I began trading in 2015 and started coaching in 2019. Remote work transformed my investment approach completely.

Furthermore, geographic flexibility opens investment opportunities that traditional workers never consider.

Therefore, this guide explains how location independence creates wealth-building advantages and tax optimization strategies.

👉 In this guide, you will learn:

- 📍 How geographic arbitrage amplifies your investment contributions dramatically

- 🏛️ Which states offer the best tax advantages for remote investors

- 💰 Where cost-of-living differences create surplus capital for investing

- 🧾 How to structure accounts across multiple states legally and efficiently

- 🌐 Which international opportunities become accessible through remote work

- 📱 How digital nomad lifestyles affect investment strategy and asset allocation

- 🎯 How to build a location-independent portfolio that travels with you

Remote work creates investment superpowers when you optimize location strategically.

Therefore, I wrote this guide to help you maximize these geographic advantages.

Because flexibility equals opportunity, your investment strategy should evolve with your mobility.

Table of Contents

Remote Work Creates Investment Superpowers 💪

Remote work delivers three massive investment advantages that traditional workers cannot access easily.

First, geographic arbitrage lets you earn big-city wages while living in low-cost areas.

Moreover, state tax optimization can save thousands annually on investment income.

Finally, location flexibility creates opportunities for international investing and currency diversification.

Key advantages that boost investment capacity:

- 💵 Cost savings become automatic investment contributions without lifestyle changes

- 🏛️ Tax-friendly state residency maximizes after-tax investment returns significantly

- 🌍 International living expands asset allocation options beyond domestic markets

- ⏰ Time zone flexibility enables global market access during optimal hours

- 🏠 Housing cost reductions free up 20-40% more capital for investing

Therefore, remote workers who plan strategically can accelerate wealth building by decades.

However, you must structure these advantages correctly to avoid tax complications and maximize benefits.

The Power of Geographic Arbitrage in 2025 📈

Geographic arbitrage means earning income from expensive locations while living in affordable areas.

Consequently, your purchasing power increases dramatically without changing your income.

Furthermore, the savings difference can fund investment accounts that traditional workers struggle to fill.

