I began trading in 2015 and started coaching in 2019. Fear of losing money prevents millions from building wealth through investing. However, this fear often causes more financial damage than market volatility ever could. Therefore, this guide helps you overcome investment anxiety while building long-term wealth systematically.

👉 In this guide, you will learn:

- 🧠 How to transform investment fear into strategic caution

- 💰 Risk management techniques that protect your money

- 📊 Conservative investment strategies for nervous beginners

- 🎯 How to start investing with minimal risk exposure

- 💡 Emergency fund strategies that provide psychological safety

- 📈 Dollar-cost averaging methods that reduce timing anxiety

- ⚖️ Balancing safety with growth for long-term wealth building

Investment fear stems from natural human psychology and negative media coverage.

Unfortunately, avoiding investing creates guaranteed wealth erosion through inflation.

Additionally, starting late dramatically reduces your compound growth potential permanently.

Table of Contents

Understanding Investment Fear: Psychology Behind the Anxiety 🧠

Investment fear represents normal human psychology responding to uncertainty. Furthermore, our brains evolved to avoid potential threats rather than seek growth opportunities. Additionally, financial media amplifies worst-case scenarios because fear generates attention and engagement.

Common fears that prevent people from investing:

- 💸 Complete loss of initial investment capital

- 📉 Market crashes that eliminate retirement savings

- 🎰 Feeling like investing resembles gambling rather than planning

- 📺 Media coverage emphasizing market disasters over growth

- 🤯 Complexity and confusion about investment options

- 💰 Not having enough money to start meaningfully

However, these fears often prove more dangerous than actual market risks. Moreover, inflation guaranteed reduces purchasing power while investment risk merely represents possibility. Therefore, understanding real versus perceived risks becomes crucial for financial success.

