I began trading in 2015 and started coaching in 2019. During countless sessions, beginners asked whether one hundred dollars truly matters. Fortunately, it does, because compounding rewards consistency more than raw size alone.

Moreover, starting small builds habits that outlast fear, headlines, and temporary luck.

Today, I will show you a clean plan beginning with exactly one hundred dollars.

You will see steps, visuals, and checkpoints that keep everything simple and encouraging.

👉 In this guide, you will learn:

- 📖 What passive investing means when beginning with only one hundred dollars

- ⚙️ How to open the right account and automate contributions quickly

- 💸 Which funds match beginners and why tiny fees matter dramatically

- 📈 How one hundred monthly grows over time using dollar cost averaging

- 🛡️ Mistakes to avoid so your first dollars never lose their purpose

Passive investing is not laziness. Instead, it means building a system that works while you sleep.

Automation moves money on schedule and removes unhelpful hesitation.

Diversification spreads risk across many companies and industries efficiently.

Additionally, low expenses keep more gains compounding quietly for you. Consequently, the process feels boring in the best possible way.

After this guide, you will know exactly what to do this week.

You will also know how to stay disciplined when headlines shout otherwise. Confidence grows when actions stay consistent.

Table of Contents

Why one hundred dollars actually works

🎯 Starting with one hundred dollars feels tiny, yet momentum matters greatly. Moreover, momentum builds confidence quickly because actions become habits worth repeating. Therefore, I focus beginners on fast wins that reinforce disciplined behavior consistently.

📊 Compounding rewards time more than size when habits stay consistent monthly. For example, ten years of monthly contributions beats one large deposit. Additionally, markets reward patience because volatility smooths as holding periods lengthen.

🌍 Modern platforms allow fractional shares and tiny minimums without penalties. Consequently, your first deposit purchases diversified funds immediately instead of waiting months. Meanwhile, automation schedules the next deposit before hesitation can appear again.

💸 Costs matter because expenses compound negatively against every new contribution.

Choose funds with expense ratios under ten basis points whenever possible.

Furthermore, avoid account fees, trading commissions, and unnecessary add-ons that siphon returns.

🧠 Psychology matters because fear and excitement derail unstructured beginners quickly. However, a simple checklist reduces decisions and protects energy every week. Instead, you follow rules, review briefly, and then live your life.

In short, one hundred dollars works because discipline compounds outcomes more reliably than guesses.

I have watched small consistent investors outperform sporadic high rollers repeatedly.

Because they automate contributions, they avoid timing errors and analysis paralysis effectively.

When markets wobble, they continue buying pieces of entire economies across decades.

That approach transforms small beginnings into meaningful wealth using patience, automation, and humility.

Open your account in ten focused minutes

🚀 I favor brokers that support fractional shares, automatic investing, and DRIP.

Additionally, I prefer clean interfaces because beginners stay consistent when friction disappears.

Therefore, choose a platform that removes excuses and supports long-term behavior naturally.

👉 Follow these steps quickly:

- 🧭 Select account type: taxable brokerage for flexibility, or IRA for taxes

- 🪪 Verify identity with your government ID and accurate personal information

- 🏦 Link your bank using secure connections and small test transfers

- 🔒 Enable two-factor authentication before funding to protect your money

- ⚙️ Turn on DRIP so dividends reinvest automatically into your chosen fund

Next, schedule your first transfer for today, not next month or someday.

Because action beats intention, moving the money matters more than researching platforms.

However, review the trade confirmation screens carefully to ensure everything matches your plan.

Then save your login in a password manager and disable distracting notifications immediately.

Finally, bookmark your portfolio page and your automatic investment settings for easy reviews.

Moreover, add a calendar reminder for monthly checkups that last five minutes.

During those checkups, confirm transfers ran, DRIP worked, and allocations still match goals.

When issues arise, fix them immediately rather than postponing decisions for weeks.

Pick one diversified fund and keep it beautifully simple

🌱 Beginners win by buying one broad market fund and holding patiently.

Consequently, you avoid stock picking, headline chasing, and emotional trading loops entirely.

Moreover, a single fund reduces costs, paperwork, and decision fatigue for years.

Here are three beginner friendly choices:

- 📦 Total U.S. market ETF tracking thousands of domestic companies

- 🌎 Global equity ETF covering developed and emerging markets together

- 🧰 Balanced target-date index fund that auto-adjusts risk over time

💡 Focus on expense ratio first because every basis point compounds forever.

