I began trading in 2015 and started coaching in 2019. Social media transformed investment education completely. However, it also created dangerous misinformation that destroys portfolios. Therefore, this guide helps you separate legitimate advice from harmful content.

👉 In this guide, you will learn:

- 🚩 Major red flags that signal dangerous investment advice

- ✅ How to identify legitimate financial educators and tips

- 📱 Which platforms provide the most reliable investment content

- 🧠 Psychological tricks influencers use to manipulate followers

- 🔍 Fact-checking techniques for investment claims and strategies

- 💰 How to build wealth without falling for get-rich-quick schemes

- 🎯 Creating your own investment filter system for social content

Social media offers incredible investment education opportunities when used correctly. Unfortunately, it also enables scammers and incompetent advisors to reach millions. Additionally, the consequences of following bad advice can devastate your financial future.

Table of Contents

The Social Media Investment Revolution 📱

Social media democratized investment education in unprecedented ways. Previously, quality financial advice required expensive advisors or lengthy courses. Furthermore, investment strategies remained locked behind paywalls and professional barriers. Now, anyone can access world-class education instantly through their phone.

Positive changes social media created:

- 📚 Free access to high-quality investment education

- 🌍 Global perspectives from diverse financial experts

- ⚡ Real-time market analysis and breaking news

- 💡 Creative explanations that simplify complex concepts

- 🤝 Communities of like-minded investors sharing experiences

However, social media also unleashed serious problems for investors. Consequently, bad advice spreads faster than quality education. What’s more, entertainment often masquerades as legitimate financial guidance.

Serious risks that emerged:

- 🎭 Entertainers posing as qualified financial advisors

- 💸 Get-rich-quick schemes targeting desperate investors

- 📈 Pump-and-dump scams disguised as stock tips

- 🎰 Gambling mentality promoted as investment strategy

- 📊 Cherry-picked results that hide massive losses

Smart investors must learn to navigate this landscape carefully. Therefore, developing strong filtering skills becomes essential for protection.