The Hidden Cost of Not Investing

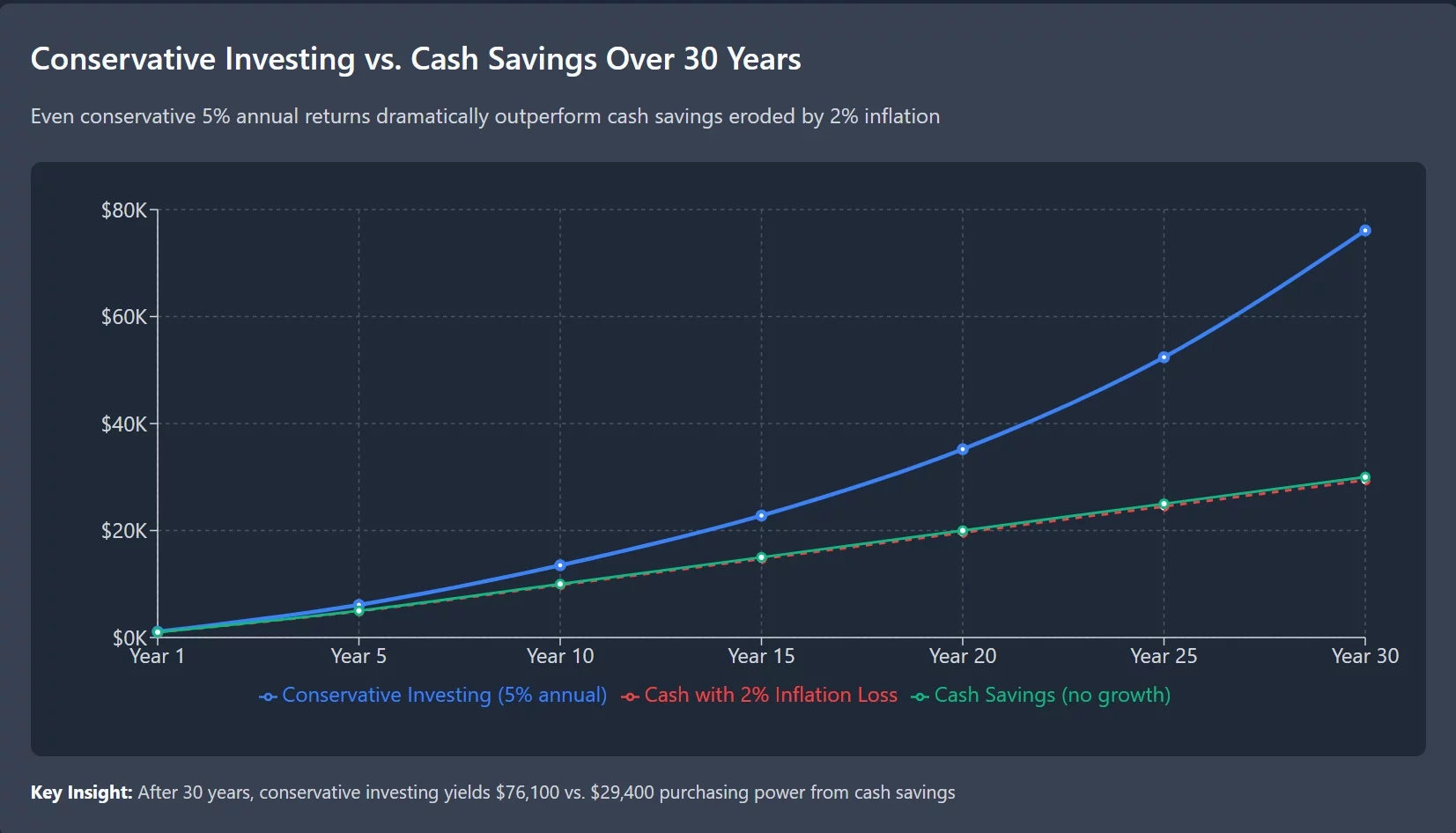

Cash savings lose purchasing power guaranteed through inflation. Furthermore, even conservative 2% annual inflation cuts your money’s value in half over 35 years. Additionally, opportunity cost compounds dramatically over time through missed investment growth.

Inflation impact on $10,000 over 30 years:

- 💰 Purchasing power with 2% inflation: $5,537

- 💰 Purchasing power with 3% inflation: $4,120

- 💰 Potential investment value at 7% growth: $76,123

- 💰 Real cost of investment avoidance: $71,586 opportunity loss

Reframing Investment Risk Perspective

Market volatility creates short-term uncertainty but historical growth remains consistent. Furthermore, diversified investing through index funds has never produced negative returns over 20-year periods. Additionally, starting early provides time for recovery from any temporary downturns.

Historical market perspective for scared investors:

- 📊 S&P 500 has positive returns in 73% of all years since 1926

- 📊 No 20-year period has produced negative total returns

- 📊 Average annual returns approximate 10% before inflation over 90+ years

- 📊 Worst single-year loss (-37% in 2008) recovered within 3 years

Building Your Financial Safety Net First 🛡️

Smart investing requires adequate emergency funds before market exposure. Furthermore, financial security reduces emotional investment decisions during volatility. Additionally, emergency funds prevent forced investment liquidations during personal crises.

Emergency Fund Foundation Strategy

Three to six months of essential expenses in high-yield savings provide crucial psychological safety. Moreover, separate emergency funds from checking accounts prevent casual spending. Furthermore, automatic transfers build emergency funds systematically without decision fatigue.

Emergency fund building approach:

- 💰 Start with $1,000 minimum for immediate emergencies

- 💰 Calculate true monthly essential expenses accurately

- 💰 Build to 3 months expenses for dual-income households

- 💰 Expand to 6 months for single-income or irregular income

- 💰 Keep funds in high-yield savings for inflation protection

Separate Investment from Emergency Money

Never invest money you might need within 5 years. Furthermore, emergency funds should remain completely separate from investment accounts. Additionally, this separation prevents emotional decision-making during market downturns.

Money categorization for scared investors:

- 🏦 Emergency fund: High-yield savings, completely safe

- 🏦 Short-term goals (1-5 years): CDs or conservative bond funds

- 🏦 Long-term investing (5+ years): Stock market index funds

- 🏦 Retirement accounts: Most aggressive growth allocation

Insurance as Additional Safety Layer

Adequate insurance coverage protects investments from unexpected expenses. Moreover, health insurance prevents medical bankruptcies that destroy portfolios. Additionally, disability insurance protects future earning capacity.