I prefer funds under ten basis points with deep liquidity and reliable tracking.

Additionally, examine index methodology, securities lending policies, and historical tracking error carefully.

📈 If you want bonds, choose a core bond market index for stability.

However, remember that longer bonds swing more when interest rates move around.

Therefore, beginners usually prefer intermediate duration funds that balance risk intelligently.

🔁 Reinvest dividends automatically and avoid manual tinkering between contributions.

Instead, let compounding lift share counts quietly through every market season.

Then review annually to confirm the fund still aligns with your target allocation.

If your life changes, adjust the plan rather than chasing performance charts. That mindset keeps you consistent, calm, and focused on controllable levers.

Automate deposits and reinvestment so discipline becomes your default

🤖 Automation turns intentions into results without daily willpower or motivation struggles.

Therefore, schedule transfers the moment your paycheck arrives to prevent lifestyle creep.

Additionally, split deposits weekly because smaller, frequent contributions feel painless and consistent.

Set automation like this:

- 🗓️ Transfer twenty five dollars every Friday from checking to brokerage

- 🔁 Enable automatic ETF purchases immediately after each transfer settles

- 🎯 Round up purchases on your debit card into weekly micro deposits

- 🧾 Turn on dividend reinvestment for every holding inside the account

- 📬 Enable monthly statements and alerts for failed transfers or unusual activity

Moreover, protect the system with two strong guardrails that preserve momentum.

First, forbid yourself from canceling transfers unless income truly changes for months. Second, refuse to time markets because feelings rarely predict future returns reliably.

However, do review your account monthly using a two minute checklist. Confirm transfers happened, shares purchased, and dividends reinvested exactly as expected.

Additionally, verify your allocation matches the plan and no cash idles unnecessarily.

If something broke, fix it immediately and document the solution for next time.

Finally, treat automation like watering a garden rather than chasing fireworks.

Because the system keeps working, your attention can focus on career growth.

Consequently, your savings rate increases naturally while your lifestyle remains thoughtful and sustainable.