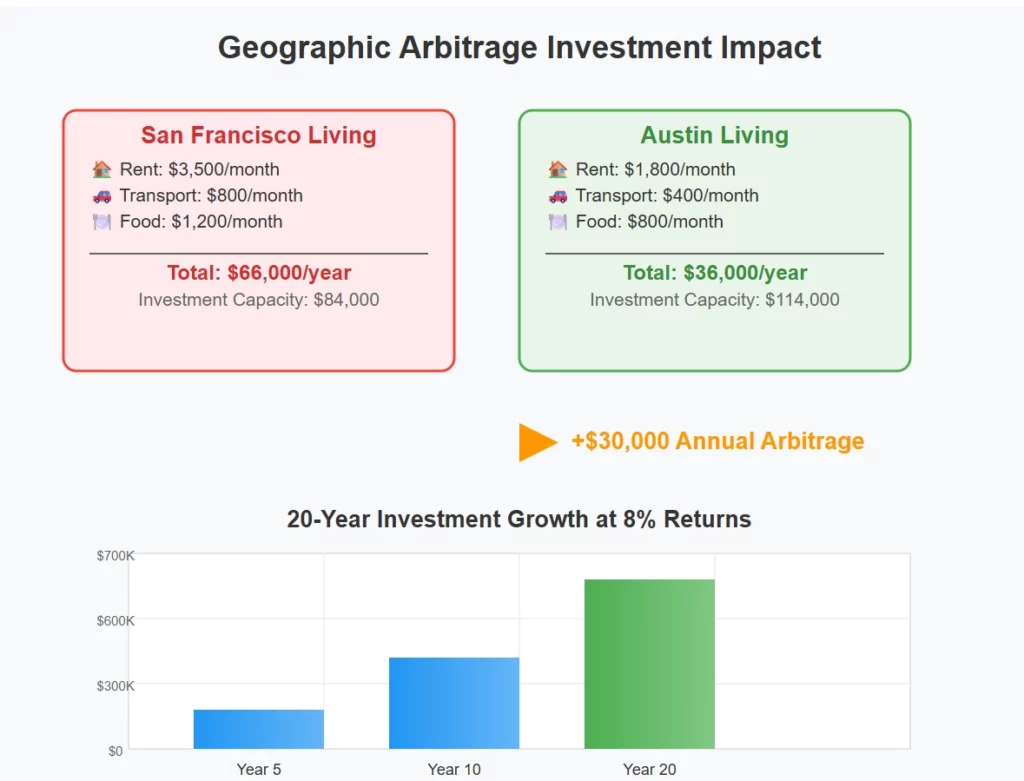

San Francisco vs. Austin Example 🏙️

Consider a software engineer earning $150,000 remotely from San Francisco while living in Austin:

San Francisco Living Costs:

- 🏠 Rent: $3,500/month ($42,000 annually)

- 🚗 Transportation: $800/month ($9,600 annually)

- 🍽️ Food/Entertainment: $1,200/month ($14,400 annually)

- Total Annual Costs: $66,000

Austin Living Costs:

- 🏠 Rent: $1,800/month ($21,600 annually)

- 🚗 Transportation: $400/month ($4,800 annually)

- 🍽️ Food/Entertainment: $800/month ($9,600 annually)

- Total Annual Costs: $36,000

Annual Investment Surplus: $30,000 🎯

Moreover, this $30,000 difference invested at 8% annual returns grows to $680,000 over twenty years. Additionally, compound interest turns geographic arbitrage into massive wealth creation automatically.

Emerging Arbitrage Opportunities 🌟

Tier 2 Cities with Big-City Access:

- 📍 Raleigh, NC (Tech hub wages, 40% lower costs)

- 📍 Nashville, TN (No state income tax, growing economy)

- 📍 Tampa, FL (No state income tax, coastal lifestyle)

- 📍 Phoenix, AZ (Lower costs, Southwest convenience)

International Arbitrage Options:

- 🌎 Mexico City (80% cost reduction, similar time zone)

- 🌎 Lisbon, Portugal (70% cost reduction, EU access)

- 🌎 Bangkok, Thailand (85% cost reduction, modern infrastructure)

- 🌎 Buenos Aires, Argentina (90% cost reduction, Western culture)

Therefore, location flexibility multiplies investment capacity beyond traditional salary increases.

![Geographic Arbitrage Investment Impact Infographic]

Infographic showing cost savings from major cities to remote-friendly locations with investment potential calculations

State Tax Optimization for Remote Investors 🏛️

State taxes dramatically impact investment returns over decades. Therefore, choosing your tax residency strategically can save tens of thousands annually. Moreover, remote work enables residency in tax-friendly states without career limitations.

Zero State Income Tax Champions 🏆

Florida 🌴

- ✅ No state income tax on wages or investment gains

- ✅ No inheritance tax or estate tax burden

- ✅ Strong asset protection laws for investors

- ✅ Year-round living climate and infrastructure

Texas 🤠

- ✅ No state income tax on any income sources

- ✅ Business-friendly environment for side hustles

- ✅ Major metropolitan areas with coworking spaces

- ✅ Central time zone convenient for both coasts

Tennessee 🎵

- ✅ No state income tax on wages or most investments

- ✅ Low property taxes in many counties

- ✅ Growing tech scene in Nashville and Memphis

- ✅ Reasonable cost of living with cultural amenities

Nevada 🎰

- ✅ No state income tax and business-friendly policies

- ✅ No corporate income tax for side businesses

- ✅ Las Vegas and Reno offer urban amenities

- ✅ Western location with California market access

High-Tax States to Avoid ❌

California (13.3% top rate)

- 💸 Highest state income tax in the nation

- 💸 Additional taxes on stock options and capital gains

- 💸 Complex residency rules that trap former residents

New York (10.9% top rate)

- 💸 High state and local income taxes combined

- 💸 New York City adds additional tax burden

- 💸 Aggressive auditing of residency claims

New Jersey (10.75% top rate)

- 💸 High taxes on investment income specifically

- 💸 Estate taxes that affect inheritance planning

- 💸 Limited geographic arbitrage opportunities

Annual Tax Savings Example 💰

Remote worker earning $120,000 with $20,000 investment income:

- 🏛️ California Tax Bill: $8,500 annually

- 🏛️ Florida Tax Bill: $0 annually

- 💰 Annual Savings: $8,500

Furthermore, this $8,500 savings invested annually at 8% returns becomes $193,000 over twenty years. Additionally, compound growth makes tax optimization incredibly powerful for wealth building.