Essential insurance coverage for new investors:

- 🏥 Health insurance with reasonable deductibles and coverage

- 🏠 Renters or homeowners insurance for property protection

- 🚗 Auto insurance meeting state requirements and asset protection

- 💼 Disability insurance through employer or private coverage

Conservative Investment Strategies for Beginners 📊

Conservative strategies provide market exposure while minimizing risk perception. Furthermore, these approaches build confidence through consistent, modest returns. Additionally, conservative start enables gradual risk tolerance development over time.

Target-Date Funds for Hands-Off Investing

Target-date funds automatically adjust risk based on retirement timeline. Moreover, they provide professional diversification without investment knowledge requirements. Furthermore, automatic rebalancing prevents emotional decision-making during market changes.

Target-date fund advantages for scared investors:

- 🎯 Professional portfolio management and rebalancing

- 🎯 Automatic risk adjustment as retirement approaches

- 🎯 Diversification across thousands of stocks and bonds

- 🎯 Low costs through index fund construction

- 🎯 Set-and-forget simplicity reduces anxiety

Conservative Portfolio Allocation

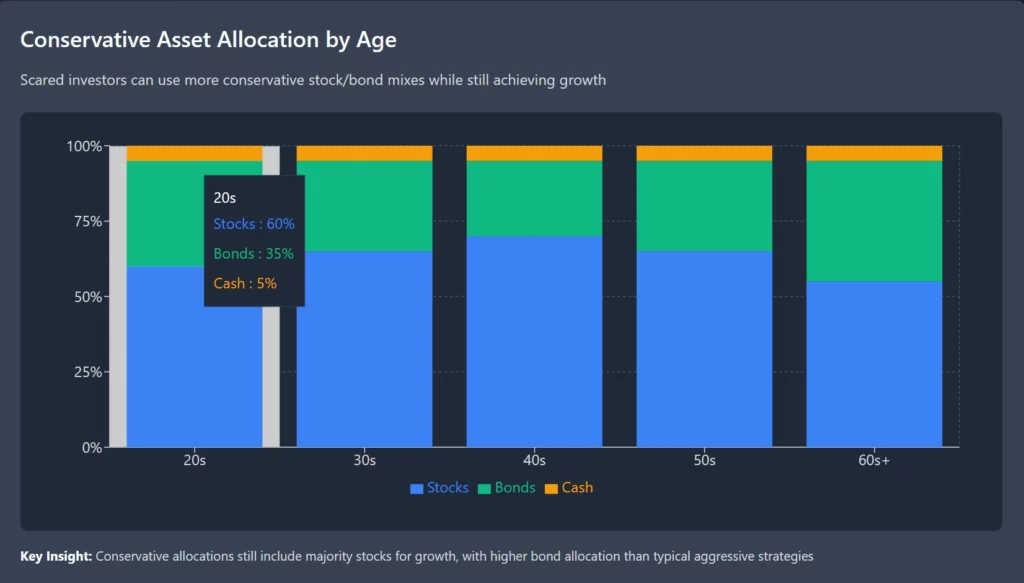

Balanced portfolios include both stocks and bonds for stability. Furthermore, higher bond allocations reduce portfolio volatility significantly. Additionally, this approach provides some growth while limiting downside risk.

Suggested conservative allocations for scared investors:

- 📊 Age 20-30: 60% stocks, 40% bonds (more conservative than typical)

- 📊 Age 30-40: 65% stocks, 35% bonds

- 📊 Age 40-50: 70% stocks, 30% bonds

- 📊 Age 50+: Gradually increase bonds by 1% annually

Dollar-Cost Averaging Implementation

Dollar-cost averaging removes market timing anxiety through systematic investing. Moreover, regular investments purchase more shares when prices fall and fewer when prices rise. Additionally, this approach smooths out market volatility over time.

Dollar-cost averaging strategy:

- 🔄 Invest fixed amount monthly regardless of market conditions

- 🔄 Automate investments to remove emotional decisions

- 🔄 Start with small amounts to build confidence gradually

- 🔄 Increase contributions with income growth or confidence

- 🔄 Never attempt to time market entries or exits

Starting Small: The Minimal Risk Approach 💰

Beginning with small amounts reduces financial and emotional risk significantly. Furthermore, small starting amounts allow learning without major consequences. Additionally, success with small investments builds confidence for larger commitments.