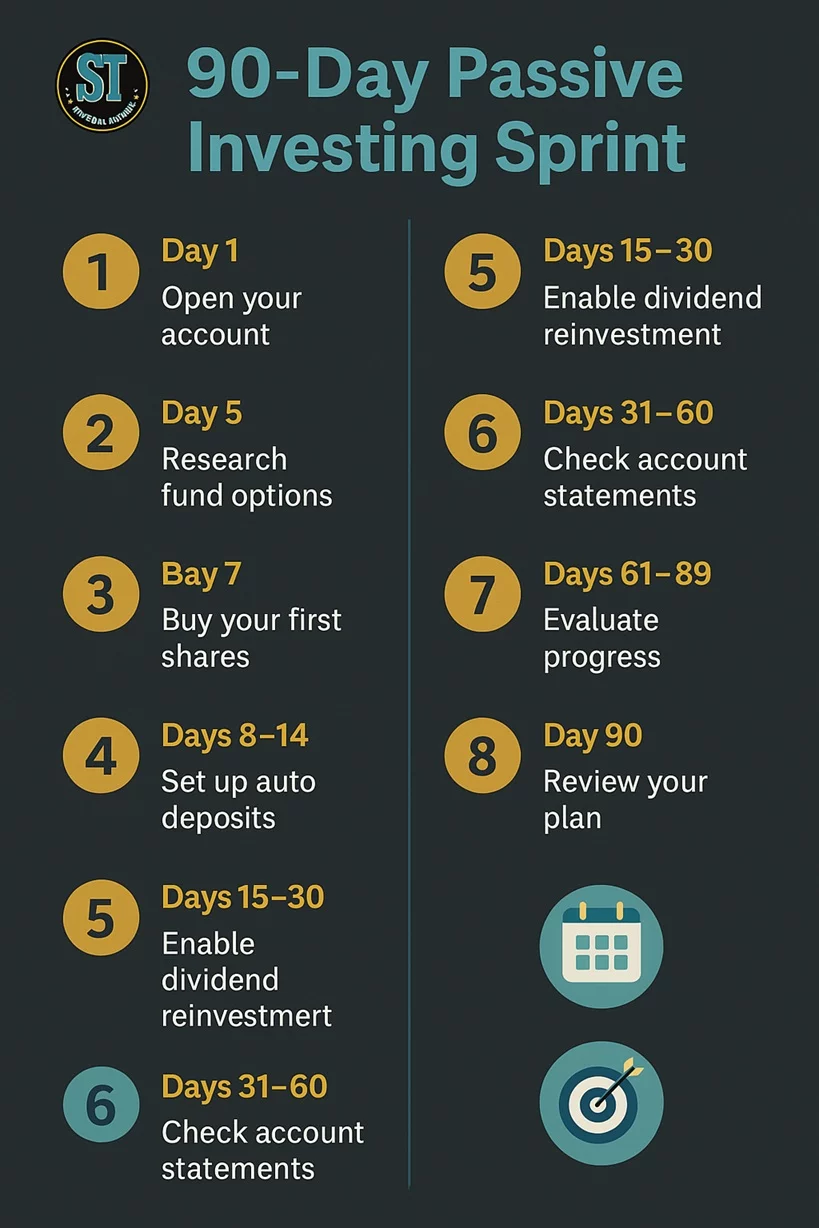

Your first ninety days roadmap

🚦 The first ninety days establish habits that stick through market weather. Therefore, we create a short, repeatable loop that fits ordinary busy schedules. Moreover, this loop protects energy because decisions happen on a fixed calendar.

Follow this simple ninety day loop:

- 🗓️ Week one: open the account and fund it with one hundred

- 💳 Week two: start twenty five dollar weekly transfers and enable automation

- 📈 Week three: buy your chosen fund and confirm DRIP functions properly

- 📚 Week four: learn statements, tax documents, and contribution history pages

- 🔁 Weeks five to thirteen: repeat transfers, ignore headlines, and log quick reviews

📊 Here is a visual for your first ninety days of deposits:

Additionally, write a tiny rule that manages reactions during volatility.

When markets fall, acknowledge feelings privately, then continue buying your scheduled amount.

However, if income changes dramatically, pause transfers temporarily and protect essentials first. Meanwhile, recommit as soon as stability returns rather than resetting the entire plan.

Finally, celebrate the first quarter by reviewing progress and updating goals thoughtfully. Because momentum now exists, increasing contributions becomes easier than starting from zero. Consequently, your compounding engine strengthens while stress declines across future market cycles.

Case studies: one hundred once versus one hundred monthly

🔍 People often underestimate the power of steady contributions across long periods. Therefore, I show two simple paths using the same assumed market return.

Moreover, these examples highlight behavior more than market forecasting or clever timing.

Case one: deposit one hundred dollars once, then hold patiently for ten years. Case two: deposit one hundred dollars monthly, then hold the same ten years. Additionally, reinvest dividends for both paths to keep the comparison straightforward and fair.

📈 The chart below models those two paths using a seven percent assumption:

As you can see, the monthly path dwarfs the single deposit meaningfully.

Because contributions continue, you buy more shares during dips without extra thinking.

Consequently, your average cost trends lower and your share count climbs steadily. Meanwhile, the one time deposit compounds alone and cannot accelerate during opportunities.

However, both paths work if you remain patient and avoid emotional detours. If cash flow limits monthly deposits, start with one hundred then schedule smaller automations. For example, ten dollars weekly still builds momentum while protecting your budget. In time, raises or side income can raise deposits without disrupting your lifestyle.

Therefore, behavior beats brilliance when building wealth from small beginnings. I have watched disciplined contributors surpass talented traders who chased perfection unsuccessfully. Start small, automate consistently, and let the boring math quietly reward your patience.

Infographic: starter portfolio blueprint for one hundred dollars

🖼️ Visuals help beginners remember important steps during busy weeks.

Therefore, I created a simple infographic you can screenshot and revisit quickly.

Moreover, it matches our system and reinforces the four actions that matter.

Use the blueprint like a checklist whenever distractions try to steal attention.

First, open the account and fund it today rather than waiting.

Next, contribute twenty five dollars weekly so momentum never disappears between paychecks.

Then, buy one diversified fund that tracks a broad index reliably.

Finally, automate dividend reinvestment so every distribution purchases additional fractional shares automatically.

Additionally, pin the graphic inside your budgeting app or phone home screen.

When you feel uncertain, read the four boxes aloud and breathe slowly.

However, if major life changes occur, pause, review cash flow, and adjust carefully.

After decisions settle, restart automation using the same four boxes without hesitation.

