I began trading in 2015 and started coaching in 2019. Women face unique investment challenges that require targeted strategies and confidence building. However, traditional financial advice often ignores gender-specific barriers to wealth building. Therefore, this guide helps you overcome confidence gaps while implementing proven investment strategies.

👉 In this guide, you will learn:

- 💪 How to overcome investment confidence barriers that hold women back

- 📚 Essential financial knowledge every woman should master

- 💰 Investment strategies designed for women’s unique financial situations

- 🎯 Building wealth despite wage gaps and career interruptions

- 📊 Creating portfolios that address women’s longer lifespans

- 🏠 Balancing multiple financial priorities women typically manage

- 🚀 Advanced strategies for high-earning professional women

Women control significant wealth globally yet remain underrepresented in investment markets. Additionally, societal factors create confidence barriers that limit financial growth. Furthermore, women’s longer lifespans require more aggressive wealth-building strategies than traditionally recommended.

Table of Contents

The Women’s Investment Confidence Crisis 💪

Research consistently shows women lack investment confidence compared to men. However, this confidence gap does not reflect actual investment ability or knowledge. Furthermore, women often outperform men when they do invest actively.

Confidence barriers women face in investing:

- 🧠 Imposter syndrome in financial decision-making

- 📚 Perceived knowledge gaps compared to male counterparts

- 💬 Exclusion from financial discussions and networks

- 🎯 Perfectionism that delays investment action

- 💰 Risk aversion that limits growth potential

- 📊 Information overload creating analysis paralysis

However, women possess natural advantages in investment management. Moreover, they typically demonstrate more disciplined, long-term approaches. Additionally, women research investments more thoroughly before committing capital.

Women’s natural investment advantages:

- 📈 Lower portfolio turnover and better buy-and-hold discipline

- 🔍 More thorough research before making investment decisions

- ⚖️ Better risk management and diversification practices

- 🎯 Clearer long-term goal orientation in financial planning

- 💡 Less susceptible to overconfidence and market timing mistakes

- 🤝 More likely to seek professional advice when needed

Smart women recognize these advantages while systematically addressing confidence barriers through education and action.

Women’s Unique Financial Reality 📊

Women face distinct financial challenges requiring specialized strategies. Career interruptions for family care significantly impact earning potential. Furthermore, the gender pay gap affects lifetime wealth accumulation substantially.

Financial challenges specific to women:

- 💸 Average 20% wage gap across all professions and ages

- 👶 Career interruptions for childcare affecting advancement and earnings

- 👴 Longer lifespans requiring more retirement savings (2-3 years longer)

- 🏠 Greater likelihood of becoming single parents with sole financial responsibility

- 💼 Higher healthcare costs throughout lifetime

- 📉 Less employer retirement benefits due to part-time work

However, women also benefit from increasing educational achievement and career advancement. Additionally, entrepreneurship rates among women continue growing rapidly. Furthermore, inheritance patterns increasingly favor women as primary beneficiaries.

Emerging advantages for women investors:

- 🎓 Higher college graduation rates creating income opportunities

- 💼 Increasing representation in high-paying professional careers

- 🏢 Growing entrepreneurship enabling wealth creation

- 💰 Longer working years as career interruptions decrease

- 📈 Better investment education access through technology

Building Investment Confidence Through Knowledge 📚

Investment confidence grows through systematic education and gradual experience building. Therefore, women should focus on foundational knowledge before complex strategies. Furthermore, starting with basic concepts prevents overwhelm and analysis paralysis.

Essential Investment Knowledge for Women

Understanding Risk vs. Volatility Many women avoid investing due to perceived risk. However, not investing represents the greatest long-term risk. Furthermore, understanding the difference between volatility and risk enables better decision-making.