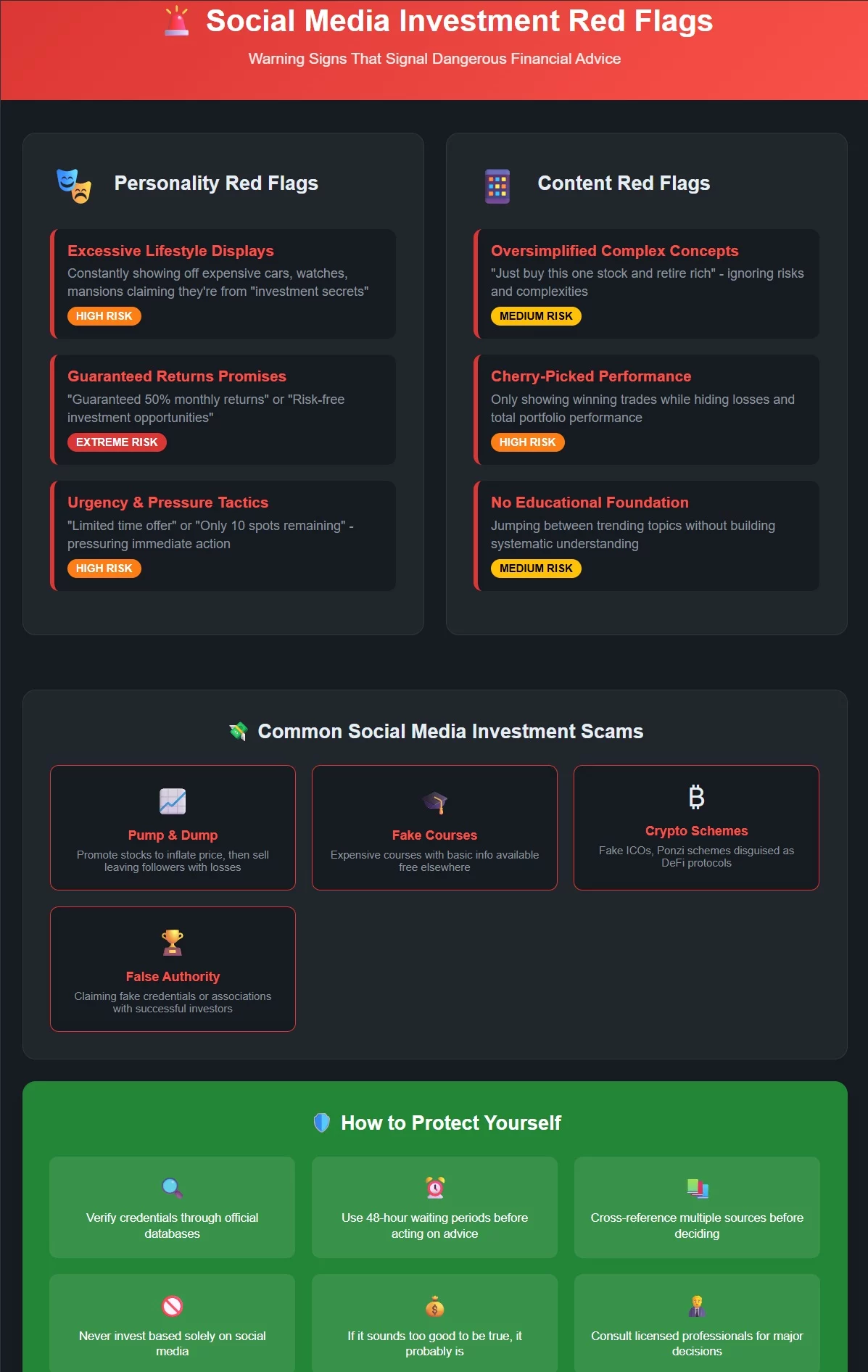

Major Red Flags in Social Media Investment Content 🚨

Certain warning signs consistently appear in dangerous investment content. Meanwhile, legitimate educators rarely exhibit these behaviors. Learning these red flags protects you from costly mistakes and financial disasters.

Personality-Based Red Flags

Excessive Lifestyle Displays Legitimate financial educators focus on education rather than lifestyle promotion. However, scammers constantly showcase expensive cars, watches, and mansions. Additionally, they claim these possessions result from their investment “secrets.”

Real educators understand that sustainable wealth building takes time. Therefore, they avoid flashy displays that suggest overnight success. Instead, they emphasize patience, discipline, and long-term thinking.

Guaranteed Returns Promises No legitimate investment professional guarantees specific returns. Furthermore, anyone promising guaranteed profits likely runs illegal schemes. What’s more, real markets involve uncertainty that makes guarantees impossible.

Watch for phrases like:

- “Guaranteed 50% monthly returns”

- “Risk-free investment opportunities”

- “Never lose money with this strategy”

- “100% success rate guaranteed”

Urgency and Pressure Tactics Scammers create artificial urgency to prevent careful consideration. Consequently, they use phrases like “limited time offer” or “only 10 spots remaining.” Additionally, they pressure followers to act immediately without research.

Legitimate educators encourage thorough research and patient decision-making. Plus, they never pressure followers into immediate financial commitments.

Content-Based Red Flags

Oversimplified Complex Concepts Real investing involves nuanced strategies that require careful explanation. However, scammers oversimplify everything into catchy soundbites. Furthermore, they ignore important risks and complexities.

Examples of dangerous oversimplification:

- “Just buy this one stock and retire rich”

- “Options trading is easy money for everyone”

- “Crypto always goes up in the long run”

- “Day trading beats index fund investing”

Cherry-Picked Performance Claims Fraudulent advisors show only their winning trades while hiding losses. Meanwhile, legitimate educators discuss both successes and failures honestly. Additionally, they explain how losses contribute to learning and improvement.

