I remember when I first started trading in 2015, convinced I could outsmart the market with perfect timing and brilliant stock picks. I’d spend hours analyzing charts, reading analyst reports, and jumping in and out of positions. After six months, I was down 15% while the S&P 500 was up 8%.

That humbling experience changed everything. Over the past decade of trading and six years of coaching investors, I’ve watched passive investing consistently outperform my best active trading efforts. The strategy that once seemed “boring” has become the foundation of real wealth building.

Understanding passive investing can transform your financial future without requiring you to become a market expert or spend hours managing your portfolio daily.

Table of Contents

What Exactly Is Passive Investing? 🤔

Passive investing means buying and holding diversified portfolios that track broad market indices rather than trying to beat the market. Think of it as riding the escalator instead of running up the stairs – you still reach the top, but with much less effort and stress.

The strategy operates on a simple principle: markets are generally efficient over long periods. Most available information gets quickly incorporated into stock prices, making consistent outperformance extremely difficult for individual investors.

Core passive investing benefits:

- Lower costs (expense ratios as low as 0.03%)

- Less time required (set-and-forget approach)

- Reduced stress (no daily market monitoring needed)

- Proven results (historically beats 80-90% of active funds)

- Better tax efficiency

I learned this lesson the hard way in 2016 when I spent three months researching a “sure thing” biotech stock.

Despite my analysis, it dropped 40% after an FDA rejection.

Meanwhile, my boring S&P 500 index fund gained 12% that year with zero effort on my part.

The Four Pillars of Passive Investment Success 🏛️

After coaching hundreds of investors since 2019, I’ve identified four principles that separate successful passive investors from those who struggle.

Market Efficiency Advantage

Markets efficiently price securities based on available information, making consistent outperformance challenging. Instead of fighting this reality, passive investors harness it by capturing overall market growth without needing to identify undervalued opportunities.

Cost Minimization Strategy

Every dollar you pay in fees is a dollar that can’t grow over time. This difference becomes massive over decades.

Here’s what shocked one of my clients last year:

Real Client Example:

- 💸 Active fund with 1.5% fee: $150 annually on $10,000

- ✅ Passive fund with 0.1% fee: $10 annually on $10,000

- 🚀 Annual savings: $140 that compounds for decades

Over 30 years, that $140 annual difference becomes nearly $110,000 in lost wealth.

Time in Market Beats Timing the Market

Long-term investing allows compound returns to work effectively. I watched too many of my early trading clients try to time market movements perfectly – a task that even professional fund managers fail at consistently.

The math is simple: missing just the 10 best market days over 20 years can cut your returns nearly in half.

Diversification Protection

Broad market exposure reduces individual security risk while maintaining growth potential. Passive portfolios automatically include hundreds or thousands of securities across different sectors, so poor performance in one area gets offset by strength in others.

Essential Investment Vehicles for Passive Investors 🛠️

Three main vehicles power most passive investment strategies. Each serves different needs and investor preferences.

| Vehicle | Best For | Expense Ratio | Minimum | Trading |

| Index Funds | 401(k) plans, Auto-investing | 0.03% to 0.2% | $1000 – $3000 | End of Day |

| ETFs | Taxable accounts, Flexibility | 0.03% to 0.15% | 1 hare price | Market Hours |

| Target-Date Funds | Beginners | 0.1% to 0.75% | $1000 – $3000 | End of Day |

Index Funds: The Original Passive Vehicle

These mutual funds track specific market indices like the S&P 500 or total stock market. They automatically reinvest dividends and handle all portfolio management decisions, making them perfect for hands-off investors.

One of my coaching clients, Sarah, has used the same target-date index fund in her 401(k) for eight years. She’s never changed her allocation, never tried to time the market, and her account has grown from $15,000 to over $85,000 through consistent contributions and market growth.

ETFs: Maximum Flexibility and Efficiency

Exchange-Traded Funds trade like individual stocks while providing diversified index exposure throughout market hours. They often have lower expense ratios than traditional mutual funds and offer superior tax efficiency.