Risk education fundamentals:

- 📊 Volatility is temporary price fluctuation, risk is permanent capital loss

- ⏰ Time horizon reduces volatility impact significantly

- 📈 Diversification reduces risk without eliminating growth potential

- 💰 Inflation risk makes cash dangerous for long-term goals

- 🎯 Market timing increases risk more than buy-and-hold strategies

Power of Compound Interest for Women Women’s longer lifespans make compound interest even more powerful. Moreover, early investment creates exponential growth over extended time periods. Additionally, consistent investing matters more than perfect timing or large initial amounts.

Compound growth examples for women:

- 💰 $300 monthly starting at age 25 = $1.1 million at 65 (7% returns)

- 💰 $600 monthly starting at age 35 = $1.3 million at 65 (7% returns)

- 💰 Women’s additional 2-3 retirement years require 10-15% more savings

- 💰 Career gaps make early starting and consistent investing crucial

Women’s Investment Priority Framework 🎯

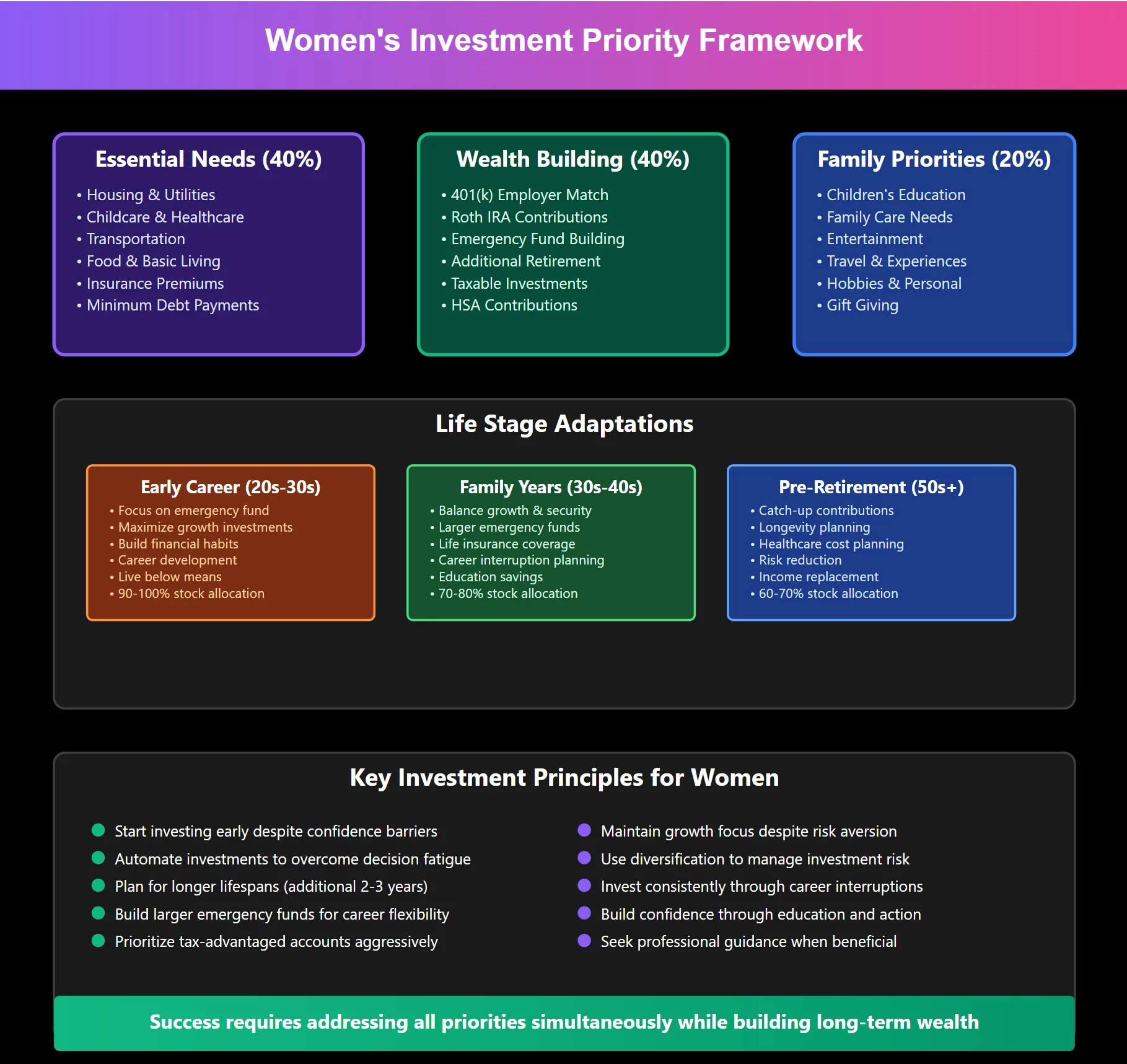

Women often manage multiple family financial priorities simultaneously. Therefore, investment strategies must address competing demands while building long-term wealth. Furthermore, flexible approaches accommodate life changes and career interruptions.

Show Image

The Balanced Approach for Women

Rather than choosing between competing goals, successful women create systematic approaches. Furthermore, they understand that perfect optimization matters less than consistent progress. Additionally, they build flexibility into plans for life changes.

Core principles for women’s investing:

- 🎯 Address multiple priorities simultaneously rather than sequentially

- 💪 Build confidence through education and gradual experience

- 👶 Plan for potential career interruptions and income changes

- 📈 Emphasize automation to overcome confidence barriers

- ⚖️ Balance growth needs with security preferences

- 🤝 Leverage professional guidance when appropriate

The 40/40/20 Women’s Framework:

- 40% to essential needs (housing, childcare, healthcare)

- 40% to wealth building (retirement, investments, emergency fund)

- 20% to family priorities (education, care, discretionary)

This framework ensures aggressive wealth building while managing family responsibilities. Moreover, it adapts to different life stages and income levels.