Real performance discussions include:

- Total portfolio returns, not just winners

- Risk-adjusted performance metrics

- Losses and mistakes alongside successes

- Long-term track records, not short-term wins

Lack of Educational Foundation Quality investment education builds understanding systematically. However, entertainment-focused content jumps between trending topics randomly. Furthermore, it lacks the foundational knowledge necessary for success.

Legitimate educators cover basics thoroughly before advancing to complex strategies. Plus, they ensure followers understand risks before discussing high-risk investments.

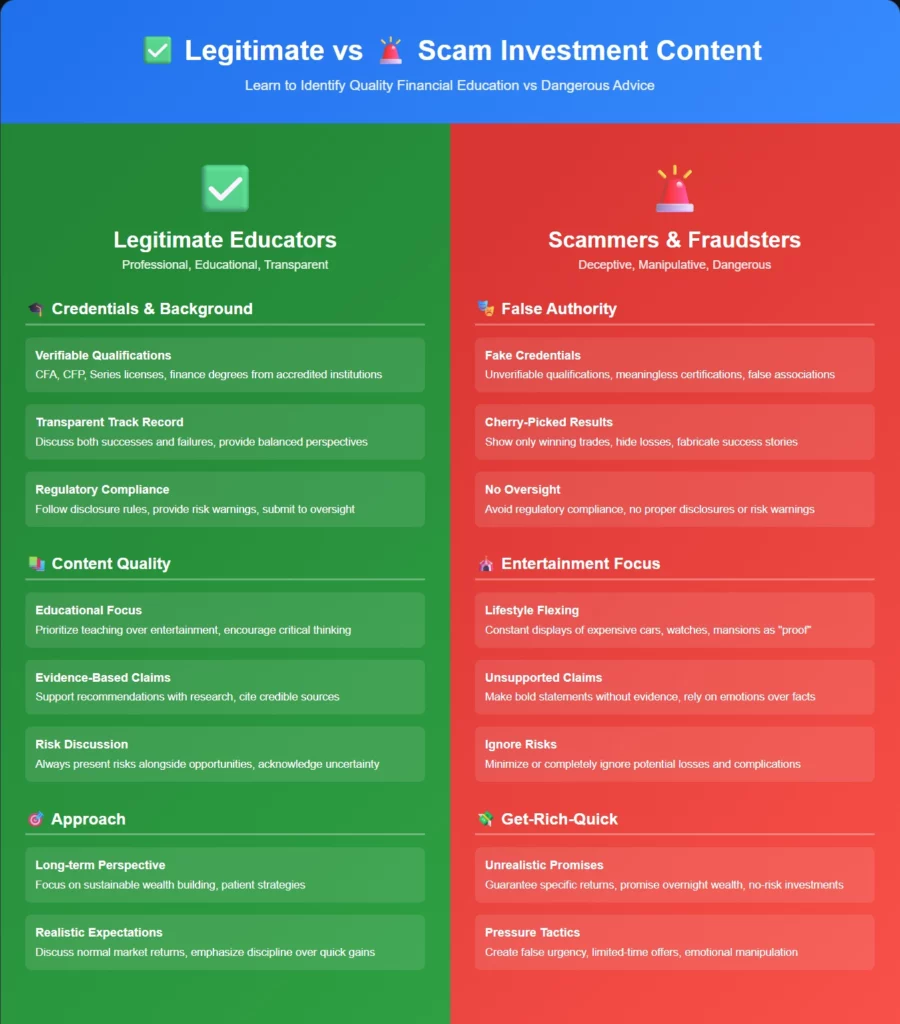

Identifying Legitimate Investment Educators ✅

Quality financial educators share certain characteristics that distinguish them from entertainers and scammers. Understanding these traits helps you find trustworthy sources for investment education.

Professional Credentials and Background

Relevant Qualifications Legitimate advisors typically hold recognized financial certifications. Furthermore, they openly discuss their educational background and professional experience. Additionally, they submit to regulatory oversight and disclosure requirements.