Target-Date Funds: Complete Autopilot

These funds automatically adjust asset allocation based on target retirement dates, becoming more conservative over time. They provide complete portfolio solutions for truly hands-off investors.

I typically recommend target-date funds for beginners who feel overwhelmed by allocation decisions. They handle everything automatically while you learn about investing fundamentals.

[See Infographic 1: Passive Investment Vehicles Comparison – displayed above showing detailed breakdown of Index Funds, ETFs, and Target-Date Funds]

How Passive Investing Works in Practice ⚙️

Building a passive investment portfolio involves four straightforward steps that anyone can implement, regardless of investment experience or account size.

Step 1: Choose Your Platform

Select a reputable discount brokerage that offers low-cost index funds and ETFs. Consider factors like minimum investments, available funds, customer service quality, and educational resources.

Top platform options:

- 🏆 Fidelity – Zero-fee index funds and excellent research tools

- 🥈 Schwab – Outstanding customer service and comprehensive planning tools

- 🥉 Vanguard – Pioneer of low-cost investing with investor-owned structure

Step 2: Start Simple

Begin with total stock market index funds or target-date funds that provide instant diversification. These funds handle asset allocation decisions while you learn about investing fundamentals.

Beginner-friendly options:

- Total Stock Market Index (FZROX, SWTSX, VTSAX)

- Target-Date Fund based on planned retirement year

- Total World Stock Index for global exposure

Step 3: Automate Everything

Set up automatic transfers from your bank account to your investment account on regular schedules. Then arrange automatic investment of transferred funds into your chosen index funds.

Essential automation checklist:

- 🔄 Automatic bank transfers (weekly or monthly)

- 💰 Automatic fund purchases

- 📈 Dividend reinvestment

- ⚖️ Annual rebalancing alerts

Step 4: Monitor Quarterly, Not Daily

Review your portfolio quarterly rather than daily, focusing on contribution consistency rather than short-term market performance. Use review time to learn about investing concepts and gradually expand your knowledge.

The biggest mistake I see new passive investors make is checking their accounts too frequently. Daily market movements are noise – what matters is your long-term progress toward financial goals.

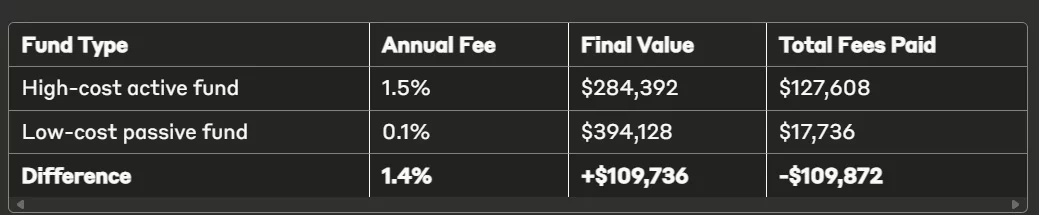

Why Investment Costs Matter More Than You Think 💸

Investment fees compound dramatically over long time periods, making cost minimization crucial for building wealth. Small differences in annual fees can result in hundreds of thousands of dollars over investment lifetimes.

The Real Cost of High Fees

Let me share a calculation that changed one client’s entire investment approach.

30-year comparison starting with $10,000 plus $200 monthly:

🎉 Bottom Line: $109,736 more wealth with passive investing

That single percentage point in fees cost this investor over $100,000 in retirement wealth. When I showed him this calculation, he moved his entire 401(k) to low-cost index funds the next day.

Passive strategies involve minimal buying and selling, reducing trading costs significantly. Many brokers now offer commission-free trading for ETFs and index funds, eliminating another barrier to getting started.

Setting Realistic Performance Expectations 📊

Passive investing aims to capture broad market returns rather than generating exceptional performance. Understanding historical data and normal market behavior helps maintain realistic expectations and prevents costly emotional decisions.

Historical Market Performance

The S&P 500 has averaged approximately 10% annual returns over the past century, though individual years vary dramatically. This includes reinvested dividends, which represent a substantial portion of total returns.