Investment Strategies for Different Life Stages 📈

Women’s investment needs evolve significantly throughout different life phases. Career building requires different approaches than family years or pre-retirement. Therefore, strategies must adapt while maintaining long-term wealth building focus.

Early Career Women (20s-30s)

Aggressive Growth Focus Young women should prioritize aggressive growth despite risk aversion. Furthermore, long time horizons enable recovery from market volatility. Additionally, early aggressive investing compensates for potential future career interruptions.

Early career investment priorities:

- 📊 Employer 401(k) match – immediate 100% return

- 📊 Roth IRA maximization for tax-free growth

- 📊 90-100% stock allocation for maximum growth

- 📊 Automatic investing to build consistent habits

- 📊 Emergency fund building for job flexibility

Building Financial Independence Foundation Early career focuses on building financial independence rather than lifestyle enhancement. Moreover, aggressive saving and investing during high-energy years creates future options. Additionally, financial independence provides freedom during family-building years.

Financial independence strategies:

- 💰 Live on entry-level salary while investing raises

- 💰 Develop multiple income streams and skills

- 💰 Avoid lifestyle inflation with career advancement

- 💰 Build network and professional credentials

- 💰 Consider geographic arbitrage for savings acceleration

Family Building Years (30s-40s)

Balancing Growth with Security Women during family years need balanced approaches addressing both growth and security. Furthermore, potential income disruptions require more conservative emergency funds. However, growth investing remains crucial for long-term security.

Family years portfolio considerations:

- ⚖️ 70-80% stocks, 20-30% bonds for balance

- ⚖️ Larger emergency funds (6-12 months expenses)

- ⚖️ Life insurance to protect family income

- ⚖️ 529 plans for children’s education after retirement funding

- ⚖️ Flexible investment accounts for unexpected needs

Managing Career Interruption Impact Career interruptions can significantly impact wealth building. Therefore, strategies must maintain investment momentum during reduced income periods. Additionally, spousal coordination becomes crucial for family wealth optimization.