Look for credentials such as:

- CFA (Chartered Financial Analyst)

- CFP (Certified Financial Planner)

- Series 7, 66, or other FINRA licenses

- Academic degrees in finance or economics

Transparent Track Record Real professionals provide verifiable performance history when appropriate. However, they focus more on education than personal trading results. Moreover, they explain their investment philosophy clearly and consistently.

Quality educators also discuss their failures and learning experiences. Therefore, they present balanced perspectives on investing realities.

Regulatory Compliance Licensed professionals must follow strict disclosure rules. Consequently, they clearly state when content constitutes advertising or recommendations. Additionally, they provide required risk disclosures and disclaimers.

Unlicensed entertainers often ignore these requirements completely. Therefore, absence of proper disclosures signals potential problems.

Content Quality Indicators

Educational Focus Over Entertainment Legitimate educators prioritize teaching over viral content creation. Furthermore, they explain concepts thoroughly rather than chasing trending topics. What’s more, they encourage followers to think critically and ask questions.

Quality content characteristics:

- Detailed explanations of investment concepts

- Historical context and market analysis

- Risk discussion alongside opportunity presentation

- Encouragement of further research and learning

Consistent Investment Philosophy Real advisors maintain consistent investment approaches over time. However, entertainers frequently change strategies chasing whatever generates views. Additionally, legitimate educators explain their reasoning when adjusting strategies.

Consistency indicators include:

- Stable core investment principles

- Logical evolution of strategies over time

- Clear explanations for any major changes

- Alignment between stated philosophy and recommendations

Evidence-Based Recommendations Quality advisors support recommendations with research and analysis. Furthermore, they cite credible sources and explain their reasoning process. Additionally, they acknowledge uncertainty and alternative viewpoints.

Poor advisors make claims without supporting evidence. Therefore, they rely on emotions and hype rather than facts and analysis.

Platform-Specific Evaluation Guidelines 📊

Different social media platforms create different incentive structures for content creators. Understanding these dynamics helps you evaluate advice quality more effectively.

YouTube Investment Content

Advantages of YouTube Format Long-form video content allows detailed explanations and comprehensive analysis. Furthermore, creators can demonstrate concepts visually and build sustained arguments. Additionally, comment sections enable community discussion and feedback.

Quality YouTube educators often:

- Create educational series that build knowledge systematically

- Provide detailed analysis with supporting charts and data

- Engage thoughtfully with viewer questions and comments

- Maintain consistent upload schedules and content quality

YouTube Red Flags Clickbait titles and thumbnails often signal low-quality content. However, entertainment-focused creators prioritize views over education. Moreover, they frequently promote affiliate products aggressively.

Warning signs include:

- Extreme thumbnail images with money and arrows

- Titles promising unrealistic returns

- Heavy promotion of trading platforms or courses

- Comments disabled or heavily moderated

TikTok and Instagram Investment Content

Platform Limitations Short-form content severely limits educational depth. Therefore, complex investment concepts cannot receive adequate treatment. Furthermore, entertainment value often trumps educational accuracy.

Even quality creators struggle with these constraints. Consequently, TikTok and Instagram work better for inspiration than education.

Higher Risk of Misinformation Short videos encourage oversimplification of complex topics. Additionally, younger audiences may lack experience to evaluate advice quality. What’s more, viral algorithms reward sensational claims over accurate information.

Common problems include:

- Day trading promoted as easy money

- Crypto investments presented without risk discussion

- Complex options strategies oversimplified dangerously

- Tax implications ignored completely

Twitter Investment Discussion

Real-Time Market Commentary Twitter excels at providing immediate market reactions and news analysis. Furthermore, many legitimate professionals share insights through the platform. However, the character limit prevents detailed explanations.