Building Your Remote Investment Infrastructure 🛠️

Remote investors need specialized account structures that optimize taxes while maintaining flexibility. Therefore, your investment infrastructure must work across state lines and international borders seamlessly.

Essential Account Types 📊

Tax-Advantaged Accounts (Priority #1):

- 🏦 401(k) or Solo 401(k) for high contribution limits

- 🏦 Roth IRA for tax-free growth and flexibility

- 🏦 HSA for triple tax advantage when available

- 🏦 SEP-IRA if you have freelance income

Taxable Investment Accounts:

- 🏦 Primary brokerage account in tax-friendly state

- 🏦 International brokerage for global diversification

- 🏦 High-yield savings for emergency fund and cash buffer

- 🏦 Business account if location enables side hustles

Account Domicile Strategy 🏠

Choose Your Primary State Carefully:

- 📍 Establish residency in zero-tax state before large investments vest

- 📍 Use that state address for all investment accounts

- 📍 Maintain clear documentation of residency for tax purposes

- 📍 Understand residency rules to avoid dual-state taxation

International Account Considerations:

- 🌐 Research FATCA reporting requirements for US citizens abroad

- 🌐 Consider international brokerages for currency diversification

- 🌐 Understand tax treaty benefits between countries

- 🌐 Plan for repatriation of funds when returning to US

Geographic Arbitrage Investment Strategies 💡

Location independence creates unique investment opportunities that stationary workers cannot access. Therefore, your asset allocation should reflect this geographic flexibility and take advantage of global markets.

The Remote Worker Portfolio Mix 📈

Core Holdings (60-70%):

- 📊 US Total Stock Market Index (40%)

- 📊 International Developed Markets (15%)

- 📊 Emerging Markets (5%)

- 📊 US Bond Market Index (10-20%)

Geographic Opportunity Sleeve (20-30%):

- 🌍 Currency-hedged international funds for stability

- 🌍 Regional ETFs for areas where you might live

- 🌍 Commodity funds for inflation protection across borders

- 🌍 International real estate ETFs for global property exposure

Location-Specific Investments (10-20%):

- 🏠 Local real estate where you establish residency

- 🏠 REITs focused on remote-work friendly cities

- 🏠 International property through crowdfunding platforms

- 🏠 Cryptocurrency for borderless value storage

Currency Diversification Strategy 💱

Remote workers should diversify currency exposure strategically:

Low Currency Risk Approach:

- 💵 Keep 70-80% in USD-denominated assets

- 💵 Use currency-hedged international funds

- 💵 Maintain USD emergency fund regardless of location

Moderate Currency Risk Approach:

- 💵 Split 60% USD, 25% EUR, 10% other currencies

- 💵 Hold unhedged international funds for currency upside

- 💵 Keep emergency funds in multiple currencies

High Currency Risk Approach:

- 💵 Diversify equally across major currencies

- 💵 Invest directly in foreign markets where you live

- 💵 Use cryptocurrency for borderless transactions

Cost-of-Living Arbitrage Calculator 🧮

Understanding your savings potential helps optimize investment contributions. Therefore, calculate your geographic arbitrage benefit before making location decisions.