Consistency beats complexity because repetition strengthens the mindset required for long horizons.

Infographic: common pitfalls and quick fixes for small starters

🧨 New investors often stumble on predictable mistakes that drain motivation fast. Therefore, I built a second infographic that pairs each pitfall with a fix. Moreover, the design stays bold, readable, and aligned with our brand palette.

Review the graphic before placing any trade and especially during turbulence.

If you feel pressure to pick individual stocks, remember diversification first. If you feel tempted to wait months, remember that time matters most. Additionally, if you worry about failing, remember that skills grow through repetition.

Finally, keep those fixes visible where you make financial decisions daily. Because cues shape behavior, helpful reminders steer actions toward your long-term plan. Consequently, you protect your mindset and preserve momentum throughout market ups and downs.

Video recommendation 🎥

🎬 For a visual walkthrough, watch my Successful Tradings video covering small starts. The episode explains dollar cost averaging, automation, and mindset for tiny accounts. Moreover, it shows on-screen steps matching this guide’s exact blueprint and cadence. Therefore, beginners can follow along and pause during each action comfortably. Watch here: https://www.youtube.com/@SuccessfulTradings and search “Start Passive Investing with $100”. I walk through opening the account, buying one fund, and turning on automation settings properly for consistent investing.

Frequently asked questions

❓ How much do I need to begin passive investing today?

💡 One hundred dollars is enough because fractional shares remove old minimums completely.

❓ Should I wait until markets calm before starting my plan?

💡 No. Begin now and let dollar cost averaging handle future volatility automatically.

❓ Which account should I open first with one hundred dollars?

💡 Open a taxable brokerage if retirement accounts are unavailable this month.

❓ Which single fund should beginners choose for maximal simplicity and diversification?

💡 Pick a total market index fund or global equity fund with low fees.

❓ How often should I contribute after the first one hundred dollars?

💡 Weekly works beautifully because smaller amounts feel painless and build momentum reliably.

❓ How do I avoid selling during scary headlines or sudden drops?

💡 Write rules now, automate deposits, and review monthly with a short checklist.

❓ What about bonds when my risk tolerance feels uncertain or low?

💡 Add a core bond fund gradually until sleep improves and nerves settle down.

❓ Do taxes change anything for very small beginner accounts?

💡 Usually not much, yet automation still helps and records simplify later filings.

❓ Which mistakes should beginners watch for during the first quarter?

💡 Canceling transfers, chasing hot tips, ignoring fees, and abandoning rules during volatility.

❓ When should I raise contributions beyond one hundred dollars monthly?

💡 Increase amounts after raises, bonuses, or debt paydowns while keeping automation running.

Conclusion

Since 2015, I have traded through frenzied rallies and sharp corrections.

Since 2019, I have coached beginners who believed small starts never mattered. However, one hundred dollars becomes powerful when paired with automation, diversification, and patience.

Therefore, I built this plan to transform hesitation into action within one focused evening.

🎯 Your blueprint stays simple: open an account, buy one diversified fund, and automate.

Additionally, reinvest dividends so every distribution increases your share count without effort.

Meanwhile, weekly micro deposits keep momentum high and decision fatigue remarkably low.

Consequently, your budget adapts comfortably while your investing habit strengthens every month.

📈 Charts showed how steady contributions beat lonely lump sums decisively.

Moreover, the first ninety days established structure, guardrails, and quick review rituals.

When turbulence arrives, your rules protect decisions and your automation keeps buying systematically.

Therefore, you avoid timing errors and preserve the compounding engine powering long-term results.

🧠 Mindset matters because markets challenge patience with noise and dramatic stories.

Instead of reacting, return to the checklist and the simple four boxes.

Additionally, measure progress quarterly so motivation comes from behavior rather than headlines.

Consequently, you maintain discipline while life stays centered around priorities beyond markets.

Finally, raise contributions when income grows or expenses fall through thoughtful adjustments.

Keep the brokerage fees tiny and taxes smart while your diversified fund continues compounding. With this approach, one hundred dollars becomes your first brick in lasting freedom. Start today, follow the steps faithfully, and let time amplify every disciplined choice.

Track deposits monthly and celebrate every automatic purchase with gratitude.

Share progress with a friend, because accountability accelerates consistent investing.

👉 Next Step 1: Dollar Cost Averaging Strategy

👉 Next Step 2: Dividend Reinvestment Plans

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/