The $25 Monthly Start Strategy

Many brokerages allow investing with no minimum balance requirements.

Moreover, fractional shares enable diversification even with minimal funds. Therefore, starting with $25-50 monthly provides real investment experience without major risk.

Minimal investment approach benefits:

- 💵 Learn investment basics with minimal financial exposure

- 💵 Develop emotional comfort with market fluctuations

- 💵 Build automatic investment habits gradually

- 💵 Prove to yourself that investing works over time

- 💵 Increase contributions as confidence and income grow

Fractional Share Investing

Fractional shares allow purchasing partial ownership in expensive stocks. Furthermore, this enables diversification across multiple companies with small amounts. Additionally, fractional investing removes barriers that previously required large minimum investments.

Fractional share advantages:

- 📈 Buy portions of expensive stocks like Amazon or Google

- 📈 Diversify across multiple companies with small amounts

- 📈 Reinvest dividends automatically for compound growth

- 📈 No minimum investment requirements or account fees

- 📈 Access to same returns as large investors proportionally

Automatic Investment Features

Automation removes emotional decision-making from investment process. Moreover, automatic investments ensure consistency regardless of market conditions or personal emotions. Furthermore, this approach builds wealth through systematic discipline.

Automation benefits for scared investors:

- 🤖 Removes emotional investment timing decisions

- 🤖 Ensures consistent investing regardless of market news

- 🤖 Builds habits through repetition and routine

- 🤖 Reduces analysis paralysis that prevents starting

- 🤖 Creates discipline that wealthy investors follow

Index Fund Investing: Your Safety Through Diversification 🌍

Index funds provide instant diversification across hundreds or thousands of companies. Furthermore, they eliminate individual stock risk through broad market exposure. Additionally, low costs maximize long-term returns through reduced fees.

Understanding Index Fund Safety

Index funds spread risk across entire markets rather than individual companies. Moreover, business failures affect index funds minimally due to diversification. Furthermore, index funds track overall economic growth rather than single company success.

Index fund diversification benefits:

- 📊 Own pieces of 500+ companies through single investment

- 📊 Individual company failures have minimal portfolio impact

- 📊 Benefit from overall economic growth and productivity

- 📊 Professional management without active management fees

- 📊 Historical performance provides predictable return expectations

Total Market vs. S&P 500 Index Funds

Total stock market index funds provide broader diversification than S&P 500 funds. Furthermore, they include small and medium companies alongside large companies. Additionally, broader diversification potentially reduces risk further.

Comparison of index fund options:

- 🏢 S&P 500: 500 largest U.S. companies, proven track record

- 🏢 Total Stock Market: 3,000+ U.S. companies, broader diversification

- 🏢 International Index: Global diversification outside U.S. markets

- 🏢 Bond Index: Government and corporate bonds for stability

Low-Cost Provider Selection

Investment fees compound over time and dramatically reduce returns. Therefore, selecting low-cost providers becomes crucial for long-term success. Furthermore, major providers offer nearly identical index funds at varying costs.

Recommended low-cost index fund providers:

- 💰 Vanguard: Industry-leading low expense ratios

- 💰 Fidelity: Zero-fee funds available for many indexes

- 💰 Schwab: Competitive fees and excellent customer service

- 💰 Target expense ratios under 0.20% for index funds

Managing Market Volatility Anxiety 📈

Market fluctuations create anxiety even for experienced investors. However, understanding volatility as normal market behavior reduces emotional reactions. Furthermore, systematic approaches help maintain long-term perspective during short-term turbulence.

Historical Context for Market Movements

Markets experience short-term volatility but long-term growth consistently. Moreover, understanding historical patterns provides context during current downturns. Additionally, temporary declines often precede significant growth periods.

Historical volatility perspective:

- 📉 Average annual volatility ranges from 15-20% in normal years

- 📉 10% market corrections occur annually on average

- 📉 20% bear markets happen every 3-5 years typically

- 📉 Despite volatility, long-term trend remains consistently upward

- 📉 Patient investors benefit from volatility through lower purchase prices

Techniques for Emotional Management

Developing emotional discipline prevents costly investment mistakes during volatility. Furthermore, systematic approaches remove emotion from investment decisions. Additionally, focusing on long-term goals reduces short-term anxiety.