Quality Twitter users often:

- Share market analysis with supporting links

- Engage in thoughtful discussions with other professionals

- Provide context for their commentary and opinions

- Maintain consistent quality across their tweet history

Echo Chamber Risks Twitter’s algorithm can create investment echo chambers. Consequently, users see primarily information that confirms existing beliefs. Additionally, group-think can reinforce dangerous investment behaviors.

Mitigate these risks by:

- Following diverse viewpoints and investment styles

- Seeking contradictory opinions and analysis

- Fact-checking claims through independent sources

- Avoiding investment decisions based solely on Twitter sentiment

Psychological Manipulation Techniques 🧠

Social media investment content often employs sophisticated psychological tricks to influence behavior. Understanding these techniques protects you from manipulation and poor decision-making.

Fear of Missing Out (FOMO)

How FOMO Gets Weaponized Content creators deliberately trigger FOMO to drive engagement and sales. Furthermore, they present limited-time opportunities that pressure immediate action. Additionally, they showcase others’ success to create jealousy and desperation.

FOMO manipulation tactics:

- Showing followers’ supposed massive gains

- Creating artificial scarcity around advice or products

- Emphasizing how much money viewers are “losing” by waiting

- Highlighting trending investments everyone else is supposedly buying

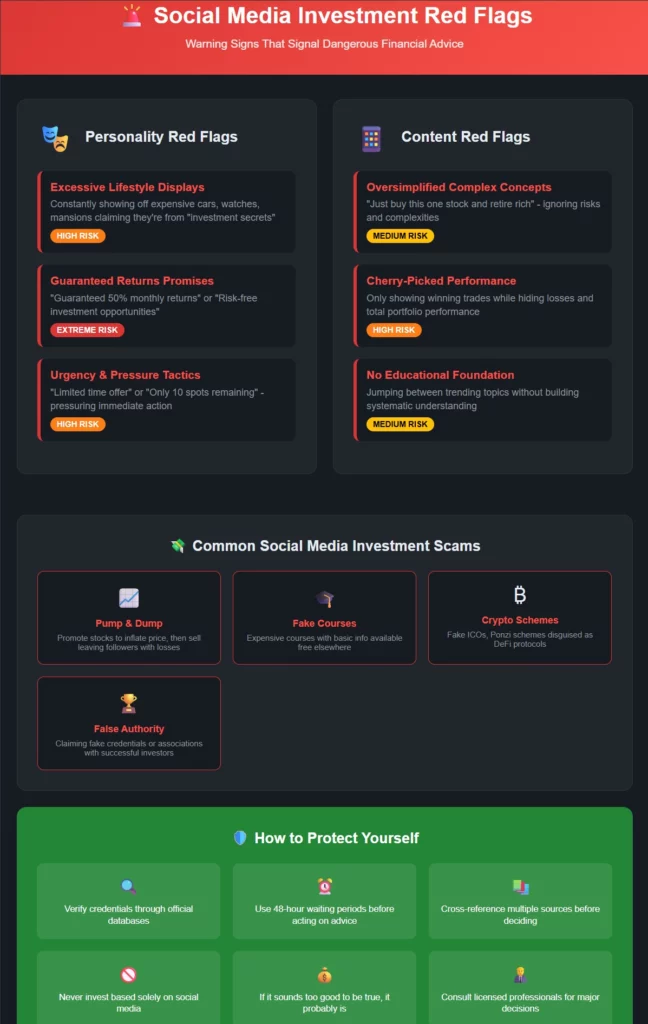

Protecting Yourself from FOMO Real investment opportunities rarely disappear overnight. Therefore, legitimate investments allow time for research and consideration. Moreover, sustainable wealth building follows patient, systematic approaches.

FOMO protection strategies:

- Never invest based on social media urgency

- Research any investment opportunity thoroughly

- Consult multiple sources before making decisions

- Remember that FOMO often signals overvalued markets

Social Proof Manipulation

Fake Success Stories Scammers frequently fabricate follower success stories to create social proof. However, these testimonials lack verification and often seem suspiciously similar. Furthermore, real success stories include specific details and realistic timelines.