Key market statistics:

- Average annual return: ~10% (including dividends)

- Real return after inflation: ~7-8%

- Best year: +37.6% (1995)

- Worst year: -37.0% (2008)

- Positive return years: About 75% of all years

Understanding Normal Market Volatility

Markets go up and down regularly. This is completely normal, not a sign something is wrong.

What to Expect:

- Small drops (10%+ decline): Happen every 1-2 years

- Big drops (20%+ decline): Happen every 3-5 years

- Recovery time: Usually takes 6-18 months

- Long-term direction: Markets always recover and hit new highs

I learned about volatility firsthand during March 2020. The COVID crash was scary – markets dropped 30% in weeks. My active trading clients panicked and sold near the bottom. My passive investing clients who stayed put saw their accounts fully recover within six months. By year-end, they reached new highs.

🧘 Key Mindset: Volatility is the price you pay for long-term growth.

Asset Allocation Strategies for Different Life Stages 🎯

Successful passive investing requires appropriate asset allocation between stocks and bonds based on individual circumstances and investment timelines. Your allocation should evolve as you approach your financial goals.

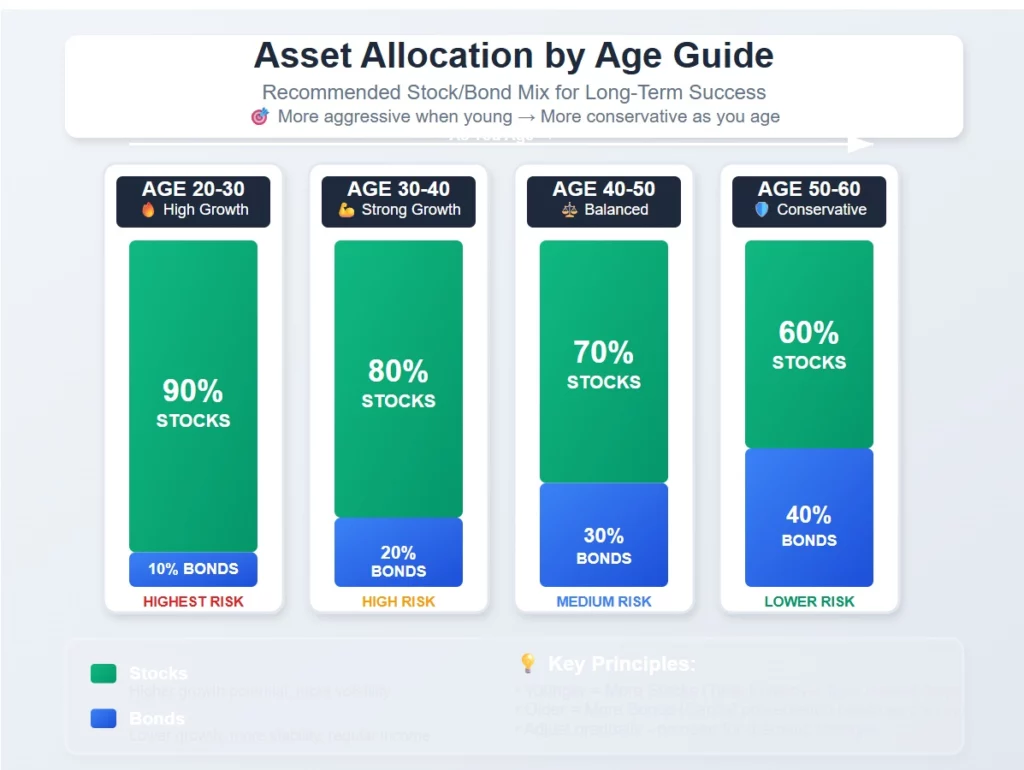

[See Infographic 2: Asset Allocation by Age Guide – displayed above showing recommended stock/bond allocations from age 20-60]