Emotional management strategies:

- 🧘 Avoid checking investment accounts daily during volatile periods

- 🧘 Focus on contribution consistency rather than account balances

- 🧘 Remember your investment timeline extends decades, not months

- 🧘 View market declines as investment sales rather than losses

- 🧘 Maintain perspective through historical market context

The Power of Staying Invested

Market timing consistently fails even for professional investors. Furthermore, missing the best market days dramatically reduces returns. Additionally, the best and worst market days often occur close together.

Staying invested benefits:

- ⏰ Missing best 10 market days reduces 20-year returns by 50%

- ⏰ Best market days often follow worst market days closely

- ⏰ Time in market beats timing the market consistently

- ⏰ Dollar-cost averaging captures both market highs and lows

- ⏰ Patient investors achieve superior returns through consistency

Creating Your Step-by-Step Investment Plan 🎯

Systematic investment plans remove guesswork and reduce anxiety through clear action steps.

Furthermore, written plans provide accountability and progress tracking. Additionally, gradual implementation builds confidence while managing risk.

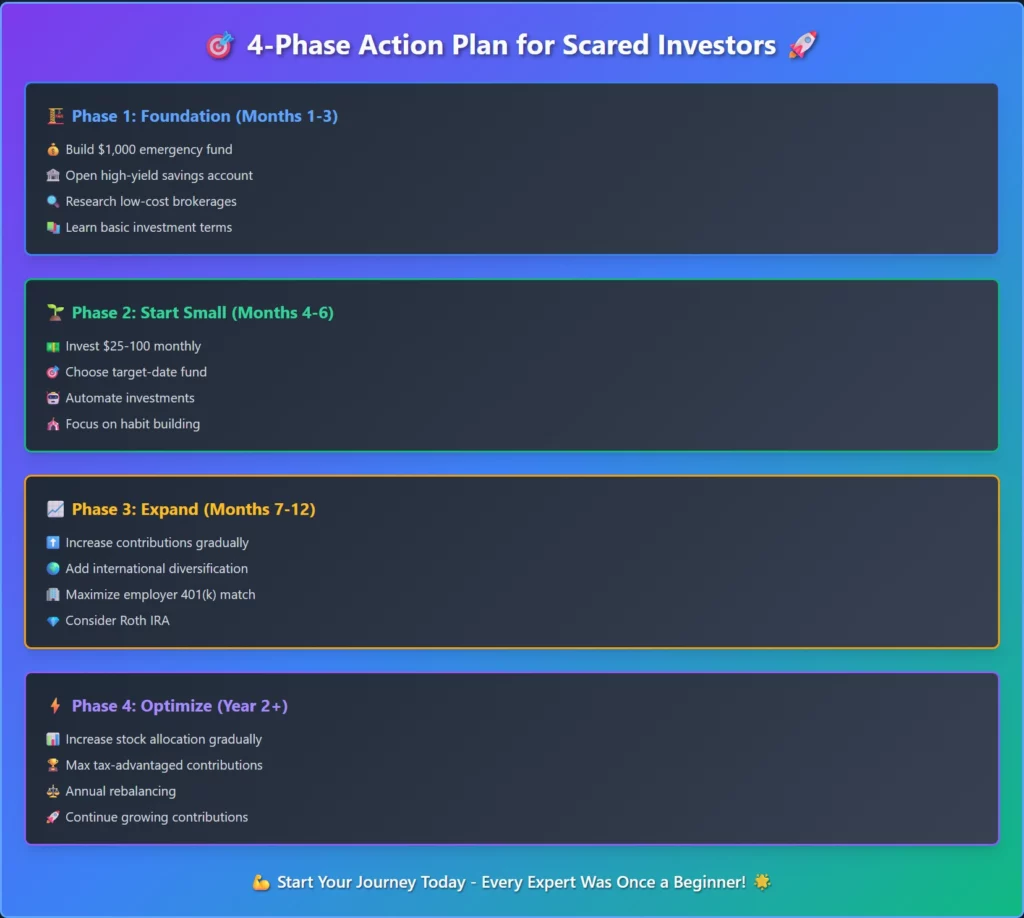

Phase 1: Foundation Building (Months 1-3)

Establish emergency fund and basic investment knowledge before market exposure. Moreover, this foundation provides psychological safety during later investment phases. Furthermore, education reduces fear through understanding.

