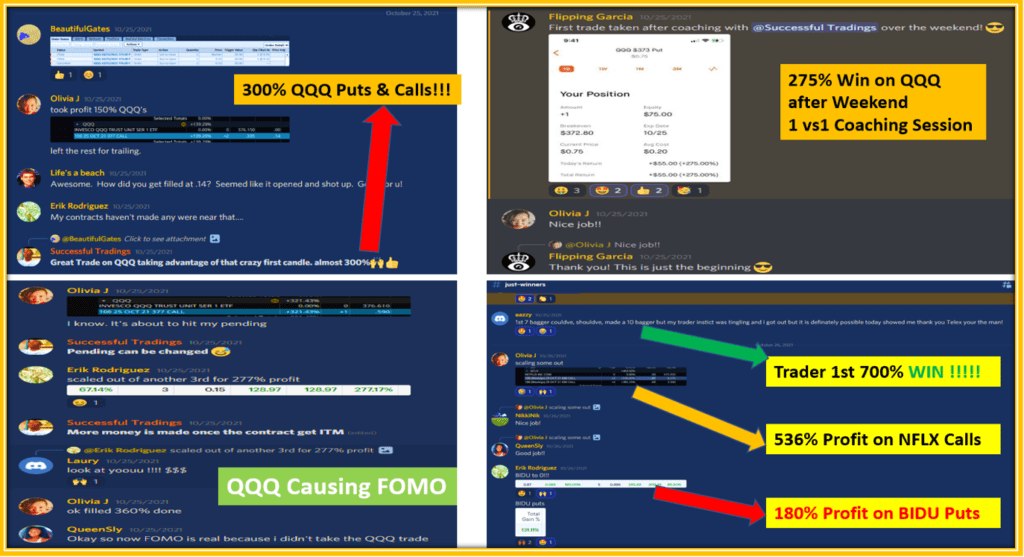

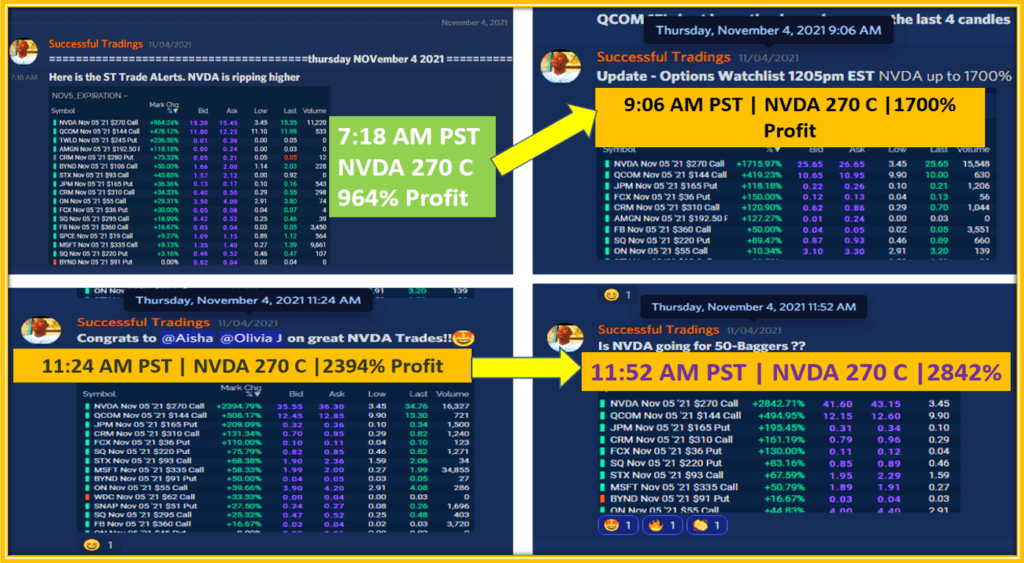

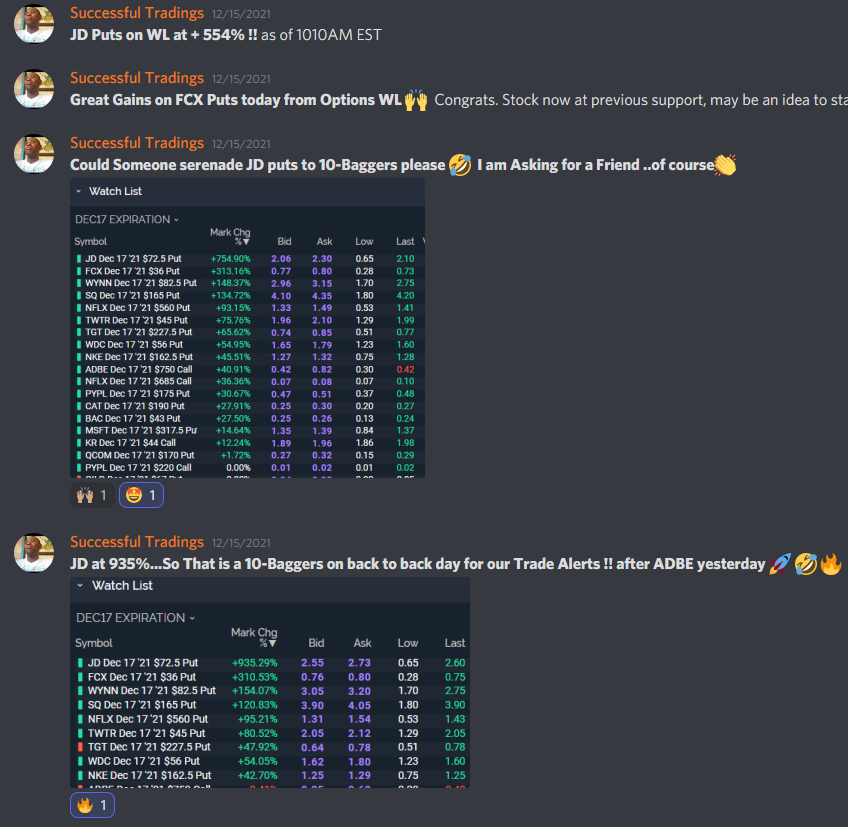

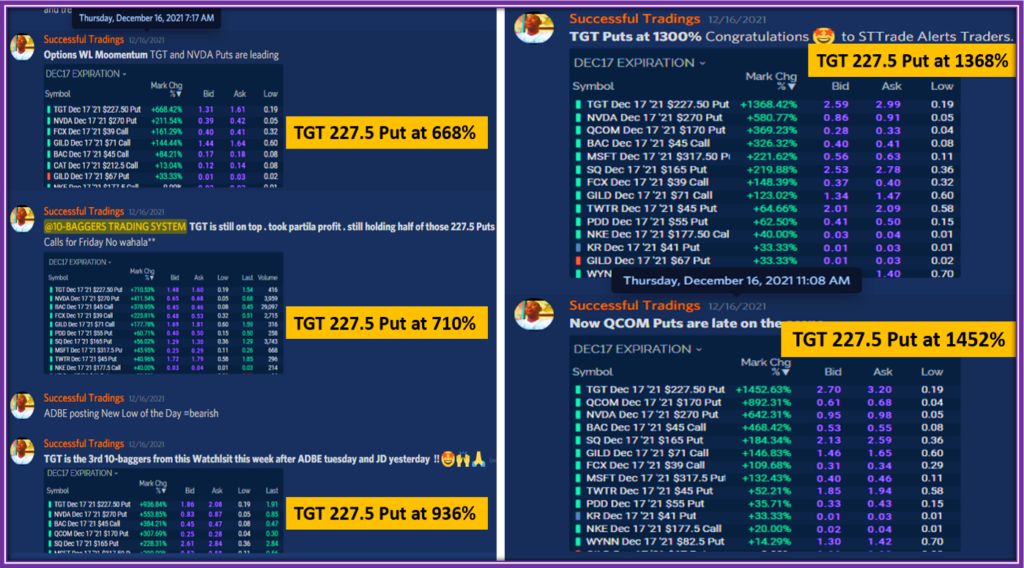

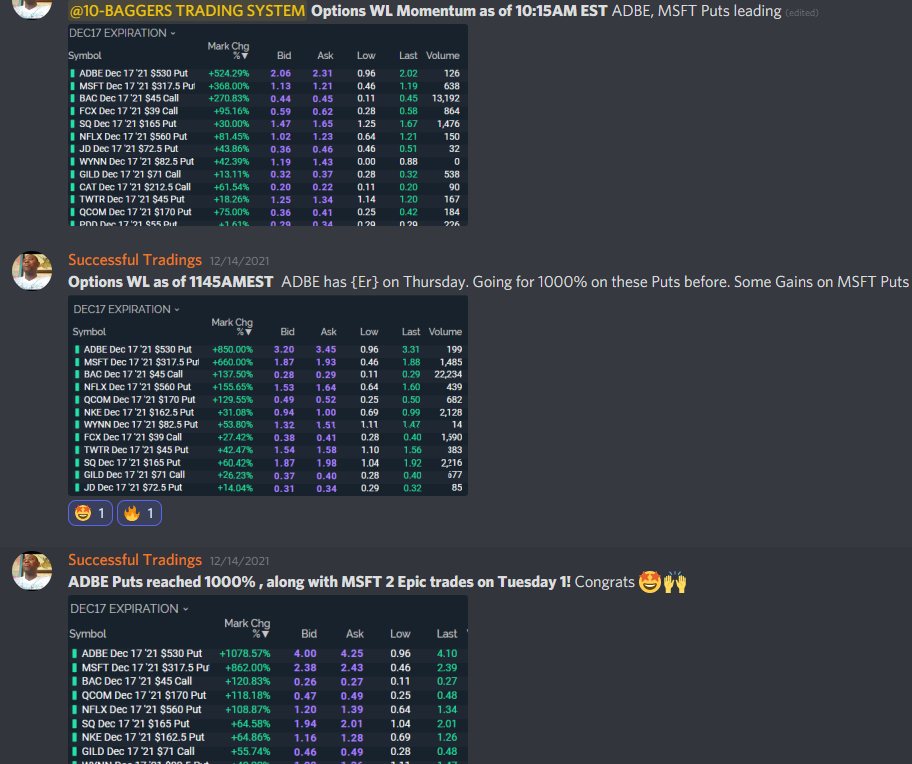