Monthly Expense Categories 📊

Housing (Biggest Impact):

- 🏠 Research rent prices in target locations

- 🏠 Factor in utilities, internet, and workspace costs

- 🏠 Consider short-term rental premiums for flexibility

- 🏠 Calculate property tax differences for home buyers

Transportation:

- 🚗 Compare car ownership versus public transit costs

- 🚗 Factor in gas prices and insurance variations

- 🚗 Consider international transportation needs

- 🚗 Calculate ride-sharing costs in different cities

Food and Entertainment:

- 🍽️ Research restaurant and grocery price differences

- 🍽️ Factor in cultural entertainment costs

- 🍽️ Consider international food cost variations

- 🍽️ Calculate membership and subscription differences

Healthcare:

- 🏥 Compare health insurance costs across states

- 🏥 Research international health insurance needs

- 🏥 Factor in prescription drug price variations

- 🏥 Consider dental and vision care costs

![Cost of Living vs Investment Potential Chart]

Infographic showing investment potential from cost savings in major remote-work destinations

International Investment Opportunities 🌏

Remote work enables access to international markets and opportunities that domestic workers rarely consider. Furthermore, living abroad provides firsthand market knowledge and currency diversification benefits.

Direct International Investing 📈

European Markets:

- 🇪🇺 Access to Euro-denominated assets through local brokerages

- 🇪🇺 Real estate investment in growing tech hubs

- 🇪🇺 Currency diversification through direct Euro exposure

- 🇪🇺 Tax-efficient European fund structures

Asian Markets:

- 🇸🇬 Singapore as gateway to Asian growth markets

- 🇸🇬 Access to emerging market opportunities unavailable in US

- 🇸🇬 Technology and manufacturing sector exposure

- 🇸🇬 Currency diversification across Asian currencies

Latin American Markets:

- 🇲🇽 Real estate opportunities in expat-friendly cities

- 🇲🇽 Currency arbitrage opportunities during volatility

- 🇲🇽 Commodity exposure through regional investments

- 🇲🇽 Lower correlation with US market cycles

Tax-Efficient International Structures 🏛️

Foreign Earned Income Exclusion:

- ✅ Exclude up to $112,000 of foreign income from US taxes

- ✅ Requires physical presence test or bona fide residence

- ✅ Creates massive tax savings for high-earning remote workers

- ✅ Stacks with geographic arbitrage for compound benefits

Tax Treaty Benefits:

- ✅ Avoid double taxation through treaty provisions

- ✅ Reduced withholding taxes on investment income

- ✅ Social security treaty benefits for long-term residents

- ✅ Estate tax benefits for international assets

Technology Tools for Remote Investors 📱

Modern technology enables sophisticated investment management from anywhere globally. Therefore, your tech stack should support seamless investing regardless of location or time zone.

Essential Investment Apps 📲

Portfolio Management:

- 📱 Personal Capital for comprehensive tracking across accounts

- 📱 Mint for budgeting and expense categorization

- 📱 YNAB for zero-based budgeting discipline

- 📱 Tiller for spreadsheet-based expense tracking

Trading Platforms:

- 📱 Fidelity for commission-free trades and international access

- 📱 Charles Schwab for global ATM access and banking

- 📱 Interactive Brokers for international market access

- 📱 Vanguard for low-cost index fund investing

Currency and International:

- 📱 Wise (formerly TransferWise) for international transfers

- 📱 XE Currency for real-time exchange rate monitoring

- 📱 Revolut for multi-currency banking and spending

- 📱 CurrencyFair for large international transfers

VPN Considerations for Investing 🔒

Why VPNs Matter:

- 🛡️ Some brokerages restrict access from certain countries

- 🛡️ Protect financial data on public WiFi networks

- 🛡️ Access US-based financial services while traveling

- 🛡️ Maintain consistent login patterns for security

Best Practices:

- 🛡️ Always connect to your home country server for banking

- 🛡️ Use premium VPN services with banking-grade encryption

- 🛡️ Notify brokerages of travel plans in advance

- 🛡️ Keep backup internet connections for trading access

Building Passive Income Streams 💰

Remote work creates opportunities for location-independent passive income that traditional workers cannot pursue easily. Therefore, diversifying income sources accelerates investment contributions and provides geographic flexibility insurance.