Foundation building checklist:

- ✅ Build $1,000 emergency fund minimum

- ✅ Open high-yield savings account for emergency funds

- ✅ Research and select low-cost brokerage firm

- ✅ Open investment account (IRA or taxable)

- ✅ Learn basic investment terminology and concepts

Phase 2: Conservative Start (Months 4-6)

Begin investing small amounts in conservative target-date funds or balanced portfolios. Moreover, automate investments to build consistency and discipline. Furthermore, focus on habit formation rather than returns initially.

Conservative start implementation:

- 💰 Start with $25-100 monthly automatic investments

- 💰 Choose target-date fund matching retirement timeline

- 💰 Set up automatic transfers from checking to investment account

- 💰 Track progress monthly but avoid daily account checking

- 💰 Continue building emergency fund simultaneously

Phase 3: Gradual Expansion (Months 7-12)

Increase investment amounts as comfort and income allow. Furthermore, consider adding international diversification through global index funds. Additionally, begin exploring tax-advantaged retirement accounts.

Expansion strategies:

- 📈 Increase monthly contributions by $25-50 every 3 months

- 📈 Add international index fund for global diversification

- 📈 Maximize employer 401(k) match if available

- 📈 Consider opening Roth IRA for tax-free growth

- 📈 Maintain conservative allocation until confidence builds

Phase 4: Optimization and Growth (Year 2+)

Optimize asset allocation based on experience and risk tolerance. Moreover, maximize tax-advantaged account contributions for retirement. Furthermore, consider slightly more aggressive allocations as comfort increases.

Long-term optimization focus:

- 🎯 Gradually increase stock allocation as confidence builds

- 🎯 Maximize all available tax-advantaged account contributions

- 🎯 Add small-cap and emerging market exposure for diversification

- 🎯 Rebalance portfolio annually to maintain target allocation

- 🎯 Continue increasing contributions with income growth

Common Mistakes Scared Investors Make 🚨

Understanding typical mistakes helps scared investors avoid costly errors. Furthermore, these mistakes often result from emotional decision-making rather than systematic planning. Therefore, awareness and prevention prove crucial for investment success.

Paralysis by Analysis

Endless research without action prevents wealth building entirely. However, basic diversified index fund investing requires minimal knowledge to start successfully. Moreover, learning through small-scale experience beats theoretical study.

Analysis paralysis prevention:

- 🚫 Set research deadlines and stick to action timelines

- 🚫 Start with simple target-date funds before complex strategies

- 🚫 Accept that perfect timing and selections don’t exist

- 🚫 Remember that starting imperfectly beats never starting

- 🚫 Plan to improve strategy gradually through experience

Market Timing Attempts

Scared investors often try timing market entries during “safe” periods. However, market timing consistently fails and creates worse outcomes than consistent investing. Furthermore, waiting for perfect entry points delays wealth building indefinitely.

Market timing dangers:

- ⏰ Missing best market days while waiting for perfect entry

- ⏰ Emotional decisions during volatility lead to buying high, selling low

- ⏰ Analysis paralysis prevents any investment action

- ⏰ Perfect market timing requires predicting unpredictable events

- ⏰ Consistent passive investing beats timing attempts over long periods

Emotional Selling During Downturns

Market declines trigger panic selling that locks in losses permanently.

Furthermore, scared investors often sell during market lows when they should continue buying.

Additionally, emotional decisions typically oppose optimal investment behavior.

Emotional selling prevention:

- 🛡️ Automate investments to remove emotional decisions

- 🛡️ Avoid daily account checking during volatile periods

- 🛡️ Remember that temporary declines are normal and expected

- 🛡️ Focus on long-term goals rather than short-term fluctuations

- 🛡️ Consider market declines as investment sales opportunities

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/