Red flags in testimonials:

- Vague claims without specific details

- Unrealistic returns in short timeframes

- Professional-quality photos with amateur stories

- Similar language patterns across multiple testimonials

Manufactured Consensus Bad actors create false impressions of widespread agreement or success. Additionally, they use bots and fake accounts to amplify their message. What’s more, they suppress negative comments and criticism.

Verify social proof by:

- Checking commenter profiles for authenticity

- Looking for detailed, specific success stories

- Seeking independent verification of claims

- Noticing unusual comment patterns or language

Authority and Credibility Illusions

False Expertise Claims Many social media personalities claim expertise they do not possess. Furthermore, they use impressive-sounding titles and credentials that are meaningless. Additionally, they associate themselves with legitimate professionals to borrow credibility.

Research claimed credentials through:

- Official licensing body databases

- Professional association member directories

- Educational institution records

- Independent verification services

Association Marketing Scammers often claim relationships with successful investors or firms. However, these associations are usually exaggerated or completely fabricated. Moreover, legitimate professionals rarely endorse questionable schemes.

Verify claimed associations by:

- Checking directly with the mentioned parties

- Looking for official endorsements or partnerships

- Researching the claimed relationship history

- Asking for specific evidence of the association

Building Your Investment Content Filter System 🔍

Creating systematic approaches to evaluate investment content protects you from misinformation while maximizing learning opportunities.

The Three-Layer Verification Process

Layer 1: Source Credibility Check Always research content creators before considering their advice. Furthermore, verify their claimed credentials and professional background. Additionally, examine their content history for consistency and quality.

Source evaluation checklist:

- Professional credentials and licensing status

- Educational background and work experience

- Regulatory compliance and disclosure practices

- Content quality and consistency over time

Layer 2: Content Quality Analysis Evaluate individual pieces of content using objective criteria. However, focus on educational value rather than entertainment appeal. Moreover, consider whether claims are supported by evidence and research.

Content quality indicators:

- Detailed explanations with supporting evidence

- Balanced presentation of risks and opportunities

- Acknowledgment of uncertainty and complexity

- Encouragement of additional research

Layer 3: Cross-Reference Verification Never rely on single sources for important investment decisions. Instead, seek multiple perspectives on any investment strategy or opportunity. Additionally, consult traditional financial resources and professionals.

Verification sources include:

- Multiple independent social media educators

- Traditional financial publications and websites

- Academic research and professional studies

- Licensed financial advisors and consultants

Creating Personal Investment Guidelines

Establish Clear Boundaries Define specific rules for how you will use social media investment content. Furthermore, decide in advance which types of advice you will consider versus ignore. Additionally, set limits on how much influence social media will have on your decisions.

Recommended boundaries:

- Never make investment decisions based solely on social media

- Require 48-hour waiting periods before acting on advice

- Limit social media influence to education and inspiration

- Maintain diversified information sources beyond social platforms

Develop Decision-Making Protocols Create systematic processes for evaluating investment opportunities discovered through social media. However, ensure these processes include traditional research methods and professional consultation. Moreover, document your reasoning to learn from both successes and mistakes.

Decision protocol steps:

- Initial social media discovery and interest

- Independent research using multiple sources

- Professional consultation when appropriate

- Final decision based on comprehensive analysis

Video Recommendation 🎥

🎬 For practical guidance on evaluating investment content, watch my Successful Tradings video about identifying credible financial information sources. The video demonstrates red flag recognition techniques using real examples. Furthermore, it shows how to verify claims and credentials effectively.

Watch it here: https://www.youtube.com/@SuccessfulTradings and search for “How to Spot Investment Scams on Social Media.”

You will learn specific techniques that protect you from misinformation while maximizing learning from legitimate educators.

Common Social Media Investment Scams 💸

Understanding prevalent scam types helps you recognize and avoid them. Additionally, scammers continuously evolve their tactics to stay ahead of awareness efforts.