Career interruption strategies:

- 📈 Maintain retirement contributions even during part-time work

- 📈 Use spousal IRAs when not working

- 📈 Continue investment education during career breaks

- 📈 Plan re-entry strategies to minimize income impact

- 📈 Consider entrepreneur opportunities during flexibility years

Pre-Retirement and Beyond (50s+)

Catch-Up Strategies for Women Women over 50 can make additional retirement contributions through catch-up provisions. Furthermore, peak earning years enable aggressive savings acceleration. Additionally, empty nest years often reduce expenses significantly.

Catch-up contribution opportunities:

- 💰 401(k) catch-up: Additional $7,500 annually

- 💰 IRA catch-up: Additional $1,000 annually

- 💰 HSA catch-up: Additional $1,000 annually

- 💰 Focus on maxing all tax-advantaged accounts

Longevity Planning for Women Women’s longer lifespans require more conservative withdrawal rates and larger retirement savings. Therefore, portfolios must balance current income needs with long-term growth requirements.

Longevity planning considerations:

- ⏰ Plan for 25-30 year retirement periods

- ⏰ Maintain growth allocation throughout retirement

- ⏰ Consider delayed Social Security for higher benefits

- ⏰ Healthcare cost planning for extended old age

- ⏰ Long-term care insurance evaluation

Overcoming Common Investment Barriers 🚨

Women face specific behavioral and psychological barriers to successful investing. Understanding these patterns enables targeted strategies for overcoming them. Furthermore, recognizing these tendencies prevents costly mistakes.

Analysis Paralysis and Perfectionism

The Research Trap Women often research investments exhaustively without taking action. However, perfect information never exists, and delays cost more than imperfect early starts. Moreover, basic diversified portfolios work excellently for wealth building.

Overcoming analysis paralysis:

- 🎯 Set decision deadlines for investment choices

- 📈 Start with simple index fund portfolios

- 🔄 Plan to optimize strategy over time

- 💰 Begin with small amounts to build confidence

- 📚 Separate education from action timelines

Fear of Making Mistakes Investment perfectionism prevents many women from starting. However, the biggest mistake is not investing at all. Furthermore, diversified portfolios minimize individual decision impact significantly.

Mistake management strategies:

- 💪 Accept that some investments will underperform

- 📊 Focus on overall portfolio performance over individual holdings

- 🎯 Use target-date funds to reduce decision complexity

- 🤖 Implement automated investing to reduce active decisions

- 📈 View mistakes as learning opportunities rather than failures

Social and Cultural Barriers

Breaking Investment Stereotypes Cultural messages often discourage women from active investing. However, women’s natural advantages in planning and research make them excellent investors. Furthermore, financial independence provides security regardless of relationship status.

Building investment confidence:

- 💪 Join women’s investment clubs and networks

- 📚 Follow female financial educators and role models

- 🎯 Celebrate investment wins and learning milestones

- 🤝 Find accountability partners for financial goals

- 💰 Track progress regularly to see compound growth results

Advanced Strategies for Professional Women 💼

High-earning professional women face unique opportunities and challenges. Complex compensation packages require sophisticated planning. Furthermore, demanding careers may limit time for active investment management.

Executive Compensation Optimization

Stock Options and Equity Compensation Many professional women receive equity compensation requiring strategic management. However, concentration risk makes diversification crucial. Furthermore, tax planning becomes essential for optimization.

Equity compensation strategies:

- 🎯 Diversify away from company stock systematically

- 📊 Understand vesting schedules and exercise timing

- 🧾 Optimize tax timing for stock option exercises

- 💰 Use proceeds for diversified portfolio building

- 📈 Avoid emotional attachment to company shares

High-Income Tax Strategies Professional women in high tax brackets can benefit from advanced tax planning. Furthermore, maximizing tax-deferred contributions becomes increasingly valuable. Additionally, alternative investment strategies may provide tax benefits.