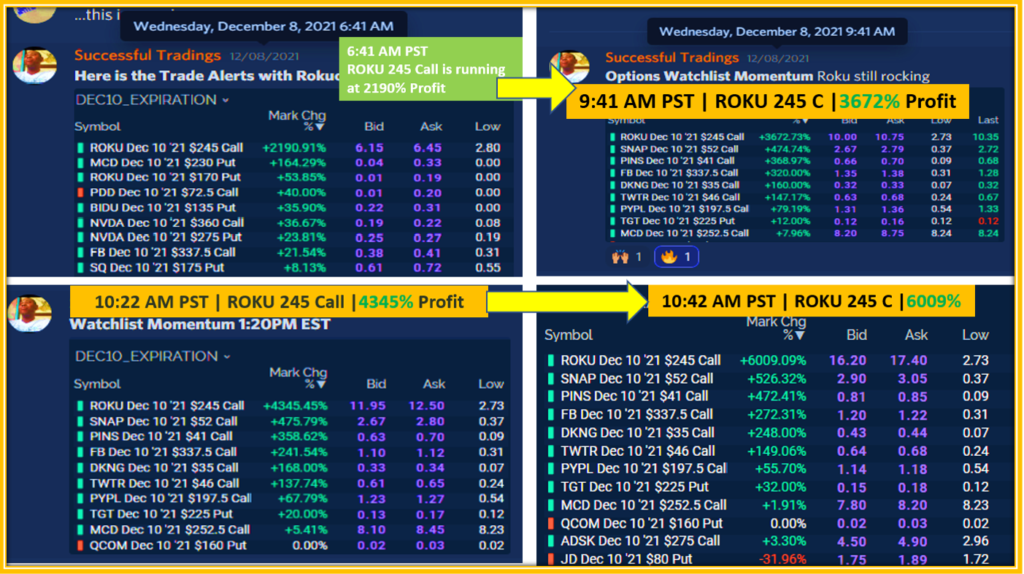

The return depicted in the video can be quite impressive thus making this one of our favorite way to generate 10-Baggers options profit.

We invite to check out our other techniques on making money trading options consistently with our 10-Baggers Trading System.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/

Thank you for this great article.

You are welcome.

Thank you for stopping by.