Digital Asset Creation 💻

Online Course Development:

- 🎓 Create courses about your professional expertise

- 🎓 Use platforms like Teachable or Thinkific

- 🎓 Generate recurring revenue from anywhere globally

- 🎓 Scale income without geographic limitations

Digital Product Sales:

- 💾 Develop software tools for your industry

- 💾 Create templates and resources for professionals

- 💾 Build email lists for recurring product launches

- 💾 Automate fulfillment and customer service

Content Monetization:

- ✍️ Start a blog about remote work and investing

- ✍️ Create YouTube content about geographic arbitrage

- ✍️ Develop podcasts for global remote worker audience

- ✍️ Build affiliate income from location-independent products

Investment-Based Passive Income 📊

Dividend-Focused Strategies:

- 💰 Build laddered CD portfolios in high-yield states

- 💰 Focus on international dividend-paying stocks

- 💰 Create REIT portfolios for global real estate exposure

- 💰 Use covered call strategies for enhanced income

Alternative Investment Platforms:

- 🏠 Real estate crowdfunding for geographic diversification

- 🏠 Peer-to-peer lending platforms for yield enhancement

- 🏠 Art and collectibles for inflation protection

- 🏠 Business lending platforms for higher yields

Tax Filing Complexities for Remote Investors 📋

Remote work investing creates tax complications that require careful planning and professional guidance. Therefore, understanding these complexities prevents costly mistakes and audit triggers.

Multi-State Tax Issues 🏛️

Residency Determination:

- 📍 Days-present test varies by state significantly

- 📍 Permanent home location affects tax liability

- 📍 Voter registration and driver’s license matter

- 📍 Professional connections tie you to states

Investment Income Sourcing:

- 💰 Where dividends get taxed depends on residency

- 💰 Capital gains taxation follows residence rules

- 💰 Business income may create tax nexus issues

- 💰 Retirement account distributions follow federal rules

International Tax Complications 🌍

FATCA Reporting Requirements:

- 📋 Foreign bank accounts over $10,000 require reporting

- 📋 Foreign investment accounts trigger FBAR filing

- 📋 Form 8938 required for significant foreign assets

- 📋 Penalties for non-compliance are severe

Tax Treaty Navigation:

- 📋 Each country has different treaty provisions

- 📋 Withholding tax rates vary significantly

- 📋 Social security taxation depends on treaties

- 📋 Estate tax implications affect inheritance planning

Video Recommendation 🎥

🎬 For a practical walkthrough of investment strategies, watch my Successful Tradings video about building wealth with systematic investing approaches. It explains how consistent contributions and strategic asset allocation compound over time.

For a detailed guide on determining the right asset allocation based on your age and risk tolerance, s

ee our asset allocation guide for passive investors.

The video demonstrates portfolio construction techniques that work perfectly for remote workers seeking geographic arbitrage benefits.

Watch it here: https://www.youtube.com/@SuccessfulTradings and search for “Building Wealth with Dollar Cost Averaging.”

You will see how regular investing combined with location optimization accelerates wealth building significantly.

Risk Management for Remote Investors ⚠️

Geographic flexibility creates investment advantages but also introduces unique risks that traditional workers avoid. Therefore, your risk management strategy must account for location changes and international complications.

Currency Risk Management 💱

Emergency Fund Considerations:

- 💰 Maintain emergency funds in multiple currencies

- 💰 Keep 6-12 months expenses in local currency

- 💰 Hold USD for international travel and emergencies

- 💰 Consider precious metals for currency collapse protection

Investment Portfolio Protection:

- 🛡️ Use currency-hedged funds for stability

- 🛡️ Limit single-currency exposure to 60% maximum

- 🛡️ Rebalance currency exposure quarterly

- 🛡️ Monitor exchange rate trends affecting major holdings

Political and Economic Risk 🏛️

Country Risk Factors:

- ⚖️ Political stability affects investment security

- ⚖️ Economic policies impact currency values

- ⚖️ Banking regulations may restrict account access

- ⚖️ Tax law changes can affect residency benefits

Mitigation Strategies:

- 🛡️ Diversify across multiple countries and currencies

- 🛡️ Maintain accounts in stable financial jurisdictions

- 🛡️ Keep important documents in cloud storage

- 🛡️ Establish backup residency options in advance

Planning Your Remote Investment Timeline 📅

Successful remote work investing requires strategic planning across multiple time horizons. Therefore, your timeline should coordinate location changes with investment goals and tax optimization opportunities.