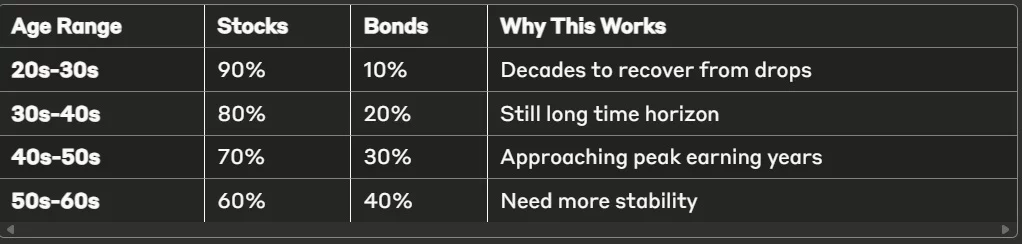

Age-Based Allocation Guidelines

Old rule: Hold your age in bonds (30-year-old = 30% bonds, 70% stocks)

New approach: More aggressive due to longer lifespans and low bond rates.

Your Personal Comfort Level

Age guidelines are just starting points. Your comfort with ups and downs should drive the final decision.

I learned this with a client who had the “perfect” 90/10 allocation for his age. But he couldn’t handle watching his account drop during 2018’s market decline. We adjusted to 70/30, and he’s been much more consistent with investing since then.

💡 Remember: The best allocation is one you can stick with during tough times.

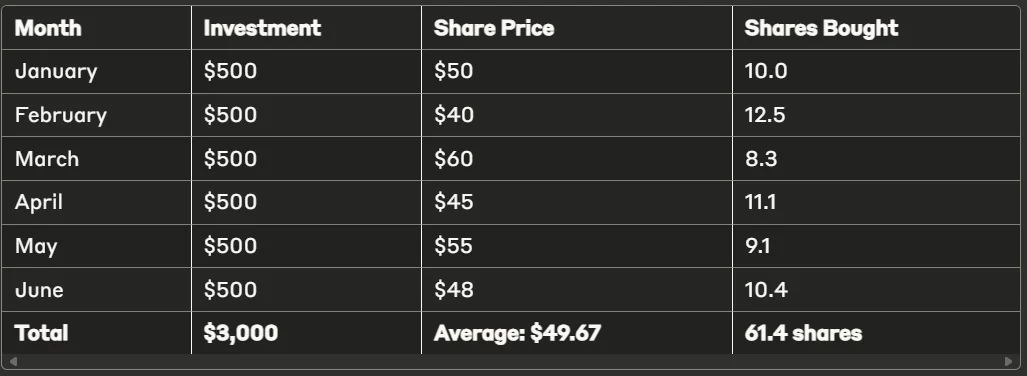

Dollar-Cost Averaging: Your Automatic Wealth Builder 🔄

Dollar-cost averaging represents one of the most powerful yet simple strategies for building wealth through passive investing. This approach involves investing fixed amounts at regular intervals regardless of market conditions.

How Dollar-Cost Averaging Eliminates Timing Risk

This strategy works through simple math. You buy more shares when prices are low and fewer shares when prices are high. No market timing required.

Real example over six months:

Average cost per share: $48.86

Even though the stock price bounced around dramatically, dollar-cost averaging gave a reasonable average purchase price. No timing decisions needed.

Since I started coaching in 2019, clients who automate achieve consistently better results. They never stop investing during scary market times – exactly when they should be buying more shares at lower prices.

Building Your First Passive Investment Portfolio 🏗️

Starting a passive investment portfolio requires selecting appropriate funds, determining allocation, and establishing systematic contribution schedules. Beginners should focus on simplicity rather than optimization when building their first portfolios.

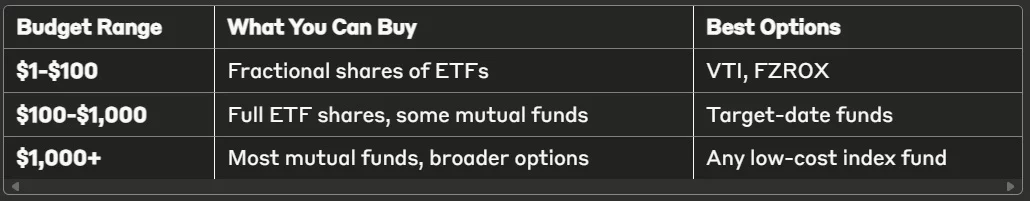

Getting Started by Budget

Complete Automation Setup

Set up automatic transfers from your bank account to your investment account on regular schedules. Then arrange automatic investment of transferred funds into your chosen index funds.