Advanced tax planning for high earners:

- 🏦 Maximize all retirement account contributions

- 🧾 Use backdoor Roth IRA conversions

- 📊 Implement tax-loss harvesting strategies

- 💰 Consider municipal bonds for high tax states

- 🏢 Explore business structure benefits for consulting income

Work-Life Balance Investment Strategies

Automation for Busy Professionals Demanding careers require automated investment systems. Furthermore, robo-advisors can provide professional management without time investment. Additionally, systematic approaches prevent career demands from derailing wealth building.

Automation strategies for professionals:

- 🤖 Automatic 401(k) contributions from payroll

- 🤖 Robo-advisor management for taxable portfolios

- 🤖 Automatic rebalancing and tax-loss harvesting

- 🤖 Bill pay automation for all fixed expenses

- 🤖 Regular portfolio review scheduling

Delegation and Professional Help High-earning professional women often benefit from comprehensive financial planning. Moreover, fee-only financial advisors can provide objective guidance. Additionally, tax professionals become essential for complex situations.

When to seek professional help:

- 💼 Complex executive compensation packages

- 💼 Multiple investment account coordination

- 💼 Tax planning for high income levels

- 💼 Estate planning for substantial assets

- 💼 Insurance needs analysis and optimization

Video Recommendation 🎥

🎬 For detailed guidance on women’s investment strategies, watch my Successful Tradings video about building confidence and wealth for female investors. The video demonstrates practical approaches to overcoming confidence barriers while implementing proven investment strategies.

Watch it here: https://www.youtube.com/@SuccessfulTradings and search for “Women’s Investment Confidence and Wealth Building.”

You will learn specific techniques for building investment confidence while creating optimal portfolios for women’s unique financial situations.

FAQs 🤔

Q: How do I start investing with limited confidence and knowledge? A: Begin with target-date funds or robo-advisors that provide professional management automatically. Start with small amounts to build confidence, then increase contributions as knowledge grows through education and experience.

Q: Should I prioritize investing or paying off debt as a woman? A: Always capture employer 401(k) matches first. For other debt, focus on high-interest debt (above 6%) before investing. However, maintain retirement investing even while paying moderate-rate debt below 4%.

Q: How do career interruptions affect my investment strategy? A: Maintain investment momentum through spousal IRAs when not working. Build larger emergency funds before planned interruptions. Consider part-time work to maintain benefits and retirement contributions when possible.

Q: What’s the ideal investment allocation for women? A: Women can typically maintain more aggressive allocations longer due to longer lifespans. Consider 80-90% stocks in your 40s, 70-80% in your 50s, and 60-70% in early retirement, adjusting for risk tolerance.

Q: How much should women save for retirement compared to men? A: Women need 10-15% more retirement savings due to longer lifespans and typically lower lifetime earnings. Aim for 15-20% of income in retirement accounts, including 401k employer matches.

Q: Should I invest differently if I’m single versus married? A: Single women need more conservative emergency funds and comprehensive insurance coverage. However, investment strategies remain similar. Married women should coordinate with spouses for household optimization.

Q: How do I overcome fear of investment losses? A: Understand that diversified portfolios reduce individual stock risk significantly. Focus on long-term growth rather than short-term volatility. Remember that not investing guarantees purchasing power loss to inflation.

Q: What’s the biggest investment mistake women make? A: Waiting too long to start due to confidence barriers and perfectionism. Time in market beats timing the market, and early imperfect investing outperforms late perfect strategies significantly.

Conclusion

Women possess natural advantages in investment management but often lack confidence to leverage them effectively. Therefore, systematic education and gradual experience building overcome these barriers successfully. Furthermore, women’s longer lifespans make aggressive wealth building even more crucial than traditionally recommended.

Smart women recognize their unique financial challenges while developing strategies to address them systematically. Additionally, they understand that confidence grows through action rather than endless preparation.

Finally, women who invest early and consistently throughout their careers achieve financial independence that provides security and options regardless of life circumstances.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/