Year One: Foundation Building 🏗️

Months 1-3: Setup Phase

- ✅ Establish residency in tax-friendly state

- ✅ Open investment accounts with new address

- ✅ Research cost-of-living arbitrage opportunities

- ✅ Calculate potential investment surplus from location change

Months 4-6: Implementation Phase

- ✅ Begin systematic investment contributions from cost savings

- ✅ Optimize asset allocation for international exposure

- ✅ Set up automated investing systems

- ✅ Track actual versus projected arbitrage benefits

Months 7-12: Optimization Phase

- ✅ Fine-tune location for maximum arbitrage benefit

- ✅ Establish international banking relationships if needed

- ✅ Optimize tax withholding for new state residency

- ✅ Plan next year’s location and investment strategy

Years 2-5: Acceleration Phase 🚀

Investment Growth Focus:

- 📈 Maximize contributions from geographic arbitrage savings

- 📈 Add international diversification as portfolio grows

- 📈 Consider alternative investments with larger balance

- 📈 Optimize asset location across account types

Location Optimization:

- 🌍 Experiment with international living for FEIE benefits

- 🌍 Test different time zones for market access

- 🌍 Build network in multiple geographic locations

- 🌍 Establish backup plans for political or economic changes

Years 5+: Sophistication Phase 💎

Advanced Strategies:

- 🎯 International real estate investment opportunities

- 🎯 Currency carry trade strategies with larger portfolio

- 🎯 Direct investment in foreign markets and businesses

- 🎯 Estate planning across multiple jurisdictions

FAQs 🤔

Can I claim residency in a tax-free state while traveling internationally? Yes, but you must meet domicile requirements like voter registration, driver’s license, and permanent address. Moreover, maintain clear documentation of your primary residence and spending patterns to support residency claims.

How much should I save through geographic arbitrage before investing? Start investing immediately with any savings rather than waiting. Furthermore, even $500 monthly from arbitrage compounds significantly over decades. Therefore, automate investments from your first month of savings.

Which international markets offer the best opportunities for remote workers? Focus on developed markets initially through broad international index funds. Subsequently, consider emerging markets where you have personal experience or plan to live long-term.

How do I handle taxes when living in multiple countries annually? Consult a tax professional specializing in expatriate taxation immediately. Moreover, track days spent in each country carefully and understand tax treaty implications before investing internationally.

Should I use a VPN when accessing investment accounts while traveling? Use VPNs for security but connect to your home country server. Additionally, notify brokerages of travel plans in advance to avoid account restrictions or security holds.

What happens to my state tax residency if I become a digital nomad? Maintain a primary domicile in your chosen state through voting, banking, and official documents. Furthermore, avoid creating tax nexus in high-tax states through extended stays or business activities.

How much currency exposure should remote workers have? Start with 20-30% non-USD exposure and increase based on living locations. Moreover, emergency funds should match your spending currency needs regardless of investment portfolio allocation.

Can I open investment accounts while living abroad? US citizens can usually maintain existing accounts but opening new accounts abroad may be restricted. Therefore, establish all necessary accounts before leaving the US for extended periods.

How do I optimize retirement account contributions while remote? Maximize 401(k) contributions first, then Roth IRA, then taxable accounts. Furthermore, consider Solo 401(k) if you have freelance income for higher contribution limits.

Conclusion 🎯

Remote work investing transforms geographic flexibility into wealth-building superpowers through strategic arbitrage and tax optimization. Therefore, choose tax-friendly residency, maximize cost-of-living differences, and diversify globally to accelerate investment growth. Moreover, automate contributions from arbitrage savings and maintain currency diversification for location independence.

Finally, plan systematically across multiple time horizons while managing international risks and tax complexities through professional guidance when needed.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/