One client called automation “the best financial decision I never have to think about.” She’s been investing automatically for five years and her account has grown steadily without any active management on her part.

The most important step is actually starting rather than waiting for perfect market conditions or complete investment knowledge. Begin with whatever amount you can invest consistently and build your knowledge and contributions over time.

Video Recommendation from my Successful Tradings Youtube channel

Common Mistakes and How to Avoid Them ⚠️

Even simple passive investing strategies can be derailed by behavioral mistakes that reduce long-term returns.

The Frequent Tinkering Trap

Some investors constantly adjust their passive portfolios. This defeats the strategy’s hands-off purpose.

Real example: I worked with a client who changed his 401(k) allocation eight times in 2020. He always chased the previous quarter’s best performer. His returns lagged a simple target-date fund by over 4% that year due to poor timing decisions.

Performance Chasing Errors

Switching between funds based on recent performance often results in buying high and selling low. Yesterday’s winner rarely leads next year’s performance rankings.

💡 Key insight: Consistency beats chasing winners.

Market Timing Attempts

Trying to move in and out of markets based on predictions violates passive investing principles. Market timing requires being right twice: when to sell AND when to buy back. Even professional investors struggle with this.

The most successful passive investors focus on what they can control: costs, asset allocation, and contribution consistency. They ignore daily market noise while maintaining long-term perspective.

Frequently Asked Questions 🤔

How much money do I need to start passive investing?

You can begin passive investing with as little as $1 through fractional shares offered by many modern brokerages. The key is beginning with whatever amount you can invest consistently.

How often should I check my passive investment portfolio?

Passive investors should review their portfolios quarterly or annually rather than daily or weekly. Focus your reviews on contribution consistency and rebalancing needs rather than short-term performance fluctuations.

Should I invest everything at once or gradually over time?

Dollar-cost averaging through regular investments often provides better results than lump-sum investing for most individual investors. Systematic investing also provides psychological benefits by reducing timing anxiety.

What’s the difference between index funds and ETFs?

Both provide similar passive investment exposure, but ETFs trade throughout market hours while index funds price once daily. ETFs often have lower expense ratios and better tax efficiency, while index funds may offer easier automatic investing.

How do I know if passive investing is working?

Your portfolio should roughly match the performance of your chosen index funds minus expenses. Focus on process consistency rather than short-term performance comparisons.

Can I lose money with passive investing?

Yes, passive investing involves market risk and your portfolio value will fluctuate. However, long-term investors who stay committed have historically been rewarded despite short-term volatility.

Your Path to Financial Independence 🎯

Passive investing represents the most reliable path to long-term wealth building for most individual investors seeking financial independence. Throughout my journey since 2015 as a trader and six years coaching investors, I’ve witnessed countless people achieve their financial goals through simple, consistent passive strategies.

The beauty of passive investing lies in its simplicity and proven effectiveness over decades of market history. This approach allows you to benefit from overall market growth without requiring extensive financial expertise, constant portfolio monitoring, or perfect market timing abilities.

Key principles for passive investing success:

- 🌱 Start early to maximize compound growth

- 🔄 Invest consistently regardless of market conditions

- 💰 Keep costs low through index funds and ETFs

- 🤖 Automate everything to remove emotional decisions

- 🧘 Stay disciplined during market volatility

The strategy requires patience and long-term thinking, but the results speak for themselves through decades of superior performance compared to active investing attempts. Consider passive investing as your foundation for financial security and independence.

Start today with whatever amount you can invest consistently.

Let the power of compound growth, broad diversification, and low costs work for your financial future while you focus on other important aspects of your life.

👉 Next Step : Start Passive Investing with just $100

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/