Pump and Dump Schemes

How They Operate Scammers accumulate positions in low-priced stocks before promoting them heavily. Subsequently, they encourage followers to buy while they sell their holdings. Finally, prices collapse when the promotion ends, leaving followers with worthless investments.

Social media makes these schemes easier to execute and harder to detect. Furthermore, micro-influencers can coordinate to amplify the effect. Additionally, automated accounts can create false buzz around targeted securities.

Protection Strategies Avoid stocks promoted heavily on social media without fundamental justification. Moreover, research any investment thoroughly before committing money. What’s more, be especially cautious of penny stocks and cryptocurrency projects.

Fake Trading Course Scams

Common Characteristics Scammers promise to teach “secret” trading strategies for large upfront fees. However, the courses contain basic information available for free elsewhere. Furthermore, many focus on high-risk strategies inappropriate for beginners.

Warning signs include:

- Unrealistic Return On Investment (ROI) promises from course completion

- High-pressure sales tactics and false scarcity

- Lack of detailed curriculum information

- No refund policies or money-back guarantees

Better Education Alternatives Many legitimate organizations offer quality investment education at reasonable costs. Additionally, numerous free resources provide excellent foundational knowledge. Therefore, expensive social media courses rarely justify their cost.

Quality education sources:

- University extension programs and MOOCs

- Professional financial organization courses

- Established online learning platforms

- Books by recognized investment experts

Cryptocurrency Investment Schemes

Proliferation of Crypto Scams Cryptocurrency’s complexity and volatility create opportunities for scammers. Furthermore, regulatory uncertainty makes prosecution difficult. Additionally, young investors often lack experience to evaluate crypto investment claims.

Common crypto scam types:

- Fake initial coin offerings (ICOs)

- Ponzi schemes disguised as DeFi protocols

- Celebrity endorsement scams

- Fake exchange platforms

Crypto Due Diligence Research any cryptocurrency project thoroughly before investing. Moreover, verify team members and technical claims independently. Additionally, understand that most crypto projects fail regardless of their initial promise.

Essential crypto research steps:

- Verify team credentials and project history

- Read technical documentation and code audits

- Check regulatory compliance status

- Understand the specific use case and competition

FAQs 🤔

How can I tell if social media investment advice is legitimate? Check the creator’s credentials, look for balanced risk discussions, and verify claims through independent sources. Avoid anyone promising guaranteed returns.

Are there any trustworthy investment influencers? Yes, but focus on licensed professionals who provide educational content rather than specific investment recommendations. Always verify credentials independently.

Should I ever make investment decisions based on social media? Use social media for education and inspiration only. Always conduct thorough independent research before making any investment decisions.

What are the biggest red flags in investment content? Guaranteed returns, lifestyle flexing, urgency tactics, oversimplified complex topics, and lack of risk discussions are major warning signs.

How do I fact-check investment claims I see online? Cross-reference multiple sources, check official regulatory filings, consult professional databases, and seek opinions from licensed advisors.

Can social media help me learn about investing? Absolutely, when used correctly. Follow credentialed educators who focus on teaching rather than selling, and always supplement with traditional learning resources.

What should I do if I suspect investment fraud? Report suspected fraud to the SEC, FINRA, or your state’s securities regulator. Additionally, warn others and document evidence of fraudulent claims.

How can I protect myself from FOMO-driven investment mistakes? Establish clear investment criteria in advance, use waiting periods before making decisions, and remember that real opportunities rarely require immediate action.

Conclusion

Social media offers incredible investment education opportunities alongside serious risks of misinformation and fraud. Therefore, developing strong filtering skills becomes essential for modern investors. Furthermore, the ability to distinguish legitimate advice from entertainment or scams protects your financial future.

Quality investment education emphasizes patience, research, and risk management over quick profits. Additionally, legitimate educators encourage critical thinking rather than blind following. Finally, remember that sustainable wealth building requires time, discipline, and continuous learning from credible sources.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/